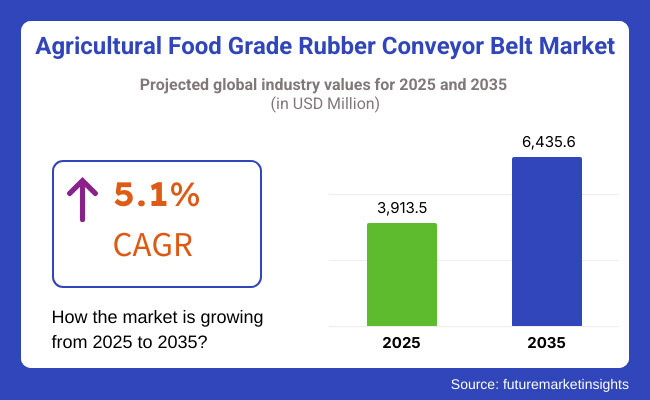

The agricultural food grade rubber conveyor belt market is projected to witness steady growth over the forecast period, with an estimated market size of USD 3,913.5 million in 2025, reaching USD 6,435.6 million by 2035 at a CAGR of 5.1%.

This growth is driven by the increasing demand for efficient material handling solutions in the agricultural sector, particularly in food processing, grain transportation, and packaging. The rising focus on food safety regulations and the need for contamination-free conveyor systems further fuel the adoption of food-grade rubber conveyor belts.

The agricultural food grade rubber conveyor belt market is on a significant upward trend with the modern farming and food processing industries adopting automation, efficiency, and food safety as their primary concerns. Conveyor belts are primarily used in agriculture to increase efficiency, from harvesting and sorting to packing and shipping.

Population growth and urbanization drive the trade-off between food and resource allocation, which induces more investments in agricultural equipment thereby boosting the market. Concerning contamination and food handling laws which are set by the government have motivated the installation of FDA and EU-compliant food-grade rubber conveyor belts, thus ensuring the market's continuity, and long-standing prosperity.

The market is influenced by various factors, such as technological breakthrough, improvement in the level of automation in agricultural food-processing, and the introduction of stringent food safety regulations. Food-grade rubber conveyor belts are primarily instrumental in maintaining hygiene in agricultural applications, which includes stopping contamination and enhancing productivity.

The agricultural food-grade rubber conveyor belt market has a very quick development with farming and food processing moving towards the automated trend. This type of belt is used for the hygienic, efficient, and rapid transportation of grains, fruits, vegetables, and dairy goods thereby minimizing the risks of contamination.

The application of the Precautionary Hazard Analysis Critical Control Point (HACCP), the Food and Drug Administration (FDA), and the European Union (EU) norms has made food producers go for non-toxic wear-resistant rubber conveyor belt. The introduction of new technologies such as antimicrobial and oil-resistant rubber materials is also enhancing product life.

Moreover, the transformation to sustainable, biodegradable rubber conveyor belts is a new opportunity for people. The increasing trend of food supply globalization and agricultural trade is creating a strong demand for quality long-lasting conveyor solutions which will in turn promote the market for the next ten years.

Technology and strict food safety policies steer the North American agricultural food-grade rubber conveyor belt market forward. The USA and Canada processing industries that are mainly engaged in the agricultural sector are the biggest players operating complex mechanisms in a need of reliable and cost-effective conveyor systems for handling and processing of various goods like grains, fruits, and dairy products.

The FDA and USDA policies suggest the use of non-toxic, wear-resistant, and easily cleaned conveyor belts in food production plants. There has also been a spurt in the food processing sector, which is further pushing the demand for durable and food-safe rubber conveyor solutions.

Besides, the shift towards the adoption of sustainable agricultural practices and organic food production has led to the use of biodegradable rubber conveyor belts. With continued investments in smart and precision agriculture, North America is still a principal market for conveyor belt manufacturers.

The European agricultural food-grade rubber conveyor belt market is experiencing growth due to the influence of the EU's strict food safety regulations and increased money put in green food processing technologies. Nations such as Germany, France, and the Netherlands have a competitive edge because of their active roles in establishing solid agriculture and food export industries.

The EU Regulation 1935/2004 regarding food-contact materials has mandated the manufacturers of conveyor belts to manufacture non-toxic, resistant to chemicals conveyor belts that are in line with the HACCP (Hazard Analysis and Critical Control Point) standards.

On top of that, the European Association of Food Producers is putting emphasis on energy efficiency and the use of biodegradable rubber materials as a way of looking after the environment. The increase in demand for more advanced and automated conveyor belts in the according to the latest trend of bakery, dairy, and meat processing in the sector, is what makes Europe a key market for food-grade conveyor belts.

In the Asia-Pacific region, agricultural food-grade rubber conveyor belts are registering high growth, as a result of the agricultural sector rapidly industrializing and the demand for food on the rise. These countries are China, India, and Indonesia, who are modernizing the food-processing facility in their battle with food supply both at home and abroad. Initiatives from the government focused on food security are driving the sector toward the food-safe conveyor belt adoption.

The agriculture mechanization trend is snowballing with the technologically driven operations in grain handling, fruit sorting, and dairy processing further boosting the market growth. The Industrial Cooperation program between countries on the "Belt and Road" is translating into heightened demand for high-quality conveyor systems. With the increasing number of smart farming technologies, the region is on its course towards becoming the fastest regional market for growth.

The market is gradually growing for the Rest of the World (RoW), such as Latin America, the Middle East, and Africa in terms of the adoption of agricultural food-grade rubber conveyor belts. Latin America led by Brazil and Argentina is a geographically advantageous location with a well-developed agribusiness sector which will drive the demand for conveyor systems, especially for grain handling and meat processing.

The activities in food import and export in the Middle East are booming which has increased the opportunities for the usage of food-safe conveyor belts in logistics and packaging. The market in Africa is at an early stage with the establishment of modern farming practices and food processing units that will enhance the cheap and quality belts demand. Though the financial burdens, and lack of infrastructure investments remain unfixed, the governments are creating food security through the implementation of new projects.

High Initial Investment Costs

One of the major predicaments that the agricultural food-grade rubber conveyor belt market is facing is the very high initial costs which are related to advanced technology. Small and medium-sized food processing plants, predominantly those which are situated in developing areas, often experience difficulties in the procurement of high-grade FDA-compliant conveyor belts because of financial constraints.

The costs that are related to the installation, repair, and change of food-grade rubber belts are massive and this is also another factor that hampers their buying. The customized conveyor systems are necessary for the functional and productivity needs of specific agricultural applications (dairy, grain handling, and meat processing) that add to the overall cost.

Even if the long-term paybacks of automation and efficiency are clear, a lot of agricultural sectors are reluctant to adopt the conveyor belt solution for various reasons, which in return delays the market entry; especially in countries with a bad financial situation like India, Africa, and Latin America.

Regulatory Compliance Complexity

Manufacturers and food processors face an alarming problem arising from the complexity of the regulatory compliance. Different areas have regional food safety and hygiene standards, which include the FDA and USDA regulations in North America, EU Regulation 1935/2004 in Europe, and the particular national safety guidelines in Asia-Pacific and Latin America.

Producers have to ensure that their food-grade rubber belts are non-toxic, chemical resistant, and meet the very strict migration limits which can be both time- and cost-consuming. Also, the frequent changes in food safety laws lead to compliance problems that require continuous product testing and reformulation.

For the global players, handling the various regional rules brings about operational difficulties, increasing R&D spending and slowing down the expansion of the market particularly in areas where food safety laws are changing quickly.

Rising Adoption of Automation in Agriculture and Food Processing

The increased trend towards automation in agriculture and food processing is a primary opportunity for the agricultural food-grade rubber conveyor belt market. The main focus of food production is scaling up and mechanization, therefore, manufacturers are opting for smart conveyor systems in order to achieve better efficiency, hygiene, and productivity.

Probable paths in terms of profits are provided by smart conveyor belts designed for the internet of things helping producers keep quality under control and reduce food wastage. In developed economies like North America and Europe, the capital that's being injected into Industry 4.0 and intelligent agricultural solutions is contributing to the demand for technology belt upgrades.

On the other hand, the rising economies like India and China are availing themselves of government support in the purchase of new machines to accelerate the modernization of the processing facilities with scrolling up the automation trend.

Development of Antimicrobial and Biodegradable Rubber Conveyor Belts

Sustainability and food security are key drivers behind the development of antimicrobial and biodegradable rubber conveyor belts which can be great opportunities for the market. The manufacturers are looking for innovative technological breakthroughs in the fight against food processes being contaminated by the bacteria.

The gents for the eco-green, biodegradable rubber belts, which are on the rise as environmental laws are tightening down on Europe and North America, obliterate the image of companies investing in natural rubber-based non-toxic conveyor belts as winners in markets with greener production.

The growth of organic farming and the increased production of organic foods will ensure that the belts which are environmental and food safety standards compliant will be more in demand, hence, they will provide significant growth opportunities.

The evolution of the agricultural food grade rubber conveyor belt market is very visible in the years of 2020 and 2024. The fear concerning food safety, the regulatory framework that is becoming stricter, and the technical progress in material science determine the availability of conveyor belts that are of high quality for the handling and processing of food. During that time, the sector was primarily made up of synthetic rubber belts, which were introduced as those having a longer lifetime and an outstanding record of hygiene.

Automating agriculture will power the market's growth in manufacturing due to the emphasis on environmental sustainability regulations and the need for food to be transported without the risk of contamination. For sure, we will see the usage of new materials like biodegradable and sustainable ones again and STEAM conveyor systems mixed with IoT-enabled devices will handle the tasks efficiently.

Comparative Market Analysis

| Market Shift | 2020 to 2024 |

|---|---|

| Regulatory Landscape | Implementation of food safety standards such as FDA and EU 1935/2004 for rubber conveyor belts. |

| Technological Advancements | Introduction of synthetic rubber belts with antimicrobial properties and high durability. |

| Industry-Specific Demand | Demand driven by large-scale farming and food processing industries. |

| Sustainability & Circular Economy | Initial efforts to reduce environmental impact by limiting the use of hazardous substances. |

| Market Growth Drivers | Growth fueled by expanding food processing industries, rising food safety concerns, and global agricultural mechanization. |

| Market Shift | 2025 to 2035 |

|---|---|

| Regulatory Landscape | Stricter global regulations on material composition and sustainability requirements for eco-friendly belts. |

| Technological Advancements | Development of biodegradable, recyclable belts and IoT-integrated monitoring for real-time efficiency tracking. |

| Industry-Specific Demand | Increased adoption in precision agriculture and automated food handling systems. |

| Sustainability & Circular Economy | Shift towards bio-based rubber belts, enhanced recycling, and closed-loop manufacturing processes. |

| Market Growth Drivers | Market expansion driven by automation, sustainability initiatives, and the demand for cost-effective, long-lasting conveyor solutions. |

The United States or USA, is a region and market that is continuing to grow (about 4.8% CAGR through 2025 to 2035 period), is uplifted by different factors/documents namely rising automation in food processing, business-related FDA regulations, and also the sustainability trends i.e. mechanization in granary handling, dairy, and fresh produce logistics. The main driver of demand for high-quality conveyor belts is mechanization in grain handling, dairy, and fresh produce logistics.

The trend of opting for bio-based, low-VOC rubber materials, is in sync with sustainability goals. Manufacturers are being persuaded to come up with inventions such as nylon belts that are both strong and harmless to the environment, by the rules of food safety compliance. Despite the maturity of the market, the inventive antimicrobial coatings and temperature-resistant belts are ensuring the constant demand.

Also, the high labor costs are the root cause of the problem, where automation in food supply chains is being accelerated which in turn helps in the adoption of automation. The USA market is expected to grow at a compound annual growth rate (CAGR) of 4.8% between 2025 and 2035, which is slightly lower than the global average of 5.5% because of regulatory costs but is also driven by technological progress.

| Country | CAGR (2025 to 2035) |

|---|---|

| United States | 4.8% |

The UK conveyor belt market is showing a strong potential for growth after the recovery of the supply chain in the post-Brexit period with increasing demand for high-quality materials and solutions from the food industry where automation is becoming the norm. The rate of introduction of clean, disinfectant-resistant conveyor belts is increasing, particularly in the meat, dairy, and bakery sectors.

Manufactures are driven by the need for sustainable materials which is being upheld by concerns about the environment. Ongoing issues of labor shortages in warehouses are giving rise to more automation in food logistics, packaging along the lines of conveyor belts which in turn is the most preferred choice.

However, post-Brexit, the minor challenges present such as economic uncertainties and unpredictable import/export policies. The UK market is likely to achieve a CAGR of 5.0% (2025 to 2035) backed by food safety, production efficiency, and sustainable material investments despite regulatory and economic changes.

| Country | CAGR (2025 to 2035) |

|---|---|

| United Kingdom | 5.0% |

The high demand for the EU market is a consequence of the EFSA food safety regulations and sustainability initiatives that necessitate compliance with tough requirements. The conveyor belt producers are facing high demand for durable and sturdy conveyor belts as Germany, France, and the Netherlands are progressing in food processing automation the fastest. The trend of using bio-based and antimicrobial materials not only goes along with the green policies but also supports the objectives of the circular economy.

The increase in food logistics and warehousing automation also contributes to the further demand for these items. Along with the increased food exports, the need for efficient processing and packaging comes into the picture, hence the market expansion is consolidated.

The EU market is expected to develop at a CAGR of 5.3% (2025 to 2035), which is slightly higher than the global average, and the things which will help are sustainability regulations, more automation, and the increase in food exports.

| Region | CAGR (2025 to 2035) |

|---|---|

| European Union | 5.3% |

Japan's market is technologically advanced, exhibiting automation in food processing, strictly follows hygiene standards, as well as embraces technological innovations in conveyor belts. The antibacterial-coated and precision-engineered belts are in very high demand as they help to minimize the contamination risks. The decrease in personnel due to the aging workforce in the food supply chains is further convincing companies to adopt conveyor belts, the main focus of Japan's on food quality with proper packaging.

The only and very small concerns about the expansion of the market are the very high costs of state-of-the-art conveyor systems and the limited labor force available in the agricultural sector despite the benefits of automating.

The Japanese market is likely to grow at a CAGR rate of 4.7% during 2025 to 2035, just a little less than the global standard, and stay stable due to automation, food safety concerns, and technological improvements.

| Country | CAGR (2025 to 2035) |

|---|---|

| Japan | 4.7% |

The market in South Korea is on the rise as a result of adhering to rigorous food safety rules, targeting the global market for food production, and the growing trend of automation in agriculture. Investments in the internet of things (IoT) in smart farming and automated food processing plants are two of the major growth drivers. The seafood, grain, and meat sectors look for high-grade, hygienic conveyor belts that can resist wear and tear.

What is more, the increase in demand for food processing that uses high efficiency is a government initiative that is also contributing to the solution. At the same time, the continuous rise in labor costs encourages manufacturers to add integrated conveyor belt systems to their production lines making it easier to increase both productivity and hygiene.

In South Korea, the most likely market is with a CAGR of 5.5% (2025 to 2035) which is expected to grow beyond the global average due to the government's strong backing of smart agriculture and food processing automation.

| Country | CAGR (2025 to 2035) |

|---|---|

| South Korea | 5.5% |

White Food Grade Rubber Conveyor & Elevator Belt Dominates Due to Hygiene Compliance

The white color of food-grade rubber conveyor belts, especially those made from rubber, is largely associated with hygiene compliance and is thus the most dominant among them. White food-grade rubber conveyor belts are now considered the premium choice in agricultural operations because of their impressive hygiene rating and their adaptation to food safety regulations such as FDA and EU guidelines.

The belts are non-toxic & odorless, moisture-resistant, and the growth of bacteria is also a problem with them. They are used in the handling of fresh products, grains, and dairy products. Non-marking types of conveyor belts ensure there is no contamination, and the food safety issue till the supply route is not there.

Request for white food-grade rubber conveyor belts is reporters in the machinery sector where cleanliness and the materials have the utmost importance. In view of the increase in organic and clean-labeled foods that consumers are looking for, it is expected that the implementation of these belts will become even more widespread. The belts are particularly used in North America and Europe which have stringent food safety regulations.

Green Food Grade Rubber Conveyor & Elevator Belt Gains Popularity for Durability and Versatility

The green food-grade rubber conveyor belts are one of the belts that are made of recycled materials showing the green of the color that they are environmentally friendly. The use of green food-grade rubber conveyor belts is significantly increased mainly due to their extremely high reliability and stage to reduced waste.

Green food-grade rubber conveyor belts are the hottest right now because they are quite practical and long-lasting. Farmers use this kind of machinery where they need more human power on planting, harvesting crops, and moving materials. It can be seen from the fruit, vegetable, and food processing industry belt, which has an excellent oil, and grease technicality. They are oil and grease-resistant therefore they are suitable for handling fruits, vegetables, and processed food items.

The green color helps to separate different belt applications in the facilities, which enhances safety and operation efficiency. The countries that are situated in the Asia-Pacific region and Latin America are experiencing a rapid growth in the demand for green food-grade conveyor belts as a result of the mechanization of agriculture and food processing industries. Besides reducing start-up time, the emphasis on making agricultural processes more efficient is expected to give rise to a gradual increase in the demand for these belts.

Harvesting Equipment Drives Demand for Durable Conveyor Belts

The agricultural sector is one of the main areas of application where food-grade rubber conveyor belts are used, and harvesting machinery is one of the most significant applications. These belts are used in farmers' vehicles such as combines and harvesters and they simplify the work of collecting, sorting, and transporting crops like wheat, corn, and fruits to storage facilities.

As these belts are used in tough working environments, they must have high tensile strength, elasticity, and resistance to environmental factors such as moisture and UV rays. The propulsion of mechanized techniques in farming, especially within regions as North America and Europe, keeps on leading to the increased demand for the durable food-grade rubber conveyor belts.

New inventions in belt materials, for example, reinforced synthetic fibers and antimicrobial coatings are also responsible for this fact. This helps in making longer-lasting conveyor belts and therefore, there is a reduction in the frequency of replacements that in turn lead to lower maintenance costs.

Processing Equipment Segment Dominates with a Focus on Food Safety

Food-grade rubber conveyor belts are mainly applied in processing equipment that has the largest area of applications and it is through this application that the belt directly interacts with food quality and hygiene compliance. In food processing plants, these belts manage the raw materials, the sorting of produce required, and the transportation of semi-processed and wrapped food products. White food-grade rubber conveyor belts are preferred based on their good properties which are non-contaminating, easy cleaning, and resistance to microbial growth.

The demand for conveyor belts in processing equipment is going up due to the increasing obligation of the regulatory authorities related to food safety, particularly in developed markets. The need for conveyor belts with better temperature resistance and anti-static properties has expanded, promoting the selling of high-performance conveyor belts as well as the climatic conditioning in the production field due to the automation of food processing facilities.

The Agricultural Food Grade Rubber Conveyor Belt Market plays a significant role in food processing, grain handling, and agricultural logistics. The market is going through positive progress thanks to the increased demands for food safety compliance, the adoption of automation in food production, and the need for hygienic material handling solutions.

Regulations, such as those from the FDA, EU, and the FSMA, are driving the need for high-quality and non-toxic rubber belts. Also, companies are concentrated on developing sustainable and antimicrobial rubber formulations that enhance the wear-and-tear resistance, temperature tolerance, and productivity. Moreover, the concerns about cross-contamination, hygiene standards, and efficiency in production are directing the industry to innovate new technologies hence conveyor belt designs are growing smarter and IoT monitoring systems are introduced.

Market Share Analysis by Company

| Company Name | Estimated Market Share (%) |

|---|---|

| Continental AG | 12-16% |

| Fenner Group | 10-14% |

| Ammeraal Beltech | 8-12% |

| Intralox | 7-10% |

| Habasit | 6-9% |

| Other Companies | 45-55% |

| Company Name | Key Offerings/Activities |

|---|---|

| Continental AG | Produces high-durability rubber belts with FDA-approved coatings for food processing. Focuses on sustainable rubber solutions. |

| Fenner Group | Specializes in agriculture and grain handling conveyor belts with anti-microbial properties and moisture resistance. |

| Ammeraal Beltech | Develops heat-resistant and non-stick belts for food production lines, ensuring high efficiency and hygiene standards. |

| Intralox | Known for modular conveyor belts for the agri-food industry, providing customized automation solutions. |

| Habasit | Offers flexible, food-safe conveyor belts with energy-efficient designs to enhance processing efficiency. |

Key Company Insights

Continental AG

Continental AG is the world's leading manufacturer of conveyor belts, especially for applications in the food industry. The company is committed to producing abrasion-resistant, sustainable, and very efficient rubber belts to be utilized under extreme conditions in the food processing and agricultural sector. Continental's belts are FDA-approved and come with an antimicrobial coating, thereby ensuring safety in the transport of materials.

The company is working on bio-based rubber production as part of its green initiative. Networking with smart monitoring systems for belts that increase efficiency and decrease the time required for maintenance are other features.

The company achieved the announced targets not only by the production of temperature-resistant rubber belts but also through inventing and making custom solutions for grain handling and dairy processing, thus standing as a main competitive player in providing high-performance conveyor solutions.

Fenner Group

Fenner Group is a leader in the agriculture and food processing sector with a concentration on hygienic and durable belts. The brand is notable for its moisture-resistant, and anti-microbial rubber belts that guarantee food safety adherence. The introduction of woven belt technology at Fenner has improved the load capacity and efficiency, which subsequently lowered the energy use in grain and food transport.

Besides, Fenner teamed up with agricultural cooperatives and food processing plants to improve the flow of materials. The company has set a solid foundation in research and development to produce longer-lasting, high-performance belts fitting appropriate food safety controls. Hence the company is a reliable player in the agricultural belt conveyor industry.

Ammeraal Beltech

Ammeraal Beltech is the most prominent conveyor belt supplier to the food industry, with its know-how in heat-resistant and non-stick solutions dedicated to food processing and agricultural uses. The company comes up with solutions that respect hygiene standards while increasing productivity. Its closed-belt design jettisons the risks of cross-contamination for it to be certified as suitable for the prescripts demanding norms in the food industry.

Ammeraal is continuously working on the development of environmentally-friendly and energy-efficient belts, dealing with the ongoing pressure for sustainability. The most up-to-date innovations include temperature-resistant rubber compounds and lightweight belt materials for less energy consumption. Standing firmly on customization and industry-specific solutions, Ammeraal Beltech has become the number one option for food-safe conveyor systems.

Intralox

Intralox is the very first modular conveyor solutions’ provider that comes with the fit-and-food-grade belts to enhance the level of automation and efficiency at the same time. The company is clearly the forerunner in agri-food handling, focusing on sanitary belt designs which are in agreement with FSMA and HACCP standards.

The smart tracking technology of Intralox allows for real-time monitoring of the conveyors and the predictive maintenance regulation which help in cutting downtime and increasing processing accuracy. By channeling funds into AI-driven automation solutions, the company is consolidating its competitive footing.

New products on the market are the innovative easy-to-clean conveyor designs which will decrease the food contamination risk significantly. Using new styles and innovative methods, Intralox continues to both improve food processing and act as an industry leader in conveyor technology.

Habasit

Habasit is a key player and a worldwide leader in the provision of food-grade belting solutions with highly energy-efficient and top-quality conveyor belts made specifically for agriculture and the food processing industry. The company believes in durability, hygiene, and pertinence to the regulations, with the belts designed to function with various temperature and food textures.

And yet, Habasit is making investments in rubber formulations that are FDA- and EU-approved and are long-lasting. The innovations presented by the company include the release of lightweight, ultra-flexible belts which will ease handling and at the same time cut operational costs.

Alongside its customer-centric solutions, Habasit is also a strong partner who teams up with food processors all around the world to deliver conveyor systems that are tailor Engineered, thus ensuring relied power and performance for years down the road.

In terms of Product Type, the industry is divided into White food grade rubber conveyor & elevator belt, Green food grade rubber conveyor & elevator belt, Standard black rubber conveyor & elevator belt

In terms of Application, the industry is divided into Harvesting equipment, Processing equipment, Material handling & packaging equipment, Bottling equipment

The report covers key regions, including North America, Latin America, Western Europe, Eastern Europe, East Asia, South Asia, and the Middle East and Africa (MEA).

The global Agricultural Food Grade Rubber Conveyor Belt market is projected to reach USD 3,913.5 million by the end of 2025.

The market is anticipated to grow at a CAGR of 5.1% over the forecast period.

By 2035, the Agricultural Food Grade Rubber Conveyor Belt market is expected to reach USD 6,435.6 million.

The White food grade rubber conveyor & elevator belt segment is expected to dominate the market, due to its higher bandwidth, longer transmission distances, lower attenuation, and superior signal integrity, essential for aerospace applications.

Key players in the Agricultural Food Grade Rubber Conveyor Belt market include Amphenol Corporation, TE Connectivity, Corning Inc., Radiall, OFS Fitel, LLC.

Table 1: Global Market Value (US$ Million) Forecast by Region, 2018 to 2033

Table 2: Global Market Volume (Metre) Forecast by Region, 2018 to 2033

Table 3: Global Market Value (US$ Million) Forecast by Product Type, 2018 to 2033

Table 4: Global Market Volume (Metre) Forecast by Product Type, 2018 to 2033

Table 5: Global Market Value (US$ Million) Forecast by Material Type, 2018 to 2033

Table 6: Global Market Volume (Metre) Forecast by Material Type, 2018 to 2033

Table 7: Global Market Value (US$ Million) Forecast by Application, 2018 to 2033

Table 8: Global Market Volume (Metre) Forecast by Application, 2018 to 2033

Table 9: Global Market Value (US$ Million) Forecast by End-use, 2018 to 2033

Table 10: Global Market Volume (Metre) Forecast by End-use, 2018 to 2033

Table 11: North America Market Value (US$ Million) Forecast by Country, 2018 to 2033

Table 12: North America Market Volume (Metre) Forecast by Country, 2018 to 2033

Table 13: North America Market Value (US$ Million) Forecast by Product Type, 2018 to 2033

Table 14: North America Market Volume (Metre) Forecast by Product Type, 2018 to 2033

Table 15: North America Market Value (US$ Million) Forecast by Material Type, 2018 to 2033

Table 16: North America Market Volume (Metre) Forecast by Material Type, 2018 to 2033

Table 17: North America Market Value (US$ Million) Forecast by Application, 2018 to 2033

Table 18: North America Market Volume (Metre) Forecast by Application, 2018 to 2033

Table 19: North America Market Value (US$ Million) Forecast by End-use, 2018 to 2033

Table 20: North America Market Volume (Metre) Forecast by End-use, 2018 to 2033

Table 21: Latin America Market Value (US$ Million) Forecast by Country, 2018 to 2033

Table 22: Latin America Market Volume (Metre) Forecast by Country, 2018 to 2033

Table 23: Latin America Market Value (US$ Million) Forecast by Product Type, 2018 to 2033

Table 24: Latin America Market Volume (Metre) Forecast by Product Type, 2018 to 2033

Table 25: Latin America Market Value (US$ Million) Forecast by Material Type, 2018 to 2033

Table 26: Latin America Market Volume (Metre) Forecast by Material Type, 2018 to 2033

Table 27: Latin America Market Value (US$ Million) Forecast by Application, 2018 to 2033

Table 28: Latin America Market Volume (Metre) Forecast by Application, 2018 to 2033

Table 29: Latin America Market Value (US$ Million) Forecast by End-use, 2018 to 2033

Table 30: Latin America Market Volume (Metre) Forecast by End-use, 2018 to 2033

Table 31: Western Europe Market Value (US$ Million) Forecast by Country, 2018 to 2033

Table 32: Western Europe Market Volume (Metre) Forecast by Country, 2018 to 2033

Table 33: Western Europe Market Value (US$ Million) Forecast by Product Type, 2018 to 2033

Table 34: Western Europe Market Volume (Metre) Forecast by Product Type, 2018 to 2033

Table 35: Western Europe Market Value (US$ Million) Forecast by Material Type, 2018 to 2033

Table 36: Western Europe Market Volume (Metre) Forecast by Material Type, 2018 to 2033

Table 37: Western Europe Market Value (US$ Million) Forecast by Application, 2018 to 2033

Table 38: Western Europe Market Volume (Metre) Forecast by Application, 2018 to 2033

Table 39: Western Europe Market Value (US$ Million) Forecast by End-use, 2018 to 2033

Table 40: Western Europe Market Volume (Metre) Forecast by End-use, 2018 to 2033

Table 41: Eastern Europe Market Value (US$ Million) Forecast by Country, 2018 to 2033

Table 42: Eastern Europe Market Volume (Metre) Forecast by Country, 2018 to 2033

Table 43: Eastern Europe Market Value (US$ Million) Forecast by Product Type, 2018 to 2033

Table 44: Eastern Europe Market Volume (Metre) Forecast by Product Type, 2018 to 2033

Table 45: Eastern Europe Market Value (US$ Million) Forecast by Material Type, 2018 to 2033

Table 46: Eastern Europe Market Volume (Metre) Forecast by Material Type, 2018 to 2033

Table 47: Eastern Europe Market Value (US$ Million) Forecast by Application, 2018 to 2033

Table 48: Eastern Europe Market Volume (Metre) Forecast by Application, 2018 to 2033

Table 49: Eastern Europe Market Value (US$ Million) Forecast by End-use, 2018 to 2033

Table 50: Eastern Europe Market Volume (Metre) Forecast by End-use, 2018 to 2033

Table 51: South Asia and Pacific Market Value (US$ Million) Forecast by Country, 2018 to 2033

Table 52: South Asia and Pacific Market Volume (Metre) Forecast by Country, 2018 to 2033

Table 53: South Asia and Pacific Market Value (US$ Million) Forecast by Product Type, 2018 to 2033

Table 54: South Asia and Pacific Market Volume (Metre) Forecast by Product Type, 2018 to 2033

Table 55: South Asia and Pacific Market Value (US$ Million) Forecast by Material Type, 2018 to 2033

Table 56: South Asia and Pacific Market Volume (Metre) Forecast by Material Type, 2018 to 2033

Table 57: South Asia and Pacific Market Value (US$ Million) Forecast by Application, 2018 to 2033

Table 58: South Asia and Pacific Market Volume (Metre) Forecast by Application, 2018 to 2033

Table 59: South Asia and Pacific Market Value (US$ Million) Forecast by End-use, 2018 to 2033

Table 60: South Asia and Pacific Market Volume (Metre) Forecast by End-use, 2018 to 2033

Table 61: East Asia Market Value (US$ Million) Forecast by Country, 2018 to 2033

Table 62: East Asia Market Volume (Metre) Forecast by Country, 2018 to 2033

Table 63: East Asia Market Value (US$ Million) Forecast by Product Type, 2018 to 2033

Table 64: East Asia Market Volume (Metre) Forecast by Product Type, 2018 to 2033

Table 65: East Asia Market Value (US$ Million) Forecast by Material Type, 2018 to 2033

Table 66: East Asia Market Volume (Metre) Forecast by Material Type, 2018 to 2033

Table 67: East Asia Market Value (US$ Million) Forecast by Application, 2018 to 2033

Table 68: East Asia Market Volume (Metre) Forecast by Application, 2018 to 2033

Table 69: East Asia Market Value (US$ Million) Forecast by End-use, 2018 to 2033

Table 70: East Asia Market Volume (Metre) Forecast by End-use, 2018 to 2033

Table 71: Middle East and Africa Market Value (US$ Million) Forecast by Country, 2018 to 2033

Table 72: Middle East and Africa Market Volume (Metre) Forecast by Country, 2018 to 2033

Table 73: Middle East and Africa Market Value (US$ Million) Forecast by Product Type, 2018 to 2033

Table 74: Middle East and Africa Market Volume (Metre) Forecast by Product Type, 2018 to 2033

Table 75: Middle East and Africa Market Value (US$ Million) Forecast by Material Type, 2018 to 2033

Table 76: Middle East and Africa Market Volume (Metre) Forecast by Material Type, 2018 to 2033

Table 77: Middle East and Africa Market Value (US$ Million) Forecast by Application, 2018 to 2033

Table 78: Middle East and Africa Market Volume (Metre) Forecast by Application, 2018 to 2033

Table 79: Middle East and Africa Market Value (US$ Million) Forecast by End-use, 2018 to 2033

Table 80: Middle East and Africa Market Volume (Metre) Forecast by End-use, 2018 to 2033

Figure 1: Global Market Value (US$ Million) by Product Type, 2023 to 2033

Figure 2: Global Market Value (US$ Million) by Material Type, 2023 to 2033

Figure 3: Global Market Value (US$ Million) by Application, 2023 to 2033

Figure 4: Global Market Value (US$ Million) by End-use, 2023 to 2033

Figure 5: Global Market Value (US$ Million) by Region, 2023 to 2033

Figure 6: Global Market Value (US$ Million) Analysis by Region, 2018 to 2033

Figure 7: Global Market Volume (Metre) Analysis by Region, 2018 to 2033

Figure 8: Global Market Value Share (%) and BPS Analysis by Region, 2023 to 2033

Figure 9: Global Market Y-o-Y Growth (%) Projections by Region, 2023 to 2033

Figure 10: Global Market Value (US$ Million) Analysis by Product Type, 2018 to 2033

Figure 11: Global Market Volume (Metre) Analysis by Product Type, 2018 to 2033

Figure 12: Global Market Value Share (%) and BPS Analysis by Product Type, 2023 to 2033

Figure 13: Global Market Y-o-Y Growth (%) Projections by Product Type, 2023 to 2033

Figure 14: Global Market Value (US$ Million) Analysis by Material Type, 2018 to 2033

Figure 15: Global Market Volume (Metre) Analysis by Material Type, 2018 to 2033

Figure 16: Global Market Value Share (%) and BPS Analysis by Material Type, 2023 to 2033

Figure 17: Global Market Y-o-Y Growth (%) Projections by Material Type, 2023 to 2033

Figure 18: Global Market Value (US$ Million) Analysis by Application, 2018 to 2033

Figure 19: Global Market Volume (Metre) Analysis by Application, 2018 to 2033

Figure 20: Global Market Value Share (%) and BPS Analysis by Application, 2023 to 2033

Figure 21: Global Market Y-o-Y Growth (%) Projections by Application, 2023 to 2033

Figure 22: Global Market Value (US$ Million) Analysis by End-use, 2018 to 2033

Figure 23: Global Market Volume (Metre) Analysis by End-use, 2018 to 2033

Figure 24: Global Market Value Share (%) and BPS Analysis by End-use, 2023 to 2033

Figure 25: Global Market Y-o-Y Growth (%) Projections by End-use, 2023 to 2033

Figure 26: Global Market Attractiveness by Product Type, 2023 to 2033

Figure 27: Global Market Attractiveness by Material Type, 2023 to 2033

Figure 28: Global Market Attractiveness by Application, 2023 to 2033

Figure 29: Global Market Attractiveness by End-use, 2023 to 2033

Figure 30: Global Market Attractiveness by Region, 2023 to 2033

Figure 31: North America Market Value (US$ Million) by Product Type, 2023 to 2033

Figure 32: North America Market Value (US$ Million) by Material Type, 2023 to 2033

Figure 33: North America Market Value (US$ Million) by Application, 2023 to 2033

Figure 34: North America Market Value (US$ Million) by End-use, 2023 to 2033

Figure 35: North America Market Value (US$ Million) by Country, 2023 to 2033

Figure 36: North America Market Value (US$ Million) Analysis by Country, 2018 to 2033

Figure 37: North America Market Volume (Metre) Analysis by Country, 2018 to 2033

Figure 38: North America Market Value Share (%) and BPS Analysis by Country, 2023 to 2033

Figure 39: North America Market Y-o-Y Growth (%) Projections by Country, 2023 to 2033

Figure 40: North America Market Value (US$ Million) Analysis by Product Type, 2018 to 2033

Figure 41: North America Market Volume (Metre) Analysis by Product Type, 2018 to 2033

Figure 42: North America Market Value Share (%) and BPS Analysis by Product Type, 2023 to 2033

Figure 43: North America Market Y-o-Y Growth (%) Projections by Product Type, 2023 to 2033

Figure 44: North America Market Value (US$ Million) Analysis by Material Type, 2018 to 2033

Figure 45: North America Market Volume (Metre) Analysis by Material Type, 2018 to 2033

Figure 46: North America Market Value Share (%) and BPS Analysis by Material Type, 2023 to 2033

Figure 47: North America Market Y-o-Y Growth (%) Projections by Material Type, 2023 to 2033

Figure 48: North America Market Value (US$ Million) Analysis by Application, 2018 to 2033

Figure 49: North America Market Volume (Metre) Analysis by Application, 2018 to 2033

Figure 50: North America Market Value Share (%) and BPS Analysis by Application, 2023 to 2033

Figure 51: North America Market Y-o-Y Growth (%) Projections by Application, 2023 to 2033

Figure 52: North America Market Value (US$ Million) Analysis by End-use, 2018 to 2033

Figure 53: North America Market Volume (Metre) Analysis by End-use, 2018 to 2033

Figure 54: North America Market Value Share (%) and BPS Analysis by End-use, 2023 to 2033

Figure 55: North America Market Y-o-Y Growth (%) Projections by End-use, 2023 to 2033

Figure 56: North America Market Attractiveness by Product Type, 2023 to 2033

Figure 57: North America Market Attractiveness by Material Type, 2023 to 2033

Figure 58: North America Market Attractiveness by Application, 2023 to 2033

Figure 59: North America Market Attractiveness by End-use, 2023 to 2033

Figure 60: North America Market Attractiveness by Country, 2023 to 2033

Figure 61: Latin America Market Value (US$ Million) by Product Type, 2023 to 2033

Figure 62: Latin America Market Value (US$ Million) by Material Type, 2023 to 2033

Figure 63: Latin America Market Value (US$ Million) by Application, 2023 to 2033

Figure 64: Latin America Market Value (US$ Million) by End-use, 2023 to 2033

Figure 65: Latin America Market Value (US$ Million) by Country, 2023 to 2033

Figure 66: Latin America Market Value (US$ Million) Analysis by Country, 2018 to 2033

Figure 67: Latin America Market Volume (Metre) Analysis by Country, 2018 to 2033

Figure 68: Latin America Market Value Share (%) and BPS Analysis by Country, 2023 to 2033

Figure 69: Latin America Market Y-o-Y Growth (%) Projections by Country, 2023 to 2033

Figure 70: Latin America Market Value (US$ Million) Analysis by Product Type, 2018 to 2033

Figure 71: Latin America Market Volume (Metre) Analysis by Product Type, 2018 to 2033

Figure 72: Latin America Market Value Share (%) and BPS Analysis by Product Type, 2023 to 2033

Figure 73: Latin America Market Y-o-Y Growth (%) Projections by Product Type, 2023 to 2033

Figure 74: Latin America Market Value (US$ Million) Analysis by Material Type, 2018 to 2033

Figure 75: Latin America Market Volume (Metre) Analysis by Material Type, 2018 to 2033

Figure 76: Latin America Market Value Share (%) and BPS Analysis by Material Type, 2023 to 2033

Figure 77: Latin America Market Y-o-Y Growth (%) Projections by Material Type, 2023 to 2033

Figure 78: Latin America Market Value (US$ Million) Analysis by Application, 2018 to 2033

Figure 79: Latin America Market Volume (Metre) Analysis by Application, 2018 to 2033

Figure 80: Latin America Market Value Share (%) and BPS Analysis by Application, 2023 to 2033

Figure 81: Latin America Market Y-o-Y Growth (%) Projections by Application, 2023 to 2033

Figure 82: Latin America Market Value (US$ Million) Analysis by End-use, 2018 to 2033

Figure 83: Latin America Market Volume (Metre) Analysis by End-use, 2018 to 2033

Figure 84: Latin America Market Value Share (%) and BPS Analysis by End-use, 2023 to 2033

Figure 85: Latin America Market Y-o-Y Growth (%) Projections by End-use, 2023 to 2033

Figure 86: Latin America Market Attractiveness by Product Type, 2023 to 2033

Figure 87: Latin America Market Attractiveness by Material Type, 2023 to 2033

Figure 88: Latin America Market Attractiveness by Application, 2023 to 2033

Figure 89: Latin America Market Attractiveness by End-use, 2023 to 2033

Figure 90: Latin America Market Attractiveness by Country, 2023 to 2033

Figure 91: Western Europe Market Value (US$ Million) by Product Type, 2023 to 2033

Figure 92: Western Europe Market Value (US$ Million) by Material Type, 2023 to 2033

Figure 93: Western Europe Market Value (US$ Million) by Application, 2023 to 2033

Figure 94: Western Europe Market Value (US$ Million) by End-use, 2023 to 2033

Figure 95: Western Europe Market Value (US$ Million) by Country, 2023 to 2033

Figure 96: Western Europe Market Value (US$ Million) Analysis by Country, 2018 to 2033

Figure 97: Western Europe Market Volume (Metre) Analysis by Country, 2018 to 2033

Figure 98: Western Europe Market Value Share (%) and BPS Analysis by Country, 2023 to 2033

Figure 99: Western Europe Market Y-o-Y Growth (%) Projections by Country, 2023 to 2033

Figure 100: Western Europe Market Value (US$ Million) Analysis by Product Type, 2018 to 2033

Figure 101: Western Europe Market Volume (Metre) Analysis by Product Type, 2018 to 2033

Figure 102: Western Europe Market Value Share (%) and BPS Analysis by Product Type, 2023 to 2033

Figure 103: Western Europe Market Y-o-Y Growth (%) Projections by Product Type, 2023 to 2033

Figure 104: Western Europe Market Value (US$ Million) Analysis by Material Type, 2018 to 2033

Figure 105: Western Europe Market Volume (Metre) Analysis by Material Type, 2018 to 2033

Figure 106: Western Europe Market Value Share (%) and BPS Analysis by Material Type, 2023 to 2033

Figure 107: Western Europe Market Y-o-Y Growth (%) Projections by Material Type, 2023 to 2033

Figure 108: Western Europe Market Value (US$ Million) Analysis by Application, 2018 to 2033

Figure 109: Western Europe Market Volume (Metre) Analysis by Application, 2018 to 2033

Figure 110: Western Europe Market Value Share (%) and BPS Analysis by Application, 2023 to 2033

Figure 111: Western Europe Market Y-o-Y Growth (%) Projections by Application, 2023 to 2033

Figure 112: Western Europe Market Value (US$ Million) Analysis by End-use, 2018 to 2033

Figure 113: Western Europe Market Volume (Metre) Analysis by End-use, 2018 to 2033

Figure 114: Western Europe Market Value Share (%) and BPS Analysis by End-use, 2023 to 2033

Figure 115: Western Europe Market Y-o-Y Growth (%) Projections by End-use, 2023 to 2033

Figure 116: Western Europe Market Attractiveness by Product Type, 2023 to 2033

Figure 117: Western Europe Market Attractiveness by Material Type, 2023 to 2033

Figure 118: Western Europe Market Attractiveness by Application, 2023 to 2033

Figure 119: Western Europe Market Attractiveness by End-use, 2023 to 2033

Figure 120: Western Europe Market Attractiveness by Country, 2023 to 2033

Figure 121: Eastern Europe Market Value (US$ Million) by Product Type, 2023 to 2033

Figure 122: Eastern Europe Market Value (US$ Million) by Material Type, 2023 to 2033

Figure 123: Eastern Europe Market Value (US$ Million) by Application, 2023 to 2033

Figure 124: Eastern Europe Market Value (US$ Million) by End-use, 2023 to 2033

Figure 125: Eastern Europe Market Value (US$ Million) by Country, 2023 to 2033

Figure 126: Eastern Europe Market Value (US$ Million) Analysis by Country, 2018 to 2033

Figure 127: Eastern Europe Market Volume (Metre) Analysis by Country, 2018 to 2033

Figure 128: Eastern Europe Market Value Share (%) and BPS Analysis by Country, 2023 to 2033

Figure 129: Eastern Europe Market Y-o-Y Growth (%) Projections by Country, 2023 to 2033

Figure 130: Eastern Europe Market Value (US$ Million) Analysis by Product Type, 2018 to 2033

Figure 131: Eastern Europe Market Volume (Metre) Analysis by Product Type, 2018 to 2033

Figure 132: Eastern Europe Market Value Share (%) and BPS Analysis by Product Type, 2023 to 2033

Figure 133: Eastern Europe Market Y-o-Y Growth (%) Projections by Product Type, 2023 to 2033

Figure 134: Eastern Europe Market Value (US$ Million) Analysis by Material Type, 2018 to 2033

Figure 135: Eastern Europe Market Volume (Metre) Analysis by Material Type, 2018 to 2033

Figure 136: Eastern Europe Market Value Share (%) and BPS Analysis by Material Type, 2023 to 2033

Figure 137: Eastern Europe Market Y-o-Y Growth (%) Projections by Material Type, 2023 to 2033

Figure 138: Eastern Europe Market Value (US$ Million) Analysis by Application, 2018 to 2033

Figure 139: Eastern Europe Market Volume (Metre) Analysis by Application, 2018 to 2033

Figure 140: Eastern Europe Market Value Share (%) and BPS Analysis by Application, 2023 to 2033

Figure 141: Eastern Europe Market Y-o-Y Growth (%) Projections by Application, 2023 to 2033

Figure 142: Eastern Europe Market Value (US$ Million) Analysis by End-use, 2018 to 2033

Figure 143: Eastern Europe Market Volume (Metre) Analysis by End-use, 2018 to 2033

Figure 144: Eastern Europe Market Value Share (%) and BPS Analysis by End-use, 2023 to 2033

Figure 145: Eastern Europe Market Y-o-Y Growth (%) Projections by End-use, 2023 to 2033

Figure 146: Eastern Europe Market Attractiveness by Product Type, 2023 to 2033

Figure 147: Eastern Europe Market Attractiveness by Material Type, 2023 to 2033

Figure 148: Eastern Europe Market Attractiveness by Application, 2023 to 2033

Figure 149: Eastern Europe Market Attractiveness by End-use, 2023 to 2033

Figure 150: Eastern Europe Market Attractiveness by Country, 2023 to 2033

Figure 151: South Asia and Pacific Market Value (US$ Million) by Product Type, 2023 to 2033

Figure 152: South Asia and Pacific Market Value (US$ Million) by Material Type, 2023 to 2033

Figure 153: South Asia and Pacific Market Value (US$ Million) by Application, 2023 to 2033

Figure 154: South Asia and Pacific Market Value (US$ Million) by End-use, 2023 to 2033

Figure 155: South Asia and Pacific Market Value (US$ Million) by Country, 2023 to 2033

Figure 156: South Asia and Pacific Market Value (US$ Million) Analysis by Country, 2018 to 2033

Figure 157: South Asia and Pacific Market Volume (Metre) Analysis by Country, 2018 to 2033

Figure 158: South Asia and Pacific Market Value Share (%) and BPS Analysis by Country, 2023 to 2033

Figure 159: South Asia and Pacific Market Y-o-Y Growth (%) Projections by Country, 2023 to 2033

Figure 160: South Asia and Pacific Market Value (US$ Million) Analysis by Product Type, 2018 to 2033

Figure 161: South Asia and Pacific Market Volume (Metre) Analysis by Product Type, 2018 to 2033

Figure 162: South Asia and Pacific Market Value Share (%) and BPS Analysis by Product Type, 2023 to 2033

Figure 163: South Asia and Pacific Market Y-o-Y Growth (%) Projections by Product Type, 2023 to 2033

Figure 164: South Asia and Pacific Market Value (US$ Million) Analysis by Material Type, 2018 to 2033

Figure 165: South Asia and Pacific Market Volume (Metre) Analysis by Material Type, 2018 to 2033

Figure 166: South Asia and Pacific Market Value Share (%) and BPS Analysis by Material Type, 2023 to 2033

Figure 167: South Asia and Pacific Market Y-o-Y Growth (%) Projections by Material Type, 2023 to 2033

Figure 168: South Asia and Pacific Market Value (US$ Million) Analysis by Application, 2018 to 2033

Figure 169: South Asia and Pacific Market Volume (Metre) Analysis by Application, 2018 to 2033

Figure 170: South Asia and Pacific Market Value Share (%) and BPS Analysis by Application, 2023 to 2033

Figure 171: South Asia and Pacific Market Y-o-Y Growth (%) Projections by Application, 2023 to 2033

Figure 172: South Asia and Pacific Market Value (US$ Million) Analysis by End-use, 2018 to 2033

Figure 173: South Asia and Pacific Market Volume (Metre) Analysis by End-use, 2018 to 2033

Figure 174: South Asia and Pacific Market Value Share (%) and BPS Analysis by End-use, 2023 to 2033

Figure 175: South Asia and Pacific Market Y-o-Y Growth (%) Projections by End-use, 2023 to 2033

Figure 176: South Asia and Pacific Market Attractiveness by Product Type, 2023 to 2033

Figure 177: South Asia and Pacific Market Attractiveness by Material Type, 2023 to 2033

Figure 178: South Asia and Pacific Market Attractiveness by Application, 2023 to 2033

Figure 179: South Asia and Pacific Market Attractiveness by End-use, 2023 to 2033

Figure 180: South Asia and Pacific Market Attractiveness by Country, 2023 to 2033

Figure 181: East Asia Market Value (US$ Million) by Product Type, 2023 to 2033

Figure 182: East Asia Market Value (US$ Million) by Material Type, 2023 to 2033

Figure 183: East Asia Market Value (US$ Million) by Application, 2023 to 2033

Figure 184: East Asia Market Value (US$ Million) by End-use, 2023 to 2033

Figure 185: East Asia Market Value (US$ Million) by Country, 2023 to 2033

Figure 186: East Asia Market Value (US$ Million) Analysis by Country, 2018 to 2033

Figure 187: East Asia Market Volume (Metre) Analysis by Country, 2018 to 2033

Figure 188: East Asia Market Value Share (%) and BPS Analysis by Country, 2023 to 2033

Figure 189: East Asia Market Y-o-Y Growth (%) Projections by Country, 2023 to 2033

Figure 190: East Asia Market Value (US$ Million) Analysis by Product Type, 2018 to 2033

Figure 191: East Asia Market Volume (Metre) Analysis by Product Type, 2018 to 2033

Figure 192: East Asia Market Value Share (%) and BPS Analysis by Product Type, 2023 to 2033

Figure 193: East Asia Market Y-o-Y Growth (%) Projections by Product Type, 2023 to 2033

Figure 194: East Asia Market Value (US$ Million) Analysis by Material Type, 2018 to 2033

Figure 195: East Asia Market Volume (Metre) Analysis by Material Type, 2018 to 2033

Figure 196: East Asia Market Value Share (%) and BPS Analysis by Material Type, 2023 to 2033

Figure 197: East Asia Market Y-o-Y Growth (%) Projections by Material Type, 2023 to 2033

Figure 198: East Asia Market Value (US$ Million) Analysis by Application, 2018 to 2033

Figure 199: East Asia Market Volume (Metre) Analysis by Application, 2018 to 2033

Figure 200: East Asia Market Value Share (%) and BPS Analysis by Application, 2023 to 2033

Figure 201: East Asia Market Y-o-Y Growth (%) Projections by Application, 2023 to 2033

Figure 202: East Asia Market Value (US$ Million) Analysis by End-use, 2018 to 2033

Figure 203: East Asia Market Volume (Metre) Analysis by End-use, 2018 to 2033

Figure 204: East Asia Market Value Share (%) and BPS Analysis by End-use, 2023 to 2033

Figure 205: East Asia Market Y-o-Y Growth (%) Projections by End-use, 2023 to 2033

Figure 206: East Asia Market Attractiveness by Product Type, 2023 to 2033

Figure 207: East Asia Market Attractiveness by Material Type, 2023 to 2033

Figure 208: East Asia Market Attractiveness by Application, 2023 to 2033

Figure 209: East Asia Market Attractiveness by End-use, 2023 to 2033

Figure 210: East Asia Market Attractiveness by Country, 2023 to 2033

Figure 211: Middle East and Africa Market Value (US$ Million) by Product Type, 2023 to 2033

Figure 212: Middle East and Africa Market Value (US$ Million) by Material Type, 2023 to 2033

Figure 213: Middle East and Africa Market Value (US$ Million) by Application, 2023 to 2033

Figure 214: Middle East and Africa Market Value (US$ Million) by End-use, 2023 to 2033

Figure 215: Middle East and Africa Market Value (US$ Million) by Country, 2023 to 2033

Figure 216: Middle East and Africa Market Value (US$ Million) Analysis by Country, 2018 to 2033

Figure 217: Middle East and Africa Market Volume (Metre) Analysis by Country, 2018 to 2033

Figure 218: Middle East and Africa Market Value Share (%) and BPS Analysis by Country, 2023 to 2033

Figure 219: Middle East and Africa Market Y-o-Y Growth (%) Projections by Country, 2023 to 2033

Figure 220: Middle East and Africa Market Value (US$ Million) Analysis by Product Type, 2018 to 2033

Figure 221: Middle East and Africa Market Volume (Metre) Analysis by Product Type, 2018 to 2033

Figure 222: Middle East and Africa Market Value Share (%) and BPS Analysis by Product Type, 2023 to 2033

Figure 223: Middle East and Africa Market Y-o-Y Growth (%) Projections by Product Type, 2023 to 2033

Figure 224: Middle East and Africa Market Value (US$ Million) Analysis by Material Type, 2018 to 2033

Figure 225: Middle East and Africa Market Volume (Metre) Analysis by Material Type, 2018 to 2033

Figure 226: Middle East and Africa Market Value Share (%) and BPS Analysis by Material Type, 2023 to 2033

Figure 227: Middle East and Africa Market Y-o-Y Growth (%) Projections by Material Type, 2023 to 2033

Figure 228: Middle East and Africa Market Value (US$ Million) Analysis by Application, 2018 to 2033

Figure 229: Middle East and Africa Market Volume (Metre) Analysis by Application, 2018 to 2033

Figure 230: Middle East and Africa Market Value Share (%) and BPS Analysis by Application, 2023 to 2033

Figure 231: Middle East and Africa Market Y-o-Y Growth (%) Projections by Application, 2023 to 2033

Figure 232: Middle East and Africa Market Value (US$ Million) Analysis by End-use, 2018 to 2033

Figure 233: Middle East and Africa Market Volume (Metre) Analysis by End-use, 2018 to 2033

Figure 234: Middle East and Africa Market Value Share (%) and BPS Analysis by End-use, 2023 to 2033

Figure 235: Middle East and Africa Market Y-o-Y Growth (%) Projections by End-use, 2023 to 2033

Figure 236: Middle East and Africa Market Attractiveness by Product Type, 2023 to 2033

Figure 237: Middle East and Africa Market Attractiveness by Material Type, 2023 to 2033

Figure 238: Middle East and Africa Market Attractiveness by Application, 2023 to 2033

Figure 239: Middle East and Africa Market Attractiveness by End-use, 2023 to 2033

Figure 240: Middle East and Africa Market Attractiveness by Country, 2023 to 2033

Our Research Products

The "Full Research Suite" delivers actionable market intel, deep dives on markets or technologies, so clients act faster, cut risk, and unlock growth.

The Leaderboard benchmarks and ranks top vendors, classifying them as Established Leaders, Leading Challengers, or Disruptors & Challengers.

Locates where complements amplify value and substitutes erode it, forecasting net impact by horizon

We deliver granular, decision-grade intel: market sizing, 5-year forecasts, pricing, adoption, usage, revenue, and operational KPIs—plus competitor tracking, regulation, and value chains—across 60 countries broadly.

Spot the shifts before they hit your P&L. We track inflection points, adoption curves, pricing moves, and ecosystem plays to show where demand is heading, why it is changing, and what to do next across high-growth markets and disruptive tech

Real-time reads of user behavior. We track shifting priorities, perceptions of today’s and next-gen services, and provider experience, then pace how fast tech moves from trial to adoption, blending buyer, consumer, and channel inputs with social signals (#WhySwitch, #UX).

Partner with our analyst team to build a custom report designed around your business priorities. From analysing market trends to assessing competitors or crafting bespoke datasets, we tailor insights to your needs.

Supplier Intelligence

Discovery & Profiling

Capacity & Footprint

Performance & Risk

Compliance & Governance

Commercial Readiness

Who Supplies Whom

Scorecards & Shortlists

Playbooks & Docs

Category Intelligence

Definition & Scope

Demand & Use Cases

Cost Drivers

Market Structure

Supply Chain Map

Trade & Policy

Operating Norms

Deliverables

Buyer Intelligence

Account Basics

Spend & Scope

Procurement Model

Vendor Requirements

Terms & Policies

Entry Strategy

Pain Points & Triggers

Outputs

Pricing Analysis

Benchmarks

Trends

Should-Cost

Indexation

Landed Cost

Commercial Terms

Deliverables

Brand Analysis

Positioning & Value Prop

Share & Presence

Customer Evidence

Go-to-Market

Digital & Reputation

Compliance & Trust

KPIs & Gaps

Outputs

Full Research Suite comprises of:

Market outlook & trends analysis

Interviews & case studies

Strategic recommendations

Vendor profiles & capabilities analysis

5-year forecasts

8 regions and 60+ country-level data splits

Market segment data splits

12 months of continuous data updates

DELIVERED AS:

PDF EXCEL ONLINE

Rubber Conveyor Belt Market Size, Growth, and Forecast 2025 to 2035

Food Grade Crosslinked Polyvinylpolypyrrolidone (PVPP) Market Size and Share Forecast Outlook 2025 to 2035

Food Grade Cassia Gum Powder Market Size and Share Forecast Outlook 2025 to 2035

Food Grade Dry Film Lubricant Market Size and Share Forecast Outlook 2025 to 2035

Food Grade Tremella Polysaccharide Market Size and Share Forecast Outlook 2025 to 2035

Food Grade Solvent Market Analysis - Size and Share Forecast Outlook 2025 to 2035

Food Grade Industrial Gases Market Size and Share Forecast Outlook 2025 to 2035

Food-Grade Mixing Tank Market Size and Share Forecast Outlook 2025 to 2035

Food Grade Glass Market Analysis - Size, Share, & Forecast Outlook 2025 to 2035

Food Grade Gas Market Analysis - Size, Share, and Forecast Outlook 2025 to 2035

Food Grade Antifoams Market Size, Growth, and Forecast for 2025 to 2035

Analysis and Growth Projections for Food Grade Phosphate Business

Analysis and Growth Projections for Food Grade Carrageenan Market

Food Grade Lubricant Market Analysis by Base Oil Type, Product Type and Application Through 2035

Food Grade Butyric Acid Market Growth - Trends & Forecast 2025 to 2035

Food-Grade Glycerin Market Outlook - Growth & Industry Trends 2025 to 2035

Food Grade Sodium Hypochlorite Market Growth -Industry Trends 2025 to 2035

Food Grade Alcohol Market Trends - Growth & Industry Forecast 2025 to 2035

Food Grade Silica Market Insights – Demand & Applications 2025 to 2035

Food Grade Activated Carbon Market Report - Applications & Growth 2025 to 2035

Thank you!

You will receive an email from our Business Development Manager. Please be sure to check your SPAM/JUNK folder too.

Chat With

MaRIA