The profiled steel sheet decking market is projected to reach USD 7.3 billion in 2025 and expand to USD 19.2 billion by 2035, reflecting a compound annual growth rate of 10.1% over the decade. During the early adoption phase from 2020 to 2024, the market experienced gradual uptake as construction firms and developers explored its practical benefits.

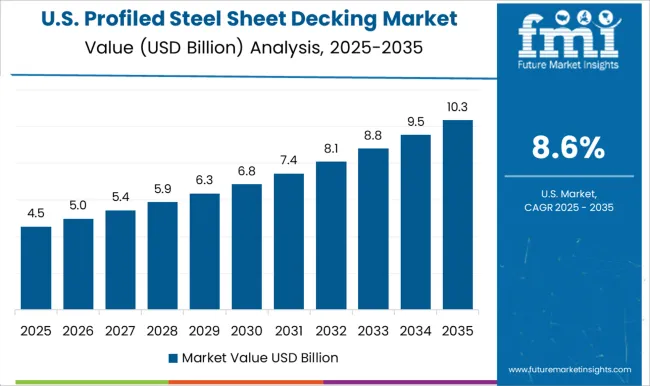

Market value increased from USD 4.5 billion to 6.7 billion, driven by pilot projects and selective integration into infrastructure developments. This period was marked by careful evaluation, learning curves, and establishing trust in performance and cost-effectiveness. Early adopters played a critical role in demonstrating viability, building references, and preparing the groundwork for broader acceptance and accelerated growth in the next phase. From 2025 to 2030, the market expands rapidly, growing from USD 7.3 billion to approximately USD 13.1 billion, signaling a strong scaling phase with widespread integration. During these years, mainstream construction projects increasingly implement profiled steel sheet decking, supported by expanding supply chains and standardized products. Competition intensifies as manufacturers optimize operations and distribution. By the end of this period, adoption reaches high levels, and leading players consolidate market positions. This sets the stage for the consolidation phase between 2030 and 2035, where the market stabilizes around USD 19.2 billion, marked by mature demand patterns and steady growth as dominant participants strengthen their presence.

| Metric | Value |

|---|---|

| Profiled Steel Sheet Decking Market Estimated Value in (2025 E) | USD 7.3 billion |

| Profiled Steel Sheet Decking Market Forecast Value in (2035 F) | USD 19.2 billion |

| Forecast CAGR (2025 to 2035) | 10.1% |

As observed in construction industry news, investor presentations, and press briefings by major steel manufacturers, demand for structural efficiency and faster project timelines has led to broader adoption of profiled steel decking systems across commercial, residential, and industrial projects.

The market is benefiting from the rising use of lightweight yet high-strength materials that enhance load-bearing capacity while reducing construction costs. Government-led infrastructure investments and commercial building renovations are also providing consistent demand.

Advancements in protective coatings and steel grades, coupled with growing adoption of modular construction practices, are expected to further support long-term market growth. Industry publications have reported that the recyclability and sustainability attributes of profiled steel sheets are aligning well with green building regulations and corporate sustainability goals, strengthening the market’s future outlook across key regional markets.

The profiled steel sheet decking market is segmented by product, application grade, and geographic regions. By product, the profiled steel sheet decking market is divided into Galvanized Steel and Cold Rolled Steel. In terms of application, the profiled steel sheet decking market is classified into Decking and Flooring. Based on grade, the profiled steel sheet decking market is segmented into Commercial, Residential, and Industrial. Regionally, the profiled steel sheet decking industry is classified into North America, Latin America, Western Europe, Eastern Europe, Balkan & Baltic Countries, Russia & Belarus, Central Asia, East Asia, South Asia & Pacific, and the Middle East & Africa.

The galvanized steel product segment is projected to hold 62.7% of the Profiled Steel Sheet Decking Market revenue share in 2025, making it the leading product category. This dominance has been supported by its superior corrosion resistance, durability, and cost-efficiency in demanding construction environments. According to engineering bulletins and supplier announcements, galvanized steel provides a longer service life in moisture-prone conditions, which enhances its suitability for both interior and exterior applications.

It has also been observed that its protective zinc coating ensures structural integrity while reducing maintenance needs over time. The commercial preference for this material has been driven by its availability in a wide range of thicknesses and profiles, making it compatible with diverse architectural requirements.

Reports from building system manufacturers have highlighted its adaptability in prefabricated systems, which further streamlines installation and project timelines. These benefits, combined with compliance with quality and safety standards, have established galvanized steel as the preferred choice in profiled sheet decking systems globally.

The decking application segment is anticipated to contribute 54.1% of the total market revenue in 2025, making it the largest application segment in the Profiled Steel Sheet Decking Market. This leadership position has been reinforced by the increased demand for efficient structural flooring solutions across commercial and industrial buildings.

As noted in civil engineering journals and construction material bulletins, profiled steel sheets have become integral to composite floor decking systems due to their high strength-to-weight ratio and excellent bonding capabilities with concrete. Industry professionals have indicated that the usage of steel decking significantly reduces construction time and labor requirements, making it highly attractive for high-rise and fast-track projects.

The application’s growth has been further encouraged by its compatibility with fire-resistant coatings and acoustic insulation systems, enhancing its performance in building safety and comfort. As urban infrastructure projects continue to scale up, the reliance on steel sheet decking for structural decks is expected to remain strong across developed and emerging markets.

The commercial grade segment is expected to account for 43.8% of the Profiled Steel Sheet Decking Market revenue share in 2025, establishing itself as the dominant grade category. The segment’s growth has been driven by the widespread demand for reliable and cost-effective steel grades suitable for non-critical structural applications. Commercial grade steel offers adequate strength and formability while remaining economically viable, which has made it highly favored in mid-rise commercial buildings, retail developments, and institutional structures.

Statements from manufacturers and procurement departments highlight that this grade ensures ease of fabrication and compatibility with large-volume construction demands, without compromising on standard performance metrics. The availability of commercial grade steel in various dimensions and finishes has allowed it to cater to a wide range of decking configurations.

Its steady demand has also been supported by contractors’ preference for materials that balance performance with project budgets. These factors have positioned the commercial grade as a key contributor to the overall market revenue in 2025.

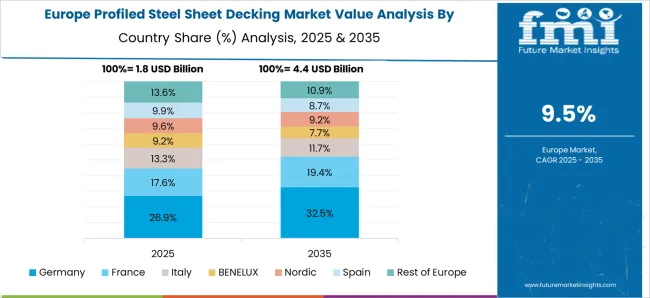

The profiled steel sheet decking market is experiencing significant growth as construction and infrastructure sectors increasingly adopt lightweight, durable, and cost-effective materials. Known for its high load-bearing capacity, fast installation, and versatility, profiled steel decking is widely applied in commercial, industrial, and residential projects. Market expansion is driven by innovations in coating technologies, structural design, and manufacturing automation, combined with growing urbanization and infrastructure development in emerging economies. North America and Europe currently lead the market due to established construction industries and supportive building codes, while Asia-Pacific shows emerging opportunities. Market focus emphasizes durability, sustainability, and enhanced performance across large-scale construction and infrastructure applications.

Ensuring consistent quality in profiled steel sheet decking remains a critical challenge. Variations in steel grade, coating processes, and production tolerances can impact structural integrity and corrosion resistance. Manufacturers must comply with diverse regional building codes and safety standards, which can differ widely across markets. Supply chain variability, such as seasonal availability of raw steel and logistical disruptions, further complicates quality assurance. Certification under recognized construction and material standards adds credibility but increases operational complexity. Companies investing in rigorous quality systems, precision manufacturing, and traceable supply chains gain competitive advantages. Until harmonized industry protocols are widely adopted, producers face challenges in maintaining consistent product performance, regulatory compliance, and end-user confidence.

Technological advancements are reshaping the profiled steel decking market. Modern manufacturing techniques, including precision roll forming and automated welding, improve dimensional accuracy and structural performance. Advanced coatings, such as galvanization and polymer-based finishes, enhance corrosion resistance and longevity. Smart integration, including embedded sensors for structural health monitoring, supports proactive maintenance and safety assurance. Lightweight yet high-strength profiles allow for faster construction and reduced load on underlying structures. Manufacturers collaborating with engineering research institutions validate innovations, enabling premium products for demanding applications. As performance and durability become key differentiators, companies leveraging technology to optimize structural, aesthetic, and functional characteristics are driving adoption in high-value construction and infrastructure projects.

Regulatory frameworks for profiled steel sheet decking vary by region, influencing market adoption. In North America and Europe, strict building codes regulate load-bearing capacity, fire resistance, and environmental compliance. In emerging markets, standards may be less defined, creating uncertainty for manufacturers and project planners. Certifications for safety, environmental impact, and performance consistency are increasingly required for large-scale construction projects. Labels and product documentation must comply with local regulations, and deviations can result in project delays or legal issues. Suppliers aligning with recognized regulatory standards improve market access and reduce risk exposure. Until global harmonization emerges, companies must navigate complex, region-specific rules to ensure compliance and support sustainable market growth.

Competition in the profiled steel sheet decking market is intense, involving established global players and local producers. Leading manufacturers maintain reputations for quality, research collaboration, and broad product portfolios, while smaller entrants may compete on price but lack standardization. Raw material sourcing, particularly steel, is affected by global supply fluctuations, tariffs, and seasonal availability. Logistical challenges during transport and fabrication further influence delivery reliability. Companies investing in vertically integrated sourcing, contract steel farming, or geographic diversification achieve supply chain stability. Differentiation increasingly focuses on sustainable materials, eco-friendly production methods, and performance optimization. Until raw material consistency and production scalability improve, competition and supply chain constraints will continue to impact adoption across construction, infrastructure, and industrial applications.

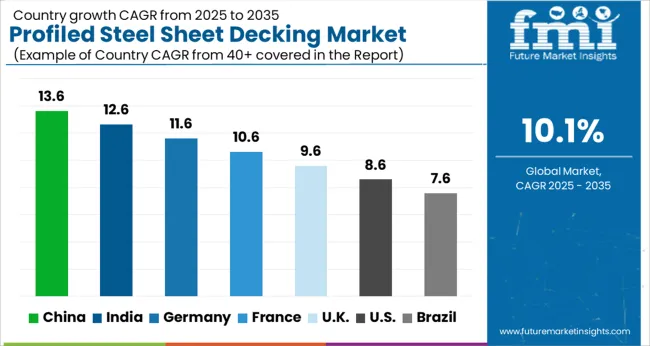

The global Steel Sheet Decking Market is projected to grow at a CAGR of 10.1% through 2035, supported by increasing demand across commercial, industrial, and infrastructure projects. Among BRICS nations, China has been recorded with 13.6% growth, driven by large-scale construction and industrial manufacturing, while India has been observed at 12.6%, supported by rising demand in residential and commercial building projects. In the OECD region, Germany has been measured at 11.6%, where steel production and industrial applications have been steadily expanded. The United Kingdom has been noted at 9.6%, as construction and refurbishment activities have been steadily supplied, and the USA has been recorded at 8.6%, with production for commercial and industrial sectors being consistently increased. This report includes insights on 40+ countries; the top five markets are shown here for reference.

The profiled steel sheet decking market in China is growing at 13.6%, driven by rapid urbanization, industrial expansion, and infrastructure development. Increasing construction activities, particularly in commercial and high-rise buildings, are creating strong demand for steel decking solutions that offer structural strength, durability, and cost efficiency. Local manufacturers are adopting advanced production techniques to improve quality and reduce material waste, while government initiatives promoting smart city development and sustainable construction are supporting market expansion. Additionally, collaborations with international suppliers are facilitating technology transfer and innovation in steel decking products. Rising investments in infrastructure projects, including bridges, metro rail systems, and industrial complexes, are further boosting demand. The Chinese market is expected to continue its upward trajectory as construction and industrial growth sustain the need for reliable and versatile steel decking solutions.

The profiled steel sheet decking market in India is expanding at 12.6%, fueled by the country’s growing construction and infrastructure sector. Rapid urban development, government-backed housing schemes, and commercial real estate projects are increasing the demand for durable and cost-effective steel decking systems. Indian manufacturers are investing in modern production technologies to enhance product quality and meet international standards. The government’s focus on industrial corridors, smart cities, and transportation infrastructure is further boosting market growth. Rising awareness of safety, sustainability, and fire-resistant construction materials is driving the adoption of profiled steel sheet decking in both residential and commercial projects. With ongoing infrastructure initiatives and expanding industrial construction, India’s market for steel decking solutions is poised for steady growth, offering opportunities for local producers, international suppliers, and technology providers.

Germany’s profiled steel sheet decking market is growing at 11.6%, supported by modernization of industrial facilities, commercial construction, and sustainable building practices. German construction projects increasingly require steel decking solutions that combine strength, durability, and compliance with stringent environmental regulations. Advanced manufacturing technologies, precision engineering, and adherence to European quality standards are key factors supporting the market. The integration of steel decking in industrial plants, warehouses, and high-rise commercial buildings is contributing to steady demand. Germany’s focus on energy-efficient and sustainable construction is driving innovation in lightweight and fire-resistant steel decking systems. Local manufacturers and international suppliers are collaborating to deliver high-quality solutions, optimizing structural performance while meeting environmental and safety standards. The market is expected to maintain consistent growth due to ongoing infrastructure modernization and construction projects.

The profiled steel sheet decking market in the United Kingdom is expanding at 9.6%, supported by growing construction activities, urban redevelopment projects, and infrastructure modernization. Steel decking is increasingly preferred in commercial buildings, industrial facilities, and high-rise construction due to its structural strength, durability, and fire resistance. The adoption of advanced manufacturing processes and modular construction techniques is enhancing efficiency and reducing construction timelines. Government initiatives promoting sustainable and safe construction are also driving the use of steel decking solutions. Investment in industrial projects, commercial complexes, and urban infrastructure is creating demand for innovative decking systems. The UK market is expected to experience steady growth as construction activity continues and developers prioritize durable, high-performance materials.

The profiled steel sheet decking market in the United States is growing at 8.6%, fueled by ongoing construction of commercial, industrial, and high-rise buildings. Steel decking solutions are preferred for their strength, versatility, and cost-effectiveness. The USA market benefits from advanced manufacturing technologies, standardized production processes, and adherence to building codes and safety regulations. Increasing demand for modular construction, sustainable materials, and fire-resistant systems is driving adoption across various construction projects. Investments in infrastructure, warehouses, office complexes, and residential high-rises are supporting market expansion. Collaboration between local manufacturers and international suppliers is facilitating access to innovative solutions. With steady construction activity and modernization of facilities, the USA market for profiled steel sheet decking is poised for sustainable growth.

The profiled steel sheet decking market is a critical component of the construction and infrastructure sector, providing durable, high-strength solutions for floors, roofs, and composite structures. These decking systems enhance structural integrity, reduce construction time, and allow for cost-effective load-bearing designs in commercial, industrial, and residential buildings. The market is witnessing growth due to increasing urbanization, rising demand for high-rise buildings, and the push for faster, safer, and more sustainable construction techniques. Leading players in the market include Tata Steel, recognized for its high-quality steel decking solutions and wide distribution network, and Vulcraft Group, a major provider of steel deck products for commercial and industrial construction. Kingspan Group focuses on innovative, energy-efficient, and lightweight steel solutions, while Canam Group Inc. offers custom-designed decking systems for large-scale construction projects. Other notable players include D-MAC Industries, Inc. and Marlyn Steel Decks, Inc., which supply specialized and cost-effective decking products tailored to specific structural needs. Nippon Steel Corporation brings global expertise and advanced steel manufacturing capabilities to the market, whereas Emirates Building System addresses the Middle Eastern construction sector with durable and climate-adapted solutions. The market’s growth is further driven by increased adoption of prefabricated and modular construction methods, rising infrastructure investments, and advancements in high-strength, corrosion-resistant steel. As construction standards evolve, profiled steel sheet decking is expected to play an increasingly vital role in delivering efficient, resilient, and sustainable building solutions worldwide.

| Item | Value |

|---|---|

| Quantitative Units | USD 7.3 Billion |

| Product | Galvanized Steel and Cold Rolled Steel |

| Application | Decking and Flooring |

| Grade | Commercial, Residential, and Industrial |

| Regions Covered | North America, Europe, Asia-Pacific, Latin America, Middle East & Africa |

| Country Covered | United States, Canada, Germany, France, United Kingdom, China, Japan, India, Brazil, South Africa |

| Key Companies Profiled | TATA Steel, Vulcraft Group, Kingspan Group, Canam Group Inc., D-MAC Industries, Inc., Marlyn Steel Decks, Inc., Nippon Steel Corporation, and Emirates Building System |

| Additional Attributes | Dollar sales by type including galvanized, painted, and stainless steel sheets, application across commercial buildings, industrial facilities, and residential construction, and region covering North America, Europe, and Asia-Pacific. Growth is driven by rising construction activities, demand for durable and cost-effective flooring solutions, and adoption of modern building techniques. |

The global profiled steel sheet decking market is estimated to be valued at USD 7.3 billion in 2025.

The market size for the profiled steel sheet decking market is projected to reach USD 19.2 billion by 2035.

The profiled steel sheet decking market is expected to grow at a 10.1% CAGR between 2025 and 2035.

The key product types in profiled steel sheet decking market are galvanized steel, _double side primer coated, _pre-coated underside and cold rolled steel.

In terms of application, decking segment to command 54.1% share in the profiled steel sheet decking market in 2025.

Our Research Products

The "Full Research Suite" delivers actionable market intel, deep dives on markets or technologies, so clients act faster, cut risk, and unlock growth.

The Leaderboard benchmarks and ranks top vendors, classifying them as Established Leaders, Leading Challengers, or Disruptors & Challengers.

Locates where complements amplify value and substitutes erode it, forecasting net impact by horizon

We deliver granular, decision-grade intel: market sizing, 5-year forecasts, pricing, adoption, usage, revenue, and operational KPIs—plus competitor tracking, regulation, and value chains—across 60 countries broadly.

Spot the shifts before they hit your P&L. We track inflection points, adoption curves, pricing moves, and ecosystem plays to show where demand is heading, why it is changing, and what to do next across high-growth markets and disruptive tech

Real-time reads of user behavior. We track shifting priorities, perceptions of today’s and next-gen services, and provider experience, then pace how fast tech moves from trial to adoption, blending buyer, consumer, and channel inputs with social signals (#WhySwitch, #UX).

Partner with our analyst team to build a custom report designed around your business priorities. From analysing market trends to assessing competitors or crafting bespoke datasets, we tailor insights to your needs.

Supplier Intelligence

Discovery & Profiling

Capacity & Footprint

Performance & Risk

Compliance & Governance

Commercial Readiness

Who Supplies Whom

Scorecards & Shortlists

Playbooks & Docs

Category Intelligence

Definition & Scope

Demand & Use Cases

Cost Drivers

Market Structure

Supply Chain Map

Trade & Policy

Operating Norms

Deliverables

Buyer Intelligence

Account Basics

Spend & Scope

Procurement Model

Vendor Requirements

Terms & Policies

Entry Strategy

Pain Points & Triggers

Outputs

Pricing Analysis

Benchmarks

Trends

Should-Cost

Indexation

Landed Cost

Commercial Terms

Deliverables

Brand Analysis

Positioning & Value Prop

Share & Presence

Customer Evidence

Go-to-Market

Digital & Reputation

Compliance & Trust

KPIs & Gaps

Outputs

Full Research Suite comprises of:

Market outlook & trends analysis

Interviews & case studies

Strategic recommendations

Vendor profiles & capabilities analysis

5-year forecasts

8 regions and 60+ country-level data splits

Market segment data splits

12 months of continuous data updates

DELIVERED AS:

PDF EXCEL ONLINE

Steel Drum Market Size and Share Forecast Outlook 2025 to 2035

Steel Drums & IBCs Market Size and Share Forecast Outlook 2025 to 2035

Steel Roll-on Tube Market Size and Share Forecast Outlook 2025 to 2035

Steel Testing Equipment Market Size and Share Forecast Outlook 2025 to 2035

Steel Salvage Drums Market Size and Share Forecast Outlook 2025 to 2035

Steel Wire Reinforced Polyethylene Pipe Market Size and Share Forecast Outlook 2025 to 2035

Steel Wire Market Size and Share Forecast Outlook 2025 to 2035

Steel Strapping Market Size and Share Forecast Outlook 2025 to 2035

Steel Drum Industry Analysis in Southeast Asia Size and Share Forecast Outlook 2025 to 2035

Steel Studs Market Size and Share Forecast Outlook 2025 to 2035

Steel Rebar Market Size and Share Forecast Outlook 2025 to 2035

Steel Sections Market Analysis - Size, Share, and Forecast Outlook 2025 to 2035

Steel Market Size, Growth, and Forecast 2025 to 2035

Steel Containers Market Analysis by Product Type, Capacity Type, End Use, and Region through 2025 to 2035

Steel Pipe Market Growth - Trends & Forecast 2025 to 2035

Key Players & Market Share in the Steel Containers Industry

Competitive Overview of Steel Drum Market Share

Examining Market Share Trends in Steel Drums and IBCs Industry

Japan Steel Drum Market Analysis – Trends & Forecast 2023-2033

Korea Steel Drum Market Growth – Trends & Forecast 2023-2033

Thank you!

You will receive an email from our Business Development Manager. Please be sure to check your SPAM/JUNK folder too.

Chat With

MaRIA