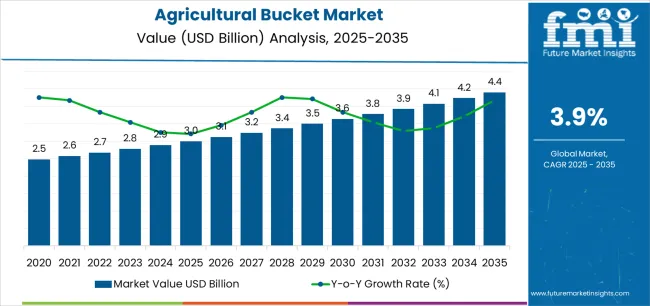

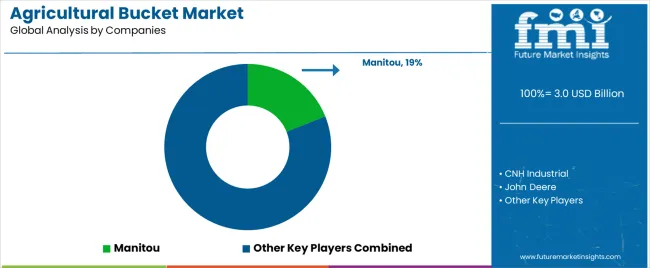

The global agricultural bucket market is projected to grow from USD 3.0 billion in 2025 to approximately USD 4.4 billion by 2035, recording an absolute increase of USD 1.4 billion over the forecast period. This translates into a total growth of 46.6%, with the market forecast to expand at a CAGR of 3.9% between 2025 and 2035. The market size is expected to grow by nearly 1.5X during the same period, supported by increasing mechanization of agricultural operations driving demand for versatile attachment systems, growing adoption of precision farming equipment requiring specialized bucket configurations, and rising efficiency requirements in material handling operations across farming and forestry applications.

Farm equipment operators and agricultural contractors across developed and emerging markets are investing in bucket attachments that enhance operational versatility of tractors and loaders while reducing labor requirements for routine material handling tasks. Consolidation of agricultural operations into larger commercial farming enterprises creates demand for durable equipment capable of sustained daily operation across diverse applications including feed distribution, soil management, and crop material transport. Forestry operations and orchard management increasingly rely on specialized bucket designs that accommodate irregular materials and operate effectively in challenging terrain conditions.

Government support programs promoting agricultural mechanization in emerging economies are accelerating adoption of loader equipment and compatible bucket attachments that improve productivity metrics. Infrastructure development in rural regions including road construction and drainage projects creates secondary demand for agricultural buckets through contractor procurement channels serving multiple application segments beyond traditional farming operations.

| Metric | Value |

|---|---|

| Market Value (2025) | USD 3.0 billion |

| Market Forecast Value (2035) | USD 4.4 billion |

| Forecast CAGR (2025-2035) | 3.9% |

| MECHANIZATION TRENDS | OPERATIONAL EFFICIENCY | EQUIPMENT VERSATILITY |

|---|---|---|

| Agricultural Modernization Continuous expansion of mechanized farming practices across established and emerging agricultural regions driving demand for versatile equipment attachments. Farm Consolidation Patterns Growing scale of commercial farming operations requiring durable equipment supporting diverse material handling applications throughout production cycles. Labor Shortage Response Declining agricultural workforce availability creating pressure to adopt mechanical solutions that reduce manual labor requirements for routine operations. |

Material Handling Requirements Daily farm operations requiring efficient transfer of feed materials, soil amendments, harvested crops, and waste products across production facilities. Multi-Purpose Equipment Farm operators investing in attachment systems that maximize utility of existing tractor and loader fleets while minimizing capital expenditure. Productivity Enhancement Operational efficiency targets driving adoption of specialized bucket designs that reduce cycle times and improve material handling precision. |

Application Flexibility Diverse farming operations requiring bucket configurations that adapt to varying material types, density characteristics, and handling requirements. Terrain Adaptability Agricultural and forestry operations in challenging terrain requiring specialized tilt mechanisms that maintain material control on sloped surfaces. Quick Attachment Systems Growing preference for universal mounting standards enabling rapid bucket changes between different operational tasks throughout working days. |

| Category | Segments Covered |

|---|---|

| By Bucket Type | Tilt Bucket, Clamshell Bucket, Others |

| By Application | Traditional Agriculture, Forestry and Orchards, Others |

| By Region | North America, Europe, Asia Pacific, Latin America, Middle East & Africa |

| Segment | 2025 to 2035 Outlook |

|---|---|

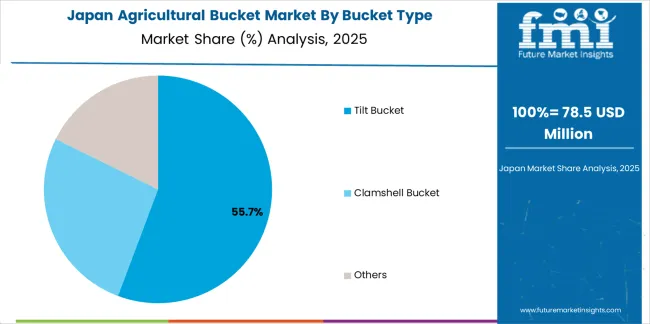

| Tilt Bucket | Leader in 2025 with 57.3% market share, expected to maintain dominance through 2035. Widely adopted for general material handling applications requiring controlled dumping angles and precise material placement. Mechanical or hydraulic tilt mechanisms provide operational flexibility across varied terrain conditions, supporting adoption in traditional farming, construction, and landscaping applications. Momentum: steady growth driven by farm mechanization and equipment replacement cycles in established agricultural markets. Watchouts: hydraulic system complexity increasing maintenance requirements, price sensitivity in cost-focused agricultural segments limiting premium feature adoption. |

| Clamshell Bucket | Represents 31.8% market share in 2025, serving specialized applications requiring material containment during transport or handling of loose materials including grain, feed, and organic matter. Dual-jaw design provides superior material retention compared to standard buckets, supporting adoption in confined spaces and operations requiring minimal spillage. Momentum: moderate growth driven by livestock operations and material processing applications requiring controlled handling of bulk agricultural products. Watchouts: higher complexity and cost compared to tilt buckets, maintenance requirements for hydraulic cylinders and pivot mechanisms, limited utility for dense or compacted materials. |

| Others | Niche segment at 10.9% share including specialty designs such as grapple buckets, rock buckets, and screening buckets serving specific agricultural and land management applications. Limited volume but supports specialized operations requiring unique material handling characteristics. Momentum: selective growth in forestry operations and land clearing applications requiring integrated grapple functionality. Watchouts: application-specific designs limiting market potential, higher unit costs restricting adoption to specialized contractors and large farming operations. |

| Segment | 2025 to 2035 Outlook |

|---|---|

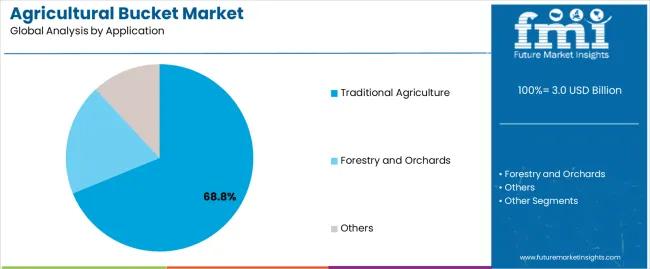

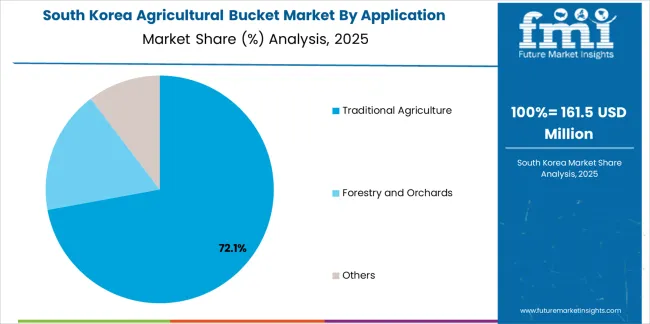

| Traditional Agriculture | Dominant segment with 68.9% market share in 2025, encompassing crop farming, livestock operations, and general farm maintenance activities requiring versatile material handling capabilities. Applications include feed distribution, manure management, soil preparation, and crop material transport supporting daily operational requirements across diverse farming operations. Momentum: steady growth supported by ongoing farm mechanization in emerging markets and equipment replacement cycles in developed agricultural regions. Efficiency improvements and labor cost pressures driving adoption of mechanical handling solutions. Watchouts: commodity price volatility affecting farm equipment investment decisions, weather-related disruptions impacting agricultural incomes and capital spending, regional variations in mechanization rates creating uneven market development patterns. |

| Forestry and Orchards | Accounts for 22.4% share in 2025, serving specialized operations in timber management, orchard maintenance, and land clearing applications requiring bucket designs adapted to irregular materials and challenging terrain. Operations demand enhanced tilt capabilities for slope work and durable construction for handling branches, stumps, and dense vegetation. Momentum: moderate growth driven by commercial forestry operations and high-value orchard developments requiring specialized equipment. Sustainability initiatives supporting forest management activities creating demand for efficient material handling systems. Watchouts: seasonal operational patterns affecting equipment utilization rates, specialized design requirements limiting supplier options, higher price points compared to agricultural buckets restricting adoption in cost-sensitive forestry contractors. |

| Others | Residual segment at 8.7% share including rural construction, landscaping, municipal maintenance, and infrastructure projects utilizing agricultural-grade buckets for non-farming applications. Diverse applications ranging from roadwork to facility maintenance where agricultural equipment serves secondary functions. Momentum: selective growth as contractors and municipalities leverage agricultural equipment for versatile material handling across multiple project types. Watchouts: competition from purpose-built construction equipment, limited product differentiation for non-agricultural applications, price pressure from industrial-grade alternatives offering comparable functionality. |

| DRIVERS | RESTRAINTS | KEY TRENDS |

|---|---|---|

| Farm Mechanization Expansion Continuing adoption of mechanical equipment across global agricultural regions reducing manual labor requirements and improving operational productivity. Commercial Agriculture Growth Increasing scale of farming operations requiring versatile equipment supporting diverse material handling applications throughout production cycles. Equipment Replacement Cycles Aging agricultural equipment fleets in developed markets creating sustained demand for bucket attachments compatible with modern loader systems. |

Agricultural Income Volatility Commodity price fluctuations and weather uncertainties affecting farm profitability and equipment investment decisions across agricultural sectors. Initial Cost Barriers Capital expenditure requirements for bucket attachments and compatible loader systems limiting adoption among small-scale farmers in emerging markets. Maintenance Complexity Hydraulic systems and mechanical components requiring regular maintenance and creating operational cost considerations for equipment operators. |

Quick Coupling Systems Standardization of universal mounting interfaces enabling rapid bucket changes and improving equipment versatility across multiple daily operations. Material Optimization Development of high-strength steel formulations and advanced welding techniques improving bucket durability while reducing unit weight and operational costs. Precision Design Integration Incorporation of optimized bucket geometries and edge configurations improving material penetration, retention, and discharge characteristics for specific applications. |

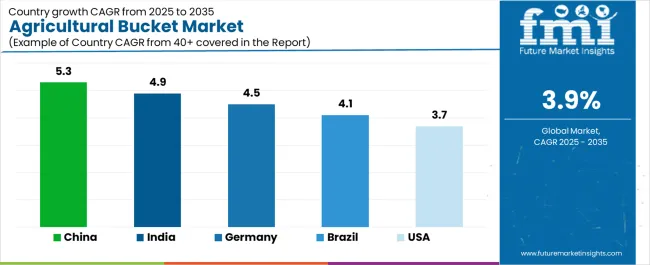

| Country | CAGR (2025-2035) |

|---|---|

| China | 5.3% |

| India | 4.9% |

| Germany | 4.5% |

| Brazil | 4.1% |

| United States | 3.7% |

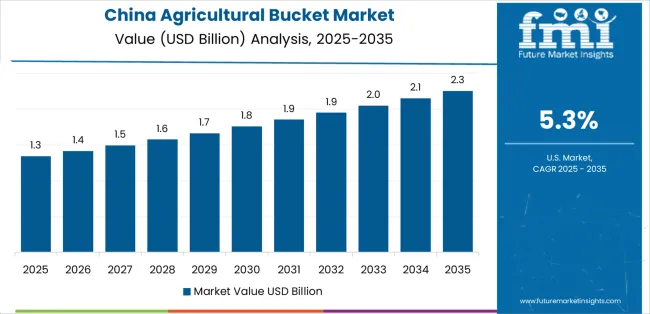

Revenue from agricultural buckets in China is projected to grow at a CAGR of 5.3%, driven by comprehensive agricultural modernization initiatives and government programs promoting mechanized farming practices across rural regions. The country’s transition toward large-scale commercial agriculture and rural infrastructure development is creating sustained demand for loader attachments that support diverse material handling requirements. State subsidies for agricultural equipment purchases provide financial support, enabling farmers to invest in mechanized solutions that improve operational efficiency. Major agricultural provinces, including Heilongjiang, Henan, and Shandong, are implementing mechanization programs that prioritize equipment capable of supporting multiple farming operations, creating opportunities for versatile bucket attachment suppliers.

Revenue from agricultural buckets in India is expanding at a CAGR of 4.9% from 2025 to 2035, supported by government initiatives promoting agricultural mechanization and increasing tractor ownership across farming communities. The Pradhan Mantri Kisan Sampada Yojana and other agricultural development programs provide subsidies and financing mechanisms that enable farmers to invest in equipment, improving productivity and reducing manual labor requirements. States such as Punjab, Haryana, and Maharashtra demonstrate the highest mechanization rates, with adoption expanding across southern and eastern agricultural regions. Equipment distributors and agricultural cooperatives are establishing distribution networks that extend equipment availability into rural areas while providing financing options tailored to farming income patterns

Demand for agricultural buckets in Germany is projected to grow at a CAGR of 4.5% through 2035, supported by the country’s advanced agricultural sector and emphasis on equipment quality and operational reliability. German farmers operate some of Europe’s largest mechanized farming operations, driving demand for durable bucket attachments capable of intensive daily use across diverse applications. The market emphasizes premium construction standards, with buyers prioritizing lifecycle costs and operational reliability over initial purchase price considerations. Equipment dealers maintain comprehensive service networks that support rapid maintenance response and minimize operational downtime for farming customers.

Revenue from agricultural buckets in Brazil is growing at a CAGR of 4.1% through 2035, driven by expanding agricultural production and increasing mechanization rates across major farming regions. The country's position as a leading agricultural exporter creates demand for efficient production methods, including mechanized material handling that reduces operational costs and improves productivity. Major agricultural states, including Mato Grosso, São Paulo, and Paraná, demonstrate strong equipment adoption patterns, with expanding mechanization across livestock operations and diversified crop production. Equipment financing programs through agricultural banks and dealer networks provide access to mechanized solutions for farming operations of varying scales.

Demand for agricultural buckets in the United States is projected to grow at a CAGR of 3.7% through 2035, driven by equipment replacement cycles in mature agricultural markets and ongoing efficiency improvements across farming operations. The country’s established mechanization infrastructure supports consistent demand for bucket attachments compatible with existing loader fleets operated by commercial farms, ranches, and agricultural contractors. Regional variations in farming practices create diverse application requirements, with bucket specifications adapted to crop types, soil conditions, and operational methods across different agricultural zones. Dealer networks maintained by major equipment manufacturers provide comprehensive distribution and service coverage, supporting equipment availability across rural regions.

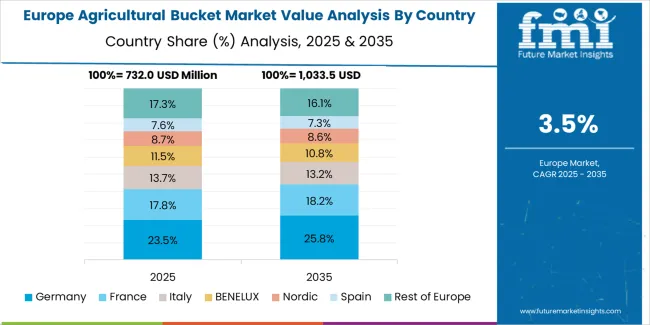

The agricultural bucket market in Europe is projected to grow from USD 892.3 million in 2025 to USD 1.5 billion by 2035, registering a CAGR of 4.2% over the forecast period. Germany is expected to maintain its leadership position with a 27.4% market share in 2025, expanding slightly to 28.1% by 2035, supported by its advanced agricultural mechanization infrastructure and emphasis on equipment quality standards.

France follows with a 22.6% share in 2025, projected to reach 23.2% by 2035, driven by extensive agricultural operations and comprehensive equipment dealer networks serving diverse farming sectors. The United Kingdom holds a 16.8% share in 2025, expected to maintain 16.5% by 2035, supported by established livestock farming operations requiring versatile material handling equipment. Italy commands a 14.3% share in 2025, while Poland accounts for 10.2% driven by agricultural modernization programs and expanding commercial farming operations. The Rest of Europe region is anticipated to maintain a 8.7% share through 2035, with gradual mechanization adoption in Eastern European agricultural regions implementing EU-aligned farming practices and equipment standards requiring compatible bucket attachment systems.

Japanese agricultural bucket operations reflect the country's emphasis on equipment precision and reliability standards adapted to small-scale farming operations. Major agricultural regions including Hokkaido, Tohoku, and Kyushu utilize compact tractors and loaders requiring bucket attachments designed for limited space conditions and diverse terrain characteristics. Equipment manufacturers including Kubota, Iseki, and Yanmar maintain comprehensive dealer networks providing technical support and maintenance services that ensure consistent operational capability across rural areas.

The Japanese market demonstrates unique design preferences, with significant demand for lightweight bucket configurations compatible with compact tractors that dominate domestic agriculture. Farmers specify precise weight limits and dimensional constraints reflecting operational requirements in rice paddies, vegetable operations, and orchard management where equipment must navigate confined spaces and soft soil conditions. Quality standards emphasize durability and corrosion resistance for equipment operating in humid conditions and exposure to organic materials.

Regulatory oversight through agricultural equipment standards establishes safety requirements and performance specifications that influence product certification processes. The procurement system favors domestic manufacturers with established service networks and parts availability that minimize operational downtime during critical farming periods. Seasonal agricultural patterns create concentrated demand periods requiring reliable equipment performance and rapid maintenance response.

Supply chain management prioritizes relationship-based distribution through agricultural cooperatives and equipment dealers maintaining long-term partnerships with farming communities. Japanese farmers typically maintain equipment for extended periods, emphasizing quality construction and manufacturer support over frequent replacement cycles. This stability supports specialized product development tailored to domestic agricultural practices and terrain conditions.

South Korean agricultural bucket operations reflect government initiatives promoting farm mechanization and rural infrastructure development. Major agricultural provinces including Jeolla, Gyeongsang, and Chungcheong are implementing equipment adoption programs that provide subsidies and financing mechanisms enabling farmers to invest in mechanized material handling solutions. Government agencies including the Rural Development Administration promote agricultural efficiency improvements that reduce labor requirements and support sustainable farming practices.

The Korean market demonstrates particular emphasis on equipment supporting rice farming operations and intensive vegetable production that dominate domestic agriculture. This creates demand for bucket attachments adapted to wet field conditions and organic material handling including soil amendments, crop residues, and harvest materials. Technical requirements emphasize durability under intensive use patterns and compatibility with locally manufactured tractor systems that represent majority market share.

Regulatory frameworks administered by agricultural agencies establish equipment standards and safety requirements that influence product certification and market access. Government subsidy programs specify approved equipment categories and technical specifications that eligible products must meet, creating preference for certified suppliers with established regulatory compliance. The environment particularly favors domestic manufacturers and international suppliers with local partnerships providing technical support and warranty service.

Supply chain efficiency benefits from concentrated manufacturing in industrial zones and established distribution networks connecting equipment dealers with farming communities. Korean farmers increasingly adopt mechanized solutions to address labor shortages and improve operational efficiency, creating sustained demand growth for bucket attachments and compatible loader equipment. Small average farm sizes compared to other markets influence product specifications toward compact designs and versatile functionality supporting multiple daily applications across limited operational areas.

Market structure reflects consolidated equipment manufacturing combined with fragmented regional attachment suppliers serving local distribution channels. Global agricultural equipment manufacturers maintain bucket product lines as complementary offerings to tractor and loader systems, leveraging dealer networks and brand recognition to capture attachment sales. Independent attachment specialists compete through product specialization, custom configurations, and competitive pricing strategies targeting aftermarket buyers and multi-brand equipment operators. Distribution advantages accrue to suppliers with comprehensive dealer relationships and parts availability supporting rural customers requiring rapid service response during operational periods.

Product differentiation emphasizes construction quality, mounting compatibility, and operational features rather than proprietary technologies with patent protection. Tilt bucket manufacturers compete on hydraulic system reliability and tilt angle ranges supporting diverse terrain applications. Clamshell designs differentiate through jaw opening dimensions, closing force specifications, and material retention characteristics. Premium segments emphasize advanced materials including high-strength steel alloys and wear-resistant edge treatments that extend operational lifespan and reduce maintenance frequency.

Market entry barriers include capital requirements for manufacturing facilities, dealer relationship development, and brand recognition essential for equipment purchase decisions in conservative agricultural markets. Established manufacturers maintain advantages through product reliability histories, comprehensive warranty support, and integration with loader mounting systems. Consolidation pressures increase as equipment manufacturers acquire attachment specialists to expand product portfolios and capture aftermarket revenue streams.

Vertical integration remains limited beyond major manufacturers, with most independent suppliers maintaining pure manufacturing and distribution roles. Strategic priorities include expanding product lines across bucket types and capacity ranges, establishing distribution partnerships in emerging agricultural markets, and developing mounting systems compatible with diverse loader brands to maximize addressable market across fragmented equipment fleets.

| Items | Values |

|---|---|

| Quantitative Units | USD 3 billion |

| Bucket Type | Tilt Bucket, Clamshell Bucket, Others |

| Application | Traditional Agriculture, Forestry and Orchards, Others |

| Distribution Channel | Not Applicable |

| Regions Covered | North America, Latin America, Europe, Asia Pacific, Middle East & Africa |

| Country Covered | China, India, Germany, Brazil, United States, and other 40+ countries |

| Key Companies Profiled | Manitou, CNH Industrial, John Deere, AGCO, JC, Kubota, Virnig, Bobcat, Alo, HLA, Paladin, Werk-Brau |

| Additional Attributes | Dollar sales by bucket type/application, regional demand (NA, EU, APAC), competitive landscape, traditional agriculture vs forestry adoption, farm mechanization integration, and material handling innovations driving agricultural efficiency, operational versatility, and equipment productivity |

The global agricultural bucket market is estimated to be valued at USD 3.0 billion in 2025.

The market size for the agricultural bucket market is projected to reach USD 4.4 billion by 2035.

The agricultural bucket market is expected to grow at a 3.9% CAGR between 2025 and 2035.

The key product types in agricultural bucket market are tilt bucket, clamshell bucket and others.

In terms of application, traditional agriculture segment to command 68.8% share in the agricultural bucket market in 2025.

Full Research Suite comprises of:

Market outlook & trends analysis

Interviews & case studies

Strategic recommendations

Vendor profiles & capabilities analysis

5-year forecasts

8 regions and 60+ country-level data splits

Market segment data splits

12 months of continuous data updates

DELIVERED AS:

PDF EXCEL ONLINE

Agricultural Multifunction Grab Bucket Market Size and Share Forecast Outlook 2025 to 2035

Agricultural Lighting Market Forecast and Outlook 2025 to 2035

Agricultural Sprayers Market Size and Share Forecast Outlook 2025 to 2035

Agricultural Fumigant Market Size and Share Forecast Outlook 2025 to 2035

Agricultural Coatings Market Size and Share Forecast Outlook 2025 to 2035

Agricultural Secondary Nutrients Market Size and Share Forecast Outlook 2025 to 2035

Agricultural Chelates Market Size and Share Forecast Outlook 2025 to 2035

Agricultural Tractors Market Analysis - Size, Share, and Forecast Outlook 2025 to 2035

Agricultural Tires Market Analysis - Size, Share, and Forecast Outlook 2025 to 2035

Agricultural Pheromones Market Size and Share Forecast Outlook 2025 to 2035

Agricultural Adjuvant Market - Size, Share, and Forecast Outlook 2025 to 2035

Agricultural Microbials Market Size and Share Forecast Outlook 2025 to 2035

Agricultural Gloves Market Size and Share Forecast Outlook 2025 to 2035

Agricultural Activator Adjuvant Market Analysis - Size, Share, and Forecast Outlook 2025 to 2035

Agricultural Surfactants Market Analysis – Size, Share, and Forecast Outlook 2025 to 2035

Agricultural Testing Services Market Growth - Trends & Forecast 2025 to 2035

Agricultural Mapping Services Market Growth - Trends & Forecast 2025 to 2035

Agricultural Grade Zinc Chemicals Market Growth - Trends & Forecast 2025 to 2035

Agricultural Fabrics Market Growth - Trends & Forecast 2025 to 2035

Agricultural Food Grade Rubber Conveyor Belt Market Growth - Trends & Forecast 2025 to 2035

Thank you!

You will receive an email from our Business Development Manager. Please be sure to check your SPAM/JUNK folder too.

Chat With

MaRIA