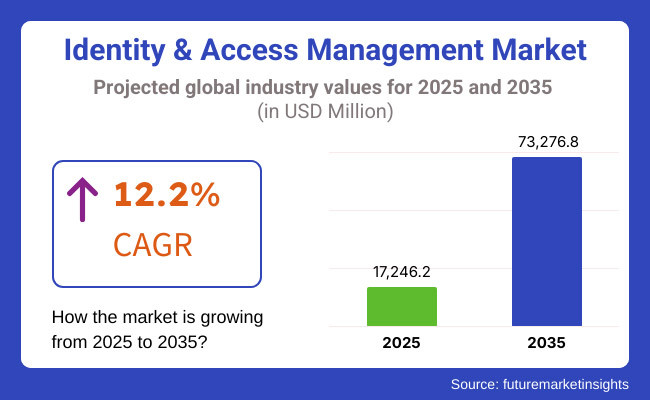

The global Identity and access Management market is projected to grow significantly, from USD 17,246.2 million in 2025 to USD 73,276.8 million by 2035, reflecting a strong CAGR of 12.2%.

An external IAM (identity and access management) vendor often brings such capabilities in, and organizations are leaning heavily on them. BFSI, healthcare, and IT industries need to secure their IAM solution to provide legitimate third-party access while also preventing unauthorized actions. The never-ending expansion of ecosystems and partnerships with an ever-growing number of external partners has demanded better identity risk management.

Data protection regulations such as GDPR, CCPA, and HIPAA require organizations to adopt identity governance, audit trails, and access controls for third-party engagements. Having a central IAM solution enables you to automate compliance processes with minimum human effort, helping businesses comply. With the shifting regulations around the globe, businesses are putting identity security at the forefront to prevent costly legal and financial consequences.

As organizations adopt IT acceleration to the cloud and need third-party cloud services, IT providers, and outsourcing partners, IAM solutions become imperative. Advanced authentication, Single Sign-On (SSO), and identity provisioning enable organizations to secure interactions with these third parties without compromising compliance, security, or both.

These factors have instigated organizations to solidify security for third-party access. IAM solutions provide continuous monitoring, adaptive authentication, and real-time risk assessment to counter identity-based threats. Protecting against intrusion and securing privileged accounts is now a priority to protect sensitive data from outside attacks.

North America accounts for the largest share in the IAM market, owing to the stringent compliance and regulatory framework, the presence of key IAM vendors, and strong cybersecurity investments. Apart from these, India and the other constituents of India - Australia are squarely observing the adoption of IAM at an impressive rate, propelled by augmenting regulatory scrutiny and the requirement for identity governance and privileged access management (PAM).

IAM (Identity and Access Management) solutions are gaining importance for helping businesses securely and compliantly manage digital identities as they expand vertically or horizontally.

| Company | Okta, Inc. |

|---|---|

| Contract/Development Details | Partnered with a financial services firm to deploy a robust IAM solution, enhancing security protocols and ensuring compliance with regulatory standards across digital platforms. |

| Date | February 2024 |

| Contract Value (USD Million) | Approximately USD 20 |

| Renewal Period | 4 years |

| Company | IBM Security |

|---|---|

| Contract/Development Details | Secured a contract with a healthcare provider to implement an IAM framework, aiming to protect sensitive patient data and streamline user access management across multiple systems. |

| Date | October 2024 |

| Contract Value (USD Million) | Approximately USD 25 |

| Renewal Period | 5 years |

Increasing cybersecurity threats are pushing the demand for robust IAM solutions

The increasing prevalence and complexity of cyberattacks have made strong Identity and Access Management (IAM) solutions essential for organizations across many sectors. For example, high-profile events like the infiltration of Western IT departments by North Korean agents acting like remote software engineers revealed serious flaws at the foundation of organizational security architectures.

The risks of password-based authentication are well-known. Once users are compromised, attackers routinely jump from application to application to perform privilege escalation, tamper with data, and steal sensitive user information.

As a result, organizations are increasingly implementing robust IAM solutions to protect against such advanced attacks, allowing only authorized and authenticated users access to key systems and data. Data up until October 2023 has been the training ground to help generate responses.

Rising adoption of cloud services and digital transformation is driving IAM needs

Due to the global adoption of cloud services and the speed up of digital transformation initiatives, organizations have previously managed identities and access controls in drastically different ways. So when organizations start shifting to the cloud and apply remote work, the existing network perimeter disintegrates, which has made it fundamental for IAM (Identity Access Management) solutions to ensure effective management of user Identities over heterogeneous environments.

Government initiatives like the USA General Services Administration’s Login. gov, which showcases initiatives for secure and unified access to multiple services under a singular digital identity. Login. Gov users can access various government services using a single login, making the process more efficient and secure.

Such IAM implementations help facilitate the smooth integration of cloud services and digital applications, ensuring secure and efficient access management and thus facilitating organizations' agility and resilience in the digital age.

Increasing use of Single Sign-On (SSO) and multi-factor authentication (MFA) for enhanced security

To improve security, many organizations are adopting SSO (Single Sign-On) and MFA (Multi-Factor Authentication). Single Sign-On (SSO) is a process that allows a user to sign in once and gain access to a suite of applications without the need to log in to each one separately.

Multifactor authentication (MFA) provides an additional security layer by demanding multiple verification types; for instance, a user may need to input a password as well as biometrics or time-sensitive codes. However, increasingly complex attack vectors, such as MFA fatigue attacks, which spam users with authentication requests until they accidentally tap to approve one, show that these technologies need to continue to improve and evolve.

Companies such as Microsoft have taken the opportunity to enhance their authenticator apps to combat MFA fatigue attacks in response to such threats, showcasing how companies are evolving their approach to securing user identities.

High implementation costs deter small and mid-sized enterprises from adoption.

The high implementation cost, especially for small and mid-sized enterprises (SMEs), prevents them from adopting Identity and access management (IAM) solutions. A full IAM system will require a great deal of investment in software, hardware, and specifically skilled individuals to administer and maintain the infrastructure.

Organizations in this category typically have tight IT budgets so the upfront capital investment for advanced identity security solutions is not easily afforded. Many smaller organizations struggle with lump sum licensing fees, ongoing subscription charges (which can be rather high), and integration costs as opposed to larger companies that can absorb such costs.

Customizing IAM solutions to match an organization's existing IT ecosystem is expensive. This specialization extends the deployment timeframe and requires organizations to hire or train people (or teams) with IAM expertise, thus incurring additional costs.

IAM solutions also incur a steep financial cost associated with maintaining and regularly updating them to safeguard against ever-evolving security threats, meaning they are not a one-time cost but a continuous investment.

Consequently, numerous SMEs settle for rudimentary security solutions, making them more susceptible to cyberattacks and unauthorized exposure. The costs associated with effective IAM solutions represent a major hurdle for smaller enterprises looking to protect their assets with advanced identity-related security measures, as the specter of cybersecurity threats looms larger.

| Market Shift | 2020 to 2024 |

|---|---|

| Regulatory Landscape | Stricter identity protection laws led to increased IAM adoption. |

| Zero Trust & Adaptive Security | Zero-trust models gained traction for enterprise security. |

| Multi-Factor Authentication (MFA) | Widespread adoption of biometrics and token-based authentication. |

| Cloud & Hybrid Environments | Cloud-based IAM solutions surged to support remote work. |

| Market Growth Drivers | Rise in cybersecurity threats and digital transformation initiatives. |

| Market Shift | 2025 to 2035 |

|---|---|

| Regulatory Landscape | AI-powered decentralized identity management ensures privacy-first security. |

| Zero Trust & Adaptive Security | AI-driven identity analytics predict and prevent security breaches autonomously. |

| Multi-Factor Authentication (MFA) | Brainwave and behavioral biometrics redefine authentication standards. |

| Cloud & Hybrid Environments | AI-powered identity orchestration integrates seamless access across platforms. |

| Market Growth Drivers | AI-driven identity ecosystems enhance user convenience and risk management. |

This section highlights the CAGRs of countries experiencing growth in the Identity and access Management market and the latest advancements contributing to overall market development. Based on current estimates, China, India, and the USA are expected to see steady growth during the forecast period.

| Countries | CAGR from 2025 to 2035 |

|---|---|

| India | 15.6% |

| China | 14.5% |

| Germany | 10.8% |

| Japan | 13.1% |

| United States | 12.0% |

The Identity & Access Management (IAM) solutions ensure that secure transactions in cyberspace are in high demand in China due to its rapid digital transformation. As the country's digital economy, such as e-commerce, fintech, and online banking, grows rapidly, so does the danger of cyber threats and fraudulent transactions.

With more than 1.05 billion users, China has a share of the IAM solutions market. This encourages organizations to invest in IAM solutions that can secure user identities, provide an effective solution to identity verification, and prevent unauthorized access.

The need for a novel identity and access management (IAM) framework has become urgent with the emergence of mobile payments via platform giants like Alipay and WeChat Pay, which collectively processed over USD 17 trillion in transactions in 2023 alone.

On October 15, 2023, the Cyberspace Administration of China (CAC) announced new regulations on cybersecurity and data protection regarding online transactions. These regulations require businesses to implement stringent identity verification and multi-factor authentication (MFA) to reduce data breaches.

Cases of online fraud, which increased by 24% per annum, according to a 2023 government report, have resulted in the brisk uptake of strict IAM not only on corporate web pages but also in how accounts are accessed generally in the digital domain. China is anticipated to see substantial growth at a CAGR of 14.5% from 2025 to 2035 in the Identity & Access Management market.

Aadhaar-based authentication is a game changer when it comes to the IAM marketplace in India, as we continue to see organisations from the public and private sectors embrace biometric and digital identity verification as part of their security strategy. Aadhaar now has over 1.3 billion registrations, and it is now the largest biometric-based identity system globally. It provides integral authentication of heap digital transactions, access to banking services, and unlocking key government schemes.

In fact, the Indian government's requirement for Aadhaar authentication for financial transactions will further augment Aadhaar's influence on IAM adoption in the country. Banks, telcos, and other e-commerce companies are deploying eKYC (electronic Know Your Customer) Enabled Aadhaar (the Indian biometric identity system) to enhance their authentication process and comply with security regulations.

The Unique Identification Authority of India (UIDAI) recently announced a change in its Aadhaar-based authentication system. As a measure to restrict identity theft and unauthorized access, AI (artificial intelligence)- driven fraud detection mechanisms have been introduced. Government data shows a 45% jump in Aadhaar-based eKYC transactions in 2023, showing increased dependence on IAM frameworks.

Aadhar verification: Reserve Bank Circle helico to fintech companies. These measures are designed to prevent identity theft and fraud in the digital age. India's Identity and access Management market is growing at a CAGR of 15.6% during the forecast period.

Regulatory frameworks such as the California Consumer Privacy Act (CCPA) and the National Institute of Standards and Technology(NIST) guidelines cover extensive areas, and the United States is also experiencing a growing trend toward the utilization of IAM solutions.

Following the rise of cyber risk, compliance with such frameworks has become the topmost concern for USA-based businesses, both to avoid the threats of legal penalties and, most importantly, to guard consumer data.

The CCPA focuses on organizational control over the secFw, forcing organizations to follow strict IAM measures, including role-based access control (RBAC), multi-factor authentication (MFA), and zero-trust security models.

Likewise, NIST Special Publication 800-63 offers comprehensive guidelines on keeping digital identity secure, affecting IAM strategies not just among federal agencies but also in the private enterprise world. The USA is anticipated to see substantial growth in the Identity & Access Management market, which will hold a dominant share of 74.2% in 2025.

This section contains information about the industry's leading segments. By Solution, the Advanced Authentication segment is estimated to grow quickly from 2025 to 2035. Additionally, by End User, the BFSI segment will hold a dominant share in 2025.

| Solution | CAGR (2025 to 2035) |

|---|---|

| Advanced Authentication | 14.2% |

The Advanced Authentication segment is expected to grow at a CAGR of 14.2% from 2025 to 2035. The market trend also represents that the Advanced Authentication segment is booming in the overall Authentication Market in Everything of Identity & Access Management (IAM) Market due to the growing focus of organizations from various industries toward multi-factor authentication (MFA), biometrics, and AI-driven authentication to improve security.

As cyberattacks grow more sophisticated, organizations are shifting from traditional password-based authentication to zero-trust security models, where verifying identity is ongoing and risk-based. Technologies like facial recognition, fingerprint scanning, behavioral biometrics, and adaptive authentication are being embraced to protect against unauthorized access. MFA adoption worldwide increased by more than 50% in 2023 due to the continuing rise in credential theft and phishing attacks.

In 2023, the USA federal government required phishing-resistant MFA for all federal agencies, covering more than 2.5 million government employees. As also above, the EU set new authentication standards with the eIDAS regulation, mandating businesses that use sensitive data to deploy stronger identity verification methods.

| End User | Value Share (2025) |

|---|---|

| BFSI | 24.8% |

The BFSI is poised to capture a share of 24.8% in 2025. The identity and access management market share Analysis by BFSI application sector holds the largest market identification in the banking, financial services, and insurance (BFSI) segments due to the critical need for secure transactions with fraud prevention and regulatory compliance.

Transaction banks hold millions of transactions a day, which makes them a favorite for cybercriminals. To overcome the drawbacks, BFSI companies utilize multi-factor authentication (MFA), risk-based authentication (RBA), identity governance, and AI-enabled fraud detection. The rise of digital banking and mobile payments has further increased the need for IAM solutions.

Global financial institutions spent over USD 15 billion on IAM solutions in 2023, demonstrating their investment in creating secure environments for customer identities and preventing financial crimes.

In China, the People’s Bank of China (PBOC) imposed tighter identity checks on digital payments, affecting more than 900 million mobile banking customers. The Reserve Bank of India (RBI) also implemented new authentication measures for online transactions, which helped to reduce fraud in digital payments by 40% in 2023.

The IAM market is one of those high-growing markets as enterprises focus more on cybersecurity, compliance, and digital transformation. Organizations in every vertical rely on IAM solutions to secure users, manage permissions, and minimize data breaches.

Credentialing will be a competitive landscape in which well-known technology giants and specialized security suppliers (2024- 2026 will provide IAM solutions: Single Sign-On (SSO), Multi-Factor Authentication (MFA), Privileged Access Management (PAM), and Identity Governance.

Market Share Analysis by Company

| Company Name | Estimated Market Share (%) |

|---|---|

| Microsoft | 22-27% |

| IBM | 15-20% |

| Okta | 12-18% |

| CyberArk | 8-12% |

| ForgeRock | 6-10% |

| Other Companies (combined) | 25-35% |

| Company Name | Key Offerings/Activities |

|---|---|

| Microsoft | Provides Azure Active Directory (Azure AD) for cloud-based identity and access management. Leads in enterprise IAM integration and zero-trust security models. |

| IBM | Offers IBM Security Verify for identity governance, authentication, and risk-based access management. Enhances AI-driven identity protection. |

| Okta | Specializes in cloud-based IAM with strong SSO, MFA, and adaptive authentication solutions. Focuses on seamless user experience and enterprise flexibility. |

| CyberArk | Leader in Privileged Access Management (PAM), providing strong protection against insider threats and credential theft. Expands in cloud security. |

| ForgeRock | Offers AI-driven IAM with a focus on customer identity and access management (CIAM). Develops cloud-native and scalable identity solutions. |

Strategic Outlook

Microsoft (22-27%)

IAM has traditionally been dominated by Microsoft, with its cloud-based Azure Active Directory (Azure AD), one of the most widely adopted identity/access management options available for enterprises, governments, and SMBs.

Microsoft's zero-trust security architecture, seamless tweaks to Microsoft 365, and AI-induced threat monitoring distinguish it from competitors. With continuous investment, its leadership position in decentralized identity and adaptive authentication will evolve further.

IBM (15-20%)

IBM provides identity as a service (IDaaS) capabilities through IBM Security Verify, including AI-based authentication and identity governance, and risk-based access management. The company integrates its IAM with its broader cybersecurity portfolio including threat intelligence and analytics.

IBM enterprise security identity fraud protection solutions. IBM focuses on enterprise-scale identity security, hybrid cloud IAM, and advanced AI-driven anomaly detection to combat identity fraud.

Okta (12-18%)

As a single Sign-On, multi-factor authentication, and adaptive multi-factor authentication provider, Okta is considered a cloud-native IAM leader, providing customer-friendly interfaces along with a wide range of 3rd party integrations. The independent identity platform it offers is likely attractive to businesses seeking vendor-agnostic solutions. Okta consistently leads the charge in CIAM, zero-trust security, and API-first identity verification.

CyberArk (8-12%)

CyberArk is a PAM specialist that secures privileged credentials and protects enterprises from insider threats and credentials-based cyberattacks. The company builds out its controlled DevOps and hybrid IT, as well as critical infrastructure-based identity security cloud security capabilities. What CyberArk brings: CyberArk continues to deliver its offerings as a privileged access solution leader, making it a popular choice for highly regulated industries.

ForgeRock (6-10%)

ForgeRock specializes in AI-enabled IAM solutions, specifically within CIAM, enabling organizations to deliver secure and seamless user authentication. The firm focuses on cloud-based IAM solutions to strengthen identity governance, risk management, and automation of digital identity security. Due to its scalability and API-based integrations, ForgeRock is also strong in customer-facing applications.

Other Key Players (25-35% Combined)

Identity and Access Management (IAM) is a major aspect of cybersecurity, with notable contributors such as Oracle, RSA Security, HID Global, One Identity, and Ping Identity.

Some of these vendors also offer focused specialized solutions such as identity proofing, fraud prevention, workforce IAM, and decentralized identity frameworks. They have developed such niche expertise in industry-specific IAM solutions, compliance-focused security, or cloud-based identity management that they also provide market growth.

In terms of Solution, the segment is segregated into Provisioning, Password Management, Directory Service, Advanced Authentication, Single Sign-On (SSO), Audit, Compliance and Governance.

In terms of Organisation Size, the segment is segregated into SME and Large Organization.

In terms of End user, it is distributed into Government and Defense, BFSI, Consumer Electronics, IT and Telecom, Healthcare and Lifesciences, Retail and E-commerce and Others.

A regional analysis has been carried out in key countries of North America, Latin America, East Asia, South Asia & Pacific, Western Europe, Eastern Europe and Middle East and Africa (MEA), and Europe.

The Global Identity & Access Management industry is projected to witness CAGR of 12.2% between 2025 and 2035.

The Global Identity & Access Management industry stood at USD 17,246.2 million in 2025.

The Global Identity & Access Management industry is anticipated to reach USD 73,276.8 million by 2035 end.

South Asia & Pacific is set to record the highest CAGR of 14.3% in the assessment period.

The key players operating in the Global Identity & Access Management Industry Microsoft, IBM, Okta, CyberArk, ForgeRock, Ping Identity, Oracle, RSA Security, HID Global, One Identity.

Table 1: Global Market Value (US$ Million) Forecast by Region, 2019 to 2034

Table 2: Global Market Value (US$ Million) Forecast by Solution, 2019 to 2034

Table 3: Global Market Value (US$ Million) Forecast by Deployment, 2019 to 2034

Table 4: Global Market Value (US$ Million) Forecast by Organization Size, 2019 to 2034

Table 5: Global Market Value (US$ Million) Forecast by End Use Industry, 2019 to 2034

Table 6: North America Market Value (US$ Million) Forecast by Country, 2019 to 2034

Table 7: North America Market Value (US$ Million) Forecast by Solution, 2019 to 2034

Table 8: North America Market Value (US$ Million) Forecast by Deployment, 2019 to 2034

Table 9: North America Market Value (US$ Million) Forecast by Organization Size, 2019 to 2034

Table 10: North America Market Value (US$ Million) Forecast by End Use Industry, 2019 to 2034

Table 11: Latin America Market Value (US$ Million) Forecast by Country, 2019 to 2034

Table 12: Latin America Market Value (US$ Million) Forecast by Solution, 2019 to 2034

Table 13: Latin America Market Value (US$ Million) Forecast by Deployment, 2019 to 2034

Table 14: Latin America Market Value (US$ Million) Forecast by Organization Size, 2019 to 2034

Table 15: Latin America Market Value (US$ Million) Forecast by End Use Industry, 2019 to 2034

Table 16: Western Europe Market Value (US$ Million) Forecast by Country, 2019 to 2034

Table 17: Western Europe Market Value (US$ Million) Forecast by Solution, 2019 to 2034

Table 18: Western Europe Market Value (US$ Million) Forecast by Deployment, 2019 to 2034

Table 19: Western Europe Market Value (US$ Million) Forecast by Organization Size, 2019 to 2034

Table 20: Western Europe Market Value (US$ Million) Forecast by End Use Industry, 2019 to 2034

Table 21: Eastern Europe Market Value (US$ Million) Forecast by Country, 2019 to 2034

Table 22: Eastern Europe Market Value (US$ Million) Forecast by Solution, 2019 to 2034

Table 23: Eastern Europe Market Value (US$ Million) Forecast by Deployment, 2019 to 2034

Table 24: Eastern Europe Market Value (US$ Million) Forecast by Organization Size, 2019 to 2034

Table 25: Eastern Europe Market Value (US$ Million) Forecast by End Use Industry, 2019 to 2034

Table 26: South Asia and Pacific Market Value (US$ Million) Forecast by Country, 2019 to 2034

Table 27: South Asia and Pacific Market Value (US$ Million) Forecast by Solution, 2019 to 2034

Table 28: South Asia and Pacific Market Value (US$ Million) Forecast by Deployment, 2019 to 2034

Table 29: South Asia and Pacific Market Value (US$ Million) Forecast by Organization Size, 2019 to 2034

Table 30: South Asia and Pacific Market Value (US$ Million) Forecast by End Use Industry, 2019 to 2034

Table 31: East Asia Market Value (US$ Million) Forecast by Country, 2019 to 2034

Table 32: East Asia Market Value (US$ Million) Forecast by Solution, 2019 to 2034

Table 33: East Asia Market Value (US$ Million) Forecast by Deployment, 2019 to 2034

Table 34: East Asia Market Value (US$ Million) Forecast by Organization Size, 2019 to 2034

Table 35: East Asia Market Value (US$ Million) Forecast by End Use Industry, 2019 to 2034

Table 36: Middle East and Africa Market Value (US$ Million) Forecast by Country, 2019 to 2034

Table 37: Middle East and Africa Market Value (US$ Million) Forecast by Solution, 2019 to 2034

Table 38: Middle East and Africa Market Value (US$ Million) Forecast by Deployment, 2019 to 2034

Table 39: Middle East and Africa Market Value (US$ Million) Forecast by Organization Size, 2019 to 2034

Table 40: Middle East and Africa Market Value (US$ Million) Forecast by End Use Industry, 2019 to 2034

Figure 1: Global Market Value (US$ Million) by Solution, 2024 to 2034

Figure 2: Global Market Value (US$ Million) by Deployment, 2024 to 2034

Figure 3: Global Market Value (US$ Million) by Organization Size, 2024 to 2034

Figure 4: Global Market Value (US$ Million) by End Use Industry, 2024 to 2034

Figure 5: Global Market Value (US$ Million) by Region, 2024 to 2034

Figure 6: Global Market Value (US$ Million) Analysis by Region, 2019 to 2034

Figure 7: Global Market Value Share (%) and BPS Analysis by Region, 2024 to 2034

Figure 8: Global Market Y-o-Y Growth (%) Projections by Region, 2024 to 2034

Figure 9: Global Market Value (US$ Million) Analysis by Solution, 2019 to 2034

Figure 10: Global Market Value Share (%) and BPS Analysis by Solution, 2024 to 2034

Figure 11: Global Market Y-o-Y Growth (%) Projections by Solution, 2024 to 2034

Figure 12: Global Market Value (US$ Million) Analysis by Deployment, 2019 to 2034

Figure 13: Global Market Value Share (%) and BPS Analysis by Deployment, 2024 to 2034

Figure 14: Global Market Y-o-Y Growth (%) Projections by Deployment, 2024 to 2034

Figure 15: Global Market Value (US$ Million) Analysis by Organization Size, 2019 to 2034

Figure 16: Global Market Value Share (%) and BPS Analysis by Organization Size, 2024 to 2034

Figure 17: Global Market Y-o-Y Growth (%) Projections by Organization Size, 2024 to 2034

Figure 18: Global Market Value (US$ Million) Analysis by End Use Industry, 2019 to 2034

Figure 19: Global Market Value Share (%) and BPS Analysis by End Use Industry, 2024 to 2034

Figure 20: Global Market Y-o-Y Growth (%) Projections by End Use Industry, 2024 to 2034

Figure 21: Global Market Attractiveness by Solution, 2024 to 2034

Figure 22: Global Market Attractiveness by Deployment, 2024 to 2034

Figure 23: Global Market Attractiveness by Organization Size, 2024 to 2034

Figure 24: Global Market Attractiveness by End Use Industry, 2024 to 2034

Figure 25: Global Market Attractiveness by Region, 2024 to 2034

Figure 26: North America Market Value (US$ Million) by Solution, 2024 to 2034

Figure 27: North America Market Value (US$ Million) by Deployment, 2024 to 2034

Figure 28: North America Market Value (US$ Million) by Organization Size, 2024 to 2034

Figure 29: North America Market Value (US$ Million) by End Use Industry, 2024 to 2034

Figure 30: North America Market Value (US$ Million) by Country, 2024 to 2034

Figure 31: North America Market Value (US$ Million) Analysis by Country, 2019 to 2034

Figure 32: North America Market Value Share (%) and BPS Analysis by Country, 2024 to 2034

Figure 33: North America Market Y-o-Y Growth (%) Projections by Country, 2024 to 2034

Figure 34: North America Market Value (US$ Million) Analysis by Solution, 2019 to 2034

Figure 35: North America Market Value Share (%) and BPS Analysis by Solution, 2024 to 2034

Figure 36: North America Market Y-o-Y Growth (%) Projections by Solution, 2024 to 2034

Figure 37: North America Market Value (US$ Million) Analysis by Deployment, 2019 to 2034

Figure 38: North America Market Value Share (%) and BPS Analysis by Deployment, 2024 to 2034

Figure 39: North America Market Y-o-Y Growth (%) Projections by Deployment, 2024 to 2034

Figure 40: North America Market Value (US$ Million) Analysis by Organization Size, 2019 to 2034

Figure 41: North America Market Value Share (%) and BPS Analysis by Organization Size, 2024 to 2034

Figure 42: North America Market Y-o-Y Growth (%) Projections by Organization Size, 2024 to 2034

Figure 43: North America Market Value (US$ Million) Analysis by End Use Industry, 2019 to 2034

Figure 44: North America Market Value Share (%) and BPS Analysis by End Use Industry, 2024 to 2034

Figure 45: North America Market Y-o-Y Growth (%) Projections by End Use Industry, 2024 to 2034

Figure 46: North America Market Attractiveness by Solution, 2024 to 2034

Figure 47: North America Market Attractiveness by Deployment, 2024 to 2034

Figure 48: North America Market Attractiveness by Organization Size, 2024 to 2034

Figure 49: North America Market Attractiveness by End Use Industry, 2024 to 2034

Figure 50: North America Market Attractiveness by Country, 2024 to 2034

Figure 51: Latin America Market Value (US$ Million) by Solution, 2024 to 2034

Figure 52: Latin America Market Value (US$ Million) by Deployment, 2024 to 2034

Figure 53: Latin America Market Value (US$ Million) by Organization Size, 2024 to 2034

Figure 54: Latin America Market Value (US$ Million) by End Use Industry, 2024 to 2034

Figure 55: Latin America Market Value (US$ Million) by Country, 2024 to 2034

Figure 56: Latin America Market Value (US$ Million) Analysis by Country, 2019 to 2034

Figure 57: Latin America Market Value Share (%) and BPS Analysis by Country, 2024 to 2034

Figure 58: Latin America Market Y-o-Y Growth (%) Projections by Country, 2024 to 2034

Figure 59: Latin America Market Value (US$ Million) Analysis by Solution, 2019 to 2034

Figure 60: Latin America Market Value Share (%) and BPS Analysis by Solution, 2024 to 2034

Figure 61: Latin America Market Y-o-Y Growth (%) Projections by Solution, 2024 to 2034

Figure 62: Latin America Market Value (US$ Million) Analysis by Deployment, 2019 to 2034

Figure 63: Latin America Market Value Share (%) and BPS Analysis by Deployment, 2024 to 2034

Figure 64: Latin America Market Y-o-Y Growth (%) Projections by Deployment, 2024 to 2034

Figure 65: Latin America Market Value (US$ Million) Analysis by Organization Size, 2019 to 2034

Figure 66: Latin America Market Value Share (%) and BPS Analysis by Organization Size, 2024 to 2034

Figure 67: Latin America Market Y-o-Y Growth (%) Projections by Organization Size, 2024 to 2034

Figure 68: Latin America Market Value (US$ Million) Analysis by End Use Industry, 2019 to 2034

Figure 69: Latin America Market Value Share (%) and BPS Analysis by End Use Industry, 2024 to 2034

Figure 70: Latin America Market Y-o-Y Growth (%) Projections by End Use Industry, 2024 to 2034

Figure 71: Latin America Market Attractiveness by Solution, 2024 to 2034

Figure 72: Latin America Market Attractiveness by Deployment, 2024 to 2034

Figure 73: Latin America Market Attractiveness by Organization Size, 2024 to 2034

Figure 74: Latin America Market Attractiveness by End Use Industry, 2024 to 2034

Figure 75: Latin America Market Attractiveness by Country, 2024 to 2034

Figure 76: Western Europe Market Value (US$ Million) by Solution, 2024 to 2034

Figure 77: Western Europe Market Value (US$ Million) by Deployment, 2024 to 2034

Figure 78: Western Europe Market Value (US$ Million) by Organization Size, 2024 to 2034

Figure 79: Western Europe Market Value (US$ Million) by End Use Industry, 2024 to 2034

Figure 80: Western Europe Market Value (US$ Million) by Country, 2024 to 2034

Figure 81: Western Europe Market Value (US$ Million) Analysis by Country, 2019 to 2034

Figure 82: Western Europe Market Value Share (%) and BPS Analysis by Country, 2024 to 2034

Figure 83: Western Europe Market Y-o-Y Growth (%) Projections by Country, 2024 to 2034

Figure 84: Western Europe Market Value (US$ Million) Analysis by Solution, 2019 to 2034

Figure 85: Western Europe Market Value Share (%) and BPS Analysis by Solution, 2024 to 2034

Figure 86: Western Europe Market Y-o-Y Growth (%) Projections by Solution, 2024 to 2034

Figure 87: Western Europe Market Value (US$ Million) Analysis by Deployment, 2019 to 2034

Figure 88: Western Europe Market Value Share (%) and BPS Analysis by Deployment, 2024 to 2034

Figure 89: Western Europe Market Y-o-Y Growth (%) Projections by Deployment, 2024 to 2034

Figure 90: Western Europe Market Value (US$ Million) Analysis by Organization Size, 2019 to 2034

Figure 91: Western Europe Market Value Share (%) and BPS Analysis by Organization Size, 2024 to 2034

Figure 92: Western Europe Market Y-o-Y Growth (%) Projections by Organization Size, 2024 to 2034

Figure 93: Western Europe Market Value (US$ Million) Analysis by End Use Industry, 2019 to 2034

Figure 94: Western Europe Market Value Share (%) and BPS Analysis by End Use Industry, 2024 to 2034

Figure 95: Western Europe Market Y-o-Y Growth (%) Projections by End Use Industry, 2024 to 2034

Figure 96: Western Europe Market Attractiveness by Solution, 2024 to 2034

Figure 97: Western Europe Market Attractiveness by Deployment, 2024 to 2034

Figure 98: Western Europe Market Attractiveness by Organization Size, 2024 to 2034

Figure 99: Western Europe Market Attractiveness by End Use Industry, 2024 to 2034

Figure 100: Western Europe Market Attractiveness by Country, 2024 to 2034

Figure 101: Eastern Europe Market Value (US$ Million) by Solution, 2024 to 2034

Figure 102: Eastern Europe Market Value (US$ Million) by Deployment, 2024 to 2034

Figure 103: Eastern Europe Market Value (US$ Million) by Organization Size, 2024 to 2034

Figure 104: Eastern Europe Market Value (US$ Million) by End Use Industry, 2024 to 2034

Figure 105: Eastern Europe Market Value (US$ Million) by Country, 2024 to 2034

Figure 106: Eastern Europe Market Value (US$ Million) Analysis by Country, 2019 to 2034

Figure 107: Eastern Europe Market Value Share (%) and BPS Analysis by Country, 2024 to 2034

Figure 108: Eastern Europe Market Y-o-Y Growth (%) Projections by Country, 2024 to 2034

Figure 109: Eastern Europe Market Value (US$ Million) Analysis by Solution, 2019 to 2034

Figure 110: Eastern Europe Market Value Share (%) and BPS Analysis by Solution, 2024 to 2034

Figure 111: Eastern Europe Market Y-o-Y Growth (%) Projections by Solution, 2024 to 2034

Figure 112: Eastern Europe Market Value (US$ Million) Analysis by Deployment, 2019 to 2034

Figure 113: Eastern Europe Market Value Share (%) and BPS Analysis by Deployment, 2024 to 2034

Figure 114: Eastern Europe Market Y-o-Y Growth (%) Projections by Deployment, 2024 to 2034

Figure 115: Eastern Europe Market Value (US$ Million) Analysis by Organization Size, 2019 to 2034

Figure 116: Eastern Europe Market Value Share (%) and BPS Analysis by Organization Size, 2024 to 2034

Figure 117: Eastern Europe Market Y-o-Y Growth (%) Projections by Organization Size, 2024 to 2034

Figure 118: Eastern Europe Market Value (US$ Million) Analysis by End Use Industry, 2019 to 2034

Figure 119: Eastern Europe Market Value Share (%) and BPS Analysis by End Use Industry, 2024 to 2034

Figure 120: Eastern Europe Market Y-o-Y Growth (%) Projections by End Use Industry, 2024 to 2034

Figure 121: Eastern Europe Market Attractiveness by Solution, 2024 to 2034

Figure 122: Eastern Europe Market Attractiveness by Deployment, 2024 to 2034

Figure 123: Eastern Europe Market Attractiveness by Organization Size, 2024 to 2034

Figure 124: Eastern Europe Market Attractiveness by End Use Industry, 2024 to 2034

Figure 125: Eastern Europe Market Attractiveness by Country, 2024 to 2034

Figure 126: South Asia and Pacific Market Value (US$ Million) by Solution, 2024 to 2034

Figure 127: South Asia and Pacific Market Value (US$ Million) by Deployment, 2024 to 2034

Figure 128: South Asia and Pacific Market Value (US$ Million) by Organization Size, 2024 to 2034

Figure 129: South Asia and Pacific Market Value (US$ Million) by End Use Industry, 2024 to 2034

Figure 130: South Asia and Pacific Market Value (US$ Million) by Country, 2024 to 2034

Figure 131: South Asia and Pacific Market Value (US$ Million) Analysis by Country, 2019 to 2034

Figure 132: South Asia and Pacific Market Value Share (%) and BPS Analysis by Country, 2024 to 2034

Figure 133: South Asia and Pacific Market Y-o-Y Growth (%) Projections by Country, 2024 to 2034

Figure 134: South Asia and Pacific Market Value (US$ Million) Analysis by Solution, 2019 to 2034

Figure 135: South Asia and Pacific Market Value Share (%) and BPS Analysis by Solution, 2024 to 2034

Figure 136: South Asia and Pacific Market Y-o-Y Growth (%) Projections by Solution, 2024 to 2034

Figure 137: South Asia and Pacific Market Value (US$ Million) Analysis by Deployment, 2019 to 2034

Figure 138: South Asia and Pacific Market Value Share (%) and BPS Analysis by Deployment, 2024 to 2034

Figure 139: South Asia and Pacific Market Y-o-Y Growth (%) Projections by Deployment, 2024 to 2034

Figure 140: South Asia and Pacific Market Value (US$ Million) Analysis by Organization Size, 2019 to 2034

Figure 141: South Asia and Pacific Market Value Share (%) and BPS Analysis by Organization Size, 2024 to 2034

Figure 142: South Asia and Pacific Market Y-o-Y Growth (%) Projections by Organization Size, 2024 to 2034

Figure 143: South Asia and Pacific Market Value (US$ Million) Analysis by End Use Industry, 2019 to 2034

Figure 144: South Asia and Pacific Market Value Share (%) and BPS Analysis by End Use Industry, 2024 to 2034

Figure 145: South Asia and Pacific Market Y-o-Y Growth (%) Projections by End Use Industry, 2024 to 2034

Figure 146: South Asia and Pacific Market Attractiveness by Solution, 2024 to 2034

Figure 147: South Asia and Pacific Market Attractiveness by Deployment, 2024 to 2034

Figure 148: South Asia and Pacific Market Attractiveness by Organization Size, 2024 to 2034

Figure 149: South Asia and Pacific Market Attractiveness by End Use Industry, 2024 to 2034

Figure 150: South Asia and Pacific Market Attractiveness by Country, 2024 to 2034

Figure 151: East Asia Market Value (US$ Million) by Solution, 2024 to 2034

Figure 152: East Asia Market Value (US$ Million) by Deployment, 2024 to 2034

Figure 153: East Asia Market Value (US$ Million) by Organization Size, 2024 to 2034

Figure 154: East Asia Market Value (US$ Million) by End Use Industry, 2024 to 2034

Figure 155: East Asia Market Value (US$ Million) by Country, 2024 to 2034

Figure 156: East Asia Market Value (US$ Million) Analysis by Country, 2019 to 2034

Figure 157: East Asia Market Value Share (%) and BPS Analysis by Country, 2024 to 2034

Figure 158: East Asia Market Y-o-Y Growth (%) Projections by Country, 2024 to 2034

Figure 159: East Asia Market Value (US$ Million) Analysis by Solution, 2019 to 2034

Figure 160: East Asia Market Value Share (%) and BPS Analysis by Solution, 2024 to 2034

Figure 161: East Asia Market Y-o-Y Growth (%) Projections by Solution, 2024 to 2034

Figure 162: East Asia Market Value (US$ Million) Analysis by Deployment, 2019 to 2034

Figure 163: East Asia Market Value Share (%) and BPS Analysis by Deployment, 2024 to 2034

Figure 164: East Asia Market Y-o-Y Growth (%) Projections by Deployment, 2024 to 2034

Figure 165: East Asia Market Value (US$ Million) Analysis by Organization Size, 2019 to 2034

Figure 166: East Asia Market Value Share (%) and BPS Analysis by Organization Size, 2024 to 2034

Figure 167: East Asia Market Y-o-Y Growth (%) Projections by Organization Size, 2024 to 2034

Figure 168: East Asia Market Value (US$ Million) Analysis by End Use Industry, 2019 to 2034

Figure 169: East Asia Market Value Share (%) and BPS Analysis by End Use Industry, 2024 to 2034

Figure 170: East Asia Market Y-o-Y Growth (%) Projections by End Use Industry, 2024 to 2034

Figure 171: East Asia Market Attractiveness by Solution, 2024 to 2034

Figure 172: East Asia Market Attractiveness by Deployment, 2024 to 2034

Figure 173: East Asia Market Attractiveness by Organization Size, 2024 to 2034

Figure 174: East Asia Market Attractiveness by End Use Industry, 2024 to 2034

Figure 175: East Asia Market Attractiveness by Country, 2024 to 2034

Figure 176: Middle East and Africa Market Value (US$ Million) by Solution, 2024 to 2034

Figure 177: Middle East and Africa Market Value (US$ Million) by Deployment, 2024 to 2034

Figure 178: Middle East and Africa Market Value (US$ Million) by Organization Size, 2024 to 2034

Figure 179: Middle East and Africa Market Value (US$ Million) by End Use Industry, 2024 to 2034

Figure 180: Middle East and Africa Market Value (US$ Million) by Country, 2024 to 2034

Figure 181: Middle East and Africa Market Value (US$ Million) Analysis by Country, 2019 to 2034

Figure 182: Middle East and Africa Market Value Share (%) and BPS Analysis by Country, 2024 to 2034

Figure 183: Middle East and Africa Market Y-o-Y Growth (%) Projections by Country, 2024 to 2034

Figure 184: Middle East and Africa Market Value (US$ Million) Analysis by Solution, 2019 to 2034

Figure 185: Middle East and Africa Market Value Share (%) and BPS Analysis by Solution, 2024 to 2034

Figure 186: Middle East and Africa Market Y-o-Y Growth (%) Projections by Solution, 2024 to 2034

Figure 187: Middle East and Africa Market Value (US$ Million) Analysis by Deployment, 2019 to 2034

Figure 188: Middle East and Africa Market Value Share (%) and BPS Analysis by Deployment, 2024 to 2034

Figure 189: Middle East and Africa Market Y-o-Y Growth (%) Projections by Deployment, 2024 to 2034

Figure 190: Middle East and Africa Market Value (US$ Million) Analysis by Organization Size, 2019 to 2034

Figure 191: Middle East and Africa Market Value Share (%) and BPS Analysis by Organization Size, 2024 to 2034

Figure 192: Middle East and Africa Market Y-o-Y Growth (%) Projections by Organization Size, 2024 to 2034

Figure 193: Middle East and Africa Market Value (US$ Million) Analysis by End Use Industry, 2019 to 2034

Figure 194: Middle East and Africa Market Value Share (%) and BPS Analysis by End Use Industry, 2024 to 2034

Figure 195: Middle East and Africa Market Y-o-Y Growth (%) Projections by End Use Industry, 2024 to 2034

Figure 196: Middle East and Africa Market Attractiveness by Solution, 2024 to 2034

Figure 197: Middle East and Africa Market Attractiveness by Deployment, 2024 to 2034

Figure 198: Middle East and Africa Market Attractiveness by Organization Size, 2024 to 2034

Figure 199: Middle East and Africa Market Attractiveness by End Use Industry, 2024 to 2034

Figure 200: Middle East and Africa Market Attractiveness by Country, 2024 to 2034

Full Research Suite comprises of:

Market outlook & trends analysis

Interviews & case studies

Strategic recommendations

Vendor profiles & capabilities analysis

5-year forecasts

8 regions and 60+ country-level data splits

Market segment data splits

12 months of continuous data updates

DELIVERED AS:

PDF EXCEL ONLINE

Identity And Access Management As A Service (IAMaaS) Market Size and Share Forecast Outlook 2025 to 2035

Identity Verification Market Analysis - Size, Share, and Forecast 2025 to 2035

Identity Analytics Market Size and Share Forecast Outlook 2025 to 2035

Identity-as-a-Service (IDaaS) Market Outlook 2025 to 2035 by Access Type, Enterprise Size, Service Type, Application, Industry, and Region

Identity Governance and Administration Market Size and Share Forecast Outlook 2025 to 2035

Cloud Identity Management Market

Digital Identity Services Market Size and Share Forecast Outlook 2025 to 2035

Bimodal Identity Management Solutions Market Size and Share Forecast Outlook 2025 to 2035

Understanding Market Share Trends in Travelers Identity Protection

Travelers Identity Protection Services Market Analysis by Service Type, by Subscription Model, by End User , by Nationality and by Region - Forecast for 2025 to 2035

Blockchain Identity Management Market Size and Share Forecast Outlook 2025 to 2035

e-Government Identity Management Market

Android Automotive OS (AAOS) Market Size and Share Forecast Outlook 2025 to 2035

Anderson Cascade Impactor Market Size and Share Forecast Outlook 2025 to 2035

Andersen-Tawil Syndrome Treatment Market Trends - Growth & Future Prospects 2025 to 2035

Andro Supplements Market

Handheld Ultrasound Scanner Market Size and Share Forecast Outlook 2025 to 2035

Handheld Tagging Gun Market Forecast and Outlook 2025 to 2035

Handheld Imaging Systems Market Size and Share Forecast Outlook 2025 to 2035

Sandwich Panel System Market Size and Share Forecast Outlook 2025 to 2035

Thank you!

You will receive an email from our Business Development Manager. Please be sure to check your SPAM/JUNK folder too.

Chat With

MaRIA