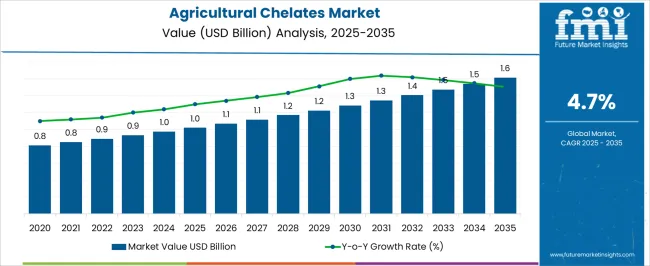

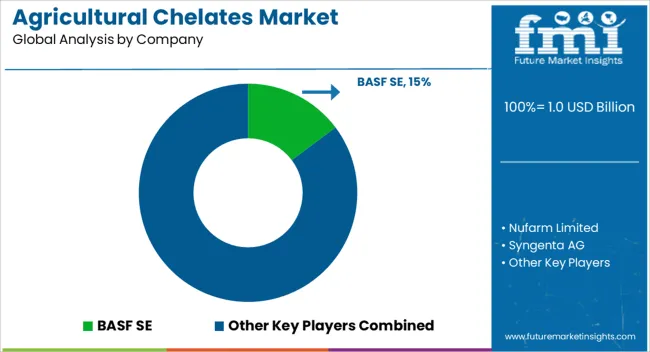

The Agricultural Chelates Market is estimated to be valued at USD 1.0 billion in 2025 and is projected to reach USD 1.6 billion by 2035, registering a compound annual growth rate (CAGR) of 4.7% over the forecast period. This growth is supported by a steady CAGR of 4.7%, driven by increasing demand for nutrient-dense fertilizers and soil conditioners in the agricultural sector.

In the first five-year phase (2025–2030), the market is expected to expand from USD 1 billion to USD 1.3 billion, adding USD 300 million, which accounts for 50% of the total incremental growth, driven by expanding agricultural needs in developing regions and the adoption of sustainable farming practices. The second phase (2030–2035) contributes USD 300 million, representing 50% of the total growth, driven by technological advancements in chelation and a focus on improving crop yield and quality. Annual increments rise from USD 50 million in early years to USD 80 million by 2035, reflecting stronger growth driven by innovations in biochelates, soil management technologies, and organic agriculture. Manufacturers focusing on bio-based chelates, cost-effective production, and environmentally friendly formulations will capture the largest share of this USD 600 million opportunity.

| Metric | Value |

|---|---|

| Agricultural Chelates Market Estimated Value in (2025 E) | USD 1.0 billion |

| Agricultural Chelates Market Forecast Value in (2035 F) | USD 1.6 billion |

| Forecast CAGR (2025 to 2035) | 4.7% |

The agricultural chelates market is expanding steadily, driven by the increasing need to enhance crop nutrition and soil fertility. Growing awareness of micronutrient deficiencies in soils has encouraged the use of chelated fertilizers to improve nutrient uptake efficiency.

Advancements in agricultural practices, coupled with rising demand for higher crop yields and quality, have further stimulated market growth. Environmental concerns over traditional fertilizers have also shifted focus toward more sustainable and efficient nutrient delivery methods.

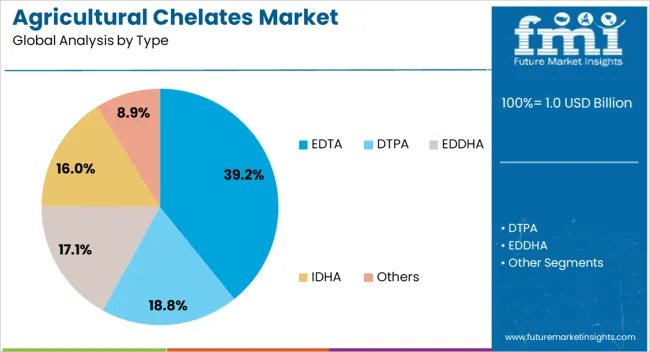

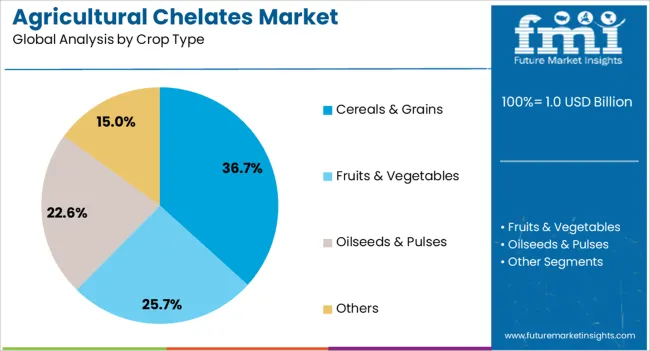

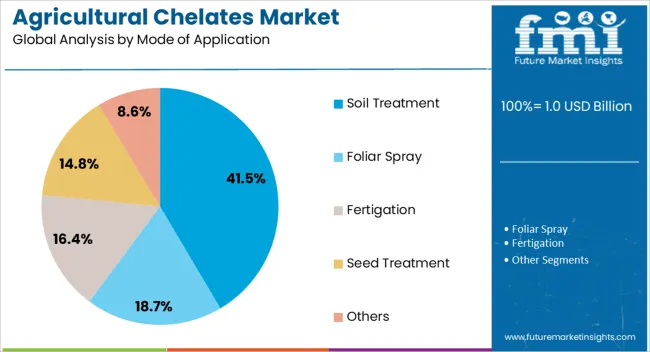

Increasing investment in cereal and grain cultivation, especially in emerging agricultural economies, has supported the demand for specialized nutrient solutions. The market is expected to benefit from innovations in chelate formulations and application techniques that optimize nutrient availability while minimizing environmental impact. Segmental growth is projected to be led by EDTA as the preferred chelate type, cereals and grains as the major crop segment, and soil treatment as the dominant mode of application.

The agricultural chelates market is segmented by type, crop type, mode of application, end-use, and geographic regions. By type, the agricultural chelates market is divided into EDTA, DTPA, EDDHA, IDHA, and Others. In terms of crop type, the agricultural chelates market is classified into Cereals & Grains, Fruits & Vegetables, Oilseeds & Pulses, and Others. Based on mode of application, the agricultural chelates market is segmented into Soil Treatment, Foliar Spray, Fertigation, Seed Treatment, and Others.

The agricultural chelates market is segmented by end-use into Agriculture, Horticulture, Floriculture, and Others. Regionally, the agricultural chelates industry is classified into North America, Latin America, Western Europe, Eastern Europe, Balkan & Baltic Countries, Russia & Belarus, Central Asia, East Asia, South Asia & Pacific, and the Middle East & Africa.

The EDTA segment is expected to contribute 39.2% of the agricultural chelates market revenue in 2025, retaining its position as the leading chelate type. This segment’s growth is driven by EDTA’s strong ability to bind with essential micronutrients, enhancing their solubility and bioavailability to plants.

EDTA chelates have been widely adopted due to their effectiveness across various soil types and crop conditions. The segment benefits from proven performance in correcting micronutrient deficiencies and supporting healthy plant development.

Additionally, EDTA’s compatibility with multiple nutrient formulations makes it a preferred choice among farmers and agronomists. As the demand for precision agriculture and soil health management rises, the EDTA segment is expected to continue its dominance.

The Cereals & Grains segment is projected to account for 36.7% of the agricultural chelates market revenue in 2025, establishing itself as the largest crop type segment. This growth reflects the global importance of cereals and grains as staple foods, driving continuous efforts to improve productivity and quality.

Farmers cultivating these crops increasingly rely on chelated micronutrients to address soil nutrient imbalances that impact yield and crop resilience. The segment has benefited from targeted nutrient management programs and government initiatives aimed at boosting food security.

As demand for cereals and grains grows with rising populations, the adoption of agricultural chelates in this crop segment is expected to remain strong.

The Soil Treatment segment is anticipated to hold 41.5% of the agricultural chelates market revenue in 2025, maintaining its lead as the primary application method. Soil treatment with chelates enhances nutrient availability directly in the root zone, promoting efficient uptake by plants.

This approach is favored by farmers seeking to improve soil fertility and address micronutrient deficiencies in a targeted manner. Advances in application techniques have made soil treatment more precise and effective, reducing nutrient wastage and environmental runoff.

The segment’s growth is also supported by sustainable farming practices and regulatory encouragement for eco-friendly fertilization. With increasing awareness of soil health’s impact on crop productivity, soil treatment with agricultural chelates is expected to remain the dominant mode of application.

The agricultural chelates market is driven by increasing demand for efficient crop nutrition solutions, particularly in fertilizers and crop protection. Opportunities in expanding agricultural sectors and the shift toward bio-based chelates are shaping the market. However, high production costs and raw material availability remain challenges. By 2025, overcoming these barriers through more cost-effective production methods and alternative materials will be essential for continued market growth.

The agricultural chelates market is growing due to the increasing demand for efficient crop nutrition solutions. Chelates are widely used to improve the bioavailability of essential micronutrients in crops, enhancing their growth and resistance to diseases. As farmers seek ways to boost crop yields, reduce wastage, and optimize nutrient uptake, the market for agricultural chelates is expanding. By 2025, the market will continue to benefit from this rising demand for advanced solutions that improve productivity in farming.

Opportunities in the agricultural chelates market are increasing with the expansion of the fertilizer and crop protection sectors. Chelates are increasingly being incorporated into fertilizers to improve the efficiency of micronutrient delivery, ensuring better growth and higher-quality harvests. Additionally, their role in enhancing pesticide effectiveness is gaining attention. By 2025, these sectors will drive further adoption of chelates as agriculture focuses on improving efficiency, crop resilience, and overall sustainability.

Emerging trends in the agricultural chelates market highlight a growing preference for bio-based and organic chelates. As demand for organic farming continues to rise, chelates derived from renewable resources are gaining popularity. These bio-based chelates are seen as a safer, environmentally friendly alternative to traditional synthetic products. By 2025, this shift toward organic and bio-based chelates will reshape the market, with more focus on natural, non-toxic solutions that meet the needs of organic farmers.

Despite growth, challenges related to high costs and the limited availability of raw materials persist in the agricultural chelates market. The production of chelates requires specialized, often expensive, raw materials, making them more costly than conventional fertilizers. Additionally, fluctuations in the availability of these materials can disrupt production and increase prices. By 2025, addressing these barriers through alternative sourcing and cost-efficient production techniques will be crucial for ensuring market expansion.

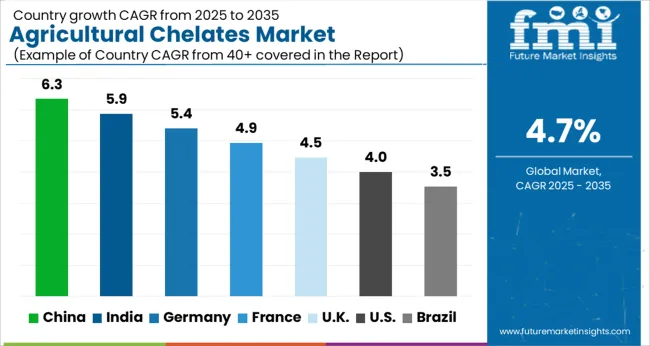

The global agricultural chelates market is projected to grow at a 4.7% CAGR from 2025 to 2035. China leads with a growth rate of 6.3%, followed by India at 5.9%, and Germany at 5.4%. The United Kingdom records a growth rate of 4.5%, while the United States shows the slowest growth at 4.0%. These varying growth rates are driven by factors such as increasing demand for micronutrient-rich fertilizers, advancements in sustainable farming practices, and the growing focus on improving soil health and crop yield. Emerging markets like China and India are experiencing higher growth due to rapid agricultural sector expansion, government investments in modern farming technologies, and rising demand for high-efficiency fertilizers, while more mature markets like the USA and the UK show steady growth driven by sustainable farming practices, precision agriculture, and regulatory standards. This report includes insights on 40+ countries; the top markets are shown here for reference.

The agricultural chelates market in China is growing at a strong pace, with a projected CAGR of 6.3%. China’s rapidly expanding agricultural sector, driven by the need to enhance crop productivity and soil health, is fueling the demand for agricultural chelates. The country’s increasing focus on sustainable farming, along with government investments in modern agricultural technologies, is further boosting market growth. Additionally, the rising demand for high-quality fertilizers to improve micronutrient availability in soil and enhance crop yield supports the adoption of chelates as a key component in fertilizer solutions.

The agricultural chelates market in India is projected to grow at a CAGR of 5.9%. India’s growing agricultural sector, coupled with the increasing demand for high-yield crops and sustainable farming practices, is driving the demand for agricultural chelates. The need for micronutrient-rich fertilizers to improve soil health, along with rising awareness of the benefits of chelates in enhancing nutrient uptake, contributes to market growth. Additionally, India’s focus on precision agriculture, increased adoption of modern farming technologies, and government initiatives to improve agricultural sustainability further accelerates the demand for chelates.

The agricultural chelates market in Germany is projected to grow at a CAGR of 5.4%. Germany’s well-established agricultural sector, combined with a growing focus on sustainable farming and improving soil health, continues to drive steady demand for agricultural chelates. The increasing demand for micronutrient-rich fertilizers, particularly in organic farming and precision agriculture, is contributing to market growth. Additionally, Germany’s strong emphasis on regulatory standards for food safety, environmental protection, and soil management further accelerates the adoption of agricultural chelates in the country.

The agricultural chelates market in the United Kingdom is projected to grow at a CAGR of 4.5%. The UK’s growing focus on sustainable farming and reducing environmental impacts in agriculture is driving the adoption of agricultural chelates. The need for micronutrient-rich fertilizers to improve soil health and crop productivity, particularly in organic farming and greenhouse horticulture, is contributing to market growth. Additionally, the UK government’s regulatory focus on promoting sustainable agricultural practices and reducing chemical usage in farming is accelerating the demand for chelates as part of integrated crop management solutions.

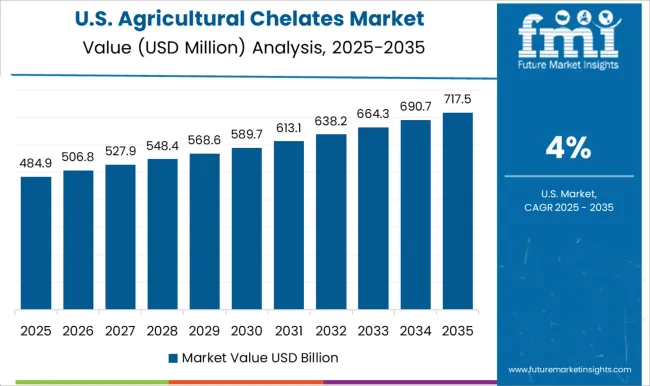

The agricultural chelates market in the United States is expected to grow at a CAGR of 4.0%. The USA market remains steady, driven by the increasing demand for efficient and sustainable farming solutions. The adoption of precision agriculture, combined with the need for high-quality fertilizers to improve soil nutrient availability and crop productivity, is contributing to market growth. Additionally, the USA focus on reducing environmental impacts in agriculture and promoting soil health is fueling the demand for chelates, although growth is slower compared to emerging markets due to the maturity of the market.

BASF’s dominance is supported by its strong R&D capabilities, global distribution network, and commitment to sustainable farming practices. Key players such as Syngenta AG, The Dow Chemical Company, and AkzoNobel N.V. maintain significant market shares by offering high-performance agricultural chelates that provide essential nutrients like iron, zinc, and manganese to plants, improving crop yield and quality. These companies focus on providing customized solutions for various soil types and farming conditions, ensuring enhanced crop productivity and resource efficiency.

Emerging players like Haifa Group, Valagro S.p.A., and Arysta LifeScience Corporation are expanding their market presence by offering specialized chelate solutions for niche agricultural applications such as organic farming, specialty crops, and high-value horticulture. Their strategies include improving product formulations, offering environmentally friendly solutions, and focusing on increasing nutrient efficiency. Market growth is driven by the increasing demand for sustainable agricultural practices, rising global food production needs, and the adoption of precision farming technologies. Innovations in chelate formulations, bio-based alternatives, and advanced nutrient delivery systems are expected to continue shaping competitive dynamics and drive further growth in the global agricultural chelates market.

| Item | Value |

|---|---|

| Quantitative Units | USD 1.0 Billion |

| Type | EDTA, DTPA, EDDHA, IDHA, and Others |

| Crop Type | Cereals & Grains, Fruits & Vegetables, Oilseeds & Pulses, and Others |

| Mode of Application | Soil Treatment, Foliar Spray, Fertigation, Seed Treatment, and Others |

| End-Use | Agriculture, Horticulture, Floriculture, and Others |

| Regions Covered | North America, Europe, Asia-Pacific, Latin America, Middle East & Africa |

| Country Covered | United States, Canada, Germany, France, United Kingdom, China, Japan, India, Brazil, South Africa |

| Key Companies Profiled | BASF SE, Nufarm Limited, Syngenta AG, The Dow Chemical Company, AkzoNobel N.V., Haifa Group, Aries Agro Limited, Valagro S.p.A., Yara International ASA, Protex International, Van Iperen International, Arysta LifeScience Corporation, Isagro S.p.A., Compo Expert GmbH, and Micromix Plant Health Limited |

| Additional Attributes | Dollar sales by chelate type and application, demand dynamics across agriculture, horticulture, and turf management sectors, regional trends in agricultural chelate adoption, innovation in bio-based and slow-release formulations, impact of regulatory standards on environmental safety, and emerging use cases in precision farming and nutrient management technologies. |

The global agricultural chelates market is estimated to be valued at USD 1.0 billion in 2025.

The market size for the agricultural chelates market is projected to reach USD 1.6 billion by 2035.

The agricultural chelates market is expected to grow at a 4.7% CAGR between 2025 and 2035.

The key product types in agricultural chelates market are edta, dtpa, eddha, idha and others.

In terms of crop type, cereals & grains segment to command 36.7% share in the agricultural chelates market in 2025.

Full Research Suite comprises of:

Market outlook & trends analysis

Interviews & case studies

Strategic recommendations

Vendor profiles & capabilities analysis

5-year forecasts

8 regions and 60+ country-level data splits

Market segment data splits

12 months of continuous data updates

DELIVERED AS:

PDF EXCEL ONLINE

Agricultural Sprayers Market Size and Share Forecast Outlook 2025 to 2035

Agricultural Fumigant Market Size and Share Forecast Outlook 2025 to 2035

Agricultural Coatings Market Size and Share Forecast Outlook 2025 to 2035

Agricultural Secondary Nutrients Market Size and Share Forecast Outlook 2025 to 2035

Agricultural Tractors Market Analysis - Size, Share, and Forecast Outlook 2025 to 2035

Agricultural Tires Market Analysis - Size, Share, and Forecast Outlook 2025 to 2035

Agricultural Pheromones Market Size and Share Forecast Outlook 2025 to 2035

Agricultural Adjuvant Market - Size, Share, and Forecast Outlook 2025 to 2035

Agricultural Microbials Market Size and Share Forecast Outlook 2025 to 2035

Agricultural Gloves Market Size and Share Forecast Outlook 2025 to 2035

Agricultural Activator Adjuvant Market Analysis - Size, Share, and Forecast Outlook 2025 to 2035

Agricultural Surfactants Market Analysis – Size, Share, and Forecast Outlook 2025 to 2035

Agricultural Testing Services Market Growth - Trends & Forecast 2025 to 2035

Agricultural Mapping Services Market Growth - Trends & Forecast 2025 to 2035

Agricultural Grade Zinc Chemicals Market Growth - Trends & Forecast 2025 to 2035

Agricultural Fabrics Market Growth - Trends & Forecast 2025 to 2035

Agricultural Food Grade Rubber Conveyor Belt Market Growth - Trends & Forecast 2025 to 2035

Agricultural Nets Market Growth - Trends & Forecast 2025 to 2035

Agricultural Equipment Market Growth - Trends & Forecast 2025 to 2035

A Detailed Competition Share Assessment of the Agricultural Sprayers Market

Thank you!

You will receive an email from our Business Development Manager. Please be sure to check your SPAM/JUNK folder too.

Chat With

MaRIA