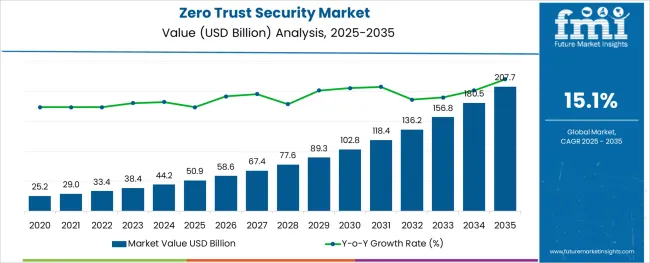

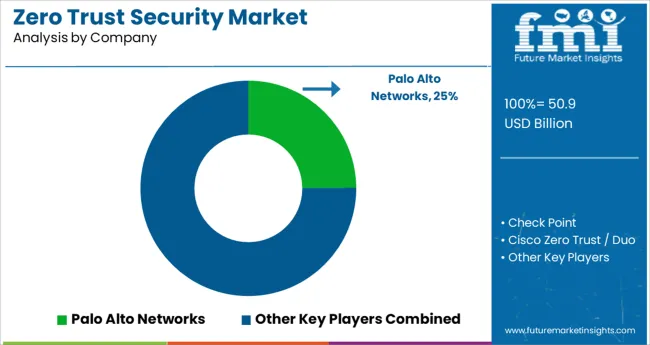

The Zero Trust Security Market is estimated to be valued at USD 50.9 billion in 2025 and is projected to reach USD 207.7 billion by 2035, registering a compound annual growth rate (CAGR) of 15.1% over the forecast period.

The advancement of the zero trust security market is being shaped by a dynamic cybersecurity landscape, increasingly sophisticated threats, and the critical need for perimeter-less, identity centric security models. Organizations are shifting away from legacy perimeter based frameworks to architectures that verify every access attempt, regardless of user or location.

Government cybersecurity frameworks and enterprise digital transformation initiatives have fueled the transition, particularly within hybrid and multi cloud environments. The proliferation of remote workforces and IoT integrations has further necessitated robust zero trust approaches.

With growing emphasis on protecting sensitive data, especially in regulated industries such as finance, healthcare, and critical infrastructure, zero trust security is increasingly being adopted not as a standalone solution, but as an integrated strategy across applications, endpoints, and networks. The market trajectory is anticipated to remain strong, supported by rising regulatory compliance requirements and ongoing investments in identity management, threat detection, and authentication technologies.

The market is segmented by Solution, Deployment, Authentication Type, Enterprise Size, and Industry and region. By Solution, the market is divided into Integrated Zero Trust Security Platform, Standalone Software, Services, Professional Services, and Managed Services. In terms of Deployment, the market is classified into Cloud-Based and On-premises. Based on Authentication Type, the market is segmented into Single Authentication and Multi Authentication. By Enterprise Size, the market is divided into Small and Mid-Sized Enterprises (SMEs) and Large Enterprises. By Industry, the market is segmented into BFSI, Retail and eCommerce, Healthcare, IT & Telecom, Government and Defense, and Others. Regionally, the market is classified into North America, Latin America, Western Europe, Eastern Europe, Balkan & Baltic Countries, Russia & Belarus, Central Asia, East Asia, South Asia & Pacific, and the Middle East & Africa.

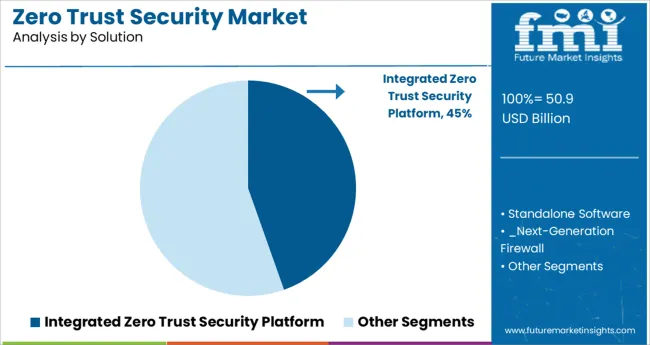

The integrated zero trust security platform segment is projected to contribute 44.60% of total revenue by 2025 within the solution category, making it the most prominent offering in the market. Its dominance is attributed to the need for a unified, end to end security posture that reduces silos between identity, access control, endpoint monitoring, and threat analytics.

Enterprises have increasingly preferred all-in-one platforms to simplify deployment, enhance interoperability, and centralize visibility across distributed IT environments. These platforms have enabled more consistent policy enforcement and faster incident response, aligning with operational efficiency goals.

Additionally, integration has lowered the total cost of ownership by reducing the reliance on multiple point solutions. As organizations prioritize scalable, centralized architectures to support complex hybrid ecosystems, the integrated platform approach has emerged as the strategic cornerstone of zero trust implementations.

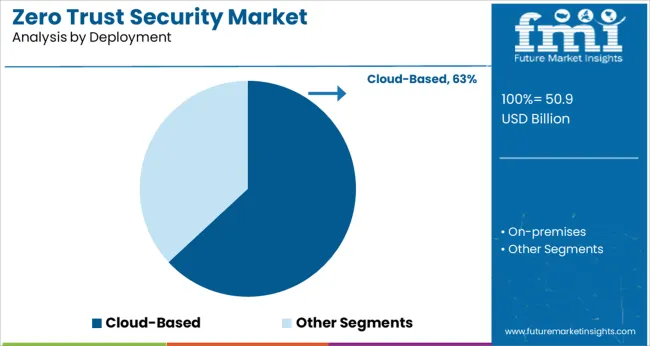

Cloud-based deployment models are expected to account for 63.10% of the overall market in 2025, reflecting the growing enterprise preference for scalable, agile, and remotely manageable security infrastructure. The shift toward cloud-native applications and data storage has prompted organizations to adopt cloud first security strategies that support dynamic environments and remote users.

Cloud-based zero trust deployments have been favored for their ease of integration, faster time to value, and reduced infrastructure overhead. Furthermore, continuous updates and threat intelligence integration have enhanced their appeal amid fast evolving threat landscapes.

Enterprises have also benefited from the model's inherent flexibility, supporting secure access across geographies without compromising performance. This convergence of adaptability, reduced capital expenditure, and operational resilience has firmly positioned cloud deployment as the preferred approach in zero trust architecture adoption.

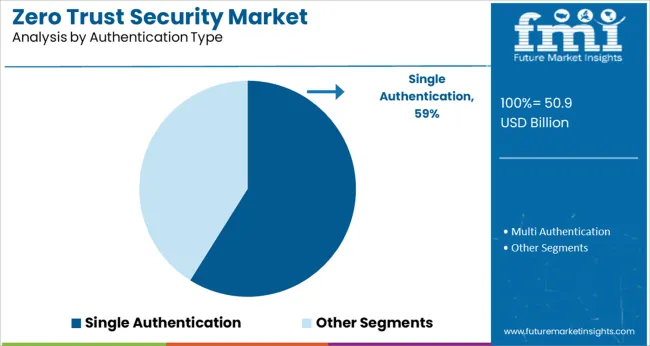

Single authentication methods are anticipated to generate 58.90% of total market revenue by 2025 within the authentication type category, establishing themselves as the dominant segment. This share is driven by the increasing use of streamlined identity verification techniques that reduce friction in user experience while maintaining compliance and security controls.

Enterprises have adopted single authentication models, especially in low to medium risk environments, to optimize access speed and reduce administrative burdens associated with multi factor protocols. Their implementation has been particularly widespread in cloud applications and user centric platforms where usability and response time are critical.

Additionally, cost efficiency and integration simplicity have supported continued reliance on single authentication, especially for organizations in early stages of zero trust maturity. While multi factor authentication remains essential in high risk use cases, the prominence of single authentication reflects a balanced approach between usability and risk tolerance in modern access control strategies.

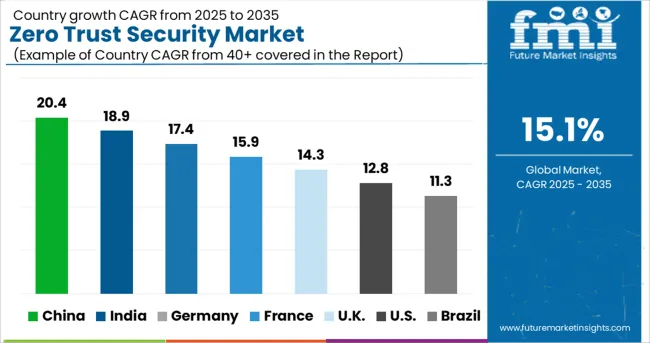

The zero trust security is expected to grow at 15.1% CAGR between 2025 to 2035 and the market grew by 14.3% from 2020 to 2024.

The way businesses set up their IT networks has seen a significant change during the past decade. Today, networks usually include various cloud applications that can be accessed from anywhere with multiple cloud applications, as opposed to the past when resources were maintained on physical servers running an on-premises network that could only be accessed from an office location. Furthermore, the acceleration of demand in zero trust security is majorly due to remote work, Companies have also been pushed to expand access locations and devices beyond the home office.

Over the past years, the increase in cyberattacks internally and network infiltrations in organisations has been a critical disaster. Due to such malpractices, zero trust security has been implemented in numerous industrial verticals to protect the Insider data breach, which helps in securing endpoints accessing applications (regardless of whether those are native cloud, SaaS, classic and custom applications), identity services, and network infrastructure with multi-layered security protection.

North America is estimated to hold the largest market share of 34.8% for the zero trust security market in 2025. Whereas South Asia and the Pacific are expected to be the fastest-growing region with a CAGR of 34.6% during the forecast period 2025 to 2035.

The presence of numerous companies provides zero trust security and a larger implementation in North America. Developed countries have higher probabilities of insider data breaches within organisations.

There are several companies in the USA that provide zero-trust security solutions and services like next-generation firewalls, identity & access management, data loss prevention, etc. Several large technology companies which are implementing zero trust for several purposes such as Ping Identity, IBM, Cisco, and Cloudflare are headquartered in the USA.

Over the past few years, several enterprises in India have implemented zero-trust security solutions and services, majorly in BFSI and IT industry. Many of these businesses were shifted to software platforms. As a result of this, there has been an increase in insider threats across industries. banking and financial industry has witnessed growth across the country over the years. Similarly, zero trust security has witnessed growth in the IT & Telecom industry as well.

The countries considered leading economies are potentially targeted by cyberattacks which eventually shows the demand for zero-trust security solutions across such countries. The adoption of zero-trust security solutions is occurring at a faster rate in the UK, and several companies in Europe have started offering zero-trust security solutions and services. This is also promoted by the government upon the institution to implement a zero-trust security model to secure privacy.

North America has the highest revenue volatility, the reason being that North America has several vendors which dominate the zero-trust security market at a global level. They also have several end users, such as BFSI, IT, and Telecom, small businesses that are implementing zero trust security solutions and services compared to other regions.

South Asia and Pacific is the fastest growing region for zero trust security, reasons include high penetration of the internet and growth in enterprises offering zero trust security solutions, zero trust security solutions can be implemented through cloud-based or on-premises.

Europe has a large market share of BFSI, and there have been developments in this region in the field of FinTech. BFSI implements security for next-generation firewalls, identity & access management, data loss prevention, etc. The European Commission has been working on policies to secure privacy with the help of zero trust security. The COVID-19 pandemic has adopted the zero trust model's implementation in Europe. Organizations in Europe are moving workloads to the cloud to take advantage of enhanced flexibility for staff as hybrid working models become the norm. To deal with an increasingly scattered workforce, including contractors and third parties, working from a variety of devices, many organisations are revaluating their security approaches.

Standalone zero trust security is a framework that can be used with many different security solutions such as identity security, endpoint security, network security, data security, application security, and automation. Vendors have specialised in these solutions and serve them individually through cloud-based or on-premises. Mostly, the end user depending on their requirements prefers standalone zero-trust security over integrated zero-trust security. Thus, standalone software holds the largest market share with USD 17,554.56 Million in solutions for the zero trust security market.

Cloud Based mode provides users with a consistent, secure, and seamless experience irrespective of location, and improved visibility for data, assets, and risks. It also reduces operational costs for the end user, any upgradation is in real-time. This facilitates the end user to prefer cloud-based deployment for zero trust security.

In order to increase security in banking services and operations, zero trust security is being implemented in the BFSI sector. The modernisation in the banking industry with essential IT & data management can result in new cyber threats. The growth of 5G, smart devices, artificial intelligence, analytics, and edge computing results in increased databases, which tends to increase in cyberattacks.

Cyberattacks on the backend systems of banks have an impact on the bottom line, as a result, technology companies provide best practices that banks can implement, such as micro-segmentation, least-privileged access, and automated detection. On regular basis to measure the attacks and effectiveness of critical security measures BFSI has adopted zero trust security at a faster rate and as a result, holds the largest market share in zero trust security.

Zero trust security provides security solutions to various industries which have shifted the company data to storage systems, as a result, this, tends to increase cyber threats for the stored data. To resolve these several companies have launched their zero trust security for multiple/specific purposes.

| Attribute | Details |

|---|---|

| Market value in 2024 | USD 2,581.3 Million |

| Market CAGR 2025 to 2035 | 15.1% |

| Share of top 5 players | Around 35% |

| Forecast Period | 2025 to 2035 |

| Historical Data Available for | 2020 to 2024 |

| Market Analysis | million for Value |

| Key Regions Covered | North America; Latin America; Europe; South Asia & Pacific; East Asia; and the Middle East & Africa |

| Key Countries Covered | USA, Canada, Germany, UK, France, Italy, Spain, Russia, China, Japan, South Korea, India, Australia & New Zealand, GCC Countries, Turkey, and South Africa |

| Key Segments Covered | The solution, Deployment Mode, Authentication Type, Enterprise Size, Industry, and Region |

| Key Companies Profiled | Check Point; Cisco; IBM; Palo Alto Networks; Okta; Ping Identity; Thales; Cloudflare; Akamai Technologies; Avast Business; Citrix; NetMotion; Zscaler; Proofpoint; Varonis; ExtraHop |

| Report Coverage | Market Forecast, Company Share Analysis, Competition Intelligence, Drivers, Restraints, Opportunities and Threats Analysis, Market Dynamics and Challenges, and Strategic Growth Initiatives |

| Customization & Pricing | Available upon Request |

The global zero trust security market is estimated to be valued at USD 50.9 billion in 2025.

It is projected to reach USD 207.7 billion by 2035.

The market is expected to grow at a 15.1% CAGR between 2025 and 2035.

The key product types are integrated zero trust security platform, standalone software, _next-generation firewall, _identity & access management, _data loss prevention, _others, services, professional services, _security consulting, _integration & implementation, _support & maintenance and managed services.

cloud-based segment is expected to dominate with a 63.1% industry share in 2025.

Full Research Suite comprises of:

Market outlook & trends analysis

Interviews & case studies

Strategic recommendations

Vendor profiles & capabilities analysis

5-year forecasts

8 regions and 60+ country-level data splits

Market segment data splits

12 months of continuous data updates

DELIVERED AS:

PDF EXCEL ONLINE

Zero Liquid Discharge System Market Size and Share Forecast Outlook 2025 to 2035

Zero-Waste Packaging Technologies Market Size and Share Forecast Outlook 2025 to 2035

Zero Emission Aircraft Market Size and Share Forecast Outlook 2025 to 2035

Zero-Waste Refill Packaging Market Analysis - Size, Share, and Forecast Outlook 2025 to 2035

Zero-Fishmeal Feed Market Analysis - Size and Share Forecast Outlook 2025 to 2035

Zero Friction Coatings Market Size and Share Forecast Outlook 2025 to 2035

Zero Emission Vehicle Market Growth - Trends & Forecast 2025 to 2035

Zero-Touch Provisioning (ZTP) Market - Growth & Demand 2025 to 2035

Zero Calorie Chips Market Outlook - Growth, Demand & Forecast 2025 to 2035

Zero Sugar Beverages Market Analysis by Product Type and Sales Channel Through 2035

Zero-Waste Packaging Market Report – Sustainable Growth & Trends 2023-2033

Africa’s Zero Liquid Discharge System Market - Size, Share, and Forecast 2025 to 2035

Trusted Platform Module (TPM) Market

Digital Trust Market Size and Share Forecast Outlook 2025 to 2035

Security Tape Market Size and Share Forecast Outlook 2025 to 2035

Security Alarm Communicator Market Size and Share Forecast Outlook 2025 to 2035

Security and Vulnerability Management Market Forecast and Outlook 2025 to 2035

Security Holograms Market Size and Share Forecast Outlook 2025 to 2035

Security Paper Market Size and Share Forecast Outlook 2025 to 2035

Security System Tester Market Size and Share Forecast Outlook 2025 to 2035

Thank you!

You will receive an email from our Business Development Manager. Please be sure to check your SPAM/JUNK folder too.

Chat With

MaRIA