The agricultural secondary nutrients market is estimated to be valued at USD 42.5 billion in 2025 and is projected to reach USD 64.1 billion by 2035, registering a compound annual growth rate (CAGR) of 4.2% over the forecast period.

Growth is being driven by the rising focus on crop nutrient management, soil health improvement, and balanced fertilization practices. Demand for calcium, magnesium, and sulfur-based fertilizers is anticipated to increase as farmers seek higher yields, improved crop quality, and reduced nutrient deficiencies in cereal, vegetable, and fruit production. Regional adoption patterns show that Asia-Pacific and Latin America are expected to contribute significantly to market expansion due to intensive farming practices and government support programs promoting nutrient efficiency.

The use of secondary nutrients in combination with primary macronutrients is gaining traction, highlighting integrated nutrient management strategies. Dollar sales and share analyses indicate that large-scale commercial farms and high-value crop cultivation are leading segments, while smallholder adoption is gradually increasing with awareness campaigns and subsidy schemes. Innovations in formulation types, such as water-soluble and slow-release blends, are projected to enhance efficiency, ease of application, and nutrient uptake. Market players are focusing on distribution network expansion, partnerships with agri-retailers, and farmer education programs to ensure consistent adoption and improve market penetration globally. Overall, the market demonstrates steady, long-term growth supported by technological interventions, evolving farming practices, and a growing emphasis on sustainable nutrient management.

| Metric | Value |

|---|---|

| Agricultural Secondary Nutrients Market Estimated Value in (2025 E) | USD 42.5 billion |

| Agricultural Secondary Nutrients Market Forecast Value in (2035 F) | USD 64.1 billion |

| Forecast CAGR (2025 to 2035) | 4.2% |

The agricultural secondary nutrients market is influenced by several interconnected parent markets, each contributing differently to overall demand and growth. The cereal and grain cultivation segment holds the largest share at 40%, as farmers increasingly rely on calcium, magnesium, and sulfur-based fertilizers to enhance crop yields, improve soil nutrient balance, and prevent deficiencies that can limit productivity. The horticulture and vegetable farming market contributes 25%, driven by the need for high-quality produce and improved post-harvest shelf life, where secondary nutrients play a key role in plant health and nutrient uptake. The fruit orchards and plantation segment accounts for 15%, focusing on nutrient enrichment to support long-term soil fertility, fruit size, and quality, particularly in apple, citrus, and banana plantations.

The greenhouse and protected cultivation sector holds 12%, as controlled-environment agriculture integrates secondary nutrients into fertigation systems to maximize growth efficiency and nutrient availability. Finally, the organic and specialty crop market represents 8%, where nutrient management through secondary fertilizers ensures compliance with certification standards and supports premium pricing. Collectively, cereal cultivation, horticulture, and fruit orchards account for 80% of total demand, highlighting that staple crops, high-value vegetables, and plantation crops remain the main drivers, while greenhouses and specialty farming provide consistent, complementary growth opportunities globally.

The agricultural secondary nutrients market is experiencing steady growth, driven by the need to enhance soil fertility, improve crop yield, and correct nutrient deficiencies. Industry publications and agricultural extension reports have emphasized the increasing awareness among farmers about the role of secondary nutrients, calcium, magnesium, and sulfur, in supporting plant health beyond primary macronutrients.

Rising concerns over soil degradation, caused by intensive farming practices and over-reliance on chemical fertilizers, have accelerated the adoption of balanced nutrient application strategies. Additionally, climate variability and water stress have heightened the importance of nutrient management to ensure crop resilience and productivity.

Government initiatives and subsidies promoting soil testing and integrated nutrient management have further encouraged the use of secondary nutrients. Technological advancements in nutrient formulation and controlled-release products are enhancing application efficiency. Moving forward, demand growth is expected to be led by calcium for soil treatment in major crop-producing regions, soil-based nutrient delivery methods, and applications in cereals and grains to meet rising global food demand.

The agricultural secondary nutrients market is segmented by nutrition type, application, crop type, form, and geographic regions. By nutrition type, agricultural secondary nutrients market is divided into calcium, magnesium, and sulfur. In terms of application, agricultural secondary nutrients market is classified into soil, foliar, and fertigation. Based on crop type, agricultural secondary nutrients market is segmented into cereals & grains, oilseeds & pulses, fruits & vegetables, and others (Turf, Ornamentals, etc.). By form, agricultural secondary nutrients market is segmented into liquid and dry. Regionally, the agricultural secondary nutrients industry is classified into North America, Latin America, Western Europe, Eastern Europe, Balkan & Baltic Countries, Russia & Belarus, Central Asia, East Asia, South Asia & Pacific, and the Middle East & Africa.

The calcium segment is projected to hold 46.8% of the agricultural secondary nutrients market revenue in 2025, securing its position as the largest nutrition type. Growth in this segment has been driven by calcium’s essential role in cell wall development, root growth, and nutrient absorption.

Agronomic studies have shown that calcium deficiency can significantly reduce crop quality and shelf life, making it a priority nutrient in commercial farming. High adoption has been observed in regions with acidic or sandy soils, where calcium supplementation corrects pH imbalances and improves soil structure.

Additionally, the widespread availability of calcium-based fertilizers, such as calcium nitrate and gypsum, has facilitated adoption across various farming systems. Extension programs and farmer training initiatives have further promoted the importance of calcium in achieving higher yield stability, reinforcing its market leadership.

The soil segment is projected to account for 54.2% of the agricultural secondary nutrients market revenue in 2025, maintaining its dominance due to its effectiveness in correcting nutrient deficiencies at the root zone.

Soil application allows for uniform nutrient distribution and long-lasting impact on soil fertility, particularly for calcium, magnesium, and sulfur. Agricultural research has highlighted soil treatment as a preferred approach for improving nutrient uptake efficiency, especially in field crops and large-scale farming.

Granular and powdered nutrient formulations have been widely adopted for soil application due to ease of use and compatibility with existing fertilization practices. Furthermore, integrated nutrient management programs promoted by government agencies often emphasize soil-based supplementation, which has supported this segment’s strong market position.

The cereals and grains segment is projected to contribute 38.6% of the agricultural secondary nutrients market revenue in 2025, leading the crop type category due to the global scale of production and consumption of staple crops.

Crops such as wheat, rice, and maize have high nutrient demands, and secondary nutrients play a critical role in achieving optimal yield and grain quality. Field trials and agronomic data have shown that secondary nutrient supplementation can significantly enhance kernel weight, disease resistance, and post-harvest storage stability.

With cereals and grains forming the backbone of food security in many countries, farmers have increasingly adopted balanced nutrient application practices. Rising population-driven demand for staple foods and export-oriented grain production have reinforced the importance of secondary nutrients in this segment, ensuring its continued leadership in the market.

Demand for secondary nutrients is driven by crop yield improvement and nutrient deficiency management. Policy support, high-value crop adoption, and education campaigns remain key growth drivers globally.

The agricultural secondary nutrients market is primarily driven by the need to address crop nutrient deficiencies in cereal, vegetable, and fruit production. Calcium, magnesium, and sulfur deficiencies reduce yield, quality, and marketability, prompting farmers to adopt secondary nutrients as part of balanced fertilization programs. Dollar sales and share indicate that cereal crops contribute the largest consumption, followed by horticultural and plantation crops. Regions with intensive grain cultivation, particularly Asia-Pacific and Latin America, are seeing higher adoption rates. Increased awareness among farmers about soil testing and nutrient management is influencing formulation selection, application frequency, and dosage. Government support programs and agricultural extension services further accelerate usage, creating long-term growth opportunities for manufacturers and distributors.

Government initiatives and regulatory frameworks play a key role in the adoption of secondary nutrients. Subsidies, financial incentives, and crop-specific guidance encourage farmers to integrate calcium, magnesium, and sulfur fertilizers into their nutrient management strategies. Dollar sales, share, and adoption patterns show that markets in India, China, and Brazil are benefiting from policy-driven adoption. Programs promoting crop productivity, chemical reduction, and soil fertility improvement are influencing purchasing decisions and supply chain expansion. Training and awareness campaigns on nutrient application improve correct usage, minimizing wastage and maximizing crop response. As governments prioritize agriculture productivity and food security, secondary nutrient demand is expected to remain strong across major cereal, vegetable, and plantation farming regions globally.

High-value crops such as vegetables, fruits, and greenhouse-grown plants are increasingly adopting secondary nutrients to enhance yield, quality, and post-harvest performance. Dollar sales and share analyses indicate that vegetable farms are the fastest-growing segment due to sensitivity to nutrient imbalances. Fertigation and blended formulations allow precise application of calcium, magnesium, and sulfur, improving crop uniformity and nutrient uptake efficiency. Orchard crops benefit from improved fruit firmness, size, and shelf life. Farmers are also combining secondary nutrients with macro fertilizers for integrated nutrient management. Market participants are leveraging product differentiation, crop-specific formulations, and educational campaigns to encourage adoption, particularly in regions focused on high-value and export-oriented produce.

The market faces challenges from inconsistent product quality, price-sensitive buyers, and limited awareness in some regions. Competing nutrient solutions and generic fertilizers can limit dollar sales and share for branded secondary nutrient products. Smallholder farmers may lack knowledge about application techniques, timing, and dosage, reducing effectiveness and adoption. Companies are responding with training programs, farmer workshops, and demonstration plots to educate end users. Quality certifications, standardized formulations, and reliable supply chains help build trust and market credibility. Regions with strong awareness programs and efficient distribution networks show higher adoption, suggesting that addressing knowledge gaps and ensuring product quality are essential for long-term growth and stable market penetration globally.

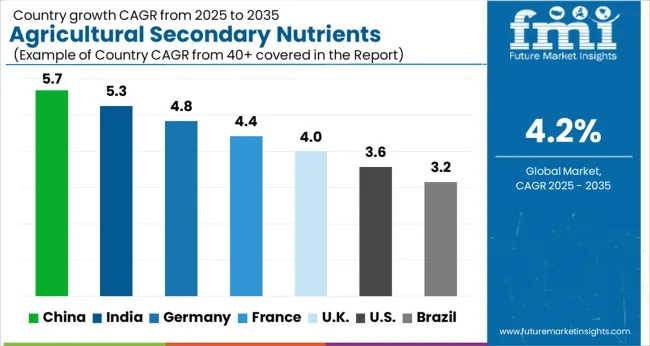

| Country | CAGR |

|---|---|

| China | 5.7% |

| India | 5.3% |

| Germany | 4.8% |

| France | 4.4% |

| U.K. | 4.0% |

| U.S. | 3.6% |

| Brazil | 3.2% |

The global agricultural secondary nutrients market is projected to grow at a CAGR of 4.2% from 2025 to 2035. China leads at 5.7%, followed by India at 5.3%, Germany at 4.8%, the U.K. at 4.0%, and the U.S. at 3.6%. Growth is driven by increasing adoption of calcium, magnesium, and sulfur-based fertilizers to improve soil fertility, crop yields, and quality in cereals, vegetables, and fruit crops. Asia, particularly China and India, demonstrates rapid expansion due to high-intensity farming and government nutrient management programs, whereas Europe and North America focus on precision application, certified formulations, and high-value crop performance. Dollar sales, share, and regional adoption patterns highlight the strategic importance of policy support, education programs, and integrated nutrient management in sustaining market growth. The analysis spans over 40+ countries, with the leading markets shown above.

The agricultural secondary nutrients market in China is projected to grow at a CAGR of 5.7% from 2025 to 2035. Growth is driven by the high intensity of cereal, grain, and horticultural cultivation, where calcium, magnesium, and sulfur fertilizers are increasingly applied to enhance soil fertility, improve crop yield, and prevent nutrient deficiencies. Government programs promoting balanced fertilization and nutrient management further support adoption, particularly in wheat, maize, and rice regions. Farmers are increasingly using water-soluble and granular formulations, integrated with macro fertilizers, to optimize plant nutrient uptake. Research collaborations with agricultural universities and local distributors ensure quality formulations and consistent supply. The expansion is also aided by awareness campaigns, farmer training, and demonstration plots.

The agricultural secondary nutrients market in India is expected to expand at a CAGR of 5.3% from 2025 to 2035, driven by intensive cereal and vegetable cultivation and growing demand for high-quality produce. Adoption of calcium, magnesium, and sulfur fertilizers is increasing across wheat, rice, maize, and high-value vegetable farms. Government schemes, subsidies, and crop-specific recommendations encourage proper nutrient application. Awareness programs, soil testing campaigns, and regional demonstrations improve farmer knowledge and optimize usage. Water-soluble, slow-release, and foliar-applied formulations are gaining traction due to their efficiency and ease of use. Dollar sales and share indicate that commercial farms and high-value crop operations are leading contributors to market expansion.

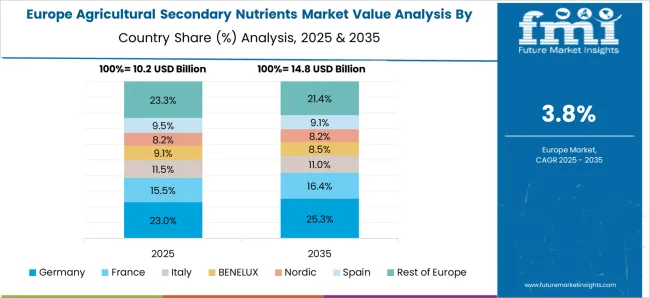

Germany’s agricultural secondary nutrients market is projected to grow at a CAGR of 4.8% from 2025 to 2035, driven by high-value crop production, controlled-environment farming, and regulatory compliance with EU fertilizer standards. Calcium, magnesium, and sulfur fertilizers are applied to cereals, vegetables, and orchards to improve soil health, nutrient balance, and crop quality. Precision application techniques, such as fertigation and foliar sprays, are increasingly adopted to enhance nutrient efficiency. Research-driven product development ensures high-quality, standardized formulations that meet regional crop requirements. Dollar sales and share trends show steady growth, particularly in greenhouse cultivation and high-value fruit and vegetable operations. Awareness campaigns and partnerships with agricultural institutes support informed farmer adoption.

The agricultural secondary nutrients market in the U.K. is anticipated to grow at a CAGR of 4.0% from 2025 to 2035. Adoption is driven by cereal, vegetable, and orchard cultivation, where calcium, magnesium, and sulfur fertilizers support soil health and crop quality. Farmers are increasingly using integrated nutrient management systems combining macro and secondary nutrients. Dollar sales and share indicate that greenhouse operators and high-value crop producers are adopting water-soluble and foliar formulations for uniform nutrient distribution. Education initiatives and agri-environmental schemes encourage responsible application and improved productivity. Domestic and international suppliers focus on quality certifications, reliable supply chains, and region-specific formulations to maintain market credibility and penetration.

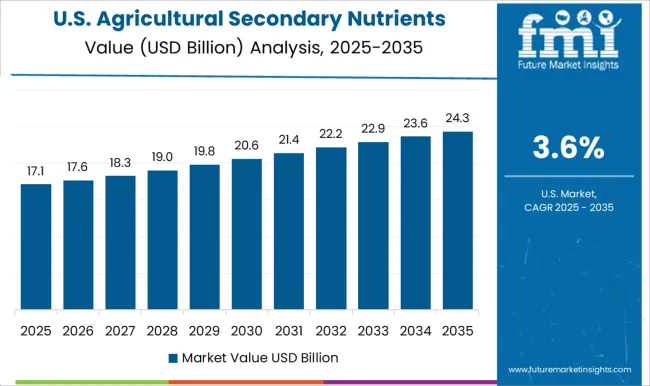

The agricultural secondary nutrients market in the U.S. is projected to grow at a CAGR of 3.6% from 2025 to 2035, driven by corn, soybean, and wheat cultivation. Farmers are applying calcium, magnesium, and sulfur fertilizers to improve soil nutrient balance, enhance yield, and support high-value vegetable and orchard production. Precision agriculture practices, such as fertigation and GPS-guided application, help maximize nutrient efficiency. Dollar sales and share trends indicate that both large-scale commercial farms and smallholder operations contribute to market expansion. Market growth is supported by government guidance, technical advisory services, and research collaborations with universities to optimize formulations and application techniques for local soil conditions.

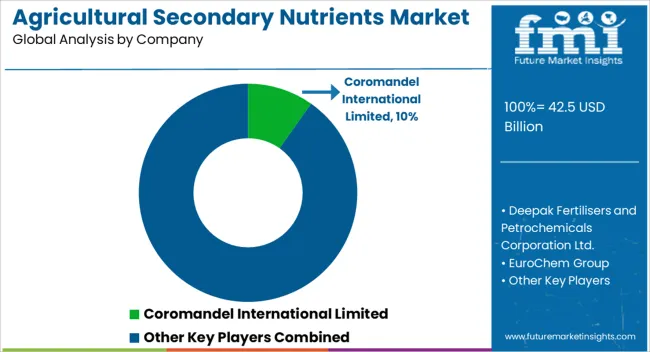

Competition in the agricultural secondary nutrients market is shaped by product quality, nutrient efficiency, formulation variety, and regional distribution capabilities. Coromandel International Limited and Deepak Fertilisers and Petrochemicals Corporation Ltd. lead with high-quality calcium, magnesium, and sulfur fertilizers tailored for cereals, vegetables, and fruit crops, emphasizing soil health and crop yield improvement. EuroChem Group and Haifa Group compete through specialty formulations, slow-release nutrients, and water-soluble blends that improve nutrient uptake and support precision farming practices. ICL Group and K+S Aktiengesellschaft focus on research-driven products, integrating innovative carriers and granular solutions to optimize crop response and maintain regulatory compliance.

Koch Industries, Inc. and Kugler Company emphasize scale, global distribution networks, and formulation consistency across multiple crop types. Nufarm Limited and Nutrien Ltd. differentiate with customized crop-specific solutions and digital advisory platforms that guide application techniques, dosage, and timing. Sulphur Mills Limited and The Mosaic Company compete in key regional markets, leveraging quality certifications, supply chain efficiency, and partnerships with agricultural cooperatives. UPL Limited and Yara International ASA focus on integrated nutrient management solutions, offering secondary nutrients alongside macro and micronutrient blends for balanced fertilization strategies. Zuari Agro Chemicals Ltd. emphasizes localized formulations and technical support for smallholder and large-scale farmers, ensuring consistent adoption and yield enhancement. Strategies across market players include product diversification into granular, liquid, and powder formulations, research collaboration with universities and agricultural institutes, and farmer education programs to ensure correct usage. Distribution networks, supply chain optimization, and regional production facilities maintain microbial viability and nutrient stability. Companies also invest in marketing campaigns, field demonstrations, and partnerships with agri-retailers to boost market penetration and farmer trust.

Product portfolios highlight specifications such as nutrient content, solubility, carrier type, and crop compatibility. Packaging sizes, storage conditions, and application guidelines are detailed to ensure ease of use and consistent results. Safety, regulatory compliance, and quality certifications are emphasized to establish market credibility. Complementary advisory services, training programs, and on-field demonstrations further reinforce adoption and demonstrate the value of secondary nutrients in enhancing soil fertility and crop productivity.

| Item | Value |

|---|---|

| Quantitative Units | USD 42.5 billion |

| Nutrition Type | Calcium, Magnesium, and Sulfur |

| Application | Soil, Foliar, and Fertigation |

| Crop Type | Cereals & Grains, Oilseeds & Pulses, Fruits & Vegetables, and Others (Turf, Ornamentals, etc.) |

| Form | Liquid and Dry |

| Regions Covered | North America, Europe, Asia-Pacific, Latin America, Middle East & Africa |

| Country Covered | United States, Canada, Germany, France, United Kingdom, China, Japan, India, Brazil, South Africa |

| Key Companies Profiled | Coromandel International Limited, Deepak Fertilisers and Petrochemicals Corporation Ltd., EuroChem Group, Haifa Group, ICL Group, K+S Aktiengesellschaft, Koch Industries, Inc., Kugler Company, Nufarm Limited, Nutrien Ltd., Sulphur Mills Limited, The Mosaic Company, UPL Limited, Yara International ASA, and Zuari Agro Chemicals Ltd. |

| Additional Attributes | Dollar sales, share by region and crop type, key competitors, formulation trends, adoption in cereals, vegetables, orchards, distribution channels, government incentives, and emerging growth opportunities. |

The global agricultural secondary nutrients market is estimated to be valued at USD 42.5 billion in 2025.

The market size for the agricultural secondary nutrients market is projected to reach USD 64.1 billion by 2035.

The agricultural secondary nutrients market is expected to grow at a 4.2% CAGR between 2025 and 2035.

The key product types in agricultural secondary nutrients market are calcium, magnesium and sulfur.

In terms of application, soil segment to command 54.2% share in the agricultural secondary nutrients market in 2025.

Full Research Suite comprises of:

Market outlook & trends analysis

Interviews & case studies

Strategic recommendations

Vendor profiles & capabilities analysis

5-year forecasts

8 regions and 60+ country-level data splits

Market segment data splits

12 months of continuous data updates

DELIVERED AS:

PDF EXCEL ONLINE

Agricultural Lighting Market Forecast and Outlook 2025 to 2035

Agricultural Sprayers Market Size and Share Forecast Outlook 2025 to 2035

Agricultural Fumigant Market Size and Share Forecast Outlook 2025 to 2035

Agricultural Coatings Market Size and Share Forecast Outlook 2025 to 2035

Agricultural Chelates Market Size and Share Forecast Outlook 2025 to 2035

Agricultural Tractors Market Analysis - Size, Share, and Forecast Outlook 2025 to 2035

Agricultural Tires Market Analysis - Size, Share, and Forecast Outlook 2025 to 2035

Agricultural Pheromones Market Size and Share Forecast Outlook 2025 to 2035

Agricultural Adjuvant Market - Size, Share, and Forecast Outlook 2025 to 2035

Agricultural Microbials Market Size and Share Forecast Outlook 2025 to 2035

Agricultural Gloves Market Size and Share Forecast Outlook 2025 to 2035

Agricultural Activator Adjuvant Market Analysis - Size, Share, and Forecast Outlook 2025 to 2035

Agricultural Surfactants Market Analysis – Size, Share, and Forecast Outlook 2025 to 2035

Agricultural Testing Services Market Growth - Trends & Forecast 2025 to 2035

Agricultural Mapping Services Market Growth - Trends & Forecast 2025 to 2035

Agricultural Grade Zinc Chemicals Market Growth - Trends & Forecast 2025 to 2035

Agricultural Fabrics Market Growth - Trends & Forecast 2025 to 2035

Agricultural Food Grade Rubber Conveyor Belt Market Growth - Trends & Forecast 2025 to 2035

Agricultural Nets Market Growth - Trends & Forecast 2025 to 2035

Agricultural Equipment Market Growth - Trends & Forecast 2025 to 2035

Thank you!

You will receive an email from our Business Development Manager. Please be sure to check your SPAM/JUNK folder too.

Chat With

MaRIA