The precipitation hardening market valuation is anticipated to grow at a considerable pace, with an estimated 2025 valuation ofUSD 3.17 billion, which is likely to reach around USD 7.04 billion by 2035, growing at a CAGR of about 8.3%. The robust growth of the industry is driven by applications for high-strength, corrosion-resistant alloys in the aerospace, automotive, and industrial manufacturing industries.

One of the key drivers of growth is the aerospace sector, for which precipitation-hardened alloys are utilized for landing gear, engine components, and structural elements. These alloys offer the thermal stability, fatigue life, and strength-to-weight ratio required for aircraft performance, fuel efficiency, and safety standards.

The automotive sector is also adopting precipitation-hardening alloys, especially for electric vehicle (EV) lightweighting initiatives. These alloys are used in powertrain components, transmission systems, and structural parts. With OEMs focusing on emission reduction and improved energy efficiency, high-strength alloys become a competitive edge.

In marine, power generation, and oil & gas, nickel alloys and precipitation-hardened stainless steels guarantee high corrosion and wear resistance. Such functionality is critical for service in hostile environments such as offshore rigs, high-pressure turbines, and chemical process facilities, where part longevity dictates operational reliability.

Technical advances are increasingly enhancing the diversity of precipitation hardening. Advances in powder metallurgy, additive manufacturing, and high-performance heat treatment are enabling tighter control over microstructures, thereby enabling tailor-made mechanical properties optimized based on specific functions and industries.

Although these materials have advantages, they are confronted with higher production and processing costs, unique heat treatment equipment, and expert labor. However, performance improvement in harsh applications usually outweighs initial cost considerations, especially in applications where reliability is not a choice.

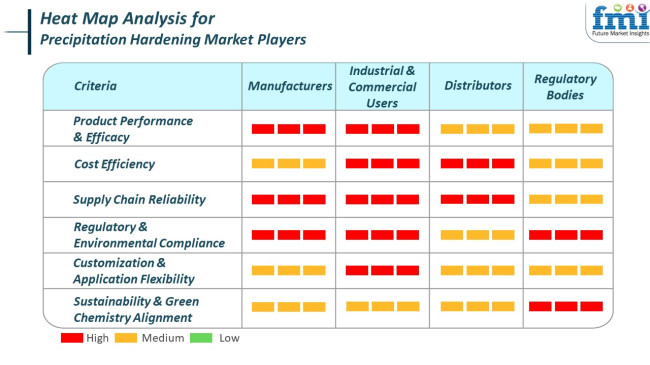

Producers focus on manufacturing high-performance precipitation hardening alloys that meet the demanding requirements of commercial and industrial customers. They ensure using eco-friendly manufacturing processes and aim to deliver a stable supply chain to meet the growing worldwide demand.

Industrial and commercial customers, including aerospace, automotive, construction, and medical devices markets, appreciate low-cost and reliable precipitation hardening solutions that ensure top performance in multi-application applications. They seek products with high performance, conforming to environmental specifications, and adjustable to specific operating conditions.

Distributors emphasize the necessity of maintaining a regular supply chain to supply industrial and commercial customers, emphasizing on-time delivery and competitive pricing. They focus on providing a wide range of products with different applications while maintaining competitive pricing and on-time delivery.

Expropriation authorities enforce the implementation of environmental and safety standards, promoting the adoption of sustainable and environmentally friendly precipitation hardening technologies. The regulatory agencies are also responsible for determining the direction of the industry by enforcing regulations that promote the uptake of clean technology and minimize the footprint of industrial activities on the environment.

Growth in the precipitation hardening industry in the period from 2020 to 2024 was picking up mainly in the aerospace, auto, and manufacturing industries. It increased demand for more durable materials with corrosion-resistant properties, mainly in aircraft body structures, engine turbine components, and high-end parts.

Producers during this period depended heavily on traditional alloys like stainless steel (17-4 PH) and aluminum-based variants. Developments focused on improving machine efficiency and improving fatigue life in extreme conditions dominated. However, limitations in the flexibility of alloys and production costs restricted widespread applications beyond niche industries.

Between 2025 and 2035, the industry is expected to develop more rapidly, with a greater focus on high-performance materials science and energy-saving production techniques. As additive manufacturing continues to grow and greater emphasis is placed on high-performance materials for electric vehicles, renewable energy equipment, and space exploration, precipitation-hardened alloys will become further diversified.

Industry players will invest in nano-precipitation process research and hybrid alloy systems to meet niche needs. Lifecycle analysis models and regulatory demands will spur demand for durable, lightweight materials with higher recyclability and lower carbon footprints.

A Comparative Market Shift Analysis (2020 to 2024 vs. 2025 to 2035)

| 2020 to 2024 | 2025 to 2035 |

|---|---|

| Parts for aerospace, turbine blades, and precision instruments. | Electric vehicles, green infrastructure, space technology, and advanced robotics. |

| Majorly traditional alloys such as stainless steel (17-4 PH) and aluminum alloys. | Emphasis on nano -structured alloys, hybrid materials, and additive manufacturing-specific alloys. |

| Enhancements in heat treatment and machinability. | Advancements in nano -precipitation hardening, AI-driven alloy design, and environmentally friendly material development. |

| Traditional casting and forging processes prevailed. | Transition towards additive manufacturing, precision laser sintering, and integrated performance modeling. |

| Limited recycling and high energy consumption in production. | Strong emphasis on low-emission processing, recyclability, and lifecycle optimization. |

| Strong presence in North America and Western Europe as a result of defense and aerospace. | Balanced growth in Asia-Pacific and Middle East as industrial modernization and aerospace programs increase. |

The industry finds roles in the production of high-strength alloys used in aerospace, automotive, defense, and precision engineering and is gradually growing, but not without enormous challenges. One of the biggest risks facing the company in 2024 is the cost of alloying elements and complex heat treatment steps involved in achieving optimum material properties.

Aluminum, nickel, and precipitation-hardening stainless steels require closely controlled heat cycling and purpose-prepared hardware, and these are more costly to operate. These considerations tend to discourage usage in cost-conscious applications or low-volume manufacturing situations. On top of these, the industry is extremely competitive, with numerous local and international producers eager to present cost-competitive alternatives.

Environmental standards are another major challenge. The usage of certain chemicals in surface treatment and heat processes has come into question, where companies need to invest in cleaner technologies or replace existing industrial procedures. These overhauls are capital-intensive and may, from time to time, close down business procedures or increase the cost of compliance.In the future, technological disruption poses a threat.

With newer materials like high-end composites and additive manufacturing alloys gaining mainline production status, precipitation-hardened metals will lose their traction in those end-use applications where lighter or flexible substitutes are an option. In addition, global supply chain risk-especially in major raw materials of politically unstable regions-is a long-term risk. Rare earth or special alloying element sourcing slippage freezes production and tests contract terms.

| Countries | Projected CAGR (2025 to 2035) |

|---|---|

| USA | 8.2% |

| UK | 8.0% |

| France | 8.1% |

| Germany | 8.3% |

| Italy | 8.0% |

| South Korea | 8.4% |

| Japan | 8.2% |

| China | 8.6% |

| Australia | 8.1% |

| New Zealand | 8.0% |

The USA is projected to grow at a CAGR of 8.2% from 2025 to 2035. Growth in aerospace, defense, and energy sectors, where corrosion-resistant, high-strength alloys are essential, is driving the rising demand. The usage of precipitation-hardened stainless steels and aluminum alloys in turbine components, airframes, and critical joints is propelling sales growth.

Industry leaders such as Allegheny Technologies Inc. (ATI), Carpenter Technology Corp., and Special Metals Corp. are investing in advanced metallurgical processes and hardening alloys compatible with additive manufacturing. Government spending on aerospace R&D and defense modernization is anticipated to drive adoption further.

The UK is expected to grow at a CAGR of 8.0% during the forecast period. High demand comes from the aerospace and automotive industries due to precision engineering applications. The superior mechanical properties and weldability of precipitation-hardened alloys make them imperative in jet engines, gear sets, and medical implants.

Industry like Rolls-Royce plc and BAE Systems are actually using precipitation-hardened superalloys in propulsion systems and airframe components. National investment in clean aviation technology and defense resilience is poised to underpin further long-term demand.

France is also likely to have a CAGR of 8.1%. The country's strong aerospace manufacturing base, particularly in Toulouse, is among the key drivers of growth. Precipitation-hardened materials are extensively used in airplane structures, turbine disks, and engine casings due to their high tensile strength and fatigue resistance.

Large suppliers such as Aubert & Duval and Aperam are focusing on alloy development and thermomechanical processing. Collaboration with Airbus and participation in European defense programs further consolidate France's position in this industry.

Germany is poised to expand with a CAGR of 8.3%. Industrial machinery, automobile, and high-speed rail industries are key drivers of demand owing to strong industries. Strong alloys are required in applications relating to durability with respect to extreme loads and cycling temperatures.

Voestalpine High-Performance Metals GmbH and Deutsche Edelstahlwerke are the major contributors, supplying hardening alloys for toolmaking, transportation technology, and energy applications. Germany's focus on engineering quality and sustainability in production is matched by the precision demands of this material industry.

Italy is expected to achieve a CAGR of 8.0% from 2025 to 2035. The market benefits from growing demand in defense production, aerospace tooling, and offshore equipment production. Precipitation-hardened materials find extensive applications in valve bodies, fasteners, and structural supports.

Producers such as AcciaierieValbruna and FonderieAriotti are increasing their capacity in corrosion-resistant alloys and advanced heat-treatment methods. Italian industrial policy emphasizing localization and high-performance materials in defense and energy applications provides additional support to the market.

South Korea is projected to grow at a CAGR of 8.4% on the basis of aerospace, shipbuilding, and high-tech manufacturing industries. Precipitation hardening is a critical characteristic in turbine blades made from superalloys, naval equipment, and semiconductor manufacturing equipment, requiring dimensional stability and wear resistance.

Companies such as POSCO and Hyundai Steel are investing in alloy portfolios and making alliances with global aerospace suppliers. Investments in national defense autonomy and aerospace innovation are set to fuel market growth throughout the decade.

Japan will advance at an 8.2% CAGR. The aerospace, robotics, and energy markets are significant consumers of precipitation-hardened alloys. Precipitation-hardened materials are interested in highly demanding load-carrying parts as well as temperature components that need continuous mechanical behavior.

Major producers such as Nippon Steel Corporation and Daido Steel are developing powder metallurgy and microalloying techniques to promote precipitation kinetics as well as resist stress. Government actions in rejuvenating high-value manufacturing and insuring rare alloy resources enhance the long-term perspective.

China is estimated to lead with a CAGR of 8.6%, the highest among nations surveyed. Strong growth in military, aerospace, and nuclear energy markets is driving heavy investment in precipitation-hardening technologies. Structural reform and technological self-reliance policies are supporting the indigenous development of advanced metallurgical capabilities.

Government-owned enterprises such as Baosteel and AVIC Manufacturing Technology are investing in alloys for high-performance aircraft engines, marine propulsion equipment, and reactor internals. Other strategic national initiatives, such as Made in China 2025, continue to propel domestic R&D and alloy development.

Australia is anticipated to record a CAGR of 8.1%. Sales are driven by usage in mining machinery, offshore engineering, and defense ships. Precipitation-hardened stainless steels and aluminum alloys are heavily used in drill bits, subsea connectors, and structural supports in harsh environments.

Firms like Austal Limited and Bisalloy Steel are forming global partnerships to co-develop solar energy-based equipment for naval vessel construction and energy infrastructure. Government-supported industry transformation plans are enhancing competitiveness in the advanced processing of materials.

New Zealand is also expected to grow at a CAGR of 8.0%. The industry size is smaller in this country. However, demand is emerging from aerospace maintenance, farm machinery, and seaborne transportation industries. Precipitation-hardened grade components offer advantages in terms of wear life and fatigue resistance under harsh conditions of operation.

Engineering firms and materials research institutions are joining forces more and more to promote the use of high-strength alloys. Precision manufacturing and export-oriented growth-promoting policy actions are propelling sales expansion.

By hardening types, the industry is segmented into coherency strain and chemical hardening, with the former being related to the expected uptake of 42% of the industry share in 2025 and the latter accounting for 30%.

Coherency strain hardening occurs when fine precipitation is generated in the crystal lattice of a material, restricting dislocation movements to enhance material strength thereby. The process is most common in aerospace, automotive, and high-performance engineering materials, including aluminum alloys, titanium alloys, and some steel alloys.

Companies such as Alcoa and ATI Metals are taking advantage of coherency strain to manufacture lightweight strength materials for their aircraft and automotive applications. For example, Alcoa's major commercial application of aluminum alloys is aerospace, where the alloys are perfectly set to employ coherency strain hardening for the attainment of desired strength/weight properties. The key factor for driving the industry is advanced material development for very high-performance applications where strength-to-weight ratios are critical.

Chemical hardening generally involves the addition of alloying elements or chemical treatment for the hardening and strength improvement of material. This hardening is known to be most practiced in the production of steel, stainless steel, and nickel-based alloys in petrochemicals, power generation, and manufacturing industries.

Sandvik and Carpenter Technology are among the significant players in this segment, providing chemical hardening technology for high-performance materials in turbine blades, oil pipelines, and other industrial machinery. For example, Sandvik makes use of its high-performance steel grades, which are chemically hardened, mainly in critical applications, such as gas turbines and downhole oil tools, where high resistance to wear and corrosion is essential.

By material, the industry is segmented into stainless steel and aluminum. Stainless steel is expected to account for 38% of the revenue share, and aluminum will account for 32%.

The apparent strength and corrosion-resistant characteristics of stainless steel have earned it a favorable reputation in industries such as aerospace, automotive, medical, and chemical processing. Partial precipitation-hardening of stainless steel imparts a significant improvement in some physical characteristics, including strength, hardness, and fatigue resistance.

Some major companies that manufacture precipitation-hardened stainless steels for demanding applications include Carpenter Technology and Allegheny Technologies Incorporated (ATI). For instance, ATI's precipitation-hardened alloy 17-4PH stainless steel is used in aerospace applications such as landing gears and jet engine components that are exposed to high-temperature and high-stress environments. As the demand for materials with high strength and corrosion-resistant properties keeps on rising globally, the role of stainless steel in the industry will remain vital.

Aluminum, lightweight with a high strength-to-weight ratio, determines its foremost usage in applications where performance and weight reduction are of utmost importance, i.e., aerospace, automotive, and defense. Precipitation-hardened aluminum alloys offer superior mechanical properties, strength, and hardness and can be used in demanding applications, such as structure components, airplanes and high-performance vehicles.

Precipitation-hardened aluminum products are supplied by major manufacturers like Alcoa and Rio Tinto, focusing primarily on the production of alloys for industries where weight reduction and high strength are essential. For instance, precipitation hardening of Alcoa's 7050 aluminum alloy serves the aerospace industry by allowing load-bearing structures to achieve optimal strength and stress resistance while maintaining low weight, which is critical for aircraft construction.

The industry is dominated by preeminent metallurgical service providers specializing in advanced heat treatment solutions. Further, Bodycote and Paulo are also vying for a cut on the competitive edge by building their facilities and leveraging automation for process optimization.

On that, both Wallwork Heat Treatment Ltd. and Pilkington Metal Finishing are bent upon precision alloy treatments for aerospace, automotive, and industrial applications, strengthening their market tripods. Besides, Bluewater Thermal Solutions recently unveiled AI-driven monitors to gauge precipitation hardening processes continuously.

However, innovations and technological advancements remain marks that set these companies apart. In 2024, Bodycote unveiled North America's advanced vacuum heat treatment and achieved a new stand with in-house capability to produce next-generation aerospace alloys.

Paulo also uses artificial intelligence to control its facilities and technologies, hence streamlining its entire hardening activity in order to spur up hardening efficiency while ensuring material property consistency. Similarly, Wallwork Heat Treatment Ltd. is heavily investing in sought-after automation to minimize cycle times and thus improve competitiveness on highly precise applications.

Innovative product additions have been among the eminent sections in shaping the competition. AI-associated process optimization was recently unveiled by Bluewater Thermal Solutions to improve efficiency in hardening high-performance alloys. Pilkington Metal Finishing has created proprietary rapid-cycle heat treatment development for tooling and abrasive applications. Further, Indo-German Vacu Treat Pvt. Ltd. and Thermex Metal Treating have advanced by honing aging treatments to improve strength-to-ductility ratios in precipitation-hardened materials.

Sustainability and processing efficiency continue to forge competition. In the process, Specialty Steel Treating has adopted low-emission heat treatment techniques to be in line with the stringent environmental standards. These trends point towards an industry shift to make the processes better, more efficient, automated, and environmentally much more sustainable.

Market Share Analysis by Company

| Company Name | Market Share (%) |

|---|---|

| Bodycote | 20-24% |

| Paulo | 15-19% |

| Wallwork Heat Treatment Ltd. | 10-14% |

| Pilkington Metal Finishing | 8-12% |

| Bluewater Thermal Solutions | 6-10% |

| Other Players (Combined) | 27-32% |

| Company Name | Offerings & Activities |

|---|---|

| Bodycote | Advanced vacuum heat treatment for aerospace and defense. Expanding North American operations. |

| Paulo | AI-integrated precipitation hardening for automotive and industrial applications. Process optimization focus. |

| Wallwork Heat Treatment Ltd. | High-precision hardening for medical and tooling applications. Investing in automation. |

| Pilkington Metal Finishing | Custom heat treatment solutions with fast cycle times. Growing in industrial tooling segments. |

| Bluewater Thermal Solutions | AI-driven process control for consistent alloy hardening. Enhancing treatment efficiency. |

The segmentation is into Coherency Strain, Chemical, and Dispersion.

The segmentation is into Stainless Steel, Aluminium, Magnesium, and Others.

The segmentation is into the Automotive Industry, Aerospace Industry, and Others.

The report covers North America, Latin America, Western Europe, Eastern Europe, South Asia and Pacific, East Asia, and the Middle East and Africa.

The industry valuation is estimated to reach USD 3.17 billion by 2025.

The industry is projected to grow to USD 7.04 billion by 2035, driven by increasing demand for high-strength and corrosion-resistant materials in aerospace, automotive, and industrial applications.

China is expected to grow at a rate of 8.6%, supported by rapid industrialization and advancements in manufacturing technologies.

Coherency strain and chemical hardening are leading mechanisms that are preferred for enhancing mechanical properties in stainless steel and superalloys.

Key players in this industry include Bodycote, Paulo, Wallwork Heat Treatment Ltd., Pilkington Metal Finishing, Bluewater Thermal Solutions, MSL Heat Treatment Limited, Indo-German Vacu Treat Pvt. Ltd., Irwin Automation Inc., Pacific Metallurgical, Inc., Thermex Metal Treating, Hauck Heat Treatment Ltd., and Specialty Steel Treating.

Table 1: Global Market Value (US$ Million) Forecast by Region, 2018 to 2033

Table 2: Global Market Volume (Tons) Forecast by Region, 2018 to 2033

Table 3: Global Market Value (US$ Million) Forecast by Hardening Type, 2018 to 2033

Table 4: Global Market Volume (Tons) Forecast by Hardening Type, 2018 to 2033

Table 5: Global Market Value (US$ Million) Forecast by Material, 2018 to 2033

Table 6: Global Market Volume (Tons) Forecast by Material, 2018 to 2033

Table 7: Global Market Value (US$ Million) Forecast by End Use, 2018 to 2033

Table 8: Global Market Volume (Tons) Forecast by End Use, 2018 to 2033

Table 9: North America Market Value (US$ Million) Forecast by Country, 2018 to 2033

Table 10: North America Market Volume (Tons) Forecast by Country, 2018 to 2033

Table 11: North America Market Value (US$ Million) Forecast by Hardening Type, 2018 to 2033

Table 12: North America Market Volume (Tons) Forecast by Hardening Type, 2018 to 2033

Table 13: North America Market Value (US$ Million) Forecast by Material, 2018 to 2033

Table 14: North America Market Volume (Tons) Forecast by Material, 2018 to 2033

Table 15: North America Market Value (US$ Million) Forecast by End Use, 2018 to 2033

Table 16: North America Market Volume (Tons) Forecast by End Use, 2018 to 2033

Table 17: Latin America Market Value (US$ Million) Forecast by Country, 2018 to 2033

Table 18: Latin America Market Volume (Tons) Forecast by Country, 2018 to 2033

Table 19: Latin America Market Value (US$ Million) Forecast by Hardening Type, 2018 to 2033

Table 20: Latin America Market Volume (Tons) Forecast by Hardening Type, 2018 to 2033

Table 21: Latin America Market Value (US$ Million) Forecast by Material, 2018 to 2033

Table 22: Latin America Market Volume (Tons) Forecast by Material, 2018 to 2033

Table 23: Latin America Market Value (US$ Million) Forecast by End Use, 2018 to 2033

Table 24: Latin America Market Volume (Tons) Forecast by End Use, 2018 to 2033

Table 25: Western Europe Market Value (US$ Million) Forecast by Country, 2018 to 2033

Table 26: Western Europe Market Volume (Tons) Forecast by Country, 2018 to 2033

Table 27: Western Europe Market Value (US$ Million) Forecast by Hardening Type, 2018 to 2033

Table 28: Western Europe Market Volume (Tons) Forecast by Hardening Type, 2018 to 2033

Table 29: Western Europe Market Value (US$ Million) Forecast by Material, 2018 to 2033

Table 30: Western Europe Market Volume (Tons) Forecast by Material, 2018 to 2033

Table 31: Western Europe Market Value (US$ Million) Forecast by End Use, 2018 to 2033

Table 32: Western Europe Market Volume (Tons) Forecast by End Use, 2018 to 2033

Table 33: Eastern Europe Market Value (US$ Million) Forecast by Country, 2018 to 2033

Table 34: Eastern Europe Market Volume (Tons) Forecast by Country, 2018 to 2033

Table 35: Eastern Europe Market Value (US$ Million) Forecast by Hardening Type, 2018 to 2033

Table 36: Eastern Europe Market Volume (Tons) Forecast by Hardening Type, 2018 to 2033

Table 37: Eastern Europe Market Value (US$ Million) Forecast by Material, 2018 to 2033

Table 38: Eastern Europe Market Volume (Tons) Forecast by Material, 2018 to 2033

Table 39: Eastern Europe Market Value (US$ Million) Forecast by End Use, 2018 to 2033

Table 40: Eastern Europe Market Volume (Tons) Forecast by End Use, 2018 to 2033

Table 41: South Asia and Pacific Market Value (US$ Million) Forecast by Country, 2018 to 2033

Table 42: South Asia and Pacific Market Volume (Tons) Forecast by Country, 2018 to 2033

Table 43: South Asia and Pacific Market Value (US$ Million) Forecast by Hardening Type, 2018 to 2033

Table 44: South Asia and Pacific Market Volume (Tons) Forecast by Hardening Type, 2018 to 2033

Table 45: South Asia and Pacific Market Value (US$ Million) Forecast by Material, 2018 to 2033

Table 46: South Asia and Pacific Market Volume (Tons) Forecast by Material, 2018 to 2033

Table 47: South Asia and Pacific Market Value (US$ Million) Forecast by End Use, 2018 to 2033

Table 48: South Asia and Pacific Market Volume (Tons) Forecast by End Use, 2018 to 2033

Table 49: East Asia Market Value (US$ Million) Forecast by Country, 2018 to 2033

Table 50: East Asia Market Volume (Tons) Forecast by Country, 2018 to 2033

Table 51: East Asia Market Value (US$ Million) Forecast by Hardening Type, 2018 to 2033

Table 52: East Asia Market Volume (Tons) Forecast by Hardening Type, 2018 to 2033

Table 53: East Asia Market Value (US$ Million) Forecast by Material, 2018 to 2033

Table 54: East Asia Market Volume (Tons) Forecast by Material, 2018 to 2033

Table 55: East Asia Market Value (US$ Million) Forecast by End Use, 2018 to 2033

Table 56: East Asia Market Volume (Tons) Forecast by End Use, 2018 to 2033

Table 57: Middle East and Africa Market Value (US$ Million) Forecast by Country, 2018 to 2033

Table 58: Middle East and Africa Market Volume (Tons) Forecast by Country, 2018 to 2033

Table 59: Middle East and Africa Market Value (US$ Million) Forecast by Hardening Type, 2018 to 2033

Table 60: Middle East and Africa Market Volume (Tons) Forecast by Hardening Type, 2018 to 2033

Table 61: Middle East and Africa Market Value (US$ Million) Forecast by Material, 2018 to 2033

Table 62: Middle East and Africa Market Volume (Tons) Forecast by Material, 2018 to 2033

Table 63: Middle East and Africa Market Value (US$ Million) Forecast by End Use, 2018 to 2033

Table 64: Middle East and Africa Market Volume (Tons) Forecast by End Use, 2018 to 2033

Figure 1: Global Market Value (US$ Million) by Hardening Type, 2023 to 2033

Figure 2: Global Market Value (US$ Million) by Material, 2023 to 2033

Figure 3: Global Market Value (US$ Million) by End Use, 2023 to 2033

Figure 4: Global Market Value (US$ Million) by Region, 2023 to 2033

Figure 5: Global Market Value (US$ Million) Analysis by Region, 2018 to 2033

Figure 6: Global Market Volume (Tons) Analysis by Region, 2018 to 2033

Figure 7: Global Market Value Share (%) and BPS Analysis by Region, 2023 to 2033

Figure 8: Global Market Y-o-Y Growth (%) Projections by Region, 2023 to 2033

Figure 9: Global Market Value (US$ Million) Analysis by Hardening Type, 2018 to 2033

Figure 10: Global Market Volume (Tons) Analysis by Hardening Type, 2018 to 2033

Figure 11: Global Market Value Share (%) and BPS Analysis by Hardening Type, 2023 to 2033

Figure 12: Global Market Y-o-Y Growth (%) Projections by Hardening Type, 2023 to 2033

Figure 13: Global Market Value (US$ Million) Analysis by Material, 2018 to 2033

Figure 14: Global Market Volume (Tons) Analysis by Material, 2018 to 2033

Figure 15: Global Market Value Share (%) and BPS Analysis by Material, 2023 to 2033

Figure 16: Global Market Y-o-Y Growth (%) Projections by Material, 2023 to 2033

Figure 17: Global Market Value (US$ Million) Analysis by End Use, 2018 to 2033

Figure 18: Global Market Volume (Tons) Analysis by End Use, 2018 to 2033

Figure 19: Global Market Value Share (%) and BPS Analysis by End Use, 2023 to 2033

Figure 20: Global Market Y-o-Y Growth (%) Projections by End Use, 2023 to 2033

Figure 21: Global Market Attractiveness by Hardening Type, 2023 to 2033

Figure 22: Global Market Attractiveness by Material, 2023 to 2033

Figure 23: Global Market Attractiveness by End Use, 2023 to 2033

Figure 24: Global Market Attractiveness by Region, 2023 to 2033

Figure 25: North America Market Value (US$ Million) by Hardening Type, 2023 to 2033

Figure 26: North America Market Value (US$ Million) by Material, 2023 to 2033

Figure 27: North America Market Value (US$ Million) by End Use, 2023 to 2033

Figure 28: North America Market Value (US$ Million) by Country, 2023 to 2033

Figure 29: North America Market Value (US$ Million) Analysis by Country, 2018 to 2033

Figure 30: North America Market Volume (Tons) Analysis by Country, 2018 to 2033

Figure 31: North America Market Value Share (%) and BPS Analysis by Country, 2023 to 2033

Figure 32: North America Market Y-o-Y Growth (%) Projections by Country, 2023 to 2033

Figure 33: North America Market Value (US$ Million) Analysis by Hardening Type, 2018 to 2033

Figure 34: North America Market Volume (Tons) Analysis by Hardening Type, 2018 to 2033

Figure 35: North America Market Value Share (%) and BPS Analysis by Hardening Type, 2023 to 2033

Figure 36: North America Market Y-o-Y Growth (%) Projections by Hardening Type, 2023 to 2033

Figure 37: North America Market Value (US$ Million) Analysis by Material, 2018 to 2033

Figure 38: North America Market Volume (Tons) Analysis by Material, 2018 to 2033

Figure 39: North America Market Value Share (%) and BPS Analysis by Material, 2023 to 2033

Figure 40: North America Market Y-o-Y Growth (%) Projections by Material, 2023 to 2033

Figure 41: North America Market Value (US$ Million) Analysis by End Use, 2018 to 2033

Figure 42: North America Market Volume (Tons) Analysis by End Use, 2018 to 2033

Figure 43: North America Market Value Share (%) and BPS Analysis by End Use, 2023 to 2033

Figure 44: North America Market Y-o-Y Growth (%) Projections by End Use, 2023 to 2033

Figure 45: North America Market Attractiveness by Hardening Type, 2023 to 2033

Figure 46: North America Market Attractiveness by Material, 2023 to 2033

Figure 47: North America Market Attractiveness by End Use, 2023 to 2033

Figure 48: North America Market Attractiveness by Country, 2023 to 2033

Figure 49: Latin America Market Value (US$ Million) by Hardening Type, 2023 to 2033

Figure 50: Latin America Market Value (US$ Million) by Material, 2023 to 2033

Figure 51: Latin America Market Value (US$ Million) by End Use, 2023 to 2033

Figure 52: Latin America Market Value (US$ Million) by Country, 2023 to 2033

Figure 53: Latin America Market Value (US$ Million) Analysis by Country, 2018 to 2033

Figure 54: Latin America Market Volume (Tons) Analysis by Country, 2018 to 2033

Figure 55: Latin America Market Value Share (%) and BPS Analysis by Country, 2023 to 2033

Figure 56: Latin America Market Y-o-Y Growth (%) Projections by Country, 2023 to 2033

Figure 57: Latin America Market Value (US$ Million) Analysis by Hardening Type, 2018 to 2033

Figure 58: Latin America Market Volume (Tons) Analysis by Hardening Type, 2018 to 2033

Figure 59: Latin America Market Value Share (%) and BPS Analysis by Hardening Type, 2023 to 2033

Figure 60: Latin America Market Y-o-Y Growth (%) Projections by Hardening Type, 2023 to 2033

Figure 61: Latin America Market Value (US$ Million) Analysis by Material, 2018 to 2033

Figure 62: Latin America Market Volume (Tons) Analysis by Material, 2018 to 2033

Figure 63: Latin America Market Value Share (%) and BPS Analysis by Material, 2023 to 2033

Figure 64: Latin America Market Y-o-Y Growth (%) Projections by Material, 2023 to 2033

Figure 65: Latin America Market Value (US$ Million) Analysis by End Use, 2018 to 2033

Figure 66: Latin America Market Volume (Tons) Analysis by End Use, 2018 to 2033

Figure 67: Latin America Market Value Share (%) and BPS Analysis by End Use, 2023 to 2033

Figure 68: Latin America Market Y-o-Y Growth (%) Projections by End Use, 2023 to 2033

Figure 69: Latin America Market Attractiveness by Hardening Type, 2023 to 2033

Figure 70: Latin America Market Attractiveness by Material, 2023 to 2033

Figure 71: Latin America Market Attractiveness by End Use, 2023 to 2033

Figure 72: Latin America Market Attractiveness by Country, 2023 to 2033

Figure 73: Western Europe Market Value (US$ Million) by Hardening Type, 2023 to 2033

Figure 74: Western Europe Market Value (US$ Million) by Material, 2023 to 2033

Figure 75: Western Europe Market Value (US$ Million) by End Use, 2023 to 2033

Figure 76: Western Europe Market Value (US$ Million) by Country, 2023 to 2033

Figure 77: Western Europe Market Value (US$ Million) Analysis by Country, 2018 to 2033

Figure 78: Western Europe Market Volume (Tons) Analysis by Country, 2018 to 2033

Figure 79: Western Europe Market Value Share (%) and BPS Analysis by Country, 2023 to 2033

Figure 80: Western Europe Market Y-o-Y Growth (%) Projections by Country, 2023 to 2033

Figure 81: Western Europe Market Value (US$ Million) Analysis by Hardening Type, 2018 to 2033

Figure 82: Western Europe Market Volume (Tons) Analysis by Hardening Type, 2018 to 2033

Figure 83: Western Europe Market Value Share (%) and BPS Analysis by Hardening Type, 2023 to 2033

Figure 84: Western Europe Market Y-o-Y Growth (%) Projections by Hardening Type, 2023 to 2033

Figure 85: Western Europe Market Value (US$ Million) Analysis by Material, 2018 to 2033

Figure 86: Western Europe Market Volume (Tons) Analysis by Material, 2018 to 2033

Figure 87: Western Europe Market Value Share (%) and BPS Analysis by Material, 2023 to 2033

Figure 88: Western Europe Market Y-o-Y Growth (%) Projections by Material, 2023 to 2033

Figure 89: Western Europe Market Value (US$ Million) Analysis by End Use, 2018 to 2033

Figure 90: Western Europe Market Volume (Tons) Analysis by End Use, 2018 to 2033

Figure 91: Western Europe Market Value Share (%) and BPS Analysis by End Use, 2023 to 2033

Figure 92: Western Europe Market Y-o-Y Growth (%) Projections by End Use, 2023 to 2033

Figure 93: Western Europe Market Attractiveness by Hardening Type, 2023 to 2033

Figure 94: Western Europe Market Attractiveness by Material, 2023 to 2033

Figure 95: Western Europe Market Attractiveness by End Use, 2023 to 2033

Figure 96: Western Europe Market Attractiveness by Country, 2023 to 2033

Figure 97: Eastern Europe Market Value (US$ Million) by Hardening Type, 2023 to 2033

Figure 98: Eastern Europe Market Value (US$ Million) by Material, 2023 to 2033

Figure 99: Eastern Europe Market Value (US$ Million) by End Use, 2023 to 2033

Figure 100: Eastern Europe Market Value (US$ Million) by Country, 2023 to 2033

Figure 101: Eastern Europe Market Value (US$ Million) Analysis by Country, 2018 to 2033

Figure 102: Eastern Europe Market Volume (Tons) Analysis by Country, 2018 to 2033

Figure 103: Eastern Europe Market Value Share (%) and BPS Analysis by Country, 2023 to 2033

Figure 104: Eastern Europe Market Y-o-Y Growth (%) Projections by Country, 2023 to 2033

Figure 105: Eastern Europe Market Value (US$ Million) Analysis by Hardening Type, 2018 to 2033

Figure 106: Eastern Europe Market Volume (Tons) Analysis by Hardening Type, 2018 to 2033

Figure 107: Eastern Europe Market Value Share (%) and BPS Analysis by Hardening Type, 2023 to 2033

Figure 108: Eastern Europe Market Y-o-Y Growth (%) Projections by Hardening Type, 2023 to 2033

Figure 109: Eastern Europe Market Value (US$ Million) Analysis by Material, 2018 to 2033

Figure 110: Eastern Europe Market Volume (Tons) Analysis by Material, 2018 to 2033

Figure 111: Eastern Europe Market Value Share (%) and BPS Analysis by Material, 2023 to 2033

Figure 112: Eastern Europe Market Y-o-Y Growth (%) Projections by Material, 2023 to 2033

Figure 113: Eastern Europe Market Value (US$ Million) Analysis by End Use, 2018 to 2033

Figure 114: Eastern Europe Market Volume (Tons) Analysis by End Use, 2018 to 2033

Figure 115: Eastern Europe Market Value Share (%) and BPS Analysis by End Use, 2023 to 2033

Figure 116: Eastern Europe Market Y-o-Y Growth (%) Projections by End Use, 2023 to 2033

Figure 117: Eastern Europe Market Attractiveness by Hardening Type, 2023 to 2033

Figure 118: Eastern Europe Market Attractiveness by Material, 2023 to 2033

Figure 119: Eastern Europe Market Attractiveness by End Use, 2023 to 2033

Figure 120: Eastern Europe Market Attractiveness by Country, 2023 to 2033

Figure 121: South Asia and Pacific Market Value (US$ Million) by Hardening Type, 2023 to 2033

Figure 122: South Asia and Pacific Market Value (US$ Million) by Material, 2023 to 2033

Figure 123: South Asia and Pacific Market Value (US$ Million) by End Use, 2023 to 2033

Figure 124: South Asia and Pacific Market Value (US$ Million) by Country, 2023 to 2033

Figure 125: South Asia and Pacific Market Value (US$ Million) Analysis by Country, 2018 to 2033

Figure 126: South Asia and Pacific Market Volume (Tons) Analysis by Country, 2018 to 2033

Figure 127: South Asia and Pacific Market Value Share (%) and BPS Analysis by Country, 2023 to 2033

Figure 128: South Asia and Pacific Market Y-o-Y Growth (%) Projections by Country, 2023 to 2033

Figure 129: South Asia and Pacific Market Value (US$ Million) Analysis by Hardening Type, 2018 to 2033

Figure 130: South Asia and Pacific Market Volume (Tons) Analysis by Hardening Type, 2018 to 2033

Figure 131: South Asia and Pacific Market Value Share (%) and BPS Analysis by Hardening Type, 2023 to 2033

Figure 132: South Asia and Pacific Market Y-o-Y Growth (%) Projections by Hardening Type, 2023 to 2033

Figure 133: South Asia and Pacific Market Value (US$ Million) Analysis by Material, 2018 to 2033

Figure 134: South Asia and Pacific Market Volume (Tons) Analysis by Material, 2018 to 2033

Figure 135: South Asia and Pacific Market Value Share (%) and BPS Analysis by Material, 2023 to 2033

Figure 136: South Asia and Pacific Market Y-o-Y Growth (%) Projections by Material, 2023 to 2033

Figure 137: South Asia and Pacific Market Value (US$ Million) Analysis by End Use, 2018 to 2033

Figure 138: South Asia and Pacific Market Volume (Tons) Analysis by End Use, 2018 to 2033

Figure 139: South Asia and Pacific Market Value Share (%) and BPS Analysis by End Use, 2023 to 2033

Figure 140: South Asia and Pacific Market Y-o-Y Growth (%) Projections by End Use, 2023 to 2033

Figure 141: South Asia and Pacific Market Attractiveness by Hardening Type, 2023 to 2033

Figure 142: South Asia and Pacific Market Attractiveness by Material, 2023 to 2033

Figure 143: South Asia and Pacific Market Attractiveness by End Use, 2023 to 2033

Figure 144: South Asia and Pacific Market Attractiveness by Country, 2023 to 2033

Figure 145: East Asia Market Value (US$ Million) by Hardening Type, 2023 to 2033

Figure 146: East Asia Market Value (US$ Million) by Material, 2023 to 2033

Figure 147: East Asia Market Value (US$ Million) by End Use, 2023 to 2033

Figure 148: East Asia Market Value (US$ Million) by Country, 2023 to 2033

Figure 149: East Asia Market Value (US$ Million) Analysis by Country, 2018 to 2033

Figure 150: East Asia Market Volume (Tons) Analysis by Country, 2018 to 2033

Figure 151: East Asia Market Value Share (%) and BPS Analysis by Country, 2023 to 2033

Figure 152: East Asia Market Y-o-Y Growth (%) Projections by Country, 2023 to 2033

Figure 153: East Asia Market Value (US$ Million) Analysis by Hardening Type, 2018 to 2033

Figure 154: East Asia Market Volume (Tons) Analysis by Hardening Type, 2018 to 2033

Figure 155: East Asia Market Value Share (%) and BPS Analysis by Hardening Type, 2023 to 2033

Figure 156: East Asia Market Y-o-Y Growth (%) Projections by Hardening Type, 2023 to 2033

Figure 157: East Asia Market Value (US$ Million) Analysis by Material, 2018 to 2033

Figure 158: East Asia Market Volume (Tons) Analysis by Material, 2018 to 2033

Figure 159: East Asia Market Value Share (%) and BPS Analysis by Material, 2023 to 2033

Figure 160: East Asia Market Y-o-Y Growth (%) Projections by Material, 2023 to 2033

Figure 161: East Asia Market Value (US$ Million) Analysis by End Use, 2018 to 2033

Figure 162: East Asia Market Volume (Tons) Analysis by End Use, 2018 to 2033

Figure 163: East Asia Market Value Share (%) and BPS Analysis by End Use, 2023 to 2033

Figure 164: East Asia Market Y-o-Y Growth (%) Projections by End Use, 2023 to 2033

Figure 165: East Asia Market Attractiveness by Hardening Type, 2023 to 2033

Figure 166: East Asia Market Attractiveness by Material, 2023 to 2033

Figure 167: East Asia Market Attractiveness by End Use, 2023 to 2033

Figure 168: East Asia Market Attractiveness by Country, 2023 to 2033

Figure 169: Middle East and Africa Market Value (US$ Million) by Hardening Type, 2023 to 2033

Figure 170: Middle East and Africa Market Value (US$ Million) by Material, 2023 to 2033

Figure 171: Middle East and Africa Market Value (US$ Million) by End Use, 2023 to 2033

Figure 172: Middle East and Africa Market Value (US$ Million) by Country, 2023 to 2033

Figure 173: Middle East and Africa Market Value (US$ Million) Analysis by Country, 2018 to 2033

Figure 174: Middle East and Africa Market Volume (Tons) Analysis by Country, 2018 to 2033

Figure 175: Middle East and Africa Market Value Share (%) and BPS Analysis by Country, 2023 to 2033

Figure 176: Middle East and Africa Market Y-o-Y Growth (%) Projections by Country, 2023 to 2033

Figure 177: Middle East and Africa Market Value (US$ Million) Analysis by Hardening Type, 2018 to 2033

Figure 178: Middle East and Africa Market Volume (Tons) Analysis by Hardening Type, 2018 to 2033

Figure 179: Middle East and Africa Market Value Share (%) and BPS Analysis by Hardening Type, 2023 to 2033

Figure 180: Middle East and Africa Market Y-o-Y Growth (%) Projections by Hardening Type, 2023 to 2033

Figure 181: Middle East and Africa Market Value (US$ Million) Analysis by Material, 2018 to 2033

Figure 182: Middle East and Africa Market Volume (Tons) Analysis by Material, 2018 to 2033

Figure 183: Middle East and Africa Market Value Share (%) and BPS Analysis by Material, 2023 to 2033

Figure 184: Middle East and Africa Market Y-o-Y Growth (%) Projections by Material, 2023 to 2033

Figure 185: Middle East and Africa Market Value (US$ Million) Analysis by End Use, 2018 to 2033

Figure 186: Middle East and Africa Market Volume (Tons) Analysis by End Use, 2018 to 2033

Figure 187: Middle East and Africa Market Value Share (%) and BPS Analysis by End Use, 2023 to 2033

Figure 188: Middle East and Africa Market Y-o-Y Growth (%) Projections by End Use, 2023 to 2033

Figure 189: Middle East and Africa Market Attractiveness by Hardening Type, 2023 to 2033

Figure 190: Middle East and Africa Market Attractiveness by Material, 2023 to 2033

Figure 191: Middle East and Africa Market Attractiveness by End Use, 2023 to 2033

Figure 192: Middle East and Africa Market Attractiveness by Country, 2023 to 2033

Full Research Suite comprises of:

Market outlook & trends analysis

Interviews & case studies

Strategic recommendations

Vendor profiles & capabilities analysis

5-year forecasts

8 regions and 60+ country-level data splits

Market segment data splits

12 months of continuous data updates

DELIVERED AS:

PDF EXCEL ONLINE

Chromatin Immunoprecipitation Sequencing Market Size and Share Forecast Outlook 2025 to 2035

Chromatin Immunoprecipitation Testing Market Size and Share Forecast Outlook 2025 to 2035

Soil Hardening Agent Market Size and Share Forecast Outlook 2025 to 2035

Thank you!

You will receive an email from our Business Development Manager. Please be sure to check your SPAM/JUNK folder too.

Chat With

MaRIA