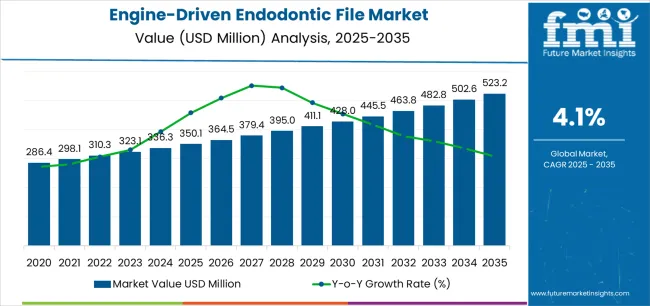

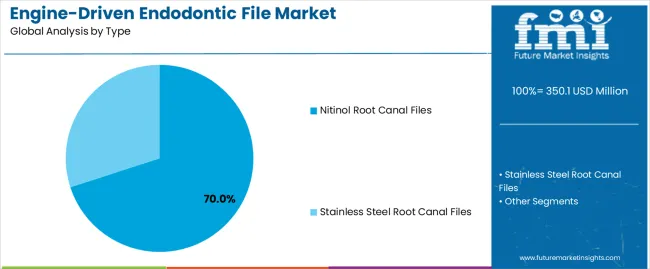

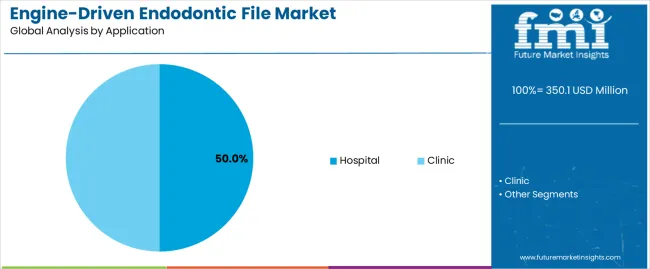

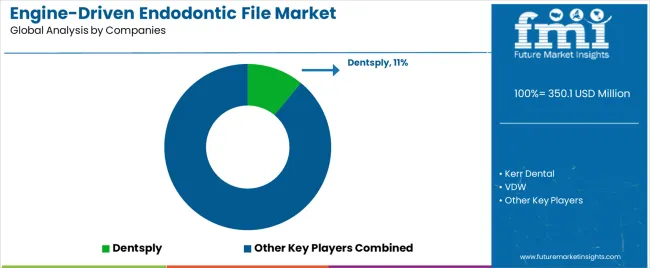

The engine-driven endodontic file market is set to grow from USD 350.1 million in 2025 to USD 523.2 million by 2035, advancing at a 4.1% CAGR and adding USD 173.1 million in new value across the decade. Demand is driven by the increasing adoption of engine-driven systems in dental practices, improving treatment speed, precision, and outcomes in root canal procedures. Nitinol root canal files lead with an estimated 70% market share, supported by their superior flexibility, fatigue resistance, and durability. Hospitals form the dominant application segment with a 50% share, driven by higher procedural volumes and investment in advanced endodontic tools.

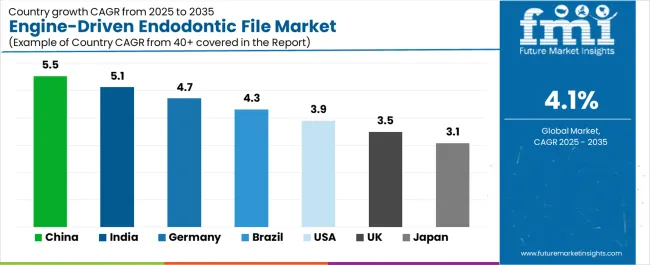

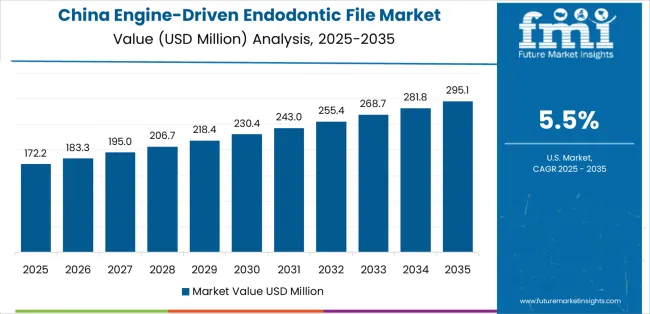

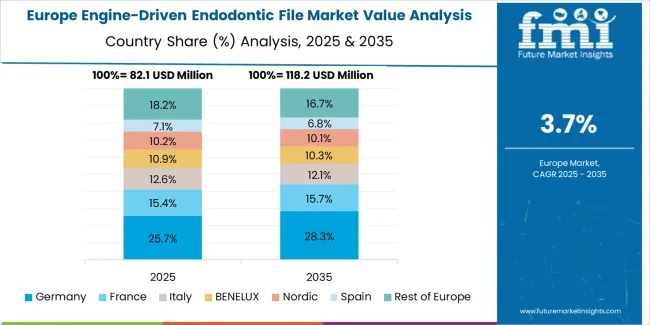

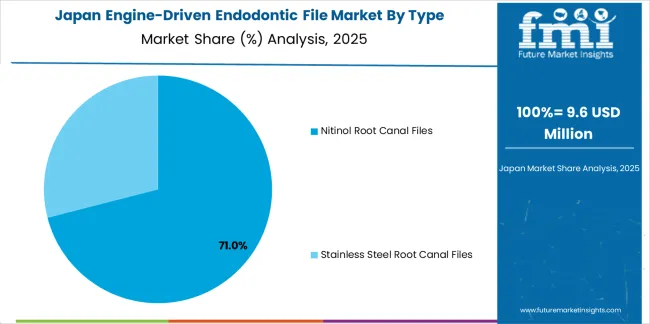

China grows at a 5.5% CAGR, followed by India at 5.1%, and Germany at 4.7%, supported by expanding dental infrastructure and rising patient demand. Brazil records 4.3% growth, while the USA grows at 3.9%, influenced by ongoing technological adoption and strong market maturity. The UK shows 3.5%, and Japan, at 3.1% grows at a steady pace through incremental innovations in dental care. Competitive dynamics are led by Dentsply with an estimated 11% share, followed by Kerr Dental, VDW, COLTENE, and Ultradent Products. Growth is propelled by innovations in NiTi alloys, ergonomic designs, and bundled dental systems, with an increasing focus on high-performance, durable, and cost-effective solutions for endodontic procedures.

The period from 2030 to 2035 will see more accelerated YoY growth as the market moves towards broader adoption. From USD 428.0 million in 2030, the market will grow to USD 445.5 million in 2031, an increase of USD 17.5 million. This phase is marked by a growing preference for high-performance engine-driven systems in dental practices worldwide. The development of materials such as nickel-titanium alloys, known for their enhanced flexibility and durability, will make these products more appealing. As dental clinics adopt more advanced systems, demand for high-quality endodontic files will increase.

In the latter part of the forecast period, from 2031 to 2035, the market will continue its steady rise, reaching USD 523.2 million by 2035, an increase of USD 78.7 million. This will be driven by broader adoption in emerging regions, where rising dental practices and patient numbers will drive demand for more advanced tools. Technological innovations in endodontic files, such as better ergonomics, improved precision, and faster treatment times, will make these products more attractive. The increase in dental tourism in regions like Asia Pacific will further push the demand for engine-driven systems, contributing to accelerated market growth in the final years of the forecast period.

| Metric | Value |

|---|---|

| Market Value (2025) | USD 350.1 million |

| Market Forecast Value (2035) | USD 523.2 million |

| Forecast CAGR (2025-2035) | 4.1% |

The engine-driven endodontic file market is expanding as dental professionals increasingly seek efficient, precise, and reliable tools for root canal procedures. With advancements in dental technology, engine-driven endodontic files offer enhanced cutting efficiency, reduced procedural time, and improved treatment outcomes, driving demand among clinicians.

The need for high-quality, durable, and ergonomic instruments in endodontics is increasing as more dental clinics aim to improve patient care and procedural effectiveness. Engine-driven files are increasingly preferred over manual alternatives due to their ability to provide consistent performance and reduce the likelihood of procedural errors, which results in better patient satisfaction and clinical results.

The growth of the market is also being driven by rising awareness of dental health, increasing numbers of dental procedures, and a surge in dental care investments in emerging markets. Government policies promoting dental healthcare advancements and the rising number of dental professionals are further contributing to market growth.

The high cost of advanced engine-driven endodontic files may limit their adoption in certain regions with lower-income populations or in smaller dental practices. The required training for proper use and the integration of these advanced tools may present barriers for some practitioners.

The engine-driven endodontic file market is segmented by type, application, and region. By type, the market is divided into nitinol root canal files and stainless steel root canal files. Based on application, the market is categorized into hospital and clinic. Regionally, the market is divided into Asia Pacific, Europe, North America, and other key regions. This segmentation helps to understand the diverse needs in different markets, driving innovation and growth across the industry.

Nitinol root canal files are the leading product type in the engine-driven endodontic file market, comprising 70% of the total market share. This dominance is primarily due to the material's unique properties, which combine strength and flexibility in a way that other materials cannot. Nitinol, an alloy of nickel and titanium, is known for its superelasticity, allowing the files to bend and return to their original shape without breaking. This quality makes them ideal for navigating the curved, intricate pathways found in root canals.

Nitinol's resistance to corrosion and fatigue ensures that the files maintain their effectiveness over multiple uses, making them highly reliable for dental professionals. The material's memory effect allows it to maintain its shape during use, providing better precision and reduced risk of file fracture, which is a significant concern in root canal procedures. As a result, Nitinol files are increasingly preferred by endodontists, enhancing the treatment outcome for patients. With ongoing advancements in Nitinol-based technology, such as improvements in file design and manufacturing techniques, the segment is expected to retain its dominant position in the market.

The hospital application category represents 50% of the engine-driven endodontic file market, making it a critical segment for market expansion. Hospitals are key players in the delivery of endodontic care due to their access to advanced medical equipment and skilled dental professionals. Endodontic treatments, particularly root canal procedures, are commonly performed in hospitals, and these institutions require high-quality, reliable tools to ensure the safety and success of these treatments.

The adoption of engine-driven endodontic files in hospitals is further encouraged by the increasing patient demand for efficient and minimally invasive treatments. Nitinol-based files are preferred for their ability to provide precision, reduce procedural risks, and offer superior outcomes compared to traditional files. With hospitals increasingly investing in modern dental technologies and expanding their dental services, the demand for advanced endodontic tools continues to grow.

The hospital segment benefits from the growing global emphasis on healthcare quality and patient safety, which drives the need for reliable and innovative medical devices. As urbanization increases and the healthcare infrastructure expands, the hospital segment is expected to remain a significant contributor to the growth of the engine-driven endodontic file market, especially in emerging economies with expanding healthcare systems.

Rotary systems using nickel-titanium (NiTi) files are replacing manual techniques, driven by their higher flexibility, fracture resistance, and ability to navigate complex canal anatomies. The market is further fueled by technological advancements, rising dental awareness, and growing infrastructure in emerging regions, where endodontic systems are becoming increasingly accessible and popular.

The growing adoption of advanced endodontic techniques, particularly rotary instrumentation using nickel‑titanium (NiTi) files, is driving the market forward as clinicians prefer faster, more predictable root canal treatments. Manufacturers are innovating in file materials, with newer NiTi alloys offering greater flexibility, enhanced fracture resistance, and refined cross‑sectional geometries. There is also a shift toward minimally invasive dentistry, as demand increases for files that preserve tooth structure and better navigate complex canal anatomies. Emerging markets, particularly in regions like Asia‑Pacific, are gaining traction as dental infrastructure and disposable incomes grow. Lastly, there is a trend toward bundled endodontic systems, which include compatible motors, education modules, and end‑to‑end solutions to simplify adoption.

The rising prevalence of dental diseases such as pulp infections and caries is increasing the demand for root canal treatments. The need for more efficient and predictable root canal procedures is driving clinicians to shift from manual to engine-driven systems, which offer faster procedures and fewer complications. Technological advancements, especially in NiTi file materials and design, have made engine-driven files more attractive by enhancing flexibility, fracture resistance, and ease of use in difficult root canal anatomies. Expanding dental infrastructure and increasing numbers of dental clinics, particularly in developing regions, facilitate the adoption of advanced instrumentation like engine-driven files. As patients become more aware of dental health and aesthetics, demand for high-quality endodontic care is on the rise, further boosting the market for premium instrumentation.

A major challenge is the high cost associated with engine-driven systems, including the files, compatible motors, and necessary training, which can be a barrier for smaller clinics or those in emerging markets. The risk of file separation or fracture during use remains a concern for clinicians, despite improvements in NiTi alloys that reduce this risk. This uncertainty can make some practitioners hesitant to fully adopt engine-driven systems. These systems often require specialized training and a learning curve, which can slow down adoption, particularly in regions where skilled professionals are in short supply. Finally, in areas with less developed dental infrastructure or lower awareness of advanced endodontic techniques, market penetration remains limited.

| Country | CAGR (%) |

|---|---|

| China | 5.5% |

| India | 5.1% |

| Germany | 4.7% |

| Brazil | 4.3% |

| USA | 3.9% |

| UK | 3.5% |

| Japan | 3.1% |

The global engine-driven endodontic file market is growing, propelled by increased dental procedures, technological advances in NiTi alloy systems, and rising awareness of minimally invasive techniques. China leads with a 5.5% CAGR, driven by expanding dental infrastructure and a growing patient base. India follows at 5.1%, supported by increased disposable income and demand for specialized dental care. Germany shows 4.7% growth, owing to high adoption of advanced dental technologies and strong healthcare systems. Brazil’s 4.3% CAGR is backed by infrastructure development and increased dental service access. The USA grows at 3.9%, influenced by mature markets and incremental technological uptake. The UK at 3.5% focuses on upgrading dental practice standards, while Japan’s 3.1% reflects a mature market with emphasis on precision and innovation.

China is the leader in the engine-driven endodontic file market with a 5.5% CAGR. The country’s rapid urbanisation, increased healthcare investment, and growing awareness of dental health are driving the demand for advanced dental technologies, including engine-driven endodontic files. The rising number of dental procedures, particularly in urban areas, has contributed significantly to the market growth. China’s expanding dental infrastructure, supported by government initiatives and a growing middle class with increased disposable income, further propels the market for specialized dental care products. The adoption of modern dental tools and techniques, including NiTi rotary files, is gaining momentum due to their precision and efficiency in root canal treatments. The increasing number of dental professionals and clinics, especially in Tier 1 and Tier 2 cities, is enhancing the availability and accessibility of such equipment. With a growing focus on improving the quality of healthcare services and expanding insurance coverage for dental care, China’s engine-driven endodontic file market is set for sustained growth. Moreover, the development of local manufacturing and competitive pricing of endodontic files makes it an attractive market for both domestic and international players.

India is experiencing steady growth in the engine-driven endodontic file market, with a 5.1% CAGR. The country’s expanding dental sector, supported by rising awareness of oral health, plays a significant role in driving demand for advanced dental technologies. Urbanisation and an increase in disposable income have led to greater demand for dental care, including specialized services like root canal treatments. As more dental professionals adopt modern techniques and equipment, the use of engine-driven endodontic files has risen due to their effectiveness in performing precision-driven procedures. The rising popularity of cosmetic dentistry, coupled with an increasing number of dental clinics and professionals, contributes to the market’s expansion. Government initiatives aimed at improving healthcare services, especially in urban and rural areas, also enhance access to modern dental solutions. The growing middle class in India, combined with a focus on affordable yet advanced dental tools, makes it a strong market for engine-driven endodontic files. The market also benefits from technological advancements, such as innovations in NiTi alloy files, making treatments more efficient and less painful for patients. As the dental industry continues to evolve in India, the demand for advanced endodontic products is expected to keep rising in the coming years.

Germany’s engine-driven endodontic file market is growing at a steady pace, with a 4.7% CAGR. Known for its advanced healthcare system, Germany is seeing a rise in the adoption of innovative dental technologies. The country’s highly developed dental infrastructure, coupled with a strong emphasis on quality healthcare, has led to increased demand for precision tools like engine-driven endodontic files. German dental professionals are increasingly adopting advanced, efficient tools to meet the growing number of root canal treatments and cosmetic procedures. As one of Europe’s most industrialised countries, Germany benefits from a well-established manufacturing and research base, driving the development of state-of-the-art dental tools. The dental sector’s focus on sustainability and precision contributes to the demand for durable, high-performance endodontic files, particularly in the high-end market segment. Furthermore, Germany’s commitment to reducing patient discomfort and enhancing treatment outcomes through the adoption of minimally invasive technologies boosts the use of engine-driven files in clinical practices. The country also plays a key role in the education and training of dental professionals, ensuring that modern dental technologies are integrated into practice across both private and public dental clinics. This continued innovation and adoption are expected to maintain Germany’s strong position in the engine-driven endodontic file market.

Brazil’s engine-driven endodontic file market is growing at a 4.3% CAGR, driven by expanding infrastructure in the dental sector and increasing access to specialized dental care. As Brazil’s economy continues to grow, more people are able to afford dental treatments, and the demand for effective, high-quality tools like engine-driven endodontic files has risen significantly. The country’s expanding urban centres and healthcare infrastructure have made advanced dental services more accessible, particularly in major cities. The rising number of dental procedures, along with an increasing preference for minimally invasive treatments, has bolstered the demand for engine-driven files. Brazilian dentists are increasingly adopting rotary and motor-driven techniques due to their enhanced precision, efficiency, and faster patient recovery times compared to traditional manual methods. Furthermore, Brazil’s large population and growing middle class contribute to a rising need for dental services, making it a key market for dental equipment suppliers. Government health initiatives and dental programs aimed at improving oral health further push the adoption of advanced dental tools. As Brazil continues to invest in the healthcare sector and the demand for specialized dental treatments grows, the engine-driven endodontic file market will continue to expand, benefiting both local and international manufacturers.

The USA engine-driven endodontic file market is growing at a 3.9% CAGR, driven by ongoing demand for advanced dental tools in both cosmetic and therapeutic procedures. As one of the largest markets for dental products, the USA has seen a significant shift towards precision-driven, efficient solutions like engine-driven files for root canal treatments. The country’s mature healthcare system and widespread adoption of modern dental technologies contribute to the sustained demand for these products. The USA dental industry is focused on improving treatment efficiency and reducing patient discomfort, with endodontic files playing a key role in achieving these goals. The increasing popularity of minimally invasive dentistry, combined with advancements in NiTi alloy technology, further supports the market growth. Rising awareness about oral health and increased access to dental insurance drive more people to seek professional dental care. The USA also benefits from a robust network of dental professionals and educational institutions that promote the use of advanced technologies. As the country continues to prioritise dental innovation and patient comfort, the demand for engine-driven endodontic files is expected to remain steady, with an emphasis on quality, performance, and patient satisfaction.

The UK is witnessing moderate growth in the engine-driven endodontic file market, with a 3.5% CAGR. A significant driver of this growth is the increasing focus on improving the quality of dental care, with more professionals adopting advanced tools for root canal treatments. As patient preferences shift toward minimally invasive and more comfortable procedures, engine-driven files are gaining popularity due to their efficiency, precision, and reduced recovery times. The UK also benefits from a well-established dental industry, with a high number of dental professionals who are keen to integrate new technologies into their practices. Moreover, rising awareness about the importance of oral health, along with an increasing number of dental clinics offering specialized services, is contributing to the demand for engine-driven endodontic files. The government’s investment in improving healthcare infrastructure and dental access, particularly in underserved areas, is also playing a role in driving market growth. However, the UK market is more mature compared to emerging economies, with growth driven by incremental technological advancements rather than rapid adoption. Despite this, the continued adoption of modern, high-efficiency dental tools ensures that the engine-driven endodontic file market will remain stable in the UK.

Japan’s engine-driven endodontic file market is growing at a 3.1% CAGR, driven by technological advancements and the country’s strong focus on high-quality dental care. Japan’s dental industry is one of the most advanced globally, with dentists frequently adopting cutting-edge technologies to enhance treatment outcomes. The country’s aging population has also led to an increase in dental procedures, including root canal treatments, driving demand for efficient, high-precision dental tools. As the Japanese dental sector emphasizes durability and minimal discomfort, the use of engine-driven endodontic files has become increasingly popular. Japan’s focus on precision and technological innovation in dental care continues to push the adoption of advanced materials like NiTi alloys, which are critical for the efficiency and effectiveness of engine-driven files. The country’s high standard of healthcare, combined with a focus on patient satisfaction and treatment precision, ensures that the market for engine-driven endodontic files remains stable, with moderate growth expected in the coming years. Furthermore, Japan’s expertise in material science and manufacturing continues to contribute to the development of next-generation endodontic products that meet both local and international standards. As a result, Japan remains an important player in the global engine-driven endodontic file market.

The engine-driven endodontic file market is highly competitive, featuring a blend of established dental device manufacturers and emerging regional players. Dentsply leads the market with an 11% share, offering a wide range of high-performance endodontic files designed for efficient and precise root canal treatments. Other significant global players, such as Kerr Dental, VDW, and COLTENE, have carved out their niches by focusing on product innovation and precision engineering. These companies cater to both professional dentists and end-users, with an emphasis on quality and reliability.

Competition in the market is further driven by continuous product innovation and advancements in material technology. Companies like Ultradent Products and Mani focus on developing durable and efficient files that improve procedural accuracy and patient outcomes, ensuring they meet the growing demand for advanced dental solutions. Brasseler and Electro Medical Systems offer a balance of cost-effectiveness and quality, appealing to a wide range of dental professionals with products that deliver both performance and value.

Regional players such as UNITED DENTAL GROUP, SANI Group, and LM-Instruments are also significant contributors to the market, providing cost-effective solutions tailored to local markets. In addition to these traditional players, the entry of consumer electronics companies like OPPO, Xiaomi, and ifanr is beginning to reshape the landscape. These companies bring new technological innovations and digital integration, intensifying competition and driving the industry towards more cutting-edge, tech-driven solutions.

| Items | Values |

|---|---|

| Quantitative Units (2025) | USD million |

| Type | Nitinol Root Canal Files, Stainless Steel Root Canal Files |

| Application | Hospital, Clinic |

| Regions Covered | Asia Pacific, Europe, North America, Latin America, Middle East & Africa |

| Countries Covered | China, Japan, South Korea, India, Australia & New Zealand, ASEAN, Rest of Asia Pacific, Germany, United Kingdom, France, Italy, Spain, Nordic, BENELUX, Rest of Europe, United States, Canada, Mexico, Brazil, Chile, Rest of Latin America, Kingdom of Saudi Arabia, Other GCC Countries, Turkey, South Africa, Other African Union, Rest of Middle East & Africa |

| Key Companies Profiled | Dentsply, Kerr Dental, VDW, COLTENE, Ultradent Products, Mani, Brasseler, Electro Medical Systems, UNITED DENTAL GROUP, SANI Group, LM-Instruments, Eighteeth |

| Additional Attributes | Dollar sales by type and application categories, market growth trends, market adoption by classification and application segments, regional adoption trends, competitive landscape, advancements in engine-driven endodontic file technologies, integration with dental care equipment and tools. |

The global engine-driven endodontic file market is estimated to be valued at USD 350.1 million in 2025.

The market size for the engine-driven endodontic file market is projected to reach USD 523.2 million by 2035.

The engine-driven endodontic file market is expected to grow at a 4.1% CAGR between 2025 and 2035.

The key product types in engine-driven endodontic file market are nitinol root canal files and stainless steel root canal files.

In terms of application, hospital segment to command 50.0% share in the engine-driven endodontic file market in 2025.

Our Research Products

The "Full Research Suite" delivers actionable market intel, deep dives on markets or technologies, so clients act faster, cut risk, and unlock growth.

The Leaderboard benchmarks and ranks top vendors, classifying them as Established Leaders, Leading Challengers, or Disruptors & Challengers.

Locates where complements amplify value and substitutes erode it, forecasting net impact by horizon

We deliver granular, decision-grade intel: market sizing, 5-year forecasts, pricing, adoption, usage, revenue, and operational KPIs—plus competitor tracking, regulation, and value chains—across 60 countries broadly.

Spot the shifts before they hit your P&L. We track inflection points, adoption curves, pricing moves, and ecosystem plays to show where demand is heading, why it is changing, and what to do next across high-growth markets and disruptive tech

Real-time reads of user behavior. We track shifting priorities, perceptions of today’s and next-gen services, and provider experience, then pace how fast tech moves from trial to adoption, blending buyer, consumer, and channel inputs with social signals (#WhySwitch, #UX).

Partner with our analyst team to build a custom report designed around your business priorities. From analysing market trends to assessing competitors or crafting bespoke datasets, we tailor insights to your needs.

Supplier Intelligence

Discovery & Profiling

Capacity & Footprint

Performance & Risk

Compliance & Governance

Commercial Readiness

Who Supplies Whom

Scorecards & Shortlists

Playbooks & Docs

Category Intelligence

Definition & Scope

Demand & Use Cases

Cost Drivers

Market Structure

Supply Chain Map

Trade & Policy

Operating Norms

Deliverables

Buyer Intelligence

Account Basics

Spend & Scope

Procurement Model

Vendor Requirements

Terms & Policies

Entry Strategy

Pain Points & Triggers

Outputs

Pricing Analysis

Benchmarks

Trends

Should-Cost

Indexation

Landed Cost

Commercial Terms

Deliverables

Brand Analysis

Positioning & Value Prop

Share & Presence

Customer Evidence

Go-to-Market

Digital & Reputation

Compliance & Trust

KPIs & Gaps

Outputs

Full Research Suite comprises of:

Market outlook & trends analysis

Interviews & case studies

Strategic recommendations

Vendor profiles & capabilities analysis

5-year forecasts

8 regions and 60+ country-level data splits

Market segment data splits

12 months of continuous data updates

DELIVERED AS:

PDF EXCEL ONLINE

Endodontics and Orthodontics Market Analysis – Growth & Forecast 2022-2032

The Dental Caries and Endodontic Market is segmented by Dental Restoration, Dental Reconstruction, Endodontic and Infection Control from 2025 to 2035

Heat-Treated NiTi Endodontic File Market Size and Share Forecast Outlook 2025 to 2035

File Sander Market Size and Share Forecast Outlook 2025 to 2035

File Integrity Monitoring Market Size and Share Forecast Outlook 2025 to 2035

Profiled Steel Sheet Decking Market Size and Share Forecast Outlook 2025 to 2035

Belt File Sander Market Size and Share Forecast Outlook 2025 to 2035

Band File Sander Belts Market Size and Share Forecast Outlook 2025 to 2035

Low Profile Compact System Closures Market Size and Share Forecast Outlook 2025 to 2035

Road Profile Laser Sensor Market Size and Share Forecast Outlook 2025 to 2035

Managed File Transfer (MFT) Market Size and Share Forecast Outlook 2025 to 2035

Network File System Market Size and Share Forecast Outlook 2025 to 2035

Enterprise File Sync And Share Platform Market Size and Share Forecast Outlook 2025 to 2035

Enterprise File Sharing And Synchronization Market

NiTi Rotary File Market Size and Share Forecast Outlook 2025 to 2035

Cordless Bandfile Sander Market Size and Share Forecast Outlook 2025 to 2035

Aluminium Profiles for Solar Panel Market Size and Share Forecast Outlook 2025 to 2035

Rotary Shaping File Market Size and Share Forecast Outlook 2025 to 2035

Ductile Iron Profile Market Size and Share Forecast Outlook 2025 to 2035

Industrial Low Profile Floor Scale Market Size and Share Forecast Outlook 2025 to 2035

Thank you!

You will receive an email from our Business Development Manager. Please be sure to check your SPAM/JUNK folder too.

Chat With

MaRIA