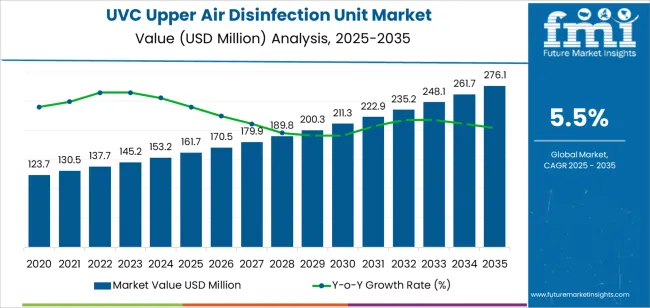

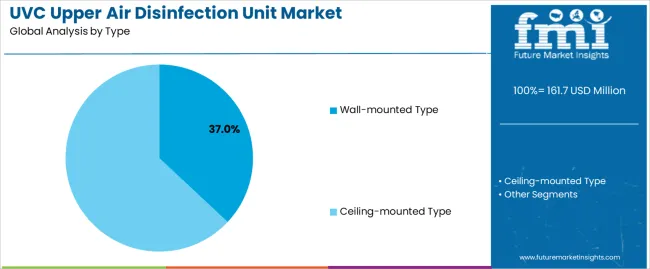

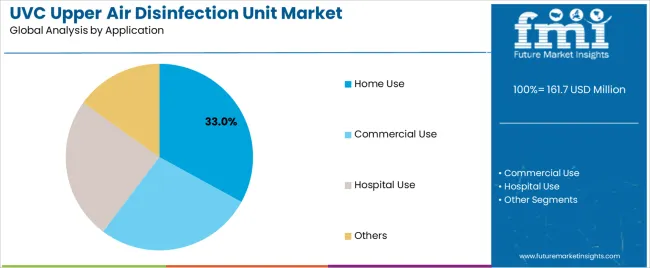

The UVC upper air disinfection unit market expands from USD 161.7 million in 2025 to USD 276.1 million by 2035, growing at a CAGR of 5.5%. Demand increases as hospitals, commercial buildings, schools, and transport hubs adopt continuous airborne-pathogen control systems that operate safely in occupied rooms. Growth from 2025 to 2030 lifts revenue from USD 161.7 million to USD 211.3 million, supported by rising deployment of units delivering 1.5–3.0 W/m² UVC intensity, with lamp lifespans of 9,000–12,000 hours and shielding designs that maintain occupant safety. From 2030 to 2035, revenue increases further, from USD 211.3 million to USD 276.1 million, as institutional retrofits become more common, driving installation volumes higher. Wall-mounted units lead with a 37.0% share due to their flexible placement and compatibility with compact indoor environments, while home use accounts for 33.0% of application demand, reflecting growing interest in continuous indoor air sanitation.

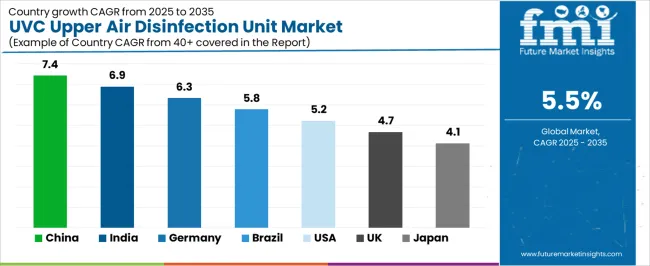

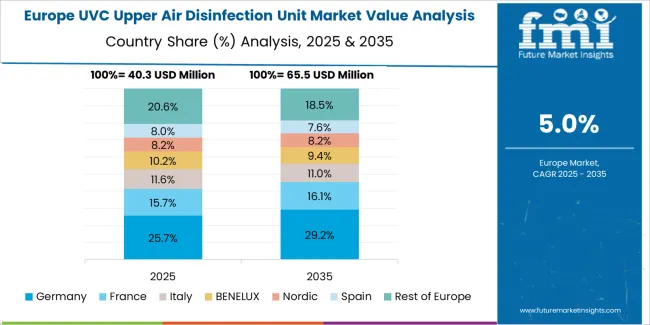

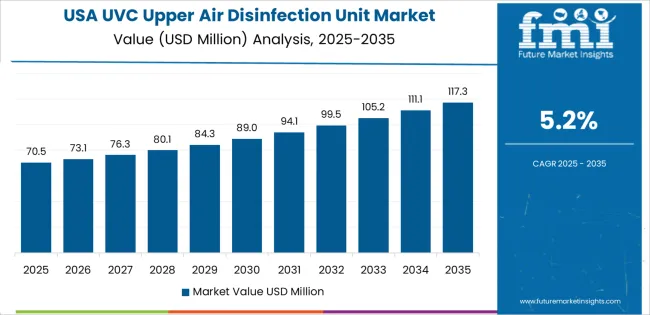

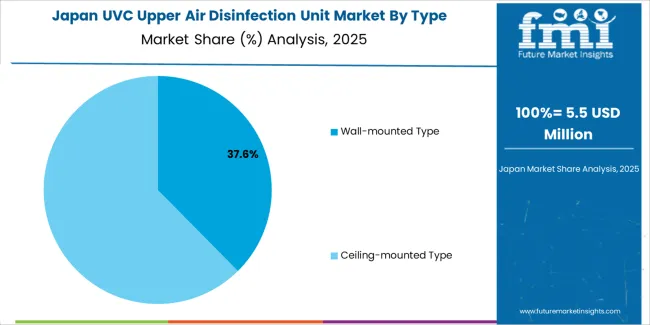

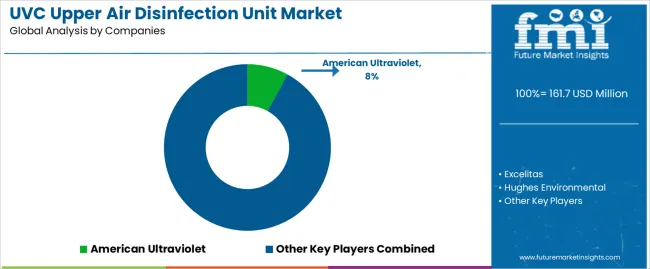

Regional expansion is strongest in China at 7.4% CAGR, followed by India at 6.9% and Germany at 6.3%, supported by healthcare upgrades, indoor-air-quality regulations, and greater use of UVC in public buildings. Brazil grows at 5.8%, the USA at 5.2%, the UK at 4.7%, and Japan at 4.1%, driven by steady procurement across hospitals, airports, classrooms, and senior-care settings. Competitive activity involves American Ultraviolet, Excelitas, Hughes Environmental, INPRO Technologies, Lena Lighting, LightProgress, LightSources, Lumalier, UVGI, Philips, Puro Lighting, Tool Klean, Ultravation, and UltraViolet Devices Inc, with differentiation based on reflector geometry, UVC output stability, shielding accuracy, and integration with ventilation patterns.

Between 2025 and 2030, the UVC Upper Air Disinfection Unit Market is projected to grow from USD 161.7 million to USD 211.3 million, with global unit deployment rising from approximately 170.5 thousand units to 211.3 thousand units. The growth volatility index (GVI) during this period is 1.1, indicating a stable acceleration phase supported by increasing adoption of airborne pathogen-control systems across hospitals, commercial buildings, transportation hubs, and high-occupancy indoor environments. Demand is driven by UVC intensity requirements in the 1.5-3.0 W/m² range, lamp lifecycles exceeding 9,000-12,000 hours, and improved shielding designs that maintain safe exposure levels while maximizing upper-air circulation. Rising emphasis on HVAC-integrated disinfection and high-ceiling deployment zones will further influence equipment specifications. North America, Europe, and East Asia together will account for more than 60% of incremental demand driven by strong infrastructure modernization initiatives.

From 2030 to 2035, the market is expected to expand from USD 211.3 million to USD 276.1 million, with annual installations rising to approximately 261.7-276.1 thousand units. The GVI decreases to 0.9, signaling a mild deceleration as large institutional buyers stabilize procurement cycles and retrofitting activities become more common than first-time deployments. Growth will continue to benefit from advances in low-mercury UVC lamps, higher-output LED-based emitters, and more efficient reflector geometries that improve irradiance distribution. Production capacity additions in South Asia and Eastern Europe are projected to contribute 10-12 % of global supply expansion, supporting both public-sector and commercial adoption.

| Metric | Value |

|---|---|

| Market Value (2025) | USD 161.7 million |

| Market Forecast Value (2035) | USD 276.1 million |

| Forecast CAGR (2025 to 2035) | 5.5% |

Demand for UVC upper air disinfection units is increasing as facilities seek continuous, passive air sanitation to reduce transmission of airborne pathogens. These units use ultraviolet-C irradiation targeted at the upper room zone, where airflow carries contaminated aerosols into the disinfecting field. Hospitals, clinics, schools, and transport hubs adopt upper air systems to supplement HVAC filtration and improve room-level air turnover without disrupting occupant activity. Manufacturers refine lamp geometry, baffle design, and wavelength stability to maintain consistent germicidal output while preventing downward UVC exposure. Growing emphasis on indoor air quality standards, along with renewed investment in infection-control infrastructure, supports steady global market expansion across both new installations and retrofit projects.

Growth is also influenced by advances in low-mercury and LED-based UVC sources that improve energy efficiency, service life, and maintenance predictability. Engineering refinements in luminaire shielding and airflow modeling help operators maximize pathogen inactivation while meeting occupational safety guidelines. Commercial buildings, long-term care facilities, and high-density public venues deploy upper air systems to maintain continuous disinfection where mechanical ventilation is limited or unreliable. Manufacturers integrate monitoring sensors, hour-meter tracking, and remote status reporting to simplify compliance documentation for facility managers. Although installation and validation costs remain challenges for smaller organizations, increased public awareness of aerosol transmission and the need for dependable, non-chemical disinfection strengthen long-term adoption of UVC upper air units across global indoor environments.

The UVC upper air disinfection unit market is segmented by type, application, and region. By type, the market is divided into wall-mounted units and ceiling-mounted units. Based on application, it is categorized into home use, commercial use, hospital use, and others. Regionally, the market is segmented into North America, Europe, East Asia, South Asia, Latin America, and the Middle East & Africa. These divisions reflect installation preferences, indoor airflow characteristics, and regional demand for upper-room germicidal systems across residential and institutional environments.

The wall-mounted type segment accounts for approximately 37.0% of the global UVC upper air disinfection unit market in 2025, making it the leading type category. This position is supported by the ease of installation, modest power requirements, and suitability for compact indoor spaces where stable upper-room air circulation can be achieved without extensive ceiling modifications. Wall-mounted units are widely used in small residences, classrooms, office suites, and waiting rooms where mounting flexibility and straightforward maintenance routines are priorities.

Manufacturers develop these units with adjustable louvers, optimized lamp positioning, and shielded designs that restrict UVC exposure to the upper air zone while allowing continuous operation in occupied rooms. Their compact form factors are well suited to retrofit projects, especially in regions where building structures limit ceiling height or access. Adoption is strong in North America and Europe, where demand for localized air disinfection solutions remains steady across public and private facilities. The segment’s leadership is reinforced by its combination of installation convenience, cost efficiency, and effective upper-air irradiation performance that meets routine indoor sanitation requirements.

The home use segment represents about 33.0% of the total UVC upper air disinfection unit market in 2025, making it the largest application category. This leadership is linked to rising interest in continuous indoor air sanitation, particularly in bedrooms, living areas, and shared residential spaces where stable airflow patterns support upper-room disinfection effectiveness. Home users adopt these units to reduce airborne microbial loads in environments where ventilation is limited or inconsistent, and where silent, low-interference operation is valued.

Manufacturers design household models with compact housings, low-noise ballasts, and simplified lamp replacement systems suitable for non-technical users. Growth is supported by expanding awareness of airborne transmission risks and increased willingness among homeowners to invest in permanent air-quality devices. Regions such as North America and East Asia exhibit strong adoption due to high urban population density and greater prevalence of sealed indoor environments. Home use also benefits from retail availability and straightforward purchase channels, enabling broader access compared with institutional procurement processes. The segment continues to lead the market because domestic settings constitute a large installed base where upper-air UVC devices provide practical, continuous air sanitation with minimal user intervention.

The UVC upper air disinfection unit market is expanding as facilities seek continuous airborne pathogen control in occupied spaces. These ceiling- or wall-mounted units circulate room air through an upper-zone UVC field, reducing microbial load without disrupting normal activity. Growth is supported by wider adoption of indoor air-quality strategies in healthcare, education, transport hubs and commercial buildings. Demand is reinforced by interest in non-chemical disinfection and ongoing infection-control protocols. Constraints include high procurement cost, installation requirements, and the need for proper shielding and airflow design. Manufacturers are developing quieter, energy-efficient units with verified performance and simpler integration options.

Demand increases as organisations prioritise airborne infection reduction in high-occupancy environments. Upper-air UVC units offer continuous operation during normal room use, making them well suited for clinics, classrooms, offices and shelters. Requirements for improved ventilation often exceed what HVAC systems can provide alone, leading facilities to adopt layered air-quality approaches that include UVC. As more institutions implement long-term pathogen-control measures rather than short-term responses, interest in fixed upper-air installations continues to rise, strengthening overall market uptake.

Adoption is moderated by initial cost, installation complexity and the need for trained personnel to position fixtures safely. Units must be installed at appropriate heights with controlled airflow patterns to prevent occupant exposure to direct UVC. Some older buildings may lack ceiling clearance or suitable ventilation dynamics. Budget-constrained facilities may prioritise simpler filtration options. Performance validation and routine maintenance, including lamp replacement and calibration, add ongoing costs. These barriers slow market penetration in settings lacking technical expertise or capital investment.

Trends include compact units with improved reflectors, LEDs with longer operating life and reduced energy consumption, and systems designed for faster installation in existing buildings. Digital monitoring of lamp hours and airflow patterns is becoming more common, supporting maintenance planning and safety assurance. Facilities increasingly seek units tested under standardized protocols to verify real-world disinfection capability. Growth is also notable in education and public-transport sectors, where permanent air-quality upgrades are being prioritised. As UVC LED technology matures, products with lower heat output and extended service life are expected to expand market adoption.

| Country | CAGR (%) |

|---|---|

| China | 7.4% |

| India | 6.9% |

| Germany | 6.3% |

| Brazil | 5.8% |

| USA | 5.2% |

| UK | 4.7% |

| Japan | 4.1% |

The UVC Upper Air Disinfection Unit Market is expanding steadily worldwide, with China leading at a 7.4% CAGR through 2035, driven by heightened public health awareness, large-scale installation in commercial buildings, and advancements in UV-C LED technologies. India follows at 6.9%, supported by hospital infrastructure upgrades, increased adoption of airborne infection control systems, and government health safety programs. Germany records 6.3%, reflecting strict air quality regulations, high engineering standards, and widespread use of UV-C solutions in healthcare and public facilities. Brazil grows at 5.8%, benefiting from improved healthcare investments and rising demand for efficient disinfection systems. The USA, at 5.2%, remains a strong market emphasizing innovation, safety certifications, and integration with HVAC systems, while the UK (4.7%) and Japan (4.1%) focus on energy-efficient UV-C designs, compact installations, and enhanced pathogen inactivation performance.

China is witnessing rising demand in the UVC upper air disinfection unit market, projected to grow at a CAGR of 7.4% through 2035. Expanded use of infection-control technologies across hospitals, transport hubs, schools, and commercial buildings is increasing large-area UVC installations. Domestic producers focus on lamp output stability, fixture spacing accuracy, and controlled exposure zones. Heightened attention to indoor air quality across dense metropolitan regions reinforces procurement. Infrastructure upgrades across public buildings continue to support broader deployment of upper-air disinfection systems.

India is observing firm expansion in the UVC upper air disinfection unit market, advancing at a CAGR of 6.9% through 2035. Increased use of ultraviolet air-treatment systems across hospitals, educational institutions, and corporate offices supports recurring procurement. Local producers refine ballast performance, wavelength consistency, and fixture durability. Rising focus on airborne infection control during high-occupancy operations contributes to steady uptake. Growth in healthcare construction and modernization programs encourages integration of upper-air UVC devices across multiple facility types.

Across Germany, the UVC upper air disinfection unit market is progressing at a CAGR of 6.3%, guided by engineering precision and strong building-safety standards. Producers emphasize uniform irradiance, optimized upper-zone airflow, and durable fixture materials. Hospitals, laboratories, and long-term care facilities continue expanding airborne-pathogen controls. Integration of advanced reflectors and controlled beam angles improves operational reliability. Research-driven indoor-air programs reinforce equipment adoption across high-occupancy environments.

Brazil is showing steady progress in the UVC upper air disinfection unit market, expected to grow at a CAGR of 5.8% through 2035. Increased adoption across clinics, public offices, and transit facilities supports broader installation. Local distributors collaborate with global manufacturers to expand access to high-output UVC fixtures. Facility upgrades in major cities encourage adoption of upper-layer air-treatment solutions. Improved component reliability and fixture alignment support consistent performance across varied environmental conditions.

In the United States, the UVC upper air disinfection unit market is expanding at a CAGR of 5.2% through 2035. Hospitals, airports, schools, and corporate facilities increasingly deploy UVC units to reduce airborne pathogen loads. Manufacturers refine lamp efficiency, shield design, and airflow channeling to maintain controlled exposure. Indoor-air improvement programs across federal and private buildings support regular procurement. Growth in engineering evaluations of UVC-based air-treatment performance reinforces long-term adoption.

Across the United Kingdom, the UVC upper air disinfection unit market is rising at a CAGR of 4.7% through 2035. High-occupancy spaces in healthcare, transport, and office buildings increasingly incorporate UVC air layers to improve airborne pathogen control. Manufacturers concentrate on compact fixture profiles, glare-shield accuracy, and stable ultraviolet output. Upgrades across public buildings and local health networks support adoption. Broad use in waiting rooms, corridors, and shared indoor areas encourages ongoing installations.

Japan is experiencing measured growth in the UVC upper air disinfection unit market, expected to rise at a CAGR of 4.1% through 2035. Hospitals, senior-care facilities, and transit stations integrate upper-air UVC units to improve air treatment in congested spaces. Domestic producers emphasize stable lamp life, controlled beam widths, and low-noise airflow assistance. Increased application across clinics and laboratories reinforces equipment turnover. Improved reflector geometry and durable housing materials strengthen system reliability.

The global UVC upper air disinfection unit market shows moderate concentration, led by manufacturers supplying germicidal systems for healthcare, commercial, and institutional environments. American Ultraviolet maintains a strong position through standardized upper-room fixtures designed for stable UVC output and continuous microbial reduction in occupied spaces. Excelitas, Hughes Environmental, and INPRO Technologies support the high-performance segment with units engineered to deliver controlled irradiance and consistent airflow interaction. Lena Lighting, LightProgress, LightSources, and Lumalier contribute established expertise in UVC lamp design and fixture engineering for schools, offices, and transit hubs. UVGI and Philips sustain market presence with tested germicidal lamps and scalable installation formats aligned with indoor air-quality requirements. Across these manufacturers, competition is influenced by optical performance, fixture durability, and compliance with recognized safety guidelines.

Puro Lighting, Tool Klean, Ultravation, and UltraViolet Devices, Inc expand market diversity by offering energy-efficient upper-air fixtures with enhanced lamp lifespans and simplified maintenance. These companies emphasize reliability under continuous operation and compatibility with building ventilation patterns. The broader competitive landscape is shaped by validated pathogen-reduction efficacy, ease of integration into existing ceiling or wall structures, and the ability to maintain safe UVC exposure levels for occupants. Strategic differentiation relies on refined reflector geometry, sensor-based operational safeguards, and reduced power consumption. As facilities seek long-term airborne infection-control solutions, manufacturers with strong optical engineering, robust quality assurance, and proven performance data are positioned to strengthen global adoption of upper-air UVC disinfection systems.

| Items | Values |

|---|---|

| Quantitative Units (2025) | USD million |

| Type / Classification | Wall-mounted units, Ceiling-mounted units |

| Application | Home use, Commercial use, Hospital use, Others |

| Regions Covered | East Asia, Europe, North America, South Asia, Latin America, Middle East & Africa, Eastern Europe |

| Countries Covered | China, India, Germany, Brazil, USA, UK, Japan, and 40+ additional countries |

| Key Companies Profiled | American Ultraviolet, Excelitas, Hughes Environmental, INPRO Technologies, Lena Lighting, LightProgress, LightSources, Lumalier, UVGI, Philips, Puro Lighting, Tool Klean, Ultravation, UltraViolet Devices Inc. |

| Additional Attributes | Dollar sales by type & application; unit shipments by installation format; mounting height & room-volume suitability; UVC lamp/LED characteristics (irradiance W/m², wavelength stability, lifecycle hours); shielding & safety compliance (exposure limits, beam control); airflow modeling requirements; retrofit vs new-installation split; maintenance intervals & cost profiles; IoT/remote monitoring capabilities (lamp hours, irradiance alerts); integration with ventilation/HVAC; case-study examples in healthcare, commercial, and residential deployments. |

The global UVC upper air disinfection unit market is estimated to be valued at USD 161.7 million in 2025.

The market size for the UVC upper air disinfection unit market is projected to reach USD 276.1 million by 2035.

The UVC upper air disinfection unit market is expected to grow at a 5.5% CAGR between 2025 and 2035.

The key product types in UVC upper air disinfection unit market are wall-mounted type and ceiling-mounted type.

In terms of application, home use segment to command 33.0% share in the UVC upper air disinfection unit market in 2025.

Our Research Products

The "Full Research Suite" delivers actionable market intel, deep dives on markets or technologies, so clients act faster, cut risk, and unlock growth.

The Leaderboard benchmarks and ranks top vendors, classifying them as Established Leaders, Leading Challengers, or Disruptors & Challengers.

Locates where complements amplify value and substitutes erode it, forecasting net impact by horizon

We deliver granular, decision-grade intel: market sizing, 5-year forecasts, pricing, adoption, usage, revenue, and operational KPIs—plus competitor tracking, regulation, and value chains—across 60 countries broadly.

Spot the shifts before they hit your P&L. We track inflection points, adoption curves, pricing moves, and ecosystem plays to show where demand is heading, why it is changing, and what to do next across high-growth markets and disruptive tech

Real-time reads of user behavior. We track shifting priorities, perceptions of today’s and next-gen services, and provider experience, then pace how fast tech moves from trial to adoption, blending buyer, consumer, and channel inputs with social signals (#WhySwitch, #UX).

Partner with our analyst team to build a custom report designed around your business priorities. From analysing market trends to assessing competitors or crafting bespoke datasets, we tailor insights to your needs.

Supplier Intelligence

Discovery & Profiling

Capacity & Footprint

Performance & Risk

Compliance & Governance

Commercial Readiness

Who Supplies Whom

Scorecards & Shortlists

Playbooks & Docs

Category Intelligence

Definition & Scope

Demand & Use Cases

Cost Drivers

Market Structure

Supply Chain Map

Trade & Policy

Operating Norms

Deliverables

Buyer Intelligence

Account Basics

Spend & Scope

Procurement Model

Vendor Requirements

Terms & Policies

Entry Strategy

Pain Points & Triggers

Outputs

Pricing Analysis

Benchmarks

Trends

Should-Cost

Indexation

Landed Cost

Commercial Terms

Deliverables

Brand Analysis

Positioning & Value Prop

Share & Presence

Customer Evidence

Go-to-Market

Digital & Reputation

Compliance & Trust

KPIs & Gaps

Outputs

Full Research Suite comprises of:

Market outlook & trends analysis

Interviews & case studies

Strategic recommendations

Vendor profiles & capabilities analysis

5-year forecasts

8 regions and 60+ country-level data splits

Market segment data splits

12 months of continuous data updates

DELIVERED AS:

PDF EXCEL ONLINE

UVC Disinfection Product Market Report – Demand, Trends & Forecast 2025–2035

UVC Surface Disinfection System Market Size and Share Forecast Outlook 2025 to 2035

Upper Limb Prosthetics Market Size and Share Forecast Outlook 2025 to 2035

Upper Respiratory Tract Infection Treatment Market

United States Hand Holes Market Size and Share Forecast Outlook 2025 to 2035

United States Walk-in Cooler and Freezer Market Size and Share Forecast Outlook 2025 to 2035

United States Commercial Refrigeration Equipment Market Forecast and Outlook 2025 to 2035

United States Dog Toys Market Size and Share Forecast Outlook 2025 to 2035

United States Biodegradable Cups and Lids Market Size and Share Forecast Outlook 2025 to 2035

United States Green Tea Supplement Market Size and Share Forecast Outlook 2025 to 2035

United States Hispanic Novelties Market Size and Share Forecast Outlook 2025 to 2035

United States Scented Garbage Bags Market Size and Share Forecast Outlook 2025 to 2035

United States and Canada Tray Sealing Machines Market Size and Share Forecast Outlook 2025 to 2035

United States Label Release Liner Market Size and Share Forecast Outlook 2025 to 2035

United States Beetroot Supplement Market Size and Share Forecast Outlook 2025 to 2035

United States Garbage Bags Market Size and Share Forecast Outlook 2025 to 2035

United States Digital Ovulation Test Kits Market Size and Share Forecast Outlook 2025 to 2035

United States Sports Tourism Market Size and Share Forecast Outlook 2025 to 2035

United States of America Digital Pregnancy Test Kits Market Size and Share Forecast Outlook 2025 to 2035

United States & Canada Pest Control Services Market Size and Share Forecast Outlook 2025 to 2035

Thank you!

You will receive an email from our Business Development Manager. Please be sure to check your SPAM/JUNK folder too.

Chat With

MaRIA