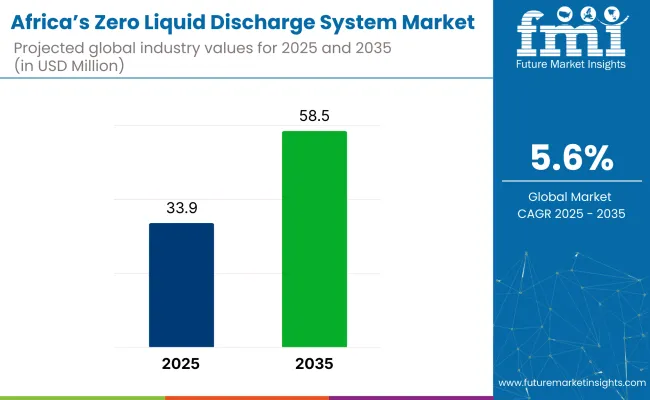

The Africa Zero Liquid Discharge (ZLD) System market is projected to grow from USD 33.9 million in 2025 to USD 58.5 million by 2035, at a CAGR of 5.6%. This steady growth is driven by increasing industrialization and stringent environmental regulations across the continent.

As industries such as mining, power generation, oil & gas, and chemicals expand, the demand for effective wastewater treatment solutions that minimize environmental impact intensifies. ZLD systems enable industries to recycle water and eliminate liquid waste discharge, addressing freshwater scarcity and pollution concerns in water-stressed African regions.

Rising government enforcement of water discharge norms and growing awareness about sustainable water management are significant factors propelling market adoption. Additionally, infrastructure investments in municipal wastewater treatment to combat urban water pollution add to market growth prospects.

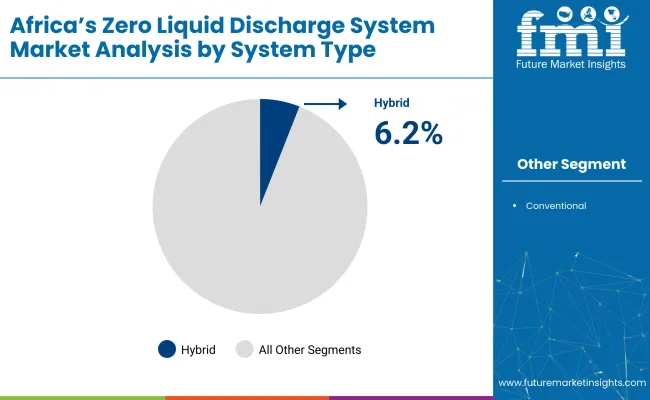

Technological advancements are enhancing the efficiency and cost-effectiveness of ZLD systems in Africa. Hybrid ZLD technologies, combining membrane filtration with evaporation and crystallization, dominate the market due to their improved performance and energy savings. Innovations such as zero liquid discharge with integrated recovery of valuable by-products and digital monitoring for process optimization are gaining traction.

urthermore, the market benefits from increasing collaborations between technology providers and local governments or industries to deploy scalable and sustainable solutions tailored to regional water challenges. The growing need to comply with global sustainability goals and reduce water footprint across industrial sectors drives ongoing research and development, pushing the market toward higher adoption rates.

Government policies and regulatory frameworks play a critical role in shaping Africa’s ZLD market landscape. Environmental agencies across major African countries, including Egypt, South Africa, Nigeria, and Kenya, have introduced stricter effluent discharge standards to reduce water pollution.

These regulations encourage industries to invest in advanced ZLD technologies to meet compliance requirements. Furthermore, financial incentives, subsidies, and support programs for sustainable water treatment solutions enhance market accessibility. International funding and partnerships also contribute to infrastructure development.

As environmental sustainability and water conservation become national priorities, leading ZLD system manufacturers are investing in product innovation and local partnerships to capture growth opportunities while aligning with Africa’s evolving regulatory environment.

The Africa zero liquid discharge system market is segmented by system type into conventional and hybrid systems; by application into power generation, oil & gas, chemicals & petrochemicals, mining & metallurgy, pharmaceuticals, food, textile & leather, paper, and others (including water utilities, electronics, municipal wastewater treatment, agriculture, and heavy manufacturing); by aircraft into commercial, regional, business, military aircraft, and helicopter. By sub-region into Northern Africa, East & West Africa, and Southern Africa.

| System Type Segment | CAGR (2025 to 2035) |

|---|---|

| Hybrid Systems | 6.2% |

Hybrid segment is expected to grow at a CAGR of 6.2% from 2025 to 2035, outpacing the overall market CAGR of 5.6%. The integrating membrane filtration with evaporation and crystallization techniques offer significant operational efficiencies and lower energy consumption. This superior growth is driven by increasing industrial demand for cost-effective, energy-efficient wastewater treatment solutions that comply with tightening environmental regulations.

Conventional ZLD systems, while essential for certain heavy industrial applications due to their simplicity and established technology base, are projected to grow more modestly, primarily constrained by higher operational costs and energy usage. Despite this, they maintain relevance in sectors with lower capital expenditure flexibility or less stringent regulatory pressure.

| Application Segment | CAGR (2025 to 2035) |

|---|---|

| Chemicals & Petrochemicals | 6.1% |

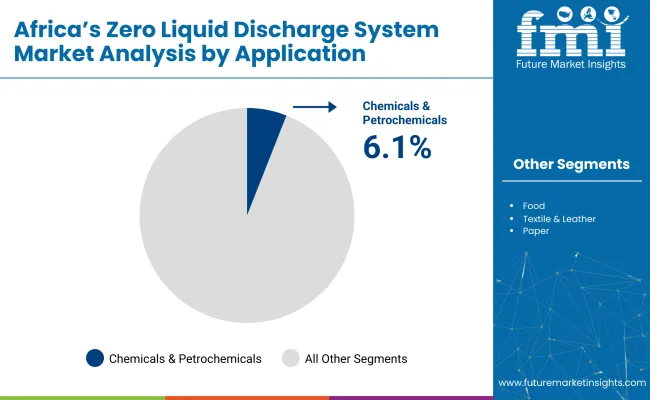

The chemicals & petrochemicals application segment is projected to be the most lucrative with expected CAGR of 6.1%, driven by its high demand for stringent wastewater management due to the complex and hazardous nature of its effluents.

This segment is reflecting its dominant role in industrial water reuse and discharge compliance. Largely driven by escalating environmental compliance requirements and the continuous expansion of petrochemical facilities in key African economies, which necessitate advanced wastewater treatment solutions to manage complex effluents efficiently.

Power generation and mining & metallurgy segments also represent significant contributors to market growth. The food, pharmaceuticals, and textile and leather industries demonstrate moderate adoption of ZLD solutions, driven by specific wastewater quality requirements and rising consumer safety standards. The Others category, including water utilities and municipal wastewater treatment, remains nascent but poised for future growth as urbanization accelerates.

| Aircraft Segment | CAGR (2025 to 2035) |

|---|---|

| Commercial Aircraft | 6.3% |

The commercial aircraft segment emerges as the most lucrative based on demand and operational scale to grow at a CAGR of 6.3% from 2025 to 2035. This segment’s growth is underpinned by increasing air travel across the continent, driven by expanding urban centers and improved airport infrastructure.

This accelerated growth reflects the segment’s heightened need for stringent environmental compliance and advanced wastewater treatment systems within ground support and maintenance operations, where managing effluents from cleaning, de-icing, and manufacturing processes is critical. Regional and Business aircraft segments, benefiting from increased regional connectivity and private aviation demand, respectively.

However, their growth is comparatively moderate due to smaller fleet sizes and limited infrastructure development. Military aircraft and helicopter segments constrained by budget cycles and slower procurement rates to maintain stable demand for specialized ZLD applications related to defense and emergency services.

Challenges

High Capital Outlay and Operating Cost

Zero Liquid Discharge (ZLD) technologies are not adopted by African nations to a large extent yet since primarily capital cost and operating cost are the issues. Technically efficient operation of waste water treatment plant, and maintenance cost, is earning an unacceptable amount of money for industries.

Lack of technocrat human resources as well as technology is also the issue for the widespread application of ZLD. Government subsidies, innovation that saves costs, and access to finances in an effort to facilitate support mechanisms must be improved so that the Zero Liquid Discharge technology can be implemented by local industries.

Opportunities

Increasing demand for Environment-Friendly Water Management Solution

Terrible water scarcity and strict environmental regulations in Africa are providing Gargantuan opportunity to the industry for Zero Liquid Discharge system. Industrialization and urbanization growth are turning the green water management system into a sharply urgent requirement. Power, chemical, and textile industries are introducing ZLD systems to avoid wastage of water and to meet environmental standards. Rising applications of energy-saving treatment technology and renewable energy fuel are boosting utilization of ZLD solutions in the nation.

South Africa has the largest African market for Zero Liquid Discharge (ZLD) technologies because of water scarcity, industrial wastewater treatment policy, and growing demand for sustainable water management. Pharmaceutical companies, power generation, and mines are implementing new ZLD technologies for going green and minimizing water loss. Growing government interest in circular water economy programs is also fueling the use of ZLD systems.

| Country | CAGR (2025 to 2035) |

|---|---|

| South Africa | 5.3% |

Egypt ZLD system market is increasing with increasing industrialization, desalination, and wastewater discharge rules. ZLD water reuse and recovery technology is being adopted by chemical, textile, and food industries in Egypt since it is confronted with Nile River water sustainability. Egypt is developing investment growth for industrial wastewater treatment facilities since Egypt is becoming a competitive market in adopting ZLD.

| Country | CAGR (2025 to 2035) |

|---|---|

| Egypt | 5.0% |

Nigeria ZLD market is gaining pace through speedy urbanization, industrial necessity for wastewater management, and increased water pollution adoption. Industry sub-segments of oil & gas, food & beverage, and chemical are making capital investments towards ZLD for reaching water savings objectives and implementing green regulations. Market growth for the long-term would be promoted through increasing industrial capacity additions along with government initiatives towards sustainability.

| Country | CAGR (2025 to 2035) |

|---|---|

| Nigeria | 5.2% |

Kenya's ZLD market is growing due to water scarcity constraints, eco-friendly wastewater treatment technologies, and government spending on industrial water recycling increasing. Textile, agricultural, and manufacturing industries are witnessing growing uptake of membrane-based ZLD technologies. With Kenya prioritizing green water management policies, it will definitely see steady market growth.

| Country | CAGR (2025 to 2035) |

|---|---|

| Kenya | 5.1% |

Morocco's ZLD system market is growing as companies need efficient wastewater treatment technology to meet environmental regulations. Government policies regarding water desalination and water recovery in industry are pushing the adoption of ZLD systems in power, mining, and chemical industries. Growing use of thermal and membrane ZLD technologies will propel the market.

| Country | CAGR (2025 to 2035) |

|---|---|

| Morocco | 5.1% |

Veolia Water Technologies (22-27%)

Veolia dominates the ZLD market in Africa with end-to-end water treatment solutions that integrate cutting-edge membrane filtration and thermal treatment technologies.

SUEZ Water Technologies & Solutions (18-22%)

SUEZ specializes in high-efficiency brine concentration systems, providing customized solutions for industrial wastewater reuse.

Aquatech International (12-16%)

Aquatech is a leader in modular ZLD systems, catering to industries such as power, chemicals, and textiles, focusing on sustainable water management.

Thermax Limited (10-14%)

Thermax offers cost-efficient, energy-optimized ZLD solutions for industrial wastewater treatment, emphasizing evaporative and crystallization technologies.

GEA Group (8-12%)

GEA Group provides innovative thermal separation solutions for water recovery, reducing liquid waste discharge in industrial processes.

Other Key Players (25-35% Combined)

Emerging companies and technology providers are driving market growth with advanced, energy-efficient ZLD solutions. Notable players include:

The overall market size for Africa’s zero liquid discharge system market was USD 33.9 million in 2025.

Africa’s zero liquid discharge system market is expected to reach USD 58.5 million in 2035.

Africa’s zero liquid discharge system market is expected to grow at a CAGR of 5.6% during the forecast period.

The demand for Africa’s zero liquid discharge system market will be driven by increasing industrial wastewater regulations, rising water scarcity concerns, advancements in membrane and thermal technologies, government initiatives for sustainable water management, and growing industrialization in key regions.

The top five countries driving the development of Africa’s zero liquid discharge system market are South Africa, Egypt, Nigeria, Kenya, and Morocco.

Full Research Suite comprises of:

Market outlook & trends analysis

Interviews & case studies

Strategic recommendations

Vendor profiles & capabilities analysis

5-year forecasts

8 regions and 60+ country-level data splits

Market segment data splits

12 months of continuous data updates

DELIVERED AS:

PDF EXCEL ONLINE

Zero-Waste Packaging Technologies Market Size and Share Forecast Outlook 2025 to 2035

Zero Emission Aircraft Market Size and Share Forecast Outlook 2025 to 2035

Zero-Waste Refill Packaging Market Analysis - Size, Share, and Forecast Outlook 2025 to 2035

Zero-Fishmeal Feed Market Analysis - Size and Share Forecast Outlook 2025 to 2035

Zero Friction Coatings Market Size and Share Forecast Outlook 2025 to 2035

Zero Trust Security Market Size and Share Forecast Outlook 2025 to 2035

Zero Emission Vehicle Market Growth - Trends & Forecast 2025 to 2035

Zero-Touch Provisioning (ZTP) Market - Growth & Demand 2025 to 2035

Zero Calorie Chips Market Outlook - Growth, Demand & Forecast 2025 to 2035

Zero Sugar Beverages Market Analysis by Product Type and Sales Channel Through 2035

Zero-Waste Packaging Market Report – Sustainable Growth & Trends 2023-2033

Zero Liquid Discharge System Market Size and Share Forecast Outlook 2025 to 2035

System-On-Package Market Size and Share Forecast Outlook 2025 to 2035

Systems Administration Management Tools Market Size and Share Forecast Outlook 2025 to 2035

Systemic Sclerosis Treatment Market - Trends & Forecast 2025 to 2035

System on Module Market Growth – Trends & Forecast 2025 to 2035

SLE Drugs Market Insights - Growth & Forecast 2025 to 2035

Systemic Mastocytosis Treatment Market

Systemic Infection Treatment Market

5G System Integration Market Insights - Demand & Growth Forecast 2025 to 2035

Thank you!

You will receive an email from our Business Development Manager. Please be sure to check your SPAM/JUNK folder too.

Chat With

MaRIA