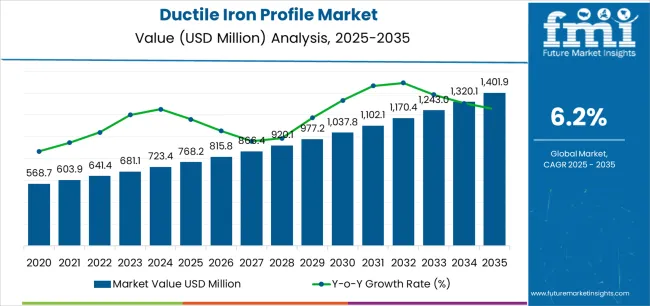

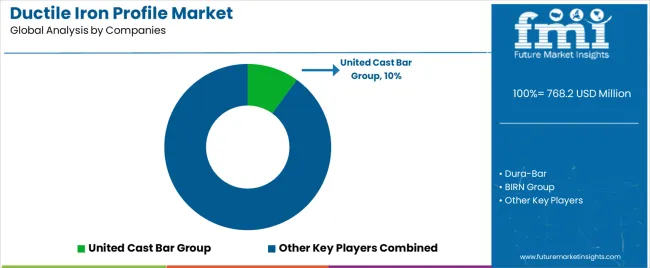

The ductile iron profile market is forecast to grow significantly from USD 768.2 million in 2025 to USD 1,401.9 million by 2035, reflecting a CAGR of 6.2%. This growth is driven by increasing demand for ductile iron profiles across construction, automotive, infrastructure, and industrial applications. Ductile iron profiles are favored for their high strength, durability, and corrosion resistance, making them essential components in the construction of pipes, valves, and machinery parts.

The demand for ductile iron profiles is further driven by their widespread use in water management, sewerage, and transportation infrastructure, where their resilience and ability to withstand harsh conditions are critical. Moreover, the increasing focus on sustainability and cost-effectiveness in the construction and manufacturing industries will likely boost the adoption of ductile iron as a material of choice. Additionally, advancements in manufacturing technologies and the growing use of ductile iron profiles in emerging markets will contribute to sustained market expansion through 2035.

From 2025 to 2030, the market is expected to grow from USD 768.2 million to USD 1,037.8 million, adding USD 269.6 million. This growth represents a 35% increase and is driven by rising demand in infrastructure projects, industrial applications, and automotive sectors. As the global focus on infrastructure development and the need for high-performance materials in water and sewage systems intensifies, ductile iron profiles will continue to be a preferred material for their durability and cost-effectiveness.

Between 2030 and 2035, the market is forecast to expand from USD 1,037.8 million to USD 1,401.9 million, a growth of USD 364.1 million. This phase will see further adoption in industrial sectors, as well as global infrastructure growth, particularly in emerging economies. The increased focus on sustainable and resilient materials in construction and transportation, combined with innovations in ductile iron manufacturing, will continue to drive the market’s upward trajectory, securing a strong position for ductile iron profiles in the coming decade.

| Metric | Value |

|---|---|

| Market Value (2025) | USD 768.2 million |

| Market Forecast Value (2035) | USD 1,401.9 million |

| Forecast CAGR (2025 to 2035) | 6.2% |

The ductile iron profile market is expanding due to increasing demand for high-strength, durable, and cost-efficient industrial materials across key end-use sectors. One of the primary growth drivers is the automotive industry, where ductile iron profiles are widely utilized in engine components, suspension systems, crankshafts, and structural parts that require superior impact resistance and fatigue performance. As automotive manufacturers pursue longer-lasting vehicle systems and cost optimization, ductile iron provides an advantage due to its high tensile strength, fracture resistance, and lightweight performance capabilities relative to traditional cast iron.

The market is also being propelled by rapid growth in construction and infrastructure development, particularly in emerging economies where demand for water pipelines, drainage systems, structural supports, and municipal engineering components continues to rise. Ductile iron offers longer service life and corrosion resistance, reducing maintenance and replacement costs, which is highly attractive for public infrastructure projects. Additionally, the machinery manufacturing and energy sectors rely on ductile iron profiles to produce industrial equipment, turbine components, power transmission parts, and heavy-duty machine frames, benefiting from their high wear resistance and shape versatility.

Technological advancements in continuous casting, heat treatment, and automated machining have further enhanced production efficiency, enabling manufacturers to provide more customized and performance-optimized ductile iron profiles. Growing emphasis on sustainable materials and increased use of recycled iron also support the market’s long-term growth trajectory.

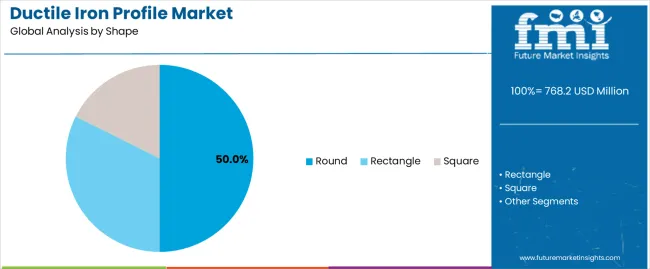

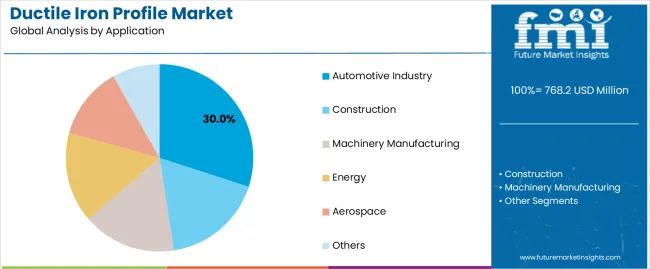

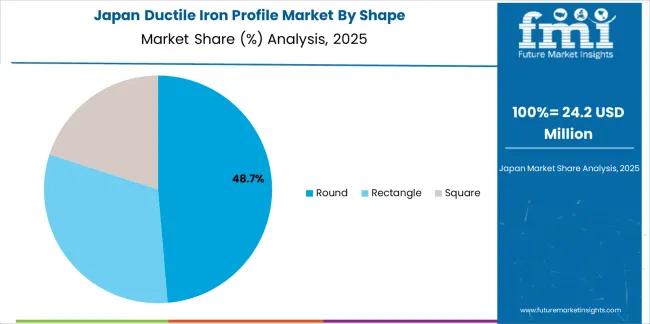

The Ductile Iron Profile Market is segmented into two key categories: shape and application. By shape, the market is divided into round, rectangle, and square profiles, with the round segment holding the largest market share due to its widespread use in high-performance applications. The automotive industry, construction, machinery manufacturing, and energy sectors are the primary end-users of ductile iron profiles, with the automotive industry being the leading application segment. Geographically, regions such as China, India, and Germany are seeing the most significant demand, driven by their strong manufacturing bases and robust industrial growth, while regions like the USA and Brazil exhibit steady growth.

The round shape segment is the dominant force in the Ductile Iron Profile Market, holding approximately 50% of the total market share. This segment’s leadership is driven by its superior versatility, strength, and adaptability across multiple industrial sectors. Round ductile iron profiles are preferred for applications that require high load-bearing capacity, tensile strength, and corrosion resistance, particularly in automotive and construction industries. In the automotive sector, round profiles are extensively used in the production of engine components, suspension parts, and brake systems due to their ability to withstand high stress and vibration. Moreover, their malleability allows for better customization and precision casting, making them ideal for complex parts like crankshafts and connecting rods. In construction, round profiles are favored for water pipelines, drainage systems, and structural reinforcement due to their strength, resistance to corrosion, and flexibility in handling pressure. The growing demand for energy-efficient and long-lasting materials in these sectors further bolsters the round shape’s position as the leading segment in the market.

The automotive industry is the largest application segment in the Ductile Iron Profile Market, commanding around 30% of the total market share. The automotive sector’s demand for ductile iron profiles is driven by the need for high-performance materials that offer strength, lightweight, and resilience in the manufacturing of critical vehicle components. Engine blocks, cylinder heads, brake discs, and suspension components are typically produced using ductile iron due to its excellent machinability, shock absorption, and vibration resistance. The demand for fuel-efficient and lightweight vehicles is pushing the adoption of ductile iron over traditional materials, as it provides the desired durability while minimizing weight. The automotive industry’s shift towards sustainable production and reduced emissions is further driving the need for high-strength, cost-effective materials like ductile iron, as they contribute to the overall energy efficiency of vehicles. Furthermore, the increasing production of electric vehicles (EVs), where lightweight materials and cost-efficiency are crucial, is expected to further propel the demand for ductile iron profiles in this sector, ensuring its continued dominance in the market.

The ductile iron profile market is driven by the increasing demand from the automotive, construction, and machinery manufacturing sectors. The automotive industry drives significant growth due to the need for high-performance materials for critical components such as engine blocks, brake systems, and suspension parts. Additionally, the growing need for sustainable construction materials is propelling demand for ductile iron profiles in pipes and structural components. However, the market faces challenges, such as high production costs and the complexity of manufacturing ductile iron profiles, which may limit their adoption in cost-sensitive applications. Despite these challenges, key trends such as increasing automation, advancements in casting techniques, and the growing adoption of eco-friendly materials are positively impacting the market. Technological innovations are making ductile iron profiles more cost-effective and high-performing, supporting long-term growth in sectors like automotive and energy.

What Are the Key Drivers of the Ductile Iron Profile Market?

The ductile iron profile market is primarily driven by increasing demand from the automotive, construction, and machinery manufacturing sectors. The automotive industry, in particular, drives market growth as manufacturers increasingly adopt ductile iron profiles for critical components like engine blocks, cylinder heads, and suspension parts. The material's ability to offer high strength, corrosion resistance, and cost-effectiveness makes it ideal for automotive applications. The construction industry also contributes significantly to the market, where ductile iron profiles are used in pipes, valves, and structural reinforcements. The demand for high-performance materials in heavy-duty machinery and power generation equipment continues to propel market growth. Additionally, the increasing focus on sustainability and eco-friendly materials in manufacturing is further driving the use of ductile iron, which can be produced using recycled materials, contributing to its growing adoption.

What Are the Key Restraints in the Ductile Iron Profile Market?

Despite its growth, the ductile iron profile market faces challenges, including the high cost of manufacturing compared to other materials. While ductile iron profiles offer superior strength and durability, their production costs can be higher than alternative materials, such as steel or plastic, which may limit their adoption in cost-sensitive applications. Moreover, the market’s growth is hampered by the complexity of production, as the manufacturing of high-quality ductile iron profiles requires specialized equipment and skilled labor. Additionally, fluctuations in the price of raw materials, particularly iron ore, can impact production costs. The market also faces regional limitations, with some emerging markets experiencing slower adoption due to limited access to advanced manufacturing technologies and infrastructure.

What Are the Key Trends in the Ductile Iron Profile Market?

Several trends are shaping the ductile iron profile market. Sustainability is a key driver, with increasing demand for eco-friendly materials and the growing use of recycled iron in ductile iron profiles. The automotive industry is particularly focused on lightweight vehicles and fuel-efficient technologies, which are boosting the adoption of ductile iron for automotive parts like engine blocks and suspension components. Minimally invasive construction techniques and sustainable building practices in the construction sector are also contributing to market growth. Additionally, advancements in casting technologies and material innovations are enabling manufacturers to produce higher-quality, cost-effective ductile iron profiles that meet the demands of modern industries. The market is also witnessing increased adoption of ductile iron profiles in aerospace and energy sectors, where high-performance materials are needed to withstand extreme operating conditions.

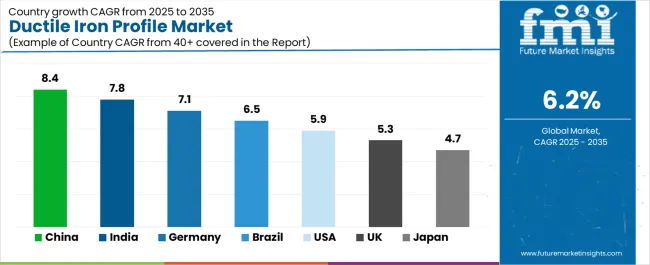

The ductile iron profile market is growing across different regions, with China, India, and Germany leading the charge due to strong demand in automotive, construction, and machinery manufacturing sectors. These countries benefit from advanced manufacturing technologies, a robust industrial base, and significant infrastructure investments. The USA and UK show steady growth, supported by their advanced automotive and construction sectors. Meanwhile, Brazil and Japan present moderate growth opportunities, driven by rising demand in machinery manufacturing and energy production.

| Country | CAGR (%) |

|---|---|

| China | 8.4 |

| India | 7.8 |

| Germany | 7.1 |

| Brazil | 6.5 |

| USA | 5.9 |

| UK | 5.3 |

| Japan | 4.7 |

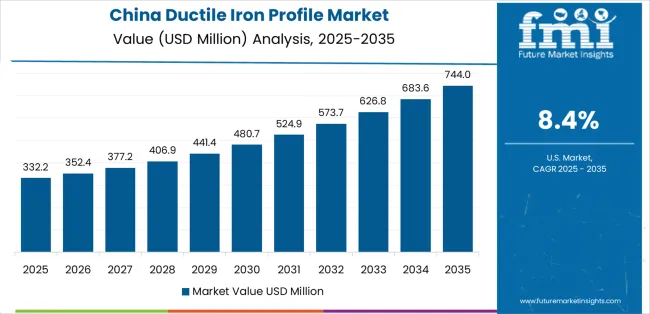

China is expected to register a robust CAGR of 8.4% in the ductile iron profile market. The country’s expansive manufacturing base across automotive, construction, and machinery sectors drives demand for high performance profiles such as ductile iron. As China pursues large scale infrastructure development bridges, railways, highways, and industrial plants the use of ductile iron profiles with excellent tensile strength, ductility, and corrosion resistance becomes a strategic choice for equipment manufacturers. In the automotive domain, Chinese OEMs increasingly specify ductile iron profiles for engine components, suspension parts, and structural elements to meet standards of durability, weight efficiency, and cost effectiveness. The regional supply chain ecosystem foundries, machining centres, and downstream processing also supports rapid production scalability and localisation, allowing manufacturers to meet both domestic and export demand efficiently. Given China’s push toward sustainable manufacturing, increased regulatory emphasis on emissions and recycling further favours ductile iron profiles made from recycled raw materials, highlighting the strong tailwinds behind the projected 8.4% CAGR.

India’s ductile iron profile market is projected to grow at a CAGR of 7.8%, positioning it among the fastest growing geographies. Rapid urbanisation, expanding automotive production, and the rise of heavy machinery manufacturing stations are key demand catalysts. India’s construction boom particularly in public infrastructure, smart city rollouts, and power transmission projects relies heavily on robust metallic profiles that can endure harsh conditions. Ductile iron profiles with enhanced impact resistance and die forged finish are increasingly chosen for structural frameworks, automotive chassis elements, and machinery components. Additionally, India’s emphasis on import substitution and development of domestic foundries allows local producers to scale cost effectively, thereby enabling widespread adoption across both Tier 1 and Tier 2 suppliers. Growing environmental awareness and the ability to recycle iron scrap further contribute to ductile iron’s appeal, aligning with India’s sustainability agenda. As a result, the 7.8% CAGR reflects a potent blend of infrastructure expansion, automotive sector growth and localisation of high performance materials.

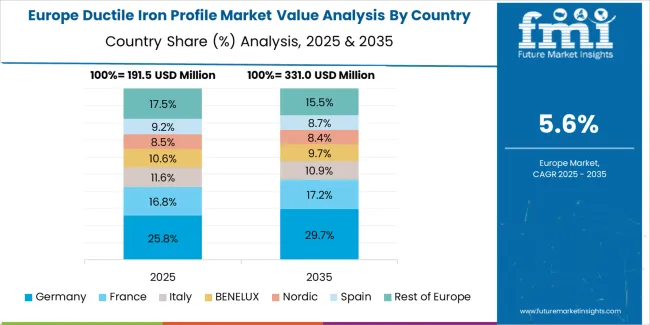

Germany is forecast to grow at a CAGR of 7.1% in the ductile iron profile market. Known for its advanced automotive, industrial machinery and construction equipment industries, Germany demands precision engineered profiles with superior mechanical properties. In this context, ductile iron profiles are prized for their fatigue resistance, machinability, and ability to be cast and shaped into complex geometries required for high end machines and automotive components. German manufacturers value long life materials with low life cycle costs, making ductile iron profiles a preferred choice from both performance and sustainability perspectives. Further, Germany’s emphasis on Industry 4.0, automation in foundries and materials innovation supports rapid adoption of high quality profiles. With stringent EU regulations on materials, emissions and recyclability, ductile iron’s recyclability and robustness bolster its market position. The combination of technical sophistication, sustainability criteria and well established industrial value chains underlies Germany’s projected 7.1% CAGR.

Brazil is estimated to grow at a CAGR of 6.5% in the ductile iron profile market, supported by expanding infrastructure, automotive production and energy sector investment. The construction of pipelines, road networks, and heavy machinery manufacturing plants in Brazil is generating demand for rugged profiles capable of withstanding harsh environments, heavy loads and corrosion from tropical climates. Ductile iron offers suitable characteristics such as high strength, good ductility and wear resistance, making it an attractive option for Brazilian applications in construction, energy, and automotive. Moreover, Brazil’s local foundry base and rising domestic demand allow manufacturers to supply cost effective ductile iron profiles domestically. As Brazil modernises its industrial base and integrates sustainable manufacturing practices, the shift toward materials with higher lifecycle performance and recyclability further supports ductile iron’s adoption. The 6.5% CAGR reflects a growing but moderate pace aligned with Brazil’s infrastructural development tempo.

The United States is projected to register a CAGR of 5.9% in the ductile iron profile market. With a mature automotive industry, advanced machinery manufacturing and large scale infrastructure systems, the USA demand centres on high performance materials that meet stringent standards for durability, safety, and cost efficiency. Ductile iron profiles are utilized in engine housings, transmission components, construction frameworks and energy sector parts where robustness and tilt toward lighter weight are required. USA foundries are also investing in automated casting, heat treatment, and quality inspection processes, enabling the supply of premium ductile iron profiles. The regulatory environment particularly around materials, emissions and recyclability—is driving manufacturers toward more sustainable materials, and ductile iron’s recyclability supports this shift. While growth is slower compared to emerging economies, the focus on material performance, engineering specificity and lifecycle cost ensures the USA remains a significant market for ductile iron profiles.

The United Kingdom is forecast to grow at a CAGR of 5.3% in the ductile iron profile sector. Although the UK market is smaller than some global peers, it benefits from strong industrial manufacturing, refurbishment of infrastructure, and niche engineering applications. UK manufacturers and end users favour materials with high reliability, low maintenance and ability to integrate with automation and smart manufacturing. Ductile iron profiles offer robust mechanical properties, ease of casting into tailored shapes and maintenance friendly characteristics that align with UK requirements for high spec industrial components, automotive supply and infrastructure upgrades. With increasing emphasis on sustainable manufacturing, circular economy principles, and light weighting in automotive and machinery sectors, ductile iron’s recyclability and strength provide a compelling value proposition. The moderate CAGR of 5.3% reflects the UK’s mature but evolving industrial landscape.

Japan’s ductile iron profile market is projected to grow at a CAGR of 4.7%, reflecting a more mature market environment and slower infrastructure investment growth. Japanese manufacturers prioritise precision engineering, light weight materials, and high strength to weight ratios, and while ductile iron profiles offer commendable properties, alternatives such as aluminium alloys often compete in high end industries. Nonetheless, ductile iron finds use in automotive components, industrial machinery, and infrastructure applications where long life and recyclability matter. The established manufacturing base, strong materials ecosystem and stringent quality standards in Japan support the use of advanced ductile iron profiles. Moreover, Japan’s drive toward sustainability, material circularity and advanced casting technologies means ductile iron continues to maintain relevance as manufacturing evolves. The 4.7% CAGR reflects a stable but slower growth path in a highly developed industrial market.

The ductile iron profile market is highly competitive, with a mix of global leaders and regional players. United Cast Bar Group is a key player in the market, holding approximately 10% of the market share, thanks to its strong presence in the production of high-quality ductile iron profiles for various applications, including automotive and machinery manufacturing. Other major players such as Dura-Bar, BIRN Group, and ACO Eurobar focus on producing durable, high-performance profiles and are known for their expertise in custom casting and material innovation. Their investments in R&D and expansion in emerging markets further strengthen their competitive position.

Regional companies such as Hitachi Metals, KOGI Corporation, and Encore Metals are also making significant strides, particularly in Asia and South America, by leveraging local manufacturing capabilities and offering cost-effective solutions. These companies are expanding their portfolios of ductile iron profiles with a focus on energy and aerospace applications, where the demand for strong, lightweight materials is increasing. Strategic partnerships, acquisitions, and ongoing innovation in sustainability and casting technology are key strategies being adopted by these players to maintain their competitive edge in the market.

| Items | Details |

|---|---|

| Quantitative Units | USD Million |

| Regions Covered | China, India, Germany, Brazil, USA, UK, Japan |

| Shape | Round, Rectangle, Square |

| Application | Automotive Industry, Construction, Machinery Manufacturing, Energy, Aerospace, Others |

| Key Companies Profiled | United Cast Bar Group, Dura-Bar, BIRN Group, ACO Eurobar, Hitachi Metals, KOGI Corporation, Encore Metals, Nippon Chuzo, Hengong Precision Equipment, Jiangsu Hualong Precision Intelligent Manufacturing, Henan Guotai Profile Technology, Wuan City Qichang Casting |

| Additional Attributes | The market analysis includes dollar sales by shape and application categories. It also covers regional adoption trends across key markets such as China, India, Germany, and the USA The competitive landscape highlights key manufacturers in the ductile iron profile sector, with a focus on innovations in casting and precision manufacturing processes. Trends in demand from industries such as automotive, construction, machinery manufacturing, and aerospace are explored, along with advancements in the use of ductile iron profiles for various applications. |

The global ductile iron profile market is estimated to be valued at USD 768.2 million in 2025.

The market size for the ductile iron profile market is projected to reach USD 1,401.9 million by 2035.

The ductile iron profile market is expected to grow at a 6.2% CAGR between 2025 and 2035.

The key product types in ductile iron profile market are round, rectangle and square.

In terms of application, automotive industry segment to command 30.0% share in the ductile iron profile market in 2025.

Our Research Products

The "Full Research Suite" delivers actionable market intel, deep dives on markets or technologies, so clients act faster, cut risk, and unlock growth.

The Leaderboard benchmarks and ranks top vendors, classifying them as Established Leaders, Leading Challengers, or Disruptors & Challengers.

Locates where complements amplify value and substitutes erode it, forecasting net impact by horizon

We deliver granular, decision-grade intel: market sizing, 5-year forecasts, pricing, adoption, usage, revenue, and operational KPIs—plus competitor tracking, regulation, and value chains—across 60 countries broadly.

Spot the shifts before they hit your P&L. We track inflection points, adoption curves, pricing moves, and ecosystem plays to show where demand is heading, why it is changing, and what to do next across high-growth markets and disruptive tech

Real-time reads of user behavior. We track shifting priorities, perceptions of today’s and next-gen services, and provider experience, then pace how fast tech moves from trial to adoption, blending buyer, consumer, and channel inputs with social signals (#WhySwitch, #UX).

Partner with our analyst team to build a custom report designed around your business priorities. From analysing market trends to assessing competitors or crafting bespoke datasets, we tailor insights to your needs.

Supplier Intelligence

Discovery & Profiling

Capacity & Footprint

Performance & Risk

Compliance & Governance

Commercial Readiness

Who Supplies Whom

Scorecards & Shortlists

Playbooks & Docs

Category Intelligence

Definition & Scope

Demand & Use Cases

Cost Drivers

Market Structure

Supply Chain Map

Trade & Policy

Operating Norms

Deliverables

Buyer Intelligence

Account Basics

Spend & Scope

Procurement Model

Vendor Requirements

Terms & Policies

Entry Strategy

Pain Points & Triggers

Outputs

Pricing Analysis

Benchmarks

Trends

Should-Cost

Indexation

Landed Cost

Commercial Terms

Deliverables

Brand Analysis

Positioning & Value Prop

Share & Presence

Customer Evidence

Go-to-Market

Digital & Reputation

Compliance & Trust

KPIs & Gaps

Outputs

Full Research Suite comprises of:

Market outlook & trends analysis

Interviews & case studies

Strategic recommendations

Vendor profiles & capabilities analysis

5-year forecasts

8 regions and 60+ country-level data splits

Market segment data splits

12 months of continuous data updates

DELIVERED AS:

PDF EXCEL ONLINE

Ductile and Grey Iron Casting Products Market Size and Share Forecast Outlook 2025 to 2035

Iron and Steel Counterweight Market Size and Share Forecast Outlook 2025 to 2035

Iron and Steel Casting Market Size and Share Forecast Outlook 2025 to 2035

Iron Phosphate Market Size and Share Forecast Outlook 2025 to 2035

Ironing Table Market Size and Share Forecast Outlook 2025 to 2035

Iron Powder Market - Trends & Forecast 2025 to 2035

Iron Oxide Market Report - Growth, Demand & Forecast 2025 to 2035

Iron Ore Pellets Market Growth - Trends & Forecast 2025 to 2035

Environmentally Friendly RPET Webbing Market Size and Share Forecast Outlook 2025 to 2035

Environment Health and Safety Market Size and Share Forecast Outlook 2025 to 2035

Environmental Radiation Monitor Market Size and Share Forecast Outlook 2025 to 2035

Environmental Test Chambers Market Size and Share Forecast Outlook 2025 to 2035

Environmental Management Systems Market Size and Share Forecast Outlook 2025 to 2035

Environmental Sensor Market Size and Share Forecast Outlook 2025 to 2035

Environmental Test Equipment Market Growth - Trends & Forecast 2025 to 2035

Environment Testing, Inspection and Certification Market Report – Demand, Growth & Industry Outlook 2025 to 2035

Environmental Remediation Technology Market - Size, Share & Forecast 2025 to 2035

Environmental Catalysts Market Trends & Growth 2025 to 2035

Environmental Monitoring Market Report – Trends & Forecast 2024-2034

Grey Iron Rod Market Size and Share Forecast Outlook 2025 to 2035

Thank you!

You will receive an email from our Business Development Manager. Please be sure to check your SPAM/JUNK folder too.

Chat With

MaRIA