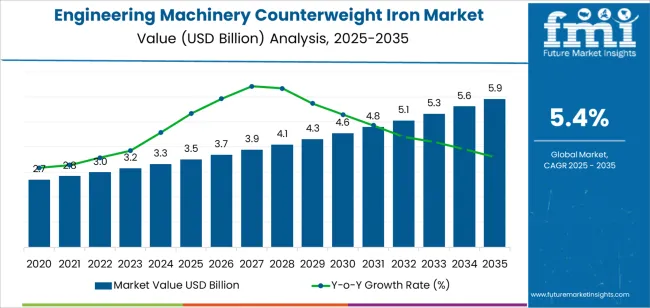

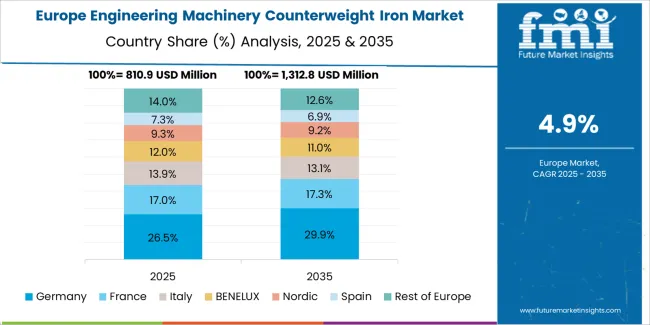

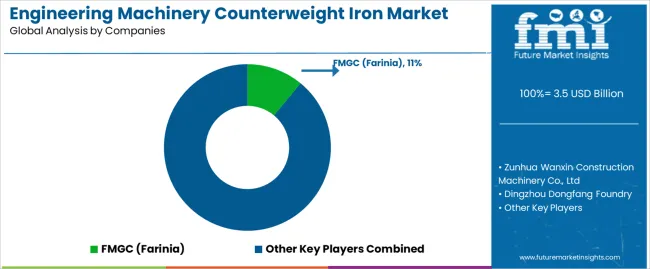

The engineering machinery counterweight iron market is valued at USD 3.5 billion in 2025 and is projected to reach USD 5.9 billion by 2035, creating an absolute opportunity of USD 2.4 billion while advancing at a 5.4% CAGR. Growth unfolds in two clear phases, with the market increasing from USD 3.5 billion to USD 4.5 billion between 2025 and 2030, adding USD 1.0 billion or 45.5% of total decade expansion, and then rising from USD 4.5 billion to USD 5.9 billion between 2030 and 2035, adding USD 1.4 billion or 54.5%. Asia Pacific remains the dominant region, supported by strong construction, mining and industrial equipment output, while North America and Europe benefit from fleet modernization and replacement cycles.

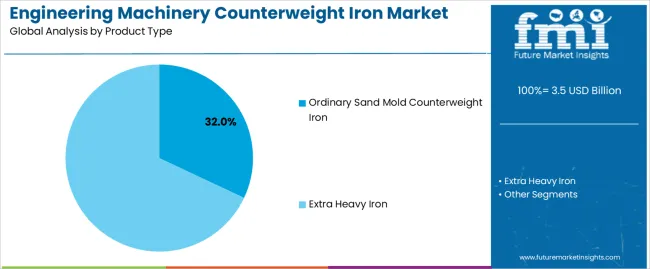

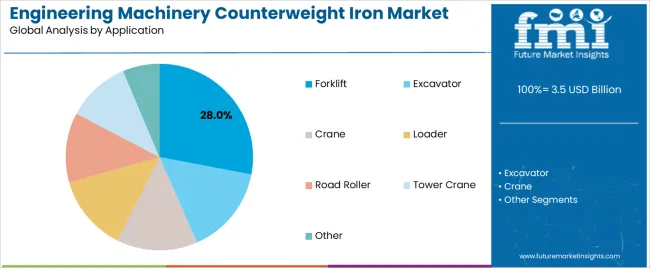

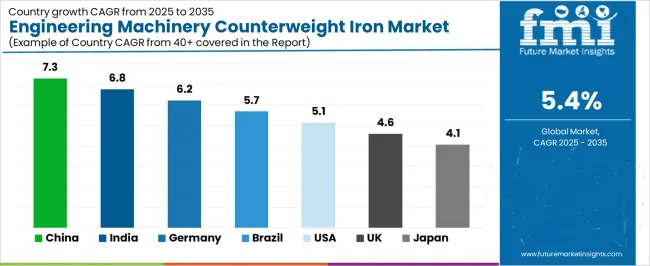

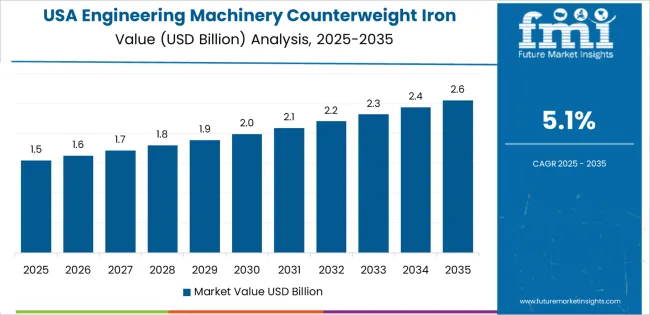

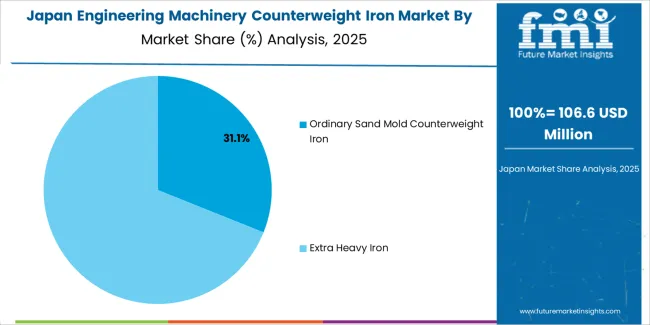

Ordinary sand mold counterweight iron leads product share at about 32%, and forklifts represent the largest application segment at approximately 28%. Country-level growth is led by China at 7.3%, followed by India at 6.8% and Germany at 6.2%, with the USA posting 5.1% and the UK 4.6%. Demand is supported by rising equipment production, increased use of cranes, excavators and loaders, and improvements in casting density, corrosion resistance and modular design. Challenges include iron-ore price fluctuations, long foundry lead times and competition from alternative counterweight materials, though suppliers continue to mitigate risks through digital casting simulation, alloy refinement and automated molding systems. Leading players such as FMGC, Zunhua Wanxin, Dingzhou Dongfang, Blackwood and SIC Lazaro are strengthening production efficiency and supply-chain capacity to capture expanding global demand.

Asia Pacific remains the dominant market, supported by continuous investment in urban expansion and industrial projects across China, India, and Southeast Asia. North America and Europe sustain steady growth through replacement demand and the modernization of construction fleets. By 2035, improvements in material efficiency, production automation, and compliance with equipment safety standards are expected to shape long-term competitiveness and manufacturing scalability in the counterweight iron segment.

Between 2025 and 2030, the Engineering Machinery Counterweight Iron Market is expected to expand from USD 3.5 billion to USD 4.5 billion, generating an absolute dollar opportunity of USD 1.0 billion, which represents 45.5% of the decade’s total projected growth. This growth will be primarily driven by rising infrastructure development, mining operations, and construction equipment demand across emerging economies. The increasing use of cranes, excavators, loaders, and forklifts will boost the need for precision-engineered counterweight systems that enhance equipment stability and safety. Manufacturers are focusing on optimizing material density, corrosion resistance, and casting efficiency to reduce production costs and improve durability.

From 2030 to 2035, the market is projected to rise from USD 4.5 billion to USD 5.9 billion, adding an absolute dollar opportunity of USD 1.4 billion, accounting for 54.5% of the decade’s total expansion. Growth in this phase will be supported by the growing shift toward hybrid and electric construction machinery, which requires customized counterweight designs for optimal load balancing. Increasing automation in manufacturing and the adoption of high-precision casting technologies will further enhance production scalability. Strategic alliances among foundries, OEMs, and material suppliers will drive innovation in eco-friendly and performance-optimized counterweight iron solutions for next-generation engineering machinery.

| Metric | Value |

|---|---|

| Market Value (2025) | USD 3.5 billion |

| Market Forecast Value (2035) | USD 5.9 billion |

| Forecast CAGR (2025–2035) | 5.4% |

The engineering machinery counterweight iron market is expanding as manufacturers of construction, lifting, and material-handling equipment prioritize stability and operational balance in heavy-duty applications. Counterweight irons, commonly integrated into cranes, excavators, and loaders, provide mechanical equilibrium by offsetting load torque and reducing structural stress. The increasing scale of infrastructure development projects across Asia-Pacific, the Middle East, and Africa sustains demand for large equipment fitted with precision-cast or modular counterweights. Manufacturers focus on optimizing casting density, dimensional accuracy, and corrosion resistance through improved metallurgical processes and automated foundry systems. These refinements ensure consistent performance and extended service life in demanding site conditions.

Market growth is reinforced by rising equipment production volumes and the transition toward standardized component manufacturing across global supply chains. The preference for iron-based counterweights, due to their cost-effectiveness and recyclability, continues despite the emergence of composite alternatives. Continuous investment in mining, road construction, and port logistics supports steady consumption levels among original equipment manufacturers and aftermarket suppliers. Challenges related to raw material price fluctuations and transportation costs persist but are offset by stable procurement agreements and regional foundry expansion. As machinery designs evolve toward higher lifting capacities and compact configurations, demand for durable, high-density counterweight iron components remains consistently strong worldwide.

The engineering machinery counterweight iron market is segmented by product type, application, and region. By product type, the market is divided into ordinary sand mold counterweight iron and extra heavy iron. Based on application, it is categorized into forklift, excavator, crane, loader, road roller, tower crane, and others. Regionally, the market is segmented into North America, Europe, East Asia, South Asia, Latin America, and the Middle East & Africa. These segments define manufacturing characteristics, equipment integration patterns, and regional demand distribution across heavy machinery industries.

The ordinary sand mold counterweight iron segment accounts for approximately 32.0% of the global engineering machinery counterweight iron market in 2025, representing the leading product category. Its dominance reflects the continued preference for sand-cast manufacturing processes that provide cost efficiency, design flexibility, and compatibility with a wide range of machinery models. Ordinary sand mold castings allow precise shaping and effective mass distribution, making them suitable for balancing equipment across multiple industrial applications.

The segment benefits from established foundry infrastructure and standardized production methods that support scalability for both large and small equipment components. Manufacturers favor sand mold counterweights for forklifts, loaders, and compact cranes due to lower tooling costs and shorter production cycles. The materials used in this segment typically offer adequate density and mechanical strength to ensure operational stability during machine operation. Market demand is reinforced by the growth of medium-duty construction and material handling equipment, particularly in East Asia and South Asia. The ordinary sand mold counterweight iron segment remains the industry’s foundation, providing dependable performance and affordability for diverse engineering machinery categories.

The forklift segment represents about 28.0% of the total engineering machinery counterweight iron market in 2025, making it the largest application category. This dominance is driven by the widespread use of counterweights in forklift structures to maintain balance and ensure load stability during lifting operations. Counterweight irons are integral to forklift design, compensating for load displacement and enabling precise handling across manufacturing, logistics, and warehousing operations.

Demand from the forklift sector is reinforced by expanding industrial warehousing and e-commerce distribution centers worldwide. Manufacturers emphasize the use of high-density iron materials to reduce counterweight volume while maintaining structural integrity. Sand casting and modular fabrication processes remain common due to their adaptability to varying forklift models and design specifications. Growth in electric and compact forklift production has further sustained the requirement for optimized counterweight configurations that enhance maneuverability without compromising safety. Regional demand is concentrated in East Asia, supported by extensive manufacturing output and logistics infrastructure expansion. The forklift segment continues to dominate market demand, reflecting the essential role of counterweight components in ensuring stability and efficiency within material handling and warehouse equipment operations.

The engineering machinery counterweight iron market is evolving as construction, mining, and material-handling equipment demand increasingly rigorous stability and safety standards. Machines such as excavators, cranes, and forklifts require precise counterweight systems to balance heavy loads and maintain operational integrity; iron castings continue to dominate due to cost-effectiveness and manufacturability. Growth is driven by rising infrastructure investment, equipment modernization, and strict safety norms in emerging markets. However, the market is held back by raw material price volatility, manufacturing complexity and competition from alternative weight systems. Manufacturers are responding with custom-designed iron counterweights, advanced casting techniques and improved supply-chain resilience.

Rapid growth in infrastructure projects, urbanisation and industrial-machinery deployment underpins demand for counterweights. As firms invest in larger excavators, tower cranes and automated material-handling systems, the need for high-mass iron castings that optimise machine centre-of-gravity and stability increases. OEMs and component suppliers view the key USP as “precision-cast iron counterweights customised to machine model and load-specification, reducing retrofit modifications and improving commissioning time.” This ability to deliver machine-specific castings enhances value in a market where downtime and machine stability are critical.

One significant restraint is the fluctuation in iron-ore and scrap-metal costs which affects margins for foundries producing counterweights. Manufacturing large-mass iron castings also demands high capital equipment, long lead times and quality assurance to meet tight tolerance requirements. Some equipment manufacturers may substitute with steel, composite or modular ballast systems to avoid long-casting lead times, reducing iron-counterweight demand in certain applications. For fabricators, the USP lies in “fast-turnaround foundry services with stock-pooling and modular design options to mitigate lead-time risk for OEMs,” which helps overcome one of the major adoption barriers for machine builders.

Emerging trends include the use of higher-strength iron alloys, hybrid counterweight systems and integrated mounting interfaces to simplify installation and maintenance. Foundries are also investing in digital casting simulation, 3D-printed cores and modular segments that allow easier transport and onsite assembly. Additionally, regional supply-chains are shifting toward Asia-Pacific due to equipment manufacturing growth in China, India and Southeast Asia. For component suppliers, a compelling USP is “engineering-led counterweight design with digital validation and modular sub-assembly, enabling scalable production across global OEM platforms,” aligning with the trend toward global machine platforms and standardised components.

| Country | CAGR (%) |

|---|---|

| China | 7.3% |

| India | 6.8% |

| Germany | 6.2% |

| Brazil | 5.7% |

| USA | 5.1% |

| UK | 4.6% |

| Japan | 4.1% |

The engineering machinery counterweight iron market is expanding steadily worldwide, with China leading at a 7.3% CAGR through 2035, driven by rapid industrialization, large-scale infrastructure projects, and strong domestic production capacity. India follows at 6.8%, supported by increased construction equipment demand, government-backed infrastructure development, and manufacturing growth. Germany records a 6.2% CAGR, benefiting from engineering precision and innovation in durable heavy machinery components. Brazil grows at 5.7%, reflecting increased public works investments and modernization of construction fleets. The USA, at 5.1%, remains a stable market emphasizing technological refinement and equipment efficiency, while the UK (4.6%) and Japan (4.1%) sustain progress through automation in production, export-oriented manufacturing, and improved material performance in counterweight systems.

The report covers an in-depth analysis of 40+ countries top-performing countries are highlighted below.

China is witnessing rapid growth in the engineering machinery counterweight iron market, projected to expand at a CAGR of 7.3% through 2035. Strong infrastructure development and continuous investment in heavy machinery manufacturing are driving product demand. Counterweight iron usage is increasing in cranes, excavators, and forklifts due to rising construction and logistics activity. Domestic producers are emphasizing high-density casting, surface treatment, and modular design to enhance operational stability. The country’s growing export of construction equipment continues to strengthen its industrial base.

India is experiencing significant expansion in the engineering machinery counterweight iron market, advancing at a CAGR of 6.8%, supported by rapid industrialization and infrastructure modernization. Government initiatives under national infrastructure development programs are increasing the use of heavy machinery across construction and mining sectors. Domestic manufacturers are adopting advanced casting methods and precision molding to improve quality and production output. The rising number of industrial parks and road development projects is further sustaining equipment demand nationwide.

Across Germany, the engineering machinery counterweight iron market is advancing at a CAGR of 6.2%, supported by precision manufacturing standards and a mature engineering sector. Producers emphasize material consistency, dimensional accuracy, and enhanced surface finishing to meet high-performance machinery requirements. Demand remains strong in construction, port handling, and material transport applications. Continuous improvement in foundry automation and metallurgical control ensures durability and compliance with European quality benchmarks, supporting both domestic and export-driven sales.

Brazil is recording steady progress in the engineering machinery counterweight iron market, projected to grow at a CAGR of 5.7% through 2035. Recovery in construction and mining activity continues to support machinery procurement. Local producers are improving cost efficiency through recycling-based casting and modular mold systems. Collaborations with international manufacturers enhance technology transfer and material processing standards. Growth in agricultural and logistics equipment manufacturing further contributes to the stable demand for counterweight components.

In the United States, the engineering machinery counterweight iron market is increasing at a CAGR of 5.1%, supported by adoption of advanced manufacturing technologies and expansion in construction equipment production. Producers focus on optimized casting precision, improved material density, and weight distribution control. Growth in infrastructure investment and replacement of aging machinery fleets sustain procurement levels. Integration of high-performance iron alloys strengthens component life and overall equipment stability.

Across the United Kingdom, the engineering machinery counterweight iron market is advancing at a CAGR of 4.6%, supported by production optimization and consistent machinery refurbishment activity. Local manufacturers are focusing on improving casting accuracy and reducing material waste through digital foundry control systems. Expansion in urban construction projects continues to maintain machinery utilization. The push toward lightweight counterweights with optimized mass properties is improving product performance across mobile and stationary equipment.

Japan is growing steadily in the engineering machinery counterweight iron market, expected to rise at a CAGR of 4.1% through 2035. Domestic manufacturers emphasize precision casting and metallurgical refinement to produce compact, high-density counterweights for cranes, loaders, and forklifts. Automation in foundry operations improves quality consistency and productivity. Demand from advanced construction and logistics machinery supports stable production output. Ongoing innovation in alloy formulation enhances corrosion resistance and extends operational lifespan.

The global engineering machinery counterweight iron market is moderately fragmented, driven by established foundries and diversified casting manufacturers serving construction, agricultural, and industrial equipment sectors. FMGC (Farinia) holds a leading position through large-scale production of cast iron counterweights and advanced metallurgical processes that ensure consistent density and dimensional stability. Zunhua Wanxin Construction Machinery Co., Ltd and Dingzhou Dongfang Foundry contribute significant manufacturing capacity within China, emphasizing cost-effective production and reliable quality control. Blackwood, SIC Lazaro, and Gallizo maintain strong European presence through high-precision casting solutions tailored for cranes, excavators, and material-handling machinery. Max Iron and Swebor enhance competitiveness by producing custom-weight components with superior mechanical properties and surface finishing.

Tongling Rongteng Machinery Manufacturing, Qingzhou Aopuli Metal Material, and Jiahe County Dingchang Casting Industry Hardware Factory strengthen Asia’s production base through scalable foundry operations. Toyoseitetsu and China Runlong Industrial focus on specialized castings for OEM applications. Ondo Metal, Mars Metal, International Steel & Counterweights, and Ultraray Metals serve North American and European markets with engineered ballast solutions. Crescent Foundry, Konstanta, and Innotec provide mid-tier capabilities emphasizing quality consistency and international standards compliance. HEFEI RISEVER MACHINE, Ken Garner Manufacturing, KT-Foundry, Shanxi Huaxiang Group, SHANXI HUADE Smelting & Casting, and Beijing Famed Machinery contribute diverse regional output supporting heavy machinery assembly. Competition is shaped by casting precision, weight tolerance, and corrosion resistance, while long-term differentiation depends on material innovation, automation in foundry operations, and sustainable production practices.

| Items | Values |

|---|---|

| Quantitative Units (2025) | USD billion |

| Type (Product Classification) | Ordinary Sand Mold Counterweight Iron, Extra Heavy Iron |

| Application | Forklift, Excavator, Crane, Loader, Road Roller, Tower Crane, Others |

| Regions Covered | North America, Europe, East Asia, South Asia, Latin America, Middle East & Africa, Eastern Europe |

| Countries Covered | China, India, USA, Germany, Brazil, UK, Japan, and 40+ countries |

| Key Companies Profiled | FMGC (Farinia), Zunhua Wanxin Construction Machinery, Dingzhou Dongfang Foundry, Blackwood, SIC Lazaro, Gallizo, Max Iron, Swebor, Tongling Rongteng Machinery Manufacturing, Qingzhou Aopuli Metal Material, Jiahe County Dingchang Casting, Toyoseitetsu, China Runlong Industrial, Ondo Metal, Mars Metal, International Steel & Counterweights, Ultraray Metals, Crescent Foundry, Konstanta, Innotec, Hefei Risever Machine, Ken Garner Manufacturing, KT-Foundry, Shanxi Huaxiang Group, Shanxi Huade Smelting & Casting, Beijing Famed Machinery |

| Additional Attributes | Dollar sales by product and application categories; regional adoption across infrastructure, construction, and mining sectors; comparative cost and density analysis of iron vs composite counterweights; casting material and design innovation trends; foundry automation and digital casting technology; regional production capacity benchmarks; OEM–foundry collaboration models; competitive landscape by casting precision, corrosion resistance, and supply reliability; and regulatory alignment with international material and safety standards. |

The global engineering machinery counterweight iron market is estimated to be valued at USD 3.5 billion in 2025.

The market size for the engineering machinery counterweight iron market is projected to reach USD 5.9 billion by 2035.

The engineering machinery counterweight iron market is expected to grow at a 5.4% CAGR between 2025 and 2035.

The key product types in engineering machinery counterweight iron market are ordinary sand mold counterweight iron and extra heavy iron.

In terms of application, forklift segment to command 28.0% share in the engineering machinery counterweight iron market in 2025.

Our Research Products

The "Full Research Suite" delivers actionable market intel, deep dives on markets or technologies, so clients act faster, cut risk, and unlock growth.

The Leaderboard benchmarks and ranks top vendors, classifying them as Established Leaders, Leading Challengers, or Disruptors & Challengers.

Locates where complements amplify value and substitutes erode it, forecasting net impact by horizon

We deliver granular, decision-grade intel: market sizing, 5-year forecasts, pricing, adoption, usage, revenue, and operational KPIs—plus competitor tracking, regulation, and value chains—across 60 countries broadly.

Spot the shifts before they hit your P&L. We track inflection points, adoption curves, pricing moves, and ecosystem plays to show where demand is heading, why it is changing, and what to do next across high-growth markets and disruptive tech

Real-time reads of user behavior. We track shifting priorities, perceptions of today’s and next-gen services, and provider experience, then pace how fast tech moves from trial to adoption, blending buyer, consumer, and channel inputs with social signals (#WhySwitch, #UX).

Partner with our analyst team to build a custom report designed around your business priorities. From analysing market trends to assessing competitors or crafting bespoke datasets, we tailor insights to your needs.

Supplier Intelligence

Discovery & Profiling

Capacity & Footprint

Performance & Risk

Compliance & Governance

Commercial Readiness

Who Supplies Whom

Scorecards & Shortlists

Playbooks & Docs

Category Intelligence

Definition & Scope

Demand & Use Cases

Cost Drivers

Market Structure

Supply Chain Map

Trade & Policy

Operating Norms

Deliverables

Buyer Intelligence

Account Basics

Spend & Scope

Procurement Model

Vendor Requirements

Terms & Policies

Entry Strategy

Pain Points & Triggers

Outputs

Pricing Analysis

Benchmarks

Trends

Should-Cost

Indexation

Landed Cost

Commercial Terms

Deliverables

Brand Analysis

Positioning & Value Prop

Share & Presence

Customer Evidence

Go-to-Market

Digital & Reputation

Compliance & Trust

KPIs & Gaps

Outputs

Full Research Suite comprises of:

Market outlook & trends analysis

Interviews & case studies

Strategic recommendations

Vendor profiles & capabilities analysis

5-year forecasts

8 regions and 60+ country-level data splits

Market segment data splits

12 months of continuous data updates

DELIVERED AS:

PDF EXCEL ONLINE

Engineering Service Outsourcing Industry Analysis in North America Size and Share Forecast Outlook 2025 to 2035

Engineering Service Outsourcing Market Analysis - Size, Share, & Forecast Outlook 2025 to 2035

Engineering Analytics Market Growth & Demand 2025 to 2035

Engineering Plastic Market Analysis - Size, Share & Forecast 2025 to 2035

Geoengineering Market Analysis – Size, Demand & Forecast 2025 to 2035

Chaos Engineering Platform Market Size and Share Forecast Outlook 2025 to 2035

Civil Engineering Market Size and Share Forecast Outlook 2025 to 2035

Nuclear Engineering Service Market Size and Share Forecast Outlook 2025 to 2035

Network Engineering Service Market Trends – Demand & Forecast 2025 to 2035

Aerospace Engineering Services Outsourcing (ESO) Market Analysis - Size, Share, and Forecast Outlook (025 to 2035

3D Reverse Engineering Software Market Forecast and Outlook 2025 to 2035

Automotive Engineering Service Outsourcing Market Size and Share Forecast Outlook 2025 to 2035

Automotive Engineering Services Market Growth - Trends & Forecast 2025 to 2035

Computer-aided Engineering Market Analysis - Size, Share, and Forecast 2025 to 2035

Protein/Antibody Engineering Market Size and Share Forecast Outlook 2025 to 2035

Civil Construction Design And Detailing Engineering Market Size and Share Forecast Outlook 2025 to 2035

Turbomachinery Control System Market Size and Share Forecast Outlook 2025 to 2035

Planting Machinery Market Size and Share Forecast Outlook 2025 to 2035

Printing Machinery Market Size and Share Forecast Outlook 2025 to 2035

Packaging Machinery Market Insights – Growth & Forecast 2025 to 2035

Thank you!

You will receive an email from our Business Development Manager. Please be sure to check your SPAM/JUNK folder too.

Chat With

MaRIA