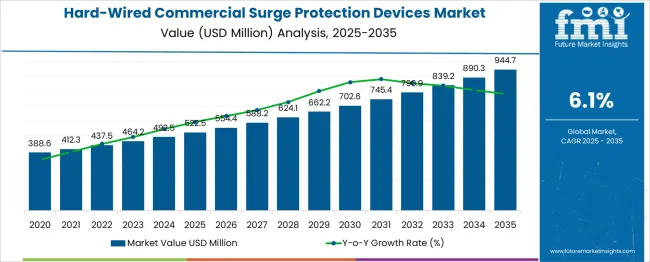

The Hard-Wired Commercial Surge Protection Devices Market is estimated to be valued at USD 522.5 million in 2025 and is projected to reach USD 944.7 million by 2035, registering a compound annual growth rate (CAGR) of 6.1% over the forecast period. Demand for hard-wired commercial surge protection devices is generating an absolute gain of USD 422.2 million at a CAGR of 6.1%. Ratio-based analysis indicates a clear acceleration pattern across the forecast period. The first half-decade, from 2025 to 2030, drives growth from USD 522.5 million to 702.6 million, contributing USD 180.1 million, which accounts for 42.6% of the total incremental value. The second phase (2030–2035) delivers USD 242.1 million, representing 57.4% of overall gains, establishing a contribution ratio of approximately 1.34:1 in favor of the latter half.

Structural shift suggests a stronger growth surge during the final years, reflecting increased adoption of advanced surge protection solutions in high-load commercial environments, driven by building electrification, regulatory compliance, and integration with smart monitoring systems. By 2030, the market is expected to achieve around 74% of its terminal value, while the remaining 26% growth occurs in the last five years, highlighting a back-loaded demand cycle. Such acceleration indicates that strategic investments in R&D for IoT-enabled surge protection and regional distribution capacity will align optimally with the demand surge anticipated in the later phase of the forecast horizon.

| Metric | Value |

|---|---|

| Hard-Wired Commercial Surge Protection Devices Market Estimated Value in (2025 E) | USD 522.5 million |

| Hard-Wired Commercial Surge Protection Devices Market Forecast Value in (2035 F) | USD 944.7 million |

| Forecast CAGR (2025 to 2035) | 6.1% |

The hard‑wired commercial surge protection devices market occupies a modest yet vital position within several broader electrical and infrastructure-related markets. In the building electrical infrastructure market, the share is 2–3%, as that market includes wiring, lighting, panels, and all electrical components. Within the commercial electrical equipment market, the share stands at 4–5%, since that sector also includes circuit breakers, transformers, and switchgear. In the power quality and electrical protection systems market, the share is 6–7%, because surge protection is one of several layers-including UPS systems, filters, and voltage regulators.

For the data center infrastructure market, the share is 1–2%, given the dominance of cooling, storage, and server hardware. In the smart building and facility management systems market, the contribution is 3-4%, as protection systems form part of broader automation, energy management, and safety controls. Although these shares are relatively low in value terms, demand is driven by increasing concerns about power disturbances, stricter safety codes, growing investment in commercial infrastructure, and rising equipment protection needs.

Trends toward integrated surge protection with IoT monitoring and compliance with regional electrical standards are reinforcing the critical role of hard‑wired surge devices in modern commercial construction and facility resilience.

Commercial establishments are increasingly investing in surge protection infrastructure to prevent costly downtime, equipment damage, and data loss. The demand is further supported by evolving building safety codes, mandatory installation regulations, and the integration of high-value electronics in modern commercial spaces such as data centers, office buildings, and industrial parks. Technological advancements in surge protection devices have enabled improved clamping voltage, faster response times, and broader compatibility with a range of power distribution systems.

The increasing digitization of commercial operations and the proliferation of automation technologies have made uninterrupted power protection a critical priority. In the coming years, widespread awareness about the lifecycle costs of electrical disruptions and emphasis on preventive maintenance are expected to accelerate further the deployment of hard-wired surge protection systems in both new and retrofit installations.

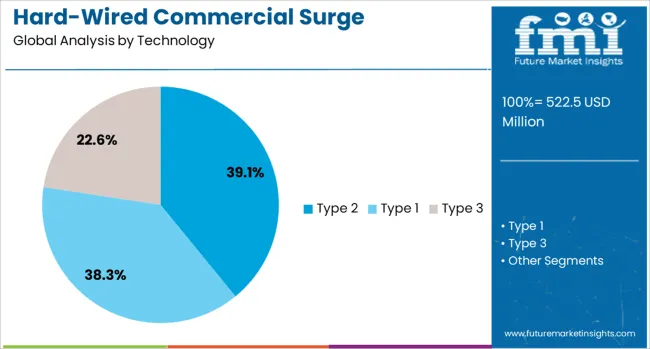

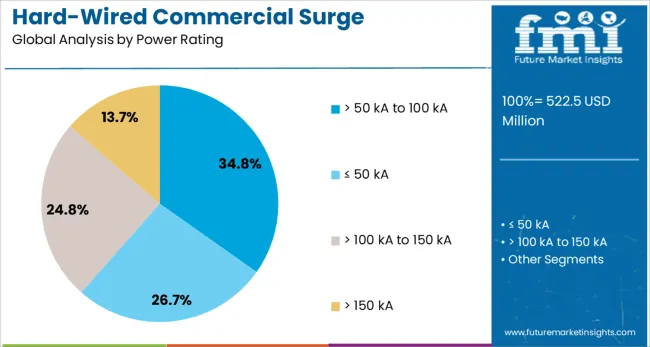

The hard-wired commercial surge protection devices market is segmented by technology, power rating, and geographic regions. The market is divided into Type 2, Type 1, and Type 3. In terms of power rating, the hard-wired commercial surge protection devices market is classified into > 50 kA to 100 kA, ≤ 50 kA, > 100 kA to 150 kA, and > 150 kA. Regionally, the industry is classified into North America, Latin America, Western Europe, Eastern Europe, Balkan & Baltic Countries, Russia & Belarus, Central Asia, East Asia, South Asia & Pacific, and the Middle East & Africa.

The type 2 segment is projected to account for 39.1% of the total revenue share in the hard-wired commercial surge protection devices market in 2025, marking it as the leading technology segment. This dominance is being driven by its strategic placement at the main distribution board, providing an essential protective barrier between external power disturbances and internal equipment.

Type 2 devices have gained preference for their ability to manage residual overvoltage following type 1 suppression, offering consistent performance in commercial environments where frequent switching events and power fluctuations are common. Their compatibility with multi-phase systems and flexibility across different voltage configurations have made them a standard in commercial safety protocols.

Advancements in MOV-based architectures and integrated thermal disconnect features have enhanced their reliability and operational lifespan. Additionally, their ease of integration into existing electrical panels and compliance with commercial electrical standards have supported their wide-scale adoption, making type 2 devices a critical component in layered surge protection strategies.

The greater than 50 kA to 100 kA power rating segment is expected to contribute 34.8% to the overall market share in 2025, establishing its significance in high-demand commercial applications. This segment’s growth is being propelled by the increasing concentration of mission-critical equipment and power-intensive operations in commercial facilities. Devices in this rating range are engineered to handle mid-to-high magnitude surge currents, which are often encountered in buildings with large HVAC systems, industrial machinery, and dense electronic loads.

Their adoption has been strengthened by evolving standards in power quality assurance and the growing demand for resilient electrical infrastructure. These devices offer a balanced trade-off between performance and cost, making them suitable for layered defense strategies in commercial electrical networks.

The integration of intelligent diagnostic capabilities and remote monitoring functions has further increased their appeal in modern commercial settings. As businesses prioritize uptime and asset longevity, the deployment of surge protection within this power class is set to expand significantly across commercial real estate portfolios.

Hard-wired surge protection devices (SPDs) are relied upon in commercial buildings to safeguard critical infrastructure such as data centers, electrical switchgear, and HVAC systems. Demand has increased for devices meeting compliance with stringent electrical standards and hazard reduction requirements. Permanent installation via panel mounting and trunk wiring ensures protection at point-of-use and main distribution boards. Downtime reduction and equipment warranty adherence have reinforced SPD uptake in environments where uninterrupted operations matter. As business operations become more digitally dependent, providers offering certified, industrial-grade surge protection systems with audit-ready documentation are best placed to support facility resilience and long-term safety.

Hard-wired surge protection devices are being implemented to prevent electrical transients that can damage sensitive systems in commercial facilities. Compliance with updated electrical codes and insurance requirements has encouraged installation at main distribution panels and sub-panels. Devices offering real-time status indicators, replaceable modules, and diagnostic monitoring have been prioritized for enhanced reliability. Their ability to protect HVAC units, lighting systems, IT infrastructure, and industrial controls from voltage spikes reduces downtime and maintenance costs. Industries operating mission-critical environments, such as healthcare and finance, have accelerated adoption of permanently wired SPDs to safeguard continuity and minimize disruption risks associated with power fluctuations.

Deployment of hard-wired SPDs has faced challenges due to the requirement for licensed electricians and adherence to strict safety protocols during panel integration. Installation within crowded electrical rooms increases labor time and costs, while improper wiring can compromise performance or invalidate warranties. Facility managers have hesitated to retrofit older buildings where breaker panel layouts and conduit pathways lack space for additional surge protection devices. Capital expenses for industrial-grade units remain higher compared to plug-in alternatives, creating budget concerns in small and medium-sized enterprises. Lack of standardized monitoring interfaces across different SPD models adds complexity for multi-facility networks seeking centralized diagnostics and performance tracking.

Opportunities have been identified in commercial buildings undergoing electrical system modernization, where hard-wired surge protection devices are being deployed to safeguard sensitive equipment. Expansion of smart offices, data centers, and healthcare facilities has increased need for protection against power disturbances. Retrofit projects in aging structures present openings for upgrading legacy panels with integrated SPD solutions. Demand for multi-stage surge protection systems supporting renewable energy inverters and electric vehicle charging stations is emerging across corporate campuses. Collaboration with electrical contractors and building management service providers is enabling bundled installation offerings. Growth in regulatory mandates for electrical safety compliance and rising emphasis on uptime assurance in critical operations are reinforcing the adoption of these protection systems in commercial environments globally.

A clear trend toward integration of hard-wired surge protection devices within building automation systems has been observed, enabling real-time monitoring and fault detection. Innovative SPD designs with modular and DIN-rail mountable formats are gaining popularity for adaptability in commercial switchgear assemblies. Advanced diagnostic features such as visual fault indicators and remote alerts are being embedded to improve maintenance workflows. Standards for surge protection performance are being tightened, prompting the development of devices with higher discharge capacity and lower let-through voltage ratings. Adoption of hybrid SPDs combining coordination across multiple protection levels in electrical distribution systems is increasing. Electrification trends in commercial facilities are reinforcing the importance of compliant, robust surge protection solutions tailored for modern power demands.

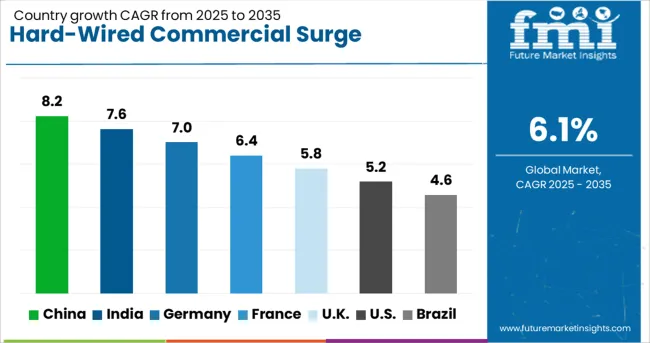

| Country | CAGR |

|---|---|

| China | 8.2% |

| India | 7.6% |

| Germany | 7.0% |

| France | 6.4% |

| UK | 5.8% |

| USA | 5.2% |

| Brazil | 4.6% |

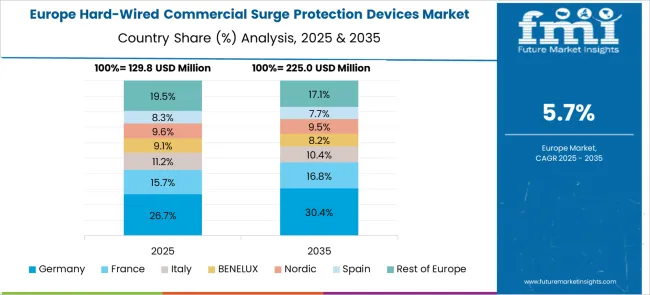

The global hard-wired commercial surge protection devices market is projected to grow at a 6.1% CAGR from 2025 to 2035, driven by growing demand for electrical reliability in commercial buildings and frequent voltage disturbances. China leads at 8.2%, fueled by data centers and industrial clusters. India follows at 7.6%, benefiting from telecom network expansion and growth in commercial real estate. Germany records 7.0%, driven by strict electrical codes and integration with building energy systems. France posts 6.4%, focusing on upgrading legacy infrastructure and ensuring equipment protection in critical facilities. The UK at 5.8% invests in surge solutions for high-rise developments and commercial electrification projects. The report includes an analysis of more than 40 countries, with the top five markets outlined below.

China is expected to grow at 8.2% CAGR, driven by the robust development of commercial spaces and advanced energy infrastructure. Demand is particularly strong in data centers, financial institutions, and industrial parks, where electrical continuity is critical. Manufacturers are scaling production of modular surge protection units with high thermal endurance to support dense load environments. Enhanced monitoring and diagnostic capabilities are becoming standard in premium solutions for preventive maintenance. Government-led power quality programs further accelerate adoption across major urban and coastal zones. Foreign technology collaborations are also increasing to improve compliance with global standards and expand local capacity.

India is forecast to grow at a 7.6% CAGR, supported by a strong pipeline of commercial real estate projects and infrastructure modernization. Surge protection requirements are becoming mandatory under updated electrical safety standards for high-occupancy buildings. Growing deployment in telecom hubs and industrial corridors adds to the momentum. Manufacturers are focusing on developing compact hard-wired devices suitable for small electrical enclosures while ensuring high surge capacity. Domestic suppliers are entering into technology-sharing agreements with global firms to meet the increasing demand for integrated safety systems.

Germany is projected to grow at a 7.0% CAGR, driven by high-value applications in healthcare, commercial complexes, and automated facilities. Demand is rising for combined Type 1 and Type 2 surge protection systems designed for critical environments with sensitive electronics. Manufacturers are introducing real-time monitoring functions to enable early fault detection, minimizing downtime. Integration with smart building management platforms is advancing to allow centralized control and energy optimization. Strong regulatory frameworks for electrical safety continue to shape product design and specifications across new and retrofit installations.

France is expected to expand at a 6.4% CAGR, driven by the renovation of aging electrical grids and an emphasis on operational safety in hospitality and retail establishments. Surge protection is being prioritized for backup power systems and sensitive commercial equipment. Manufacturers are introducing hybrid surge protection systems capable of managing both alternating and direct current loads in mixed-use environments. Features such as thermal disconnection and fault status indication are becoming standard in new models. Partnerships between local suppliers and global leaders are helping increase availability of high-performance surge devices for diverse applications.

The United Kingdom is projected to grow at a 5.8% CAGR, supported by the modernization of commercial buildings and electrical compliance initiatives. Strong demand is emerging from office complexes, educational institutions, and data-handling facilities that require uninterrupted power. Surge protection devices with thermal cutoff and advanced diagnostics are being installed in both new projects and retrofit operations. Manufacturers are developing flexible configurations for high-rise developments where electrical systems face complex load distribution. Collaborative efforts between equipment suppliers and facility managers are enabling integrated solutions that combine safety and operational efficiency.

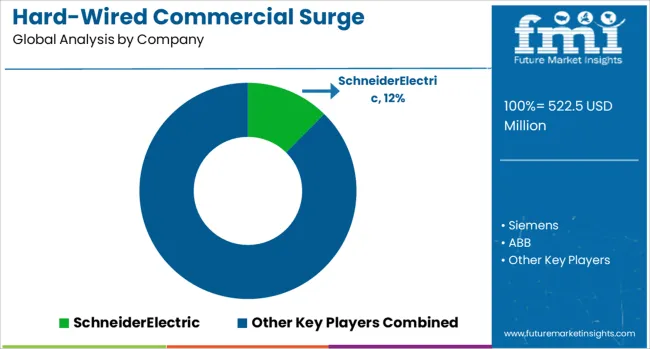

The hard-wired commercial surge protection devices market is dominated by global electrical giants such as Schneider Electric, Siemens, ABB, Eaton, and Legrand, leveraging strong brand equity, extensive distribution networks, and diversified portfolios to lead in power protection solutions for critical commercial infrastructure. Emerson Electric, Littelfuse, and Phoenix Contact strengthen their competitive positioning by integrating advanced surge suppression with power quality monitoring and predictive maintenance features, addressing the growing demand in data centers, healthcare facilities, and telecom installations.

Hubbell and Infineon Technologies focus on semiconductor-based innovations for improved performance and faster clamping response, while Belkin and Philips maintain relevance in smart building ecosystems with surge devices compatible with connected platforms. Intermatic and Socomec cater to mid-tier segments with cost-effective, standards-compliant solutions, and regional players such as JMV capture market share in emerging economies through localized manufacturing and customization aligned with regulatory frameworks. The market faces high rivalry driven by increasing dependence on sensitive electronics, regulatory mandates for surge protection, and the rising cost of downtime in commercial operations.

Differentiation revolves around product reliability, UL and IEC certification, modularity, remote monitoring capabilities, and integration with IoT-enabled energy management systems. Strategic initiatives include R&D investment for high-energy surge handling, eco-friendly materials, and smart diagnostics, alongside partnerships for expanded global distribution. Future competition is expected to pivot on AI-powered predictive analytics, cybersecurity features for connected devices, and compliance with stringent electrical safety standards. Benchmark metrics include response time, lifecycle cost, durability under high surge currents, and compatibility with digital energy platforms, ensuring long-term operational resilience for end-users.

In June 2024, Schneider Electric unveiled its PowerLogic P7 digital power-protection and control platform, designed for complex industrial and commercial installations with enhanced surge protection functionality integrated into the system.

| Item | Value |

|---|---|

| Quantitative Units | USD 522.5 Million |

| Technology | Type 2, Type 1, and Type 3 |

| Power Rating | > 50 kA to 100 kA, ≤ 50 kA, > 100 kA to 150 kA, and > 150 kA |

| Regions Covered | North America, Europe, Asia-Pacific, Latin America, Middle East & Africa |

| Country Covered | United States, Canada, Germany, France, United Kingdom, China, Japan, India, Brazil, South Africa |

| Key Companies Profiled | SchneiderElectric, Siemens, ABB, Eaton, Legrand, EmersonElectric, Littelfuse, PhoenixContact, Hubbell, InfineonTechnologies, Belkin, Philips, Intermatic, Socomec, and JMV |

| Additional Attributes | Dollar sales by device type (Type 1, Type 2) and voltage rating, with demand driven by commercial infrastructure, data centers, and smart buildings. Regional trends highlight North America as a key market, while Asia-Pacific sees accelerated growth in industrial hubs. Innovation focuses on IoT-based monitoring, modular SPD designs, and enhanced thermal protection for long-term reliability and performance. |

The global hard-wired commercial surge protection devices market is estimated to be valued at USD 522.5 million in 2025.

The market size for the hard-wired commercial surge protection devices market is projected to reach USD 944.7 million by 2035.

The hard-wired commercial surge protection devices market is expected to grow at a 6.1% CAGR between 2025 and 2035.

The key product types in hard-wired commercial surge protection devices market are type 2, type 1 and type 3.

In terms of power rating, > 50 ka to 100 ka segment to command 34.8% share in the hard-wired commercial surge protection devices market in 2025.

Our Research Products

The "Full Research Suite" delivers actionable market intel, deep dives on markets or technologies, so clients act faster, cut risk, and unlock growth.

The Leaderboard benchmarks and ranks top vendors, classifying them as Established Leaders, Leading Challengers, or Disruptors & Challengers.

Locates where complements amplify value and substitutes erode it, forecasting net impact by horizon

We deliver granular, decision-grade intel: market sizing, 5-year forecasts, pricing, adoption, usage, revenue, and operational KPIs—plus competitor tracking, regulation, and value chains—across 60 countries broadly.

Spot the shifts before they hit your P&L. We track inflection points, adoption curves, pricing moves, and ecosystem plays to show where demand is heading, why it is changing, and what to do next across high-growth markets and disruptive tech

Real-time reads of user behavior. We track shifting priorities, perceptions of today’s and next-gen services, and provider experience, then pace how fast tech moves from trial to adoption, blending buyer, consumer, and channel inputs with social signals (#WhySwitch, #UX).

Partner with our analyst team to build a custom report designed around your business priorities. From analysing market trends to assessing competitors or crafting bespoke datasets, we tailor insights to your needs.

Supplier Intelligence

Discovery & Profiling

Capacity & Footprint

Performance & Risk

Compliance & Governance

Commercial Readiness

Who Supplies Whom

Scorecards & Shortlists

Playbooks & Docs

Category Intelligence

Definition & Scope

Demand & Use Cases

Cost Drivers

Market Structure

Supply Chain Map

Trade & Policy

Operating Norms

Deliverables

Buyer Intelligence

Account Basics

Spend & Scope

Procurement Model

Vendor Requirements

Terms & Policies

Entry Strategy

Pain Points & Triggers

Outputs

Pricing Analysis

Benchmarks

Trends

Should-Cost

Indexation

Landed Cost

Commercial Terms

Deliverables

Brand Analysis

Positioning & Value Prop

Share & Presence

Customer Evidence

Go-to-Market

Digital & Reputation

Compliance & Trust

KPIs & Gaps

Outputs

Full Research Suite comprises of:

Market outlook & trends analysis

Interviews & case studies

Strategic recommendations

Vendor profiles & capabilities analysis

5-year forecasts

8 regions and 60+ country-level data splits

Market segment data splits

12 months of continuous data updates

DELIVERED AS:

PDF EXCEL ONLINE

Commercial and Industrial Rotating Rack Oven Market Size and Share Forecast Outlook 2025 to 2035

Commercial Baking Rack Oven Market Size and Share Forecast Outlook 2025 to 2035

Commercial Blast Freezer Market Size and Share Forecast Outlook 2025 to 2035

Commercial Water Heater Market Size and Share Forecast Outlook 2025 to 2035

Commercial High-Speed Oven Market Size and Share Forecast Outlook 2025 to 2035

Commercial Turboprop Aircrafts Market Size and Share Forecast Outlook 2025 to 2035

Commercial Vehicle Foundation Brakes Market Size and Share Forecast Outlook 2025 to 2035

Commercial Vehicle Brake Chambers Market Size and Share Forecast Outlook 2025 to 2035

Commercial Vehicles LED Bar Lights Market Size and Share Forecast Outlook 2025 to 2035

Commercial Vehicle AMT Transmission Market Size and Share Forecast Outlook 2025 to 2035

Commercial Greenhouse Market Size and Share Forecast Outlook 2025 to 2035

Commercial Vessel Market Size and Share Forecast Outlook 2025 to 2035

Commercial Slush Machine Market Size and Share Forecast Outlook 2025 to 2035

Commercial Medium Voltage Distribution Panel Market Size and Share Forecast Outlook 2025 to 2035

Commercial Earth Observation (CEO) Market Size and Share Forecast Outlook 2025 to 2035

Commercial Ozone Generator Market Size and Share Forecast Outlook 2025 to 2035

Commercial Gas-Fired Boiler Market Size and Share Forecast Outlook 2025 to 2035

Commercial Deep Fryer Parts & Accessories Market Size and Share Forecast Outlook 2025 to 2035

Commercial Gas Restaurant Ranges Market Size and Share Forecast Outlook 2025 to 2035

Commercial Heat Pump Market Size and Share Forecast Outlook 2025 to 2035

Thank you!

You will receive an email from our Business Development Manager. Please be sure to check your SPAM/JUNK folder too.

Chat With

MaRIA