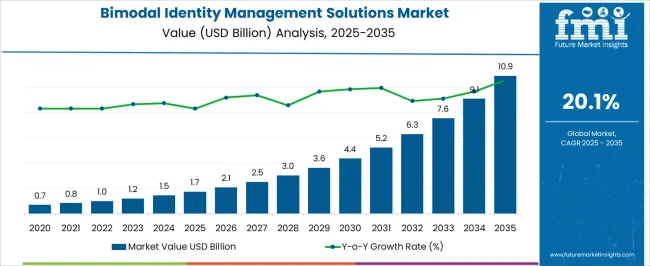

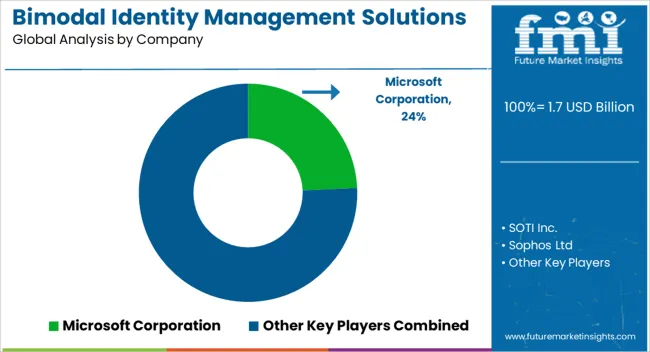

The Bimodal Identity Management Solutions Market is estimated to be valued at USD 1.7 billion in 2025 and is projected to reach USD 10.9 billion by 2035, registering a compound annual growth rate (CAGR) of 20.1% over the forecast period.

| Metric | Value |

|---|---|

| Bimodal Identity Management Solutions Market Estimated Value in (2025 E) | USD 1.7 billion |

| Bimodal Identity Management Solutions Market Forecast Value in (2035 F) | USD 10.9 billion |

| Forecast CAGR (2025 to 2035) | 20.1% |

The Bimodal Identity Management Solutions market is experiencing accelerated growth as organizations increasingly seek agile and scalable identity frameworks that support both legacy systems and modern cloud-native applications. The current environment is shaped by heightened concerns around data security, regulatory compliance, and seamless access control across hybrid environments.

The shift towards digital transformation has amplified demand for solutions that provide both traditional identity governance and adaptive access management capabilities. The growing adoption of remote work models, cloud infrastructures, and interconnected systems is creating opportunities for identity solutions that balance centralized control with flexible access.

As enterprises and educational institutions modernize their IT landscapes, investments in automated identity provisioning, risk-based authentication, and decentralized identity frameworks are rising Over the next several years, continued emphasis on regulatory compliance, zero trust architectures, and hybrid deployment models will further propel market growth, encouraging adoption across sectors that require secure, scalable, and future-ready identity management.

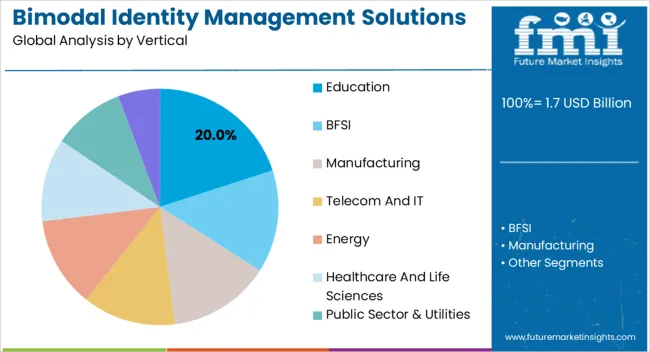

The education vertical is expected to account for 20.00% of the total revenue share in the Bimodal Identity Management Solutions market in 2025, positioning it as one of the key sectors driving growth. The segment’s prominence is attributed to the rising need for secure, cloud-enabled access across educational institutions, which are managing a growing population of students, faculty, and administrative staff.

With increasing reliance on online learning platforms and remote collaboration tools, educational organizations are being compelled to adopt identity solutions that safeguard sensitive data while enabling frictionless access. The growth of this segment has been supported by government mandates on data protection and accreditation standards requiring robust identity frameworks.

As campuses transition towards hybrid learning models, demand for scalable identity management solutions that support both legacy infrastructure and new-age digital platforms has surged The need to manage access for diverse user groups, combined with the pressure to ensure compliance and secure personal information, is expected to sustain this segment’s leadership in the market.

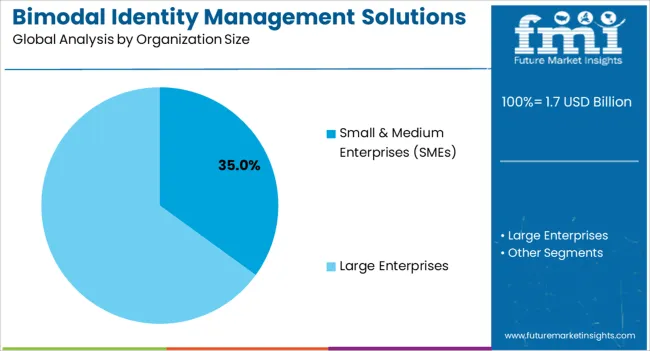

The Small and Medium Enterprises segment is projected to represent 35.00% of the overall revenue share in the Bimodal Identity Management Solutions market in 2025, marking it as the largest organizational category driving adoption. This prominence is being driven by the accelerated digital transformation efforts among SMEs, which are increasingly investing in scalable and cost-effective identity solutions to support hybrid and remote workforces.

The segment’s growth is supported by the rising frequency of cyber threats targeting smaller organizations that often lack advanced security infrastructures. SMEs are seeking identity frameworks that are simple to deploy, require minimal overhead, and can integrate with existing tools while providing enhanced access controls.

Additionally, the growing shift towards cloud computing has allowed smaller organizations to adopt advanced identity solutions without significant upfront investments in hardware or dedicated IT staff With regulatory requirements tightening across regions and the growing importance of secure access in customer-facing and operational environments, SMEs are expected to continue being significant contributors to the market’s expansion.

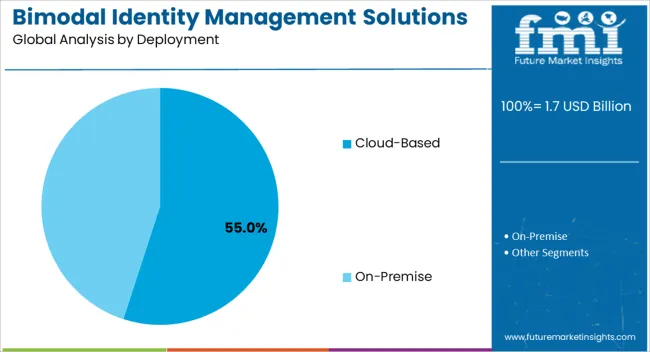

The cloud-based deployment segment is estimated to hold 55.00% of the total revenue share in the Bimodal Identity Management Solutions market in 2025, emerging as the dominant deployment model. This growth is being supported by the widespread shift to cloud infrastructures, which offer enhanced scalability, flexibility, and ease of management compared to on-premise solutions.

Organizations are increasingly opting for cloud-based identity solutions to enable secure access across dispersed networks and mobile workforces while reducing the complexity of traditional identity management systems. The ability to provision identities in real-time, integrate with third-party services, and apply adaptive security policies remotely has made cloud-based deployments highly attractive.

Furthermore, cloud-based solutions are allowing organizations to streamline compliance with data protection regulations by centralizing identity controls and improving auditability As hybrid environments become the norm and organizations seek cost-efficient solutions with faster implementation cycles, cloud-based deployments are expected to continue dominating the market, with further innovations enhancing automation, user experience, and threat mitigation.

The global demand for bimodal identity management solutions is projected to increase at a CAGR of 21.2% during the forecast period between 2025 and 2035, reaching a total of USD 10.9 million in 2035, according to a report from Future Market Insights (FMI). From 2020 to 2025, sales witnessed significant growth, registering a CAGR of 19.1%.

The increasing need for authentication and the rise in security concerns in organizations are the key factors driving the growth of bimodal identity management solutions. There is a growing demand for bimodal identity management solutions for purposes such as data security, confidential data protection, and proper authentication.

The advancement of technology has increased the likelihood of data being hacked and poses a threat to security systems, fueling demand for bimodal identity management solutions. Additionally, the market is witnessing a key trend that leads to the development of security products like the integration of identity management systems with artificial intelligence.

Increasing Demand for Proper Authentication to Boost Market Growth

The necessity for proper authentication checks, as well as increased security concerns within an organization, drives the demand for bimodal identity management solutions.

Also, keeping data safe and secure is becoming a crucial concern in organizations these days, so ensuring secrecy and proper data management is driving the demand for bimodal identity management solutions.

Advanced identity management systems integrated with artificial intelligence are key trends that are catering to the expansion of new security-related products these days. Other factors that contribute to the bimodal identity management product expansion include data security and access to information by the appropriate candidate.

In addition, the emerging utility of the bimodal identity management solution in professional and personal life is driving market growth.

People are becoming aware of advanced ways to hack security systems as technological trends change, so the increasing safety issue of high-profile data is a key driver for market growth. Furthermore, the increasing reliance on web applications and automated systems increases the possibility of cyber-attacks, so the need for an effective solution to evade such attacks is growing notably.

Scarcity of Experienced Workers to Impede Market Growth

The main challenge that organizations face in correctly deploying bimodal identity management solutions is a dearth of domain expertise in their workforce. Furthermore, data privacy concerns may limit the market's growth to some extent during the projected timeline.

The healthcare and life sciences sector holds a significant share of 18.2% in the bimodal identity management solutions market. As organizations within this sector deal with sensitive patient data and adhere to strict regulatory requirements, ensuring secure and compliant access to healthcare systems and applications is crucial.

Bimodal identity management solutions offer healthcare and life science organizations the ability to effectively manage and protect user identities, control access to patient records and confidential information, and monitor user activity for compliance purposes.

Further, these solutions enable healthcare providers, pharmaceutical companies, research institutions, and other healthcare-related organizations to enhance data security, streamline user access management processes, and improve overall operational efficiency.

The Cloud Segment to Remain High in Demand

On-premise refers to software and data that are installed and runs directly from the source media. In other words, the software and data are kept on the server where they were originally installed.

Further, the advantage of on-premise deployment is that all updates about changes in system files are done manually by an administrator or build automation tool, making it easy to manage because no third-party involvement is required.

Cloud computing and its application in BIM solutions is a new emerging trend in the industry. The primary goal of implementing cloud technology is to remotely store data, allowing users to access it via various devices such as laptops, smartphones, and tablets.

Cloud computing provides several advantages, including scalability, cost-effectiveness, and flexibility, which are expected to drive the market during the forecast period. Thus, by deployment type, the cloud segment is expected to hold a 55% market share for the bimodal identity management solutions market in the forecast period from 2025 to 2035.

Large Enterprises to Hold 65.5% Stake in the Global Market

Large organizations face unique challenges in managing user identities, access privileges, and security across multiple systems and applications with their extensive workforce and complex IT environments. Additionally, Bimodal identity management solutions provide these enterprises with comprehensive identity and access management capabilities, including user provisioning, single sign-on, multi-factor authentication, and privileged access management.

By implementing bimodal identity management solutions, large enterprises can streamline user access processes, enhance security measures, and improve overall operational efficiency. These solutions enable organizations to centrally manage user identities, ensure compliance with regulatory requirements, and mitigate the risks associated with unauthorized access and data breaches.

Increasing Reliance on Computerized Systems Creating Opportunities for Bimodal Identity Management Solutions Manufacturers

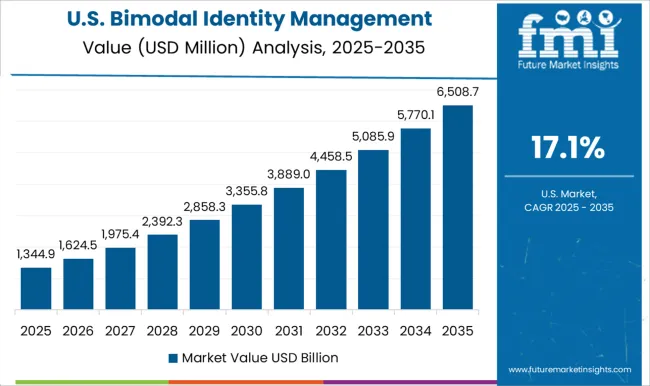

North America is expected to have a significant market share in the bimodal identity management solutions market. Because of the increasing reliance on computerized systems in countries such as Canada and the USA, the market for ensuring individual data accessibility is expected to drive market growth in the nations of North America.

North America is expected to possess a 27.5% market share in 2025, registering a CAGR of 20% for the bimodal identity management solutions market in the assessment period from 2025 to 2035 due to the aforementioned factors.

Increasing Number of Small and Medium-Sized Businesses Fueling Rapid Adoption

The bimodal identity solution market is expected to expand at a notable rate in the coming years, with an increasing number of small and medium-sized businesses in Asia Pacific countries such as India and China.

In the Asia Pacific region, developing countries such as China and India have a growing number of small and medium-sized businesses, which is contributing to the growth of the bimodal identity management solutions market. Hence, Asia Pacific is expected to procure a 17% market share in 2025, recording a CAGR of 18% for the bimodal identity management solutions market in the assessment period between 2025 and 2035.

The key vendors for the bimodal identity management solutions market are SOTI Inc., Sophos Ltd, Hitachi ID Systems, SailPoint Technologies, Ping Identity, IBM Corporation, Colligo Networks, CA Technologies, SAP, VMware, Inc., Microsoft Corporation, Good Technology, Fischer International OneLogin, Inc., MobileIron, Okta, Inc., NetIQ Corporation, Symantec Corporation, Oracle Corporation, Dell EMC, Alfresco Software, Centrify, and Citrix Systems, Inc.

Recent Developments in the Bimodal Identity Management Solutions Market

| Attribute | Details |

|---|---|

| Growth Rate | CAGR of 21.2% from 2025 to 2035 |

| Base Year of Estimation | 2025 |

| Historical Data | 2020 to 2025 |

| Forecast Period | 2025 to 2035 |

| Quantitative Units | Revenue in USD million and Volume in Units and F-CAGR from 2025 to 2035 |

| Report Coverage | Revenue Forecast, Volume Forecast, Company Ranking, Competitive Landscape, growth factors, Trends, and Pricing Analysis |

| Key Segments Covered | Vertical, Deployment, Organization Size, Region |

| Regions Covered | North America; Latin America; Europe; East Asia; South Asia; The Middle East & Africa; Oceania |

| Key Countries Profiled | The United States, Canada, Brazil, Mexico, Germany, Italy, France, The United Kingdom, Spain, Russia, China, Japan, India, GCC Countries, Australia |

| Key Companies Profiled | SOTI Inc.; Sophos Ltd; Hitachi ID Systems; SailPoint Technologies; Ping Identity; IBM Corporation; Colligo Networks; CA Technologies; SAP; VMware, Inc.; Microsoft Corporation; Good Technology; Fischer International; OneLogin, Inc.; MobileIron; Okta Inc.; NetIQ Corporation; Symantec Corporation; Oracle Corporation; Dell EMC; Alfresco Software; Centrify; Citrix Systems, Inc. |

| Customization & Pricing | Available upon Request |

The global bimodal identity management solutions market is estimated to be valued at USD 1.7 billion in 2025.

The market size for the bimodal identity management solutions market is projected to reach USD 10.9 billion by 2035.

The bimodal identity management solutions market is expected to grow at a 20.1% CAGR between 2025 and 2035.

The key product types in bimodal identity management solutions market are education, bfsi, manufacturing, telecom and it, energy, healthcare and life sciences, public sector & utilities and retail.

In terms of organization size, small & medium enterprises (smes) segment to command 35.0% share in the bimodal identity management solutions market in 2025.

Our Research Products

The "Full Research Suite" delivers actionable market intel, deep dives on markets or technologies, so clients act faster, cut risk, and unlock growth.

The Leaderboard benchmarks and ranks top vendors, classifying them as Established Leaders, Leading Challengers, or Disruptors & Challengers.

Locates where complements amplify value and substitutes erode it, forecasting net impact by horizon

We deliver granular, decision-grade intel: market sizing, 5-year forecasts, pricing, adoption, usage, revenue, and operational KPIs—plus competitor tracking, regulation, and value chains—across 60 countries broadly.

Spot the shifts before they hit your P&L. We track inflection points, adoption curves, pricing moves, and ecosystem plays to show where demand is heading, why it is changing, and what to do next across high-growth markets and disruptive tech

Real-time reads of user behavior. We track shifting priorities, perceptions of today’s and next-gen services, and provider experience, then pace how fast tech moves from trial to adoption, blending buyer, consumer, and channel inputs with social signals (#WhySwitch, #UX).

Partner with our analyst team to build a custom report designed around your business priorities. From analysing market trends to assessing competitors or crafting bespoke datasets, we tailor insights to your needs.

Supplier Intelligence

Discovery & Profiling

Capacity & Footprint

Performance & Risk

Compliance & Governance

Commercial Readiness

Who Supplies Whom

Scorecards & Shortlists

Playbooks & Docs

Category Intelligence

Definition & Scope

Demand & Use Cases

Cost Drivers

Market Structure

Supply Chain Map

Trade & Policy

Operating Norms

Deliverables

Buyer Intelligence

Account Basics

Spend & Scope

Procurement Model

Vendor Requirements

Terms & Policies

Entry Strategy

Pain Points & Triggers

Outputs

Pricing Analysis

Benchmarks

Trends

Should-Cost

Indexation

Landed Cost

Commercial Terms

Deliverables

Brand Analysis

Positioning & Value Prop

Share & Presence

Customer Evidence

Go-to-Market

Digital & Reputation

Compliance & Trust

KPIs & Gaps

Outputs

Full Research Suite comprises of:

Market outlook & trends analysis

Interviews & case studies

Strategic recommendations

Vendor profiles & capabilities analysis

5-year forecasts

8 regions and 60+ country-level data splits

Market segment data splits

12 months of continuous data updates

DELIVERED AS:

PDF EXCEL ONLINE

Identity And Access Management As A Service (IAMaaS) Market Size and Share Forecast Outlook 2025 to 2035

Identity & Access Management Market Growth – Demand, Trends & Forecast 2025-2035

Cloud Identity Management Market

Space Management Solutions Market Size and Share Forecast Outlook 2025 to 2035

Revenue Management Solutions Market Size and Share Forecast Outlook 2025 to 2035

Parking Management Solutions Market Size and Share Forecast Outlook 2025 to 2035

Network Management Solutions Market

Blockchain Identity Management Market Size and Share Forecast Outlook 2025 to 2035

e-Government Identity Management Market

Building Energy Management Solutions Market Size and Share Forecast Outlook 2025 to 2035

Enterprise Drone Management Solutions Market Analysis 2025 to 2035 by Type, Technology, Application, and Region

Hospital Capacity Management Solutions Market Insights - Growth & Forecast 2024 to 2034

Multicarrier Parcel Management Solutions Software Market Size and Share Forecast Outlook 2025 to 2035

Advanced Drill Data Management Solutions Market Size and Share Forecast Outlook 2025 to 2035

Asset And Liability Management Solutions Market

Data Security Posture Management (DSPM) Solutions Market Size and Share Forecast Outlook 2025 to 2035

Automated Infrastructure Management (AIM) Solutions Market Size and Share Forecast Outlook 2025 to 2035

Identity Governance and Administration Market Size and Share Forecast Outlook 2025 to 2035

Identity Verification Market Analysis - Size, Share, and Forecast 2025 to 2035

Identity Analytics Market Size and Share Forecast Outlook 2025 to 2035

Thank you!

You will receive an email from our Business Development Manager. Please be sure to check your SPAM/JUNK folder too.

Chat With

MaRIA