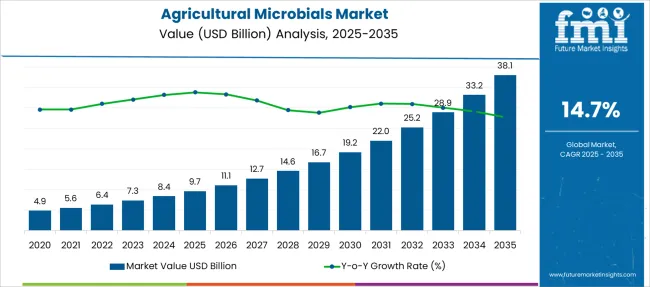

The Agricultural Microbials Market is estimated to be valued at USD 9.7 billion in 2025 and is projected to reach USD 38.1 billion by 2035, registering a compound annual growth rate (CAGR) of 14.7% over the forecast period.

| Metric | Value |

|---|---|

| Agricultural Microbials Market Estimated Value in (2025E) | USD 9.7 billion |

| Agricultural Microbials Market Forecast Value in (2035F) | USD 38.1 billion |

| Forecast CAGR (2025 to 2035) | 14.7% |

The agricultural microbials market is experiencing significant growth as sustainable farming practices and biological inputs gain widespread acceptance across global agriculture. Increasing concerns over soil health degradation, chemical overuse, and environmental toxicity have accelerated the demand for microbials that enhance crop productivity while maintaining ecological balance.

Government incentives supporting organic agriculture, combined with rising consumer preference for chemical-free produce, have positioned microbial solutions as an essential part of integrated crop management. Advancements in microbial fermentation, formulation stability, and delivery systems have made it feasible to deploy these inputs at scale across varied agro-climatic zones.

As climate variability continues to challenge conventional farming, microbials are being relied upon to improve crop resilience and nutrient uptake in a cost-effective and environmentally responsible manner. Continued investments by major agritech firms and collaborations with research institutions are expected to accelerate product innovation and market expansion, ensuring long-term growth prospects across both developed and developing regions..

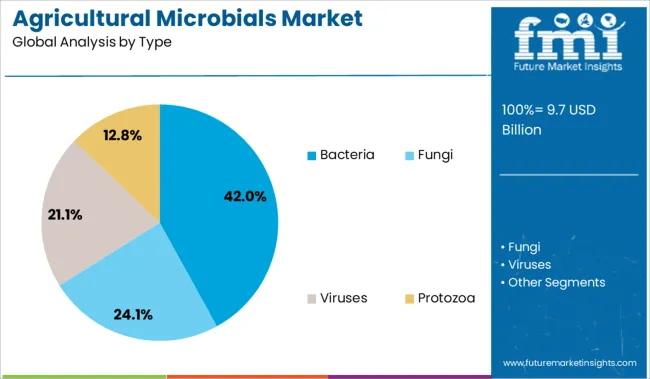

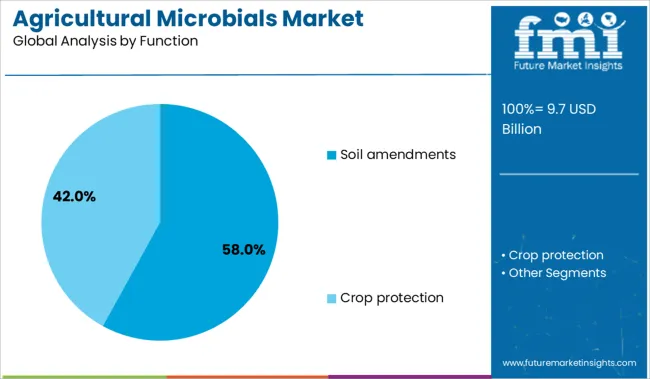

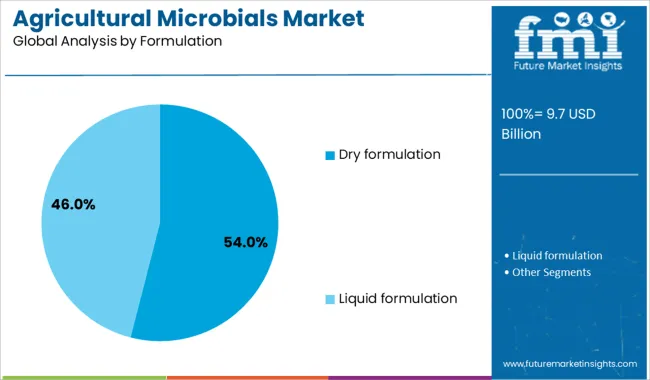

The market is segmented by Type, Function, Formulation, Mode of Application, and Crop Type, and region. By Type, the market is divided into Bacteria, Nitrogen-fixing bacteria, Phosphate-solubilizing bacteria, Potash-mobilizing bacteria, Others, Fungi, Mycorrhizal fungi, Trichoderma, Others, Viruses, and Protozoa. In terms of Function, the market is classified into Soil amendments, Biofertilizers, Biostimulants, Crop protection, Bioinsecticides, Biofungicides, Bionematicides, and Bioherbicides. Based on Formulation, the market is segmented into Dry formulation, Granules, Powder, Liquid formulation, Suspension concentrates, Emulsifiable concentrates, and Others.

By Mode of Application, the market is divided into Soil treatment, Foliar spray, Seed treatment, and Post-harvest. By Crop Type, the market is segmented into Cereals & Grains, Corn, Wheat, Rice, Barley, Others, Fruits & Vegetables, Apples, Berries, Citrus fruits, Tomatoes, Potatoes, Others, Oilseeds & Pulses, Soybean, Canola, Sunflower, Others, Other Crops, Turf & Ornamentals, Forage crops, and Others. Regionally, the market is classified into North America, Latin America, Western Europe, Eastern Europe, Balkan & Baltic Countries, Russia & Belarus, Central Asia, East Asia, South Asia & Pacific, and the Middle East & Africa.

The bacteria segment is projected to account for 42% of the Agricultural Microbials market revenue share in 2025, making it the leading type category. This segment has been favored due to the versatility and effectiveness of bacterial strains in promoting plant growth, fixing nitrogen, and suppressing soil-borne pathogens. Bacteria have been widely adopted in agriculture for their ability to colonize the rhizosphere and form symbiotic relationships that enhance nutrient availability and plant vigor.

Their adaptability to different soil types and compatibility with existing farming systems have contributed to increased usage across various crops. Bacterial formulations have also benefited from consistent performance under field conditions and a strong body of scientific validation, which has built confidence among growers.

Additionally, the relatively low production cost of bacterial microbials has allowed for competitive pricing, further supporting their market penetration. With growing demand for biologicals that deliver consistent agronomic results, the bacteria type segment has continued to solidify its leadership in the microbial input landscape..

The soil amendments segment is expected to contribute 58% to the Agricultural Microbials market revenue share in 2025, establishing itself as the dominant function category. This leadership has been driven by the growing recognition of soil microbiome health as a cornerstone of sustainable agriculture. Soil amendment microbials have been increasingly adopted to restore nutrient cycling, improve soil structure, and enhance root development, resulting in stronger plant growth and yield performance.

These microbials help mitigate the negative impacts of chemical-intensive farming by rebalancing soil ecosystems and enhancing organic matter decomposition. Farmers have shown a preference for soil-targeted solutions that not only boost productivity but also contribute to long-term soil fertility.

The ability of microbial amendments to improve nutrient efficiency and reduce reliance on synthetic fertilizers has reinforced their value in both conventional and organic farming systems. As soil health becomes a central metric for crop input decisions, the soil amendments segment is expected to maintain its dominant market position..

The dry formulation segment is projected to hold 54% of the Agricultural Microbials market revenue share in 2025, emerging as the leading formulation type. This segment has gained prominence due to the ease of handling, long shelf life, and cost efficiency offered by dry formulations. Farmers and distributors have shown a strong preference for these products because they are more stable during transportation and storage, especially in regions with limited cold chain infrastructure.

Dry microbial products are typically more concentrated and allow for better compatibility with traditional application equipment such as seed coaters, spreaders, and granule dispensers. These attributes have supported widespread adoption across row crops and horticultural segments.

Additionally, the manufacturing and packaging efficiency associated with dry formulations has contributed to their favorable pricing and large-scale commercialization. With continued innovation in carrier materials and encapsulation technologies, dry formulations are expected to remain the most practical and scalable format in microbial agriculture..

The agricultural microbials market has been shaped by precision farming practices that allow targeted application and improved input efficiency. From 2023 to 2025, tools such as variable-rate sprayers, drones, and smart seeders have been utilized to enhance microbial placement and crop response. These developments have positioned microbial solutions as performance-based inputs, rather than general soil conditioners, opening new opportunities for providers offering field-specific integration and delivery platforms.

Crop losses and yield declines recorded in 2024–2025 were noted to have driven renewed interest in microbial-based inputs. In 2023, bacterial biofertilizers were deployed to enhance nitrogen fixation and phosphorus solubilization, leading to yield improvements of 20–30% in field trials. By 2024, large-scale adoption in North America and Europe was observed, where microbial biostimulants were being applied to cereals and grains to stabilize output amid fluctuating commodity prices. In 2025, regulatory encouragement and increased farmer awareness were leveraged to expand the use of biocontrol strains that target pests previously managed chemically. These patterns suggest that yield enhancement and crop protection imperatives are reinforcing microbial uptake.

Widespread deployment of precision farming tools has been leveraged in 2023 to optimize microbial application rates and field targeting, and data-driven platforms have been used to fine-tune bioinput impact across large acreages. In 2024, variable-rate sprayers and drone-assisted delivery were employed to improve microbial strain placement, reducing inefficiencies and cost per hectare. By mid-2025, regulatory pilots will have been launched to support microbial seed coating technologies aligned with precision planters, allowing tailored nutrient and disease-protection regimes. These shifts have shown that microbial products can evolve from broad-use soil amendments to highly targeted, field-level performance enhancers. Providers offering integrated bioinput deployment systems are positioned to capture substantial market share.

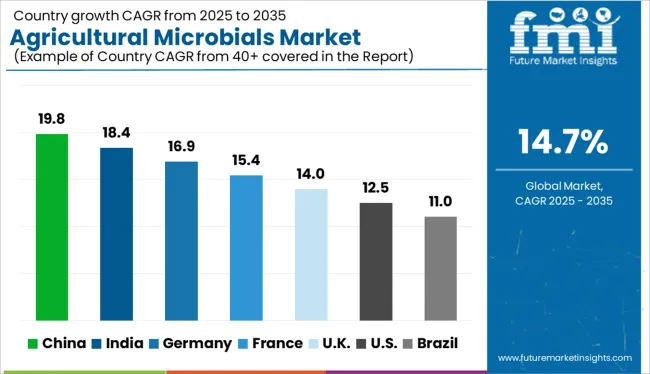

| Country | CAGR |

|---|---|

| India | 18.4% |

| Germany | 16.9% |

| France | 15.4% |

| UK | 14.0% |

| USA | 12.5% |

| Brazil | 11.0% |

The agricultural microbials market is projected to expand at a global CAGR of 15% from 2025 to 2035. Among the 40 countries studied, China leads with 19.8%, followed by India at 18.4% and Germany at 16.9%. France records moderate expansion at 15.4%, while the United Kingdom lags slightly at 14.0%. Higher growth in China and India reflects government-led biofertilizer adoption, organic farming expansion, and rising concerns over soil health. Germany drives demand through high-tech microbial inoculants and precision delivery in crop protection. France leverages R&D-driven microbial biofungicides, while the UK maintains growth through regulated use in controlled farming environments and premium organic production.

The agricultural microbials market in China is forecast to grow at a 19.8% CAGR, driven by heavy policy focus on sustainable yield enhancement and chemical fertilizer reduction. State subsidies have encouraged microbial seed treatments and biostimulant adoption in key provinces. Domestic producers are scaling fermentation capacity for nitrogen-fixing bacteria and phosphate solubilizers. Regional trials in paddy, horticulture, and specialty tea have demonstrated yield stability under microbial programs.

India is projected to expand its agricultural microbials market at an 18.4% CAGR, with rising demand from organic certification bodies, farmer cooperatives, and horticulture clusters. Biofertilizer use is rising in rain-fed zones and tribal regions through state-backed subsidy models. Domestic players are innovating with multi-strain consortia targeting micronutrient release and nematode suppression. Online agri-input platforms are enabling last-mile microbial product delivery in underserved markets.

Germany is expected to grow its agricultural microbials market at a 16.9% CAGR, shaped by adoption in precision agriculture and integration with autonomous spraying systems. Commercial farms increasingly use microbial seed treatments and root inoculants to comply with nitrate reduction mandates. Domestic biotech firms are engineering endophytic bacteria and rhizosphere fungi optimized for wheat, barley, and canola. Cross-sector partnerships with ag-tech startups ensure field-data-informed product design.

France is forecast to grow its agricultural microbials sector at 15.4% CAGR, with adoption focused on viticulture, wheat, and high-value vegetables. Biocontrol mandates under the Ecophyto 2030 plan have accelerated microbial product use. National research institutions collaborate with cooperatives to develop biopesticides from Trichoderma and Pseudomonas strains. Regulatory incentives enable microbial programs to replace conventional fungicides in large-scale farms.

The United Kingdom is projected to expand its agricultural microbials market at a 14.0% CAGR, with growth primarily driven by organic certification schemes and smart farming pilots. Usage is concentrated in protected cultivation, vertical farms, and regenerative pasture systems. Biostimulants and microbial foliar sprays are gaining traction in premium leafy greens and herb production. However, uncertainty around post-Brexit agrochemical regulations slows full-scale farm adoption.

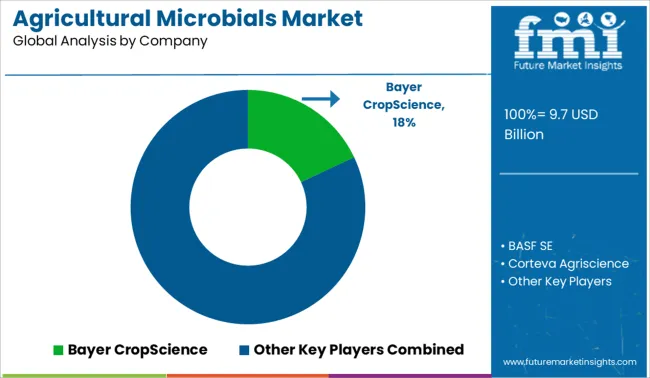

The agricultural microbials market is moderately consolidated, led by Bayer CropScience with a significant market share. The company holds a dominant position through its broad-spectrum microbial product portfolio, advanced R&D capabilities, and integration of biologicals into conventional crop protection programs. Dominant player status is held exclusively by Bayer CropScience. Key players include BASF SE, Corteva Agriscience, Syngenta AG, Novozymes A/S, and UPL Ltd., each offering fermentation-derived inoculants, microbial biopesticides, and plant growth-promoting formulations across row and specialty crops. Emerging players such as Marrone Bio Innovations, Certis Biologicals, and Koppert Biological Systems focus on targeted microbial consortia, biorational crop solutions, and IPM-aligned biological inputs. Market growth is driven by restrictions on synthetic pesticides and increasing adoption of regenerative and microbe-enhanced farming practices.

| Item | Value |

|---|---|

| Quantitative Units | USD 9.7 Billion |

| Type | Bacteria, Nitrogen-fixing bacteria, Phosphate-solubilizing bacteria, Potash-mobilizing bacteria, Others, Fungi, Mycorrhizal fungi, Trichoderma, Others, Viruses, and Protozoa |

| Function | Soil amendments, Biofertilizers, Biostimulants, Crop protection, Bioinsecticides, Biofungicides, Bionematicides, and Bioherbicides |

| Formulation | Dry formulation, Granules, Powder, Liquid formulation, Suspension concentrates, Emulsifiable concentrates, and Others |

| Mode of Application | Soil treatment, Foliar spray, Seed treatment, and Post-harvest |

| Crop Type | Cereals & Grains, Corn, Wheat, Rice, Barley, Others, Fruits & Vegetables, Apples, Berries, Citrus fruits, Tomatoes, Potatoes, Others, Oilseeds & Pulses, Soybean, Canola, Sunflower, Others, Other Crops, Turf & Ornamentals, Forage crops, and Others |

| Regions Covered | North America, Europe, Asia-Pacific, Latin America, Middle East & Africa |

| Country Covered | United States, Canada, Germany, France, United Kingdom, China, Japan, India, Brazil, South Africa |

| Key Companies Profiled | Bayer CropScience, BASF SE, Corteva Agriscience, Syngenta AG, Novozymes A/S, UPL Ltd., Marrone Bio Innovations, Certis Biologicals, Koppert Biological Systems, and Others |

| Additional Attributes | Dollar sales by microbial type (biofertilizers, biopesticides, biostimulants), Dollar sales by formulation (liquid, granular, wettable powder), Trends in organic and sustainable agriculture adoption, Use of bacterial, fungal, and viral strains in crop protection and soil health, Growth in precision farming and greenhouse applications, Regional usage patterns across North America, Europe, Latin America, and Asia‑Pacific. |

The global agricultural microbials market is estimated to be valued at USD 9.7 billion in 2025.

The market size for the agricultural microbials market is projected to reach USD 38.1 billion by 2035.

The agricultural microbials market is expected to grow at a 14.7% CAGR between 2025 and 2035.

The key product types in agricultural microbials market are bacteria, nitrogen-fixing bacteria, phosphate-solubilizing bacteria, potash-mobilizing bacteria, others, fungi, mycorrhizal fungi, trichoderma, others, viruses and protozoa.

In terms of function, soil amendments segment to command 58.0% share in the agricultural microbials market in 2025.

Full Research Suite comprises of:

Market outlook & trends analysis

Interviews & case studies

Strategic recommendations

Vendor profiles & capabilities analysis

5-year forecasts

8 regions and 60+ country-level data splits

Market segment data splits

12 months of continuous data updates

DELIVERED AS:

PDF EXCEL ONLINE

Agricultural Lighting Market Forecast and Outlook 2025 to 2035

Agricultural Sprayers Market Size and Share Forecast Outlook 2025 to 2035

Agricultural Fumigant Market Size and Share Forecast Outlook 2025 to 2035

Agricultural Coatings Market Size and Share Forecast Outlook 2025 to 2035

Agricultural Secondary Nutrients Market Size and Share Forecast Outlook 2025 to 2035

Agricultural Chelates Market Size and Share Forecast Outlook 2025 to 2035

Agricultural Tractors Market Analysis - Size, Share, and Forecast Outlook 2025 to 2035

Agricultural Tires Market Analysis - Size, Share, and Forecast Outlook 2025 to 2035

Agricultural Pheromones Market Size and Share Forecast Outlook 2025 to 2035

Agricultural Adjuvant Market - Size, Share, and Forecast Outlook 2025 to 2035

Agricultural Gloves Market Size and Share Forecast Outlook 2025 to 2035

Agricultural Activator Adjuvant Market Analysis - Size, Share, and Forecast Outlook 2025 to 2035

Agricultural Surfactants Market Analysis – Size, Share, and Forecast Outlook 2025 to 2035

Agricultural Testing Services Market Growth - Trends & Forecast 2025 to 2035

Agricultural Mapping Services Market Growth - Trends & Forecast 2025 to 2035

Agricultural Grade Zinc Chemicals Market Growth - Trends & Forecast 2025 to 2035

Agricultural Fabrics Market Growth - Trends & Forecast 2025 to 2035

Agricultural Food Grade Rubber Conveyor Belt Market Growth - Trends & Forecast 2025 to 2035

Agricultural Nets Market Growth - Trends & Forecast 2025 to 2035

Agricultural Equipment Market Growth - Trends & Forecast 2025 to 2035

Thank you!

You will receive an email from our Business Development Manager. Please be sure to check your SPAM/JUNK folder too.

Chat With

MaRIA