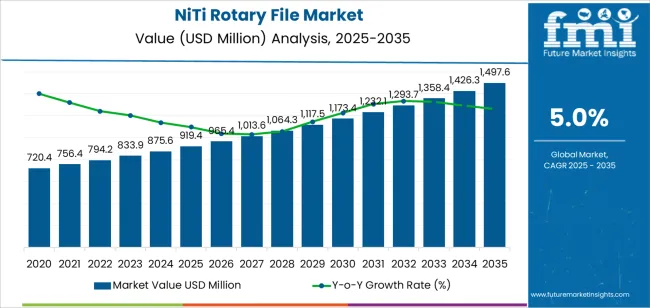

The NiTi rotary file market is valued at USD 919.4 million in 2025 and is projected to reach USD 1,497.6 million by 2035, growing at a CAGR of 5.0% over the forecast period. Growth reflects increasing global demand for advanced endodontic instrumentation, driven by rising root canal procedure volumes, expanding dental care access, and strong practitioner preference for precision-focused canal preparation systems. The 25 mm file segment maintains the leading share, supported by its optimal working length balance for diverse anatomical structures and treatment conditions. Hospitals represent the primary application environment due to higher case complexity and standardized procedural workflows, while private clinics drive steady adoption as digital dentistry integration expands.

Demand for NiTi rotary file is shaped by continuous improvements in heat-treated NiTi alloys, variable taper geometries, and torque-responsive instrumentation platforms that enhance file flexibility, fracture resistance, and clinical efficiency. Regional growth remains strongest across East Asia and South Asia Pacific, where dental care modernization and practitioner training investments accelerate technology adoption. Meanwhile, established markets in Western Europe and North America prioritize advanced system integration, evidence-based performance validation, and premium file-motor bundle procurement to support consistent clinical outcomes and streamlined treatment delivery.

Where revenue comes from - now vs next (industry-level view)

| Period | Primary Revenue Buckets | Share | Notes |

|---|---|---|---|

| Today | Standard rotary file sales (21mm, 25mm, 30mm) | 48% | Procedure-driven, clinic-based purchases |

| Specialized file systems | 22% | Advanced file designs, heat-treated alloys | |

| File holders & motors | 18% | Endodontic motors, handpieces | |

| Replacement files & consumables | 12% | Regular replacement for clinical use | |

| Future (3-5 yrs) | Advanced alloy systems | 35-40% | Heat-treated NiTi, enhanced flexibility |

| Digital integration files | 20-25% | Motion tracking, procedural guidance | |

| Subscription-based programs | 15-20% | Regular file delivery, clinical support | |

| Motor & file bundles | 12-15% | Complete endodontic systems | |

| Training & education services | 8-10% | Clinical training, technique courses | |

| Data services (case tracking, technique optimization) | 5-8% | Procedural analytics for dentists |

| Metric | Value |

|---|---|

| Market Value (2025) | USD 919.4 million |

| Market Forecast (2035) | USD 1,497.6 million |

| Growth Rate | 5.0% CAGR |

| Leading Product | 25 mm Length Files |

| Primary Application | Hospital Segment |

The market demonstrates strong fundamentals with 25 mm rotary files capturing a dominant share through optimal length balance and clinical versatility for diverse endodontic procedures. Hospital applications drive primary demand, supported by increasing root canal treatment volumes and advanced dental care requirements. Geographic expansion remains concentrated in developed markets with established dental infrastructure, while emerging economies show accelerating adoption rates driven by dental care modernization and rising treatment standards.

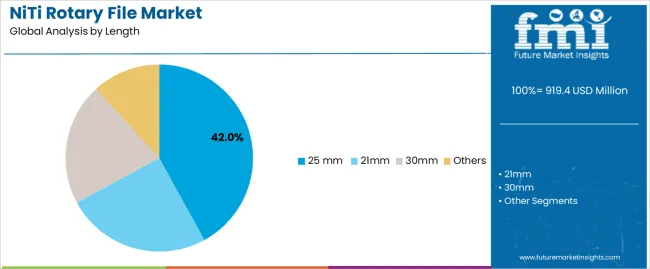

Primary Classification: The market segments by file length into 21 mm, 25 mm, 30 mm, and Others, representing the evolution from standard endodontic instruments to specialized canal preparation solutions for comprehensive root canal treatment optimization.

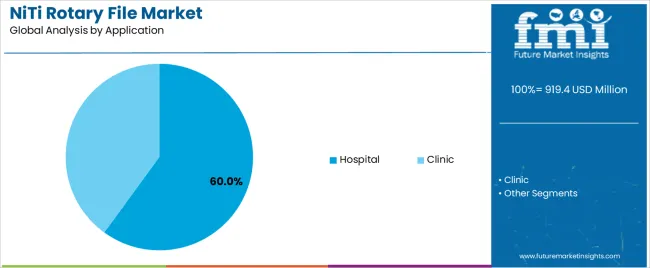

Secondary Classification: Application segmentation divides the market into Hospital and Clinic sectors, reflecting distinct requirements for procedural volume, patient demographics, and facility treatment protocols.

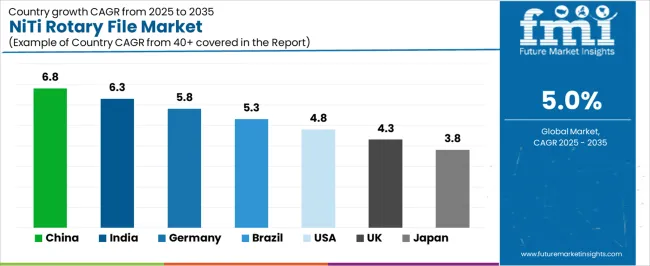

Regional Classification: Geographic distribution covers major markets including China, India, Germany, Brazil, United States, United Kingdom, and Japan, with developed markets leading adoption while emerging economies show accelerating growth patterns driven by dental care expansion programs.

The segmentation structure reveals technology progression from standard file designs toward specialized endodontic systems with enhanced flexibility and cutting efficiency, while application diversity spans from hospital dental departments to private clinical practices requiring precise canal preparation solutions.

Market Position: The 25 mm file length commands the leading position in the NiTi rotary file market with 42% market share through optimal length balance, including superior clinical versatility, anatomical compatibility, and endodontic procedure optimization that enable dental practitioners to achieve optimal canal preparation across diverse tooth types and clinical scenarios.

Value Drivers: The segment benefits from dental practitioner preference for reliable file lengths that provide consistent performance, broad anatomical coverage, and procedural efficiency without requiring extensive file inventory. Advanced design features enable precise canal shaping, appropriate working length coverage, and integration with standard endodontic protocols, where clinical effectiveness and procedural predictability represent critical treatment requirements.

Competitive Advantages: The 25 mm files differentiate through proven clinical reliability, consistent cutting characteristics, and compatibility with standard endodontic procedures that enhance treatment effectiveness while maintaining optimal canal anatomy suitable for diverse dental applications.

Key market characteristics:

The 21 mm file length maintains a 28% market position in the NiTi rotary file market due to specialized anterior tooth applications and compact canal systems. These files appeal to practitioners treating maxillary anterior teeth with shorter root lengths for precise endodontic procedures. Market growth is driven by pediatric dentistry expansion, emphasizing reliable short-length solutions and procedural efficiency through optimized file designs.

The 30 mm file length captures 20% market share through extended reach requirements in posterior teeth, long root canals, and complex anatomical cases. These applications demand longer instrumentation capable of reaching apical regions while providing effective canal preparation and operational reliability.

Market Context: Hospital applications dominate the NiTi rotary file market with 60% market share due to widespread adoption of advanced endodontic systems and increasing focus on comprehensive dental care optimization, procedural efficiency, and high-volume treatment applications that maximize patient throughput while maintaining clinical standards.

Appeal Factors: Hospital dental departments prioritize system reliability, procedural consistency, and integration with existing dental infrastructure that enables coordinated endodontic operations across multiple treatment rooms. The segment benefits from substantial healthcare investment and modernization programs that emphasize the acquisition of advanced rotary systems for treatment optimization and procedural efficiency applications.

Growth Drivers: Hospital expansion programs incorporate NiTi rotary files as standard instrumentation for endodontic operations, while dental care growth increases demand for high-volume treatment capabilities that comply with clinical standards and minimize procedural complexity.

Market Challenges: Varying case complexity and sterilization protocols may limit system standardization across different facilities or clinical scenarios.

Application dynamics include:

Clinic applications capture 40% market share through direct patient care in private practice settings, specialized endodontic clinics, and general dental practices. These facilities demand reliable file systems capable of handling diverse case types while providing effective treatment outcomes and operational efficiency.

| Category | Factor | Impact | Why It Matters |

|---|---|---|---|

| Driver | Rising root canal treatment volumes (aging population, dental awareness) | ★★★★★ | Increased endodontic procedures drive file consumption; demographic trends support sustained demand for rotary instrumentation. |

| Driver | Shift from manual to rotary instrumentation (clinical efficiency, outcomes) | ★★★★★ | Dentists adopting rotary systems for faster procedures and improved success rates; vendors offering complete systems gain competitive advantage. |

| Driver | Expanding dental care infrastructure (emerging markets) | ★★★★☆ | New dental clinics and hospitals require endodontic equipment; growing middle class in Asia drives demand for advanced dental care. |

| Restraint | High initial investment for complete systems (files + motors) | ★★★★☆ | Small dental practices defer purchases; increases price sensitivity and slows advanced system adoption in cost-sensitive markets. |

| Restraint | File fracture concerns and learning curve | ★★★☆☆ | Practitioner hesitation due to technique sensitivity; requires comprehensive training and gradual adoption protocols. |

| Trend | Heat-treated NiTi alloys and advanced metallurgy | ★★★★★ | Enhanced flexibility and fracture resistance transform clinical capabilities; material innovation becomes core differentiation factor. |

| Trend | Single-use file systems and infection control | ★★★★☆ | Growing preference for disposable files in infection-conscious environments; shifts business model toward consumable revenue streams. |

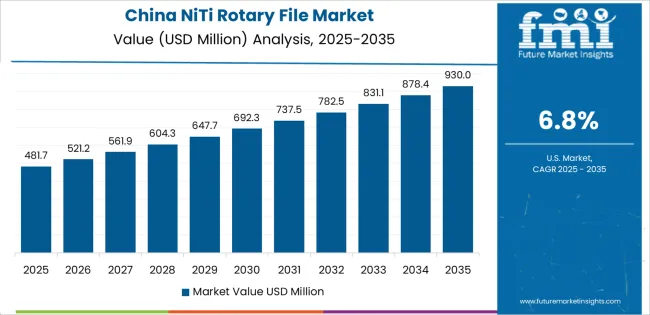

The NiTi rotary file market demonstrates varied regional dynamics with Growth Leaders including China (6.8% growth rate) and India (6.3% growth rate) driving expansion through dental care modernization initiatives and treatment capacity development. Steady Performers encompass Germany (5.8% growth rate), United States (4.8% growth rate), and developed regions, benefiting from established dental industries and advanced endodontic adoption. Emerging Markets feature Brazil (5.3% growth rate) and developing regions, where dental care initiatives and practice modernization support consistent growth patterns.

Regional synthesis reveals East Asian markets leading adoption through dental infrastructure expansion and treatment volume development, while Western European countries maintain steady expansion supported by clinical technology advancement and standardization requirements. North American markets show moderate growth driven by replacement demand and specialty practice applications.

| Region/Country | 2025-2035 Growth | How to win | What to watch out |

|---|---|---|---|

| China | 6.8% | Lead with value-oriented complete systems | Local competition; price pressure |

| India | 6.3% | Focus on training and clinical education | Infrastructure gaps; awareness levels |

| Germany | 5.8% | Offer premium precision systems with clinical evidence | Conservative adoption; reimbursement constraints |

| Brazil | 5.3% | Provide accessible pricing models | Currency volatility; economic cycles |

| United States | 4.8% | Push specialty file systems and innovations | Market saturation; group purchasing dynamics |

| United Kingdom | 4.3% | Digital integration and outcome tracking | NHS budget pressures; Brexit impacts |

| Japan | 3.8% | Emphasize quality and precision engineering | Aging practitioner base; consolidation trends |

China establishes fastest market growth through aggressive dental care expansion programs and comprehensive treatment capacity development, integrating advanced NiTi rotary files as standard instruments in hospital dental departments and specialized endodontic clinics. The country's 6.8% growth rate reflects government initiatives promoting oral healthcare and dental service accessibility that mandate the use of modern endodontic systems in public and private dental facilities. Growth concentrates in major urban centers, including Beijing, Shanghai, and Guangzhou, where dental technology development showcases integrated rotary systems that appeal to practitioners seeking advanced treatment efficiency and clinical outcome optimization.

Chinese manufacturers are developing cost-effective rotary solutions that combine domestic production advantages with advanced clinical features, including heat-treated alloys and enhanced flexibility capabilities. Distribution channels through dental equipment suppliers and clinical education programs expand market access, while government support for dental care infrastructure supports adoption across diverse hospital and clinic segments.

Strategic Market Indicators:

In Mumbai, Delhi, and Bangalore, dental clinics and hospital dental departments are implementing advanced NiTi rotary files as standard instrumentation for endodontic procedures and treatment optimization applications, driven by increasing private dental investment and practice modernization programs that emphasize the importance of clinical efficiency. The market holds a 6.3% growth rate, supported by rising dental awareness and expanding middle-class population that promotes advanced endodontic systems for quality dental care. Indian practitioners are adopting rotary files that provide consistent clinical performance and procedural efficiency features, particularly appealing in urban regions where treatment quality and time efficiency represent critical practice requirements.

Market expansion benefits from growing dental education infrastructure and international clinical technique transfer that enables widespread adoption of rotary systems for endodontic applications. Technology adoption follows patterns established in dental equipment, where clinical outcomes and procedural efficiency drive procurement decisions and operational deployment.

Market Intelligence Brief:

Advanced dental technology market in Germany demonstrates sophisticated NiTi rotary file deployment with documented clinical effectiveness in endodontic applications and specialized practices through integration with existing dental equipment and practice management systems. The country leverages engineering expertise in dental instrumentation and quality systems integration to maintain a 5.8% growth rate. Clinical centers, including university dental hospitals and specialized endodontic practices, showcase premium installations where rotary systems integrate with comprehensive digital dental platforms and procedural documentation systems to optimize treatment operations and clinical effectiveness.

German manufacturers prioritize system precision and clinical validation in rotary file development, creating demand for premium systems with advanced features, including torque control integration and clinical outcome tracking. The market benefits from established dental technology infrastructure and a willingness to invest in advanced clinical technologies that provide long-term treatment benefits and compliance with international dental standards.

Market Intelligence Brief:

Brazil's market expansion benefits from diverse dental care demand, including practice modernization in São Paulo and Rio de Janeiro, dental facility upgrades, and expanding private dental sector that increasingly incorporates rotary solutions for treatment optimization applications. The country maintains a 5.3% growth rate, driven by rising dental service utilization and increasing recognition of modern endodontic benefits, including reduced treatment time and improved clinical outcomes.

Market dynamics focus on cost-effective rotary solutions that balance advanced clinical performance with affordability considerations important to Brazilian dental practitioners. Growing dental practice establishment creates continued demand for modern endodontic systems in new clinic infrastructure and practice modernization projects.

Strategic Market Considerations:

United States establishes significant market presence through comprehensive dental care infrastructure and advanced endodontic practice development, integrating NiTi rotary files across general dental practices and specialized endodontic clinics. The country's 4.8% growth rate reflects mature dental industry relationships and established rotary technology adoption that supports widespread use of advanced file systems in diverse clinical applications. Growth concentrates in major metropolitan areas and specialty practice networks, where dental technology showcases mature rotary deployment that appeals to practitioners seeking proven clinical efficacy and procedural efficiency.

American dental practices leverage established distribution networks and comprehensive clinical support, including training programs and technique education that create practitioner relationships and clinical advantages. The market benefits from mature clinical standards and dental insurance coverage that supports endodontic procedures while driving technology advancement and technique optimization.

Market Intelligence Brief:

United Kingdom's dental care market demonstrates consistent NiTi rotary file adoption with documented clinical integration in NHS and private dental practices through compatibility with existing endodontic protocols and clinical guidelines. The country maintains a 4.3% growth rate through established dental education programs and clinical standardization initiatives. Major dental centers, including London, Manchester, and Birmingham, showcase rotary system integration where files complement comprehensive dental care delivery and quality assurance programs.

British dental practitioners balance clinical effectiveness with cost considerations in rotary system adoption, influenced by NHS treatment protocols and private practice economics. The market benefits from strong dental education infrastructure and clinical evidence requirements that drive adoption of validated endodontic technologies.

Market Intelligence Brief:

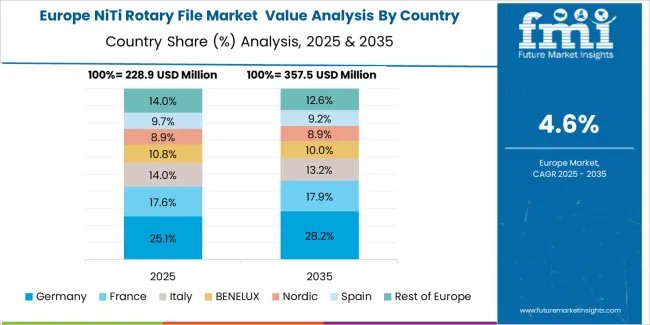

The NiTi rotary file market in Europe is projected to grow from USD 317.5 million in 2025 to USD 520.8 million by 2035, registering a CAGR of 5.1% over the forecast period. Germany is expected to maintain its leadership position with a 31.2% market share in 2025, supported by its advanced dental technology infrastructure and strong endodontic specialty networks.

United Kingdom follows with a 19.8% share in 2025, driven by comprehensive dental education programs and established clinical protocols. France holds a 16.4% share through specialized endodontic practices and dental care quality initiatives. Italy commands a 14.6% share, while Spain accounts for 10.2% in 2025. The Rest of Europe region is anticipated to gain momentum, expanding its collective share from 7.8% to 8.5% by 2035, attributed to increasing rotary file adoption in Nordic countries and emerging Eastern European dental practices implementing modern endodontic protocols.

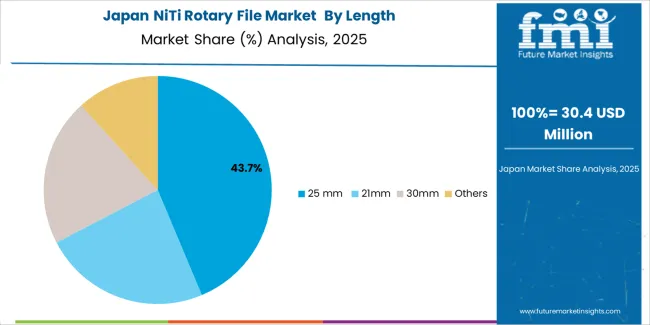

Japan's NiTi rotary file market reflects mature dental care infrastructure with sophisticated endodontic instrumentation deployment across established dental practices and university dental hospitals. The country maintains a 3.8% growth rate, supported by aging population demographics and comprehensive dental insurance coverage that sustains endodontic procedure volumes. Japanese dental practitioners emphasize precision engineering and clinical reliability in rotary file selection, with preference for established manufacturers offering validated clinical performance and comprehensive technical support.

Market dynamics focus on replacement demand and specialty file system adoption, with limited penetration growth due to high existing market saturation. Clinical education programs and dental association guidelines influence product selection, while demographic trends support sustained procedure volumes despite slower technology adoption rates. Distribution networks through established dental equipment suppliers maintain market access, with limited opportunities for new market entrants due to entrenched practitioner preferences and clinical protocol standardization.

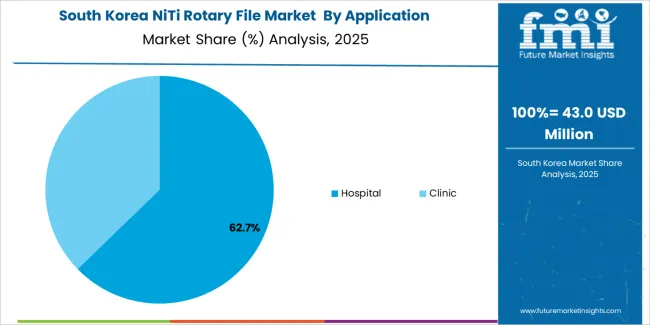

South Korea's dental technology market demonstrates active NiTi rotary file adoption with rapid integration of advanced endodontic systems in metropolitan dental clinics and specialty practices. The market exhibits 5.2% growth driven by strong dental care utilization, aesthetic dentistry expansion, and practitioner willingness to adopt advanced clinical technologies. Seoul, Busan, and other major cities showcase modern dental facilities where rotary systems represent standard endodontic instrumentation, supported by comprehensive clinical training and manufacturer technical support programs.

Korean dental practitioners prioritize clinical efficiency and patient experience, driving demand for advanced rotary systems with digital integration capabilities and comprehensive clinical protocols. Market expansion benefits from robust dental education infrastructure and international clinical technique adoption, with practitioners actively seeking latest endodontic innovations. Distribution channels combine direct manufacturer relationships with specialized dental equipment suppliers, while clinical study groups and continuing education programs facilitate technology adoption and technique standardization across the dental community.

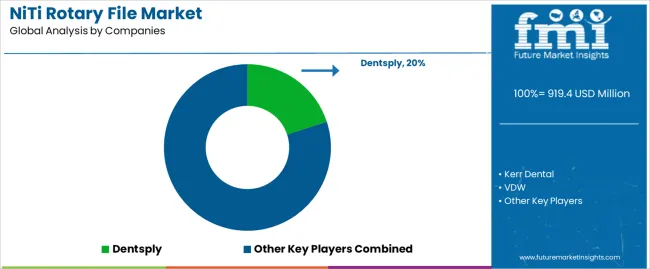

The competitive structure features 12-15 established players with the top 5 manufacturers holding approximately 68% market share by revenue. Leadership is maintained through clinical validation networks, comprehensive practitioner education programs, and continuous product innovation focused on metallurgical advancement and procedural efficiency. Market dynamics reflect ongoing consolidation with established dental equipment manufacturers acquiring specialized endodontic companies to expand product portfolios and clinical expertise.

Basic heat treatment processes and standard taper designs are commoditizing, while margin opportunities exist in advanced alloy development, clinical training programs, and integrated motor-file systems. Successful manufacturers differentiate through peer-reviewed clinical studies, practitioner education initiatives, and comprehensive technical support that builds clinical confidence and long-term product loyalty. Market entry barriers include extensive clinical validation requirements, established practitioner relationships, and regulatory compliance across multiple jurisdictions.

Competition intensifies around specialty file systems for complex anatomies, single-use versus multi-use positioning, and digital integration capabilities that connect rotary systems with practice management platforms. Manufacturers increasingly offer complete endodontic solutions combining files, motors, irrigation systems, and obturation products to capture larger share of practice purchasing budgets while simplifying procurement and ensuring system compatibility.

| Stakeholder | What they actually control | Typical strengths | Typical blind spots |

|---|---|---|---|

| Global platforms | Distribution reach, comprehensive product lines, clinical education networks | Broad practitioner access, proven reliability, multi-region support | Innovation speed; emerging market pricing |

| Technology innovators | Advanced alloy development, proprietary heat treatments, specialized geometries | Latest metallurgy first; superior clinical performance | Service network density outside core regions |

| Regional specialists | Local clinical relationships, rapid technical support, country-specific education | "Close to practitioner" support; pragmatic pricing; local preferences | Technology development resources; global scale |

| Education-focused ecosystems | Training programs, clinical technique development, peer networks | Strongest practitioner loyalty; comprehensive support | Technology refresh if over-focused on legacy products |

| Private label suppliers | Manufacturing capacity, cost efficiency, OEM relationships | Competitive pricing; volume production | Brand recognition; clinical validation |

| Item | Value |

|---|---|

| Quantitative Units | USD 919.4 million |

| Length | 21 mm, 25 mm, 30 mm, Others |

| Application | Hospital, Clinic |

| Regions Covered | East Asia, South Asia Pacific, Western Europe, North America, Latin America, Middle East & Africa |

| Countries Covered | China, India, Germany, Brazil, United States, United Kingdom, Japan, South Korea, France, Italy, Spain, Canada, Australia, and 15+ additional countries |

| Key Companies Profiled | Dentsply, Kerr Dental, VDW, COLTENE, Mani, Brasseler, EdgeEndo, Micro-Mega, Yirui, SANI, LM-Instruments, Huizhou Videya Technology |

| Additional Attributes | Dollar sales by length and application categories, regional adoption trends across East Asia, South Asia Pacific, and Western Europe, competitive landscape with dental equipment manufacturers and endodontic specialists, dental practitioner preferences for flexibility and fracture resistance, integration with endodontic motors and irrigation systems, innovations in heat treatment technology and alloy development, and development of specialized file systems with enhanced clinical performance and endodontic optimization capabilities. |

The global niti rotary file market is estimated to be valued at USD 919.4 million in 2025.

The market size for the niti rotary file market is projected to reach USD 1,497.6 million by 2035.

The niti rotary file market is expected to grow at a 5.0% CAGR between 2025 and 2035.

The key product types in niti rotary file market are 25 mm , 21mm, 30mm and others.

In terms of application, hospital segment to command 60.0% share in the niti rotary file market in 2025.

Full Research Suite comprises of:

Market outlook & trends analysis

Interviews & case studies

Strategic recommendations

Vendor profiles & capabilities analysis

5-year forecasts

8 regions and 60+ country-level data splits

Market segment data splits

12 months of continuous data updates

DELIVERED AS:

PDF EXCEL ONLINE

Nitinol Heart Valve Frames Market Analysis Size and Share Forecast Outlook 2025 to 2035

Sanitizer Sachet Market Size and Share Forecast Outlook 2025 to 2035

Sanitizer Filling Machine Market Size and Share Forecast Outlook 2025 to 2035

Sanitizer Packaging Market Growth – Demand & Trends Forecast 2025 to 2035

Key Companies & Market Share in Sanitizer Sachet Industry

Market Share Breakdown of Sanitizer Filling Machine Providers

Sanitizers Market

Sanitizing Agent Market

Cognitive Supply Chain Market Forecast Outlook 2025 to 2035

Carnitine Supplements Market Size and Share Forecast Outlook 2025 to 2035

Cognitive Computing Market Size and Share Forecast Outlook 2025 to 2035

Cognitive Impairment Biomarkers Market Size and Share Forecast Outlook 2025 to 2035

Cognitive Electronic Warfare Market Size and Share Forecast Outlook 2025 to 2035

Cognitive Agents Market Size and Share Forecast Outlook 2025 to 2035

Cognitive Network Market Size and Share Forecast Outlook 2025 to 2035

Cognitive Analytics Market Size and Share Forecast Outlook 2025 to 2035

Cognitive Diagnostics Market Analysis & Forecast by Diagnosis, Indication, End User and Region through 2035

Cognitive health supplements market analysis by product type, form, sales channel, functionality, and by region – Growth, trends, and Forecast from 2025 to 2035

Cognitive Neuroscience Market Overview – Trends & Research Insights 2024-2034

Cognitive Assessment and Training Market Report – Trends & Growth Forecast 2024-2034

Thank you!

You will receive an email from our Business Development Manager. Please be sure to check your SPAM/JUNK folder too.

Chat With

MaRIA