The liquid capsule filling machines find wide application in the manufacturing of pharmaceuticals, nutraceuticals and cosmetics products and thus, the need for liquid capsule filling machines has increased; consequently, the growth of this industry is believed to directly contribute positively to the global liquid capsule filling machines market.

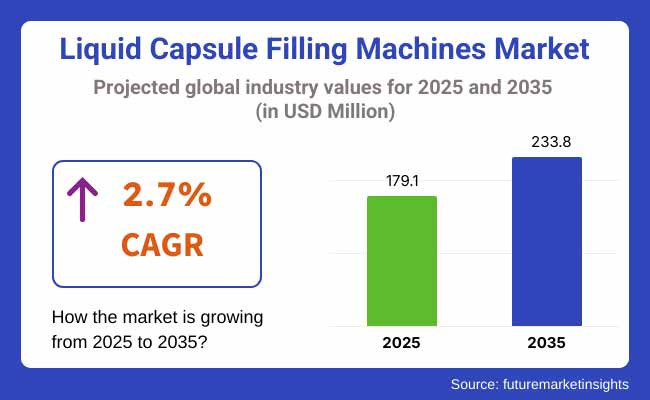

Capsule Filling Machine an ideal machine to fill capsules which are liquid formulations. Market size was valued at USD 179.1 million in 2025 and is expected to reach USD 233.8 million by 2035, at a CAGR of 2.7% during the forecast period.

Key Market Metrics

| Metric | Value |

|---|---|

| Market Size in 2025 | USD 179.1 Million |

| Projected Market Size in 2035 | USD 233.8 Million |

| CAGR (2025 to 2035) | 2.7% |

The North America region accounts for a good chunk of the liquid capsule filling machines market owing to the presence of an established pharmaceutical industry and growing nutraceuticals demand. Machine control can now access data over the Internet, allowing manufacturers to connect to many different sources of data in order to become more efficient and resolve problems. Moreover, the presence of key market players and strict regulatory standards will continue to improve the overall quality of liquid-filled capsules.

Steady growth in the liquid capsule filling machines market is attributed to pharmaceuticals manufacturing industries that focus extensively on innovation and quality, boosting the demand for liquid capsule filling machines in Europe. Germany, France, and the UK, among others, are leaders in the field, seeking precision and efficiency in capsule filling processes. Stringent governing regulations of the region, which ensure compliance with manufacturing standards, are also fueling the demand for advanced liquid capsule filling machines.

On the basis of region, the Asia-Pacific region is expected to grow at the highest CAGR, owing to high industrialization with rising healthcare expenditure and growing pharmaceutical industry. The growing prevalence of generic drugs and dietary supplements in countries such as China, India and Japan is also contributing to the growth of this market. Further, in this region, availability of skilled workforce and cost-effective manufacturing facilities also bodes well for setting up pharmaceuticals manufacturing facilities, hence assisting the market growth for such capsule filling machines.

Challenges

High Initial Investment, Complex Operational Requirements, and Regulatory Compliance

However, high initial capital investment outlay of liquid filling machines limits advanced filling technology implementation in small and medium pharmaceutical companies. Furthermore, it leads to high operational costs and risks of downtime due to complicated machined hardware maintenance and calibration. Proven regulatory obligations (e.g., FDA, EMA, cGMP standards) require firms to stay focused on accurate dosing, sterility, and contamination-free filling, which increases the complexity of the production processes.

Opportunities

Growth in Pharmaceuticals, Nutraceuticals, and Automated Filling Solutions

Factors driving the growth of the global market are fact that they provide multiple benefits over conventional capsule and tablet forms of medication and less prone to tampering and degradation, primary challenges to the growth of the global market are high production costs of liquid-filled capsules, rising demand for fixed-dose combination drugs, increasing consumer preference consisting of capsules over tablets and increased safety of the liquid-filled capsule, rising demand for liquid-filled capsules in pharmaceutical, dietary supplements, functional food formulations, expected the growth of the liquid-filled capsules market over the next few years.

Precision drug delivery and high bioavailability in liquid forms of nutraceuticals propels advanced filling machines into the market. Furthermore, Innovations in automated capsule filling, miniaturized production MoMs, and AI-based quality monitoring systems also improve efficiency, accuracy, and scalability of the capsule filling process.

| Market Shift | 2020 to 2024 Trends |

|---|---|

| Regulatory Landscape | Compliance with FDA, cGMP, and EU pharma guidelines. |

| Consumer Trends | Increased demand for gelatin-based and vegetarian liquid-filled capsules. |

| Industry Adoption | Used primarily in pharmaceuticals and dietary supplement manufacturing. |

| Supply Chain and Sourcing | Dependence on high-purity gelatin and polymer-based capsules. |

| Market Competition | Dominated by pharmaceutical machinery manufacturers and contract manufacturing organizations (CMOs). |

| Market Growth Drivers | Increased pharmaceutical drug production, demand for high-precision capsule filling, and advances in liquid drug formulations. |

| Sustainability and Environmental Impact | Early adoption of low-waste capsule filling technologies and biodegradable capsule materials. |

| Integration of Smart Technologies | Introduction of semi-automated capsule fillers and contamination-free filling mechanisms. |

| Advancements in Capsule Filling Technology | Development of high-speed, multi-nozzle filling machines and enhanced liquid sealing systems. |

| Market Shift | 2025 to 2035 Projections |

|---|---|

| Regulatory Landscape | Stricter automation standards, AI-driven quality control, and contamination-free production mandates. |

| Consumer Trends | Growth in sustainable, plant-based capsules and precision dosing for personalized medicine. |

| Industry Adoption | Expansion into biotech research, controlled drug release, and liquid-based nutraceuticals. |

| Supply Chain and Sourcing | Shift toward biodegradable capsule materials, sustainable gel formulations, and AI-driven raw material tracking. |

| Market Competition | Entry of AI-powered capsule filling tech firms, robotics-driven pharma automation, and biotech capsule innovators. |

| Market Growth Drivers | Accelerated by robotic-assisted capsule production, AI-driven defect detection, and biocompatible liquid-filled capsule solutions. |

| Sustainability and Environmental Impact | Large-scale shift toward zero-waste liquid capsule production, sustainable automation, and energy-efficient pharma manufacturing. |

| Integration of Smart Technologies | Expansion into fully automated, AI-powered quality control, and block chain-based batch tracking for pharma compliance. |

| Advancements in Capsule Filling Technology | Evolution toward self-correcting AI-powered filling machines, adaptive precision dosing, and microfluidic-based encapsulation. |

The USA liquid capsule filling machines market is being driven by increased demand for accurate and efficient drug formulation, growth of nutraceutical manufacturing, and innovations in automated pharmaceutical production. FDA regulations related to integrity and sterility of pharmaceutical capsules is driving need for high-speed contamination-free capsule filling technologies Also, the rise of personalized medicine, and AI-powered pharma making which is in turn changing how drugs are made.

| Country | CAGR (2025 to 2035) |

|---|---|

| USA | 2.8% |

Parts of clinical trial facilitation and higher efficiency of drug formulation are being tested in this market as pharmaceutical automation, growing demand for nutraceuticals, and regulatory requirements for the safety of capsule composition add up to the gradual development of the UK market.

Innovations are being led by the evolution in plant-based liquid capsules, sustainable pharma production, and robotic-assisted filling. Also, contract manufacturing organizations (CMOs) are IT focusing on high-precision liquid capsule filling lines designing help for increase drug bioavailability and stability.

| Country | CAGR (2025 to 2035) |

|---|---|

| UK | 2.6% |

The strict EU pharmaceutical regulations, expansion of biopharmaceutical production, and increasing adoption of liquid-based drug formulations are some of the most significant industry drivers in Europe’s liquid capsule filling machines market. Countries such as Germany, France, and Switzerland lead the pack when it comes to automated capsule production, AI-driven filling control, and compostable capsules. The growth of sustainable pharma initiatives is leading to demand for low waste, high precision capsule filling solutions.

| Region | CAGR (2025 to 2035) |

|---|---|

| EU | 2.7% |

High demand for drug delivery systems, increasing research in biotech encapsulation, and strong government regulations on precision dosing are the factors driving the liquid capsule filling machines market in Japan. Adoption of the next-gen capsule filling systems with real-time defect detection and self-correcting filling technology in the country is being spurred by the country’s leadership in robotics and AI-driven pharmaceutical automation.

| Country | CAGR (2025 to 2035) |

|---|---|

| Japan | 2.7% |

Increasing pharmaceutical R&D investments, a burgeoning nutraceutical sector, and the integration of AI-based production automation is likely to make South Korea a lucrative market for liquid capsule filling machines. The increasing production of biosimilar drugs and cutting-edge precision capsule filling innovations are in turn augmenting the need for high-efficiency, AI-powered capsule filling.

| Country | CAGR (2025 to 2035) |

|---|---|

| South Korea | 2.8% |

By machine type, the global liquid capsule filling machines market has been segmented into semi-automatic, and automatic machines, resulting in automatic and semi-automatic capsule filling machines being used extensively by manufacturers across the industry verticals for filling liquid capsules, as it highly scalable and highly precise. These segments are critical for increasing operational efficiency in producing pharmaceuticals and nutraceuticals, improving capsule quality and providing accuracy of dosing.

The semi-automatic liquid capsule filling machines segment is anticipated to emerge as one of the most adopted in the market, which can be attributed to the relatively inexpensive and customizable solutions available for small to mid-scale production facilities. In contrast to fully automated machines, semi-automatic models offer greater flexibility, allowing operators to manage filling processes while still ensuring efficiency.

Market adoption has been the increasing need for portable and flexible capsule filling solutions with accurate volume control, manual loading options, and adjustable fill weights. More than 55% of small-scale pharmaceutical manufacturers and CMOs choose semi-automatic machines for their cost-effectiveness and versatility when it comes to handling various formulations.

Production expansion of small batch specialty capsules, with semi-automatic equipment for liquid filled hard gelatin capsules, also plant based capsules, as well as tailored dosage forms have fortified market growth, ensuring greater availability for specialized pharmaceutical and nutraceutical applications.

The adoption has also been enhanced by the deployment of AI-assisted capsule filling systems that allow for real-time adjustment of fill weight, automated quality control, and digital operator guidance resulting in better consistency and operational efficiency. Modular semi-automatic filling systems, interchangeable dosing units, hybrid liquid-powder capabilities, and quick-to-clean designs are recent innovations that have enhanced flexibility for multi-product production facilities and optimized market growth.

Although semi-automatic segment provides benefits in terms of cost effectiveness, process control and flexibility, it has challenges like lower output rates, more number of labor required, and limited scalability in terms of high volume production. But, developments in AI-empowered fill weight calibration, advanced material handling systems, and semi-automated bulk capsule feeding are improving productivity and securing expansion in semi-automatic liquidity capsule filling applications.

Automatic liquid capsule filling machine's achieved strong market penetration mostly among bigger Fortune companies (both Pharma and Nutraceutical industries) that are looking for high-output, precision controlled mass production solutions. Unlike semi-automatic machines, fully automated models come complete with robotic handling, automated capsule sealing and real-time quality assurance, OEMing them to high-volume processing.

Growing demand for high-speed pharmaceutical production, with continuous, automated capsule filling lines that combine end-to-end processing with drying, sealing, and inspection modules, is driving market adoption.

Over 60% of the pharmaceutical production facilities find it wise to use automatic machines for maximizing output and maintaining similar capsule uniformity Increasing liquid-based nutraceutical formulations, including oil-filled soft gelatin capsules, water-soluble supplements, and encapsulated probiotics, have bolstered market growth by ensuring broader acceptance of the nutraceuticals in dietary supplement manufacturing.

The integration of AI-augmented machine learning systems with real-time viscosity control, automated dosing accuracy adjustments, and predictive maintenance alerts into these tools has further encouraged adoption, ensuring a rise in process reliability with minimal downtime.

The innovation of GMP-compliant automatic capsule filling systems, including closed-system liquid filling, contamination-resistant designs, and high-efficiency material dispensing, has facilitated the progress of the market by offering improved regulatory adherence and operational safety.

While it brings high-speed processing, automated quality control, and increased scalability, the automatic segment is limited by high initial investment costs, complex maintenance requirements, and limited adaptability for small-batch production.

However, advancements in AI-driven machine optimization, modular automation upgrades, and energy-efficient processing systems contribute to fostering the cost-effectiveness of automated liquid capsule filling machines, allowing continuous growth in their adoption.

Up to 6,000 C/hr segment and 6,001 to 12,000 C/hr segment are expected to be the key segments contributing significantly towards the growth of the market as pharmaceutical and nutraceutical industry are continuously optimizing production output to address the exponentially increasing global demand.

Machines that output up to 6,000 capsules per hour (C/hr) have seen a strong presence in the marketplace as a scalable and efficient solution for small-scale production and R&D facilities. These models offer precise dosing capabilities with a lower capital investment when compared to high-capacity machines.

Market adoption has been supported by increasing demand for small-scale & research-based capsule filling solutions, owing to compact design, adjustable fill volumes, and multi-product adaptability. Over 50% of these startup nutraceutical brands and even clinical trial manufacturers choose low-output machines which allow close control of scalability.

The growth of liquid-based personalized medicine, with machines (up to 6,000 C/hr capacity), customized prescription capsules, experimental drug formulations and low-volume specialty manufacture contributed towards market growth for greater alignment with precision healthcare trends.

Pairing Process Automation with Smart Control Systems, AI-powered process optimization, automated batch tracking, and cloud-enabled production analytics have spurred adoption of process automation in order to facilitate enhanced operational oversight and quality consistency.

Hybrid low-output machines, with compatibility for both liquid and powder filling systems, as well as soft gelatin and HPMC capsules, and real-time fill weight calibration, have contributed to the expansion of the market, enabling applications across both pharmaceutical and nutraceuticals.

Utilizing significant benefits including being cost-efficient, versatile, and capable of depositing exact amounts; however, the up to 6,000 C/hr category is limited due to insubstantial scaling toward extensive output and delayed processing as well as the dependence on manually filling capsules in bulk. But the feasibility is being improved by innovations in semi-automated material handling, AI-driven batch tracking and better fill rate efficiency, so expansion in this segment will persist.

However, machines designed for higher output capacity ranging from 6,001 to 12,000 capsules per hour has displayed a higher market adoption owing to their high-output, precision-controlled production line, and the demand from mid-to-large scale pharmaceutical manufacturers. Unlike low-output machines, these models include the capability for continuous operation integrated quality assurance and automated material handling.

Market adoption has been propelled by growing need for efficient mid-range production solutions with automated capsule feeding, continuous sealing systems and AI-empowered real-time quality control. According to the statistics, more than 55% of biomedical manufacturers and contract manufacturing organizations prefer to purchase the mid-range output machines, which are a compromise between speed and accuracy.

The diversification of high-demand nutraceuticals preparations, including the high-mix production of herbal extracts, liquid vitamins, and encapsulated dietary supplements, has favored accelerated market growth, allowing scalability of production for better outcomes.

Increased adoption due to integration of smart capsule inspection including automated reject detection, high-speed weight verification and AI-powered fill uniformity assessment have made for better Good Manufacturing Processes (GMP) compliance.

Innovative hybrid mid-to-high-output machines, equipped with modular expansion options, custom fill rate configurations, and contamination-resistant material handling, are proving to be a boon for market growth, helping to adapt to changing pharmaceutical production needs more effectively.

Although having benefits in mass production, automation capacities, production efficiency, the 6,001 to 12,000 C/hr section encounter with factors like higher capital investments, complex technical specification, and technical operators. But here the importance of AI-driven automated process control, real-time production optimization, footprint optimization, and the possibility of flexible batch customization come to play, enhancing performances and continuing to drive growth in mid-to-high-output capsule filling machines.

Growing application of liquid-filled capsules in the pharmaceutical and nutraceutical industry, increasing demand for liquid filled capsules and advances in AI-Powered filling and sealing technologies are some of the prominent drivers of the liquid capsule filling machines market. Further driving the growth in the pharmaceutical industry is the shift from the traditional gelatin capsules to the hydroxypropyl methylcellulose (HPMC) capsules and the automation of powder filling and capsule production.

Leading industry players target liquid encapsulation through AI-assisted filling accuracy, high-speed automation, and improved sterility. Pharmaceutical equipment manufacturers, automation technology providers, and capsule filling solution companies are some of the major contributors and innovators in high precision, scalable, and cost-effective solutions for liquid capsule filling machines.

Market Share Analysis by Key Players & Liquid Capsule Filling Machine Providers

| Company Name | Estimated Market Share (%) |

|---|---|

| Bosch Packaging Technology (Syntegon) | 18-22% |

| IMA Group | 14-18% |

| Capsugel (Lonza Group) | 12-16% |

| ACG Group | 8-12% |

| Shanghai Develop Machinery Co., Ltd. | 6-10% |

| Other Capsule Filling Machine Providers (combined) | 30-40% |

| Company Name | Key Offerings/Activities |

|---|---|

| Bosch Packaging Technology (Syntegon) | Develops AI-powered liquid capsule filling systems, automated production lines, and sterile filling solutions for pharmaceuticals. |

| IMA Group | Specializes in high-speed liquid capsule fillers with AI-driven volume accuracy, viscosity control, and precision dosing. |

| Capsugel (Lonza Group) | Focuses on AI-assisted encapsulation technology, seamless integration with HPMC capsules, and automated pharmaceutical-grade liquid filling. |

| ACG Group | Provides high-efficiency, AI-powered capsule filling machines with real-time monitoring and contamination-free liquid sealing. |

| Shanghai Develop Machinery Co., Ltd. | Offers cost-effective, AI-optimized liquid filling solutions with modular customization for small and large-scale production. |

Key Market Insights

Bosch Packaging Technology (Syntegon) (18-22%)

Bosch leads in AI-powered liquid capsule filling technology, offering high-speed automation, precision filling, and sterile manufacturing solutions for pharmaceuticals.

IMA Group (14-18%)

IMA specializes in high-speed liquid encapsulation, integrating AI-driven viscosity control, accurate dosing, and adaptive filling solutions for complex formulations.

Capsugel (Lonza Group) (12-16%)

Capsugel focuses on AI-enhanced liquid capsule sealing, optimizing encapsulation for HPMC and gelatin capsules in pharmaceutical and nutraceutical applications.

ACG Group (8-12%)

ACG provides high-efficiency, AI-assisted liquid capsule filling machines, ensuring sterility, automation, and minimal product loss during encapsulation.

Shanghai Develop Machinery Co., Ltd. (6-10%)

Shanghai Develop Machinery offers cost-effective, AI-powered modular filling solutions, catering to both small-scale production and high-volume pharmaceutical manufacturing.

Other Key Players (30-40% Combined)

Several pharmaceutical equipment manufacturers, automation technology firms, and capsule filling solution providers contribute to next-generation liquid capsule filling innovations, AI-driven process efficiency, and sustainable encapsulation solutions. Key contributors include:

The overall market size for the liquid capsule filling machines market was USD 179.1 Million in 2025.

The liquid capsule filling machines market is expected to reach USD 233.8 Million in 2035.

The demand for liquid capsule filling machines is rising due to increasing pharmaceutical production, advancements in encapsulation technology, and the growing demand for liquid-filled capsules in nutraceuticals. The push for high-speed, precision-based filling solutions is further driving market growth.

The top 5 countries driving the development of the liquid capsule filling machines market are the USA, China, Germany, India, and Japan.

Up to 6,000 C/hr and 6,001 to 12,000 C/hr Output Capacity are expected to command a significant share over the assessment period.

Table 1: Global Market Value (US$ Million) Forecast by Region, 2018 to 2033

Table 2: Global Market Volume (Units) Forecast by Region, 2018 to 2033

Table 3: Global Market Value (US$ Million) Forecast by Machine Type, 2018 to 2033

Table 4: Global Market Volume (Units) Forecast by Machine Type, 2018 to 2033

Table 5: Global Market Value (US$ Million) Forecast by Output Capacity, 2018 to 2033

Table 6: Global Market Volume (Units) Forecast by Output Capacity, 2018 to 2033

Table 7: Global Market Value (US$ Million) Forecast by Capsule Type, 2018 to 2033

Table 8: Global Market Volume (Units) Forecast by Capsule Type, 2018 to 2033

Table 9: Global Market Value (US$ Million) Forecast by End-user, 2018 to 2033

Table 10: Global Market Volume (Units) Forecast by End-user, 2018 to 2033

Table 11: North America Market Value (US$ Million) Forecast by Country, 2018 to 2033

Table 12: North America Market Volume (Units) Forecast by Country, 2018 to 2033

Table 13: North America Market Value (US$ Million) Forecast by Machine Type, 2018 to 2033

Table 14: North America Market Volume (Units) Forecast by Machine Type, 2018 to 2033

Table 15: North America Market Value (US$ Million) Forecast by Output Capacity, 2018 to 2033

Table 16: North America Market Volume (Units) Forecast by Output Capacity, 2018 to 2033

Table 17: North America Market Value (US$ Million) Forecast by Capsule Type, 2018 to 2033

Table 18: North America Market Volume (Units) Forecast by Capsule Type, 2018 to 2033

Table 19: North America Market Value (US$ Million) Forecast by End-user, 2018 to 2033

Table 20: North America Market Volume (Units) Forecast by End-user, 2018 to 2033

Table 21: Latin America Market Value (US$ Million) Forecast by Country, 2018 to 2033

Table 22: Latin America Market Volume (Units) Forecast by Country, 2018 to 2033

Table 23: Latin America Market Value (US$ Million) Forecast by Machine Type, 2018 to 2033

Table 24: Latin America Market Volume (Units) Forecast by Machine Type, 2018 to 2033

Table 25: Latin America Market Value (US$ Million) Forecast by Output Capacity, 2018 to 2033

Table 26: Latin America Market Volume (Units) Forecast by Output Capacity, 2018 to 2033

Table 27: Latin America Market Value (US$ Million) Forecast by Capsule Type, 2018 to 2033

Table 28: Latin America Market Volume (Units) Forecast by Capsule Type, 2018 to 2033

Table 29: Latin America Market Value (US$ Million) Forecast by End-user, 2018 to 2033

Table 30: Latin America Market Volume (Units) Forecast by End-user, 2018 to 2033

Table 31: Europe Market Value (US$ Million) Forecast by Country, 2018 to 2033

Table 32: Europe Market Volume (Units) Forecast by Country, 2018 to 2033

Table 33: Europe Market Value (US$ Million) Forecast by Machine Type, 2018 to 2033

Table 34: Europe Market Volume (Units) Forecast by Machine Type, 2018 to 2033

Table 35: Europe Market Value (US$ Million) Forecast by Output Capacity, 2018 to 2033

Table 36: Europe Market Volume (Units) Forecast by Output Capacity, 2018 to 2033

Table 37: Europe Market Value (US$ Million) Forecast by Capsule Type, 2018 to 2033

Table 38: Europe Market Volume (Units) Forecast by Capsule Type, 2018 to 2033

Table 39: Europe Market Value (US$ Million) Forecast by End-user, 2018 to 2033

Table 40: Europe Market Volume (Units) Forecast by End-user, 2018 to 2033

Table 41: Asia Pacific Market Value (US$ Million) Forecast by Country, 2018 to 2033

Table 42: Asia Pacific Market Volume (Units) Forecast by Country, 2018 to 2033

Table 43: Asia Pacific Market Value (US$ Million) Forecast by Machine Type, 2018 to 2033

Table 44: Asia Pacific Market Volume (Units) Forecast by Machine Type, 2018 to 2033

Table 45: Asia Pacific Market Value (US$ Million) Forecast by Output Capacity, 2018 to 2033

Table 46: Asia Pacific Market Volume (Units) Forecast by Output Capacity, 2018 to 2033

Table 47: Asia Pacific Market Value (US$ Million) Forecast by Capsule Type, 2018 to 2033

Table 48: Asia Pacific Market Volume (Units) Forecast by Capsule Type, 2018 to 2033

Table 49: Asia Pacific Market Value (US$ Million) Forecast by End-user, 2018 to 2033

Table 50: Asia Pacific Market Volume (Units) Forecast by End-user, 2018 to 2033

Table 51: MEA Market Value (US$ Million) Forecast by Country, 2018 to 2033

Table 52: MEA Market Volume (Units) Forecast by Country, 2018 to 2033

Table 53: MEA Market Value (US$ Million) Forecast by Machine Type, 2018 to 2033

Table 54: MEA Market Volume (Units) Forecast by Machine Type, 2018 to 2033

Table 55: MEA Market Value (US$ Million) Forecast by Output Capacity, 2018 to 2033

Table 56: MEA Market Volume (Units) Forecast by Output Capacity, 2018 to 2033

Table 57: MEA Market Value (US$ Million) Forecast by Capsule Type, 2018 to 2033

Table 58: MEA Market Volume (Units) Forecast by Capsule Type, 2018 to 2033

Table 59: MEA Market Value (US$ Million) Forecast by End-user, 2018 to 2033

Table 60: MEA Market Volume (Units) Forecast by End-user, 2018 to 2033

Figure 1: Global Market Value (US$ Million) by Machine Type, 2023 to 2033

Figure 2: Global Market Value (US$ Million) by Output Capacity, 2023 to 2033

Figure 3: Global Market Value (US$ Million) by Capsule Type, 2023 to 2033

Figure 4: Global Market Value (US$ Million) by End-user, 2023 to 2033

Figure 5: Global Market Value (US$ Million) by Region, 2023 to 2033

Figure 6: Global Market Value (US$ Million) Analysis by Region, 2018 to 2033

Figure 7: Global Market Volume (Units) Analysis by Region, 2018 to 2033

Figure 8: Global Market Value Share (%) and BPS Analysis by Region, 2023 to 2033

Figure 9: Global Market Y-o-Y Growth (%) Projections by Region, 2023 to 2033

Figure 10: Global Market Value (US$ Million) Analysis by Machine Type, 2018 to 2033

Figure 11: Global Market Volume (Units) Analysis by Machine Type, 2018 to 2033

Figure 12: Global Market Value Share (%) and BPS Analysis by Machine Type, 2023 to 2033

Figure 13: Global Market Y-o-Y Growth (%) Projections by Machine Type, 2023 to 2033

Figure 14: Global Market Value (US$ Million) Analysis by Output Capacity, 2018 to 2033

Figure 15: Global Market Volume (Units) Analysis by Output Capacity, 2018 to 2033

Figure 16: Global Market Value Share (%) and BPS Analysis by Output Capacity, 2023 to 2033

Figure 17: Global Market Y-o-Y Growth (%) Projections by Output Capacity, 2023 to 2033

Figure 18: Global Market Value (US$ Million) Analysis by Capsule Type, 2018 to 2033

Figure 19: Global Market Volume (Units) Analysis by Capsule Type, 2018 to 2033

Figure 20: Global Market Value Share (%) and BPS Analysis by Capsule Type, 2023 to 2033

Figure 21: Global Market Y-o-Y Growth (%) Projections by Capsule Type, 2023 to 2033

Figure 22: Global Market Value (US$ Million) Analysis by End-user, 2018 to 2033

Figure 23: Global Market Volume (Units) Analysis by End-user, 2018 to 2033

Figure 24: Global Market Value Share (%) and BPS Analysis by End-user, 2023 to 2033

Figure 25: Global Market Y-o-Y Growth (%) Projections by End-user, 2023 to 2033

Figure 26: Global Market Attractiveness by Machine Type, 2023 to 2033

Figure 27: Global Market Attractiveness by Output Capacity, 2023 to 2033

Figure 28: Global Market Attractiveness by Capsule Type, 2023 to 2033

Figure 29: Global Market Attractiveness by End-user, 2023 to 2033

Figure 30: Global Market Attractiveness by Region, 2023 to 2033

Figure 31: North America Market Value (US$ Million) by Machine Type, 2023 to 2033

Figure 32: North America Market Value (US$ Million) by Output Capacity, 2023 to 2033

Figure 33: North America Market Value (US$ Million) by Capsule Type, 2023 to 2033

Figure 34: North America Market Value (US$ Million) by End-user, 2023 to 2033

Figure 35: North America Market Value (US$ Million) by Country, 2023 to 2033

Figure 36: North America Market Value (US$ Million) Analysis by Country, 2018 to 2033

Figure 37: North America Market Volume (Units) Analysis by Country, 2018 to 2033

Figure 38: North America Market Value Share (%) and BPS Analysis by Country, 2023 to 2033

Figure 39: North America Market Y-o-Y Growth (%) Projections by Country, 2023 to 2033

Figure 40: North America Market Value (US$ Million) Analysis by Machine Type, 2018 to 2033

Figure 41: North America Market Volume (Units) Analysis by Machine Type, 2018 to 2033

Figure 42: North America Market Value Share (%) and BPS Analysis by Machine Type, 2023 to 2033

Figure 43: North America Market Y-o-Y Growth (%) Projections by Machine Type, 2023 to 2033

Figure 44: North America Market Value (US$ Million) Analysis by Output Capacity, 2018 to 2033

Figure 45: North America Market Volume (Units) Analysis by Output Capacity, 2018 to 2033

Figure 46: North America Market Value Share (%) and BPS Analysis by Output Capacity, 2023 to 2033

Figure 47: North America Market Y-o-Y Growth (%) Projections by Output Capacity, 2023 to 2033

Figure 48: North America Market Value (US$ Million) Analysis by Capsule Type, 2018 to 2033

Figure 49: North America Market Volume (Units) Analysis by Capsule Type, 2018 to 2033

Figure 50: North America Market Value Share (%) and BPS Analysis by Capsule Type, 2023 to 2033

Figure 51: North America Market Y-o-Y Growth (%) Projections by Capsule Type, 2023 to 2033

Figure 52: North America Market Value (US$ Million) Analysis by End-user, 2018 to 2033

Figure 53: North America Market Volume (Units) Analysis by End-user, 2018 to 2033

Figure 54: North America Market Value Share (%) and BPS Analysis by End-user, 2023 to 2033

Figure 55: North America Market Y-o-Y Growth (%) Projections by End-user, 2023 to 2033

Figure 56: North America Market Attractiveness by Machine Type, 2023 to 2033

Figure 57: North America Market Attractiveness by Output Capacity, 2023 to 2033

Figure 58: North America Market Attractiveness by Capsule Type, 2023 to 2033

Figure 59: North America Market Attractiveness by End-user, 2023 to 2033

Figure 60: North America Market Attractiveness by Country, 2023 to 2033

Figure 61: Latin America Market Value (US$ Million) by Machine Type, 2023 to 2033

Figure 62: Latin America Market Value (US$ Million) by Output Capacity, 2023 to 2033

Figure 63: Latin America Market Value (US$ Million) by Capsule Type, 2023 to 2033

Figure 64: Latin America Market Value (US$ Million) by End-user, 2023 to 2033

Figure 65: Latin America Market Value (US$ Million) by Country, 2023 to 2033

Figure 66: Latin America Market Value (US$ Million) Analysis by Country, 2018 to 2033

Figure 67: Latin America Market Volume (Units) Analysis by Country, 2018 to 2033

Figure 68: Latin America Market Value Share (%) and BPS Analysis by Country, 2023 to 2033

Figure 69: Latin America Market Y-o-Y Growth (%) Projections by Country, 2023 to 2033

Figure 70: Latin America Market Value (US$ Million) Analysis by Machine Type, 2018 to 2033

Figure 71: Latin America Market Volume (Units) Analysis by Machine Type, 2018 to 2033

Figure 72: Latin America Market Value Share (%) and BPS Analysis by Machine Type, 2023 to 2033

Figure 73: Latin America Market Y-o-Y Growth (%) Projections by Machine Type, 2023 to 2033

Figure 74: Latin America Market Value (US$ Million) Analysis by Output Capacity, 2018 to 2033

Figure 75: Latin America Market Volume (Units) Analysis by Output Capacity, 2018 to 2033

Figure 76: Latin America Market Value Share (%) and BPS Analysis by Output Capacity, 2023 to 2033

Figure 77: Latin America Market Y-o-Y Growth (%) Projections by Output Capacity, 2023 to 2033

Figure 78: Latin America Market Value (US$ Million) Analysis by Capsule Type, 2018 to 2033

Figure 79: Latin America Market Volume (Units) Analysis by Capsule Type, 2018 to 2033

Figure 80: Latin America Market Value Share (%) and BPS Analysis by Capsule Type, 2023 to 2033

Figure 81: Latin America Market Y-o-Y Growth (%) Projections by Capsule Type, 2023 to 2033

Figure 82: Latin America Market Value (US$ Million) Analysis by End-user, 2018 to 2033

Figure 83: Latin America Market Volume (Units) Analysis by End-user, 2018 to 2033

Figure 84: Latin America Market Value Share (%) and BPS Analysis by End-user, 2023 to 2033

Figure 85: Latin America Market Y-o-Y Growth (%) Projections by End-user, 2023 to 2033

Figure 86: Latin America Market Attractiveness by Machine Type, 2023 to 2033

Figure 87: Latin America Market Attractiveness by Output Capacity, 2023 to 2033

Figure 88: Latin America Market Attractiveness by Capsule Type, 2023 to 2033

Figure 89: Latin America Market Attractiveness by End-user, 2023 to 2033

Figure 90: Latin America Market Attractiveness by Country, 2023 to 2033

Figure 91: Europe Market Value (US$ Million) by Machine Type, 2023 to 2033

Figure 92: Europe Market Value (US$ Million) by Output Capacity, 2023 to 2033

Figure 93: Europe Market Value (US$ Million) by Capsule Type, 2023 to 2033

Figure 94: Europe Market Value (US$ Million) by End-user, 2023 to 2033

Figure 95: Europe Market Value (US$ Million) by Country, 2023 to 2033

Figure 96: Europe Market Value (US$ Million) Analysis by Country, 2018 to 2033

Figure 97: Europe Market Volume (Units) Analysis by Country, 2018 to 2033

Figure 98: Europe Market Value Share (%) and BPS Analysis by Country, 2023 to 2033

Figure 99: Europe Market Y-o-Y Growth (%) Projections by Country, 2023 to 2033

Figure 100: Europe Market Value (US$ Million) Analysis by Machine Type, 2018 to 2033

Figure 101: Europe Market Volume (Units) Analysis by Machine Type, 2018 to 2033

Figure 102: Europe Market Value Share (%) and BPS Analysis by Machine Type, 2023 to 2033

Figure 103: Europe Market Y-o-Y Growth (%) Projections by Machine Type, 2023 to 2033

Figure 104: Europe Market Value (US$ Million) Analysis by Output Capacity, 2018 to 2033

Figure 105: Europe Market Volume (Units) Analysis by Output Capacity, 2018 to 2033

Figure 106: Europe Market Value Share (%) and BPS Analysis by Output Capacity, 2023 to 2033

Figure 107: Europe Market Y-o-Y Growth (%) Projections by Output Capacity, 2023 to 2033

Figure 108: Europe Market Value (US$ Million) Analysis by Capsule Type, 2018 to 2033

Figure 109: Europe Market Volume (Units) Analysis by Capsule Type, 2018 to 2033

Figure 110: Europe Market Value Share (%) and BPS Analysis by Capsule Type, 2023 to 2033

Figure 111: Europe Market Y-o-Y Growth (%) Projections by Capsule Type, 2023 to 2033

Figure 112: Europe Market Value (US$ Million) Analysis by End-user, 2018 to 2033

Figure 113: Europe Market Volume (Units) Analysis by End-user, 2018 to 2033

Figure 114: Europe Market Value Share (%) and BPS Analysis by End-user, 2023 to 2033

Figure 115: Europe Market Y-o-Y Growth (%) Projections by End-user, 2023 to 2033

Figure 116: Europe Market Attractiveness by Machine Type, 2023 to 2033

Figure 117: Europe Market Attractiveness by Output Capacity, 2023 to 2033

Figure 118: Europe Market Attractiveness by Capsule Type, 2023 to 2033

Figure 119: Europe Market Attractiveness by End-user, 2023 to 2033

Figure 120: Europe Market Attractiveness by Country, 2023 to 2033

Figure 121: Asia Pacific Market Value (US$ Million) by Machine Type, 2023 to 2033

Figure 122: Asia Pacific Market Value (US$ Million) by Output Capacity, 2023 to 2033

Figure 123: Asia Pacific Market Value (US$ Million) by Capsule Type, 2023 to 2033

Figure 124: Asia Pacific Market Value (US$ Million) by End-user, 2023 to 2033

Figure 125: Asia Pacific Market Value (US$ Million) by Country, 2023 to 2033

Figure 126: Asia Pacific Market Value (US$ Million) Analysis by Country, 2018 to 2033

Figure 127: Asia Pacific Market Volume (Units) Analysis by Country, 2018 to 2033

Figure 128: Asia Pacific Market Value Share (%) and BPS Analysis by Country, 2023 to 2033

Figure 129: Asia Pacific Market Y-o-Y Growth (%) Projections by Country, 2023 to 2033

Figure 130: Asia Pacific Market Value (US$ Million) Analysis by Machine Type, 2018 to 2033

Figure 131: Asia Pacific Market Volume (Units) Analysis by Machine Type, 2018 to 2033

Figure 132: Asia Pacific Market Value Share (%) and BPS Analysis by Machine Type, 2023 to 2033

Figure 133: Asia Pacific Market Y-o-Y Growth (%) Projections by Machine Type, 2023 to 2033

Figure 134: Asia Pacific Market Value (US$ Million) Analysis by Output Capacity, 2018 to 2033

Figure 135: Asia Pacific Market Volume (Units) Analysis by Output Capacity, 2018 to 2033

Figure 136: Asia Pacific Market Value Share (%) and BPS Analysis by Output Capacity, 2023 to 2033

Figure 137: Asia Pacific Market Y-o-Y Growth (%) Projections by Output Capacity, 2023 to 2033

Figure 138: Asia Pacific Market Value (US$ Million) Analysis by Capsule Type, 2018 to 2033

Figure 139: Asia Pacific Market Volume (Units) Analysis by Capsule Type, 2018 to 2033

Figure 140: Asia Pacific Market Value Share (%) and BPS Analysis by Capsule Type, 2023 to 2033

Figure 141: Asia Pacific Market Y-o-Y Growth (%) Projections by Capsule Type, 2023 to 2033

Figure 142: Asia Pacific Market Value (US$ Million) Analysis by End-user, 2018 to 2033

Figure 143: Asia Pacific Market Volume (Units) Analysis by End-user, 2018 to 2033

Figure 144: Asia Pacific Market Value Share (%) and BPS Analysis by End-user, 2023 to 2033

Figure 145: Asia Pacific Market Y-o-Y Growth (%) Projections by End-user, 2023 to 2033

Figure 146: Asia Pacific Market Attractiveness by Machine Type, 2023 to 2033

Figure 147: Asia Pacific Market Attractiveness by Output Capacity, 2023 to 2033

Figure 148: Asia Pacific Market Attractiveness by Capsule Type, 2023 to 2033

Figure 149: Asia Pacific Market Attractiveness by End-user, 2023 to 2033

Figure 150: Asia Pacific Market Attractiveness by Country, 2023 to 2033

Figure 151: MEA Market Value (US$ Million) by Machine Type, 2023 to 2033

Figure 152: MEA Market Value (US$ Million) by Output Capacity, 2023 to 2033

Figure 153: MEA Market Value (US$ Million) by Capsule Type, 2023 to 2033

Figure 154: MEA Market Value (US$ Million) by End-user, 2023 to 2033

Figure 155: MEA Market Value (US$ Million) by Country, 2023 to 2033

Figure 156: MEA Market Value (US$ Million) Analysis by Country, 2018 to 2033

Figure 157: MEA Market Volume (Units) Analysis by Country, 2018 to 2033

Figure 158: MEA Market Value Share (%) and BPS Analysis by Country, 2023 to 2033

Figure 159: MEA Market Y-o-Y Growth (%) Projections by Country, 2023 to 2033

Figure 160: MEA Market Value (US$ Million) Analysis by Machine Type, 2018 to 2033

Figure 161: MEA Market Volume (Units) Analysis by Machine Type, 2018 to 2033

Figure 162: MEA Market Value Share (%) and BPS Analysis by Machine Type, 2023 to 2033

Figure 163: MEA Market Y-o-Y Growth (%) Projections by Machine Type, 2023 to 2033

Figure 164: MEA Market Value (US$ Million) Analysis by Output Capacity, 2018 to 2033

Figure 165: MEA Market Volume (Units) Analysis by Output Capacity, 2018 to 2033

Figure 166: MEA Market Value Share (%) and BPS Analysis by Output Capacity, 2023 to 2033

Figure 167: MEA Market Y-o-Y Growth (%) Projections by Output Capacity, 2023 to 2033

Figure 168: MEA Market Value (US$ Million) Analysis by Capsule Type, 2018 to 2033

Figure 169: MEA Market Volume (Units) Analysis by Capsule Type, 2018 to 2033

Figure 170: MEA Market Value Share (%) and BPS Analysis by Capsule Type, 2023 to 2033

Figure 171: MEA Market Y-o-Y Growth (%) Projections by Capsule Type, 2023 to 2033

Figure 172: MEA Market Value (US$ Million) Analysis by End-user, 2018 to 2033

Figure 173: MEA Market Volume (Units) Analysis by End-user, 2018 to 2033

Figure 174: MEA Market Value Share (%) and BPS Analysis by End-user, 2023 to 2033

Figure 175: MEA Market Y-o-Y Growth (%) Projections by End-user, 2023 to 2033

Figure 176: MEA Market Attractiveness by Machine Type, 2023 to 2033

Figure 177: MEA Market Attractiveness by Output Capacity, 2023 to 2033

Figure 178: MEA Market Attractiveness by Capsule Type, 2023 to 2033

Figure 179: MEA Market Attractiveness by End-user, 2023 to 2033

Figure 180: MEA Market Attractiveness by Country, 2023 to 2033

Full Research Suite comprises of:

Market outlook & trends analysis

Interviews & case studies

Strategic recommendations

Vendor profiles & capabilities analysis

5-year forecasts

8 regions and 60+ country-level data splits

Market segment data splits

12 months of continuous data updates

DELIVERED AS:

PDF EXCEL ONLINE

Hardgel Liquid Capsule Filling Machines Market

Liquid Carton Packaging Market Size and Share Forecast Outlook 2025 to 2035

Liquid Desiccant Natural Gas Dehydration Unit Market Size and Share Forecast Outlook 2025 to 2035

Liquid Filled Pressure Gauges Market Size and Share Forecast Outlook 2025 to 2035

Liquid Filtration Market Size and Share Forecast Outlook 2025 to 2035

Liquid Packaging Board Market Size and Share Forecast Outlook 2025 to 2035

Liquid Density Meters Market Size and Share Forecast Outlook 2025 to 2035

Liquid Cold Plates Market Size and Share Forecast Outlook 2025 to 2035

Liquid Crystal Polymers Market Size and Share Forecast Outlook 2025 to 2035

Liquid Embolic Agent Market Size and Share Forecast Outlook 2025 to 2035

Liquid Hydrogen Market Size and Share Forecast Outlook 2025 to 2035

Liquid Cooled Home Standby Gensets Market Size and Share Forecast Outlook 2025 to 2035

Liquid Nitrogen Purge Systems Market Size and Share Forecast Outlook 2025 to 2035

Liquid Chromatography Systems Market Size and Share Forecast Outlook 2025 to 2035

Liquid Armor Materials Market Size and Share Forecast Outlook 2025 to 2035

Liquid Synthetic Rubber Market Size and Share Forecast Outlook 2025 to 2035

Liquid Crystal Polymer (LCP) Market Size and Share Forecast Outlook 2025 to 2035

Liquid Smoke Market Analysis - Size, Share, and Forecast Outlook 2025 to 2035

Liquid-Tight Flexible Non-Metallic Conduit Market Size and Share Forecast Outlook 2025 to 2035

Liquid Hand Soap Market Size and Share Forecast Outlook 2025 to 2035

Thank you!

You will receive an email from our Business Development Manager. Please be sure to check your SPAM/JUNK folder too.

Chat With

MaRIA