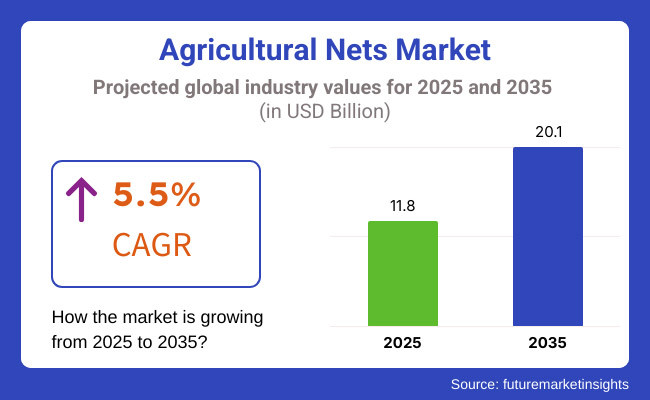

Agricultural Nets market will grow in 2025 to 2035 with enhanced adoption of protection agriculture practice as part of a measure to expand crop yield as well as nature preservation. The market will grow from USD 11.8 billion in 2025 to USD 20.1 billion in 2035 at a compound annual growth rate (CAGR) of 5.5% over the period of forecast.

Production of controlled environment agriculture, climate-resilient agriculture, and sustainable agriculture increases because of more production, the key driving force of the market. Improvements in HDPE technology and utilization of UV-resistant material have expanded applications of farm nets for green-growth cultivation, insect repellency, and shading. Global food demand growth and, as a secondary impact, enhanced agricultural production are boosting the market growth.

Government policies toward new farm trends and ongoing investment in agri-tech technology are fuelling the market. Moreover, research cooperation between research centers and farm equipment companies is increasing the shelf life and functionality of the products.

However, wastage due to man-induced nets, transparencies in the third world, and lack of suitable initial capital necessitate type-of-intervention solutions. Recycling and biodegradable products are applied by organizations at present as a step of staying ahead of the world's wave towards sustainability.

North America is a major contributor to the market of agricultural nets due to rising demand for crop protection, greenhouse horticulture, and environmentally friendly agriculture practices. United States and Canada dominate the market with growing investment in high-technology agricultural methods and climate-smart agriculture solutions.

The bird protective nets, insect-proof nets, and shade nets market is robust with the impetus of innovation in UV-stable and biodegradable material. Market forces are influenced by regulation regimes such as the United States Department of Agriculture (USDA) and agencies of environmental interests, which demand compliance with agricultural standards for safety and sustainability. Nevertheless, production costs and supply chain constraints are obstacles to their mass adoption.

Europe is an agri-nets high-potential market due to expanding demand in such markets as Spain, Italy, and the Netherlands with controlled-environment agriculture and precision agriculture. Organic focus of farming, minimizing pesticide use, and yield maximization are forces behind agri-net growth. Higher usage of shading nets, thermal screens, and hail protection nets drive market expansion.

Strategies like the European Green Deal and sustainability ethos shape development and application of agriculture netting solutions. European players concentrate on higher durability, recyclability, and alignment with evolving regulatory norms to achieve stable market expansion.

Asia-Pacific is the quickest-growing agricultural nets market area, driven by more modernization of farming at high rates, government support for sustainable farming, and growing demand for high yield crops in China, India, Japan, and Australia. Horticulture, floriculture, and aquaculture segments also experience rising demand for agricultural nets due to enhanced lightweight and weatherproof materials.

The area is endowed with emerging agribusiness industries and low-cost production sites that facilitate large-scale deployment of agribusiness netting solutions. Yet, government policies on environmental sustainability, plastic waste management, and product quality standards are not yet established, thus forcing companies to make adjustments. Smart farming, climate-resilient agriculture, and green netting solutions are setting the direction of future market trends, influencing investment in next-generation agricultural nets.

Challenge

Climate Adaptability and Durability

Agricultural net commerce is faced with climatic resistance and longevity. Harsh climatic conditions like rain, high velocity winds, and extended exposure of UV decrease material longevity in a net, thereby decreasing its lifespan and performance in shelf. Besides, difference in degrees of crop protection from region to region initiates the creation of region-specific solutions in netting. These need to be addressed through investment in more weather-resistant material and regional product innovation.

Opportunities

Increasing Demand for Smart and Eco-Friendly Netting Solutions

Rising ecological and climate change concerns are promoting the need for green agricultural netting. Biodegradable materials, UV-stable finishes, and sensor-imbedded intelligent nets are unfolding massive market potential. Furthermore, expanding uses of precision agriculture practices promote the advancement of nets for maximizing light diffusion, humidity regulation, and pest control and crop yield and sustainability.

Between 2020 to 2024, agriculture net market expanded due to growing awareness about crop protection and rising adoption of greenhouse farming methods. However, the influence of volatile raw material prices and restrictive access to sophisticated netting solutions in the developing world hampered development in the market. Focus was on the production of cost-effective and versatile nets to meet various agriculture needs.

Agricultural net technology from 2025 to 2035 will be affected by material science technology, intelligent agriculture technology, and automation. Nanotechnology for improving the lifespan of agricultural nets, artificial intelligence monitoring system to analyse the productivity of nets, and eco-friendly manufacturing processes will revolutionize the market. Supportive incentives of the government towards sustainable agriculture and protective netting products will further affect the market.

Market Shifts: A Comparative Analysis (2020 to 2024 vs. 2025 to 2035)

| Market Shift | 2020 to 2024 Trends |

|---|---|

| Regulatory Landscape | Compliance with regional agricultural safety standards |

| Technological Advancements | Introduction of UV-resistant and anti-insect nets |

| Industry Adoption | Increased use in greenhouse farming and crop protection |

| Supply Chain and Sourcing | Dependence on synthetic polymer-based nets |

| Market Competition | Presence of regional netting manufacturers |

| Market Growth Drivers | Demand for higher crop yield and pest protection |

| Sustainability and Energy Efficiency | Initial adoption of eco-friendly net coatings |

| Integration of Smart Monitoring | Limited digital tracking of net performance |

| Advancements in Net Innovation | Development of weather-resistant and pest-control nets |

| Market Shift | 2025 to 2035 Projections |

|---|---|

| Regulatory Landscape | Global standardization of eco-friendly netting solutions and sustainability incentives |

| Technological Advancements | Development of smart nets with sensors for real-time crop monitoring |

| Industry Adoption | Expansion into vertical farming and climate-adaptive netting solutions |

| Supply Chain and Sourcing | Shift toward biodegradable and recycled material-based net production |

| Market Competition | Growth of global sustainable netting providers and smart agriculture firms |

| Market Growth Drivers | Integration of AI, IoT, and nanotechnology in agricultural nets |

| Sustainability and Energy Efficiency | Full-scale implementation of biodegradable nets and low-carbon manufacturing practices |

| Integration of Smart Monitoring | AI-driven monitoring systems and automated net maintenance solutions |

| Advancements in Net Innovation | Adoption of climate-responsive, self-repairing, and multifunctional netting solutions |

The USA agricultural nets market is well on its growth trajectory with escalating demand for shielded cultivation, climate change management, and intensified horticulture practices. Utilization of shade nets, insect-proof nets, and bird-netting is growing, especially in California, Florida, and Texas, because of extreme weather events and pest control. Governmental policies promoting fresh farm infrastructure and green agriculture also fuel market development.

| Country | CAGR (2025 to 2035) |

|---|---|

| USA | 5.2% |

UK agriculture nets industry is growing because of climate resilient agriculture practices and initiatives at minimizing dependence on pesticides. Edinburgh, Manchester, and London farmers are increasingly adopting UV-resistant shade nets, windbreak nets, and greenhouse nets to improve produce. Demand is being supplemented by demand for sustainable agriculture, urban agriculture, and organics as well.

| Country | CAGR (2025 to 2035) |

|---|---|

| UK | 4.8% |

The EU agricultural net market is driven by sustainability policy, strong agriculture legislation, and investment in precision agriculture. Germany, France, and Italy dominate crop-protection-based nets, shading-based greenhouses, and pest-mitigation agriculture solutions. Pesticide management and green agriculture practices due to the EU trend of searching for pesticides are driving steady growth in the market.

| Country | CAGR (2025 to 2035) |

|---|---|

| European Union (EU) | 4.9% |

The Japanese agricultural nets market also is growing moderately with the support of high-value agriculture infrastructure, vertical farming equipment, and safe farm concepts. Tokyo and Osaka are going to be investing in future-generation shading systems, older farming nets, and intelligent agricultural farming practices. Climate monitoring technology and precision ag technologies facilitated through AI are also generating demand.

| Country | CAGR (2025 to 2035) |

|---|---|

| Japan | 5.1% |

The net market of South Korea in agriculture is increasing with higher farm technologies, increase in hydroponics farming, and the promotion of crop protection modernization by the government. Seoul and Busan are taking the lead in the development of nanotechnology-imbedded agriculture nets, recent greenhouse shading, and weather-insulated agriculture. Integration of IoT-based farm monitoring will also drive the growth of the market.

| Country | CAGR (2025 to 2035) |

|---|---|

| South Korea | 5.3% |

Net piece farming leads in the market as crop, greenhouse, and plantation protection items surge upward worldwide. Nets become necessity in protecting farm crops from nature's wrath through scorching sun, hailstorm, insect infestation, and powerful puffs of gusts. Widely used advances in high-technology farm procedures, climatically-resistant technologies, and sustainability practices have driven the development of farm net applications by various farming businesses.

Since farmers and agriculturists are trying to produce the most, reduce loss, and increase crop quality, agriculture's farm market is growing with technological innovation and environmental-friendly material. Shading Nets and Anti-Hail Nets Fuel Market Growth through Weather-Resistant Farm Solutions

Shading nets and anti-hail nets are among the most important segments of agricultural nets market, as farmers are increasingly employing such protective coverings to counteract environment attacks. Increasing effects of climatic change, unstable weather patterns, and growing problems of global warming have accelerated demand for such tailored agricultural nets. Shading nets are used commercially in horticulture, floriculture, and greenhouse farming for control of light intensity and temperature and thereby photosynthesis and growth induction.

Shading nets are produced in grades, i.e., 30% to 90%, based on the crops. In contrast to the traditional open-field crop growing mode, shaded cultivation has increased plant water content, zero water loss, and prevention of heat stress and has achieved higher crop productivity. High-durability and UV-resistant shade nets have also received growing market demand that translates to longer lives and higher protection.

Application of smart shade technologies such as light-automatic filtration and heat-controlled shade systems has also contributed to improved efficiencies in shade nets. Anti-hail nets are also popular now due to the growing frequency of the incidence of hailstorms, which is an extremely critical risk to fruit crops, vineyards, and value crops.

These nets offer a useful protective screen against hail damage and result in negligible loss of crops and fruit quality maintenance. Compared to other means of protection against hail, anti-hail nets offer a cost-effective and sure solution, limiting the economic losses for the farmers. Today, with advances in technology in the production of anti-hail nets such as reinforced polymer-based nets and multi-layer mesh, there is enhanced strength and shock resistance.

Anti-hail net weather forecasting systems are also utilized by farmers and agribusiness companies for protective purposes, another driving factor of the market growth. Since climatic conditions will worsen, shading and anti-hail netting utilization will increase predominantly primarily, with studies showing more than 65% of usage of advanced agriculture nets comprises protection applications, most of which fall in the sphere of dynamic weather.

Development of sustainable, biodegradable, and recyclable anti-hail nets and shading is also leading agriculture to become sustainable. Maintenance and installation costs being the only holdbacks, on-going development of lightweight, high-strength, and self-cleaning nets is overcoming these to create long-term market growth. Woven and Non-Woven Agricultural Nets rule the market through customization and increase in strength

Woven nets and non-woven nets are the two dominant types which occupy a large market share in agricultural nets, each of their own superiority in crop protection, ventilation control, and environmental friendliness. Both the nets have extensive application in agriculture, ranging from greenhouse covers to windbreak screens, which indicates the wide application and irreplaceable role of them in contemporary agricultural production.

They consist of long-term polymer fibres and high-density polyethylene (HDPE) and possess greater mechanical strength and UV radiation, wind speed, and insect penetration resistance. Woven nets possess an interlocked matrix compared to non-woven nets, which allows controlled air penetration and minimal temperature fluctuations. Woven-net producers have discovered more crop protection, especially among commercial agriculture companies where durability and reusability matter.

Increased use of high-tensile woven nets in vertical farms, aquaponics, and precision agriculture has also contributed to industry growth. Sustainable and environmentally friendly production of woven nets from biodegradable polymers and recycled materials based on global sustainability has also prompted producers to shift to green technology. Non-woven farm nets are becoming increasingly popular since they have a lightweight construction, are very cheap, and easy to fit.

Non-woven meshes provide a mesh of fine mesh cover against dust, air-borne disease causing bacteria, and insects and are thus utilized in organic farming and integrated pest management (IPM) schemes. Non-woven meshes are also different from woven meshes in the sense that they possess greater water holding capacities that ensure minimal water loss and allow soil conservation practices to be instituted. Their use in greenhouses and nurseries for seedlings has been further facilitated by their capability to create controlled microclimates that lead to optimal plant growth.

Technological innovations in nanotechnology-based non-woven netting like antimicrobial treatment and self-healing properties have also experienced a rise in their market value. Farmers and cooperatives are starting to use more biodegradable non-woven nets to comply with sustainability demands and reduce plastic pollution.

Weaved and non-weaved farm nets demand is likely to expand with expanding applications of precision farming and climate-resilient farming practices. Study maintains that far more than 70% of net utilizations in agriculture are woven or non-woven materials because they are strong, long-lasting, and economical.

Although much more than the mechanical strength and durability, woven nets are worse at pest control and soil retention but otherwise complete sets of recent agricultural application. Issues like raw material price volatility, UV degradation, and recycling limitation still exist, but ongoing R&D work in the area of sustainable materials and polymer technology is minimizing these issues, with the market still growing.

Competitive Scenario Growing demand for agricultural nets in agriculture, horticulture, and greenhouse use is fuelling market growth. Market drivers are greater emphasis on crop protection, climatic change, and higher agricultural productivity needs. UV-stable material quality-based precision netting technology and smart agriculture technology are focus areas for participants to control the crop yield as well as sustainability. Producers of agro-net, agro-technology companies, and providers of customized solutions to diversified farm requirements are part of the market.

Market Share Analysis by Company

| Company Name | Estimated Market Share (%) |

|---|---|

| Garware Technical Fibres Ltd. | 18-22% |

| Tenax Corporation | 14-18% |

| Thrace Group | 10-14% |

| B&V Agro Irrigation Co. | 8-12% |

| Shree Tarpaulin Industries | 5-9% |

| Other Manufacturers (Combined) | 30-40% |

| Company Name | Key Offerings/Activities |

|---|---|

| Garware Technical Fibres Ltd. | Provides high-strength agricultural nets, including shading, anti-insect, and hail protection nets. |

| Tenax Corporation | Specializes in UV-stabilized netting solutions for greenhouse and open-field farming applications. |

| Thrace Group | Develops innovative netting products for pest control, wind protection, and soil stabilization. |

| B&V Agro Irrigation Co. | Offers custom-made agricultural nets designed for irrigation and shade control. |

| Shree Tarpaulin Industries | Focuses on cost-effective, weather-resistant netting solutions for diverse farming applications. |

Key Company Insights

Garware Technical Fibres Ltd. (18-22%)

Garware dominates the agricultural net industry with its long-lasting and UV-resistant netting products, improving crop protection and farm yields.

Tenax Corporation (14-18%)

Tenax Corporation is a leading company in new-generation greenhouse netting, offering high-quality shading and pest management solutions.

Thrace Group (10-14%)

Thrace Group is a leading company in advanced agricultural netting, providing environmentally friendly and high-performance protective nets.

B&V Agro Irrigation Co. (8-12%)

B&V Agro specializes in tailored agricultural nets that improve water management and maximize plant growth conditions.

Shree Tarpaulin Industries (5-9%)

Shree Tarpaulin Industries offers long-lasting, affordable agricultural netting solutions for harsh weather conditions.

Other Key Players (30-40% Combined)

New entrants and standalone manufacturers are adding biodegradable components, IoT-based precision monitoring, and innovative shading technologies to agricultural netting solutions. These include:

The overall market size for the agricultural nets market was USD 11.8 billion in 2025.

The agricultural nets market is expected to reach USD 20.1 billion in 2035.

The agricultural nets market is expected to grow at a CAGR of 5.5% during the forecast period.

The demand for the agricultural nets market will be driven by increasing awareness of crop protection, rising adoption of greenhouse farming, growing concerns about climate change, advancements in netting materials, and the need for enhanced agricultural productivity.

The top five countries driving the development of the agricultural nets market are the USA, China, India, Brazil, and Spain.

Our Research Products

The "Full Research Suite" delivers actionable market intel, deep dives on markets or technologies, so clients act faster, cut risk, and unlock growth.

The Leaderboard benchmarks and ranks top vendors, classifying them as Established Leaders, Leading Challengers, or Disruptors & Challengers.

Locates where complements amplify value and substitutes erode it, forecasting net impact by horizon

We deliver granular, decision-grade intel: market sizing, 5-year forecasts, pricing, adoption, usage, revenue, and operational KPIs—plus competitor tracking, regulation, and value chains—across 60 countries broadly.

Spot the shifts before they hit your P&L. We track inflection points, adoption curves, pricing moves, and ecosystem plays to show where demand is heading, why it is changing, and what to do next across high-growth markets and disruptive tech

Real-time reads of user behavior. We track shifting priorities, perceptions of today’s and next-gen services, and provider experience, then pace how fast tech moves from trial to adoption, blending buyer, consumer, and channel inputs with social signals (#WhySwitch, #UX).

Partner with our analyst team to build a custom report designed around your business priorities. From analysing market trends to assessing competitors or crafting bespoke datasets, we tailor insights to your needs.

Supplier Intelligence

Discovery & Profiling

Capacity & Footprint

Performance & Risk

Compliance & Governance

Commercial Readiness

Who Supplies Whom

Scorecards & Shortlists

Playbooks & Docs

Category Intelligence

Definition & Scope

Demand & Use Cases

Cost Drivers

Market Structure

Supply Chain Map

Trade & Policy

Operating Norms

Deliverables

Buyer Intelligence

Account Basics

Spend & Scope

Procurement Model

Vendor Requirements

Terms & Policies

Entry Strategy

Pain Points & Triggers

Outputs

Pricing Analysis

Benchmarks

Trends

Should-Cost

Indexation

Landed Cost

Commercial Terms

Deliverables

Brand Analysis

Positioning & Value Prop

Share & Presence

Customer Evidence

Go-to-Market

Digital & Reputation

Compliance & Trust

KPIs & Gaps

Outputs

Full Research Suite comprises of:

Market outlook & trends analysis

Interviews & case studies

Strategic recommendations

Vendor profiles & capabilities analysis

5-year forecasts

8 regions and 60+ country-level data splits

Market segment data splits

12 months of continuous data updates

DELIVERED AS:

PDF EXCEL ONLINE

Agricultural Multifunction Grab Bucket Market Size and Share Forecast Outlook 2025 to 2035

Agricultural Bucket Market Size and Share Forecast Outlook 2025 to 2035

Agricultural Lighting Market Forecast and Outlook 2025 to 2035

Agricultural Sprayers Market Size and Share Forecast Outlook 2025 to 2035

Agricultural Fumigant Market Size and Share Forecast Outlook 2025 to 2035

Agricultural Coatings Market Size and Share Forecast Outlook 2025 to 2035

Agricultural Secondary Nutrients Market Size and Share Forecast Outlook 2025 to 2035

Agricultural Chelates Market Size and Share Forecast Outlook 2025 to 2035

Agricultural Tractors Market Analysis - Size, Share, and Forecast Outlook 2025 to 2035

Agricultural Tires Market Analysis - Size, Share, and Forecast Outlook 2025 to 2035

Agricultural Pheromones Market Size and Share Forecast Outlook 2025 to 2035

Agricultural Adjuvant Market - Size, Share, and Forecast Outlook 2025 to 2035

Agricultural Microbials Market Size and Share Forecast Outlook 2025 to 2035

Agricultural Gloves Market Size and Share Forecast Outlook 2025 to 2035

Agricultural Activator Adjuvant Market Analysis - Size, Share, and Forecast Outlook 2025 to 2035

Agricultural Surfactants Market Analysis – Size, Share, and Forecast Outlook 2025 to 2035

Agricultural Testing Services Market Growth - Trends & Forecast 2025 to 2035

Agricultural Mapping Services Market Growth - Trends & Forecast 2025 to 2035

Agricultural Grade Zinc Chemicals Market Growth - Trends & Forecast 2025 to 2035

Agricultural Fabrics Market Growth - Trends & Forecast 2025 to 2035

Thank you!

You will receive an email from our Business Development Manager. Please be sure to check your SPAM/JUNK folder too.

Chat With

MaRIA