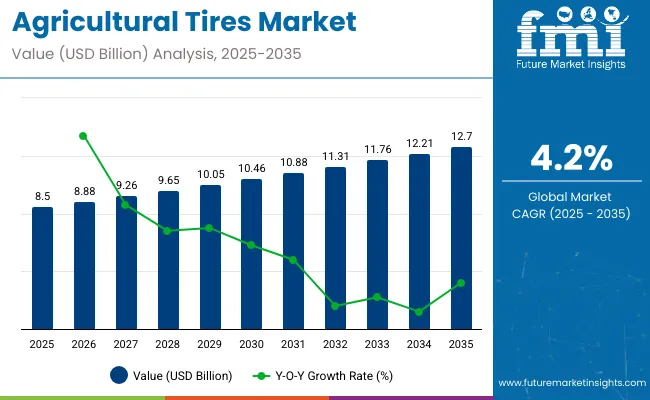

The agricultural tires market stands at USD 8.5 billion in 2025 and is expected to reach USD 12.7 billion by 2035, growing at a CAGR of 4.2%. Saturation point analysis indicates that the pace of growth will gradually moderate as key markets reach higher levels of mechanization and fleet penetration.

In mature regions such as North America and Europe, widespread adoption of modern tractors, harvesters, and specialized agricultural machinery suggests that incremental demand will increasingly be driven by replacement cycles rather than new equipment purchases. These markets approach a saturation point where volume growth slows, prompting manufacturers to focus on product differentiation, durability, and technological upgrades to sustain revenue.

Emerging regions, including Asia Pacific and parts of Latin America, still exhibit significant expansion potential as farm mechanization rises and equipment fleets are upgraded. Seasonal cycles, commodity prices, and farm income continue to influence tire replacement frequency and purchasing decisions, contributing to short-term fluctuations.

By examining saturation points, stakeholders can identify segments with limited organic growth and prioritize innovation in areas such as low-compaction tires, precision agriculture compatibility, and extended lifespan designs. These strategies allow the market to sustain value creation even as mature markets stabilize, ensuring long-term growth and reinforcing the importance of technological advancement and tailored solutions in the agricultural tires sector.

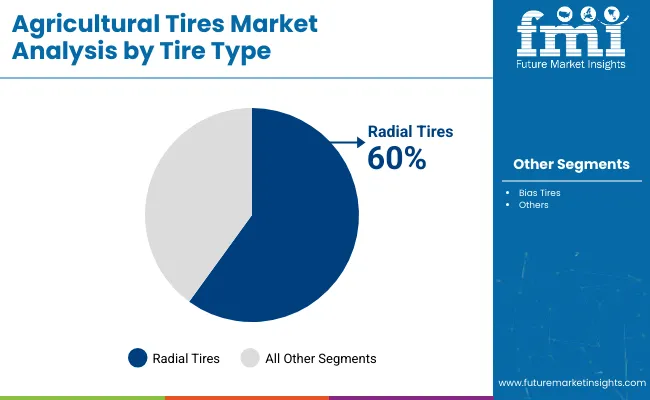

The market is growing in response to mechanization and precision farming. Global tractor production exceeded 3.2 million units in 2024, driving demand for high-performance tires. Radial tires now constitute around 55% of market volume, offering improved traction and reduced soil compaction. Advanced tread patterns and reinforced sidewalls are increasing tire lifespan by 15–20%, reducing replacement frequency.

The adoption of GPS-compatible tires for precision farming equipment has risen by 22% year-on-year, supporting optimized planting and harvesting operations. Manufacturers are investing in eco-friendly rubber compounds and tubeless designs to enhance fuel efficiency and minimize maintenance costs. Strategic alliances between tire producers and OEMs are expanding production capacity to meet projected CAGR of 5–6% through 2030.

The agricultural tires market is supported by multiple upstream sectors. Tractor and farm machinery manufacturing accounts for approximately 42%, as tires are integral to the performance and efficiency of modern agricultural equipment. Rubber and tire manufacturing contributes around 28%, supplying specialty compounds designed for load-bearing and traction.

Agricultural equipment dealers and distributors represent roughly 15%, managing distribution, replacement, and aftermarket services. Research and development in materials and tread design holds close to 10%, focusing on improving durability, fuel efficiency, and soil protection. Maintenance and service providers make up the remaining 5%, ensuring timely repairs and longevity of tire performance.

Demand is driven by rising mechanization in farming and increasing adoption of high-horsepower tractors and combine harvesters. Radial tires are gaining preference over bias-ply tires due to better fuel efficiency and longer lifespan. Replacement cycles range between 5 and 7 years for tractors and 3–5 years for smaller machinery. North America and Europe account for nearly 60% of global demand, while Asia Pacific is expanding rapidly due to the growth of mechanized farming and large-scale crop production. Emerging markets in Latin America and Africa are also witnessing increased adoption of high-performance agricultural tires.

Driving Force Mechanization and Farm Efficiency

Rising mechanization across farms is boosting the need for durable, high-performance tires. Modern tractors and harvesters require tires capable of supporting heavier loads while minimizing soil compaction. Radial tires reduce fuel consumption by up to 8% compared with traditional bias-ply tires and improve traction across varied soil conditions.

Farmers are increasingly investing in tires that provide longer operational life and reduce downtime, enhancing overall productivity. Government initiatives promoting farm modernization in emerging economies are further stimulating demand, as subsidized programs enable small and medium-sized farms to upgrade to higher-horsepower machinery equipped with advanced tires.

Growth Opportunity Specialty Tires and Aftermarket Services

Specialty tires designed for specific crops, terrains, and irrigation conditions offer significant growth potential. High-traction tires for wet paddy fields and wide-profile tires for vineyards and orchards are increasingly used. Aftermarket services such as retreading, on-farm tire installation, and maintenance contracts create recurring revenue streams

. Digital tire monitoring systems that track inflation, pressure, and wear are emerging, improving operational efficiency and reducing downtime. Manufacturers are leveraging partnerships with equipment OEMs to provide bundled solutions, driving both OEM-fitment and replacement demand. Expanding mechanized agriculture in Asia Pacific and Latin America is expected to further enhance market opportunities.

Emerging Trend Smart Tires and Technology Integration

Smart tires equipped with sensors to monitor pressure, load, and temperature are becoming more prevalent. Real-time data enables farmers to optimize field performance and reduce soil compaction. IoT-enabled solutions connect tires to farm management software, providing insights for precise planting, irrigation, and harvesting operations.

Advanced compounds and tread designs improve durability, traction, and fuel efficiency. Growth in precision agriculture and autonomous farming equipment is expected to accelerate the adoption of smart agricultural tires over the next decade, particularly in North America, Europe, and Asia Pacific.

Market Challenge High Cost and Raw Material Volatility

Agricultural tires are expensive, with prices ranging from USD 300 for small utility tires to over USD 5,000 for large tractor and harvester tires. Fluctuations in natural rubber, synthetic rubber, and steel cord prices impact manufacturing costs. Replacement and maintenance require trained personnel and specialized equipment.

Smaller farms in emerging markets may delay upgrades due to high initial investment. Supply chain disruptions and long lead times for high-performance tires can affect seasonal operations. Managing cost, raw material volatility, and timely availability remains a significant challenge for both manufacturers and farmers.

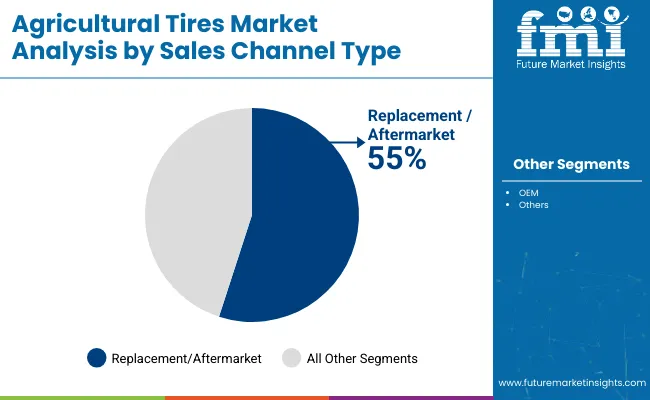

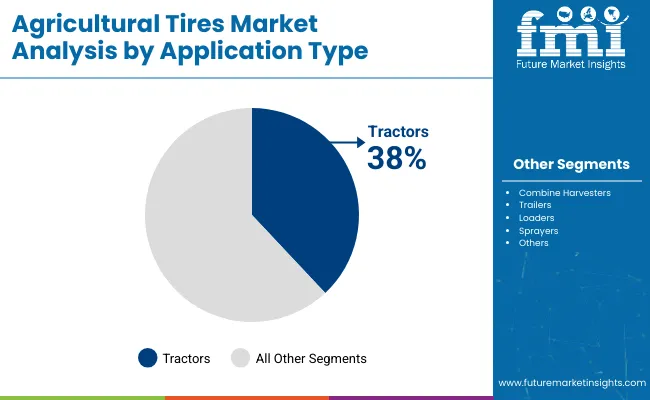

The agricultural tires market in 2025 is shaped by growing mechanization and demand for high-efficiency farm equipment. Replacement/aftermarket sales dominate at 55%, while OEM tires account for 45%. Tractors represent 38% of application-based demand, followed by combine harvesters at 25% and trailers at 15%. Radial tires hold 60% of the market, whereas bias tires account for 40%.

Major tire manufacturers such as Michelin, Bridgestone, and Titan Tire supply global OEMs and aftermarket channels. Market growth is driven by durability, traction performance, and soil preservation requirements. Advanced tread designs, load-bearing capacity, and tire longevity remain critical factors for commercial farmers, cooperatives, and OEMs investing in mechanized agriculture.

Replacement/aftermarket tires account for 55% of total sales, highlighting the need for ongoing maintenance and tire replacement in existing agricultural fleets. OEM tires contribute 45%, integrated into new tractors, harvesters, and loaders during manufacturing. Michelin, Bridgestone, and Titan Tire dominate both channels, providing durable radial and bias tires optimized for high load, traction, and soil protection.

Replacement sales are primarily driven by fleet operators seeking cost-effective performance upgrades, while OEM partnerships focus on design integration and quality certification. Regional distributors and dealers also influence aftermarket availability, ensuring timely supply and consistent tire performance. Channel segmentation supports fleet efficiency, operational cost reduction, and reliability across diverse agricultural operations.

Tractors dominate application-based demand with 38% market share, followed by combine harvesters at 25% and trailers at 15%. Loaders contribute 12%, sprayers 6%, and other equipment 4%. Radial tires are preferred for tractors and harvesters due to durability, fuel efficiency, and traction performance, whereas bias tires are widely used for trailers and sprayers requiring lower-cost solutions.

OEMs such as John Deere, AGCO, and CNH Industrial rely on Michelin, Bridgestone, and Titan Tire for equipment integration. Application-based tire selection ensures optimized soil contact, weight distribution, and operational reliability. Growth is fueled by increasing mechanization in developing markets and modernization of agricultural fleets.

Radial tires lead with 60% share, offering superior traction, lower soil compaction, and extended lifespan, particularly for tractors and combine harvesters. Bias tires account for 40%, suitable for lighter agricultural equipment and cost-sensitive applications. Radial tires are predominantly supplied by Michelin and Bridgestone, while Titan Tire and Continental focus on bias tire production.

Radial tire adoption is higher in mechanized commercial farming due to improved fuel efficiency and load capacity. Bias tires remain important in emerging markets and small-scale farms. OEMs and aftermarket suppliers collaborate to meet equipment-specific requirements and seasonal replacement cycles, ensuring performance consistency across diverse farming operations.

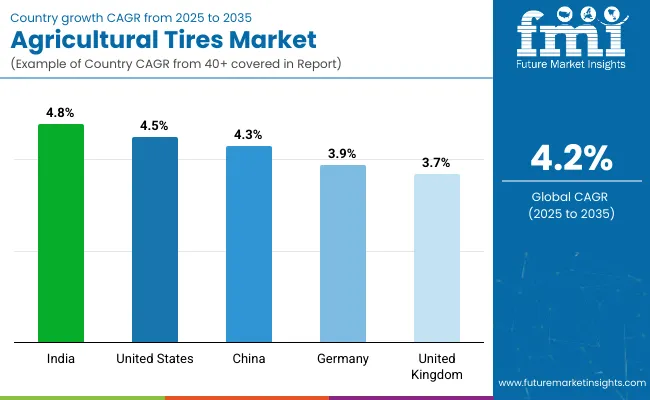

The global agricultural tires market is growing at a CAGR of 4.2% from 2025 to 2035. The United States leads at 4.5%, +7% above the global rate, driven by OECD-supported modernization of farming machinery and rising integration of high-performance tire solutions. India records 4.8%, +14% above the global benchmark, reflecting BRICS and ASEAN-linked growth in mechanized agriculture and demand for durable tires in commercial farms.

China follows at 4.3%, slightly above the global average, supported by BRICS-focused expansion in large-scale farming and domestic tire production. Germany stands at 3.9%, −7% under the global CAGR, influenced by a mature agricultural sector and gradual adoption of upgraded equipment. The United Kingdom posts 3.7%, −12% below the global rate, shaped by steady replacement cycles and incremental investment in farm machinery. Overall, BRICS nations are driving volume growth, while OECD markets maintain consistent development through equipment improvements and quality-focused solutions.

The United States agricultural tires market is projected to grow at a CAGR of 4.5%, slightly above the global 4.2%, resulting in a multiplication factor of 1.07. Growth is driven by mechanization in corn, wheat, and soybean farms, where large-scale industrial operations dominate. High-load-bearing and reinforced tires are increasingly adopted for tractors, combine harvesters, and balers to reduce downtime and improve field productivity. Titan International leads the market, supplying tires optimized for loamy and clay soils with multi-spectrum imaging compatibility. By 2035, over 1.2 million agricultural tire units are expected to be in active deployment across U.S. farms. Advanced tread designs and load-optimized compounds have enhanced durability and traction, supporting both commercial and family-owned farming operations.

China exhibits a CAGR of 4.3%, slightly above the global 4.2%, producing a multiplication factor of 1.02. Growth is attributed to mechanized rice, wheat, and corn cultivation, where both smallholder and commercial farms benefit from modern tires. Agricultural tires are designed for wet paddy fields, hilly terrains, and irrigated plains. Key companies such as Triangle Tyre have expanded domestic production and collaborated internationally to introduce durable, cost-efficient solutions. By 2035, over 1.65 million units are expected to be deployed. Modular tread patterns, long-endurance operation capability, and integration with automated farming equipment have enhanced soil protection and field efficiency. Tires supporting high-capacity tractors and rice transplanters are increasingly prioritized in strategic farming regions.

India records a CAGR of 4.8%, above the global 4.2%, yielding a multiplication factor of 1.14. Growth is fueled by rising farm mechanization and increasing deployment of small and medium tractors across rice, wheat, and sugarcane fields. Tires capable of operating in soft, water-logged soils and monsoon-affected regions are in high demand. CEAT Limited is a major manufacturer providing high-traction, reinforced tires suitable for heavy crop harvesting and irrigation-intensive fields. By 2035, over 1.4 million agricultural tire units are projected to be in use. Emphasis on load-optimized designs, sensor-integrated systems, and reinforced sidewalls ensures better durability, operational efficiency, and reduced downtime during peak farming seasons.

Germany is expected to grow at a CAGR of 3.9%, below the global 4.2%, resulting in a multiplication factor of 0.93. Growth is linked to adoption of high-efficiency tractors and specialized machinery for large-scale arable, orchard, and dairy farms. Low-compaction, soil-protecting tires are increasingly required to maintain soil health while improving traction. Continental AG dominates the German market with precision-engineered compounds and durable tread designs. By 2035, over 780,000 agricultural tire units are projected to be deployed. Focus on vineyard and orchard-specific machinery, energy infrastructure inspection, and precision farming integration has enhanced operational efficiency, fuel savings, and long-term productivity while ensuring minimal soil disruption.

The United Kingdom agricultural tires market is projected to grow at a CAGR of 3.7%, below the global 4.2%, producing a multiplication factor of 0.88. Growth is concentrated on livestock, dairy, and arable crop farms. Tires are designed to handle soft, wet fields with seasonal moisture variability. Titan International and Michelin provide durable solutions with optimized treads for traction and long service life. By 2035, over 670,000 units are expected to be deployed across UK farms. Lightweight, high-durability tires support mechanized farm operations, reduce fuel consumption, and protect soil structure. Integration with forage harvesters and tractors ensures efficiency in crop harvesting and livestock management.

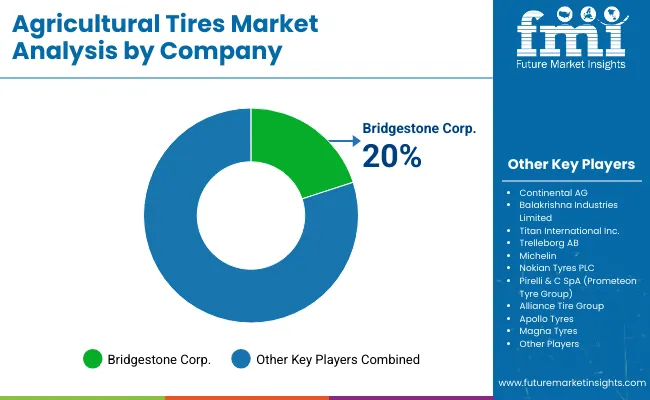

The agricultural tires sector is shaped by international tire makers and specialized farm equipment suppliers providing resilient, high-performance tires for tractors, harvesters, and other agricultural machinery. Bridgestone Corp. is recognized as the leading player in this market, supported by its wide-ranging tire portfolio, advanced rubber compounds, and a strong global distribution network spanning North America, Europe, and Asia. The company emphasizes enhanced traction, fuel efficiency, and load capacity through ongoing research, product refinement, and collaborations with equipment manufacturers. Continental AG and Balakrishna Industries Limited hold significant positions with high-quality offerings and cost-effective solutions adapted to regional farming conditions. Titan International Inc. and Trelleborg AB specialize in tires designed for heavy-duty farm equipment and large-scale operations, catering to demanding agricultural environments.

Other important players drive growth through innovation and geographic expansion. Michelin and Nokian Tyres PLC focus on long-lasting tires that protect soil integrity, while Pirelli & C SpA (PrometeonTyre Group) delivers high-performance solutions to global agricultural markets. Alliance Tire Group, Apollo Tyres, and Magna Tyres expand their reach in emerging regions by offering a variety of radial and bias tires suited for tractors and implements. The competitive environment is shaped by advancements in tire design, enhanced durability, and strategic alliances, allowing companies to support efficient operations and optimize productivity across diverse farming landscapes.

| Report Attributes | Details |

|---|---|

| Market Size (2025) | USD 8.5 billion |

| Projected Market Size (2035) | USD 12.7 billion |

| CAGR (2025 to 2035) | 4.2% |

| Base Year for Estimation | 2024 |

| Historical Period | 2020 to 2024 |

| Projection Period | 2025 to 2035 |

| Quantitative Units | USD billion for value |

| Sales Channel Types Analyzed (Segment 1) | OEM, Replacement/Aftermarket |

| Application Types Analyzed (Segment 2) | Tractors, Combine Harvesters, Sprayers, Trailers, Loaders, Other Application Types |

| Tire Types Analyzed (Segment 3) | Bias Tires, Radial Tires |

| Regions Covered | North America, Europe, Asia Pacific, Latin America, Middle East & Africa |

| Countries Covered | United States, Canada, Brazil, Mexico, Germany, France, Italy, United Kingdom, China, India, Japan, Australia, South Africa, UAE |

| Leading Players | Bridgestone Corp., Continental AG, Balakrishna Industries Limited, Titan International Inc., Trelleborg AB, Michelin, Nokian Tyres PLC, Pirelli & C SpA ( Prometeon Tyre Group), Alliance Tire Group, Apollo Tyres , Magna Tyres |

| Additional Attributes | Dollar sales by tire type and equipment application, demand dynamics across tractors, harvesters, and sprayers, regional trends across North America, Europe, and Asia-Pacific, innovation in radial and bias-ply designs, puncture-resistant materials, fuel-efficient treads, environmental impact of manufacturing and disposal, emerging use in precision farming and autonomous agricultural machinery |

The market size is valued at USD 8.5 billion in 2025.

It is projected to reach USD 12.7 billion by 2035.

The market is expected to grow at a CAGR of 4.2% during 2025-2035.

Radial Tires hold the largest share with 60% in 2025.

Bridgestone Corp. is the leading player with 20% share.

Full Research Suite comprises of:

Market outlook & trends analysis

Interviews & case studies

Strategic recommendations

Vendor profiles & capabilities analysis

5-year forecasts

8 regions and 60+ country-level data splits

Market segment data splits

12 months of continuous data updates

DELIVERED AS:

PDF EXCEL ONLINE

Agricultural Sprayers Market Size and Share Forecast Outlook 2025 to 2035

Agricultural Fumigant Market Size and Share Forecast Outlook 2025 to 2035

Agricultural Coatings Market Size and Share Forecast Outlook 2025 to 2035

Agricultural Secondary Nutrients Market Size and Share Forecast Outlook 2025 to 2035

Agricultural Chelates Market Size and Share Forecast Outlook 2025 to 2035

Agricultural Tractors Market Analysis - Size, Share, and Forecast Outlook 2025 to 2035

Agricultural Pheromones Market Size and Share Forecast Outlook 2025 to 2035

Agricultural Adjuvant Market - Size, Share, and Forecast Outlook 2025 to 2035

Agricultural Microbials Market Size and Share Forecast Outlook 2025 to 2035

Agricultural Gloves Market Size and Share Forecast Outlook 2025 to 2035

Agricultural Activator Adjuvant Market Analysis - Size, Share, and Forecast Outlook 2025 to 2035

Agricultural Surfactants Market Analysis – Size, Share, and Forecast Outlook 2025 to 2035

Agricultural Testing Services Market Growth - Trends & Forecast 2025 to 2035

Agricultural Mapping Services Market Growth - Trends & Forecast 2025 to 2035

Agricultural Grade Zinc Chemicals Market Growth - Trends & Forecast 2025 to 2035

Agricultural Fabrics Market Growth - Trends & Forecast 2025 to 2035

Agricultural Food Grade Rubber Conveyor Belt Market Growth - Trends & Forecast 2025 to 2035

Agricultural Nets Market Growth - Trends & Forecast 2025 to 2035

Agricultural Equipment Market Growth - Trends & Forecast 2025 to 2035

A Detailed Competition Share Assessment of the Agricultural Sprayers Market

Thank you!

You will receive an email from our Business Development Manager. Please be sure to check your SPAM/JUNK folder too.

Chat With

MaRIA