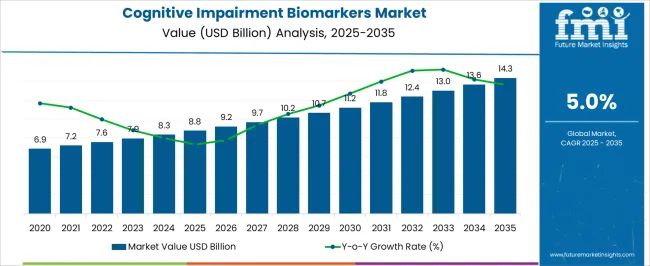

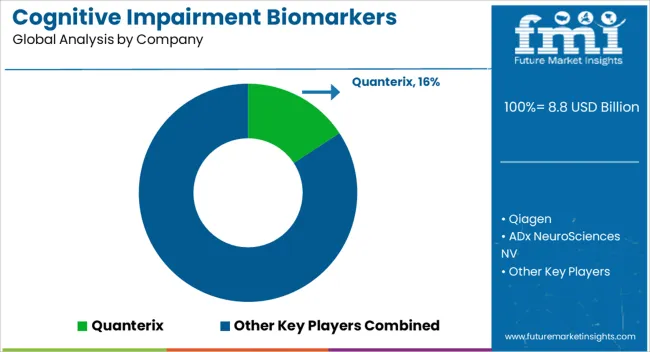

The Cognitive Impairment Biomarkers Market is estimated to be valued at USD 8.8 billion in 2025 and is projected to reach USD 14.3 billion by 2035, registering a compound annual growth rate (CAGR) of 5.0% over the forecast period.

| Metric | Value |

|---|---|

| Cognitive Impairment Biomarkers Market Estimated Value in (2025 E) | USD 8.8 billion |

| Cognitive Impairment Biomarkers Market Forecast Value in (2035 F) | USD 14.3 billion |

| Forecast CAGR (2025 to 2035) | 5.0% |

The Cognitive Impairment Biomarkers market is witnessing robust growth, driven by the increasing prevalence of neurodegenerative diseases and rising demand for early diagnosis and personalized treatment approaches. Advancements in biomarker discovery and analytical technologies are enabling more accurate identification of cognitive impairment and disease progression, particularly in Alzheimer’s disease. The integration of genomics, proteomics, and metabolomics data allows for improved understanding of molecular pathways, supporting targeted interventions and therapeutic development.

Increasing investments by pharmaceutical companies, biotechnology firms, and research organizations in biomarker research are further accelerating market adoption. Regulatory support for precision medicine and growing awareness among clinicians regarding the importance of early detection are also contributing to market expansion.

Additionally, the use of advanced diagnostics and AI-driven analytics to identify cognitive decline has enhanced the reliability and clinical utility of biomarkers As research initiatives and healthcare infrastructure continue to evolve globally, the market is expected to sustain long-term growth, with increasing opportunities in both drug development and clinical diagnostics.

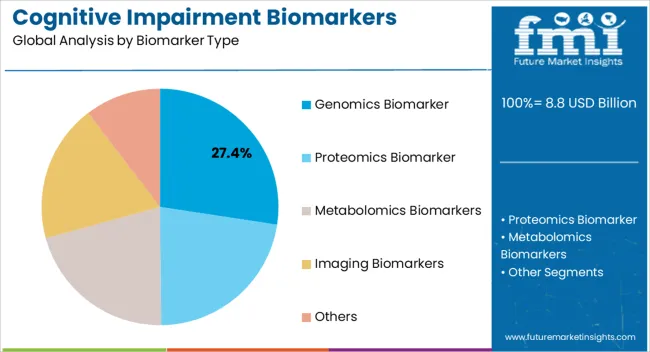

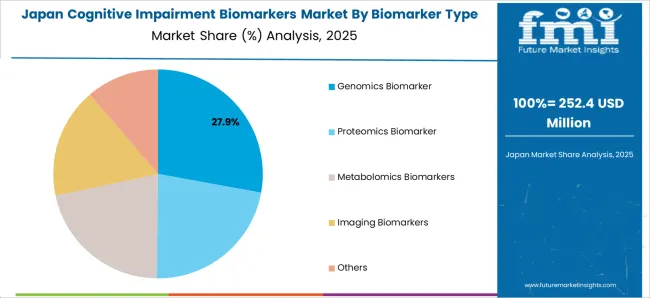

The genomics biomarker segment is projected to hold 27.4% of the market revenue in 2025, making it the leading biomarker type. Growth in this segment is being driven by the ability of genomic biomarkers to provide early and precise detection of cognitive impairment, including Alzheimer’s disease. The identification of genetic variations associated with disease susceptibility enables personalized therapeutic strategies and predictive diagnostics.

Advances in next-generation sequencing and high-throughput genomic analysis have enhanced the accuracy, sensitivity, and scalability of these biomarkers, making them valuable for both clinical and research applications. Integration of genomic data with clinical and imaging information improves the understanding of disease mechanisms and progression patterns.

Increasing investments by pharmaceutical and biotechnology companies to develop targeted interventions based on genomic biomarkers are further supporting adoption As the importance of early intervention and precision medicine continues to rise, genomics biomarkers are expected to maintain their leading position, providing actionable insights for research, diagnosis, and treatment development in cognitive impairment.

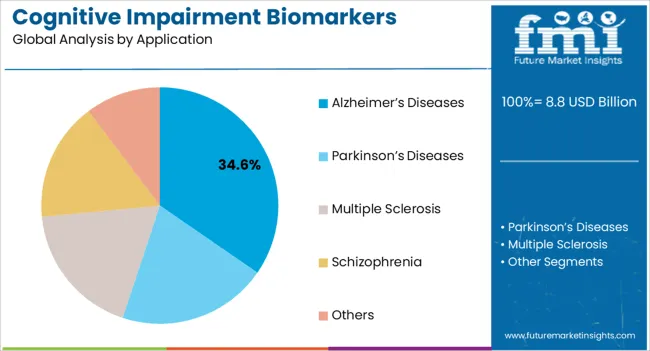

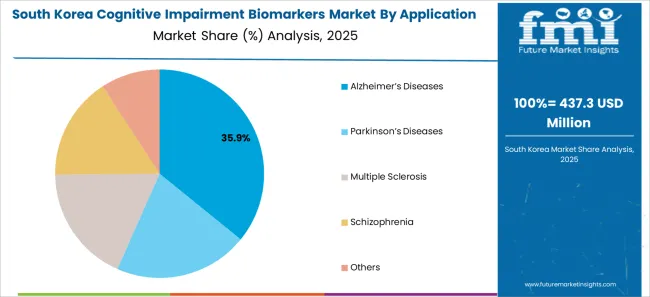

The Alzheimer’s diseases application segment is anticipated to account for 34.6% of the market revenue in 2025, establishing it as the largest application category. Its growth is being driven by the increasing prevalence of Alzheimer’s disease globally and the urgent need for early detection and effective treatment strategies. Biomarkers enable clinicians to monitor disease progression, identify at-risk populations, and implement preventive measures.

Genomics-based biomarker identification allows for precise characterization of disease subtypes, supporting personalized treatment plans and clinical trial design. Advancements in molecular diagnostics and AI-powered predictive analytics have further enhanced the reliability and clinical utility of these applications.

Growing investments by research organizations, pharmaceutical companies, and healthcare providers in Alzheimer's-focused studies and diagnostic tools are also accelerating adoption As awareness of cognitive health and early intervention strategies expands, Alzheimer’s disease remains the primary focus of biomarker development, reinforcing its position as the leading application segment and driving sustained market growth.

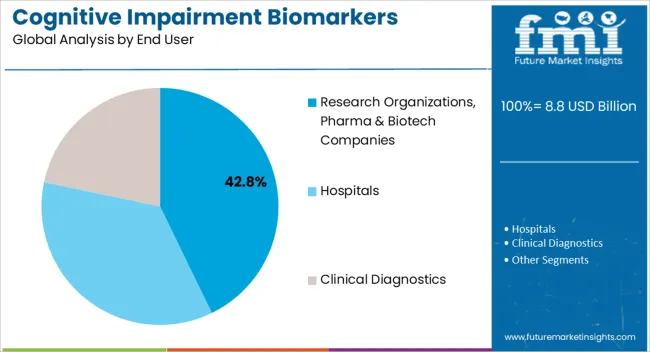

The research organizations, pharmaceutical, and biotechnology companies segment is projected to hold 42.8% of the market revenue in 2025, establishing it as the leading end-user category. Growth is driven by increasing investment in cognitive impairment research, drug discovery, and biomarker validation. These organizations leverage biomarkers to develop targeted therapeutics, monitor disease progression, and conduct clinical trials efficiently.

Genomics biomarkers are particularly valuable in understanding disease mechanisms and identifying patient populations for personalized treatment. The adoption of advanced analytical platforms, high-throughput sequencing, and AI-driven data interpretation enhances research capabilities and accelerates innovation. Partnerships and collaborations between academic institutions, pharmaceutical firms, and biotechnology companies further strengthen adoption and market penetration.

Regulatory encouragement for biomarker-driven research and clinical trials adds to the segment’s growth momentum As global demand for early detection, precision medicine, and innovative therapeutic solutions increases, research organizations, pharmaceutical, and biotechnology companies are expected to continue dominating the end-use segment, supporting overall market expansion.

From 2020 to 2025, the global cognitive impairment biomarkers market experienced a CAGR of 4.2%, reaching a market size of USD 8.8 billion in 2025.

From 2020 to 2025, The global prevalence of cognitive impairment and neurodegenerative diseases has been on the rise due to aging populations and lifestyle factors. This increasing prevalence has created a strong demand for effective diagnostic tools and biomarkers that can aid in the early identification and intervention of cognitive impairment.

Advancements in medical imaging technologies, such as PET and MRI, have played a crucial role in the growth of the market. These imaging techniques allow for the visualization of biomarkers associated with cognitive impairment, enabling researchers and clinicians to better understand the underlying disease processes.

Future Forecast for Cognitive Impairment Biomarkers Market Industry:

Looking ahead, the global cognitive impairment biomarkers market industry is expected to rise at a CAGR of 5.3% from 2025 to 2035. During the forecast period, the market size is expected to reach USD 14.3 billion by 2035.

The cognitive impairment biomarkers industry is expected to continue its growth trajectory from 2025 to 2035, there is a growing focus on identifying biomarkers with higher specificity and accuracy for different types and stages of cognitive impairment. Advancements in biomarker discovery techniques, including genomics, proteomics, and metabolomics, combined with artificial intelligence and machine learning, can enhance the identification and validation of biomarkers. More precise and reliable biomarkers will enable earlier and more accurate diagnosis, facilitating targeted interventions and treatment strategies.

The integration of digital health technologies, such as mobile apps, wearables, and connected devices, will shape the future growth of the cognitive impairment biomarkers market. These technologies enable remote monitoring, real-time data collection, and improved patient engagement.

| Country | The United States |

|---|---|

| Market Size (USD billion) by End of Forecast Period (2035) | USD 14.3 Billion |

| CAGR % 2025 to End of Forecast (2035) | 6.1% |

The cognitive impairment biomarkers industry in the United States is expected to reach a market size of USD 14.3 Billion by 2035, expanding at a CAGR of 6.1%. The development of innovative biomarker technologies is driving the cognitive impairment biomarkers market in the United States. Advancements in genetic testing, neuroimaging techniques, and fluid-based biomarker analysis have improved the accuracy and reliability of biomarker measurements, allowing for better detection and monitoring of cognitive disorders.

| Country | The United Kingdom |

|---|---|

| Market Size (USD billion) by End of Forecast Period (2035) | USD 699.6 million |

| CAGR % 2025 to End of Forecast (2035) | 6.0% |

The cognitive impairment biomarkers industry in the United Kingdom is expected to reach a market share of USD 699.6 million, expanding at a CAGR of 6.0% during the forecast period. There is a growing emphasis on early diagnosis and intervention for cognitive disorders in the United Kingdom.

Biomarkers play a crucial role in enabling early detection, which allows for timely intervention, better disease management, and improved patient outcomes. Biomarker-based tests help identify individuals at high risk or in the early stages of cognitive impairment, enabling targeted interventions and support.

| Country | China |

|---|---|

| Market Size (USD billion) by End of Forecast Period (2035) | USD 988.8 million |

| CAGR % 2025 to End of Forecast (2035) | 7.3% |

The cognitive impairment biomarkers industry in China is anticipated to reach a market size of USD 988.8 million, moving at a CAGR of 7.3% during the forecast period. There is a growing awareness among healthcare professionals, patients, and caregivers in China regarding the importance of biomarkers in cognitive impairment.

Education campaigns, conferences, and training programs contribute to increased understanding of biomarkers and their role in early detection, diagnosis, and personalized treatment of cognitive disorders.

| Country | Japan |

|---|---|

| Market Size (USD billion) by End of Forecast Period (2035) | USD 720.5 million |

| CAGR % 2025 to End of Forecast (2035) | 7.2% |

The cognitive impairment biomarkers industry in Japan is estimated to reach a market size of USD 720.5 million by 2035, thriving at a CAGR of 7.2%. The Japanese government has implemented initiatives and healthcare policies to address the challenges posed by cognitive disorders and promote healthy aging.

These initiatives include supporting the development and adoption of biomarker-based diagnostics to improve early diagnosis, intervention, and disease management.

| Country | South Korea |

|---|---|

| Market Size (USD billion) by End of Forecast Period (2035) | USD 816.5 million |

| CAGR % 2025 to End of Forecast (2035) | 7.0% |

The cognitive impairment biomarkers industry in South Korea is expected to reach a market size of USD 816.5 million, expanding at a CAGR of 7.0% during the forecast period. Collaboration between academic institutions, industry players, and healthcare providers is driving innovation in the cognitive impairment biomarkers market in South Korea.

These collaborations facilitate the exchange of knowledge, resources, and expertise, leading to the development of novel biomarker-based diagnostic tools and therapies.

Genomics Biomarker is expected to dominate the cognitive impairment biomarkers industry with a CAGR of 5.2% from 2025 to 2035. Genomics biomarkers enable early detection and risk assessment of cognitive impairment. By analyzing an individual's genetic profile, it is possible to identify those at higher risk for developing cognitive disorders.

This information can be used for targeted screening, intervention, and prevention strategies. Genomics biomarkers also help stratify individuals in clinical trials, allowing for personalized treatment approaches and monitoring of treatment response.

Alzheimer's Diseases is expected to dominate the cognitive impairment biomarkers industry with a CAGR of 5.2% from 2025 to 2035. Biomarkers are valuable tools for monitoring disease progression in Alzheimer's disease. They provide insights into the underlying pathological processes and help assess the efficacy of potential treatments.

Biomarker measurements, such as changes in beta-amyloid and tau levels, can indicate disease progression, track treatment response, and aid in evaluating the effectiveness of disease-modifying therapies.

Hospitals is expected to dominate the cognitive impairment biomarkers industry with a CAGR of 5.5% from 2025 to 2035. Hospitals serve as diagnostic centers where individuals with cognitive impairment symptoms can undergo comprehensive assessments, including the measurement of cognitive impairment biomarkers.

Hospitals with specialized neurology or geriatrics departments are equipped with the necessary infrastructure and expertise to perform biomarker testing and analysis. They provide access to various diagnostic tools, such as genetic testing, neuroimaging, and biomarker measurements from blood or cerebrospinal fluid samples.

The cognitive impairment biomarkers market is fiercely competitive, with many companies fighting for market dominance. To stay ahead of the competition in such a circumstance, essential players must develop effective conjugates.

Key Strategies Used by the Participants

Companies are investing in research & development to deliver product that improve efficiency, dependability, and cost-effectiveness. Product innovation allows businesses to differentiate themselves from their competition while also catering to the changing demands of their clients.

Key industry leaders frequently develop strategic partnerships and collaborations with other companies in order to harness their strengths and increase their market reach. Companies might also gain access to new technology and markets through such agreements.

The cognitive impairment biomarkers market is expanding rapidly in emerging regions such as China and India. Key firms are enhancing their distribution networks and developing local manufacturing facilities to increase their presence in these areas.

Mergers and acquisitions are frequently used by key players in the cognitive impairment biomarkers industry to consolidate their market position, extend their product range, and gain access to new markets.

Key Developments in the Cognitive Impairment Biomarkers Market:

In August 2025, Thermo Fisher Scientific Inc. to increase the size of its local medical device assembly facility and add more than 100 local employments, aims to invest D40 million.

The global cognitive impairment biomarkers market is estimated to be valued at USD 8.8 billion in 2025.

The market size for the cognitive impairment biomarkers market is projected to reach USD 14.3 billion by 2035.

The cognitive impairment biomarkers market is expected to grow at a 5.0% CAGR between 2025 and 2035.

The key product types in cognitive impairment biomarkers market are genomics biomarker, proteomics biomarker, metabolomics biomarkers, imaging biomarkers and others.

In terms of application, alzheimer’s diseases segment to command 34.6% share in the cognitive impairment biomarkers market in 2025.

Full Research Suite comprises of:

Market outlook & trends analysis

Interviews & case studies

Strategic recommendations

Vendor profiles & capabilities analysis

5-year forecasts

8 regions and 60+ country-level data splits

Market segment data splits

12 months of continuous data updates

DELIVERED AS:

PDF EXCEL ONLINE

Cognitive Supply Chain Market Forecast Outlook 2025 to 2035

Cognitive Computing Market Size and Share Forecast Outlook 2025 to 2035

Cognitive Electronic Warfare Market Size and Share Forecast Outlook 2025 to 2035

Cognitive Agents Market Size and Share Forecast Outlook 2025 to 2035

Cognitive Network Market Size and Share Forecast Outlook 2025 to 2035

Cognitive Analytics Market Size and Share Forecast Outlook 2025 to 2035

Cognitive Diagnostics Market Analysis & Forecast by Diagnosis, Indication, End User and Region through 2035

Cognitive health supplements market analysis by product type, form, sales channel, functionality, and by region – Growth, trends, and Forecast from 2025 to 2035

Cognitive Neuroscience Market Overview – Trends & Research Insights 2024-2034

Cognitive Assessment and Training Market Report – Trends & Growth Forecast 2024-2034

Cognitive Data Management Market

Cognitive Security Market

Cognitive Systems Spending Market Report – Growth & Forecast 2016-2026

Content Analytics Discovery And Cognitive Systems Market Size and Share Forecast Outlook 2025 to 2035

Content Analytics, Discovery, and Cognitive Software Market Analysis by Product Type, End User, and Region through 2035

EPO Biomarkers Market Size and Share Forecast Outlook 2025 to 2035

Vitamin Biomarkers Market Size and Share Forecast Outlook 2025 to 2035

Molecular Biomarkers For Cancer Detection Market Size and Share Forecast Outlook 2025 to 2035

Prognostic Biomarkers Market

Neurological Biomarkers Market Size and Share Forecast Outlook 2025 to 2035

Thank you!

You will receive an email from our Business Development Manager. Please be sure to check your SPAM/JUNK folder too.

Chat With

MaRIA