The zero liquid discharge (ZLD) system market is growing significantly due to the increasing focus on water conservation, stringent environmental regulations, and the need for sustainable industrial wastewater management. Industries across power, chemicals, and manufacturing sectors are adopting ZLD systems to minimize freshwater intake and eliminate effluent discharge.

The market is supported by advancements in thermal and membrane technologies that enhance recovery rates and reduce operational costs. Rising global awareness of water scarcity and stricter compliance norms from regulatory bodies are further driving installations, particularly in water-intensive industries.

High capital investment remains a challenge; however, long-term operational benefits and regulatory adherence continue to justify adoption. With ongoing technological improvements and government incentives promoting water reuse, the ZLD system market is expected to expand steadily, especially in regions facing acute water stress.

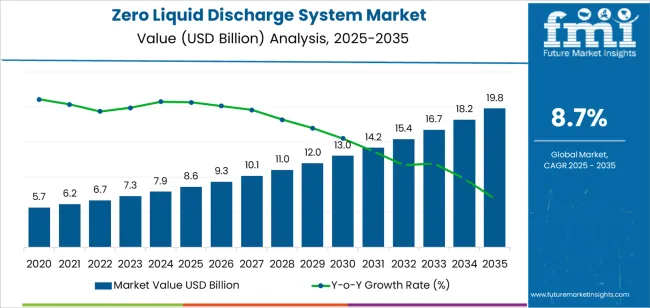

| Metric | Value |

|---|---|

| Zero Liquid Discharge System Market Estimated Value in (2025 E) | USD 8.6 billion |

| Zero Liquid Discharge System Market Forecast Value in (2035 F) | USD 19.8 billion |

| Forecast CAGR (2025 to 2035) | 8.7% |

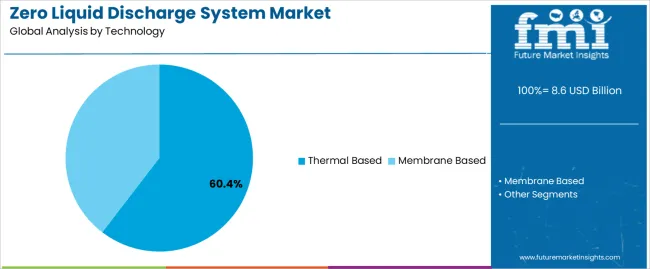

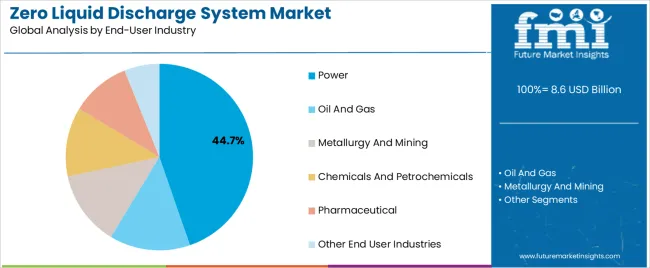

The market is segmented by Technology and End-User Industry and region. By Technology, the market is divided into Thermal Based and Membrane Based. In terms of End-User Industry, the market is classified into Power, Oil And Gas, Metallurgy And Mining, Chemicals And Petrochemicals, Pharmaceutical, and Other End User Industries. Regionally, the market is classified into North America, Latin America, Western Europe, Eastern Europe, Balkan & Baltic Countries, Russia & Belarus, Central Asia, East Asia, South Asia & Pacific, and the Middle East & Africa.

The thermal-based segment accounts for approximately 60.40% share of the technology category in the zero liquid discharge system market. This segment’s leadership is attributed to its high efficiency in achieving complete water recovery through evaporation and crystallization processes. Thermal ZLD systems are favored in industries generating complex effluents with high total dissolved solids, where membrane technologies face limitations.

Continuous advancements in multi-effect evaporation and mechanical vapor recompression have improved energy efficiency and scalability. The segment benefits from robust application in power, chemical, and textile industries, where large-scale wastewater treatment is essential.

Although thermal systems involve higher initial costs, their reliability and compliance capability ensure sustained adoption. With increasing regulatory stringency and technological refinement reducing energy consumption, the thermal-based segment is expected to maintain its dominant position in the near future.

The power segment leads the end-user industry category, holding approximately 44.70% share of the zero liquid discharge system market. Power plants generate significant wastewater volumes from cooling operations, necessitating efficient treatment and reuse systems.

The implementation of ZLD solutions ensures regulatory compliance, minimizes environmental impact, and optimizes water utilization in thermoelectric facilities. The segment’s growth is further supported by increasing electricity demand and the construction of new thermal power plants in emerging economies.

Adoption of ZLD systems within the power sector is also driven by the need to maintain operational continuity in regions facing water shortages. As global energy infrastructure modernizes and governments emphasize sustainable industrial practices, the power segment is expected to remain the largest end-user, reinforcing its critical role in the market’s expansion trajectory.

Increasingly stringent regulations regarding wastewater discharge and pollution control drive industries to adopt zero liquid discharge systems to comply with environmental standards. Governments worldwide are imposing strict guidelines to protect water bodies, creating a favorable environment for these systems.

The scope for zero liquid discharge system rose at an 11.2% CAGR between 2020 and 2025. The global market is anticipated to grow at a moderate CAGR of 8.7% over the forecast period 2025 to 2035.

Stringent environmental regulations regarding wastewater discharge and pollution control have been a primary driver of the zero liquid discharge market, during the historical period. Industries across various sectors have been compelled to adopt zero liquid discharge systems to meet regulatory standards and minimize environmental impact.

Advances in zero liquid discharge technologies, such as membrane based systems, evaporators, crystallizers, and hybrid solutions, have improved system efficiency, reliability, and cost effectiveness. The technological advancements have enhanced the attractiveness of zero liquid discharge systems to industries seeking sustainable wastewater treatment solutions.

Regulatory frameworks governing wastewater management and pollution control are expected to become even more stringent in the forecasted period. Governments worldwide are likely to impose stricter standards and enforcement measures, driving further adoption of zero liquid discharge systems across industries.

The forecasted period is expected to witness continued innovation and integration of advanced technologies into zero liquid discharge systems. Technologies such as artificial intelligence, IoT sensors, and automation will enable more efficient operation, monitoring, and optimization of zero liquid discharge processes, driving market growth and adoption.

Rapid industrialization, especially in emerging economies, leads to increased industrial wastewater generation. Industries such as power generation, chemicals, textiles, pharmaceuticals, and mining are adopting zero liquid discharge systems to manage their wastewater effectively and sustainably.

The implementation of zero liquid discharge systems requires substantial initial capital investment due to the cost of equipment, installation, and infrastructure upgrades. For some industries, especially smaller enterprises or those operating in regions with limited financial resources, the high upfront costs may act as a barrier to adoption.

The below table showcases revenues in terms of the top 5 leading countries, spearheaded by Korea and Japan. The countries are expected to lead the market through 2035.

| Countries | Forecast CAGRs from 2025 to 2035 |

|---|---|

| The United States | 9.0% |

| China | 9.5% |

| The United Kingdom | 10.0% |

| Japan | 10.2% |

| Korea | 11.1% |

The zero liquid discharge system market in the United States expected to expand at a CAGR of 9.0% through 2035. The country has stringent environmental regulations governing wastewater discharge and pollution control.

Compliance with these regulations, including the Clean Water Act and state specific standards, drives the adoption of zero liquid discharge systems by industries to achieve zero liquid discharge and minimize environmental impact.

Water scarcity is a growing concern in many parts of the United States, particularly in arid and water stressed regions such as the Southwest. The systems offer industries a sustainable solution for managing water resources by recycling and reusing wastewater, thereby reducing reliance on freshwater sources and mitigating water scarcity risks.

The zero liquid discharge system market in the United Kingdom is anticipated to expand at a CAGR of 10.0% through 2035. The country has a diverse industrial base, including sectors such as manufacturing, chemicals, pharmaceuticals, food and beverage, and energy production.

The expansion of industrial activities and infrastructure drives the demand for zero liquid discharge systems to treat and manage wastewater streams effectively, ensuring compliance with regulatory standards and environmental objectives.

The United Kingdom is a hub for technological innovation and research in environmental engineering, water treatment, and sustainability. Ongoing advancements in zero liquid discharge technologies, including membrane filtration, evaporation, crystallization, and hybrid systems, enhance treatment efficiency, reliability, and cost effectiveness, driving adoption across industries.

Zero liquid discharge system trends in China are taking a turn for the better. A 9.5% CAGR is forecast for the country from 2025 to 2035. The investments in infrastructure development, technology innovation, and industrial modernization in the country support the adoption of advanced wastewater treatment technologies, including zero liquid discharge systems.

Investments in research and development initiatives drive technological advancements and enhance the performance and efficiency of zero liquid discharge systems.

Collaboration between Chinese companies, international technology providers, and government agencies facilitates knowledge transfer, technology exchange, and capacity building in water treatment and environmental management. International partnerships support the development and adoption of zero liquid discharge systems tailored to specific industrial and environmental needs in China.

The zero liquid discharge system market in Japan is poised to expand at a CAGR of 10.2% through 2035. The country is known for its technological innovation and expertise in environmental engineering and water treatment.

Ongoing advancements in zero liquid discharge technologies, including membrane filtration, evaporation, crystallization, and hybrid systems, enhance treatment efficiency, reliability, and cost effectiveness, driving adoption across industries.

Japan has a diverse industrial base, including sectors such as manufacturing, chemicals, pharmaceuticals, electronics, and food processing. The expansion of industrial activities and infrastructure drives the demand for the systems to treat and manage wastewater streams effectively, ensuring compliance with regulatory standards and environmental objectives.

The zero liquid discharge system market in Korea is anticipated to expand at a CAGR of 11.1% through 2035. The systems offer opportunities for energy recovery and resource recovery from wastewater streams, contributing to energy efficiency and resource conservation goals in Korea.

The zero liquid discharge systems support circular economy principles and promote sustainable resource management practices, by extracting energy and valuable resources from wastewater.

The green growth and sustainable development initiatives in Korea prioritize environmental protection, renewable energy, and resource conservation. Zero liquid discharge systems align with these initiatives by minimizing water pollution, reducing carbon emissions, and promoting sustainable water management practices across industries and sectors.

The below table highlights how thermal based segment is projected to lead the market in terms of technology, and is expected to account for a CAGR of 8.5% through 2035. Based on end user industry, the power segment is expected to account for a CAGR of 8.3% through 2035.

| Category | CAGR from 2025 to 2035 |

|---|---|

| Thermal Based | 8.5% |

| Power | 8.3% |

Based on technology, the thermal based segment is expected to continue dominating the zero liquid discharge system market. Thermal based zero liquid discharge systems, such as thermal evaporation and crystallization, are highly effective in concentrating brine and other wastewater streams to achieve zero liquid discharge.

The systems utilize heat to evaporate water from the wastewater, leaving behind concentrated brine that can be further processed or disposed of in an environmentally sustainable manner.

Thermal based zero liquid discharge systems are versatile and applicable across a wide range of industries, including power generation, oil and gas, chemical processing, mining, and textiles. They can treat diverse wastewater streams with varying compositions, temperatures, and contaminants, making them suitable for different industrial applications.

In terms of end user industry, the power segment is expected to continue dominating the zero liquid discharge system market. The power generation industry is subject to strict environmental regulations governing wastewater discharge and pollution control.

Compliance with these regulations necessitates the adoption of advanced wastewater treatment solutions like zero liquid discharge systems, which enable power plants to achieve zero liquid discharge and minimize environmental impact.

Power plants require large quantities of water for cooling and other operational processes. Power plants can recycle and reuse wastewater streams, by implementing zero liquid discharge systems, thereby conserving water resources and reducing freshwater consumption. Zero liquid discharge systems enable power plants to optimize water usage and enhance water resource management practices.

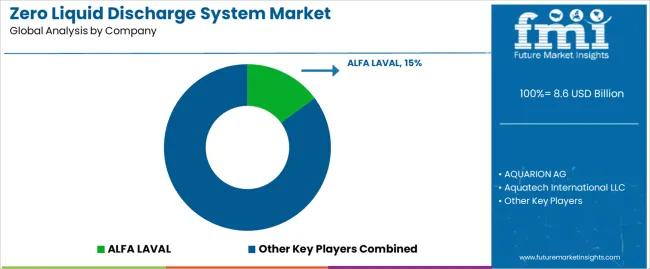

The zero liquid discharge system market is characterized by a competitive landscape shaped by various factors including technological advancements, regulatory requirements, market dynamics, and the presence of key players across different regions.

Company Portfolio

| Attribute | Details |

|---|---|

| Estimated Market Size in 2025 | USD 7.9 billion |

| Projected Market Valuation in 2035 | USD 18.1 billion |

| Value-based CAGR 2025 to 2035 | 8.7% |

| Forecast Period | 2025 to 2035 |

| Historical Data Available for | 2020 to 2025 |

| Market Analysis | Value in USD billion |

| Key Regions Covered | North America; Latin America; Western Europe; Eastern Europe; South Asia and Pacific; East Asia; The Middle East & Africa |

| Key Market Segments Covered | Technology, End User Industry, Region |

| Key Countries Profiled | The United States, Canada, Brazil, Mexico, Germany, France, France, Spain, Italy, Russia, Poland, Czech Republic, Romania, India, Bangladesh, Australia, New Zealand, China, Japan, South Korea, GCC countries, South Africa, Israel |

| Key Companies Profiled | ALFA LAVAL; AQUARION AG; Aquatech International LLC; Evoqua Water Technologies LLC; GEA Group Aktiengesellschaft; H2O GmbH; IDE Water Technologies.; Mitsubishi Power Ltd; Praj Industries; SafBon Water Technology. |

The global zero liquid discharge system market is estimated to be valued at USD 8.6 billion in 2025.

The market size for the zero liquid discharge system market is projected to reach USD 19.8 billion by 2035.

The zero liquid discharge system market is expected to grow at a 8.7% CAGR between 2025 and 2035.

The key product types in zero liquid discharge system market are thermal based and membrane based.

In terms of end-user industry, power segment to command 44.7% share in the zero liquid discharge system market in 2025.

Full Research Suite comprises of:

Market outlook & trends analysis

Interviews & case studies

Strategic recommendations

Vendor profiles & capabilities analysis

5-year forecasts

8 regions and 60+ country-level data splits

Market segment data splits

12 months of continuous data updates

DELIVERED AS:

PDF EXCEL ONLINE

Africa’s Zero Liquid Discharge System Market - Size, Share, and Forecast 2025 to 2035

Zero-Waste Packaging Technologies Market Size and Share Forecast Outlook 2025 to 2035

Zero Emission Aircraft Market Size and Share Forecast Outlook 2025 to 2035

Zero-Waste Refill Packaging Market Analysis - Size, Share, and Forecast Outlook 2025 to 2035

Zero-Fishmeal Feed Market Analysis - Size and Share Forecast Outlook 2025 to 2035

Zero Friction Coatings Market Size and Share Forecast Outlook 2025 to 2035

Zero Trust Security Market Size and Share Forecast Outlook 2025 to 2035

Zero Emission Vehicle Market Growth - Trends & Forecast 2025 to 2035

Zero-Touch Provisioning (ZTP) Market - Growth & Demand 2025 to 2035

Zero Calorie Chips Market Outlook - Growth, Demand & Forecast 2025 to 2035

Zero Sugar Beverages Market Analysis by Product Type and Sales Channel Through 2035

Zero-Waste Packaging Market Report – Sustainable Growth & Trends 2023-2033

Liquid Carton Packaging Market Size and Share Forecast Outlook 2025 to 2035

Liquid Desiccant Natural Gas Dehydration Unit Market Size and Share Forecast Outlook 2025 to 2035

Liquid Filled Pressure Gauges Market Size and Share Forecast Outlook 2025 to 2035

Liquid Filtration Market Size and Share Forecast Outlook 2025 to 2035

Liquid Packaging Board Market Size and Share Forecast Outlook 2025 to 2035

Liquid Filled Capsule Market Size and Share Forecast Outlook 2025 to 2035

Liquid Density Meters Market Size and Share Forecast Outlook 2025 to 2035

Liquid Cold Plates Market Size and Share Forecast Outlook 2025 to 2035

Thank you!

You will receive an email from our Business Development Manager. Please be sure to check your SPAM/JUNK folder too.

Chat With

MaRIA