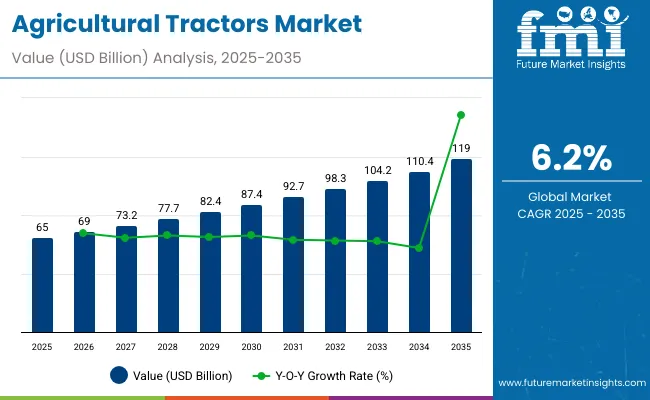

The agricultural tractors market stands at USD 65 billion in 2025 and is likely to reach USD 119 billion by 2035, growing at a CAGR of 6.2%.

| Metric | Value |

|---|---|

| Industry Size (2025E) | USD 65 billion |

| Industry Value (2035F) | USD 119 billion |

| CAGR (2025 to 2035) | 6.2% |

Analysis of elasticity of growth versus macroeconomic indicators shows that market expansion is closely linked to factors such as GDP growth in agricultural economies, farm income levels, commodity prices, and investment in rural infrastructure. In regions with robust economic growth and supportive agricultural policies, tractor sales respond strongly, reflecting high elasticity, whereas in economies experiencing slower growth or commodity price volatility, demand demonstrates lower sensitivity, moderating overall expansion.

Tractor adoption is also influenced by mechanization trends, credit availability for farmers, and government subsidies or incentive programs. During periods of favorable economic conditions, growth accelerates as farmer’s upgrade fleets and expand operations, while downturns or inflationary pressures can temporarily constrain purchases. Seasonal patterns and crop cycles further affect short-term demand, adding layers of variability in elasticity. By 2035, with the market projected to reach 119 billion, understanding the relationship between macroeconomic indicators and tractor demand will be crucial for manufacturers and investors to align production, inventory, and financing strategies. This approach ensures resilience against cyclical pressures while capturing long-term growth opportunities, indicating how macroeconomic dynamics shape the trajectory of the agricultural tractors market.

The agricultural tires market is growing in response to mechanization and precision farming. Global tractor production exceeded 3.2 million units in 2024, driving demand for high-performance tires. Radial tires now constitute around 55% of market volume, offering improved traction and reduced soil compaction. Advanced tread patterns and reinforced sidewalls are increasing tire lifespan by 15-20%, reducing replacement frequency. The adoption of GPS-compatible tires for precision farming equipment has risen by 22% year-on-year, supporting optimized planting and harvesting operations. Manufacturers are investing in eco-friendly rubber compounds and tubeless designs to enhance fuel efficiency and minimize maintenance costs. Strategic alliances between tire producers and OEMs are expanding production capacity to meet projected CAGR of 5-6% through 2030.

The industry is supported by multiple upstream sectors. Tractor and farm machinery manufacturing accounts for approximately 42%, as tires are integral to the performance and efficiency of modern agricultural equipment. Rubber and tire manufacturing contributes around 28%, supplying specialty compounds designed for load-bearing and traction. Agricultural equipment dealers and distributors represent roughly 15%, managing distribution, replacement, and aftermarket services. Research and development in materials and tread design holds close to 10%, focusing on improving durability, fuel efficiency, and soil protection. Maintenance and service providers make up the remaining 5%, ensuring timely repairs and longevity of tire performance.

Market growth is fueled by the rising adoption of mechanized farming equipment, high-horsepower tractors, and expansion of large-scale agriculture in emerging economies. Utility tractors dominate the market with roughly 60% share, while specialty tractors for vineyards, orchards, and rice paddies account for the remainder. Tractor replacement cycles range from 8 to 12 years, supporting steady aftermarket demand. North America and Europe account for approximately 55% of global consumption, while Asia Pacific shows rapid growth driven by government subsidies, rising crop production, and the expansion of smallholder and commercial farms.

Mechanization is a primary driver of agricultural tractor demand, increasing operational efficiency across plowing, planting, and harvesting. Modern tractors with advanced engines reduce fuel consumption by up to 10% per hectare while delivering 25-40% faster field operations. GPS-guided steering and precision farming technology enable farmers to optimize yield and lower labor requirements. Government incentive programs in countries like India, China, and Brazil cover up to 30% of tractor purchase costs, encouraging small and medium-scale farmers to adopt modern machinery. Increased focus on sustainable and efficient farming practices is further boosting tractor adoption in both developed and developing regions.

Specialty tractors designed for orchards, vineyards, and hilly or wetland terrains are creating new market opportunities. Compact and narrow-track models enhance productivity in small plots and difficult landscapes. Aftermarket services such as on-farm maintenance, spare parts supply, and equipment retrofitting provide recurring revenue streams. IoT-enabled monitoring systems track fuel usage, engine health, and operational efficiency, supporting precision agriculture practices. Expansion of mechanized farming in Asia Pacific, Latin America, and Africa is driving demand for both utility and specialty tractors, while partnerships between manufacturers and equipment providers enable bundled solutions that improve efficiency and reduce total cost of ownership.

Electric and hybrid tractors are entering the market, especially for low-horsepower and specialty applications. Battery-powered tractors reduce fuel costs by up to 20% and lower carbon emissions. Autonomous and semi-autonomous tractors equipped with AI-based navigation, GPS guidance, and obstacle detection increase efficiency and reduce operator workload by nearly 50%. Adoption of smart farming equipment, robotics, and autonomous machinery is expected to accelerate in North America, Europe, and Asia Pacific, complementing trends in precision agriculture and sustainable farming practices.

High upfront costs remain a barrier, with compact tractors priced around USD 15,000 and high-horsepower models exceeding USD 250,000. Annual maintenance, spare parts, and skilled labor add 10-15% to operating costs. Smallholder farmers in emerging markets may delay purchases due to affordability challenges. Supply chain constraints for engines, transmissions, and electronic components can extend lead times by 4-8 weeks. Price fluctuations in steel, rubber, and diesel also affect production and operational costs, making timely delivery and cost management crucial for manufacturers and buyers.

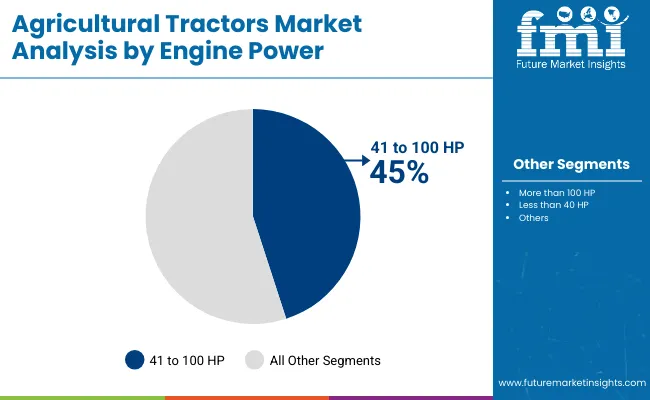

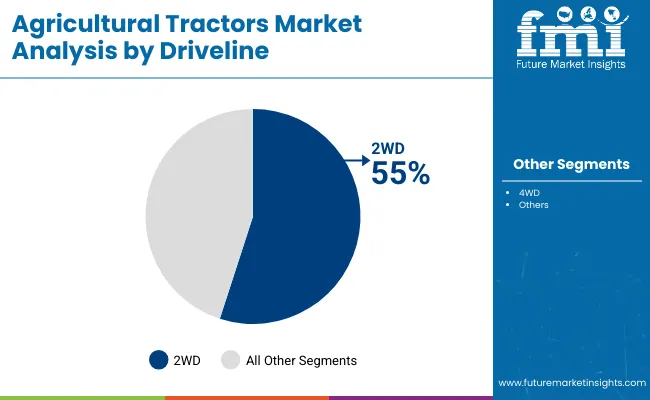

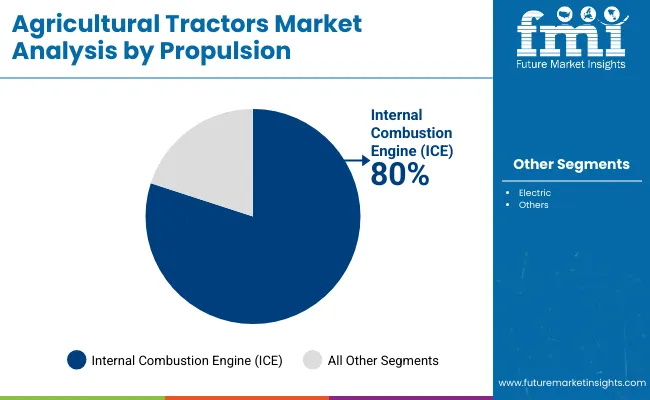

Tractors with engine power of 41 to 100 HP dominate the market with 45% share, followed by more than 100 HP at 35% and less than 40 HP at 20%. 2WD driveline tractors hold 55% of market share, while 4WD tractors contribute 45%. Internal Combustion Engine (ICE) tractors account for 80% of demand, and electric tractors 20%. Key OEMs such as John Deere, Mahindra, AGCO, and CNH Industrial supply tractors globally. Market growth is driven by reliability, fuel efficiency, durability, and operational versatility across small-scale and commercial farming operations.

Tractors with 41 to 100 HP dominate engine power demand with 45% share, ideal for small to medium-scale farms requiring balanced fuel efficiency and operational capacity. Tractors exceeding 100 HP account for 35%, used in large farms and intensive agricultural operations. Less than 40 HP tractors contribute 20%, primarily in subsistence farming or horticultural applications. John Deere, Mahindra, AGCO, and CNH Industrial are key manufacturers. Engine selection is critical for matching field requirements, terrain, and workload. High adoption of 41-100 HP tractors is driven by mechanization in developing regions, while high-power tractors meet large-scale commercial needs.

2WD tractors dominate with 55% share, offering lower cost, ease of maintenance, and suitability for flat terrain. 4WD tractors hold 45% share, preferred for hilly terrain, heavy workloads, and better traction in wet or uneven fields. OEMs including John Deere, CNH Industrial, and Mahindra manufacture both 2WD and 4WD variants to cater to commercial and small-scale farmers. 2WD adoption is higher in regions with moderate soil compaction and light-to-medium tasks, while 4WD tractors support large farms requiring plowing, tilling, and high-load transport. The segment is driven by terrain adaptability, operational efficiency, and demand for versatile agricultural machinery.

Internal Combustion Engine (ICE) tractors dominate propulsion demand with 80% share, offering high power density, field endurance, and ease of refueling. Electric tractors account for 20%, emerging in small-scale farms, controlled environments, and regions emphasizing low emissions. OEMs including John Deere, Mahindra, and AGCO provide ICE tractors for diverse applications, while Tesla, Fendt, and smaller innovators experiment with electric tractors for niche markets. ICE tractors remain the preferred choice for large-scale and high-intensity operations, whereas electric tractors grow due to cost reduction in battery technology, environmental policies, and low-maintenance requirements. The propulsion mix influences operational cost, efficiency, and sustainability for modern farming.

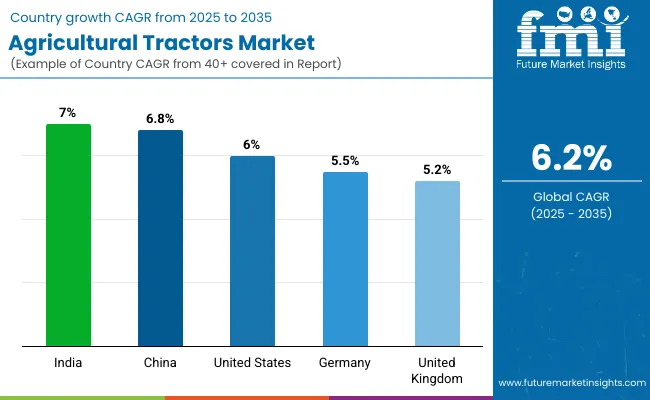

In 2025, the global agricultural tractors market is growing at a CAGR of 6.2% through 2035. India leads at 7.0%, +13% above the global average, supported by BRICS and ASEAN-linked growth in mechanized farming and rising demand for high-capacity tractors. China follows at 6.8%, +10% higher than the global rate, driven by BRICS-focused expansion of commercial farms and domestic tractor manufacturing. The United States records 6.0%, slightly below the global CAGR, reflecting steady adoption in OECD farming operations and gradual modernization of equipment. Germany stands at 5.5%, −11% under the global benchmark, influenced by a mature agricultural sector and incremental fleet upgrades. The United Kingdom posts 5.2%, −16% below the global rate, shaped by steady replacement cycles and moderate adoption of new tractor technologies. The BRICS nations are leading volume growth, while OECD countries maintain consistent development through equipment improvement and technological integration.

The agricultural tractors market in India grows at a CAGR of 7.0%, driven by mechanization across approximately 60 million hectares of rice, wheat, and sugarcane farms. Northern states lead adoption with high-traction tractors supporting sowing, plowing, and irrigation, while central and southern regions favor medium-power tractors for multi-crop operations. Mahindra & Mahindra dominates the market with models optimized for waterlogged and soft soils. Mechanized farms integrating GPS-guided implements have achieved a 25% improvement in operational efficiency. By 2035, more than 1.8 million tractors are projected in use. Investment in precision implements and soil-optimized tires reduces labor dependency, improves yield per hectare, and enhances long-term equipment durability.

The Demand of agricultural tractors in China market grows at a CAGR of 6.8%, driven by mechanized cultivation across 120 million hectares of rice, wheat, and corn farms. High-horsepower tractors with modular implement systems support plowing, soil preparation, and harvesting efficiency. YTO Group supplies durable tractors suitable for flat plains, hilly terrains, and wetland areas. Adoption of automated seeding, GPS guidance, and precision fertilizer application has reduced labor requirements by 20% and increased yield per hectare. Mechanized farms integrate tractors with reinforced tires to handle waterlogged and high-altitude fields. By 2035, more than 2 million tractors are expected in operation, improving field efficiency, resource allocation, and crop output reliability.

The United States agricultural tractors market grows at a CAGR of 6.0%, concentrated on industrial-scale corn, wheat, and soybean farms covering 80 million hectares. High-horsepower tractors with four-wheel drive and advanced hydraulic systems improve plowing, harvesting, and implement versatility. John Deere leads the market with GPS-enabled and telematics-equipped tractors that monitor performance and optimize maintenance. Deployment is concentrated in the Midwest with large acreage farms, while southern farms use compact models for smaller plots. Integration with precision implements has increased operational productivity and reduced labor costs. By 2035, over 1.5 million tractors are expected in active operation, supporting soil management and long-term farm efficiency.

The agricultural tractors market in Germany grows at a CAGR of 5.5%, focused on arable lands, orchards, and dairy farms spanning 10 million hectares. Fendt dominates with low-emission, fuel-efficient tractors equipped with low-compaction tires and precision implements. Deployment emphasizes vineyards, orchards, and pasture farms where minimal soil disruption is critical. Integration of GPS-guided implements has improved plowing efficiency by 12% and reduced fuel consumption. By 2035, over 900,000 tractors are expected to be operational. Advanced monitoring and precision farming tools allow optimized scheduling, resource allocation, and soil conservation across mechanized operations.

The United Kingdom agricultural tractors market grows at a CAGR of 5.2%, concentrated on livestock, arable, and mechanized dairy farms spanning 7 million hectares. Tractors equipped with modular implements, four-wheel drive, and durable tires support wet and soft soil conditions. JCB and Massey Ferguson dominate the market with fuel-efficient, high-durability tractors. GPS and telemetry-enabled systems allow real-time monitoring and predictive maintenance. By 2035, over 750,000 tractors are expected to be deployed, supporting multi-task farm operations and improved resource allocation. Soil protection, traction optimization, and implement versatility enhance operational efficiency and long-term equipment reliability.

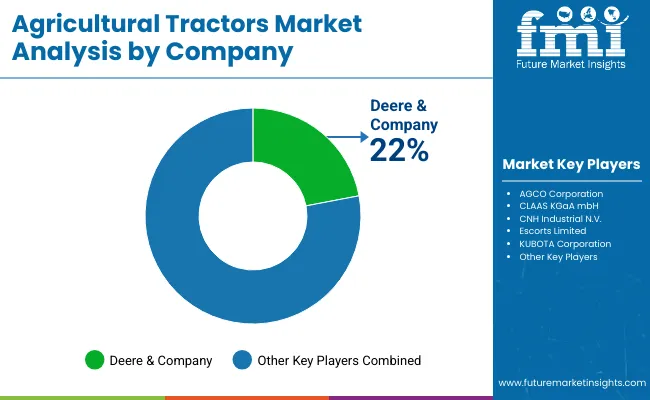

Deere & Company is the leading player, known for its extensive portfolio of models, strong global distribution network, and focus on operator comfort, fuel efficiency, and precision farming features. Continuous product development and partnerships with OEMs allow the company to maintain its competitive edge in both developed and emerging markets.

AGCO Corporation and CLAAS KGaAmbH provide tractors for small to large-scale farming, offering durable machines suited for varied terrains. CNH Industrial N.V. focuses on high-powered tractors with advanced hydraulics and transmission systems, while KUBOTA Corporation and Escorts Limited serve mid-range and compact segments, particularly in Asia and other emerging regions.

Other key players strengthen the market by emphasizing innovative designs, regional presence, and specialized solutions. They focus on enhancing tractor efficiency, performance, and longevity to meet evolving agricultural requirements. By offering operator-friendly cabins, versatile attachments, and robust engines, these companies collectively address the needs of modern agriculture, supporting productivity and operational reliability across diverse farm operations. Strategic collaborations and continuous R&D initiatives remain central to sustaining market competitiveness.

| Report Attributes | Details |

|---|---|

| Market Size (2025) | USD 65 billion |

| Projected Market Size (2035) | USD 119 billion |

| CAGR (2025 to 2035) | 6.2% |

| Base Year for Estimation | 2024 |

| Historical Period | 2020 to 2024 |

| Projection Period | 2025 to 2035 |

| Quantitative Units | USD billion for value |

| Engine Power Segments (Segment 1) | Less than 40 HP, 41 to 100 HP, More than 100 HP |

| Driveline Segments (Segment 2) | 2WD, 4WD |

| Propulsion Segments (Segment 3) | Electric, ICE |

| Regions Covered | North America, Europe, Asia Pacific, Latin America, Middle East & Africa |

| Countries Covered | United States, Canada, Brazil, Mexico, Germany, France, Italy, United Kingdom, China, India, Japan, Australia, South Africa, UAE |

| Leading Players | Deere & Company, AGCO Corporation, CLAAS KGaA mbH, CNH Industrial N.V., Escorts Limited, KUBOTA Corporation |

| Additional Attributes | Dollar sales by engine power and driveline, demand dynamics across small, medium, and large tractors, regional adoption trends across North America, Europe, and Asia-Pacific, innovation in electric propulsion and telematics, environmental impact of emissions, and emerging use in precision farming and autonomous tractor solutions |

The market size is valued at USD 65 billion in 2025.

It is projected to reach USD 119 billion by 2035.

The market is expected to grow at a CAGR of 6.2% during 2025-2035.

The 41 to 100 HP segment holds the largest share in 2025.

Deere & Company is the leading player with 22% share.

Full Research Suite comprises of:

Market outlook & trends analysis

Interviews & case studies

Strategic recommendations

Vendor profiles & capabilities analysis

5-year forecasts

8 regions and 60+ country-level data splits

Market segment data splits

12 months of continuous data updates

DELIVERED AS:

PDF EXCEL ONLINE

Agricultural Sprayers Market Size and Share Forecast Outlook 2025 to 2035

Agricultural Fumigant Market Size and Share Forecast Outlook 2025 to 2035

Agricultural Coatings Market Size and Share Forecast Outlook 2025 to 2035

Agricultural Secondary Nutrients Market Size and Share Forecast Outlook 2025 to 2035

Agricultural Chelates Market Size and Share Forecast Outlook 2025 to 2035

Agricultural Tires Market Analysis - Size, Share, and Forecast Outlook 2025 to 2035

Agricultural Pheromones Market Size and Share Forecast Outlook 2025 to 2035

Agricultural Adjuvant Market - Size, Share, and Forecast Outlook 2025 to 2035

Agricultural Microbials Market Size and Share Forecast Outlook 2025 to 2035

Agricultural Gloves Market Size and Share Forecast Outlook 2025 to 2035

Agricultural Activator Adjuvant Market Analysis - Size, Share, and Forecast Outlook 2025 to 2035

Agricultural Surfactants Market Analysis – Size, Share, and Forecast Outlook 2025 to 2035

Agricultural Testing Services Market Growth - Trends & Forecast 2025 to 2035

Agricultural Mapping Services Market Growth - Trends & Forecast 2025 to 2035

Agricultural Grade Zinc Chemicals Market Growth - Trends & Forecast 2025 to 2035

Agricultural Fabrics Market Growth - Trends & Forecast 2025 to 2035

Agricultural Food Grade Rubber Conveyor Belt Market Growth - Trends & Forecast 2025 to 2035

Agricultural Nets Market Growth - Trends & Forecast 2025 to 2035

Agricultural Equipment Market Growth - Trends & Forecast 2025 to 2035

A Detailed Competition Share Assessment of the Agricultural Sprayers Market

Thank you!

You will receive an email from our Business Development Manager. Please be sure to check your SPAM/JUNK folder too.

Chat With

MaRIA