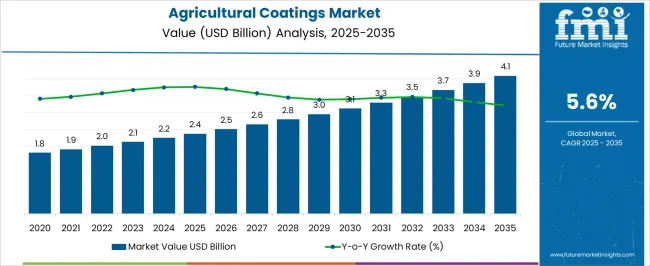

The agricultural coatings market is estimated to be valued at USD 2.4 billion in 2025 and is projected to reach USD 4.1 billion by 2035, registering a compound annual growth rate (CAGR) of 5.6% over the forecast period.

This growth represents an absolute dollar opportunity of USD 1.7 billion over the decade. Annual growth shows a consistent upward trend, with values moving from USD 2.4 billion in 2025 to USD 2.8 billion in 2028, USD 3.1 billion in 2031, and USD 3.9 billion in 2034. The steady rise highlights strong potential for manufacturers and suppliers to increase capacity, strengthen distribution, and capture greater market share across different agricultural applications.

The absolute dollar opportunity illustrates how the agricultural coatings market is steadily expanding over the forecast period. From USD 2.4 billion in 2025 to USD 4.1 billion in 2035, the market is expected to add USD 1.7 billion in new revenue opportunities. Intermediate milestones such as USD 3.0 billion in 2029 and USD 3.5 billion in 2033 indicate steady demand growth. This consistent upward trajectory allows stakeholders to strategically align resources, expand product offerings, and secure stronger positions in the market, ensuring participation in the cumulative growth potential within agricultural coating solutions between 2025 and 2035.

| Metric | Value |

|---|---|

| Agricultural Coatings Market Estimated Value in (2025 E) | USD 2.4 billion |

| Agricultural Coatings Market Forecast Value in (2035 F) | USD 4.1 billion |

| Forecast CAGR (2025 to 2035) | 5.6% |

The agricultural coatings market is part of the larger agricultural inputs market, which includes fertilizers, crop protection chemicals, biologicals, and seed technologies. In 2025, agricultural coatings are estimated to represent around 4% of the overall agricultural inputs market, reflecting their growing role in improving seed performance, crop protection, and yield efficiency. With the parent market projected to expand from about USD 60.0 billion in 2025 to USD 101.0 billion in 2035, the agricultural coatings segment’s rise from USD 2.4 billion in 2025 to USD 4.1 billion in 2035 at a CAGR of 5.6% accounts for nearly 3.5–4.0% of the incremental growth.

Within the parent market, fertilizers account for nearly 45% of total value, crop protection contributes about 35%, and biologicals hold close to 12%. Coatings, although a smaller segment at 4%, are expanding faster than several traditional categories, supported by their steady CAGR of 5.6%. The absolute increase of USD 1.7 billion over the decade represents around 4% of the parent market’s total expansion. This demonstrates how coatings are steadily gaining importance, creating opportunities for companies to strengthen their portfolios, enhance adoption in seed treatments, and build long-term value in the agricultural inputs market.

The agricultural coatings market is witnessing steady growth, supported by the rising focus on improving crop yield, protecting seeds and plants from environmental stress, and enhancing overall agricultural productivity. The increasing adoption of advanced coating technologies in seed treatment, fertilizers, and agrochemicals is driving demand globally. Government initiatives promoting sustainable farming practices and the use of environmentally friendly materials are further influencing market expansion.

Innovations in coating formulations, particularly in biodegradable and polymer-based solutions, are improving product performance and application efficiency. The ability of agricultural coatings to provide controlled release of active ingredients, protect against pests and diseases, and enhance seed germination rates is being widely recognized by farmers and agribusinesses.

Rapid growth in commercial farming, coupled with the need to optimize input usage and reduce wastage, is reinforcing the demand for high-performance coatings As climate variability continues to challenge agricultural productivity, the adoption of coatings that improve resilience and efficiency is expected to remain a key driver for the market’s growth in the coming years.

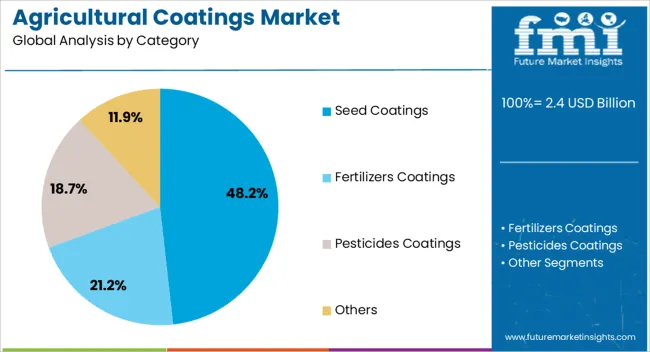

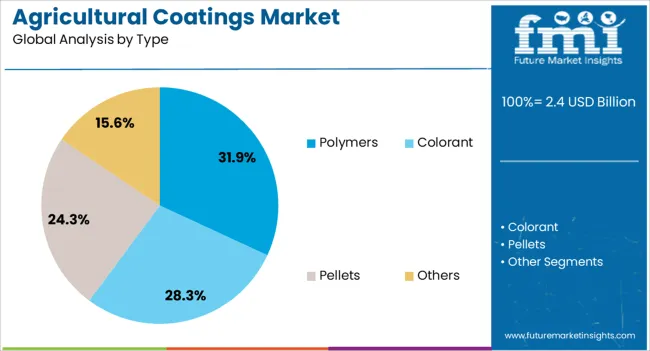

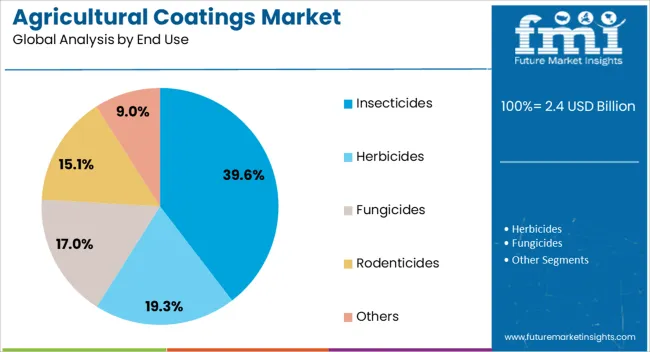

The agricultural coatings market is segmented by category, type, end use, and geographic regions. By category, agricultural coatings market is divided into seed coatings, fertilizers coatings, pesticides coatings, and others. In terms of type, agricultural coatings market is classified into polymers, colorant, pellets, and others. Based on end use, agricultural coatings market is segmented into insecticides, herbicides, fungicides, rodenticides, and others. Regionally, the agricultural coatings industry is classified into North America, Latin America, Western Europe, Eastern Europe, Balkan & Baltic Countries, Russia & Belarus, Central Asia, East Asia, South Asia & Pacific, and the Middle East & Africa.

The seed coatings segment is projected to hold 48.2% of the agricultural coatings market revenue share in 2025, making it the largest category. This leadership is being driven by the increasing focus on improving seed performance through protection and enhancement techniques. Seed coatings provide multiple benefits, including uniform planting, enhanced germination rates, and early-stage protection against pests, diseases, and environmental stress.

They enable the controlled release of nutrients and active ingredients, supporting healthier plant establishment. The demand for seed coatings is being reinforced by the growth of precision agriculture and the need to ensure optimal crop yields with minimal resource wastage.

Advancements in coating technologies have led to the development of formulations that are more durable, environmentally friendly, and compatible with various seed types As global food demand rises and arable land becomes more limited, seed coatings are expected to remain essential in ensuring consistent agricultural output while supporting sustainable farming practices.

The polymers segment is anticipated to account for 31.9% of the agricultural coatings market revenue share in 2025, positioning it as the leading type. Its dominance is attributed to the superior protective and functional properties polymers provide in agricultural applications. Polymer coatings enhance the durability, adhesion, and weather resistance of seeds, fertilizers, and agrochemicals, ensuring sustained performance under varying climatic conditions.

Their versatility allows for customized formulations that can deliver active ingredients over extended periods, improving efficacy and reducing application frequency. Growing interest in biodegradable polymer coatings is also shaping market trends, as environmental regulations and sustainability goals become more prominent in the agricultural sector.

The segment’s growth is supported by technological advancements in polymer chemistry, enabling coatings that are both high-performing and eco-friendly As farmers increasingly prioritize efficiency, cost-effectiveness, and environmental responsibility, polymer-based coatings are expected to retain their leading position in the market.

The insecticides segment is expected to represent 39.6% of the agricultural coatings market revenue share in 2025, making it the largest end-use segment. This dominance is being reinforced by the critical role insecticide coatings play in protecting crops from pest damage during vulnerable growth stages. Coatings applied to seeds or plants enable targeted delivery of active ingredients, reducing the need for repeated spraying and minimizing environmental exposure.

The segment is benefiting from growing awareness of integrated pest management practices that prioritize precise application to improve efficacy and reduce chemical usage. Rising pest resistance to conventional treatments is also driving the development of advanced insecticidal coatings with improved modes of action.

As regulatory pressures increase on broad-spectrum pesticide use, coatings that deliver controlled and localized protection are gaining traction The growing adoption of insecticide coatings in both large-scale commercial farming and specialty crop production is expected to sustain the segment’s leadership in the years ahead.

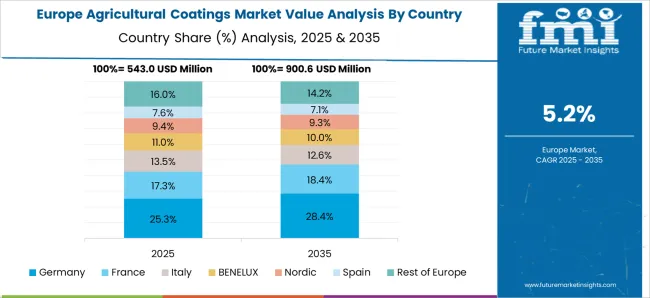

The agricultural coatings market is expanding as farmers and agribusinesses seek enhanced crop protection, improved seed performance, and optimized fertilizer efficiency. North America and Europe lead adoption with advanced polymer coatings, biobased formulations, and precision farming integration. Asia-Pacific shows rapid growth driven by rising food demand, expanding crop acreage, and government initiatives to modernize agriculture. Manufacturers differentiate through coating material innovation, controlled-release technologies, and eco-friendly solutions. Regional differences in farming practices, regulatory standards, and crop types strongly influence product adoption, performance, and global competitiveness.

Seed coatings represent one of the strongest growth areas in the agricultural coatings market. In North America and Europe, advanced polymer-based coatings with micro-nutrient delivery and pesticide integration support higher yields and resistance to diseases. Asia-Pacific markets adopt seed coatings primarily for improved germination, affordability, and resistance to variable weather conditions. Differences in crop type, farming intensity, and technology adoption strongly influence coating material, thickness, and additive selection. Leading suppliers provide multifunctional coatings designed for precision farming, while regional manufacturers focus on cost-effective seed protection solutions. Seed performance contrasts shape adoption, farmer confidence, and global market competitiveness across agricultural regions.

Fertilizer coatings are key to improving nutrient use efficiency and minimizing losses. North America and Europe emphasize controlled-release coatings with biodegradable materials to meet environmental standards and reduce leaching. Asia-Pacific markets prioritize affordability and scalability, adopting cost-effective coatings that balance efficiency and nutrient availability for staple crops. Differences in soil quality, irrigation practices, and environmental regulation affect coating adoption, formulation, and release rate design. Leading suppliers provide advanced nanocoatings and biobased polymers to extend nutrient availability, while regional players offer simple polymer or sulfur coatings. Fertilizer efficiency contrasts drive adoption, productivity gains, and competitiveness globally in the agricultural coatings market.

Regulatory standards play a crucial role in shaping agricultural coating demand. North America and Europe enforce stringent regulations that limit synthetic chemical use, pushing adoption of eco-friendly, biodegradable, and biopolymer coatings. Asia-Pacific markets vary widely: developed regions follow stricter sustainability goals, while developing regions prioritize affordability over advanced compliance. Differences in policy enforcement, certification requirements, and sustainability incentives influence material selection, production costs, and market entry strategies. Leading suppliers align products with EU REACH, EPA, and global sustainability frameworks, while regional manufacturers design practical solutions for local requirements. Regulatory contrasts drive adoption patterns, innovation strategies, and overall competitiveness across the global market.

The agricultural coatings market is diversifying beyond traditional seed and fertilizer applications. North America and Europe explore coatings for crop protection films, pesticide formulations, and precision farming tools that enhance durability and effectiveness. Asia-Pacific markets focus on affordable, multi-purpose coatings that improve efficiency across broad agricultural practices, including post-harvest treatments. Differences in technology adoption, farming scale, and crop diversity influence application expansion and formulation design. Leading suppliers invest in R&D to develop high-performance, multifunctional coatings with sustainable benefits, while regional players focus on accessible, cost-driven products. Application expansion contrasts shape innovation pipelines, adoption rates, and competitive positioning in the global agricultural coatings market.

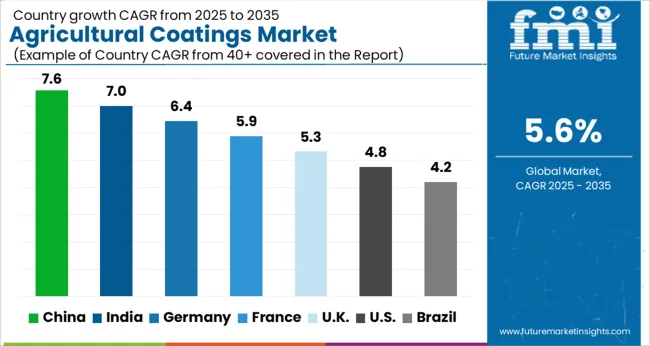

| Country | CAGR |

|---|---|

| China | 7.6% |

| India | 7.0% |

| Germany | 6.4% |

| France | 5.9% |

| UK | 5.3% |

| USA | 4.8% |

| Brazil | 4.2% |

The global agricultural coatings market is projected to grow at a 5.6% CAGR through 2035, supported by demand across seed treatments, fertilizers, and crop protection. Among BRICS nations, China led with 7.6% growth as large-scale production and field applications were advanced, while India at 7.0% expanded adoption in crop enhancement and protection practices. In the OECD region, Germany at 6.4% sustained steady utilization of coatings in precision agriculture under strict compliance frameworks, while the United Kingdom at 5.3% focused on moderate-scale use across seed and soil conditioning. The USA, growing at 4.8%, maintained consistent applications in farming and horticultural activities under federal agricultural and safety regulations. This report includes insights on 40+ countries; the top countries are shown here for reference.

The agricultural coatings market in China is anticipated to grow at a CAGR of 7.6%, supported by rising adoption in seed treatment, crop protection, and post harvest applications. Demand is being driven by coatings that enhance productivity, improve crop health, and extend shelf life. Local manufacturers are being encouraged to provide cost effective, durable, and eco friendly solutions. Distribution through agricultural suppliers, cooperatives, and farm input distributors is being strengthened. Research is being conducted to advance coating formulations that reduce waste and improve nutrient efficiency. Expanding agricultural activities, increasing food demand, and government focus on sustainable farming are considered key factors fueling the agricultural coatings market in China.

In India, the agricultural coatings market is projected to record a CAGR of 7.0%, driven by expanding cultivation areas, growing demand for food quality, and rising use of advanced farming techniques. Adoption is being promoted for coatings that improve yield, prevent spoilage, and enhance crop resilience. Local producers are being urged to deliver efficient, affordable, and sustainable solutions. Distribution through rural cooperatives, agricultural retailers, and seed companies is being expanded. Pilot projects and awareness programs are being implemented to encourage farmers to use modern coatings. Rising food production needs, adoption of scientific farming, and government incentives are considered major drivers of the agricultural coatings market in India.

Germany is expected to witness steady expansion in the agricultural coatings market at a CAGR of 6.4%, influenced by demand from seed treatment, greenhouse farming, and crop protection. Adoption is being encouraged for coatings that ensure efficiency, sustainability, and compliance with environmental standards. Manufacturers are being urged to supply innovative, reliable, and advanced coating solutions. Distribution through agricultural distributors, cooperatives, and agrochemical companies is being strengthened. Research activities targeting bio based and environmentally safe coatings are being conducted. Increasing demand for sustainable agriculture, compliance with EU regulations, and rising focus on yield improvement are considered essential drivers of the agricultural coatings market in Germany.

The agricultural coatings market in the United Kingdom is set to grow at a CAGR of 5.3%, supported by demand from seed enhancement, post harvest applications, and advanced crop protection methods. Use is being promoted for coatings that provide sustainability, efficiency, and improved productivity. Manufacturers are being encouraged to supply innovative, durable, and eco friendly solutions. Distribution through farm input suppliers, cooperatives, and agricultural retailers is being optimized. Awareness initiatives and demonstration projects are being conducted to highlight the benefits of agricultural coatings. Rising food security concerns, modernization of farming practices, and sustainability policies are considered vital factors driving the agricultural coatings market in the United Kingdom.

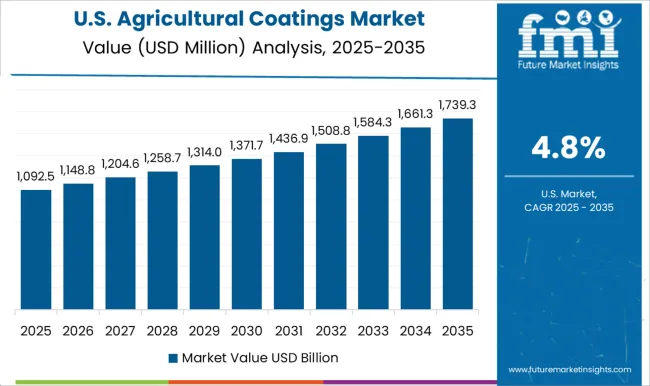

The agricultural coatings market in the United States is projected to grow at a CAGR of 4.8%, influenced by demand from precision farming, crop protection, and post harvest preservation. Adoption is being encouraged for coatings that provide reliability, sustainability, and compliance with environmental standards. Manufacturers are being urged to deliver advanced, safe, and cost effective solutions. Distribution through agricultural cooperatives, input suppliers, and seed companies is being strengthened. Research into efficiency improvements, environmental performance, and new formulations is being carried out. Expansion of precision agriculture, food preservation needs, and sustainability goals are recognized as key factors contributing to the agricultural coatings market in the United States.

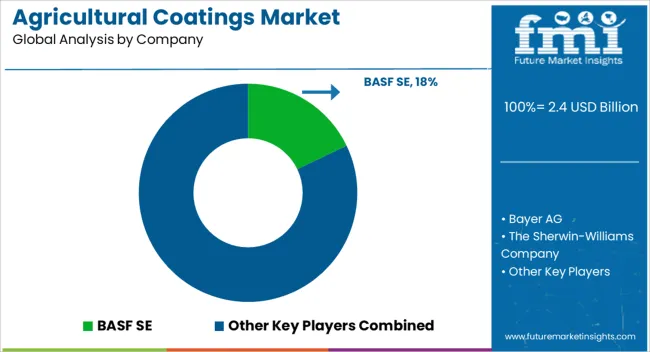

The agricultural coatings market is driven by a diverse range of global suppliers that focus on providing advanced protective and functional coatings to enhance the performance and longevity of agricultural equipment, storage, and infrastructure. BASF SE and Bayer AG play significant roles by integrating their chemical expertise into coatings that improve resistance to harsh weather, chemicals, and mechanical stress. Alongside them, The Sherwin-Williams Company and AkzoNobel bring extensive experience in industrial and specialty coatings, offering products tailored to the agricultural sector’s durability and sustainability requirements.

Other major contributors include PPG Industries and Valspar Corporation, both recognized for their wide portfolio of protective coatings that extend the service life of agricultural tools, machinery, and buildings. Hempel A/S further strengthens the market with solutions focused on corrosion protection and performance under extreme conditions. Meanwhile, Covestro AG leverages its polymer expertise to supply innovative coating materials that address the growing demand for eco-friendly and energy-efficient solutions. RPM International Inc. rounds out the competitive landscape by delivering specialty coatings and sealants that meet the evolving needs of agricultural operations.

Together, these leading companies shape the agricultural coatings market by investing in innovation, sustainability, and performance-driven products. Their focus extends beyond basic protection to include coatings that enhance efficiency, reduce maintenance costs, and contribute to the sustainability goals of modern agriculture. With increasing emphasis on environmental safety and resource optimization, the role of these suppliers will continue to expand in supporting the agricultural industry worldwide.

| Item | Value |

|---|---|

| Quantitative Units | USD 2.4 billion |

| Category | Seed Coatings, Fertilizers Coatings, Pesticides Coatings, and Others |

| Type | Polymers, Colorant, Pellets, and Others |

| End Use | Insecticides, Herbicides, Fungicides, Rodenticides, and Others |

| Regions Covered | North America, Europe, Asia-Pacific, Latin America, Middle East & Africa |

| Country Covered | United States, Canada, Germany, France, United Kingdom, China, Japan, India, Brazil, South Africa |

| Key Companies Profiled | BASF SE, Bayer AG, The Sherwin-Williams Company, AkzoNobel, PPG Industries, Valspar Corporation, Hempel A/S, Covestro AG, and RPM International Inc |

| Additional Attributes | Dollar sales vary by coating type, including seed coatings, fertilizer coatings, and pesticide coatings; by material, such as polymers, colorants, and minerals; by application, spanning crop protection, yield enhancement, and nutrient management; by end-use, covering cereals, pulses, oilseeds, and fruits & vegetables; by region, led by North America, Europe, and Asia-Pacific. Growth is driven by sustainable farming practices, precision agriculture, and demand for higher crop productivity. |

The global agricultural coatings market is estimated to be valued at USD 2.4 billion in 2025.

The market size for the agricultural coatings market is projected to reach USD 4.1 billion by 2035.

The agricultural coatings market is expected to grow at a 5.6% CAGR between 2025 and 2035.

The key product types in agricultural coatings market are seed coatings, fertilizers coatings, pesticides coatings and others.

In terms of type, polymers segment to command 31.9% share in the agricultural coatings market in 2025.

Full Research Suite comprises of:

Market outlook & trends analysis

Interviews & case studies

Strategic recommendations

Vendor profiles & capabilities analysis

5-year forecasts

8 regions and 60+ country-level data splits

Market segment data splits

12 months of continuous data updates

DELIVERED AS:

PDF EXCEL ONLINE

Agricultural Multifunction Grab Bucket Market Size and Share Forecast Outlook 2025 to 2035

Agricultural Bucket Market Size and Share Forecast Outlook 2025 to 2035

Agricultural Lighting Market Forecast and Outlook 2025 to 2035

Agricultural Sprayers Market Size and Share Forecast Outlook 2025 to 2035

Agricultural Fumigant Market Size and Share Forecast Outlook 2025 to 2035

Agricultural Secondary Nutrients Market Size and Share Forecast Outlook 2025 to 2035

Agricultural Chelates Market Size and Share Forecast Outlook 2025 to 2035

Agricultural Tractors Market Analysis - Size, Share, and Forecast Outlook 2025 to 2035

Agricultural Tires Market Analysis - Size, Share, and Forecast Outlook 2025 to 2035

Agricultural Pheromones Market Size and Share Forecast Outlook 2025 to 2035

Agricultural Adjuvant Market - Size, Share, and Forecast Outlook 2025 to 2035

Agricultural Microbials Market Size and Share Forecast Outlook 2025 to 2035

Agricultural Gloves Market Size and Share Forecast Outlook 2025 to 2035

Agricultural Activator Adjuvant Market Analysis - Size, Share, and Forecast Outlook 2025 to 2035

Agricultural Surfactants Market Analysis – Size, Share, and Forecast Outlook 2025 to 2035

Agricultural Testing Services Market Growth - Trends & Forecast 2025 to 2035

Agricultural Mapping Services Market Growth - Trends & Forecast 2025 to 2035

Agricultural Grade Zinc Chemicals Market Growth - Trends & Forecast 2025 to 2035

Agricultural Fabrics Market Growth - Trends & Forecast 2025 to 2035

Agricultural Food Grade Rubber Conveyor Belt Market Growth - Trends & Forecast 2025 to 2035

Thank you!

You will receive an email from our Business Development Manager. Please be sure to check your SPAM/JUNK folder too.

Chat With

MaRIA