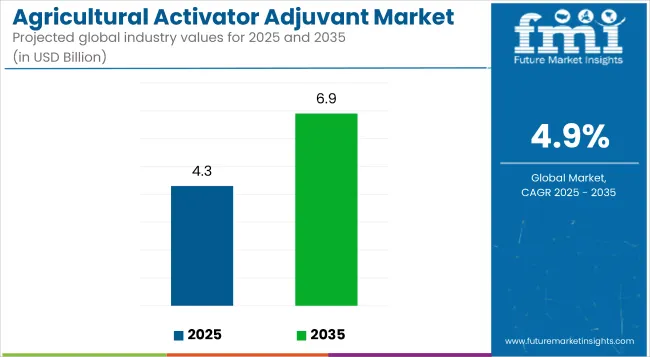

The global agricultural activator adjuvant market is projected to grow from USD 4.3 billion in 2025 to USD 6.9 billion by 2035, registering a CAGR of 4.9%.

| Metric | Value |

|---|---|

| Industry Size (2025E) | USD 4.3 billion |

| Industry Value (2035F) | USD 6.9 billion |

| CAGR (2025 to 2035) | 4.9% |

The market expansion is driven by the growing demand for crop-specific adjuvants and increasing integration of precision agriculture technologies. As sustainable farming practices gain traction globally, the adoption of advanced adjuvants with minimal chemical residues and improved efficiency in pesticide use is becoming increasingly important across sectors like agriculture, horticulture, and organic farming.

The market holds 49.1% share of the overall agricultural adjuvants market, reflecting its critical role in enhancing the performance of crop protection products. It accounts for nearly 3.2% of the crop protection chemicals market, driven by the growing need for efficient pesticide delivery and improved efficacy. The market also contributes around 0.9% to the broader agrochemicals industry, supporting advancements in sustainable and precision agriculture solutions.

Government regulations impacting the market focus on environmental sustainability, crop protection standards, and food safety. The USA Environmental Protection Agency (EPA) and the European Union’s Regulation (EC) No. 1107/2009, which governs the approval of plant protection products, play a significant role in guiding the adoption of safe and efficient adjuvants.

These regulations encourage the development of advanced agricultural adjuvants that align with sustainable farming practices, promote ecological balance, and ensure product efficacy in varying environmental conditions.

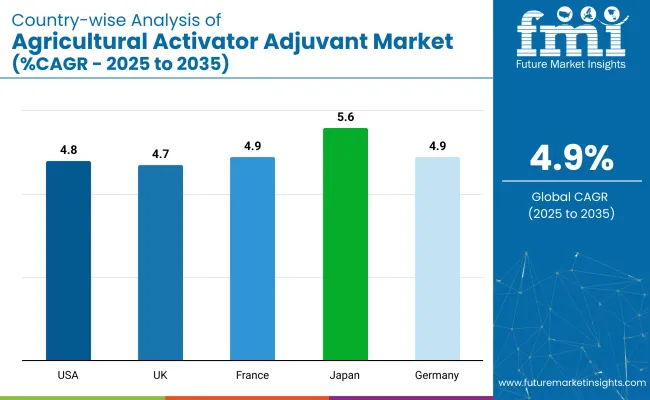

Japan is projected to be the fastest-growing market, expanding at a CAGR of 5.6% from 2025 to 2035. Activator adjuvants will lead the product segment with a 66% share, and conventional will dominate the crop-type segment at 75% in 2025. The USA. and Germany markets are expected to grow at CAGRs of 4.8% and 4.9%, respectively.

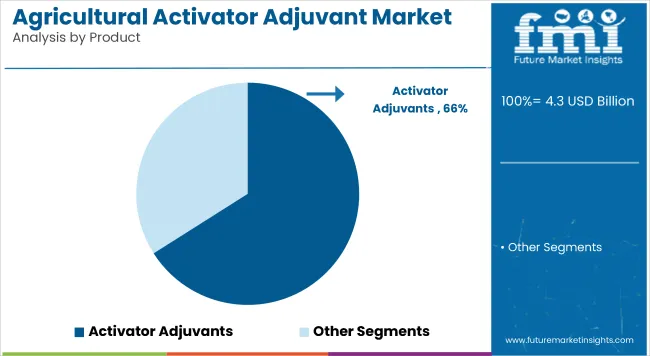

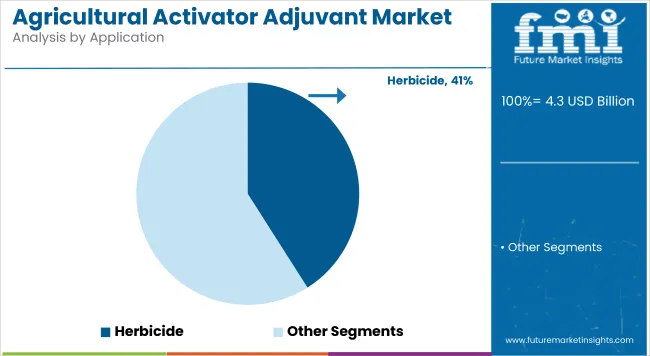

The market is segmented by product, application, source, formulation, crop type, and region. By product, the market is divided into activator adjuvants (surfactants and oil-based adjuvants) and utility adjuvants (compatibility agents, drift control agents, buffering agents, water conditioning agents, and others). In terms of application, the market is classified into herbicides, insecticides, fungicides, and others (plant growth regulators, desiccants, defoliants, micronutrients).

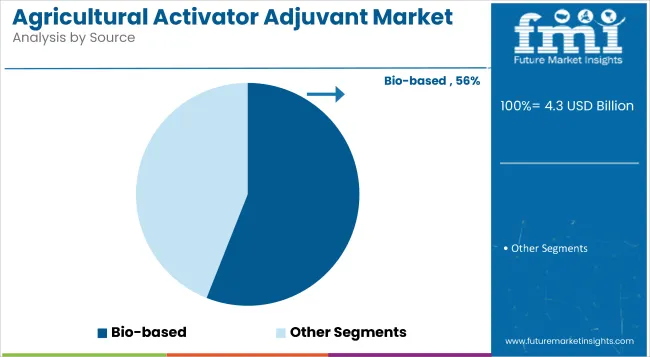

By source, the market is bifurcated into petroleum-based and bio-based. Based on formulation, it is divided into oil-based and others (emulsifiable concentrates, suspension concentrates, soluble liquids, wettable powders). By crop type, the market is bifurcated into organic and conventional.Regionally, the market is classified into North America, Latin America, Western Europe, Eastern Europe, Asia Pacific (APAC), and Middle East & Africa (MEA).

Activator adjuvants are expected to lead the product segment with a 66% market share by 2025, driven by their broad compatibility, enhanced spray performance, and growing demand across both conventional and organic farming systems.

Herbicides are expected to lead the application segment with a 41% market share by 2025, driven by widespread use in weed management and the need for enhanced pesticide effectiveness across major crop categories.

Bio-based is expected to lead the source segment with a 56% market share by 2025, supported by rising demand for sustainable inputs and stricter regulations on petroleum-based agrochemical components.

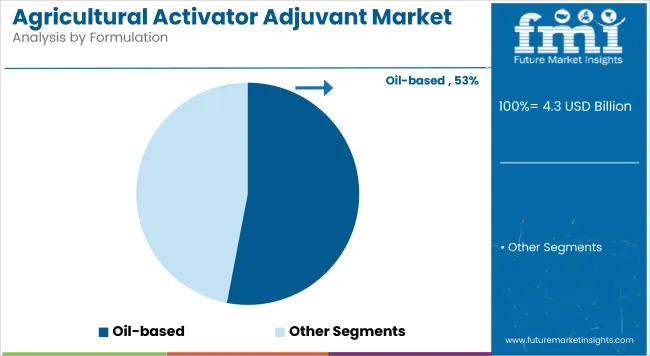

Oil-based is projected to dominate the formulation segment with a 53% market share by 2025, driven by its superior penetration, adhesion, and compatibility with systemic pesticides across various crop types.

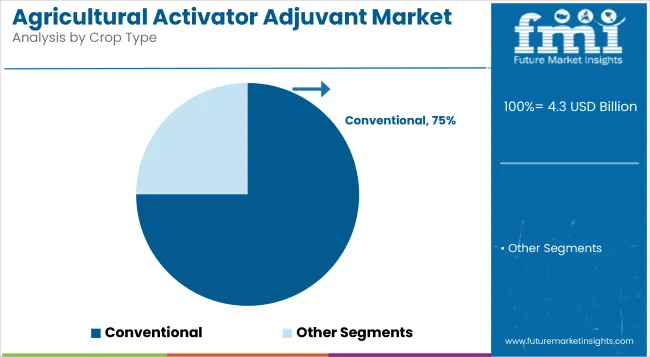

Conventional is expected to lead the crop type segment with a 75% market share by 2025, fueled by large-scale cultivation, high agrochemical usage, and strong reliance on adjuvants for efficient crop protection.

The global agricultural activator adjuvant market has been experiencing steady growth, driven by the increasing demand for crop-specific solutions and environmentally friendly adjuvants. These adjuvants play a critical role in improving pesticide effectiveness and enhancing crop protection.

Recent Trends in the Agricultural Activator Adjuvant Market

Challenges in the Agricultural Activator Adjuvant Market

Japan leads the market due to increasing demand for crop-specific adjuvants, eco-friendly solutions, and regulatory alignment with sustainable agricultural practices. Germany and France are recording steady growth, with CAGRs of 4.9% each, supported by EU environmental regulations and sustainable farming initiatives under the Green Deal. The USA market is projected to grow at 4.8%, at 4.7%, and Japan (5.6%).

Japan is witnessing increased adoption of precision farming technologies, driving demand for specialized, bio-based adjuvants in high-value crops. Germany and France are capitalizing on EU sustainability regulations, which are boosting the use of advanced adjuvant systems. The USA is focused on retrofitting existing farms to meet eco-friendly standards, while the UK emphasizes sustainability and organic farming amid post-Brexit regulatory shifts.

The report covers in-depth analysis of 40+ countries; five top-performing OECD countries are highlighted below.

The Japan agricultural activator adjuvant market is growing at a CAGR of 5.6% from 2025 to 2035. Growth is driven by the adoption of precision farming technologies and high demand for bio-based adjuvants.

The sales of agricultural activator adjuvants in Germany are expected to expand at a 4.9% CAGR during the forecast period. Growth is driven by EU sustainability goals and agricultural modernization, which are accelerating the adoption of advanced adjuvant systems.

The French agricultural activator adjuvant market is projected to grow at a 4.9% CAGR during the forecast period. Growth is driven by national sustainability targets, increasing consumer preference for organic produce, and government-led initiatives for eco-friendly farming practices.

The USA agricultural activator adjuvant market is projected to grow at a 4.8% CAGR from 2025 to 2035. Demand is driven by sustainability initiatives and regulatory compliance in large-scale farming operations.

The UK agricultural activator adjuvant revenue is projected to grow at a 4.7% CAGR from 2025 to 2035. Growth is supported by government regulations related to farm sustainability, pesticide use reduction, and environmental health.

The market is moderately consolidated, with leading players like Solvay, BASF SE, Croda International Plc, Nufarm, and CHS Inc. dominating the industry. These companies provide advanced, efficient adjuvant solutions catering to sectors such as agriculture, horticulture, and organic farming. Solvay focuses on eco-friendly, bio-based adjuvants, while BASF SE specializes in high-performance activator solutions for crop protection.

Croda International Plc offers sustainable and innovative adjuvants, and Nufarm is known for its broad range of adjuvants tailored to various crops. Other key players like Clariant, Innvictis, Helena Agri-Enterprises, LLC, Stepan Company, and Miller Chemical & Fertilizer, LLC contribute by providing specialized, high-performance adjuvants for a wide array of agricultural applications.

Recent Agricultural Adjuvant Industry News

| Report Attributes | Details |

|---|---|

| Market Size (2025) | USD 4.3 billion |

| Projected Market Size (2035) | USD 6.9 billion |

| CAGR (2025 to 2035) | 4.9% |

| Base Year for Estimation | 2024 |

| Historical Period | 2020 to 2024 |

| Projections Period | 2025 to 2035 |

| Report Parameter | USD billion for value/volume in units |

| Product Analyzed | Activator Adjuvants (Surfactants and Oil-based Adjuvants) and Utility Adjuvants (Compatibility Agents, Drift Control Agents, Buffering Agents, Water Conditioning Agents, and Others) |

| Application Analyzed | Herbici des, Insecticides, Fungicides, a nd Others (Plant Growth Regulators, Desiccants, Defoliants, and Micronutrients) |

| Source Analyzed | Petroleum-based and Bio-based |

| Formulation Analyzed | Oil-based and Others (Emulsifiable Concentrates, Suspension Concentrates, Soluble Liquids, and Wettable Powders) |

| Crop Type Analyzed | Organic and Conventional |

| Region Covered | North America, Latin America, Western Europe, Eastern Europe, Asia Pacific (APAC), and Middle East & Africa (MEA) |

| Countries Covered | United States, Canada, United Kingdom, Germany, France, China, Japan, South Korea, Brazil, Australia |

| Key Players Influencing the Market | Solvay, BASF SE, Croda International Plc, Nufarm, CHS Inc., Clariant, Innvictis, Helena Agri-Enterprises, LLC, Stepan Company, Miller Chemical & Fertilizer, LLC |

| Additional Attributes | Dollar sales by application, share by crop type, regional demand growth, policy influence, technological advancements, competitive benchmarking |

The market is valued at USD 4.3 billion in 2025.

The market is forecasted to reach USD 6.9 billion by 2035, reflecting a CAGR of 4.9%.

Activator adjuvants will lead the product segment, accounting for 66% of the global share in 2025.

Herbicides will dominate the application segment with a 41% share in 2025.

Japan is projected to grow at the fastest rate, with a CAGR of 5.6% from 2025 to 2035.

Our Research Products

The "Full Research Suite" delivers actionable market intel, deep dives on markets or technologies, so clients act faster, cut risk, and unlock growth.

The Leaderboard benchmarks and ranks top vendors, classifying them as Established Leaders, Leading Challengers, or Disruptors & Challengers.

Locates where complements amplify value and substitutes erode it, forecasting net impact by horizon

We deliver granular, decision-grade intel: market sizing, 5-year forecasts, pricing, adoption, usage, revenue, and operational KPIs—plus competitor tracking, regulation, and value chains—across 60 countries broadly.

Spot the shifts before they hit your P&L. We track inflection points, adoption curves, pricing moves, and ecosystem plays to show where demand is heading, why it is changing, and what to do next across high-growth markets and disruptive tech

Real-time reads of user behavior. We track shifting priorities, perceptions of today’s and next-gen services, and provider experience, then pace how fast tech moves from trial to adoption, blending buyer, consumer, and channel inputs with social signals (#WhySwitch, #UX).

Partner with our analyst team to build a custom report designed around your business priorities. From analysing market trends to assessing competitors or crafting bespoke datasets, we tailor insights to your needs.

Supplier Intelligence

Discovery & Profiling

Capacity & Footprint

Performance & Risk

Compliance & Governance

Commercial Readiness

Who Supplies Whom

Scorecards & Shortlists

Playbooks & Docs

Category Intelligence

Definition & Scope

Demand & Use Cases

Cost Drivers

Market Structure

Supply Chain Map

Trade & Policy

Operating Norms

Deliverables

Buyer Intelligence

Account Basics

Spend & Scope

Procurement Model

Vendor Requirements

Terms & Policies

Entry Strategy

Pain Points & Triggers

Outputs

Pricing Analysis

Benchmarks

Trends

Should-Cost

Indexation

Landed Cost

Commercial Terms

Deliverables

Brand Analysis

Positioning & Value Prop

Share & Presence

Customer Evidence

Go-to-Market

Digital & Reputation

Compliance & Trust

KPIs & Gaps

Outputs

Full Research Suite comprises of:

Market outlook & trends analysis

Interviews & case studies

Strategic recommendations

Vendor profiles & capabilities analysis

5-year forecasts

8 regions and 60+ country-level data splits

Market segment data splits

12 months of continuous data updates

DELIVERED AS:

PDF EXCEL ONLINE

Agricultural Multifunction Grab Bucket Market Size and Share Forecast Outlook 2025 to 2035

Agricultural Bucket Market Size and Share Forecast Outlook 2025 to 2035

Agricultural Lighting Market Forecast and Outlook 2025 to 2035

Agricultural Sprayers Market Size and Share Forecast Outlook 2025 to 2035

Agricultural Fumigant Market Size and Share Forecast Outlook 2025 to 2035

Agricultural Coatings Market Size and Share Forecast Outlook 2025 to 2035

Agricultural Secondary Nutrients Market Size and Share Forecast Outlook 2025 to 2035

Agricultural Chelates Market Size and Share Forecast Outlook 2025 to 2035

Agricultural Tractors Market Analysis - Size, Share, and Forecast Outlook 2025 to 2035

Agricultural Tires Market Analysis - Size, Share, and Forecast Outlook 2025 to 2035

Agricultural Pheromones Market Size and Share Forecast Outlook 2025 to 2035

Agricultural Microbials Market Size and Share Forecast Outlook 2025 to 2035

Agricultural Gloves Market Size and Share Forecast Outlook 2025 to 2035

Agricultural Surfactants Market Analysis – Size, Share, and Forecast Outlook 2025 to 2035

Agricultural Testing Services Market Growth - Trends & Forecast 2025 to 2035

Agricultural Mapping Services Market Growth - Trends & Forecast 2025 to 2035

Agricultural Grade Zinc Chemicals Market Growth - Trends & Forecast 2025 to 2035

Agricultural Fabrics Market Growth - Trends & Forecast 2025 to 2035

Agricultural Food Grade Rubber Conveyor Belt Market Growth - Trends & Forecast 2025 to 2035

Agricultural Nets Market Growth - Trends & Forecast 2025 to 2035

Thank you!

You will receive an email from our Business Development Manager. Please be sure to check your SPAM/JUNK folder too.

Chat With

MaRIA