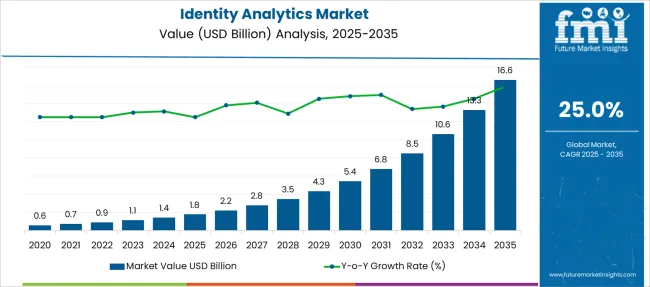

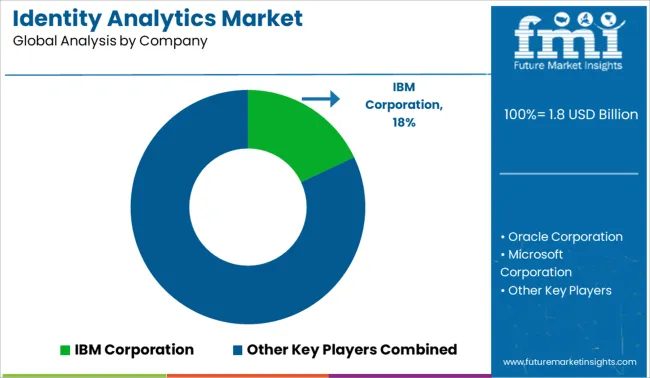

The Identity Analytics Market is estimated to be valued at USD 1.8 billion in 2025 and is projected to reach USD 16.6 billion by 2035, registering a compound annual growth rate (CAGR) of 25.0% over the forecast period.

| Metric | Value |

|---|---|

| Identity Analytics Market Estimated Value in (2025E) | USD 1.8 billion |

| Identity Analytics Market Forecast Value in (2035F) | USD 16.6 billion |

| Forecast CAGR (2025 to 2035) | 25.0% |

The Identity Analytics Market is experiencing significant expansion as enterprises strive to strengthen user authentication controls and safeguard sensitive data. Growth is being propelled by increasing adoption of centralized identity intelligence platforms that enable real‑time user behavior analysis across hybrid IT environments. Rising regulatory pressures and compliance mandates, such as GDPR and CCPA, are compelling organizations to deploy advanced identity solutions.

In addition, the shift toward remote work models and cloud‑based operations has heightened the need for adaptive security that can quickly detect anomalies and unauthorized access in real time. Continuous enhancements in machine learning and artificial intelligence are providing more accurate detection of insider threats, credential misuse and identity fraud.

With growing investments in digital transformation initiatives, Identity Analytics solutions are being integrated into broader cybersecurity strategies. As digital identities continue to proliferate and attack surfaces expand, the Identity Analytics Market is expected to sustain steady growth and increasingly be viewed as a foundational component of enterprise risk management..

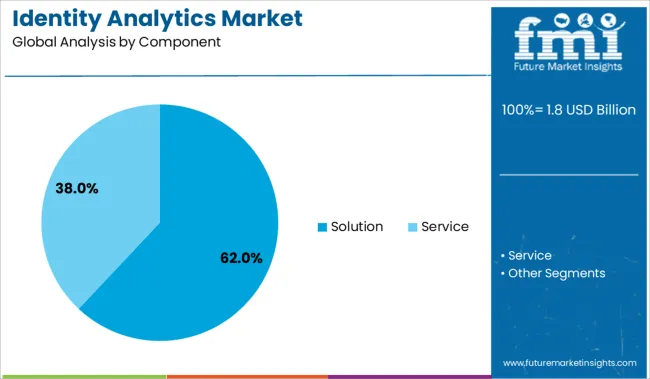

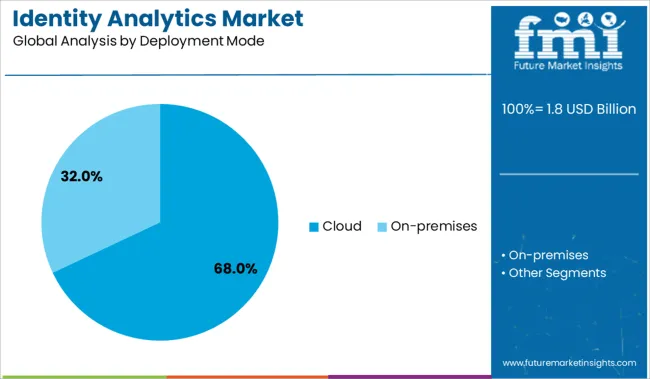

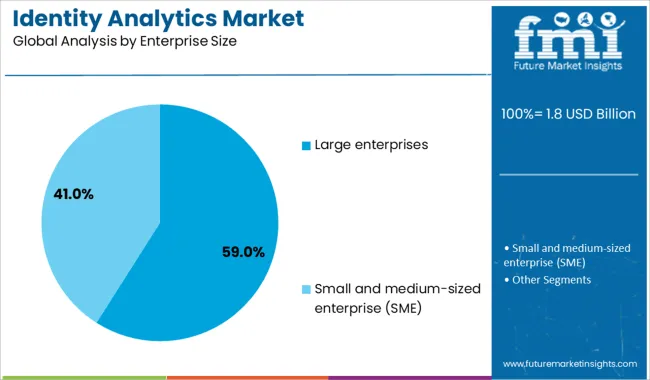

The market is segmented by Component, Deployment Mode, Enterprise Size, Application, and Industry Vertical and region. By Component, the market is divided into Solution and Service. In terms of Deployment Mode, the market is classified into Cloud and On-premises. Based on Enterprise Size, the market is segmented into Large enterprises and Small and medium-sized enterprise (SME).

By Application, the market is divided into Identity and access management, Customer management, Governance risk and compliance management, Account management, Fraud detection, and Others. By Industry Vertical, the market is segmented into BFSI, Retail & e-commerce, IT & telecommunication, Government & public sector, Healthcare, Manufacturing, Media & entertainment, and Others. Regionally, the market is classified into North America, Latin America, Western Europe, Eastern Europe, Balkan & Baltic Countries, Russia & Belarus, Central Asia, East Asia, South Asia & Pacific, and the Middle East & Africa.

The Solution component in the Identity Analytics Market is projected to hold 62% of the revenue share in 2025. This dominance is being driven by the comprehensive capabilities provided by full‑stack identity analytics platforms that combine user behavior analytics, risk scoring and identity intelligence. Adoption has been encouraged by the need for unified dashboards and consolidated workflows that support both on‑premises and cloud environments.

Solutions that offer seamless integration with existing identity governance, access management and SIEM tools have been preferred by organizations seeking reduced complexity and improved visibility. The capability to generate actionable threat insights and to deliver automated remediation workflows has been recognised as enhancing overall security posture.

Deployment of comprehensive identity analytics solutions has also been supported by growing demand for proactive detection of insider threats and policy violations. Vendors offering scalable, API‑driven platforms have been favoured, helping the Solution component maintain its market leadership..

The cloud deployment mode is expected to account for 68% of the Identity Analytics Market revenue share in 2025. This trend is being driven by preference for as‑a‑service delivery models that reduce infrastructure overhead and accelerate time‑to‑value. Cloud‑native identity analytics offerings have been favoured due to their scalability, continuous feature updates and ease of integration with multi‑cloud and SaaS environments.

Organizations are being encouraged to adopt cloud deployment as it enables centralized visibility into user behavior across distributed systems. The ability to leverage advanced analytics, machine learning and zero‑trust compliance in a managed environment has been recognised as crucial for securing dynamic digital infrastructure.

Subscription‑based pricing models have further reduced barriers to entry, allowing organizations of all sizes to adopt identity analytics capabilities. As cybersecurity becomes more strategic, cloud deployment continues to be the preferred option..

The large enterprises segment is anticipated to command 59% of the Identity Analytics Market revenue share in 2025. This dominance is being influenced by the extensive identity and access management needs of large organizations with complex IT environments. Large enterprises have been seen to invest heavily in identity analytics to support thousands of users and to ensure compliance with international regulations.

The ability to correlate user behavior across global networks and hybrid systems has been recognised as essential for real‑time risk assessment. Large enterprises are being equipped with comprehensive identity intelligence tools that integrate with broader security operations to enable automated detection and prioritization of threats.

Due to the high value placed on protecting intellectual property and sensitive customer data, large enterprises have continued to lead adoption. The scale and sophistication of identity ecosystem requirements at large organizations have reinforced their position as the primary end users of advanced identity analytics solutions..

The smart diapers market has been expanding at a double-digit CAGR, supported by rising demand in infant care and elderly care segments. This growth has been propelled by the need for real-time moisture detection, enhanced hygiene management, and reduced caregiver workload. Institutions and tech-savvy consumers have shown interest in connected hygiene tools. Despite growing attention, barriers such as elevated product costs, short battery cycles, and integration complexities with mobile platforms have limited full-scale adoption. Continued product development in sensor accuracy, connectivity, and app synchronization remains critical for capturing long-term demand across healthcare and residential settings.

The rise in sophisticated cyberattacks and fraud has been identified as a principal force fueling expansion of the identity analytics market. Throughout 2023, solutions focused on detecting anomalous login patterns and credential misuse were increasingly adopted by financial services to mitigate insider risks. By 2024, enterprises across healthcare and government sectors had begun deploying behavior-based identity scoring tools to strengthen access governance amid evolving threat landscapes. In 2025, demand was further elevated as remote and cloud-based work models became deeply embedded, leading organizations to integrate real-time identity intelligence into zero-trust frameworks. These forces have been viewed as foundational in establishing identity analytics as a strategic security control.

Rapid expansion of cloud adoption and remote work models has been leveraged by enterprises since 2023 to implement identity analytics tools within cloud-native access frameworks. In 2024, demand was heightened for behavior-based identity scoring integrated into cloud platforms, enabling granular access control for hybrid workforces. By 2025, identity intelligence has been increasingly embedded into zero-trust deployments and SaaS ecosystems, driven by necessity for continuous verification. These deployments have shown that identity analytics can evolve from perimeter-based controls to core components of dynamic security posture. Providers offering seamless integration with cloud IAM and real-time anomaly detection are poised to capture expanding market share.

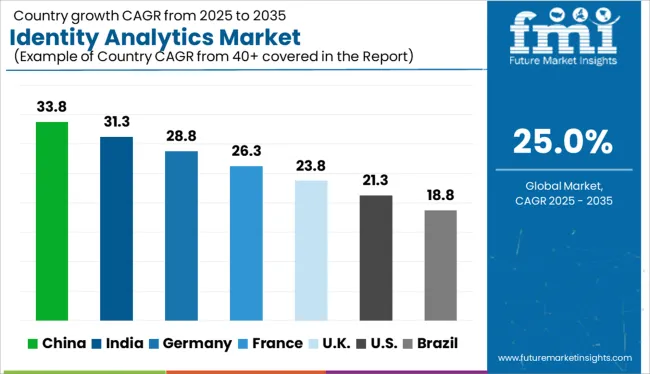

| Country | CAGR |

|---|---|

| China | 33.8% |

| India | 31.3% |

| Germany | 28.8% |

| France | 26.3% |

| UK | 23.8% |

| USA | 21.3% |

| Brazil | 18.8% |

The identity analytics market is forecast to surge globally at a CAGR of 25% from 2025 to 2035. Among the 40 countries evaluated, China leads at 33.8%, followed by India at 31.3%, Germany at 28.8%, and France at 26.3%, while the United Kingdom registers slightly below trend at 23.8%. Growth acceleration in China and India is driven by large-scale surveillance infrastructure, rapid digitization of citizen services, and aggressive government investments in zero-trust architectures. Germany benefits from GDPR-aligned identity governance platforms. France shows strong enterprise adoption in finance and telecom. In contrast, the UK reflects slower momentum, affected by post-Brexit data policy recalibrations and legacy system integration.

The identity analytics market China is expected to grow at a 33.8% CAGR, propelled by surveillance-oriented AI infrastructure and integration of facial recognition in financial and civic authentication systems. The government has endorsed real-time identity resolution platforms across banking, mobility, and education sectors. Domestic leaders such as SenseTime and Hikvision support real-time identity behavior tracking for threat mitigation and fraud prevention. Cross-sector adoption enables scalability in both public and private domains.

India is forecast to achieve 31.3% CAGR in identity analytics, driven by Aadhaar-linked service infrastructure and rising emphasis on fraud detection in fintech and e-governance. State-led projects enable secure access to health records, digital lockers, and subsidies. Startups are scaling decentralized identity protocols with blockchain backing. Analytics-enabled role-based access control is being adopted by insurance, telecom, and digital banking platforms.

The identity analytics market in Germany is expected to grow at a 28.8% CAGR, anchored in demand for compliant identity governance, risk intelligence, and behavioral profiling. Enterprise IT departments are integrating AI-powered analytics for privileged access monitoring and security policy enforcement. Local cybersecurity vendors are scaling platforms for cloud-native identity lifecycle management. Manufacturing and pharma sectors adopt identity analytics to secure industrial IoT infrastructure.

France is projected to post a 26.3% CAGR in the identity analytics sector, driven by enterprise demand in telecom, aerospace, and fintech. AI-driven access analytics are being embedded into SOC platforms for anomaly flagging. National push toward secure digital identity for citizen services accelerates analytics deployment in civic infrastructure. Collaboration with EU-wide cyber initiatives reinforces innovation.

The UK identity analytics market is expected to grow at a 23.8% CAGR, reflecting enterprise migration toward hybrid cloud and identity convergence. Post-Brexit regulatory updates have prompted review of cross-border identity federation frameworks. Fintech and insurance sectors invest in behavioral biometrics for fraud prevention. However, legacy integration challenges and slower cloud IAM adoption restrict rapid scale.

The identity analytics market is moderately consolidated, led by IBM Corporation. The company holds a dominant position through its enterprise-wide identity governance capabilities, anomaly detection frameworks, and deep integration across security operations. Dominant player status is held exclusively by IBM Corporation. Key players include Oracle Corporation, Microsoft Corporation, and SailPoint Technologies - each offering robust identity analytics tools within their identity and access management ecosystems, supporting compliance, threat scoring, and lifecycle automation. Emerging players such as Broadcom Inc. (Symantec), RSA Security LLC, Saviynt, and One Identity (Quest Software) focus on specialized identity risk analysis, cloud-native identity orchestration, and mid-market adoption. Market demand is driven by increasing emphasis on behavioral analytics and zero-trust access intelligence.

| Item | Value |

|---|---|

| Quantitative Units | USD 1.8 Billion |

| Component | Solution and Service |

| Deployment Mode | Cloud and On-premises |

| Enterprise Size | Large enterprises and Small and medium-sized enterprise (SME) |

| Application | Identity and access management, Customer management, Governance risk and compliance management, Account management, Fraud detection, and Others |

| Industry Vertical | BFSI, Retail & e-commerce, IT & telecommunication, Government & public sector, Healthcare, Manufacturing, Media & entertainment, and Others |

| Regions Covered | North America, Europe, Asia-Pacific, Latin America, Middle East & Africa |

| Country Covered | United States, Canada, Germany, France, United Kingdom, China, Japan, India, Brazil, South Africa |

| Key Companies Profiled | IBM Corporation, Oracle Corporation, Microsoft Corporation, SailPoint Technologies, Broadcom Inc. (Symantec), RSA Security LLC, Saviynt, and One Identity (Quest Software) |

| Additional Attributes | Dollar sales by product type (behavioral biometrics, risk-based authentication, identity governance), Dollar sales by deployment model (cloud, on-premise, hybrid), Trends in AI-driven identity fraud detection and privacy-first analytics, Use of identity analytics in compliance and access control, Growth in financial services, healthcare, and government sectors, Regional adoption patterns across North America, Europe, and APAC. |

The global identity analytics market is estimated to be valued at USD 1.8 billion in 2025.

The market size for the identity analytics market is projected to reach USD 16.6 billion by 2035.

The identity analytics market is expected to grow at a 25.0% CAGR between 2025 and 2035.

The key product types in identity analytics market are solution and service.

In terms of deployment mode, cloud segment to command 68.0% share in the identity analytics market in 2025.

Full Research Suite comprises of:

Market outlook & trends analysis

Interviews & case studies

Strategic recommendations

Vendor profiles & capabilities analysis

5-year forecasts

8 regions and 60+ country-level data splits

Market segment data splits

12 months of continuous data updates

DELIVERED AS:

PDF EXCEL ONLINE

Identity And Access Management As A Service (IAMaaS) Market Size and Share Forecast Outlook 2025 to 2035

Identity Governance and Administration Market Size and Share Forecast Outlook 2025 to 2035

Identity Verification Market Analysis - Size, Share, and Forecast 2025 to 2035

Identity & Access Management Market Growth – Demand, Trends & Forecast 2025-2035

Identity-as-a-Service (IDaaS) Market Outlook 2025 to 2035 by Access Type, Enterprise Size, Service Type, Application, Industry, and Region

Cloud Identity Management Market

Bimodal Identity Management Solutions Market Size and Share Forecast Outlook 2025 to 2035

Digital Identity Services Market Size and Share Forecast Outlook 2025 to 2035

Understanding Market Share Trends in Travelers Identity Protection

Travelers Identity Protection Services Market Analysis by Service Type, by Subscription Model, by End User , by Nationality and by Region - Forecast for 2025 to 2035

Blockchain Identity Management Market Size and Share Forecast Outlook 2025 to 2035

e-Government Identity Management Market

Analytics Of Things Market Size and Share Forecast Outlook 2025 to 2035

Analytics as a Service (AaaS) Market - Growth & Forecast 2025 to 2035

Analytics Sandbox Market

Ad Analytics Market Growth - Trends & Forecast 2025 to 2035

HR Analytics Market

AI-Powered Analytics – Transforming Business Intelligence

NFT Analytics Tools Market Size and Share Forecast Outlook 2025 to 2035

App Analytics Market Trends – Growth & Industry Forecast 2023-2033

Thank you!

You will receive an email from our Business Development Manager. Please be sure to check your SPAM/JUNK folder too.

Chat With

MaRIA