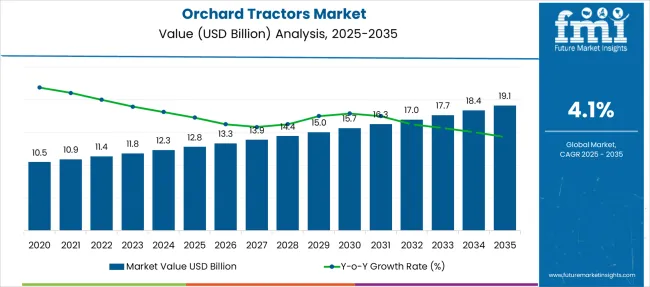

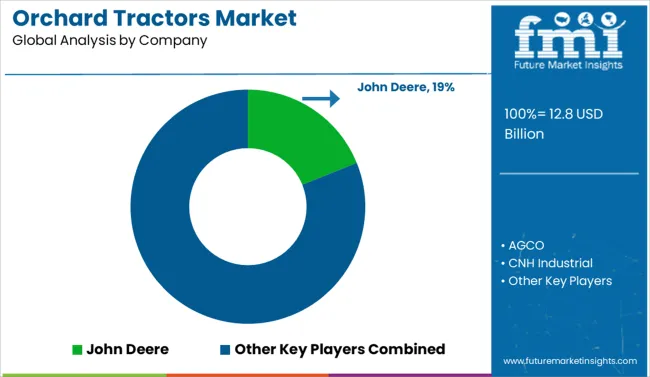

The Orchard Tractors Market is estimated to be valued at USD 12.8 billion in 2025 and is projected to reach USD 19.1 billion by 2035, registering a compound annual growth rate (CAGR) of 4.1% over the forecast period.

| Metric | Value |

|---|---|

| Orchard Tractors Market Estimated Value in (2025 E) | USD 12.8 billion |

| Orchard Tractors Market Forecast Value in (2035F) | USD 19.1 billion |

| Forecast CAGR (2025 to 2035) | 4.1% |

The orchard tractors market is steadily expanding, driven by the growing mechanization of agriculture and the rising need for efficient operations in high-density orchard environments. These specialized tractors are increasingly essential for tasks such as spraying, mowing, harvesting, and hauling within narrow orchard rows.

Market growth is further supported by the global increase in fruit cultivation, government subsidies for agricultural equipment, and labor shortages prompting higher adoption of compact mechanized solutions. Technological advancements, including better maneuverability, hydraulic systems, and enhanced fuel efficiency, are also contributing to increased preference for modern orchard tractors.

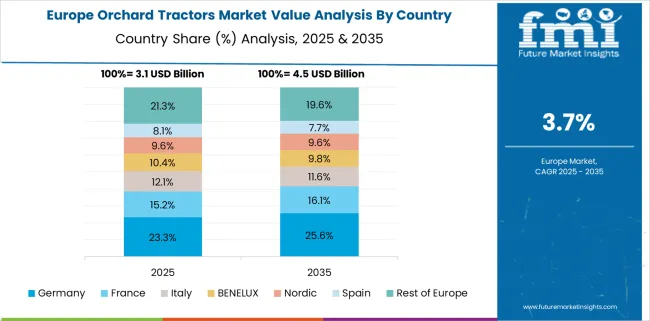

The long-term outlook remains positive as precision farming, sustainable agricultural practices, and export-driven orchard farming continue to gain traction, particularly in regions like Europe, North America, and parts of Asia-Pacific. As growers prioritize productivity and resource optimization, the demand for orchard-specific tractor models is expected to strengthen consistently.

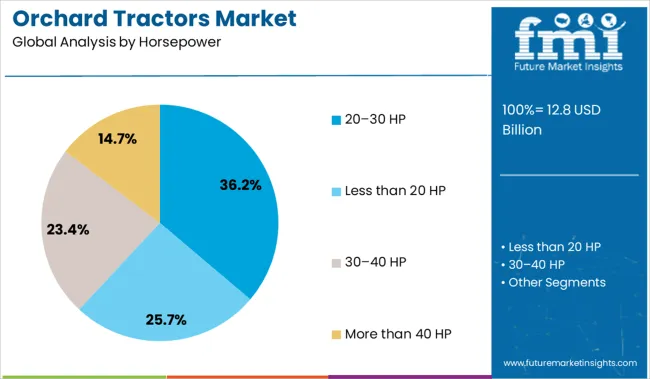

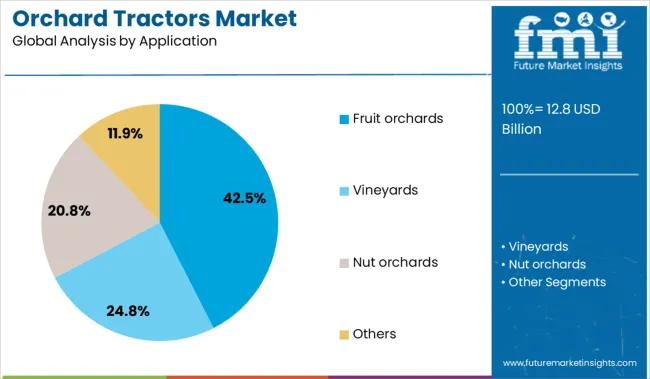

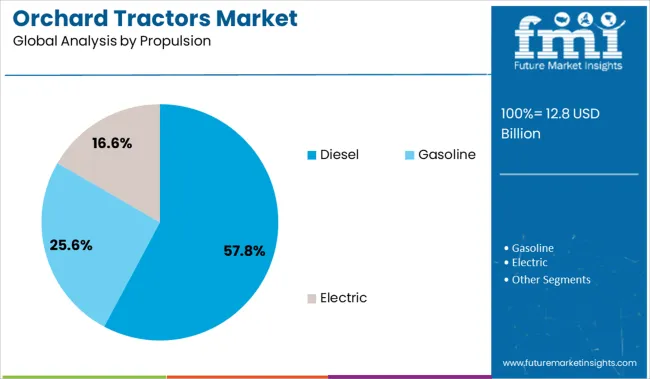

The orchard tractors market is segmented by horsepower, application, propulsion, and geographic regions. The market for orchard tractors is divided by horsepower into 20–30 HP, Less than 20 HP, 30–40 HP, and More than 40 HP. In terms of application, the orchard tractors market is classified into Fruit orchards, Vineyards, Nut orchards, and Others. Based on propulsion, the orchard tractors market is segmented into Diesel, Gasoline, and Electric. Regionally, the orchard tractors industry is classified into North America, Latin America, Western Europe, Eastern Europe, Balkan & Baltic Countries, Russia & Belarus, Central Asia, East Asia, South Asia & Pacific, and the Middle East & Africa.

The 20–30 HP segment leads the horsepower category with a 36.2% share, driven by its suitability for narrow orchard pathways and the compact maneuverability it offers. These low-to-mid horsepower tractors are favored by small to medium-sized orchard owners due to their affordability, versatility, and ability to perform essential operations such as spraying and hauling with precision in confined spaces.

Their lightweight design ensures minimal soil compaction, a critical requirement for orchard health and root stability. Increasing demand from emerging economies with fragmented landholdings and supportive government policies for smallholder farmers has further propelled this segment.

Continued improvements in durability, transmission efficiency, and ergonomic operator cabins are expected to sustain the segment’s dominance as orchardists increasingly seek cost-effective and space-efficient mechanization solutions.

The fruit orchards segment dominates the application category with a 42.5% share, supported by the continuous expansion of fruit farming and the need for specialized equipment capable of operating within tightly spaced rows. Orchard tractors designed for fruit cultivation must meet specific operational requirements including low clearance, compact dimensions, and adaptable attachments for pruning, spraying, and harvesting.

Rising global consumption of apples, citrus, grapes, and stone fruits has resulted in increased orchard acreage, thereby boosting demand for mechanized solutions tailored to fruit crops. Additionally, export-oriented fruit producers are prioritizing efficiency and consistency, driving the replacement of conventional manual labor with specialized tractors.

As orchard layouts become denser and tree spacing narrows, the need for tractors that can deliver performance without damaging crops or roots remains a key factor sustaining growth in this segment.

The diesel segment leads the propulsion category with a 57.8% market share, primarily due to its superior power output, durability, and fuel efficiency required for intensive orchard operations. Diesel-powered tractors are widely favored for their ability to operate continuously under high-load conditions and across varying terrains typical of orchard landscapes.

This propulsion type supports a wide range of auxiliary functions, making it ideal for heavy-duty attachments and long working hours. The market preference for diesel is reinforced by the limited electrification in rural and agricultural zones, where reliable power infrastructure is often lacking.

Additionally, the lower operating cost per horsepower and the extended engine lifespan associated with diesel engines contribute to their continued dominance. While electrification is gaining attention, the diesel segment is expected to retain its lead in the near term as manufacturers work toward hybrid solutions and emissions-compliant engine upgrades.

Efficient mechanization of perennial crop operations and orchard health focus are increasing demand. Growth opportunities include electrically powered compact tractors, service leasing models, and precision implements tailored for orchard terrain.

Growers of fruit orchards—including apple, citrus, grape, and olive producers—are investing in tractors designed for narrow rows, low ground pressure, and maneuverable handling between trees. These specialized tractors support tasks such as pruning, mowing, spraying, and harvesting in tight spacing environments. Improved engine designs focused on torque management and low soil compaction help preserve root structures and promote stable yields across seasons. Reliable access to aftermarket parts, implements such as multi crop sprayers or leaf removal tools, and efficient maintenance make these tractors a core asset for larger orchards. As producers seek operational continuity and yield stabilization, orchard-specific mechanization is becoming a standard investment for crop health optimization.

New market potential lies in battery powered electric orchard tractors that reduce noise, vibration and emissions to meet local environment impact goals in protected agro zones. Compact electric platforms offer torque comparable to diesel models but require less service infrastructure. Equipment manufacturers can offer tractor leasing or rental models that bundle implements, servicing and seasonal access for growers with limited capital. Partnerships with agro engineering firms and orchard service providers enable integrated planting, spraying and harvesting systems tailored to local fruit varieties. Ergonomic designs for operator comfort and modular implement compatibility also attract small and medium scale orchards. Precision GPS enabled attachments and data tracking systems offer added value, making orchard tractor solutions more versatile and cost effective.

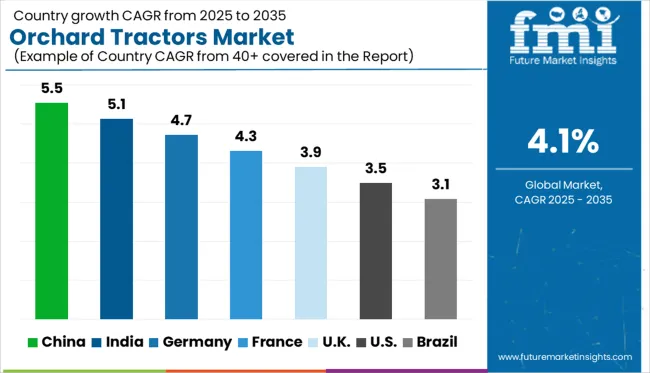

| Country | CAGR |

|---|---|

| China | 5.5% |

| India | 5.1% |

| Germany | 4.7% |

| France | 4.3% |

| UK | 3.9% |

| USA | 3.5% |

| Brazil | 3.1% |

The global market is projected to expand at a CAGR of 4.1% between 2025 and 2035, supported by mechanization in specialty crop farming and increasing orchard acreage across key regions. China leads growth with a 5.5% CAGR, driven by investments in precision agriculture and orchard modernization across major fruit-producing provinces. India follows with a 5.1% CAGR as smallholder farmers shift toward compact mechanized solutions for fruit cultivation. Germany and France, as key OECD economies, show steady growth at 4.7% and 4.3% respectively, backed by advanced farm equipment usage in vineyards and high-value orchards. The UK, with a 3.9% CAGR, and the US at 3.5%, reflect mature but innovation-focused markets emphasizing automation and sustainability. This report covers detailed analysis of 40+ countries, and the top five countries have been shared as a reference.

China is advancing at a 5.5% CAGR, with robust YoY gains fueled by orchard mechanization efforts in provinces focused on apples, pears, and citrus crops. Demand is increasing for compact tractors with narrow chassis and low turning radius to accommodate tightly spaced tree rows. Provincial subsidies are helping smaller growers adopt basic four-wheel models with adjustable attachments. Domestic manufacturers are improving hydraulic control features and offering multi-implement compatibility, catering to operators managing mixed-crop orchards. High-value fruit export regions such as Shandong and Hebei are showing strong preference for mid-range units with improved maneuverability and fuel economy.

India is growing at a 5.1% CAGR, with YoY improvements supported by rising tractor adoption in grape, pomegranate, and citrus-producing regions. Farmers are favoring orchard-specific units with smaller wheelbases and tighter steering designed for trellised or closely planted layouts. Regional governments are offering rebate-linked schemes for orchard machinery to boost productivity in Maharashtra, Andhra Pradesh, and Punjab. Low-maintenance diesel models are gaining traction among small to mid-size growers with irregular terrain. Retailers are reporting increased interest in semi-automatic gear systems and dual-purpose units that can shift between hauling and spraying operations.

Germany is growing at a 4.7% CAGR, with YoY gains backed by steady mechanization in apple and plum orchards, especially in southern and western regions. Orchard owners are upgrading to mid-power tractors with cab filtration systems, given the rise in integrated spraying requirements. Buyers prioritize stability on sloped terrain and narrow clearances, leading to demand for low-profile designs. Domestic and Italian brands dominate the market, offering PTO variants adapted for specialized pruning and mulching tools. Leasing programs are expanding for seasonal users who operate machinery only during flowering and harvest cycles.

The United Kingdom is progressing at a 3.9% CAGR, with moderate YoY growth driven by orchard upgrades in apple, cherry, and cider-producing counties. Buyers are looking for compact tractors with advanced steering support for narrow lanes common in heritage farms. High rainfall regions are favoring machines with better traction control and corrosion-resistant chassis features. Most purchases are made by long-standing growers transitioning away from manual tools. Demand for units with low ground pressure is increasing, aimed at preserving root systems during wet conditions. Fleet replacement cycles are slower, but model upgrades are picking up pace in Kent and Herefordshire.

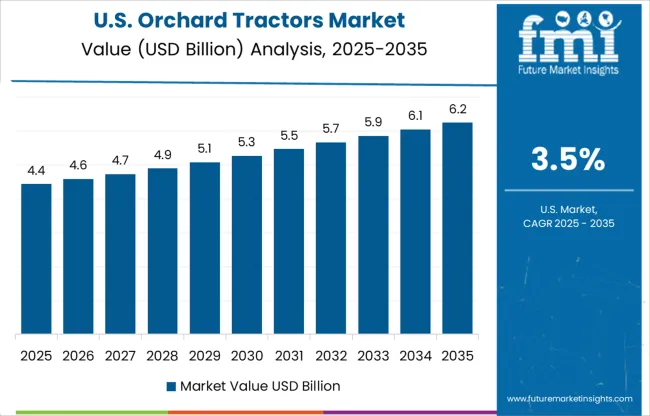

The United States is registering a 3.5% CAGR, with slower but stable YoY growth concentrated in California, Washington, and parts of the Southeast. Orchard tractors are in demand among fruit growers needing side-mounted spraying attachments and narrow-frame navigation in mature fields. Equipment buyers are prioritizing comfort and reliability, especially those managing operations across large acreages. Purchase decisions are often influenced by aftersales support and long-term maintenance costs. Brands offering customizable implements and simplified transmission systems are seeing better traction in the mid-tier market. Dealership promotions during harvest periods contribute to cyclical order volumes.

The orchard tractors market is moderately consolidated, with global agricultural machinery leaders competing across specialized horticultural segments. John Deere holds the top position, leveraging precision farming technologies, ergonomic compact designs, and a robust dealer network. Close competitors like AGCO, CNH Industrial, and Kubota focus on automation, maneuverability, and fuel efficiency for orchard-specific operations. Firms such as Mahindra & Mahindra, TAFE, and SDF Group cater to diverse regional needs with cost-effective, durable solutions. Meanwhile, brands like Valtra, Fendt, and Yanmar emphasize customization, comfort, and low-emission engines. Market growth is shaped by innovations in smart farming, sustainability, and mechanization of orchard management.

John Deere officially introduced its autonomous 5ML orchard tractor for air-blast spraying at CES 2025 on January 6, 2025, featuring a second-generation autonomy kit with LiDAR and multiple cameras, aimed at labor-intensive high-value crop farming.

| Item | Value |

|---|---|

| Quantitative Units | USD 12.8 Billion |

| Horsepower | 20–30 HP, Less than 20 HP, 30–40 HP, and More than 40 HP |

| Application | Fruit orchards, Vineyards, Nut orchards, and Others |

| Propulsion | Diesel, Gasoline, and Electric |

| Regions Covered | North America, Europe, Asia-Pacific, Latin America, Middle East & Africa |

| Country Covered | United States, Canada, Germany, France, United Kingdom, China, Japan, India, Brazil, South Africa |

| Key Companies Profiled | John Deere, AGCO, CNH Industrial, Fendt, Kubota, Mahindra & Mahindra, SDF Group, TAFE, Valtra, and Yanmar |

| Additional Attributes | Dollar sales by engine power range, drivetrain type, and orchard crop type; regional demand driven by mechanization trends, farm labor shortages, and specialty crop expansion; innovation in compact design, low-emission engines, and GPS-guided operation; cost dynamics shaped by fuel efficiency, maintenance, and seasonal usage; environmental impact from emissions and soil compaction; and emerging use cases in organic farming, vineyard automation, and precision orchard management. |

The global orchard tractors market is estimated to be valued at USD 12.8 billion in 2025.

The market size for the orchard tractors market is projected to reach USD 19.1 billion by 2035.

The orchard tractors market is expected to grow at a 4.1% CAGR between 2025 and 2035.

The key product types in orchard tractors market are 20–30 hp, less than 20 hp, 30–40 hp and more than 40 hp.

In terms of application, fruit orchards segment to command 42.5% share in the orchard tractors market in 2025.

Our Research Products

The "Full Research Suite" delivers actionable market intel, deep dives on markets or technologies, so clients act faster, cut risk, and unlock growth.

The Leaderboard benchmarks and ranks top vendors, classifying them as Established Leaders, Leading Challengers, or Disruptors & Challengers.

Locates where complements amplify value and substitutes erode it, forecasting net impact by horizon

We deliver granular, decision-grade intel: market sizing, 5-year forecasts, pricing, adoption, usage, revenue, and operational KPIs—plus competitor tracking, regulation, and value chains—across 60 countries broadly.

Spot the shifts before they hit your P&L. We track inflection points, adoption curves, pricing moves, and ecosystem plays to show where demand is heading, why it is changing, and what to do next across high-growth markets and disruptive tech

Real-time reads of user behavior. We track shifting priorities, perceptions of today’s and next-gen services, and provider experience, then pace how fast tech moves from trial to adoption, blending buyer, consumer, and channel inputs with social signals (#WhySwitch, #UX).

Partner with our analyst team to build a custom report designed around your business priorities. From analysing market trends to assessing competitors or crafting bespoke datasets, we tailor insights to your needs.

Supplier Intelligence

Discovery & Profiling

Capacity & Footprint

Performance & Risk

Compliance & Governance

Commercial Readiness

Who Supplies Whom

Scorecards & Shortlists

Playbooks & Docs

Category Intelligence

Definition & Scope

Demand & Use Cases

Cost Drivers

Market Structure

Supply Chain Map

Trade & Policy

Operating Norms

Deliverables

Buyer Intelligence

Account Basics

Spend & Scope

Procurement Model

Vendor Requirements

Terms & Policies

Entry Strategy

Pain Points & Triggers

Outputs

Pricing Analysis

Benchmarks

Trends

Should-Cost

Indexation

Landed Cost

Commercial Terms

Deliverables

Brand Analysis

Positioning & Value Prop

Share & Presence

Customer Evidence

Go-to-Market

Digital & Reputation

Compliance & Trust

KPIs & Gaps

Outputs

Full Research Suite comprises of:

Market outlook & trends analysis

Interviews & case studies

Strategic recommendations

Vendor profiles & capabilities analysis

5-year forecasts

8 regions and 60+ country-level data splits

Market segment data splits

12 months of continuous data updates

DELIVERED AS:

PDF EXCEL ONLINE

Self-propelled Orchard Top-cutting Machines Market Forecast and Outlook 2025 to 2035

Bone Distractors Market

Surgical Retractors Market Size and Share Forecast Outlook 2025 to 2035

Cervical Retractors Market

Agricultural Tractors Market Analysis - Size, Share, and Forecast Outlook 2025 to 2035

Thank you!

You will receive an email from our Business Development Manager. Please be sure to check your SPAM/JUNK folder too.

Chat With

MaRIA