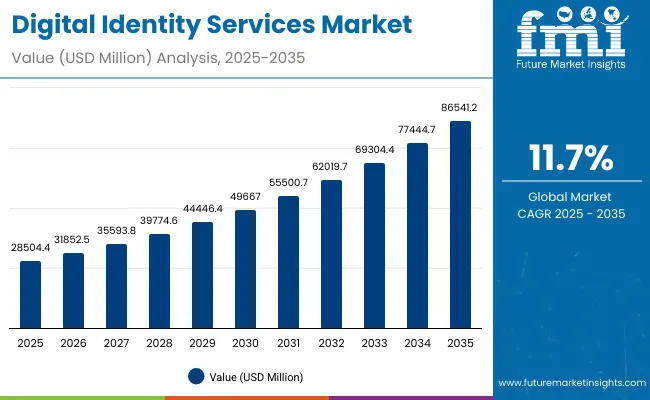

The Digital Identity Services Market is expected to record a valuation of USD 28,504.4 million in 2025 and USD 86,541.2 million in 2035, with an increase of USD 58,036.8 million, which equals a growth of 203% over the decade. The overall expansion represents a CAGR of 11.7% and a 3X increase in market size.

Digital Identity Services Market Key Takeaways

| Metric | Value |

|---|---|

| Market Estimated Value in (2025E) | USD 28,504.4 million |

| Market Forecast Value in (2035F) | USD 86,541.2 million |

| Forecast CAGR (2025 to 2035) | 11.7% |

During the first five-year period from 2025 to 2030, the market increases from USD 28,504.4 million to USD 49,667.0 million, adding USD 21,162.6 million, which accounts for 36% of the total decade growth. This phase records steady adoption in BFSI onboarding, e-commerce fraud prevention, and government citizen ID programs, driven by the need for regulatory compliance and fraud reduction. Identity verification & KYC/AML dominates this period as it caters to over 35% of critical applications requiring high-accuracy compliance checks.

The second half from 2030 to 2035 contributes USD 36,874.2 million, equal to 64% of total growth, as the market jumps from USD 49,667.0 million to USD 86,541.2 million. This acceleration is powered by widespread deployment of biometric authentication, AI-based fraud scoring, and digital identity wallets in healthcare and travel ecosystems. Cloud and hybrid deployments together capture a larger share above 70% by the end of the decade. API-first SaaS and orchestration platforms add recurring revenue, increasing the service-based share beyond 65% in total value.

From 2020 to 2024, the Global Digital Identity Services Market grew from under USD 20,000 million to over USD 26,000 million, driven by compliance-driven adoption in BFSI and government services. During this period, the competitive landscape was dominated by verification providers controlling nearly 70% of revenue, with leaders such as LexisNexis, Experian, and Trulioo focusing on KYC/AML solutions for financial institutions. Competitive differentiation relied on accuracy, fraud database coverage, and regulatory alignment, while orchestration and wallet services were still in early adoption. Service-based recurring models contributed less than 20% of the total market value.

Demand for digital identity services will expand to USD 28,504.4 million in 2025, and the revenue mix will shift as SaaS and orchestration services grow to over 65% share. Traditional verification leaders face rising competition from API-native players offering biometric onboarding, risk scoring, and cross-border digital wallet solutions. Major incumbents are pivoting to hybrid models, integrating AI-driven fraud detection and multi-factor workflows to retain relevance. Emerging entrants specializing in FIDO/WebAuthn, behavioral biometrics, and cloud-first orchestration platforms are gaining share. The competitive advantage is moving away from KYC point solutions alone to ecosystem strength, scalability, and recurring subscription revenue.

Advances in biometric authentication have improved accuracy and speed, allowing for more secure identity verification across diverse applications. API-first SaaS platforms have gained popularity due to their scalability and real-time compliance integrations. The rise of cloud deployment has contributed to flexibility and cost efficiency, enabling enterprises to embed identity services seamlessly into customer journeys. Industries such as BFSI, e-commerce, and telecom are driving demand for fraud prevention and access management solutions that can integrate across digital channels.

Expansion of automated fraud detection and cross-border compliance requirements has fueled market growth. Innovations in biometric modalities, behavioral analytics, and wallet issuance are expected to open new application areas. Segment growth is expected to be led by identity verification & KYC/AML services, API-first SaaS delivery models, and cloud deployments due to their precision, adaptability, and scalability.

The market is segmented by service type, authentication method, delivery model, deployment, customer industry, and region. Service types include identity verification & KYC/AML, authentication & access, fraud detection & risk scoring, identity orchestration & workflow, and credential issuance & wallet. Authentication methods include biometrics (face/fingerprint/voice), OTP & push approval, FIDO/WebAuthn, and device binding & behavioral signals.

Delivery models include API-first SaaS and managed services. Deployment models include cloud, hybrid, and on-prem managed. Customer industries include BFSI, e-commerce & marketplaces, government & public services, telecom, healthcare, travel & mobility, and others. Regionally, the scope spans North America, Europe, Asia-Pacific, Latin America, and the Middle East & Africa, with country-level coverage including the USA, Canada, Germany, France, United Kingdom, China, Japan, and India.

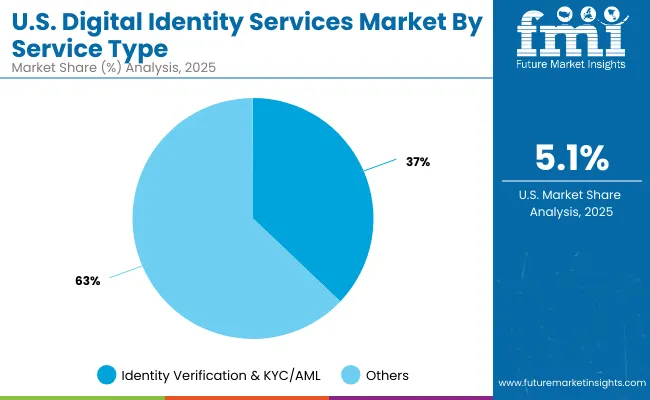

| Service Type Segment | Market Value Share, 2025 |

|---|---|

| Identity Verification & KYC/AML | 35.7% |

| Others | 64.3% |

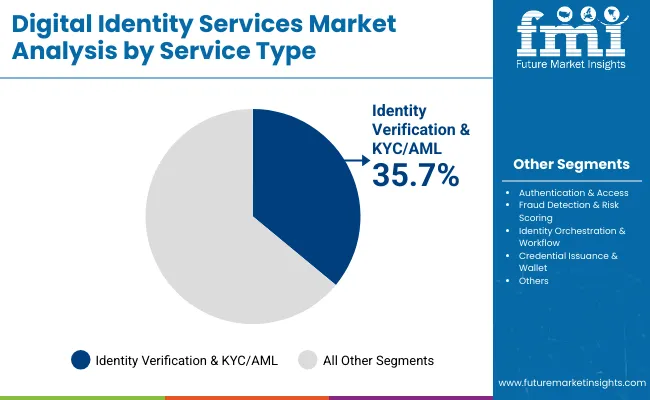

The identity verification & KYC/AML segment is projected to contribute 35.7% of the Global Digital Identity Services Market revenue in 2025, maintaining its lead as the dominant service category. This is driven by increasing regulatory mandates across BFSI, government services, and e-commerce sectors, where compliance with AML and fraud prevention remains critical. Organizations continue to prioritize KYC processes to mitigate risk, meet evolving compliance requirements, and secure digital onboarding.

The segment’s growth is also supported by widespread integration of biometric verification and document authentication technologies that improve accuracy and reduce fraud. As digital ecosystems expand globally, providers are enhancing verification platforms with AI-driven fraud detection and workflow orchestration. The identity verification & KYC/AML segment is expected to retain its position as the backbone of digital identity services through 2035.

| Delivery Model Segment | Market Value Share, 2025 |

|---|---|

| API-first SaaS | 63.8% |

| Others | 36.2% |

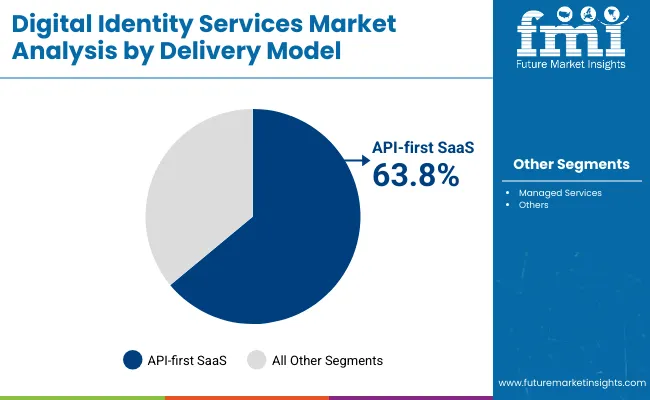

The API-first SaaS segment is projected to contribute 63.8% of the Global Digital Identity Services Market revenue in 2025, making it the clear leader in delivery models. This dominance is fueled by enterprises seeking scalable, flexible, and real-time identity solutions that can be embedded into customer-facing applications. API-first platforms allow for seamless integration into existing workflows, supporting industries such as BFSI, telecom, and e-commerce with rapid deployment and reduced operational overheads. The segment’s growth is also reinforced by the rise of subscription-based revenue models, where recurring services provide cost efficiency and predictable scalability for users. As demand for orchestration and fraud detection intensifies, SaaS providers are enhancing interoperability with third-party systems and cross-border compliance networks. The API-first SaaS segment is expected to remain the engine of recurring revenues across the digital identity services landscape.

| Deployment Segment | Market Value Share, 2025 |

|---|---|

| Cloud | 70.3% |

| Segment | 29.7% |

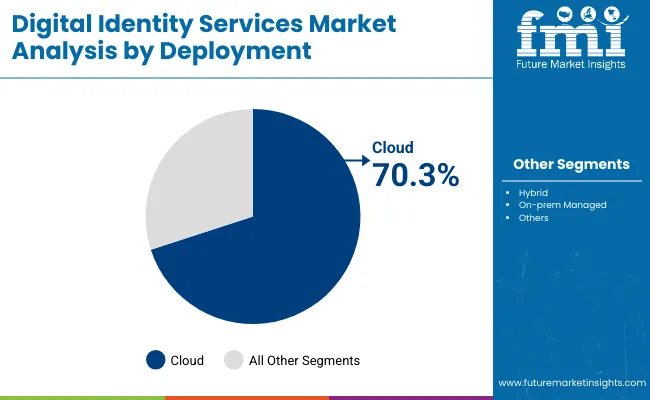

The cloud deployment segment is projected to contribute 70.3% of the Global Digital Identity Services Market revenue in 2025, positioning it as the dominant deployment model. Organizations are increasingly migrating identity services to the cloud to achieve cost efficiency, agility, and faster time-to-market for compliance solutions. Cloud-native infrastructure enables real-time identity verification, multi-factor authentication, and fraud detection at scale, which is critical for industries with high transaction volumes. The segment’s growth is also being propelled by digital transformation strategies across enterprises, governments, and healthcare systems that prioritize secure cloud identity management. Providers are embedding advanced features such as AI analytics, orchestration, and continuous monitoring into their cloud platforms to enhance security and reduce risk. The cloud segment is expected to remain the backbone of digital identity deployments, accounting for the majority of growth through 2035.

Drivers

Regulatory Compliance and KYC/AML Mandates

One of the most powerful drivers shaping the Global Digital Identity Services Market is the rise in regulatory compliance requirements across industries. Financial services, e-commerce platforms, government agencies, and telecom providers are under mounting pressure to meet stringent Know Your Customer (KYC) and Anti-Money Laundering (AML) rules. In 2025, the identity verification & KYC/AML segment alone represents 35.7% of total market value, illustrating how compliance-focused demand is central to growth. Governments are enforcing stricter onboarding processes to combat fraud, money laundering, and identity theft, which are escalating in both developed and emerging markets. The USA and Europe have well-established frameworks such as the Bank Secrecy Act (BSA), GDPR, and eIDAS, while Asia-Pacific markets including India and China are scaling national digital ID programs like Aadhaar and e-CNY integration.

The increasing globalization of financial services also compels multinational enterprises to adopt standardized digital identity solutions that can function across jurisdictions. This is driving cross-border verification and interoperability needs, accelerating innovation in API-first KYC systems. Furthermore, enterprises are seeking to automate compliance processes, replacing manual checks with biometric verification, AI-driven fraud scoring, and continuous identity monitoring. As regulatory scrutiny continues to intensify, businesses are prioritizing identity services not just as a compliance requirement but as a strategic asset that builds customer trust, reduces operational costs, and secures long-term growth. This compliance-driven momentum ensures identity verification & KYC/AML will remain the cornerstone of digital identity services throughout the decade.

Cloud and API-first Adoption Across Industries

The adoption of cloud-based and API-first delivery models has emerged as a key driver of scalability and cost efficiency in the Global Digital Identity Services Market. In 2025, API-first SaaS accounts for 63.8% of revenues, while cloud deployment captures 70.3%, underscoring how enterprises are gravitating toward flexible, subscription-driven identity solutions. Unlike traditional on-premise systems, cloud and SaaS-based identity platforms offer real-time updates, elastic scaling, and seamless integration with third-party ecosystems. This is particularly critical in industries like BFSI, healthcare, and e-commerce, where high transaction volumes require instant authentication and fraud detection without compromising user experience.

The growing shift toward digital-first customer journeys amplifies the need for API-driven identity services that can be embedded directly into mobile apps, websites, and government portals. Enterprises prefer plug-and-play models that reduce time-to-market while maintaining security and compliance. API-first SaaS platforms also provide advanced orchestration, enabling organizations to dynamically combine verification, authentication, and fraud scoring into unified workflows. This not only simplifies compliance management but also improves customer onboarding speed.

Restraints

Data Privacy Concerns and Compliance Risks

While regulatory pressure drives adoption, it simultaneously acts as a restraint by raising compliance complexity and operational risks. Digital identity service providers manage highly sensitive personal information, including biometric data, government IDs, and behavioral patterns. Any breach of this data can lead to severe financial penalties and reputational damage. The enforcement of GDPR in Europe, CCPA in California, and new data protection laws in countries such as India and Brazil introduce challenges for providers operating globally. Enterprises must adapt solutions to meet local data sovereignty laws, often requiring in-country data storage and customized compliance frameworks.

This complexity hinders the scalability of standardized identity platforms, increasing costs and operational overhead. Cross-border services, in particular, face difficulties when trying to reconcile conflicting regulatory requirements across jurisdictions. For example, a global e-commerce player may need to deploy different compliance protocols in the USA, EU, and Asia, complicating deployment and driving up costs.

High Implementation and Integration Costs

Another significant restraint for the Global Digital Identity Services Market is the cost associated with deploying advanced identity verification systems. While API-first SaaS models reduce upfront capital expenditure, enterprises adopting cutting-edge authentication solutions such as biometrics, behavioral analytics, and AI-driven fraud scoring still face high integration expenses. Small and mid-sized enterprises, particularly in emerging markets, struggle with the affordability of enterprise-grade identity solutions.

Implementation requires not only licensing fees but also investments in system integration, staff training, and ongoing maintenance. For industries with legacy IT systems, migrating to cloud or hybrid identity frameworks is often complex, requiring customized APIs and data security protocols. This increases both time-to-market and total cost of ownership. Additionally, integrating identity services into diverse industry-specific workflows such as healthcare patient records or telecom SIM registration systems demands industry-specific customization, adding further costs.

While large enterprises in BFSI and government sectors are able to absorb these expenses, smaller organizations may delay adoption or limit deployment to basic KYC checks. This uneven affordability across industries and geographies slows down mass adoption and creates barriers for service providers to penetrate certain market segments. Cost-related hurdles thus remain a restraining force on the pace of adoption, despite the clear long-term benefits of digital identity solutions.

Key Trends

Biometric-led Authentication Becoming Mainstream

Biometric authentication is rapidly transitioning from a niche capability to a mainstream feature across digital identity ecosystems. Leveraging modalities such as facial recognition, fingerprint scanning, and voice recognition, biometrics deliver superior accuracy and stronger protection against fraud compared to traditional passwords or OTP-based verification. As of 2025, biometrics are among the leading authentication methods, integrated across BFSI, healthcare, and government identity programs.

Consumers increasingly prefer passwordless authentication for convenience, while enterprises adopt it to minimize fraud and enhance user experience. The shift is driven by advancements in machine learning and AI, which significantly improve biometric accuracy even under challenging conditions such as low lighting or partial face visibility. Furthermore, the rise of mobile-first ecosystems has made biometric authentication a natural extension of smartphones, enabling instant verification without additional hardware costs. Regulatory endorsement is also encouraging adoption, with governments integrating biometrics into e-passports, digital healthcare IDs, and border security systems.

Rise of Digital Wallets and Decentralized Identity

Another key trend transforming the Global Digital Identity Services Market is the emergence of credential issuance and digital identity wallets. These solutions give individuals greater control over their personal data, enabling them to store and present verified credentials securely across platforms. With decentralized identity models gaining traction, individuals can manage their digital identities without relying solely on centralized databases, reducing single points of failure and enhancing privacy. By 2025, digital wallets are already being explored in government, mobility, and healthcare sectors. For instance, digital driver’s licenses, vaccination certificates, and cross-border travel credentials are increasingly issued through wallet-based frameworks. In the financial sector, wallets enable seamless cross-platform KYC reusability, lowering onboarding friction and improving customer experience. The trend is also closely tied to Web3 and blockchain adoption, as decentralized identity frameworks align with the principles of self-sovereign identity.

Enterprises are actively integrating wallets with mobile devices, biometric verification, and blockchain-based credential registries to ensure interoperability and trust. The ability to enable cross-border compliance while giving individuals ownership of their data is gaining significant momentum. Over the forecast period, digital wallets and decentralized identity models will likely shift the balance of power toward consumer-centric ecosystems, redefining the competitive landscape of identity services.

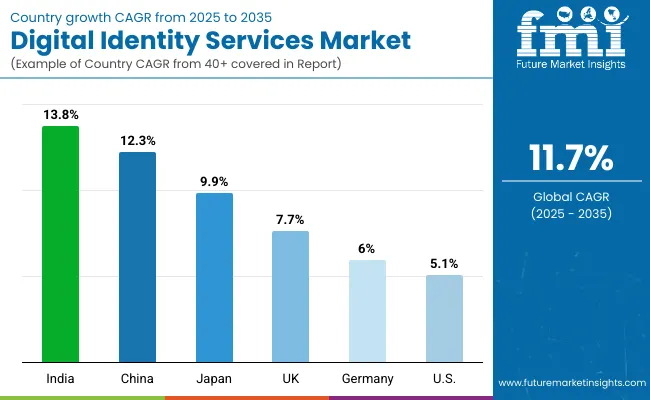

| Countries | Estimated CAGR (2025 to 2035) |

|---|---|

| China | 12.3% |

| USA | 5.1% |

| India | 13.8% |

| UK | 7.7% |

| Germany | 6.0% |

| Japan | 9.9% |

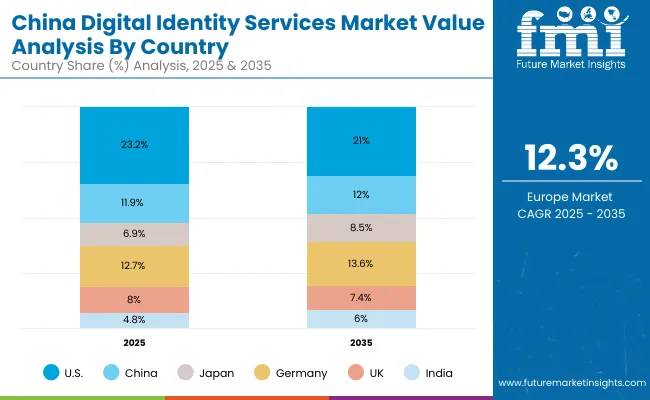

The Global Digital Identity Services Market shows pronounced regional disparities in adoption speed, strongly influenced by regulatory compliance mandates, financial inclusion initiatives, and the digital transformation of public services. Asia-Pacific emerges as the fastest-growing region, anchored by India at 13.8% CAGR and China at 12.3% CAGR. This acceleration is driven by national identity programs, digital payment ecosystems, and aggressive government investment in fraud prevention and citizen ID systems. India’s Aadhaar-linked identity framework and growing fintech sector are propelling large-scale KYC adoption.

China’s digital yuan ecosystem, e-commerce expansion, and state-backed smart city programs further accelerate cloud-based identity verification deployments. Europe maintains a strong growth profile, led by Germany at 6.0% CAGR, France near 6.5%, and the UK at 7.7% CAGR, supported by stringent GDPR compliance, eIDAS regulations, and digital onboarding mandates for banks. High levels of e-commerce and robust fintech innovation keep Europe ahead of North America in biometric adoption and digital wallet pilots. North America shows moderate expansion, with the USA at 5.1% CAGR, reflecting market maturity and slower regulatory change compared to Asia and Europe. Growth in the USA is more service-driven, with enterprises prioritizing fraud scoring, orchestration, and SaaS adoption over traditional verification alone. Latin America, represented by Brazil with an estimated CAGR of ~7%, is showing rising adoption of mobile-based KYC in banking and government welfare systems.

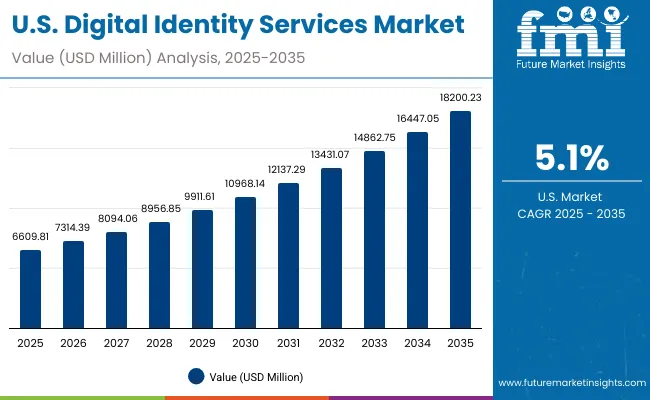

| Year | USA Digital Identity Services Market |

|---|---|

| 2025 | 6609.8 |

| 2026 | 7314.4 |

| 2027 | 8094.1 |

| 2028 | 8956.9 |

| 2029 | 9911.6 |

| 2030 | 10968.1 |

| 2031 | 12137.3 |

| 2032 | 13431.1 |

| 2033 | 14862.8 |

| 2034 | 16447.1 |

| 2035 | 18200.2 |

The Global Digital Identity Services Market in the United States is projected to grow at a CAGR of 5.1%, reflecting steady but moderate expansion compared to faster-growing regions such as Asia-Pacific. Growth is being fueled by increased investments in compliance automation across BFSI, healthcare, and government services, where identity verification and fraud detection are mission-critical. Financial institutions remain at the forefront, with fraud detection and risk scoring applications recording strong year-on-year adoption. This is particularly evident in credit issuance, cross-border payments, and high-value transaction monitoring, where regulators are tightening oversight.

The e-commerce and digital payments sectors are also driving demand for stronger identity verification frameworks. Marketplaces are integrating advanced KYC checks to secure cross-border sellers, protect against chargeback fraud, and maintain compliance with AML directives. At the same time, USA healthcare providers are embedding biometric authentication into patient portals and electronic health records, ensuring secure digital access and reducing risks of identity theft in medical insurance systems. The telecom sector is adopting identity orchestration platforms to meet SIM registration requirements and prevent fraud in mobile transactions.

Although the USA market is mature, providers are increasingly focusing on SaaS and orchestration services rather than just verification tools. Growth is more service-driven than hardware-led, with a strong emphasis on risk analytics, workflow orchestration, and AI-driven fraud scoring.

The Global Digital Identity Services Market in the United Kingdom is expected to grow at a CAGR of 7.7%, supported by widespread adoption across banking, government citizen services, and telecom identity verification. The UK government’s Digital Identity and Attributes Trust Framework is a central driver, establishing standardized rules for digital identity providers and accelerating nationwide adoption. Banks and fintech players are scaling biometric onboarding processes to comply with Financial Conduct Authority (FCA) mandates on anti-money laundering, fraud prevention, and consumer protection. Healthcare is another critical growth sector, with NHS systems investing in secure digital access for patients and providers. Identity solutions are being used to ensure compliance with data privacy standards and protect sensitive medical records from breaches. In addition, telecom companies in the UK are integrating real-time verification platforms to mitigate risks associated with SIM card fraud and mobile payment authentication.

The UK market is characterized by strong public-private collaboration. Innovation grants and digital adoption programs are fueling ecosystem growth, while startups and fintechs are testing decentralized identity and wallet solutions for retail, travel, and online services. This combination of regulatory support, government-backed frameworks, and private innovation is ensuring the UK maintains a leadership role in Europe’s digital identity adoption.

India is witnessing the fastest growth globally in the Digital Identity Services Market, with a forecast CAGR of 13.8% through 2035. This rapid expansion is anchored by the country’s Aadhaar-based identity infrastructure, which provides biometric and demographic verification for over a billion citizens. Aadhaar-enabled eKYC is widely used across banking, insurance, and telecom services, enabling instant verification and driving large-scale adoption of identity solutions.

Fintech firms and neo-banks are among the most aggressive adopters, leveraging API-first KYC systems to scale digital onboarding for millions of new users each year. India’s thriving e-commerce and digital payments ecosystem further accelerates adoption, with platforms integrating fraud detection and behavioral risk scoring to secure transactions. Mobility and ride-hailing platforms are also embedding identity verification for driver and passenger safety.

Beyond the private sector, the Indian government’s Digital India initiative and state-level e-governance programs are pushing adoption into healthcare, education, and welfare distribution. Identity solutions are being deployed in tier-2 and tier-3 cities, extending beyond metro areas, as cost-effective SaaS models make adoption feasible for MSMEs and local institutions.

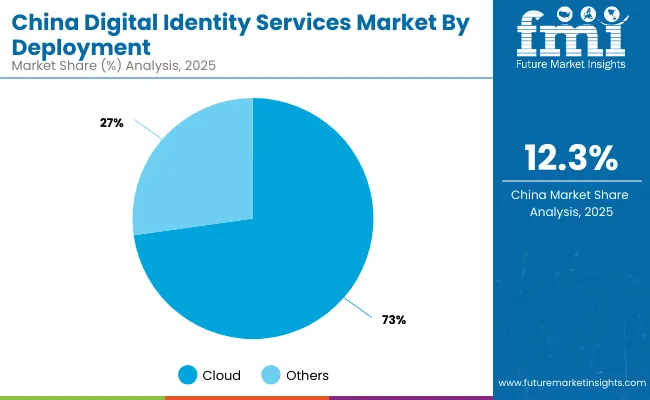

The Global Digital Identity Services Market in China is expected to grow at a CAGR of 12.3%, among the highest globally. Growth is powered by the country’s rapid transition to digital finance, underpinned by the e-CNY (digital yuan) ecosystem and large-scale government-backed initiatives. Financial services and e-commerce platforms are aggressively deploying KYC systems to manage fraud risk, while cloud adoption dominates the landscape with 72.8% share in 2025, reflecting state-driven investments in digital infrastructure. China’s smart city rollouts are another critical driver, with municipal governments deploying large-scale digital ID and biometric authentication frameworks for citizen services, mobility, and infrastructure planning. Healthcare digitization is also fueling adoption, with hospitals and insurance providers integrating AI-driven verification to improve patient data security and service efficiency.

Local technology providers are innovating rapidly, offering cost-effective, biometric-led identity solutions that compete strongly against international vendors. Domestic firms are combining AI-driven face recognition, behavioral analytics, and mobile-first platforms to deliver solutions at scale across banking, mobility, and retail. This competitive momentum, coupled with regulatory backing, is positioning China as a global leader in identity services innovation.

| Service Type Segment | Market Value Share, 2025 |

|---|---|

| Identity verification & KYC/AML | 37.1% |

| Others | 62.9% |

The Digital Identity Services Market in the United States is valued at USD 6,609.8 million in 2025, with identity verification & KYC/AML leading at 37.1% (USD 2,452.2 million). This dominance is directly tied to the USA regulatory and compliance environment, where financial institutions and fintech platforms are mandated to adopt robust AML and fraud prevention frameworks. BFSI and e-commerce platforms are the largest adopters, embedding verification services into customer onboarding, payments, and cross-border transactions. Fraud detection and risk scoring are also experiencing rapid growth in the USA, particularly with rising cybercrime incidents and stricter regulatory scrutiny from agencies such as the SEC and CFPB. Healthcare providers are integrating biometric-driven authentication into digital patient portals, reflecting demand for identity protection in electronic health records. Telecom operators are adopting orchestration workflows to secure SIM registration processes and combat mobile fraud.

The reliance on API-first SaaS solutions allows USA enterprises to integrate identity verification seamlessly into existing platforms, while cloud adoption ensures scalability for high transaction volumes. Over time, the USA market will see a gradual shift from pure verification to multi-layered orchestration, positioning fraud analytics and biometric authentication as growth accelerators.

| Deployment Segment | Market Value Share, 2025 |

|---|---|

| Cloud | 72.8% |

| Segment | 27.2% |

The Digital Identity Services Market in China is valued at approximately USD 3,378.4 million in 2025, with cloud deployment leading at 72.8% (USD 2,459.4 million). The overwhelming dominance of cloud solutions reflects government-backed investment in digital infrastructure, national data frameworks, and rapid scaling of fintech and e-commerce ecosystems. China’s digital yuan (e-CNY) ecosystem has accelerated demand for robust, scalable, cloud-hosted KYC and AML systems, ensuring compliance in digital finance. Smart city initiatives and healthcare digitization are also significant drivers, as local governments and hospitals integrate biometric authentication for secure citizen services and patient records. E-commerce platforms are embedding risk scoring and fraud prevention at checkout to secure one of the world’s largest online retail markets. Cloud adoption offers Chinese enterprises flexibility, speed, and cost efficiency to support these massive transaction volumes.

Domestic technology providers are playing a critical role by offering cost-effective, AI-driven biometric and fraud scoring tools that compete effectively against international players. This is boosting adoption across both enterprise and consumer-facing applications, from banking to mobility. Over the forecast period, the synergy between state-backed frameworks and private sector innovation will solidify China as one of the most dynamic growth hubs for digital identity services.

Key Developments in Global Digital Identity Services Market

| Item | Value |

|---|---|

| Quantitative Units | USD 28,504.4 million |

| Service Type | Identity verification & KYC/AML, Authentication & access, Fraud detection & risk scoring, Identity orchestration & workflow, Credential issuance & wallet |

| Authentication Method | Biometrics (face/fingerprint/voice), OTP & push approval, FIDO/ WebAuthn, Device binding & behavioral signals |

| Delivery Model | API-first SaaS, Managed services |

| Deployment | Cloud, Hybrid, On- prem managed |

| Customer Industry | BFSI, E-commerce & marketplaces, Government & public services, Telecom, Healthcare, Travel & mobility |

| Regions Covered | North America, Europe, Asia-Pacific, Latin America, Middle East & Africa |

| Country Covered | United States, Canada, Germany, France, United Kingdom, China, Japan, India, Brazil, South Africa |

| Key Companies Profiled | LexisNexis Risk Solutions, Experian, Trulioo, Jumio, Onfido, Mitek Systems, IDEMIA, Thales, iProov, GBG |

| Additional Attributes | Dollar sales by service type and customer industry, adoption trends in cloud and API-first SaaS delivery, rising demand for biometric authentication and digital wallets, sector-specific growth in BFSI, e-commerce, and government services, revenue segmentation by deployment model, integration with AI/ML, AR/VR, and digital twin technologies, regional trends shaped by compliance mandates and digital transformation initiatives, and innovations in behavioral biometrics, orchestration, and decentralized identity frameworks. |

The Global Digital Identity Services Market is estimated to be valued at USD 28,504.4 million in 2025.

The market size for the Global Digital Identity Services Market is projected to reach USD 86,541.2 million by 2035.

The Global Digital Identity Services Market is expected to grow at a CAGR of 11.7% between 2025 and 2035.

The key service types in the Global Digital Identity Services Market are identity verification & KYC/AML, authentication & access, fraud detection & risk scoring, identity orchestration & workflow, and credential issuance & wallet.

In terms of delivery model, API-first SaaS is expected to command the largest share of 63.8% in the Global Digital Identity Services Market in 2025.

Our Research Products

The "Full Research Suite" delivers actionable market intel, deep dives on markets or technologies, so clients act faster, cut risk, and unlock growth.

The Leaderboard benchmarks and ranks top vendors, classifying them as Established Leaders, Leading Challengers, or Disruptors & Challengers.

Locates where complements amplify value and substitutes erode it, forecasting net impact by horizon

We deliver granular, decision-grade intel: market sizing, 5-year forecasts, pricing, adoption, usage, revenue, and operational KPIs—plus competitor tracking, regulation, and value chains—across 60 countries broadly.

Spot the shifts before they hit your P&L. We track inflection points, adoption curves, pricing moves, and ecosystem plays to show where demand is heading, why it is changing, and what to do next across high-growth markets and disruptive tech

Real-time reads of user behavior. We track shifting priorities, perceptions of today’s and next-gen services, and provider experience, then pace how fast tech moves from trial to adoption, blending buyer, consumer, and channel inputs with social signals (#WhySwitch, #UX).

Partner with our analyst team to build a custom report designed around your business priorities. From analysing market trends to assessing competitors or crafting bespoke datasets, we tailor insights to your needs.

Supplier Intelligence

Discovery & Profiling

Capacity & Footprint

Performance & Risk

Compliance & Governance

Commercial Readiness

Who Supplies Whom

Scorecards & Shortlists

Playbooks & Docs

Category Intelligence

Definition & Scope

Demand & Use Cases

Cost Drivers

Market Structure

Supply Chain Map

Trade & Policy

Operating Norms

Deliverables

Buyer Intelligence

Account Basics

Spend & Scope

Procurement Model

Vendor Requirements

Terms & Policies

Entry Strategy

Pain Points & Triggers

Outputs

Pricing Analysis

Benchmarks

Trends

Should-Cost

Indexation

Landed Cost

Commercial Terms

Deliverables

Brand Analysis

Positioning & Value Prop

Share & Presence

Customer Evidence

Go-to-Market

Digital & Reputation

Compliance & Trust

KPIs & Gaps

Outputs

Full Research Suite comprises of:

Market outlook & trends analysis

Interviews & case studies

Strategic recommendations

Vendor profiles & capabilities analysis

5-year forecasts

8 regions and 60+ country-level data splits

Market segment data splits

12 months of continuous data updates

DELIVERED AS:

PDF EXCEL ONLINE

Understanding Market Share Trends in Travelers Identity Protection

Travelers Identity Protection Services Market Analysis by Service Type, by Subscription Model, by End User , by Nationality and by Region - Forecast for 2025 to 2035

Digital Hall Effect Gaussmeter Market Size and Share Forecast Outlook 2025 to 2035

Digital Group Dining Service Market Size and Share Forecast Outlook 2025 to 2035

Digital Pathology Displays Market Size and Share Forecast Outlook 2025 to 2035

Digital Rights Management Market Size and Share Forecast Outlook 2025 to 2035

Digital Liquid Filling Systems Market Size and Share Forecast Outlook 2025 to 2035

Digital Transformation Industry Analysis in MENA Size and Share Forecast Outlook 2025 to 2035

Digital X-Ray Equipment Market Size and Share Forecast Outlook 2025 to 2035

Digital Marketing Analytics Industry Analysis in Latin America Forecast Outlook 2025 to 2035

Digital Health Market Forecast and Outlook 2025 to 2035

Digital Pen Market Forecast and Outlook 2025 to 2035

Digital X-ray Market Size and Share Forecast Outlook 2025 to 2035

Digital Elevation Model Market Size and Share Forecast Outlook 2025 to 2035

Digital Pump Controller Market Size and Share Forecast Outlook 2025 to 2035

Digital Textile Printing Market Size and Share Forecast Outlook 2025 to 2035

Digital Printing Paper Market Size and Share Forecast Outlook 2025 to 2035

Digital Battlefield Market Size and Share Forecast Outlook 2025 to 2035

Digital Product Passport Software Market Size and Share Forecast Outlook 2025 to 2035

Digital Lending Platform Market Size and Share Forecast Outlook 2025 to 2035

Thank you!

You will receive an email from our Business Development Manager. Please be sure to check your SPAM/JUNK folder too.

Chat With

MaRIA