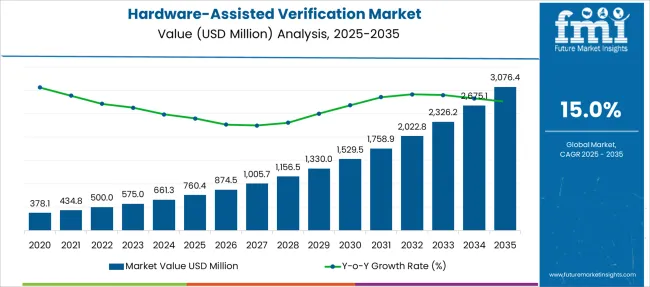

The Hardware-Assisted Verification Market is estimated to be valued at USD 760.4 million in 2025 and is projected to reach USD 3076.4 million by 2035, registering a compound annual growth rate (CAGR) of 15.0% over the forecast period.

| Metric | Value |

|---|---|

| Hardware-Assisted Verification Market Estimated Value in (2025 E) | USD 760.4 million |

| Hardware-Assisted Verification Market Forecast Value in (2035 F) | USD 3076.4 million |

| Forecast CAGR (2025 to 2035) | 15.0% |

The hardware assisted verification market is witnessing substantial growth as the complexity of semiconductor designs and the demand for faster verification cycles continue to increase. The transition from purely software based verification methods to hardware assisted platforms has been propelled by the need for higher simulation speeds and more accurate system validation.

Industry stakeholders have increasingly adopted hardware emulation and acceleration techniques to reduce time to market and improve product reliability. Future growth is expected to be driven by advancements in semiconductor technology, the rise of AI and IoT applications requiring complex chip designs, and the growing emphasis on reducing verification bottlenecks in the development cycle.

Strategic investments in scalable and flexible hardware verification solutions are paving the way for wider adoption across multiple end use industries, facilitating enhanced verification coverage and improved fault detection.

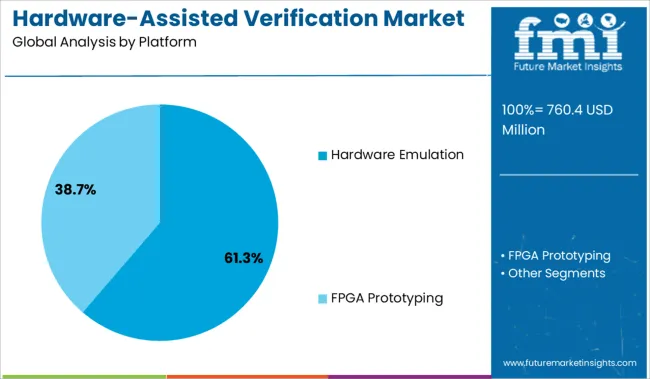

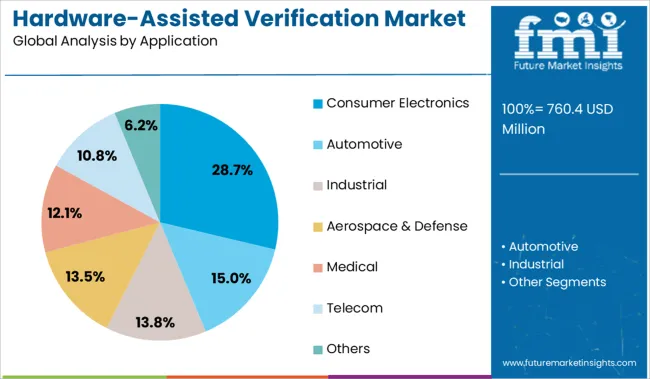

The market is segmented by Platform and Application, and region. By Platform, the market is divided into Hardware Emulation and FPGA Prototyping. In terms of Application, the market is classified into Consumer Electronics, Automotive, Industrial, Aerospace & Defense, Medical, Telecom, and Others. Regionally, the market is classified into North America, Latin America, Western Europe, Eastern Europe, Balkan & Baltic Countries, Russia & Belarus, Central Asia, East Asia, South Asia & Pacific, and the Middle East & Africa.

When segmented by platform, hardware emulation is projected to hold 61.3% of the total market revenue in 2025, making it the dominant platform segment. This leadership has been enabled by the platform’s ability to deliver significant acceleration in simulation speed compared to traditional software based methods.

Hardware emulation allows comprehensive testing of complex chip designs in real time, which supports early bug detection and validation of system level functionality. The high initial investment and operational complexity associated with hardware emulation have been offset by its capability to handle large scale designs and support extensive debug features.

These advantages have made hardware emulation the preferred choice for semiconductor companies aiming to shorten verification cycles and enhance product quality, consolidating its dominant market position.

Segmenting by application reveals that consumer electronics is expected to account for 28.7% of the market revenue in 2025, establishing it as the leading application segment. This prominence is due to the rapid evolution and high complexity of consumer electronic devices, including smartphones, wearables, and smart home products, which demand rigorous verification processes.

The pressure to deliver innovative features at faster speeds has pushed consumer electronics companies to invest heavily in hardware assisted verification solutions. The need to ensure functional correctness and reduce post production defects in highly integrated systems has further accelerated adoption.

The combination of high volume production and stringent quality expectations in this industry has driven sustained demand for efficient verification platforms, supporting the segment’s leadership in market share.

The growing demand for higher verification speed, shorter time to market, and support for complex SoC designs is accelerating the adoption of hardware-assisted verification. Emerging opportunities include FPGA-based prototyping acceleration, machine learning integration, and cloud-enabled verification platforms.

Design complexity in modern systems‑on‑chip (SoCs), multicore processors, and mixed‑signal chips is driving demand for hardware‑assisted verification. Traditional simulation methods are often too slow to handle large-scale designs in the required release cycles. Hardware acceleration via emulators or FPGA‑based platforms enables teams to run real-world test cases faster and closer to silicon timing, offering earlier bug detection and robust validation. This responsiveness translates directly to shorter development cycles and lower verification costs.

High‑performance compute clusters and enterprise verification teams rely on these tools to meet aggressive schedules and achieve first‑pass silicon success. Standards and methodologies are converging toward hardware‑assisted flows to support complex architectures, which further reinforces adoption in both established and emerging semiconductor firms.

Growth opportunities center on flexible verification ecosystems and advanced use cases such as hardware/software co‑validation, virtual prototypes, and machine‑learning‑enabled regression analysis. Integration with FPGA prototyping solutions supports real-time system validation, enabling firmware and OS integration earlier in the cycle.

Cloud‑based verification services offer scalable capacity for smaller teams or burst workloads without heavy on‑prem infrastructure. Partnerships between IP vendors, EDA suppliers, and hyperscale cloud providers can deliver on-demand verification platforms.

Also, vertical sectors such as automotive (with ISO 26262 needs), telecom (with 5G and multi‑mode devices), and aerospace require rigorous compliance driving tailored accelerator solutions. Accessible subscription pricing, remote debugging capabilities, and collaborative development portals all help extend adoption across design teams globally.

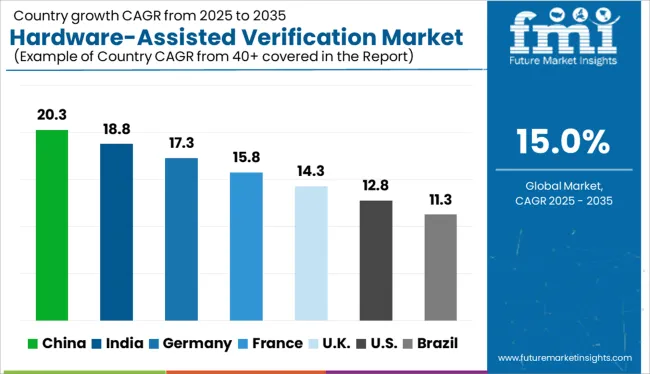

| Countries | CAGR |

|---|---|

| China | 20.3% |

| India | 18.8% |

| Germany | 17.3% |

| France | 15.8% |

| UK | 14.3% |

| USA | 12.8% |

| Brazil | 11.3% |

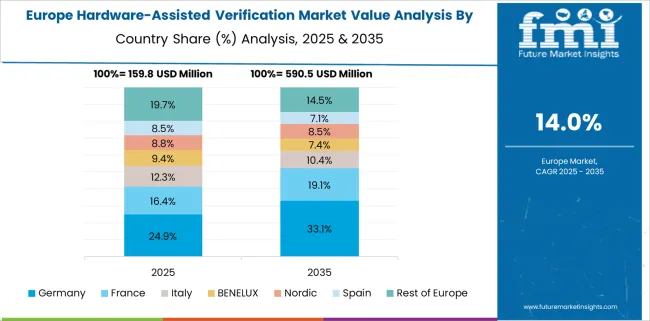

The global hardware-assisted verification market is projected to grow at a CAGR of 15.0% from 2025 to 2035, driven by rising chip complexity, time-to-market pressures, and demand for faster design verification cycles. BRICS nations lead this evolution, with China at 20.3% CAGR, fueled by national semiconductor initiatives, local EDA tool development, and AI chip proliferation. India follows at 18.8%, driven by its expanding VLSI talent pool, global design centers, and startup-driven chip innovation.

Germany leads OECD markets at 17.3%, backed by growth in automotive SoCs and industrial automation chips. In contrast, the UK (14.3%) and US (12.8%) exhibit steady growth supported by mature fabless ecosystems, cloud-enabled simulation, and RISC-V based design testing. This report covers detailed analysis of 40+ countries, and the top five countries have been shared as a reference.

China leads the global market for hardware-assisted verification, expanding rapidly with a CAGR of 20.3% as semiconductor localization initiatives fuel infrastructure investments. Domestic chipmakers and fabless design houses are ramping up simulation acceleration to handle complex workloads in AI, 5G, and edge computing.

National policies supporting EDA tool innovation and IC design independence have increased demand for emulator platforms. Cloud-based verification-as-a-service is gaining adoption among startups seeking speed and scalability. Advanced SoC and mixed-signal projects require scalable verification that traditional software-based tools cannot handle.

India registers an impressive CAGR of 18.8%, driven by growing VLSI design clusters and expanded domestic fabless activity. Universities and private R&D hubs are adopting hardware emulation platforms to support next-gen design verification. Demand is strongest in high-speed networking, automotive chips, and industrial automation segments.

Startups are increasingly using hybrid verification strategies combining FPGA-based prototyping with emulators. National investment in semiconductor infrastructure and IP development has created a stronger ecosystem for EDA adoption. Global EDA providers are localizing toolchains and offering verification-as-a-service to design houses in Bengaluru, Hyderabad, and Noida.

Germany shows a solid CAGR of 17.3%, anchored by strong demand from the automotive and industrial automation sectors. With rising design complexity in ADAS and electric vehicle systems, German firms are prioritizing early-stage hardware-assisted verification. Leading automotive OEMs are integrating in-house FPGA emulation labs to cut verification cycles.

Legacy EDA workflows are being upgraded with advanced acceleration tools, enabling real-time simulation and mixed-signal analysis. Edge computing and IIoT are also adding pressure to validate performance across multiple protocols. Regulatory standards for safety and traceability are increasing the need for transparent, verifiable flows.

The United Kingdom is poised to expand at a CAGR of 14.3%, benefiting from collaborative R&D and growing interest in sovereign chip design. Universities and R&D consortiums are piloting next-generation EDA solutions with hardware acceleration for signal integrity and memory management in custom silicon.

Demand is led by aerospace, defense, and quantum computing sectors seeking robust early-stage verification frameworks. Verification of high-frequency and low-latency chipsets is a growing bottleneck that hardware-assisted tools are well-positioned to address. Hybrid verification setups combining prototyping boards with high-performance simulators are increasingly popular.

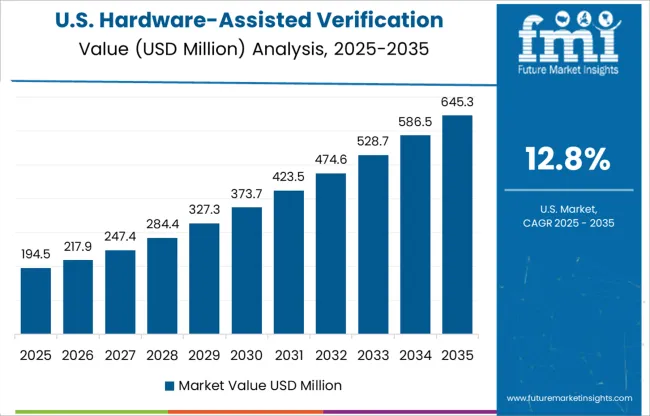

In the United States, the hardware-assisted verification market is set to grow at a CAGR of 12.8%, primarily driven by large design houses tackling SoC complexity in AI and high-performance computing. Companies are optimizing silicon bring-up cycles by deploying FPGA-based prototyping and emulator platforms in parallel with RTL simulation.

Integration with AI-assisted verification workflows and cloud-hosted testbenches has increased flexibility and resource utilization. Verification coverage is now tracked using analytics dashboards in real time to enhance speed and traceability. U.S.-based EDA firms are leading innovation, but mid-size companies are slower to adopt full hardware acceleration due to high capital costs.

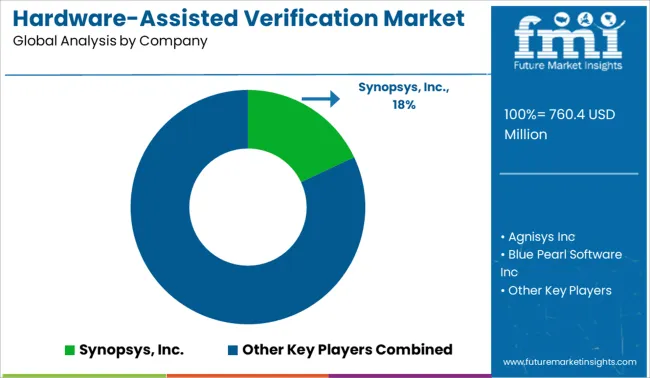

The hardware-assisted verification market is moderately consolidated, led by a handful of EDA (Electronic Design Automation) giants offering high-performance emulation, prototyping, and formal verification solutions. Synopsys, Inc. holds a significant share, driven by its advanced verification platforms, integration with AI-driven design workflows, and strong relationships with semiconductor leaders. Tier 1 competitors like Cadence Design Systems and Siemens AG (Mentor Graphics) provide comprehensive verification suites supporting SoC complexity and time-to-market demands.

Tier 2 players such as Ansys, Aldec, and Real Intent focus on niche tools for clock domain crossing, RTL linting, and formal verification. Emerging vendors like Agnisys, Blue Pearl, and Fishtail target design productivity and automation gaps. Market growth is fueled by AI chips, automotive electronics, and the increasing demand for faster, scalable chip validation.

| Item | Value |

|---|---|

| Quantitative Units | USD 760.4 Million |

| Platform | Hardware Emulation and FPGA Prototyping |

| Application | Consumer Electronics, Automotive, Industrial, Aerospace & Defense, Medical, Telecom, and Others |

| Regions Covered | North America, Europe, Asia-Pacific, Latin America, Middle East & Africa |

| Country Covered | United States, Canada, Germany, France, United Kingdom, China, Japan, India, Brazil, South Africa |

| Key Companies Profiled | Synopsys, Inc., Agnisys Inc, Blue Pearl Software Inc, Cadence Design Systems Inc, Aldec Inc, Ansys Inc, EMA Design Automation Inc, Fishtail Design Automation, Hardent, Innovative Logic, Real Intent Inc, Siemens AG, SynaptiCAD Sales Inc, and Temento Systems SAS |

| Additional Attributes | Dollar sales by verification tool type, deployment model, and end-use sector; regional demand driven by semiconductor complexity, time-to-market pressure, and R&D investments; innovation in FPGA prototyping, emulation platforms, and co-simulation techniques; cost dynamics influenced by hardware scalability and licensing models; environmental impact of hardware usage and energy consumption; and emerging use cases in AI chip design, automotive electronics, and 5G infrastructure. |

The global hardware-assisted verification market is estimated to be valued at USD 760.4 million in 2025.

The market size for the hardware-assisted verification market is projected to reach USD 3,076.4 million by 2035.

The hardware-assisted verification market is expected to grow at a 15.0% CAGR between 2025 and 2035.

The key product types in hardware-assisted verification market are hardware emulation and fpga prototyping.

In terms of application, consumer electronics segment to command 28.7% share in the hardware-assisted verification market in 2025.

Full Research Suite comprises of:

Market outlook & trends analysis

Interviews & case studies

Strategic recommendations

Vendor profiles & capabilities analysis

5-year forecasts

8 regions and 60+ country-level data splits

Market segment data splits

12 months of continuous data updates

DELIVERED AS:

PDF EXCEL ONLINE

ID Verification Market

Identity Verification Market Analysis - Size, Share, and Forecast 2025 to 2035

Ex-Employee Verification Market Size and Share Forecast Outlook 2025 to 2035

Product Design Verification And Validation Solution Market Size and Share Forecast Outlook 2025 to 2035

Thank you!

You will receive an email from our Business Development Manager. Please be sure to check your SPAM/JUNK folder too.

Chat With

MaRIA