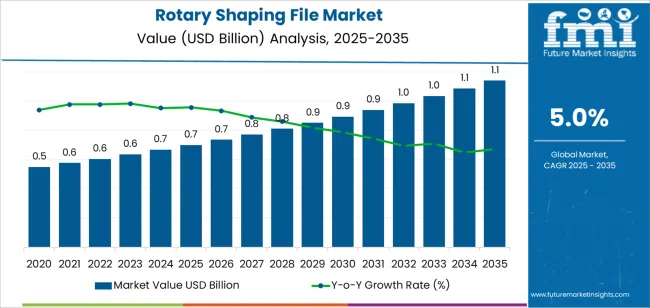

The global rotary shaping file market is forecasted to grow from USD 0.7 billion in 2025 to approximately USD 1.2 billion by 2035, recording an absolute increase of USD 0.5 billion over the forecast period. This translates into a total growth of 62.9%, with the market forecast to expand at a CAGR of 5.0% between 2025 and 2035. The market size is expected to grow by nearly 1.6 times during the same period, supported by increasing prevalence of endodontic procedures requiring precision root canal preparation, growing adoption of nickel-titanium rotary instruments in dental practices, and rising demand for efficient and minimally invasive dental treatment solutions across diverse clinical settings.

The market expansion reflects fundamental shifts in endodontic treatment methodologies focusing procedural efficiency and clinical outcome predictability. Dental practitioners are investing in advanced instrumentation systems that support consistent canal shaping, reduced treatment time, and improved patient comfort during root canal therapy. Rotary shaping files represent specialized dental instruments requiring precise metallurgical properties, geometric design optimization, and surface treatment technologies that directly impact procedural success rates.

Manufacturing standards are evolving to address diverse clinical scenarios ranging from straightforward canal anatomy to complex curved configurations, driving demand for files that combine flexibility, cutting efficiency, and fracture resistance across varied endodontic applications.

Technological advancement in file design is enabling enhanced taper configurations and variable pitch geometries while maintaining torsional strength and cyclic fatigue resistance requirements. The integration of proprietary heat treatment processes and surface finishing techniques addresses debris removal efficiency and canal wall preservation objectives. Regional variations in dental care infrastructure and endodontic training protocols create differentiated growth trajectories, with developed markets focusing on single-use file adoption and advanced material innovations while emerging markets emphasize cost-effective multi-use systems and procedural training expansion.

| Metric | Value |

|---|---|

| Market Value (2025) | USD 0.7 billion |

| Market Forecast Value (2035) | USD 1.2 billion |

| Forecast CAGR (2025-2035) | 5.0% |

| DENTAL HEALTHCARE ADVANCEMENT | CLINICAL PROCEDURE REQUIREMENTS | TECHNOLOGY & QUALITY STANDARDS |

|---|---|---|

| Global Dental Care Access Growth Continuing expansion of endodontic treatment availability across established and emerging healthcare markets driving demand for specialized root canal instrumentation solutions. | Efficient Treatment Protocols Modern endodontic standards requiring mechanized canal preparation systems offering reduced treatment time and improved procedural predictability. | Medical Device Quality Standards Regulatory requirements establishing performance benchmarks favoring certified biocompatible nickel-titanium instruments. |

| Root Canal Therapy Prevalence Growing recognition of tooth preservation importance and increasing patient preference for endodontic treatment over extraction creating steady demand for specialized files. | Complex Anatomy Management Demands Endodontic procedures requiring flexible instruments capable of navigating curved canals while maintaining centering ability and canal morphology. | Sterility and Safety Requirements Quality standards requiring validated sterilization compatibility and fracture resistance characteristics supporting patient safety protocols. |

| Dental Practice Modernization Expansion of rotary endodontic system adoption in general dental practices beyond specialist endodontists requiring user-friendly instrumentation solutions. | Procedural Precision Standards Clinical applications demanding consistent cutting efficiency and predictable file behavior supporting optimal canal preparation outcomes and minimized procedural complications. | Material Performance Certification Manufacturing standards requiring controlled phase transformation temperatures and validated cyclic fatigue resistance supporting clinical reliability. |

| Category | Segments Covered |

|---|---|

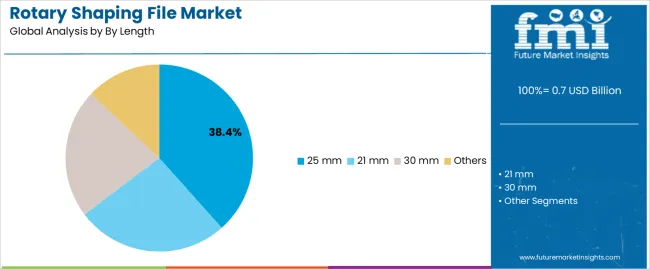

| By Length | 21 mm, 25 mm, 30 mm, Others |

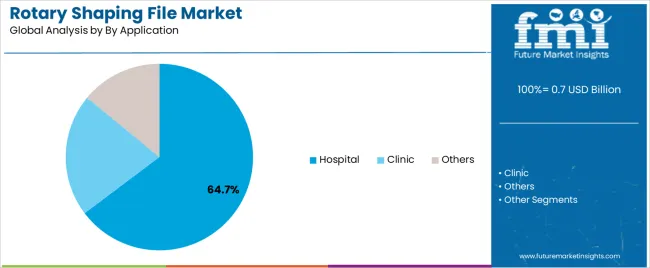

| By Application | Hospital, Clinic, Others |

| By Region | North America, Europe, Asia Pacific, Latin America, Middle East & Africa |

| Segment | 2025 to 2035 Outlook |

|---|---|

| 25 mm |

|

| 21 mm |

|

| 30 mm |

|

| Others |

|

| Segment | 2025 to 2035 Outlook |

|---|---|

| Hospital |

|

| Clinic |

|

| Others |

|

| DRIVERS | RESTRAINTS | KEY TRENDS |

|---|---|---|

| Endodontic Procedure Growth Continuing expansion of root canal therapy volumes across established and emerging dental markets driving demand for efficient mechanical preparation instruments. | Cost Sensitivity Pressures Dental practice economic constraints and patient out-of-pocket expenses affecting premium rotary file adoption and single-use instrument preference. | Advanced Heat Treatment Innovation Integration of proprietary thermal processing technologies enabling enhanced flexibility and cyclic fatigue resistance while maintaining cutting efficiency characteristics. |

| Tooth Preservation Philosophy Increasing recognition of endodontic treatment value in maintaining natural dentition and avoiding extraction-related complications supporting procedure volume growth. | Learning Curve Challenges Practitioner training requirements and technique sensitivity concerns affecting rotary system adoption rates among general dentists and recent graduates. | Single-Use System Development Enhanced disposable file designs eliminating cross-contamination risks, simplifying instrument management, and reducing sterilization burden compared to reusable systems. |

| Nickel-Titanium Superiority Recognition Growing acceptance of rotary nickel-titanium instruments over stainless steel hand files based on procedural efficiency and clinical outcome advantages. | File Fracture Risks Instrument separation concerns and clinical complication potential affecting practitioner confidence and conservative usage patterns limiting file utilization rates. | Reciprocating Motion Technology Development of alternative kinematics and specialized file designs optimizing debris removal and reducing torsional stress while maintaining preparation quality and procedural efficiency. |

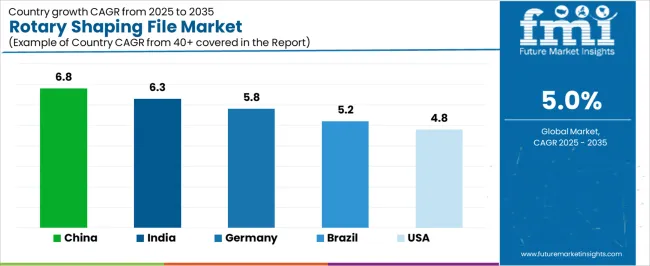

| Country | CAGR (2025-2035) |

|---|---|

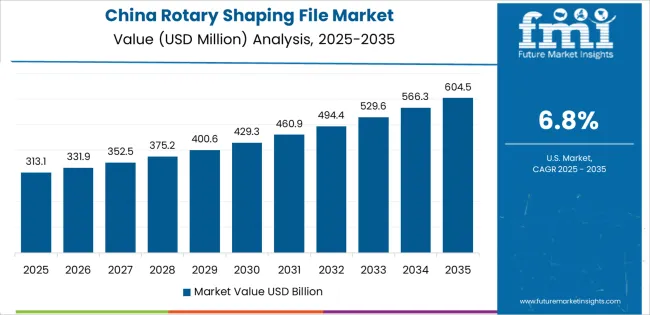

| China | 6.8% |

| India | 6.3% |

| Germany | 5.8% |

| Brazil | 5.2% |

| USA | 4.8% |

China is projected to exhibit strong growth with substantial market value by 2035, driven by expanding dental care infrastructure and comprehensive oral health awareness programs creating opportunities for dental device suppliers across public hospitals, private clinics, and specialized endodontic centers. The country's rising middle class healthcare expenditure and increasing dental insurance coverage are creating significant demand for both standard and premium rotary instrumentation systems. Major dental equipment manufacturers and distribution networks are establishing comprehensive local supply capabilities to support large-scale deployment operations and meet growing demand for modern endodontic treatment solutions.

India is expanding substantially by 2035, supported by extensive dental education infrastructure development and comprehensive private dental clinic proliferation creating steady demand for cost-effective endodontic instruments across diverse practitioner segments and regional markets. The country's large population with growing oral health awareness and expanding dental insurance penetration are driving demand for file solutions that provide clinical effectiveness while supporting affordable pricing requirements. Dental device distributors and equipment suppliers are investing in regional distribution networks to support growing market penetration and product availability enhancement.

Germany is projected to reach substantial value by 2035, supported by the country's leadership in dental care quality and advanced endodontic treatment protocols requiring premium instrumentation systems for specialist applications and complex case management. German dental practitioners are implementing high-quality rotary files that support predictable clinical outcomes, optimal patient safety, and comprehensive quality assurance protocols. The market is characterized by focus on evidence-based endodontics, material innovation, and compliance with stringent medical device and infection control standards.

The United States is growing to reach substantial value by 2035, driven by comprehensive infection control protocol focus and increasing single-use instrument preference creating opportunities for device suppliers serving both general dentists and endodontic specialists. The country's extensive dental insurance coverage and established endodontic practice networks are creating demand for file solutions that support procedural efficiency while meeting infection prevention standards. Dental device manufacturers and distribution organizations are developing comprehensive product portfolios to support diverse practitioner preferences and clinical requirement variations.

Brazil is projected to reach meaningful value by 2035, driven by private dental practice expansion and endodontic training program development supporting modern treatment technique adoption and instrument technology upgrade. The country's growing middle class and expanding private dental insurance participation are creating demand for contemporary endodontic instruments that support quality care delivery and competitive practice positioning. Dental device distributors and equipment suppliers are maintaining comprehensive technical support capabilities to support practitioner training and product adoption.

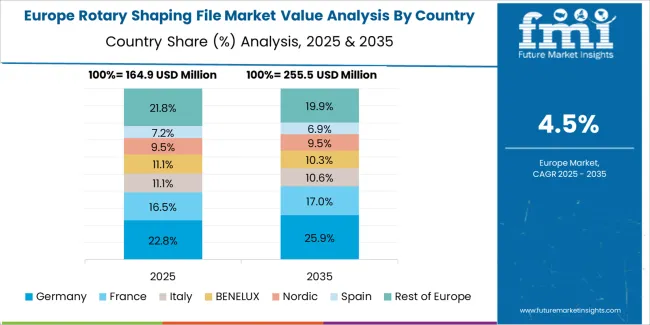

The rotary shaping file market in Europe is projected to grow from USD 252.0 million in 2025 to USD 395.2 million by 2035, registering a CAGR of 4.6% over the forecast period. Germany is expected to maintain its leadership position with a 31.2% market share in 2025, declining slightly to 30.4% by 2035, supported by its advanced dental care infrastructure and strong endodontic specialty practice presence.

France follows with a 21.8% share in 2025, projected to reach 22.3% by 2035, driven by comprehensive dental education programs and established endodontic treatment protocols. The United Kingdom holds a 18.4% share in 2025, expected to decrease to 17.9% by 2035 due to NHS budget optimization affecting elective dental procedure volumes. Italy commands a 13.9% share, while Spain accounts for 9.2% in 2025. The Rest of Europe region is anticipated to gain momentum, expanding its collective share from 5.5% to 7.1% by 2035, attributed to increasing rotary endodontic system adoption in Nordic dental practices and emerging Eastern European markets implementing modern treatment protocols.

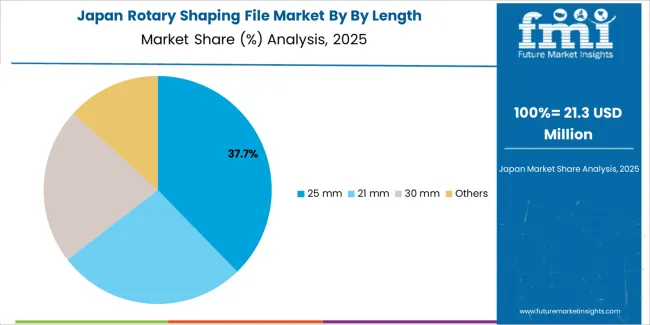

Japanese rotary shaping file operations reflect the country's meticulous approach to dental care quality and comprehensive endodontic treatment standards. Major dental device manufacturers including Mani, specialized endodontic instrument producers, and established distribution networks maintain rigorous product validation processes focusing material consistency, dimensional accuracy, and clinical performance predictability that often exceed international manufacturing standards. This creates substantial barriers for foreign suppliers but ensures exceptional quality supporting optimal treatment outcomes.

The Japanese market demonstrates unique specification preferences, with particular focus on precise taper configurations and surface finish quality standards tailored to Japanese endodontic technique philosophies. Practitioners require specific file sequence systems and comprehensive technical documentation supporting procedural protocol development and clinical outcome optimization.

Regulatory oversight through the Pharmaceuticals and Medical Devices Agency emphasizes comprehensive safety validation for dental instruments, with particular attention to nickel-titanium material properties and cyclic fatigue performance characteristics. The classification system requires extensive technical documentation and clinical performance validation, creating advantages for suppliers with established dental device expertise and comprehensive quality management capabilities.

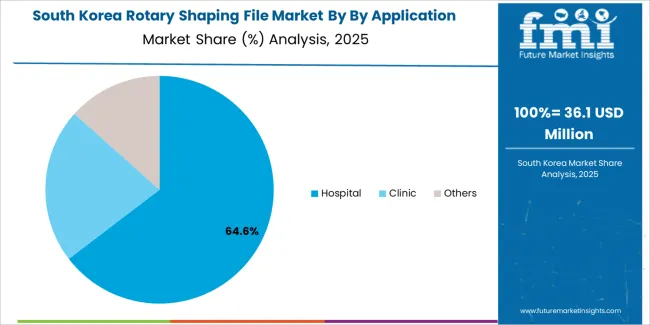

South Korean rotary shaping file operations reflect the country's advanced dental technology adoption and strong focus on aesthetic and functional dentistry. Major dental hospitals including Seoul National University Dental Hospital, Yonsei University Dental Hospital, and private dental clinic networks drive sophisticated endodontic practice standards that influence instrument selection criteria and clinical outcome expectations.

The Korean market demonstrates particular strength in adopting advanced endodontic technologies and evidence-based treatment protocols. Dental practitioners emphasize procedural efficiency and predictable outcomes, creating demand for file systems that support consistent performance while accommodating diverse anatomical challenges.

Regulatory frameworks through the Ministry of Food and Drug Safety incorporate specific dental device requirements addressing safety, material biocompatibility, and performance validation. These standards align with international dental instrument regulations while incorporating Korean-specific testing protocols that support market quality expectations and clinical reliability requirements.

Profit pools are consolidating around proprietary material processing technologies and clinical outcome validation, with value migrating from commodity file manufacturing to engineered solutions offering enhanced cyclic fatigue resistance, optimized cutting efficiency, and procedural predictability. Several competitive archetypes dominate market positioning: established dental device manufacturers leveraging comprehensive endodontic product portfolios and global distribution networks; specialized endodontic instrument companies focusing on advanced metallurgy and design innovation; regional distributors providing technical training and clinical support services; and emerging suppliers targeting cost-sensitive segments through efficient manufacturing approaches.

Switching costs remain moderate to high due to practitioner technique familiarity and procedural protocol integration, though clinical evidence demonstrating superior performance can accelerate adoption among early adopter specialists. Technology transitions toward single-use systems and reciprocating motion platforms create periodic windows for competitive repositioning, particularly among suppliers offering comprehensive instrument sequences and motor system compatibility.

Market consolidation continues as larger dental equipment companies acquire specialized endodontic instrument manufacturers to expand product portfolios and capture growing procedural volumes. Direct practitioner engagement through continuing education programs and clinical training seminars strengthens brand loyalty and technique adoption. Strategic priorities center on establishing relationships with endodontic specialty organizations and dental education institutions through comprehensive clinical evidence and validated performance advantages. Product line diversification across file lengths, taper configurations, and motion kinematics addresses varying anatomical requirements and practitioner preferences. Future positioning requires balancing manufacturing efficiency with innovation capabilities and maintaining regulatory compliance across multiple jurisdictions while adapting to evolving endodontic philosophies and single-use instrument trends.

| Items | Values |

|---|---|

| Quantitative Units | USD 0.7 billion |

| Product | 21 mm, 25 mm, 30 mm, Others |

| Application | Hospital, Clinic, Others |

| Regions Covered | North America, Latin America, Europe, Asia Pacific, Middle East & Africa |

| Country Covered | United States, Germany, China, India, Brazil, Japan, United Kingdom, and other 40+ countries |

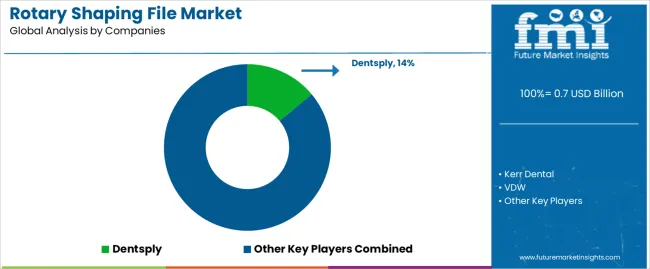

| Key Companies Profiled | Dentsply, Kerr Dental, VDW, COLTENE, Mani, Brasseler, EdgeEndo, Micro-Mega, Yirui, SANIL, M-Instruments, Huizhou Videya Technology |

| Additional Attributes | Dollar sales by length/application, regional demand (NA, EU, APAC), competitive landscape, single-use vs. reusable adoption, nickel-titanium metallurgy innovations, and heat treatment advancements driving cyclic fatigue resistance, procedural efficiency, and endodontic treatment quality |

The global rotary shaping file market is estimated to be valued at USD 0.7 billion in 2025.

The market size for the rotary shaping file market is projected to reach USD 1.1 billion by 2035.

The rotary shaping file market is expected to grow at a 5.0% CAGR between 2025 and 2035.

The key product types in rotary shaping file market are 25 mm, 21 mm, 30 mm and others.

In terms of by application, hospital segment to command 64.7% share in the rotary shaping file market in 2025.

Full Research Suite comprises of:

Market outlook & trends analysis

Interviews & case studies

Strategic recommendations

Vendor profiles & capabilities analysis

5-year forecasts

8 regions and 60+ country-level data splits

Market segment data splits

12 months of continuous data updates

DELIVERED AS:

PDF EXCEL ONLINE

Rotary DIP Switch Market Size and Share Forecast Outlook 2025 to 2035

Rotary Tables with Torque Motor Drive Market Size and Share Forecast Outlook 2025 to 2035

Rotary Band Heat Sealer Market Size and Share Forecast Outlook 2025 to 2035

Rotary Heat Pump Compressors Market Size and Share Forecast Outlook 2025 to 2035

Rotary and RF Rotary Joints Market Size and Share Forecast Outlook 2025 to 2035

Rotary Drilling Rig Market Size and Share Forecast Outlook 2025 to 2035

Rotary Tool Market Size and Share Forecast Outlook 2025 to 2035

Rotary Scroll Air Compressor Market Size and Share Forecast Outlook 2025 to 2035

Rotary Tray Sealers Market Size and Share Forecast Outlook 2025 to 2035

Rotary Indexer Market Analysis - Share, Size, and Forecast 2025 to 2035

Rotary Hopper Market Analysis by Material, Capacity, Application and Region: Forecast for 2025 and 2035

Rotary Limit Switches Market Growth - Trends & Forecast 2025 to 2035

Rotary Encoder Market

Rotary Steerable System Market

Rotary Knife Cutters Market

Rotary Sealers Market

Oil Rotary Pump Market Size and Share Forecast Outlook 2025 to 2035

Indoor Rotary High Voltage Disconnect Switch Market Size and Share Forecast Outlook 2025 to 2035

Compact Rotary Actuator Market Size and Share Forecast Outlook 2025 to 2035

Modular Rotary Table Market Size and Share Forecast Outlook 2025 to 2035

Thank you!

You will receive an email from our Business Development Manager. Please be sure to check your SPAM/JUNK folder too.

Chat With

MaRIA