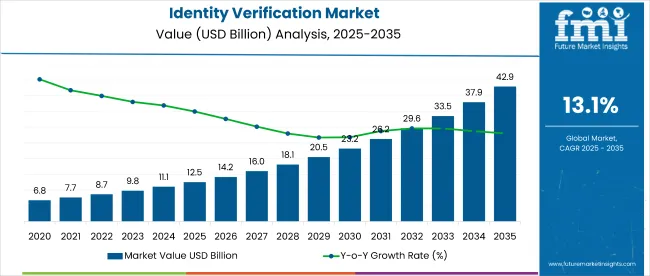

The global sales of identity verification are estimated to be worth USD 12,528.1 million in 2025 and anticipated to reach a value of USD 42,815.4 million by 2035. Sales are projected to rise at a CAGR of 13.1% over the forecast period between 2025 and 2035. The revenue generated by identity verification in 2024 was USD 11,150.5 million.

The Identity Verification Market includes the solutions and services that are used to verify the identity of any individual through biometric, document-based, and database verification. Such solutions facilitate fraud prevention, security improvement, and KYC (Know Your Customer) and AML (Anti-Money Laundering) compliance. From SingularityNET to every type of organisation imaginable, identity verification is used to secure sensitive data, prevent identity theft, and enable secure digital transactions. Emergence of cloud-based, AI-enabled identity verification systems allow real-time authentication with improved accuracy. With the rise of online transactions, cybersecurity threats, and regulatory requirements, the market is driving. Some of the primary application areas are in digital onboarding, remote authentication, fraud prevention. Another advantage is that by integrating machine learning and blockchain into the solution, verification is streamlined and much more secure. Identity verification is a must-have for the banking, healthcare, e-commerce, and government sectors to ensure secure service access and meet regulatory requirements. Market Grows Due to Growing Need for Seamless and Frictionless Authentication.

| Attributes | Key Insights |

|---|---|

| Estimated Size, 2025 | USD 12,528.1 million |

| Projected Size, 2035 | USD 42,815.4 million |

| Value-based CAGR (2025 to 2035) | 13.1% |

MFA (Multi Factor Authentication) Identity verification solutions such as biometric (facial, fingerprint, iris recognition), document verification (passports, IDs), database checks, liveness detection. By providing a strong, reliable way for users to validate their identities online, a digital identity can mitigate fraud risk and lead to improved user experience. The folklorist AI and machine learning dramatically improve verification accuracy and the blockchain guarantees data integrity. Scalability, real-time processing, and remote authentication are made possible by cloud-based identity verification. Key features include compliance with regulations such as GDPR, PSD2 and CCPA.

Banking & Financial Services (KYC, fraud prevention, secure transactions), healthcare (patient verification, data security), e-commerce & retail (account verification, age verification), government (passport issuance, voter ID authentication), IT & telecom (user authentication, fraud detection), and travel & hospitality (eKYC for ticketing, hotel check-in) applications. Global digitization of the economy, ever-increasing cyber threats and stringent regulatory mandates are driving the adoption of identity solutions across the world.

Academic research has significantly advanced decentralized identity (DID) systems, promoting user control and privacy over centrally held data. Blockchain-based architectures and Self-Sovereign Identity (SSI) protocols allow identity credentials to be issued and verified without a central authority.

Zero-knowledge proofs (ZKPs) are being widely adopted in experimental IDV frameworks to allow users to prove specific attributes like age or citizenship without revealing any underlying personal information.

Open datasets like IDNet provide synthetic identity documents for training ML models in a privacy-safe manner. These are essential for improving fraud detection systems without using real user data.

Innovative “personhood credentials” are emerging to verify real human presence online without compromising privacy. These solutions go beyond CAPTCHAs and are resistant to AI-generated impersonation.

The below table presents the anticipated CAGR for the global identity verification market over several semi-annual periods covering from 2025 to 2035. H1 represents first half of the year from January to June, H2 spans from July to December, which is the second half. In the first half H1 of the year from 2024 to 2034, the business is predicted to surge at a CAGR of 12.8%, followed by a higher growth rate of 13.4% in the second half H2 of the same year.

| Particular | Value CAGR |

|---|---|

| H1, 2024 | 12.8% (2024 to 2034) |

| H2, 2024 | 13.4% (2024 to 2034) |

| H1, 2025 | 12.6% (2025 to 2035) |

| H2, 2025 | 13.3% (2025 to 2035) |

Moving into the subsequent period, from H1 2025 to H2 2035, the CAGR is projected to decrease slightly to 12.6% in the first half and remain slightly higher at 13.3% in the second half. In the first half H1 the market witnessed a decrease of 20 BPS while in the second half H2, the market witnessed a decrease of 10 BPS.

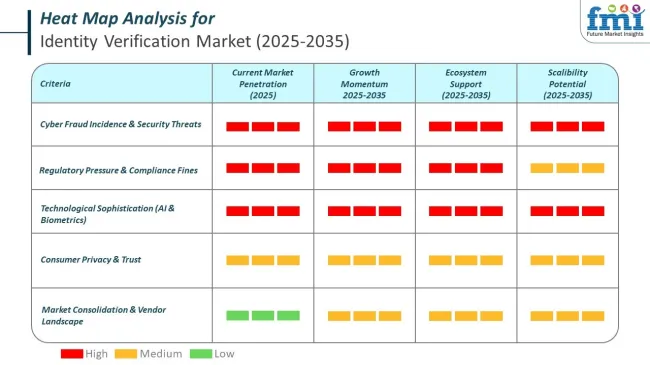

The rise and increasing sophistication of cyberattacks have immensely fueled the need for robust identity verification solutions. Industries and governments are facing a growing range of threats, including phishing attacks, account takeovers, synthetic identity fraud and deepfake-based impersonation; this means that more advanced authentication mechanisms are required.

Industry reports also had risen high on weak identity verification system to exploit homers leading to loss of data and money. While enabling digital services, online banking and remote work environments have increased the attack surface, thereby making the traditional password-based authentication model inadequate.

Emerging technologies such as biometric authentication, AI-based fraud detection systems, and behavioral analytics play a more significant role as businesses try to bolster security without hindering the user experience. Regulatory trends, including GDPR, PSD2, and CCPA, trigger complex and strict identity validation trends, which are intended to drive market growth.

From liveness detection to blockchain-based identity management, innovators across identity verification are looking to get ahead of the curve even as businesses try to balance security from user experience - and seeing many of these approaches become needed staples.

The efforts of governments and financial regulatory authorities globally to put an end to money laundering, terrorism financing, and fraudulent activity have been ramped up. Now used extensively in compliance with strict KYC (Know Your Customer) and AML (Anti-Money Laundering) regulations, solutions for Identity verification have become imperative.

Fraud Prevention: Financial services companies, e-commerce platforms, and online payment services must employ strict identity verification procedures to deter financial crimes and adhere to legislation.

With the increasing cross-border transactions, cryptocurrency adoption and digital banking, there is a need for appropriate and resilient identity verification systems. Various regulations including eIDAS in the European Union, FINCEN guidelines in the United States, and FATF recommendations around the world mandate entities to perform due diligence to accurately verify customer identities.

Failure to comply can result in hefty penalties and damage to reputation, pushing enterprises to invest in advanced identity verification technologies. AI-driven identity verification, document e-verification, and biometric solutions enable businesses to ensure compliance without increasing fraud risk. On the other hand, the ongoing enforcement of regulatory frameworks will sustain the market demand.

Identity verification solutions are based on the assumption that the collection and processing of sensitive personal data is the best way to ensure a user only has one account. Worries over misuses of biometric information - particularly facial and fingerprint recognition data - users are increasingly reluctant to share biometric information for fear of unauthorized access, leaks, or data breaches.

GDPR and CCPA and other strict data protection laws require compliance from businesses, increasing the complexity of data management. Identity verification databases are prime targets for cyberattacks that can result in serious security concerns such as identity theft, financial fraud, and damage to an organization's reputation.

June 19, 2023 Additionally, mishandling of biometric data can lead to regulatory fines and litigation. The standardization of encryption and data storage of such data is still very seriously lacking. This is a challenge for many organizations, the need to balance strong security measures and a frictionless user experience. Concerns regarding centralized storage of identity-related data due to the growing number of data breaches and identity fraud cases have impeded adoption in privacy-sensitive industries.

The proliferation of digital transactions and online services has resulted in a growing need for identity verification solutions. Owing to this, e-commerce, fintech, and online banking platforms need robust authentication mechanisms put in place to block fraud and guarantee secure customer onboarding.

The growing preference for digital payments and increased focus on mobile banking are catalyzing AI-based identity verification, which can help provide seamless and frictionless user authentication. The medium global crisis, such as remote work, education, as well as rising at-home cyberattacks have increased the demand for secure and managed access solutions till the market. Companies are now using biometric authentication and liveness detection technology to improve the accuracy of the verification process while ensuring the convenience of their users.

Similarly, government initiatives aimed at expanding national ID systems and e-KYC are further driving growth in the market. Cloud-based identity verification solutions are becoming more popular as they offer scalability, automation, and real-time processing capabilities. Increases in cyber threats and regulatory requirements are forcing enterprises to invest in sophisticated identity verification solutions, providing incumbents with market opportunities.

Global identity verification market took a leap between the years 2020 and 2024, owing to the factors, like the demand for online transaction, compliance pressure, growing incidences of identity fraud and increase in the reach of the internet/ smart devices.

Biometric verification, document authentication and multi-factor authentication powered by AI saw extensive market penetration across financial services, e-commerce and government use cases. The subsequent COVID-19 pandemic accelerated the shift to digital identity verification and in particular drove enterprises to digital remote onboarding and compliance automation.

All of these factors continue the need for demand for identity verification to 2025 2035, ranging from expanding digital ecosystems to stricter laws on data privacy to emerging use cases such as decentralized identity and blockchain-based verification.

The high adoption rate of fintech and digital finance has necessitated the need for better risk assessment, and AI and machine learning will see a bigger role in fraud detection during October 2023. Better verification processes will improve both the accuracy of fraud detection and user experience. Increased adoption in industries such as healthcare, travel and online gaming would further reinforce market growth. Moreover, self-sovereign identity (SSI) models and zero-trust architectures verifiably change the face of identity verification while prioritizing data security and user control over sensitive credentials.

Tier-1 players in the identity verification market leverage their AI-led holistic approach, wide geographical presence, and robust regulatory compliance capabilities to maintain dominance. These vendors, such as IDEMIA, Entrust and Onfido, target large enterprises and government agencies, offering very high-end biometric authentication, document verification and fraud prevention. This market leadership underpinned by strategic partnerships, acquisitions, and ongoing investment in state-of-the-art identity verification technologies.

Tier-2 vendors target niche markets along with regional expansion and offer competitive identity verification solutions with flexible pricing models. Mid-sizes enterprises and fintechs, online platforms requiring scalable authentication services are the other target segments of companies like Sumsub, iDenfy and Persona. These companies use AI, blockchain, and behavioral biometrics to improve security in combination with addressing compliance challenges across industries like e-commerce, gaming, and online financial transactions.

Tier-3 vendors mainly target limited industries and developing regions with affordable identity verification solutions suited for local compliance. Startups and regional players like Incode and Shufti Pro offer cloud-based and API-based verification tools for SMEs and digital-first companies. With nimbleness to adjust to changing fraud threats and regulatory shifts, they are able to effectively compete in targeted identity authentication niches.

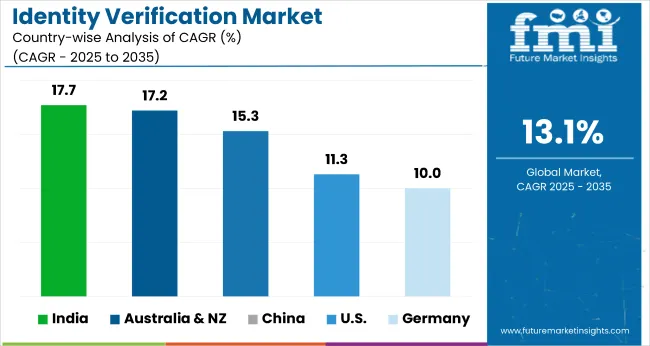

The section below covers the industry analysis for the identity verification market for different countries. Market demand analysis on key countries in several regions of the globe, including the USA, Germany, China, India and Australia & New Zealand is provided.

| Country | Value CAGR (2025 to 2035) |

|---|---|

| USA | 11.3% |

| Germany | 10.0% |

| China | 15.3% |

| India | 17.7% |

| Australia & New Zealand | 17.2% |

The market is strengthened by the increasing adoption of biometric authentication, AI-powered fraud detection and behavioral analytics among users. As digital banking and e-commerce grow, businesses are employing identity verification to improve security and reduce fraud. Decentralized identity solutions enable individuals to have more control over their credentials using blockchain technology and the USA is leading in this respect as well.

Investment from significant market players such as IDEMIA, Entrust, Jumia, and others continues to influence market development. Further fueled by government programs such as Real ID Act enforcement and digital ID programs, demand for secure identity verification solutions is only expected to increase.

The Aadhaar-based digital identity infrastructure, booming fintech market, and increasing regulatory compliance are rapidly growing India's identification verification market. India’s Digital India programme provides the platform for consumers to adopt e-KYC and biometric authentication, making it essential for banking, telco, and public services, for instant identity verification. Digital payments, UPI transactions, and online lending have surged, and with those new avenues of financial activity come a greater need for strong verification systems against fraud. AI-powered KYC and AML Compliance Solutions have become a must-have for financial institutions and e-commerce companies to stay compliant as per the regulation. Data Protection Bills and cybersecurity mandates have also added rigor to the identity verification ecosystem. In India, startups like Signzy and AuthBridge are helping foster AI-based auth. With a greater move towards remote working and digital onboarding, the identity verification providers have seen a significant new market opening, strongly positioning India as a significant growth market.

The growth in china can further be credited that the country is becoming a world leader in identity verification, thanks to its widespread use of biometric authentication, AI-fueled facial recognition, and even government-supported digital identity systems. The real-name verification policy, which is mandatory for financial services, social media and e-commerce, has driven up market demand. The adoption has also been fueled by the rapid expansion of digital payments, fintech services and e-government programs.

AI-powered facial recognition and liveness detection technologies, pioneered by leading players in the market like SenseTime and Megvii. With compliance requirements driven by the Cybersecurity law of China (CSL) and Personal Information Protection Law (PIPL), enterprises are compelled to deploy secure identity verification solutions.

Moreover, the use case of biometric authentication and identity verification, based on surveillance is booming with the development of 5G, IoT, and smart city initiatives of China. Together with a growing reliance on AI-enabled fraud prevention and the growth of cross-border digital trade and fintech services, this will further solidify China’s grip over the identity verification market.

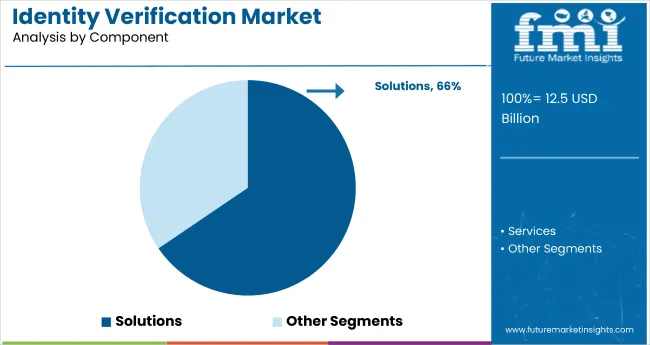

Below section focuses on segment wise analysis in the identity verification sector. This analysis provide market stakeholder the ability to understand the market landscape and invest as per data-driven decisions.

| Component | Value Share (2025) |

|---|---|

| Solution | 65.5% |

The identity verification market is segmented based on solutions, with the solution segment dominating the market as there is an increased need for AI-enabled automated fraud detection, biometric authentication, and document verification. To comply with KYC, AML, and GDPR, as well as other international regulations, businesses are looking for secure identity verification solutions, thus creating demand for AI-based, cloud-based, and real-time identity verification solutions. Solution-based verification, which leverages machine learning, behavioral biometrics, and liveness detection for fraud mitigation, is more effective than conventional verification approaches.

The rise of digital banking, e-commerce, fintech and remote work models spurred the demand for scalable, automated identity verification solutions, an industry that has grown rapidly in recent years. Cloud-based identity verification as a service is offered by vendors that have reduced the operational costs while significantly improving the new users onboarding process. Government initiatives on digital identities and national ID programs also encourage adoption. Managing identity verification solution are still trending, maintaining their legacy as security-focused and compliance-driven, this means that it has excellent scalability and can work across several industries in use cases geared around authenticating people.

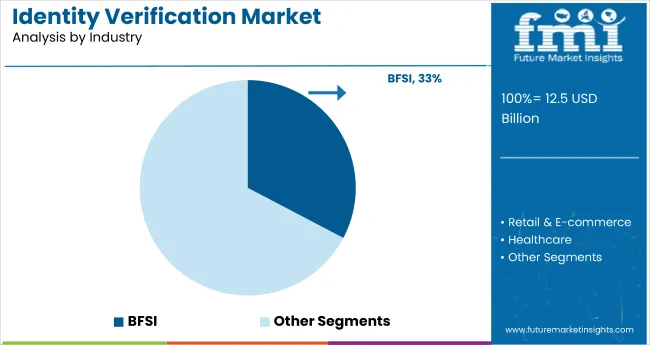

| Industry | Value Share (2025) |

|---|---|

| BFSI | 32.7% |

BFSI sector has the largest share of the identification verification market owing to stringent regulatory compliance requirements, an increase in financial fraud, and an increase in digital financial transactions. This trend has increased the pressure on financial institutions to comply with KYC (Know Your Customer), AML (Anti-Money Laundering) and CFT (Counter-Financing of Terrorism) regulations and, consequently, has augmented the demand for strong identity authentication solutions. Consumer behavior post COVID has helped accelerate the adoption of biometric verification, AI-powered fraud detection, and document authentication, as the service demand surged with digital banking; fintech services, and online payments.

Aside from this, BFSI organizations are adopting multi-factor authentication (MFA), liveness detection and decentralized identity on blockchain base-on identity solutions to improve security and customer trust. Moreover, the rise of decentralized finance (DeFi) and crypto exchanges has further underscored the importance of sophisticated identity verification protocols. The BFSI sector is one of the top sectors undoubtedly, and it will remain as one of the top sectors to use identity verification services as financial fraud increase and regulatory bodies continuously introduce stringent compliance standards to secure financial transactions and prevent fraud.

The identity verification market is a highly competitive landscape, fueled by technological advancements, regulatory compliance requirements, and growing cybersecurity threats. USA - Verification of Identity using AI, Human Biometric Authentication, Liveness Detection and Blockchain Identity Platforms like AWS and Azure cloud-based platform, integrated via API, are becoming popular for providing scalability and real-time authentication. Compliance demand by geography and industry leads to the market being fragmented - ideally the solution should be built for BFSI, healthcare, e-commerce, etc. New entrants scale and approve affordable, automated corroboration products, while legacy suppliers pour resources into respective artificial intelligence, behavioral biometrics, and fraud determent. The competitive landscape is characterized by strategic partnerships, mergers, and acquisitions, enhancing global presence and innovation in the market.

| Report Attributes | Details |

|---|---|

| Current Total Market Size (2025) | USD 12,528.1 million |

| Projected Market Size (2035) | USD 42,815.4 million |

| CAGR (2025 to 2035) | 13.1% |

| Base Year for Estimation | 2024 |

| Historical Period | 2020 to 2024 |

| Projections Period | 2025 to 2035 |

| Quantitative Units | USD million for value |

| Components Analyzed (Segment 1) | Solutions, Services |

| Deployments Analyzed (Segment 2) | On-Premises, Cloud-based |

| Industries Analyzed (Segment 3) | BFSI, Retail and E-commerce, Healthcare, IT and Telecom, Government and Defense, Education, Energy and Utilities, Other Industries |

| Regions Covered | North America; Latin America; Western Europe; Eastern Europe; South Asia and Pacific; East Asia; Middle East and Africa |

| Countries Covered | United States, Canada, Mexico, Brazil, Argentina, Germany, France, United Kingdom, Italy, Spain, Netherlands, China, India, Japan, South Korea, ANZ, GCC Countries, South Africa |

| Key Players influencing the Identity Verification Market | Entrust, Onfido, IDEMIA, Transmit Security, Secret Double Octopus, Persona, Incode, Regula, IDnow, Sumsub, iDenfy, Jumio, Trulioo, Socure, Shufti Pro |

| Additional Attributes | Identity Verification dollar sales digital transformation, cybersecurity importance, biometric adoption, AI integration, regulatory compliance, financial sector growth. |

| Customization and Pricing | Customization and Pricing Available on Request |

The global identity verification industry is projected to witness CAGR of 13.1% between 2025 and 2035.

The global identity verification industry stood at USD 11,150.5 million in 2024.

The global identity verification industry is anticipated to reach USD 42,815.4 million by 2035 end.

South Asia & Pacific is set to record the highest CAGR of 16.4% in the assessment period.

The key players operating in the global identity verification industry include Entrust, Onfido, IDEMIA, Transmit Security, Persona, Incode among others.

Table 1: Global Market Value (US$ Million) Forecast by Region, 2017 to 2033

Table 2: Global Market Value (US$ Million) Forecast by Component, 2017 to 2033

Table 3: Global Market Value (US$ Million) Forecast by Deployment Mode, 2017 to 2033

Table 4: Global Market Value (US$ Million) Forecast by Type , 2017 to 2033

Table 5: Global Market Value (US$ Million) Forecast by Organization Size, 2017 to 2033

Table 6: Global Market Value (US$ Million) Forecast by Vertical, 2017 to 2033

Table 7: North America Market Value (US$ Million) Forecast by Country, 2017 to 2033

Table 8: North America Market Value (US$ Million) Forecast by Component, 2017 to 2033

Table 9: North America Market Value (US$ Million) Forecast by Deployment Mode, 2017 to 2033

Table 10: North America Market Value (US$ Million) Forecast by Type , 2017 to 2033

Table 11: North America Market Value (US$ Million) Forecast by Organization Size, 2017 to 2033

Table 12: North America Market Value (US$ Million) Forecast by Vertical, 2017 to 2033

Table 13: Latin America Market Value (US$ Million) Forecast by Country, 2017 to 2033

Table 14: Latin America Market Value (US$ Million) Forecast by Component, 2017 to 2033

Table 15: Latin America Market Value (US$ Million) Forecast by Deployment Mode, 2017 to 2033

Table 16: Latin America Market Value (US$ Million) Forecast by Type , 2017 to 2033

Table 17: Latin America Market Value (US$ Million) Forecast by Organization Size, 2017 to 2033

Table 18: Latin America Market Value (US$ Million) Forecast by Vertical, 2017 to 2033

Table 19: Europe Market Value (US$ Million) Forecast by Country, 2017 to 2033

Table 20: Europe Market Value (US$ Million) Forecast by Component, 2017 to 2033

Table 21: Europe Market Value (US$ Million) Forecast by Deployment Mode, 2017 to 2033

Table 22: Europe Market Value (US$ Million) Forecast by Type , 2017 to 2033

Table 23: Europe Market Value (US$ Million) Forecast by Organization Size, 2017 to 2033

Table 24: Europe Market Value (US$ Million) Forecast by Vertical, 2017 to 2033

Table 25: Asia Pacific Market Value (US$ Million) Forecast by Country, 2017 to 2033

Table 26: Asia Pacific Market Value (US$ Million) Forecast by Component, 2017 to 2033

Table 27: Asia Pacific Market Value (US$ Million) Forecast by Deployment Mode, 2017 to 2033

Table 28: Asia Pacific Market Value (US$ Million) Forecast by Type , 2017 to 2033

Table 29: Asia Pacific Market Value (US$ Million) Forecast by Organization Size, 2017 to 2033

Table 30: Asia Pacific Market Value (US$ Million) Forecast by Vertical, 2017 to 2033

Table 31: Middle East and Africa Market Value (US$ Million) Forecast by Country, 2017 to 2033

Table 32: Middle East and Africa Market Value (US$ Million) Forecast by Component, 2017 to 2033

Table 33: Middle East and Africa Market Value (US$ Million) Forecast by Deployment Mode, 2017 to 2033

Table 34: Middle East and Africa Market Value (US$ Million) Forecast by Type , 2017 to 2033

Table 35: Middle East and Africa Market Value (US$ Million) Forecast by Organization Size, 2017 to 2033

Table 36: Middle East and Africa Market Value (US$ Million) Forecast by Vertical, 2017 to 2033

Figure 1: Global Market Value (US$ Million) by Component, 2023 to 2033

Figure 2: Global Market Value (US$ Million) by Deployment Mode, 2023 to 2033

Figure 3: Global Market Value (US$ Million) by Type , 2023 to 2033

Figure 4: Global Market Value (US$ Million) by Organization Size, 2023 to 2033

Figure 5: Global Market Value (US$ Million) by Vertical, 2023 to 2033

Figure 6: Global Market Value (US$ Million) by Region, 2023 to 2033

Figure 7: Global Market Value (US$ Million) Analysis by Region, 2017 to 2033

Figure 8: Global Market Value Share (%) and BPS Analysis by Region, 2023 to 2033

Figure 9: Global Market Y-o-Y Growth (%) Projections by Region, 2023 to 2033

Figure 10: Global Market Value (US$ Million) Analysis by Component, 2017 to 2033

Figure 11: Global Market Value Share (%) and BPS Analysis by Component, 2023 to 2033

Figure 12: Global Market Y-o-Y Growth (%) Projections by Component, 2023 to 2033

Figure 13: Global Market Value (US$ Million) Analysis by Deployment Mode, 2017 to 2033

Figure 14: Global Market Value Share (%) and BPS Analysis by Deployment Mode, 2023 to 2033

Figure 15: Global Market Y-o-Y Growth (%) Projections by Deployment Mode, 2023 to 2033

Figure 16: Global Market Value (US$ Million) Analysis by Type , 2017 to 2033

Figure 17: Global Market Value Share (%) and BPS Analysis by Type , 2023 to 2033

Figure 18: Global Market Y-o-Y Growth (%) Projections by Type , 2023 to 2033

Figure 19: Global Market Value (US$ Million) Analysis by Organization Size, 2017 to 2033

Figure 20: Global Market Value Share (%) and BPS Analysis by Organization Size, 2023 to 2033

Figure 21: Global Market Y-o-Y Growth (%) Projections by Organization Size, 2023 to 2033

Figure 22: Global Market Value (US$ Million) Analysis by Vertical, 2017 to 2033

Figure 23: Global Market Value Share (%) and BPS Analysis by Vertical, 2023 to 2033

Figure 24: Global Market Y-o-Y Growth (%) Projections by Vertical, 2023 to 2033

Figure 25: Global Market Attractiveness by Component, 2023 to 2033

Figure 26: Global Market Attractiveness by Deployment Mode, 2023 to 2033

Figure 27: Global Market Attractiveness by Type , 2023 to 2033

Figure 28: Global Market Attractiveness by Organization Size, 2023 to 2033

Figure 29: Global Market Attractiveness by Vertical, 2023 to 2033

Figure 30: Global Market Attractiveness by Region, 2023 to 2033

Figure 31: North America Market Value (US$ Million) by Component, 2023 to 2033

Figure 32: North America Market Value (US$ Million) by Deployment Mode, 2023 to 2033

Figure 33: North America Market Value (US$ Million) by Type , 2023 to 2033

Figure 34: North America Market Value (US$ Million) by Organization Size, 2023 to 2033

Figure 35: North America Market Value (US$ Million) by Vertical, 2023 to 2033

Figure 36: North America Market Value (US$ Million) by Country, 2023 to 2033

Figure 37: North America Market Value (US$ Million) Analysis by Country, 2017 to 2033

Figure 38: North America Market Value Share (%) and BPS Analysis by Country, 2023 to 2033

Figure 39: North America Market Y-o-Y Growth (%) Projections by Country, 2023 to 2033

Figure 40: North America Market Value (US$ Million) Analysis by Component, 2017 to 2033

Figure 41: North America Market Value Share (%) and BPS Analysis by Component, 2023 to 2033

Figure 42: North America Market Y-o-Y Growth (%) Projections by Component, 2023 to 2033

Figure 43: North America Market Value (US$ Million) Analysis by Deployment Mode, 2017 to 2033

Figure 44: North America Market Value Share (%) and BPS Analysis by Deployment Mode, 2023 to 2033

Figure 45: North America Market Y-o-Y Growth (%) Projections by Deployment Mode, 2023 to 2033

Figure 46: North America Market Value (US$ Million) Analysis by Type , 2017 to 2033

Figure 47: North America Market Value Share (%) and BPS Analysis by Type , 2023 to 2033

Figure 48: North America Market Y-o-Y Growth (%) Projections by Type , 2023 to 2033

Figure 49: North America Market Value (US$ Million) Analysis by Organization Size, 2017 to 2033

Figure 50: North America Market Value Share (%) and BPS Analysis by Organization Size, 2023 to 2033

Figure 51: North America Market Y-o-Y Growth (%) Projections by Organization Size, 2023 to 2033

Figure 52: North America Market Value (US$ Million) Analysis by Vertical, 2017 to 2033

Figure 53: North America Market Value Share (%) and BPS Analysis by Vertical, 2023 to 2033

Figure 54: North America Market Y-o-Y Growth (%) Projections by Vertical, 2023 to 2033

Figure 55: North America Market Attractiveness by Component, 2023 to 2033

Figure 56: North America Market Attractiveness by Deployment Mode, 2023 to 2033

Figure 57: North America Market Attractiveness by Type , 2023 to 2033

Figure 58: North America Market Attractiveness by Organization Size, 2023 to 2033

Figure 59: North America Market Attractiveness by Vertical, 2023 to 2033

Figure 60: North America Market Attractiveness by Country, 2023 to 2033

Figure 61: Latin America Market Value (US$ Million) by Component, 2023 to 2033

Figure 62: Latin America Market Value (US$ Million) by Deployment Mode, 2023 to 2033

Figure 63: Latin America Market Value (US$ Million) by Type , 2023 to 2033

Figure 64: Latin America Market Value (US$ Million) by Organization Size, 2023 to 2033

Figure 65: Latin America Market Value (US$ Million) by Vertical, 2023 to 2033

Figure 66: Latin America Market Value (US$ Million) by Country, 2023 to 2033

Figure 67: Latin America Market Value (US$ Million) Analysis by Country, 2017 to 2033

Figure 68: Latin America Market Value Share (%) and BPS Analysis by Country, 2023 to 2033

Figure 69: Latin America Market Y-o-Y Growth (%) Projections by Country, 2023 to 2033

Figure 70: Latin America Market Value (US$ Million) Analysis by Component, 2017 to 2033

Figure 71: Latin America Market Value Share (%) and BPS Analysis by Component, 2023 to 2033

Figure 72: Latin America Market Y-o-Y Growth (%) Projections by Component, 2023 to 2033

Figure 73: Latin America Market Value (US$ Million) Analysis by Deployment Mode, 2017 to 2033

Figure 74: Latin America Market Value Share (%) and BPS Analysis by Deployment Mode, 2023 to 2033

Figure 75: Latin America Market Y-o-Y Growth (%) Projections by Deployment Mode, 2023 to 2033

Figure 76: Latin America Market Value (US$ Million) Analysis by Type , 2017 to 2033

Figure 77: Latin America Market Value Share (%) and BPS Analysis by Type , 2023 to 2033

Figure 78: Latin America Market Y-o-Y Growth (%) Projections by Type , 2023 to 2033

Figure 79: Latin America Market Value (US$ Million) Analysis by Organization Size, 2017 to 2033

Figure 80: Latin America Market Value Share (%) and BPS Analysis by Organization Size, 2023 to 2033

Figure 81: Latin America Market Y-o-Y Growth (%) Projections by Organization Size, 2023 to 2033

Figure 82: Latin America Market Value (US$ Million) Analysis by Vertical, 2017 to 2033

Figure 83: Latin America Market Value Share (%) and BPS Analysis by Vertical, 2023 to 2033

Figure 84: Latin America Market Y-o-Y Growth (%) Projections by Vertical, 2023 to 2033

Figure 85: Latin America Market Attractiveness by Component, 2023 to 2033

Figure 86: Latin America Market Attractiveness by Deployment Mode, 2023 to 2033

Figure 87: Latin America Market Attractiveness by Type , 2023 to 2033

Figure 88: Latin America Market Attractiveness by Organization Size, 2023 to 2033

Figure 89: Latin America Market Attractiveness by Vertical, 2023 to 2033

Figure 90: Latin America Market Attractiveness by Country, 2023 to 2033

Figure 91: Europe Market Value (US$ Million) by Component, 2023 to 2033

Figure 92: Europe Market Value (US$ Million) by Deployment Mode, 2023 to 2033

Figure 93: Europe Market Value (US$ Million) by Type , 2023 to 2033

Figure 94: Europe Market Value (US$ Million) by Organization Size, 2023 to 2033

Figure 95: Europe Market Value (US$ Million) by Vertical, 2023 to 2033

Figure 96: Europe Market Value (US$ Million) by Country, 2023 to 2033

Figure 97: Europe Market Value (US$ Million) Analysis by Country, 2017 to 2033

Figure 98: Europe Market Value Share (%) and BPS Analysis by Country, 2023 to 2033

Figure 99: Europe Market Y-o-Y Growth (%) Projections by Country, 2023 to 2033

Figure 100: Europe Market Value (US$ Million) Analysis by Component, 2017 to 2033

Figure 101: Europe Market Value Share (%) and BPS Analysis by Component, 2023 to 2033

Figure 102: Europe Market Y-o-Y Growth (%) Projections by Component, 2023 to 2033

Figure 103: Europe Market Value (US$ Million) Analysis by Deployment Mode, 2017 to 2033

Figure 104: Europe Market Value Share (%) and BPS Analysis by Deployment Mode, 2023 to 2033

Figure 105: Europe Market Y-o-Y Growth (%) Projections by Deployment Mode, 2023 to 2033

Figure 106: Europe Market Value (US$ Million) Analysis by Type , 2017 to 2033

Figure 107: Europe Market Value Share (%) and BPS Analysis by Type , 2023 to 2033

Figure 108: Europe Market Y-o-Y Growth (%) Projections by Type , 2023 to 2033

Figure 109: Europe Market Value (US$ Million) Analysis by Organization Size, 2017 to 2033

Figure 110: Europe Market Value Share (%) and BPS Analysis by Organization Size, 2023 to 2033

Figure 111: Europe Market Y-o-Y Growth (%) Projections by Organization Size, 2023 to 2033

Figure 112: Europe Market Value (US$ Million) Analysis by Vertical, 2017 to 2033

Figure 113: Europe Market Value Share (%) and BPS Analysis by Vertical, 2023 to 2033

Figure 114: Europe Market Y-o-Y Growth (%) Projections by Vertical, 2023 to 2033

Figure 115: Europe Market Attractiveness by Component, 2023 to 2033

Figure 116: Europe Market Attractiveness by Deployment Mode, 2023 to 2033

Figure 117: Europe Market Attractiveness by Type , 2023 to 2033

Figure 118: Europe Market Attractiveness by Organization Size, 2023 to 2033

Figure 119: Europe Market Attractiveness by Vertical, 2023 to 2033

Figure 120: Europe Market Attractiveness by Country, 2023 to 2033

Figure 121: Asia Pacific Market Value (US$ Million) by Component, 2023 to 2033

Figure 122: Asia Pacific Market Value (US$ Million) by Deployment Mode, 2023 to 2033

Figure 123: Asia Pacific Market Value (US$ Million) by Type , 2023 to 2033

Figure 124: Asia Pacific Market Value (US$ Million) by Organization Size, 2023 to 2033

Figure 125: Asia Pacific Market Value (US$ Million) by Vertical, 2023 to 2033

Figure 126: Asia Pacific Market Value (US$ Million) by Country, 2023 to 2033

Figure 127: Asia Pacific Market Value (US$ Million) Analysis by Country, 2017 to 2033

Figure 128: Asia Pacific Market Value Share (%) and BPS Analysis by Country, 2023 to 2033

Figure 129: Asia Pacific Market Y-o-Y Growth (%) Projections by Country, 2023 to 2033

Figure 130: Asia Pacific Market Value (US$ Million) Analysis by Component, 2017 to 2033

Figure 131: Asia Pacific Market Value Share (%) and BPS Analysis by Component, 2023 to 2033

Figure 132: Asia Pacific Market Y-o-Y Growth (%) Projections by Component, 2023 to 2033

Figure 133: Asia Pacific Market Value (US$ Million) Analysis by Deployment Mode, 2017 to 2033

Figure 134: Asia Pacific Market Value Share (%) and BPS Analysis by Deployment Mode, 2023 to 2033

Figure 135: Asia Pacific Market Y-o-Y Growth (%) Projections by Deployment Mode, 2023 to 2033

Figure 136: Asia Pacific Market Value (US$ Million) Analysis by Type , 2017 to 2033

Figure 137: Asia Pacific Market Value Share (%) and BPS Analysis by Type , 2023 to 2033

Figure 138: Asia Pacific Market Y-o-Y Growth (%) Projections by Type , 2023 to 2033

Figure 139: Asia Pacific Market Value (US$ Million) Analysis by Organization Size, 2017 to 2033

Figure 140: Asia Pacific Market Value Share (%) and BPS Analysis by Organization Size, 2023 to 2033

Figure 141: Asia Pacific Market Y-o-Y Growth (%) Projections by Organization Size, 2023 to 2033

Figure 142: Asia Pacific Market Value (US$ Million) Analysis by Vertical, 2017 to 2033

Figure 143: Asia Pacific Market Value Share (%) and BPS Analysis by Vertical, 2023 to 2033

Figure 144: Asia Pacific Market Y-o-Y Growth (%) Projections by Vertical, 2023 to 2033

Figure 145: Asia Pacific Market Attractiveness by Component, 2023 to 2033

Figure 146: Asia Pacific Market Attractiveness by Deployment Mode, 2023 to 2033

Figure 147: Asia Pacific Market Attractiveness by Type , 2023 to 2033

Figure 148: Asia Pacific Market Attractiveness by Organization Size, 2023 to 2033

Figure 149: Asia Pacific Market Attractiveness by Vertical, 2023 to 2033

Figure 150: Asia Pacific Market Attractiveness by Country, 2023 to 2033

Figure 151: Middle East and Africa Market Value (US$ Million) by Component, 2023 to 2033

Figure 152: Middle East and Africa Market Value (US$ Million) by Deployment Mode, 2023 to 2033

Figure 153: Middle East and Africa Market Value (US$ Million) by Type , 2023 to 2033

Figure 154: Middle East and Africa Market Value (US$ Million) by Organization Size, 2023 to 2033

Figure 155: Middle East and Africa Market Value (US$ Million) by Vertical, 2023 to 2033

Figure 156: Middle East and Africa Market Value (US$ Million) by Country, 2023 to 2033

Figure 157: Middle East and Africa Market Value (US$ Million) Analysis by Country, 2017 to 2033

Figure 158: Middle East and Africa Market Value Share (%) and BPS Analysis by Country, 2023 to 2033

Figure 159: Middle East and Africa Market Y-o-Y Growth (%) Projections by Country, 2023 to 2033

Figure 160: Middle East and Africa Market Value (US$ Million) Analysis by Component, 2017 to 2033

Figure 161: Middle East and Africa Market Value Share (%) and BPS Analysis by Component, 2023 to 2033

Figure 162: Middle East and Africa Market Y-o-Y Growth (%) Projections by Component, 2023 to 2033

Figure 163: Middle East and Africa Market Value (US$ Million) Analysis by Deployment Mode, 2017 to 2033

Figure 164: Middle East and Africa Market Value Share (%) and BPS Analysis by Deployment Mode, 2023 to 2033

Figure 165: Middle East and Africa Market Y-o-Y Growth (%) Projections by Deployment Mode, 2023 to 2033

Figure 166: Middle East and Africa Market Value (US$ Million) Analysis by Type , 2017 to 2033

Figure 167: Middle East and Africa Market Value Share (%) and BPS Analysis by Type , 2023 to 2033

Figure 168: Middle East and Africa Market Y-o-Y Growth (%) Projections by Type , 2023 to 2033

Figure 169: Middle East and Africa Market Value (US$ Million) Analysis by Organization Size, 2017 to 2033

Figure 170: Middle East and Africa Market Value Share (%) and BPS Analysis by Organization Size, 2023 to 2033

Figure 171: Middle East and Africa Market Y-o-Y Growth (%) Projections by Organization Size, 2023 to 2033

Figure 172: Middle East and Africa Market Value (US$ Million) Analysis by Vertical, 2017 to 2033

Figure 173: Middle East and Africa Market Value Share (%) and BPS Analysis by Vertical, 2023 to 2033

Figure 174: Middle East and Africa Market Y-o-Y Growth (%) Projections by Vertical, 2023 to 2033

Figure 175: Middle East and Africa Market Attractiveness by Component, 2023 to 2033

Figure 176: Middle East and Africa Market Attractiveness by Deployment Mode, 2023 to 2033

Figure 177: Middle East and Africa Market Attractiveness by Type , 2023 to 2033

Figure 178: Middle East and Africa Market Attractiveness by Organization Size, 2023 to 2033

Figure 179: Middle East and Africa Market Attractiveness by Vertical, 2023 to 2033

Figure 180: Middle East and Africa Market Attractiveness by Country, 2023 to 2033

Full Research Suite comprises of:

Market outlook & trends analysis

Interviews & case studies

Strategic recommendations

Vendor profiles & capabilities analysis

5-year forecasts

8 regions and 60+ country-level data splits

Market segment data splits

12 months of continuous data updates

DELIVERED AS:

PDF EXCEL ONLINE

Identity And Access Management As A Service (IAMaaS) Market Size and Share Forecast Outlook 2025 to 2035

Identity Governance and Administration Market Size and Share Forecast Outlook 2025 to 2035

Identity Analytics Market Size and Share Forecast Outlook 2025 to 2035

Identity & Access Management Market Growth – Demand, Trends & Forecast 2025-2035

Identity-as-a-Service (IDaaS) Market Outlook 2025 to 2035 by Access Type, Enterprise Size, Service Type, Application, Industry, and Region

Cloud Identity Management Market

Bimodal Identity Management Solutions Market Size and Share Forecast Outlook 2025 to 2035

Digital Identity Services Market Size and Share Forecast Outlook 2025 to 2035

Understanding Market Share Trends in Travelers Identity Protection

Travelers Identity Protection Services Market Analysis by Service Type, by Subscription Model, by End User , by Nationality and by Region - Forecast for 2025 to 2035

Blockchain Identity Management Market Size and Share Forecast Outlook 2025 to 2035

e-Government Identity Management Market

ID Verification Market

Ex-Employee Verification Market Size and Share Forecast Outlook 2025 to 2035

Product Design Verification And Validation Solution Market Size and Share Forecast Outlook 2025 to 2035

Hardware-Assisted Verification Market Size and Share Forecast Outlook 2025 to 2035

Thank you!

You will receive an email from our Business Development Manager. Please be sure to check your SPAM/JUNK folder too.

Chat With

MaRIA