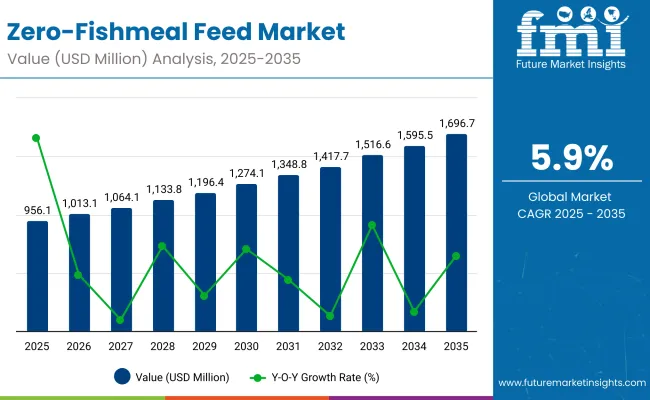

The Zero-Fishmeal Feed Market is expected to record a valuation of USD 956.1 million in 2025 and USD 1,696.7 million in 2035, with an increase of USD 740.6 million, which equals a growth of ~77% over the decade. The overall expansion represents a CAGR of 5.9% and a ~1.8X increase in market size.

Zero-Fishmeal Feed Market Key Takeaways

| Metric | Value |

|---|---|

| Market Estimated Value in (2025E) | USD 0.96 billion |

| Market Forecast Value in (2035F) | USD 1.70 billion |

| Forecast CAGR (2025 to 2035) | 5.9% |

During the first five-year period from 2025 to 2030, the market increases from USD 0.95 billion to 1.27 billion adding USD 0.32 billion, which accounts for ~42.9% of the total decade growth. This phase records steady adoption in aquaculture, poultry, and swine nutrition, driven by sustainability mandates and the need to de-risk supply chains from volatile fishmeal costs. Plant-based proteins dominate this period as they cater to over 35% of formulations requiring scalable, affordable, and eco-efficient inputs.

The second half from 2030 to 2035 contributes USD 0.42 billion, equal to ~57.1% of total growth, as the market jumps from USD 1.27 billion to USD 1.70 billion. This acceleration is powered by the wider deployment of single-cell proteins, insect-based meals, and algae-derived ingredients in aqua feeds and specialty livestock diets. Blended/functional formulations together capture a larger share above XX% by the end of the decade. Circular-economy sourcing and compliance add recurring revenue, increasing the specialty ingredient share beyond XX% in total value.

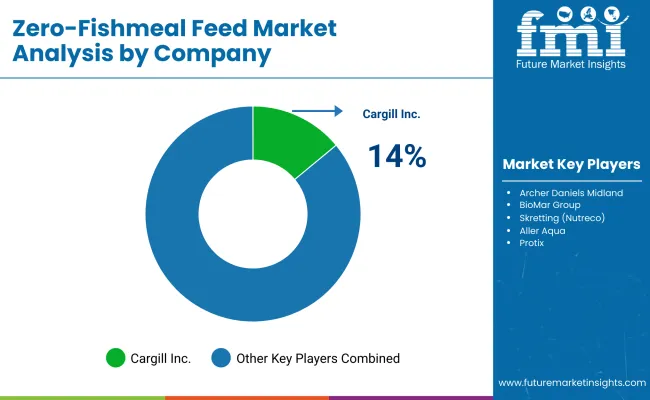

From 2020 to 2024, the Zero-Fishmeal Feed Market expanded from USD 716.4 million to USD 902.6 million, supported by the rapid adoption of plant-based proteins such as soy, pea, and corn gluten. During this period, the competitive environment was dominated by large feed manufacturers and integrators controlling nearly 70% of revenue, with leaders such as Cargill, ADM, and BioMar advancing scalable plant-based formulations for poultry and aquaculture feed. Competitive differentiation relied on cost efficiency, protein digestibility, and amino acid balancing, while premium additives such as enzymes and probiotics were often bundled as complementary features rather than standalone revenue drivers.

Demand for Zero-Fishmeal Feed is projected to reach USD 956.1 million in 2025, and the revenue mix will shift as microbial, insect-based, and algae-derived proteins expand their share beyond 25%. Traditional plant-protein leaders face rising competition from specialty players leveraging fermentation, insect bioconversion, and algae cultivation platforms. Major incumbents are pivoting toward hybrid formulations that integrate multiple protein sources with additive fortification to maintain performance standards and meet sustainability mandates. New entrants specializing in precision fermentation, single-cell proteins, and circular-economy models are gaining visibility. The competitive advantage is moving away from reliance on commodity proteins alone toward ecosystem strength, sustainability compliance, and recurring value through functional and fortified feed solutions.

Advances in alternative protein technologies have expanded ingredient availability and improved feed efficiency, allowing more sustainable replacement of fishmeal in diverse applications. Plant-based proteins such as soy, pea, and corn gluten have gained widespread use due to their scalability, affordability, and ability to deliver balanced amino acid profiles. The rise of single-cell proteins and insect meals has contributed to enhanced digestibility, gut health benefits, and resilience against raw material volatility. Aquaculture and poultry nutrition are driving demand for zero-fishmeal feed solutions that can integrate seamlessly into existing production systems without compromising performance.

Expansion of functional formulations including enzyme fortification, probiotics, and omega-3 enrichment has further fueled market growth by enabling higher feed conversion efficiency and improved animal welfare outcomes. Innovations in algae-based proteins and fermentation-derived ingredients are expected to unlock new high-value applications. Segment growth is anticipated to be led by plant-based proteins in the near term, while insect- and microbial-derived proteins accelerate adoption later in the forecast due to their precision, adaptability, and strong sustainability credentials.

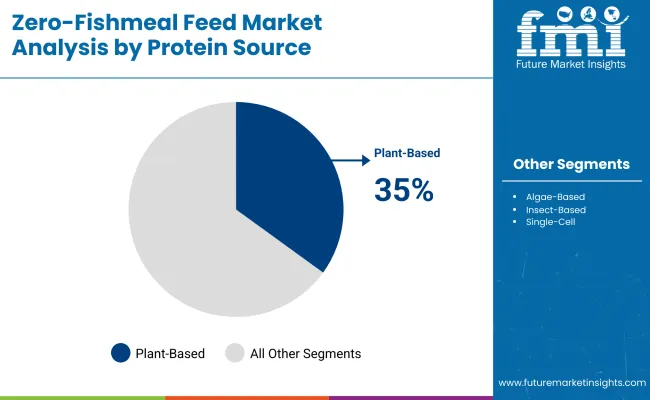

The market is segmented by protein source, livestock/aquaculture species, functionality, form, additive integration, sales channel, and region. Protein sources include plant-based proteins such as soy, pea, corn gluten, wheat gluten, canola meal, and lupin meal, as well as algae-based proteins, insect-based proteins, single-cell proteins, fermentation-derived proteins, and blended protein systems. Live stock and aquaculture species segmentation spans poultry feed, swine feed, ruminant feed, and aquaculture, which includes shrimp, tilapia, salmonids, carp, and catfish.

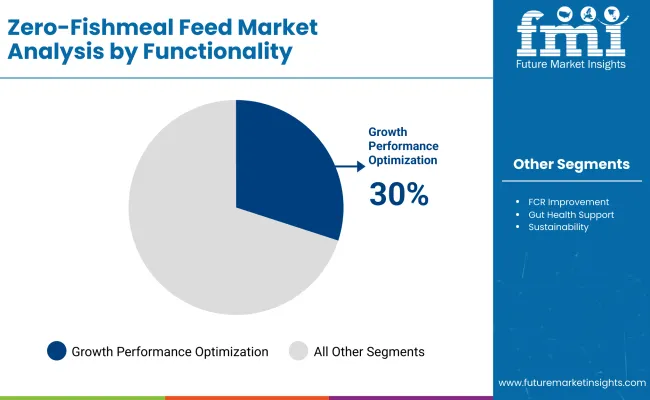

Based on functionality, the market is classified into growth performance optimization, feed conversion ratio (FCR) improvement, gut health support, and sustainability-driven environmental impact reduction. By form, zero-fishmeal feed is offered as mash, pellets, crumbles, and extruded feed to match varying farm and hatchery requirements. Additive integration covers enzyme-fortified feed, probiotic and prebiotic fortified blends, omega-3 enriched formulations, and vitamin and mineral fortification.

Sales channels include direct distribution to farmers and integrators, through large feed manufacturers, and via regional distributors and agents. Regionally, the market scope spans North America, Europe, Asia-Pacific, Latin America, and the Middle East & Africa, with Asia-Pacific emerging as the fastest-growing hub due to strong aquaculture expansion and sustainability mandates.

| Protein Source | Share (%) |

|---|---|

| Plant-based Proteins | 35% |

| Algae-based Proteins | 25% |

| Insect-based Proteins | 15% |

| Single-cell Proteins | 10% |

| Fermentation-derived Proteins | 10% |

| Blended Protein Sources | 5% |

Plant-based proteins are projected to account for the dominant share of 35% in the Zero-Fishmeal Feed Market in 2025, driven by the large-scale use of soy protein concentrate, pea protein, and corn gluten meal in aquaculture and poultry diets. These ingredients offer balanced amino acid profiles, lower costs, and proven scalability across diverse geographies. Momentum is also being recorded in insect-based proteins, particularly black soldier fly larvae meal, which is increasingly recognized for its digestibility and sustainable lifecycle.

Algae-derived proteins are gaining traction for their omega-3 enrichment capacity, while single-cell and fermentation-derived proteins enhance gut health and reduce environmental impacts. Blended protein systems are expected to rise as integrators combine plant, insect, and microbial inputs to optimize feed performance. The dominance of plant-based proteins is forecasted to continue, though their relative share will narrow as novel sources gain adoption.

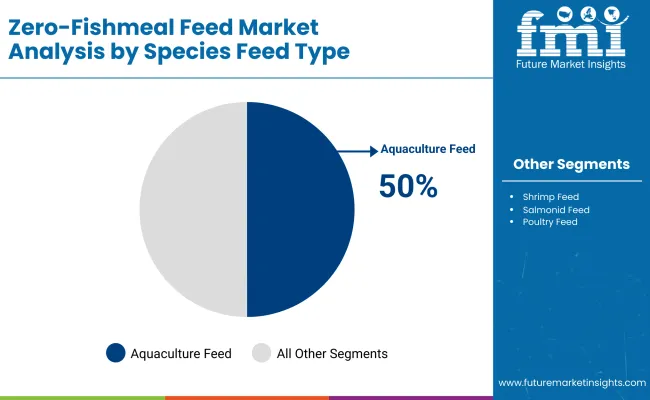

| Species Feed Type | Share (%) |

|---|---|

| Aquaculture Feed | 50% |

| Shrimp Feed | 20% |

| Salmonid Feed | 10% |

| Poultry Feed | 10% |

| Swine Feed | 5% |

| Ruminant Feed | 3% |

| Carp / Tilapia / Others | 2% |

The aquaculture feed segment is forecasted to hold 50% of the market share in 2025, driven by widespread adoption in shrimp, tilapia, and salmonid farming. Certifications promoting sustainable seafood have accelerated the integration of plant, insect, and microbial proteins into aquafeeds. Poultry feed is emerging as the second-largest user segment, where amino acid balancing and enzyme fortification allow plant-based formulations to substitute marine proteins effectively.

Swine feed adoption is growing steadily, driven by cost optimization and the need to maintain growth performance under sustainability mandates. Ruminant feed represents a smaller but steadily expanding share, particularly in regions promoting methane reduction strategies. Aquaculture is expected to remain the anchor species segment, but poultry and swine are projected to record higher growth rates, diversifying the demand base over the next decade.

| Functionality | Share (%) |

|---|---|

| Growth Performance Optimization | 30% |

| FCR Improvement | 25% |

| Gut Health Support | 20% |

| Sustainability / Environmental Impact | 25% |

The growth performance optimization segment is forecasted to hold 30% of the market share in 2025, anchored by poultry and aquaculture feed where balanced amino acid profiles and protein digestibility directly influence weight gain and output efficiency. Integrators are prioritizing plant-based and blended protein systems that ensure consistent performance across varied climatic and production conditions. Feed conversion ratio (FCR) improvement is estimated to follow closely, supported by enzyme fortification and microbial blends that reduce waste while enhancing nutrient absorption.

Gut health support is expected to rise as probiotics and prebiotics are increasingly included in insect- and microbial-based formulations. Sustainability and environmental impact reduction are becoming essential in aquaculture, where certification mandates require low-carbon, fishmeal-free solutions. Growth performance optimization will remain dominant, though its share is expected to gradually narrow as FCR efficiency gains and sustainability drivers accelerate adoption of novel proteins.

Precision Nutrition through Alternative Proteins

A major growth driver is the transition toward precision nutrition, where zero-fishmeal formulations are engineered to deliver targeted amino acid and micronutrient profiles for different livestock and aquaculture species. Unlike traditional fishmeal, which has inherent variability in nutrient density and digestibility, plant-, insect-, and microbial-based proteins allow for standardized nutrient matrices.

Feed formulators are leveraging advanced enzyme fortification and probiotic integration to improve digestibility, reduce nitrogen waste, and enhance feed conversion ratios (FCR). This capability not only ensures consistent animal performance but also aligns with sustainability mandates from regulators and certification bodies. Precision-based formulation is expected to strengthen market adoption as producers seek predictable outcomes in high-value aquaculture and poultry systems.

Integration of Circular-Economy Sourcing Models

A significant trend reshaping the zero-fishmeal feed market is the integration of circular-economy models, where protein ingredients are sourced from waste streams such as agricultural residues, brewery by-products, and food waste bioconversion. Insect-based proteins like black soldier fly larvae and microbial proteins from fermentation side-streams are gaining traction for their dual benefits of nutrient density and waste valorization.

This shift not only reduces dependence on conventional raw materials but also contributes to carbon footprint reduction, supporting the environmental goals of both governments and multinational feed producers. As sustainability-linked financing grows, adoption of circular-economy inputs is projected to move from niche to mainstream, creating recurring value streams.

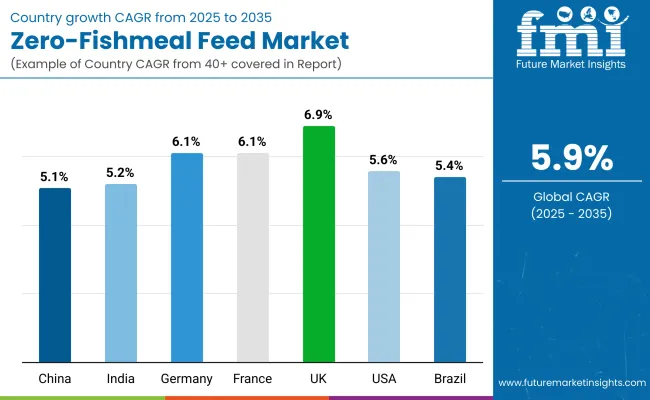

| Countries | CAGR |

|---|---|

| China | 5.16% |

| India | 5.20% |

| Germany | 6.19% |

| France | 6.13% |

| UK | 6.97% |

| USA | 5.61% |

| Brazil | 5.41% |

The Zero-Fishmeal Feed Market demonstrates varied regional growth patterns, shaped by aquaculture reliance, livestock modernization, and regulatory momentum.

Asia-Pacific emerges as a key growth hub, anchored by China at 5.16% CAGR and India at 5.20% CAGR. In China, policy-backed sustainability programs and intensified aquaculture production, especially shrimp and tilapia, are accelerating adoption of plant- and microbial-based proteins. India reflects rising demand from poultry and aquaculture sectors, where hybrid blends of plant, insect, and fermentation-derived proteins are gaining traction to support both cost competitiveness and export-led growth.

Europe maintains robust momentum, with Germany at 6.19% CAGR, France at 6.13% CAGR, and the UK leading at 6.97% CAGR. Strong regulatory frameworks on sustainability, protein diversification mandates, and significant investment in insect protein facilities underpin growth in these markets. Europe is increasingly seen as a leader in high-value, certified aquafeeds, shifting value creation toward functional blends and fortified formulations. North America shows moderate yet steady expansion, with the USA at 5.61% CAGR.

Growth is being shaped by poultry and swine feed industries, where traceability, certification, and fortified formulations are emerging as differentiators. Latin America is also progressing, led by Brazil at 5.41% CAGR, where aquaculture feed demand, particularly for tilapia and shrimp, is driving zero-fishmeal adoption. The region is expected to strengthen its role as a cost-competitive supplier of alternative protein feeds across global export chains.

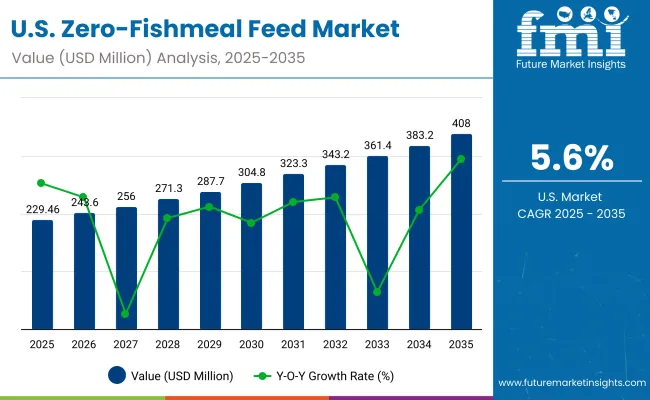

| Year | USA Zero-Fishmeal Feed Market (USD Million) |

|---|---|

| 2025 | 229.46 |

| 2026 | 243.6 |

| 2027 | 256.0 |

| 2028 | 271.3 |

| 2029 | 287.7 |

| 2030 | 304.8 |

| 2031 | 323.3 |

| 2032 | 343.2 |

| 2033 | 361.4 |

| 2034 | 383.2 |

| 2035 | 408.0 |

The Zero-Fishmeal Feed Market in the United States is projected to grow at a CAGR of 6.0% (2025-2035), supported by strong momentum in poultry and aquaculture feed. Poultry producers are increasingly adopting soy- and pea-based protein blends, while the aquaculture sector is exploring insect meals and fermentation-derived proteins to reduce dependence on marine ingredients.

Value-added feed fortified with probiotics, enzymes, and vitamins is gaining relevance as producers target better gut health and feed conversion. Growing consumer demand for sustainably sourced animal protein is also encouraging integrators to prioritize zero-fishmeal formulations with verified traceability.

The Zero-Fishmeal Feed Market in the United Kingdom is projected to expand at a CAGR of 6.97% (2025-2035), supported by sustainability mandates, aquaculture innovation, and rising demand for traceable protein sources. The aquaculture sector, particularly salmon and trout farming, is accelerating the adoption of insect-based proteins and algae-derived ingredients to meet net-zero commitments.

Poultry producers are increasingly incorporating blended plant proteins such as soy, pea, and wheat gluten to reduce reliance on imported fishmeal. Retail and foodservice channels are encouraging sustainability certifications, pushing integrators to innovate in feed formulations. Academic research collaborations and government-backed funding for circular economy projects are reinforcing the transition toward low-carbon, zero-fishmeal protein ecosystems.

The Zero-Fishmeal Feed Market in India is forecast to grow at a CAGR of 5.20% between 2025 and 2035, supported by rising aquaculture output and government-backed initiatives to reduce marine resource dependency. Shrimp farming, India’s largest aquaculture export sector, is increasingly incorporating soy protein concentrate, corn gluten meal, and pea protein in feed formulations.

Feed manufacturers are piloting microbial and insect-based protein inclusion to enhance digestibility and improve feed conversion ratios (FCR). Poultry and carp feed segments are adopting blended formulations fortified with probiotics, reflecting both cost efficiency and nutritional improvement. Public-private research collaborations and state-led blue economy programs are reinforcing demand for scalable, traceable zero-fishmeal protein sources.

The Zero-Fishmeal Feed Market in China is expected to grow at a CAGR of 5.16% from 2025 to 2035, supported by large-scale aquaculture production and rising demand for sustainable seafood exports. Shrimp, tilapia, and carp farming are driving strong adoption of plant-based proteins such as soy protein concentrate and wheat gluten, which are being fortified with enzymes for improved digestibility.

Insect-based proteins, particularly black soldier fly larvae meal, are gaining momentum with government-backed pilot projects and private investment. Algae- and microbial-derived proteins are also being introduced, aligning with national sustainability and carbon-reduction targets. Domestic feed producers are leveraging hybrid formulations to maintain nutritional performance while reducing marine dependency.

| Countries / Sub-regions | 2025 |

|---|---|

| UK | 19.02% |

| Germany | 20.08% |

| Italy | 11.06% |

| France | 13.60% |

| Spain | 11.79% |

| BENELUX | 6.87% |

| Nordic | 5.25% |

| Rest of Europe | 12% |

| Countries / Sub-regions | 2035 |

|---|---|

| UK | 20.06% |

| Germany | 20.77% |

| Italy | 10.00% |

| France | 13.69% |

| Spain | 10.30% |

| BENELUX | 5.50% |

| Nordic | 5.74% |

| Rest of Europe | 14% |

The Zero-Fishmeal Feed Market in Germany is projected to grow at a CAGR of 6.19% between 2025 and 2035, supported by the country’s leadership in sustainable livestock production and aquaculture innovation. Poultry and swine feed producers are increasingly adopting soy protein concentrate, pea protein, and lupin meal as scalable alternatives to marine proteins. Significant investment in insect farming, particularly black soldier fly larvae, is accelerating integration into feed formulations. Algae-based ingredients are also being trialed for omega-3 enrichment, addressing consumer demand for healthier, sustainable protein sources. Compliance with stringent EU sustainability directives and growing demand for certified, low-carbon food systems are reinforcing Germany’s position as a frontrunner in zero-fishmeal adoption.

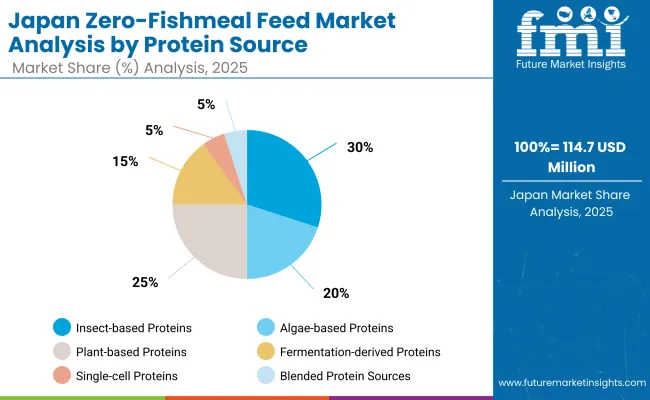

| Protein Source | Share (%) |

|---|---|

| Insect-based Proteins | 30% |

| Algae-based Proteins | 20% |

| Plant-based Proteins | 25% |

| Fermentation-derived Proteins | 15% |

| Single-cell Proteins | 5% |

| Blended Protein Sources | 5% |

The Zero-Fishmeal Feed Market in Japan is projected at USD 114.7 million in 2025, expanding at a CAGR of 8.58% through 2035. Insect-based proteins contribute the highest share at 30%, while plant-based proteins follow at 25%, reflecting the balance between novel and traditional protein alternatives. This dominance of insect-based ingredients stems from their superior feed conversion ratios, amino acid profiles, and alignment with Japan’s aquaculture innovation. Plant-based proteins remain critical due to cost efficiency and wide availability, though growth is more modest compared to newer categories. Algae-based proteins (20%) and fermentation-derived proteins (15%) are increasingly favored for functional performance and sustainability credentials. As Japanese feed manufacturers emphasize environmental compliance and resource circularity, hybrid formulations blending insects, algae, and microbial proteins are projected to define the competitive landscape.

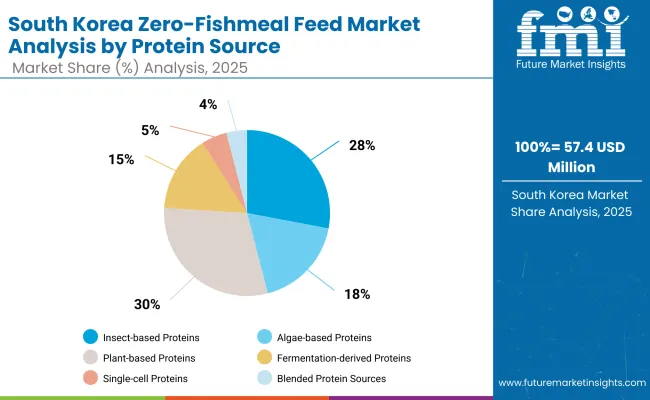

| Protein Source | Share (%) |

|---|---|

| Insect-based Proteins | 28% |

| Algae-based Proteins | 18% |

| Plant-based Proteins | 30% |

| Fermentation-derived Proteins | 15% |

| Single-cell Proteins | 5% |

| Blended Protein Sources | 4% |

The Zero-Fishmeal Feed Market in South Korea is valued at USD 57.4 million in 2025, reflecting the nation’s strong aquaculture and poultry feed sectors. Plant-based proteins lead with a 30% share, while insect-based proteins account for 28%, driven by growing acceptance of black soldier fly meal. Fermentation-derived and algae-based proteins are gaining traction, supported by the country’s biotechnology and marine resources. South Korea’s feed industry is expected to pivot toward hybrid formulations, integrating microbial and functional protein sources to meet sustainability goals and enhance feed conversion efficiency.

The Zero-Fishmeal Feed Market is moderately fragmented, with global leaders, mid-sized innovators, and specialized startups competing across protein source categories. Global feed giants such as Cargill, ADM, and Skretting command significant market share, leveraging scale, established supply chains, and investment in alternative protein R&D. Their strategies increasingly emphasize hybrid formulations combining plant-based proteins with novel inputs such as algae, insect meal, and single-cell proteins, alongside traceability and certification programs to meet sustainability standards.

Established mid-sized players, including BioMar, Aller Aqua, and Corbion, focus on targeted aquaculture and specialty livestock markets, accelerating adoption of insect-based and fermentation-derived proteins. These firms are aligning closely with regulatory frameworks and offering sustainability-driven differentiation.

Specialized providers such as Ÿnsect, Protix, and Calysta are pioneering insect bioconversion and single-cell protein production, often operating with strong regional adaptability and technology-intensive platforms. Their strength lies in innovation, vertical integration, and partnerships with aquafeed manufacturers.

Competitive differentiation is shifting away from commodity proteins toward ecosystem strength, sustainability compliance, and recurring value creation through fortified, functional formulations tailored to feed conversion efficiency and environmental goals.

Key Developments in Zero-Fishmeal Feed Market

| Item | Value |

|---|---|

| Quantitative Units | USD 0.9561 billion |

| Protein Source | Plant-based Proteins (Soy, Pea, Corn Gluten, Wheat Gluten, Canola, Lupin), Insect-based Proteins (Black Soldier Fly, Mealworm), Algae-based Proteins (Microalgae, Macroalgae), Fermentation-derived Proteins, Single-cell Proteins (Bacterial, Yeast, Fungal), Blended Protein Sources |

| Livestock / Aquaculture Species | Poultry Feed, Swine Feed, Ruminant Feed, Aquaculture Feed (Shrimp, Tilapia, Salmonid, Carp, Catfish) |

| Functionality | Growth Performance Optimization, Feed Conversion Ratio (FCR) Improvement, Gut Health Support, Sustainability & Environmental Impact Reduction |

| Form | Mash, Pellets, Crumbles, Extruded Feed |

| Additive Integration | Enzyme-fortified, Probiotic/Prebiotic-fortified, Omega-3 Enriched, Vitamin & Mineral Fortified |

| Regions Covered | North America, Europe, Asia-Pacific, Latin America, Middle East & Africa |

| Country Covered | United States, Canada, Germany, France, United Kingdom, China, Japan, India, Brazil, South Korea |

| Key Companies Profiled | Cargill Inc., Archer Daniels Midland (ADM), BioMar Group, Skretting (Nutreco ), Aller Aqua, Ÿnsect, Protix, Innovafeed, Calysta, Corbion, Novozymes, Benson Hill, Enterra Feed, and Others |

| Additional Attributes | Dollar sales by protein source and livestock species, adoption trends in aquaculture vs. poultry feed, scaling of insect bioconversion and fermentation-derived proteins, certification and traceability impacts, sustainability-driven procurement policies, regional dynamics in Asia-Pacific and Europe, innovations in algae cultivation, fermentation platforms, and blended protein formulations |

The global Zero-Fishmeal Feed Market is estimated to be valued at USD 0.96 billion in 2025.

The market size for the Zero-Fishmeal Feed Market is projected to reach USD 1.70 billion by 2035.

The Zero-Fishmeal Feed Market is expected to grow at a CAGR of 5.9% between 2025 and 2035.

The key protein types in the Zero-Fishmeal Feed Market include plant-based proteins (soy, pea, corn gluten, wheat gluten, canola, lupin), insect-based proteins (black soldier fly larvae, mealworm), algae-based proteins, fermentation-derived proteins, single-cell proteins (bacterial, yeast, fungal), and blended protein sources.

In terms of protein source, plant-based proteins are expected to command the largest share at 35% in 2025, followed closely by insect-based proteins.

Full Research Suite comprises of:

Market outlook & trends analysis

Interviews & case studies

Strategic recommendations

Vendor profiles & capabilities analysis

5-year forecasts

8 regions and 60+ country-level data splits

Market segment data splits

12 months of continuous data updates

DELIVERED AS:

PDF EXCEL ONLINE

Feed Machine Market Forecast Outlook 2025 to 2035

Feed Pigment Market Forecast and Outlook 2025 to 2035

Feed Mixer Market Forecast and Outlook 2025 to 2035

Feed Grade Spray-dried Animal Plasma (SDAP) Market Size and Share Forecast Outlook 2025 to 2035

Feed Electrolytes Market Size and Share Forecast Outlook 2025 to 2035

Feed Micronutrients Market Size and Share Forecast Outlook 2025 to 2035

Feed Acidifier Market Analysis Size Share and Forecast Outlook 2025 to 2035

Feed Flavors Market Size and Share Forecast Outlook 2025 to 2035

Feed Enzymes Market Analysis - Size, Share, and Forecast Outlook 2025 to 2035

Feed Mycotoxin Binders Market Size and Share Forecast Outlook 2025 to 2035

Feed Phytogenics Market Size and Share Forecast Outlook 2025 to 2035

Feed Carbohydrase Market Size and Share Forecast Outlook 2025 to 2035

Feed Grade Oils Market Analysis - Size, Share, and Forecast Outlook 2025 to 2035

Feed Packaging Market Size, Share & Forecast 2025 to 2035

Feed Mycotoxin Detoxifiers Market Analysis - Size, Share, and Forecast Outlook 2025 to 2035

Feed Premix Market Analysis - Size, Share, & Forecast Outlook 2025 to 2035

Feed Phytogenic Market Analysis - Size, Share, & Forecast Outlook 2025 to 2035

Feed Attractants Market Analysis by Composition, Functionality, Livestock, Packaging Type and Sales Channel Through 2035

Feed Encapsulation Market Analysis- Size, Growth, and Forecast 2025 to 2035

Feed Grain Market Analysis - Size, Share, and Forecast Outlook 2025 to 2035

Thank you!

You will receive an email from our Business Development Manager. Please be sure to check your SPAM/JUNK folder too.

Chat With

MaRIA