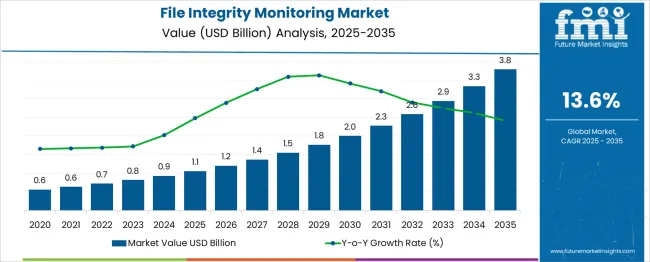

The File Integrity Monitoring Market is estimated to be valued at USD 1.1 billion in 2025 and is projected to reach USD 3.8 billion by 2035, registering a compound annual growth rate (CAGR) of 13.6% over the forecast period.

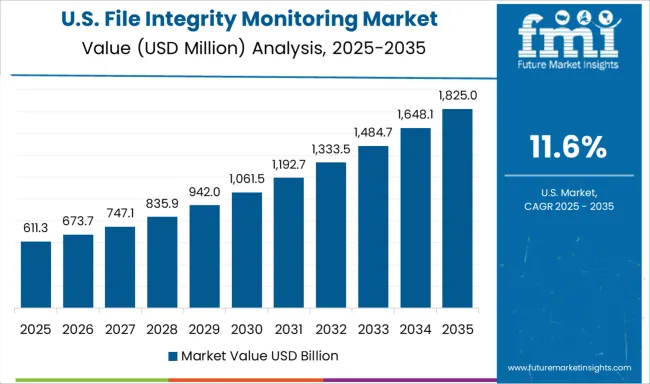

A rolling CAGR analysis of the dataset indicates consistent acceleration across sequential multi-year periods, reflecting a rapid adoption curve driven by increasing cybersecurity priorities and compliance mandates. From 2025 to 2028, the rolling CAGR is in the range of 8% to 10%, supported by early-phase adoption in heavily regulated industries such as banking, healthcare, and government. Growth in this stage is linked to organizations implementing foundational monitoring solutions to address rising data breach risks. Between 2028 and 2031, the rolling CAGR strengthens to 12% to 14%, marking an acceleration phase as advanced analytics, cloud integration, and AI-driven monitoring tools gain traction. This period also benefits from expansion in mid-sized enterprises and growth in managed security service providers. In the final years from 2031 to 2035, the rolling CAGR peaks in the 14% to 15% range, showing that market momentum continues even on a larger revenue base. This stability at high growth rates demonstrates a robust and sustained demand cycle, positioning the market for further expansion beyond 2035 as file integrity monitoring becomes a core element of enterprise security frameworks.

| Metric | Value |

|---|---|

| File Integrity Monitoring Market Estimated Value in (2025 E) | USD 1.1 billion |

| File Integrity Monitoring Market Forecast Value in (2035 F) | USD 3.8 billion |

| Forecast CAGR (2025 to 2035) | 13.6% |

The file integrity monitoring market is viewed as a specialised yet steadily expanding category across its parent industries. It is estimated to account for about 2.2 percent of the global cybersecurity software market indicating growing demand for systems securing configuration and change control. Within the threat detection and compliance software sector a share of approximately 3.5 percent is assessed driven by use in regulatory and audit critical environments. In the system monitoring and operations management segment around 3.0 percent is observed supported by enterprises seeking real time change awareness. Within the enterprise IT security tools industry about 2.7 percent is evaluated as file integrity features are embedded in broader security platforms.

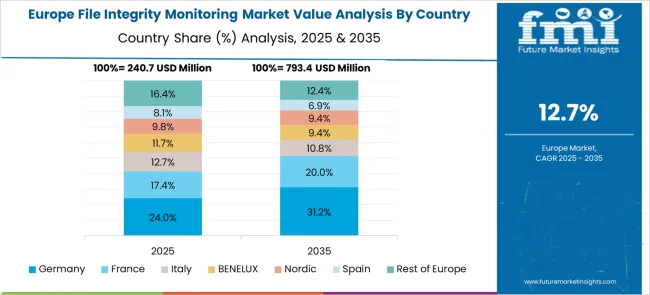

In the managed security services and governance risk compliance market a contribution of roughly 2.9 percent is calculated reflecting adoption by service providers for continuous compliance surveillance Trends in this market have been shaped by increased use of solutions enforcing continuous monitoring of file and configuration changes. Innovations have been focused on agentless deployment options artificial intelligence based anomaly detection and integration with SIEM and SOAR platforms. Interest has increased in cloud native file integrity tools for container and microservice environments. The North America region has been observed to display the fastest uptake while Europe has maintained strong adoption under strict data protection and audit regulations. Strategic initiatives have included partnerships between file integrity vendors and managed security service providers to offer unified monitoring solutions featuring predictive alerts centralised dashboards and automated compliance reporting tools.

The file integrity monitoring (FIM) market is gaining traction due to heightened cybersecurity threats, regulatory compliance mandates, and the growing need to detect unauthorized changes across IT infrastructure. Enterprises across sectors are prioritizing FIM solutions to ensure real-time visibility into critical system and configuration files.

Rising instances of insider threats, advanced persistent threats (APTs), and ransomware have amplified the importance of continuous monitoring solutions. The integration of FIM with broader security information and event management (SIEM) platforms is also expanding deployment.

Additionally, increased cloud migration and hybrid IT environments are demanding robust file monitoring tools that can function across both physical and virtualized environments.

The file integrity monitoring market is segmented by component, installation mode, deployment, enterprise size, end use, and geographic regions. The file integrity monitoring market is divided into Software and Services. In terms of installation mode, the file integrity monitoring market is classified into Agent-based and Agentless. Based on deployment, the file integrity monitoring market is segmented into On-premises and Cloud-based. The enterprise size of the file integrity monitoring market is segmented into Enterprise and SME. The end use of the file integrity monitoring market is segmented into BFSI, Government, Healthcare & life sciences, Education, Media & entertainment, Retail & eCommerce, Manufacturing & automotive, and Others. Regionally, the file integrity monitoring industry is classified into North America, Latin America, Western Europe, Eastern Europe, Balkan & Baltic Countries, Russia & Belarus, Central Asia, East Asia, South Asia & Pacific, and the Middle East & Africa.

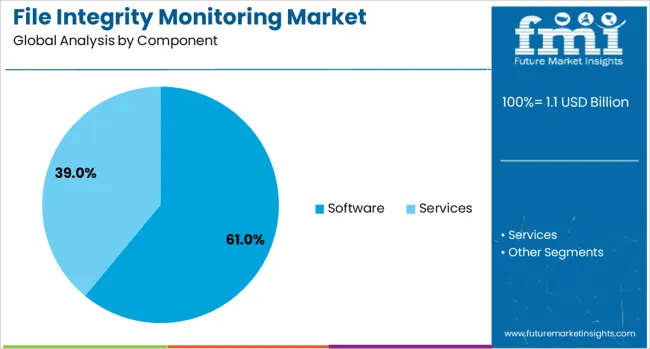

Software is projected to dominate the file integrity monitoring market with a 61.00% share in 2025, making it the leading component segment. The segment’s growth is driven by the scalability, automation, and integration capabilities offered by FIM software solutions.

Organizations prefer software-based monitoring for its ability to track and report file changes across distributed systems, especially in dynamic environments such as DevOps pipelines and containerized infrastructures. Advanced FIM software solutions offer real-time alerting, customizable baselines, and AI-driven anomaly detection, enhancing enterprise security posture.

As enterprises move toward centralized threat detection and compliance automation, software-based FIM solutions are becoming the core of cybersecurity monitoring strategies.

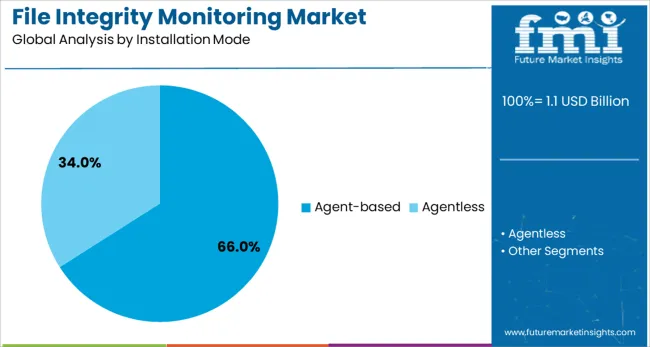

Agent-based installation is expected to account for 66.00% of the market share in 2025, establishing it as the dominant installation mode. This preference is attributed to the granular visibility and system-level access that agent-based models provide, which is critical for detailed change tracking.

Unlike agentless systems that rely on external polling, agent-based tools allow for real-time event capture and detailed audit trails across endpoints, servers, and cloud instances. Their ability to operate in offline or low-bandwidth environments makes them especially useful in industries with stringent security and uptime requirements such as banking, healthcare, and manufacturing.

Despite slightly higher management overhead, the enhanced control and accuracy continue to drive agent-based adoption.

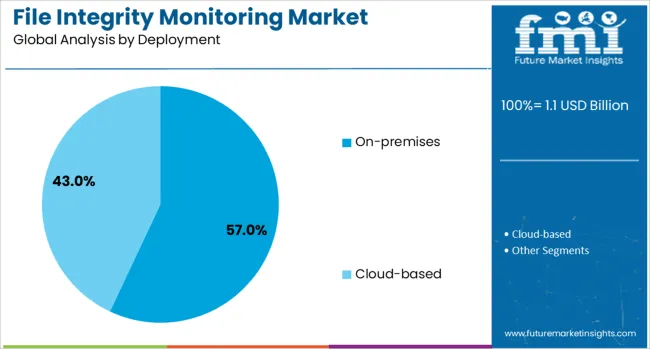

On-premises deployment is projected to lead the market with a 57.00% share in 2025, making it the top deployment model. This segment’s strength is due to the heightened sensitivity around data privacy, control, and compliance in sectors such as finance, government, and defense.

On-premises FIM solutions enable direct control over monitoring configurations, data storage, and incident response workflows without external dependencies. Organizations handling regulated workloads or classified data often favor on-premise systems to ensure security architecture remains entirely within their network perimeter.

Furthermore, the ability to integrate with legacy infrastructure and local SIEM tools provides added flexibility. Despite the shift to cloud, on-premises solutions remain critical in hybrid and high-security IT environments.

File integrity monitoring (FIM) solutions have been increasingly deployed by enterprises to detect unauthorized changes in critical files, configurations, and system registries. These tools have been widely used in industries with strict compliance requirements, including finance, healthcare, and government sectors. Demand has been influenced by the growing frequency of cyberattacks, insider threats, and data breach incidents. Vendors have been integrating real-time monitoring, automated alerts, and forensic analysis capabilities into FIM platforms, enabling organizations to improve security posture and meet audit and regulatory requirements.

Enterprises have been implementing file integrity monitoring solutions to meet regulatory mandates such as PCI DSS, HIPAA, SOX, and GDPR, which require monitoring and reporting of changes to sensitive data. FIM tools have been configured to generate detailed audit logs, enabling organizations to demonstrate compliance during inspections. Financial institutions, healthcare providers, and public sector agencies have prioritized these solutions to protect customer information and maintain operational trust. Managed security service providers have integrated FIM capabilities into broader security frameworks to assist clients in achieving continuous compliance. The ability to track both authorized and unauthorized file changes has been valued for reducing audit preparation time and strengthening compliance documentation. This compliance-driven adoption has been a consistent growth driver in mature and regulated markets worldwide.

The increasing sophistication of cyberattacks, including ransomware and advanced persistent threats, has elevated the importance of file integrity monitoring in enterprise security strategies. FIM systems have been used to detect abnormal file modifications that may indicate malicious activity, enabling rapid incident response. By establishing baselines for normal file states, these tools can identify deviations that signal security breaches. Organizations in critical infrastructure, e-commerce, and cloud service industries have deployed FIM to safeguard proprietary and customer data. Integration with security information and event management (SIEM) platforms has allowed centralized monitoring and improved correlation of alerts with other security events. The ability to detect threats early in the attack chain has made FIM a valuable component of layered cybersecurity defenses.

The shift toward cloud computing and hybrid IT architectures has driven the development of file integrity monitoring solutions capable of monitoring distributed and dynamic environments. Cloud-based FIM tools have enabled scalability and centralized management across multiple geographic locations. Integration with DevOps workflows and containerized applications has allowed security teams to monitor code changes and configuration files in agile development environments. Vendors in the United States, Israel, and Europe have been focusing on API-driven architectures to facilitate interoperability with cloud security tools. The demand for solutions that can provide consistent visibility across on-premises, cloud, and virtualized systems has grown as organizations adopt multi-cloud strategies. This adaptability has reinforced FIM’s relevance in modern IT security infrastructure.

Despite their benefits, file integrity monitoring solutions have faced challenges due to complex deployment requirements and the risk of generating excessive false positives. Organizations without mature security teams have found it difficult to fine-tune monitoring policies, leading to alert fatigue among administrators. The initial setup of baseline configurations can be time-consuming, particularly in large, heterogeneous IT environments. Some enterprises have been hesitant to expand FIM usage beyond compliance obligations due to concerns over operational overhead. High licensing costs for advanced features, combined with training needs for effective use, have also been adoption barriers. Unless solutions become more automated, user-friendly, and cost-efficient, adoption may remain concentrated in regulated industries and large enterprises with dedicated security resources.

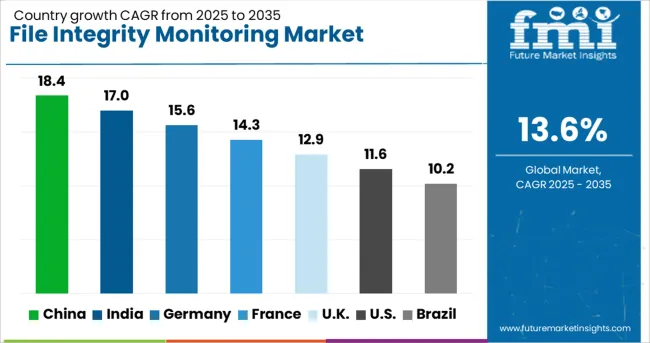

| Country | CAGR |

|---|---|

| China | 18.4% |

| India | 17.0% |

| Germany | 15.6% |

| France | 14.3% |

| UK | 12.9% |

| USA | 11.6% |

| Brazil | 10.2% |

The file integrity monitoring market is expected to grow at a global CAGR of 13.6% between 2025 and 2035, driven by the rising need for cybersecurity compliance, protection against data breaches, and integration of real-time monitoring in IT infrastructure. China leads with an 18.4% CAGR, supported by large-scale enterprise digitalization and stringent cybersecurity regulations. India follows at 17.0%, fueled by rapid cloud adoption and expansion of IT services. Germany, at 15.6%, benefits from strong data protection laws and advanced security solution development. The UK, projected at 12.9%, sees growth from financial sector adoption and regulatory compliance demands. The USA, at 11.6%, reflects steady uptake in critical infrastructure, healthcare, and enterprise IT environments. The report provides insights for 40+ countries, with the five below highlighted for their strategic importance and growth outlook.

China is projected to grow at a CAGR of 18.4% from 2025 to 2035 in the file integrity monitoring market, supported by rapid expansion in cloud computing, digital banking, and e-commerce platforms. Local cybersecurity providers such as Venustech, NSFOCUS, and TopSec are integrating FIM features into broader security information and event management (SIEM) solutions. The government’s focus on critical infrastructure security is encouraging adoption of FIM across power, telecom, and financial institutions. Increasing deployment of hybrid cloud architectures is creating demand for solutions capable of monitoring both on-premises and virtualized environments. Partnerships between domestic vendors and international cybersecurity firms are accelerating access to advanced anomaly detection capabilities.

India is forecasted to achieve a CAGR of 17.0% from 2025 to 2035, driven by the growth of IT services, fintech, and healthcare sectors. Companies such as Quick Heal Technologies, Seqrite, and Lucideus are expanding their offerings to include real-time file change detection and automated compliance reporting. The growing number of data protection regulations, including sector-specific guidelines for BFSI and healthcare, is pushing organizations toward proactive monitoring. Managed security service providers (MSSPs) are integrating FIM into their offerings for SMEs to overcome skill shortages in cybersecurity teams. The market is also benefiting from increased demand for solutions that integrate with DevSecOps pipelines for continuous compliance.

Germany is projected to post a CAGR of 15.6% from 2025 to 2035, supported by stringent data protection laws and industrial cybersecurity requirements. Vendors such as Secucloud, G DATA CyberDefense, and Rohde & Schwarz Cybersecurity are enhancing FIM tools with machine learning algorithms for anomaly detection and automated remediation workflows. The manufacturing sector, especially automotive and machinery industries, is adopting FIM to safeguard intellectual property and production data. Integration of FIM with operational technology (OT) environments is gaining importance in securing Industry 4.0 setups. Compliance with the General Data Protection Regulation (GDPR) is also driving adoption in public sector institutions.

The United Kingdom is expected to record a CAGR of 12.9% from 2025 to 2035, driven by demand from finance, government, and critical infrastructure sectors. British cybersecurity companies such as Darktrace, Sophos, and Clearswift are embedding AI-driven FIM capabilities within broader security platforms. The growing focus on zero-trust architectures is leading organizations to implement continuous file monitoring across endpoints and cloud assets. The legal sector is also adopting FIM tools to protect sensitive client data and meet compliance with data handling requirements. Demand for FIM-as-a-Service is rising among mid-sized enterprises seeking cost-effective deployment models.

The United States is forecasted to grow at a CAGR of 11.6% from 2025 to 2035, supported by heightened cybersecurity awareness and compliance mandates such as HIPAA, PCI DSS, and SOX. Leading players such as Tripwire, Qualys, and SolarWinds are focusing on advanced file monitoring solutions with integrated threat intelligence feeds. The healthcare sector is a major adopter, using FIM to prevent unauthorized access to patient records. The increasing complexity of hybrid IT environments is driving demand for centralized monitoring dashboards. Additionally, FIM adoption is expanding in government agencies to meet federal cybersecurity standards like NIST SP 800-53.

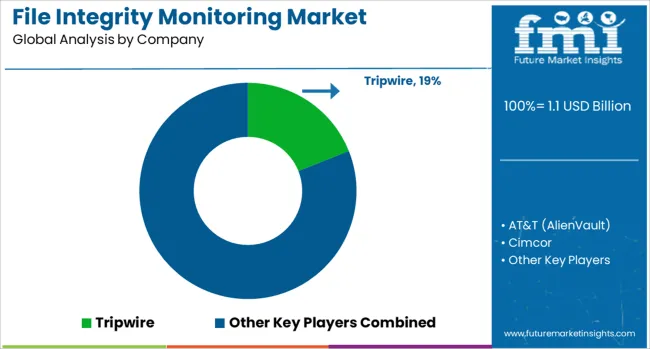

The file integrity monitoring (FIM) market is led by cybersecurity and IT operations companies delivering solutions that detect unauthorized changes to critical files, configurations, and system registries. Tripwire remains a key player with advanced FIM capabilities integrated into broader compliance and security frameworks, widely adopted in finance, healthcare, and government sectors. AT&T (AlienVault) combines file integrity monitoring with unified security management and threat intelligence for real-time incident response. Cimcor offers CimTrak, a FIM solution tailored for both security and operational control, enabling organizations to maintain system baselines and meet regulatory requirements. LogRhythm integrates FIM with security information and event management (SIEM) to provide contextualized alerts and forensic analysis.

McAfee delivers enterprise-grade monitoring through its endpoint security platform, ensuring continuous protection across distributed IT environments. Netwrix and Qualys focus on compliance-driven FIM, providing cloud-based and on-premise options that align with PCI DSS, HIPAA, and SOX standards. SolarWinds Worldwide integrates file monitoring with broader IT infrastructure management tools for operational visibility. Trend Micro offers FIM as part of its server and workload protection suite, while Trustwave Holdings delivers managed FIM services for organizations seeking outsourced security operations. Competitive strategies include bundling FIM within larger security ecosystems, enhancing automation for change detection, and integrating with cloud-native workloads. Entry into the market is restricted by the need for deep cybersecurity expertise, proven regulatory compliance capabilities, and established trust with enterprise security teams.

| Item | Value |

|---|---|

| Quantitative Units | USD 1.1 Billion |

| Component | Software and Services |

| Installation Mode | Agent-based and Agentless |

| Deployment | On-premises and Cloud-based |

| Enterprise Size | Enterprise size and SME |

| End Use | BFSI, Government, Healthcare & lifescience, Education, Media & entertainment, Retail & eCommerce, Manufacturing & automotive, and Others |

| Regions Covered | North America, Europe, Asia-Pacific, Latin America, Middle East & Africa |

| Country Covered | United States, Canada, Germany, France, United Kingdom, China, Japan, India, Brazil, South Africa |

| Key Companies Profiled | Tripwire, AT&T (AlienVault), Cimcor, LogRhythm, McAfee, Netwrix, Qualys, SolarWinds Worldwide, Trend Micro, and Trustwave Holdings |

The global file integrity monitoring market is estimated to be valued at USD 1.1 billion in 2025.

The market size for the file integrity monitoring market is projected to reach USD 3.8 billion by 2035.

The file integrity monitoring market is expected to grow at a 13.6% CAGR between 2025 and 2035.

The key product types in file integrity monitoring market are software and services.

In terms of installation mode, agent-based segment to command 66.0% share in the file integrity monitoring market in 2025.

Our Research Products

The "Full Research Suite" delivers actionable market intel, deep dives on markets or technologies, so clients act faster, cut risk, and unlock growth.

The Leaderboard benchmarks and ranks top vendors, classifying them as Established Leaders, Leading Challengers, or Disruptors & Challengers.

Locates where complements amplify value and substitutes erode it, forecasting net impact by horizon

We deliver granular, decision-grade intel: market sizing, 5-year forecasts, pricing, adoption, usage, revenue, and operational KPIs—plus competitor tracking, regulation, and value chains—across 60 countries broadly.

Spot the shifts before they hit your P&L. We track inflection points, adoption curves, pricing moves, and ecosystem plays to show where demand is heading, why it is changing, and what to do next across high-growth markets and disruptive tech

Real-time reads of user behavior. We track shifting priorities, perceptions of today’s and next-gen services, and provider experience, then pace how fast tech moves from trial to adoption, blending buyer, consumer, and channel inputs with social signals (#WhySwitch, #UX).

Partner with our analyst team to build a custom report designed around your business priorities. From analysing market trends to assessing competitors or crafting bespoke datasets, we tailor insights to your needs.

Supplier Intelligence

Discovery & Profiling

Capacity & Footprint

Performance & Risk

Compliance & Governance

Commercial Readiness

Who Supplies Whom

Scorecards & Shortlists

Playbooks & Docs

Category Intelligence

Definition & Scope

Demand & Use Cases

Cost Drivers

Market Structure

Supply Chain Map

Trade & Policy

Operating Norms

Deliverables

Buyer Intelligence

Account Basics

Spend & Scope

Procurement Model

Vendor Requirements

Terms & Policies

Entry Strategy

Pain Points & Triggers

Outputs

Pricing Analysis

Benchmarks

Trends

Should-Cost

Indexation

Landed Cost

Commercial Terms

Deliverables

Brand Analysis

Positioning & Value Prop

Share & Presence

Customer Evidence

Go-to-Market

Digital & Reputation

Compliance & Trust

KPIs & Gaps

Outputs

Full Research Suite comprises of:

Market outlook & trends analysis

Interviews & case studies

Strategic recommendations

Vendor profiles & capabilities analysis

5-year forecasts

8 regions and 60+ country-level data splits

Market segment data splits

12 months of continuous data updates

DELIVERED AS:

PDF EXCEL ONLINE

Monitoring Tool Market Size and Share Forecast Outlook 2025 to 2035

File Sander Market Size and Share Forecast Outlook 2025 to 2035

Profiled Steel Sheet Decking Market Size and Share Forecast Outlook 2025 to 2035

Pet Monitoring Camera Market Size and Share Forecast Outlook 2025 to 2035

Belt File Sander Market Size and Share Forecast Outlook 2025 to 2035

Pain Monitoring Devices Market Size and Share Forecast Outlook 2025 to 2035

Band File Sander Belts Market Size and Share Forecast Outlook 2025 to 2035

Duct Integrity Tester (DIT) Market Size and Share Forecast Outlook 2025 to 2035

Dose Monitoring Devices Market - Growth & Demand 2025 to 2035

High Integrity Pressure Protection System Market

Brain Monitoring Market Size and Share Forecast Outlook 2025 to 2035

Motor Monitoring Market Size and Share Forecast Outlook 2025 to 2035

Neuro-monitoring System Market Size and Share Forecast Outlook 2025 to 2035

Media Monitoring Tools Market Size and Share Forecast Outlook 2025 to 2035

Noise Monitoring Devices Market Size and Share Forecast Outlook 2025 to 2035

Nerve Monitoring Devices Market Insights - Growth & Forecast 2025 to 2035

Power Monitoring Market Report - Growth, Demand & Forecast 2025 to 2035

Urine Monitoring Systems Market Analysis - Size, Trends & Forecast 2025 to 2035

Asset Integrity Management Market Growth - Trends & Forecast 2025 to 2035

Brain Monitoring Systems Market is segmented by Lateral Flow Readers and Kits and Reagents from 2025 to 2035

Thank you!

You will receive an email from our Business Development Manager. Please be sure to check your SPAM/JUNK folder too.

Chat With

MaRIA