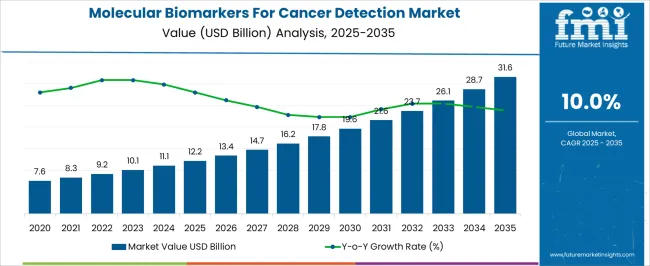

The Molecular Biomarkers For Cancer Detection Market is estimated to be valued at USD 12.2 billion in 2025 and is projected to reach USD 31.6 billion by 2035, registering a compound annual growth rate (CAGR) of 10.0% over the forecast period.

| Metric | Value |

|---|---|

| Molecular Biomarkers For Cancer Detection Market Estimated Value in (2025 E) | USD 12.2 billion |

| Molecular Biomarkers For Cancer Detection Market Forecast Value in (2035 F) | USD 31.6 billion |

| Forecast CAGR (2025 to 2035) | 10.0% |

The molecular biomarkers for cancer detection market is expanding steadily, supported by the rising global incidence of cancer and the growing importance of early and precise diagnostic methods. Demand is being driven by the role of biomarkers in improving diagnostic accuracy, guiding treatment decisions, and monitoring disease progression. Advancements in genomics, proteomics, and next-generation sequencing technologies are accelerating the discovery and validation of biomarkers with high clinical utility.

Regulatory approvals for biomarker-based assays and increasing investments by pharmaceutical and biotechnology companies are further strengthening market adoption. Hospitals and diagnostic centers are prioritizing biomarker-based screening as part of personalized medicine initiatives, reducing reliance on invasive diagnostic procedures.

Strong emphasis on early detection programs by governments and healthcare organizations is also shaping market growth, particularly in regions with rising cancer prevalence As the focus on precision oncology intensifies, the integration of molecular biomarkers into clinical practice is expected to expand further, positioning this market for sustained growth and innovation across multiple cancer types.

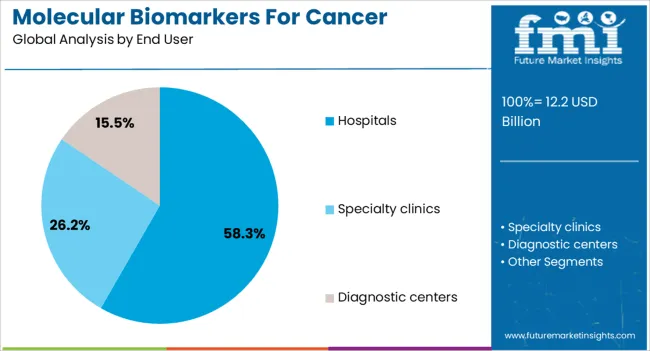

The molecular biomarkers for cancer detection market is segmented by cancer/tumor type, end user, and geographic regions. By cancer/tumor type, molecular biomarkers for cancer detection market is divided into Breast cancer, Lung cancer, Prostate cancer, Colorectal cancer, Cervical cancer, and Others. In terms of end user, molecular biomarkers for cancer detection market is classified into Hospitals, Specialty clinics, and Diagnostic centers. Regionally, the molecular biomarkers for cancer detection industry is classified into North America, Latin America, Western Europe, Eastern Europe, Balkan & Baltic Countries, Russia & Belarus, Central Asia, East Asia, South Asia & Pacific, and the Middle East & Africa.

The breast cancer segment is projected to hold 40.2% of the molecular biomarkers for cancer detection market revenue share in 2025, establishing itself as the leading cancer type. This dominance is being driven by the high global prevalence of breast cancer and the critical importance of early detection in improving survival rates. Molecular biomarkers are enabling more accurate identification of hormone receptor status, genetic mutations, and tumor-specific proteins, which play a vital role in selecting effective treatment regimens.

The segment is benefiting from increasing awareness campaigns and large-scale screening initiatives that emphasize early detection. Continuous advancements in biomarker-based assays, including liquid biopsy and genomic profiling, are improving sensitivity and specificity, thereby reinforcing adoption in clinical settings.

Hospitals and diagnostic laboratories are prioritizing breast cancer biomarker testing as part of precision medicine protocols, ensuring patients receive personalized treatment strategies Growing investments in research and development, alongside the expanding application of biomarkers in monitoring therapy response and recurrence, are further supporting the segment’s strong position in the market.

The hospitals segment is anticipated to account for 58.3% of the molecular biomarkers for cancer detection market revenue share in 2025, making it the leading end user. Its dominance is being supported by the central role hospitals play in diagnosis, treatment planning, and patient monitoring. Biomarker testing in hospitals provides access to advanced diagnostic technologies and ensures integration with oncology care pathways.

The increasing adoption of in-house molecular diagnostic laboratories within hospitals is improving the turnaround time for test results, enhancing treatment decision-making. Hospitals are also benefiting from collaborations with biotechnology and pharmaceutical companies to deploy advanced biomarker panels and companion diagnostics. The ability to deliver comprehensive cancer care, from initial screening to therapeutic monitoring, positions hospitals as the preferred setting for biomarker-based diagnostics.

Rising patient volumes, coupled with government-led screening initiatives and reimbursement policies, are further encouraging biomarker adoption in hospitals As precision oncology becomes increasingly embedded in standard clinical practice, hospitals are expected to remain the primary driver of demand for molecular biomarker-based cancer detection solutions.

Molecular biomarkers are molecules which can be used as indicators for normal biological processes, pathogenic processes and body's response to pharmacological processes.

Molecular biomarkers for cancer detection provide information of an individual's likeliness to develop cancer, provide information on the type of cancer, provide information on optimal drugs that can be used for the treatment of cancer, whether the chances of cancer returning after going into remission persist, etc.

Cancer detection molecular biomarkers are usually made up of proteins, however, in recent years the information related to cancer biomarkers has increased rapidly along with developments in gene expression technology has led to the development of DNA-based molecular biomarkers which can provide more specific information and early detection of cancer.

With the growing incidence cancer worldwide and rising economic burden caused by cancer is expected to increase demand for early detection of cancer.

Rising incidence of cancer globally is expected to boost the molecular biomarkers for cancer detection market over the forecast period. As per the CDC (Centers for Disease Control and Prevention) by 2025, 19.3 million cases of cancer cases are expected to be diagnosed each year which in turn is supposed to increase demand for early detection of cancer.

Development of molecular biomarkers – blood-based strategies to detect and monitor cancer is expected to boost demand for such biomarkers over the forecast period. The paradigm shift towards personalized medicine for treatment of cancer is expected to increase demand for cancer detection biomarkers as manufacturing personalized medicine depends on the pharmacological diagnosis of cancer.

Collaborations between research centers and manufacturers over the forecast period is expected to boost the molecular biomarkers for cancer detection market. However, a high cost of biomarkers and failure of products in R&D pipeline is expected to hamper the market growth.

As biomarkers are mostly derived from human tissue negative opinion form patients is expected to slow revenue growth of the molecular biomarkers for cancer detection.

The low shelf life of biomarkers is also a critical factor which may reduce adoption rate however with the development of biomarkers with increased shelf life by the manufacturers over the forecast period the demand for molecular biomarkers for cancer detection is expected to gain traction.

Regionally, North America is expected to be the dominant market. Rising incidence of cancer and high adoption of biomarkers is expected to boost the demand for molecular biomarkers for cancer detection. Western Europe is expected to follow next in adoption of molecular biomarkers for cancer detection.

Increasing research funding for development of novel biomarkers and presence of key players in the North America and Western Europe is expected to create high growth opportunities for biomarker manufacturers in these regions.

APEJ (Asia-Pacific excluding Japan) is expected to be next followed by North America and Western Europe owing to increasing demand for cancer diagnostics in India, Australia, and China.

Japan is expected to witness the high adoption of molecular biomarkers owing to increasing R&D investment in cancer-related research form the government and local clinical research organizations.

Latin America and MEA regions are expected to follow in line demand for molecular biomarkers for cancer detection owing to changing global trend for cancer detection.

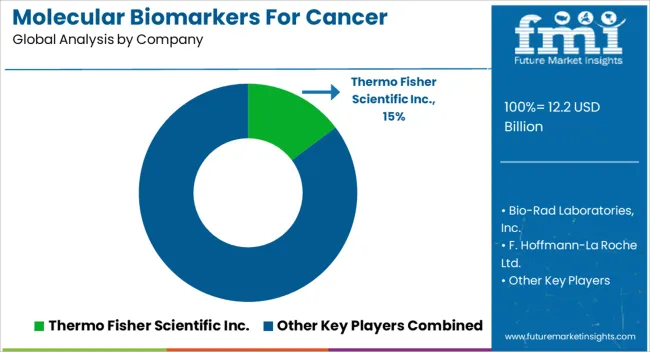

Some key players in the molecular biomarkers for cancer detection are Abbott Laboratories, Agilent Technologies, Roche Diagnostics, Ltd., Qiagen N.V., Thermo Fisher Scientific, Inc., Becton Dickenson & Company, Merck & Co, Inc.

The research report presents a comprehensive assessment of the market and contains thoughtful insights, facts, historical data, and statistically supported and industry-validated market data.

It also contains projections using a suitable set of assumptions and methodologies. The research report provides analysis and information according to categories such as market segments, geographies, types, technology and applications.

The report is a compilation of first-hand information, qualitative and quantitative assessment by industry analysts, inputs from industry experts and industry participants across the value chain.

The report provides in-depth analysis of parent market trends, macro-economic indicators and governing factors along with market attractiveness as per segments. The report also maps the qualitative impact of various market factors on market segments and geographies.

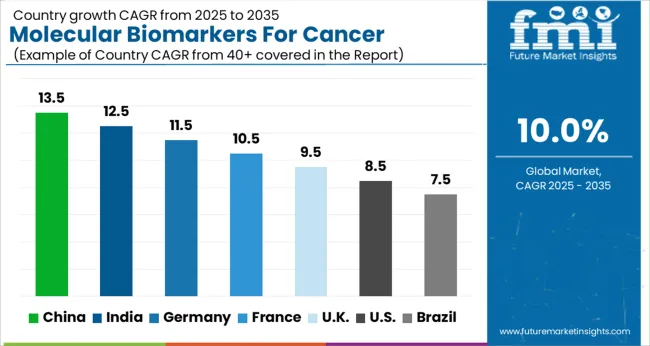

| Country | CAGR |

|---|---|

| China | 13.5% |

| India | 12.5% |

| Germany | 11.5% |

| France | 10.5% |

| UK | 9.5% |

| USA | 8.5% |

| Brazil | 7.5% |

The Molecular Biomarkers For Cancer Detection Market is expected to register a CAGR of 10.0% during the forecast period, exhibiting varied country level momentum. China leads with the highest CAGR of 13.5%, followed by India at 12.5%. Developed markets such as Germany, France, and the UK continue to expand steadily, while the USA is likely to grow at consistent rates. Brazil posts the lowest CAGR at 7.5%, yet still underscores a broadly positive trajectory for the global Molecular Biomarkers For Cancer Detection Market. In 2024, Germany held a dominant revenue in the Western Europe market and is expected to grow with a CAGR of 11.5%. The USA Molecular Biomarkers For Cancer Detection Market is estimated to be valued at USD 4.3 billion in 2025 and is anticipated to reach a valuation of USD 9.7 billion by 2035. Sales are projected to rise at a CAGR of 8.5% over the forecast period between 2025 and 2035. While Japan and South Korea markets are estimated to be valued at USD 595.7 million and USD 399.9 million respectively in 2025.

| Item | Value |

|---|---|

| Quantitative Units | USD 12.2 Billion |

| Cancer/Tumor Type | Breast cancer, Lung cancer, Prostate cancer, Colorectal cancer, Cervical cancer, and Others |

| End User | Hospitals, Specialty clinics, and Diagnostic centers |

| Regions Covered | North America, Europe, Asia-Pacific, Latin America, Middle East & Africa |

| Country Covered | United States, Canada, Germany, France, United Kingdom, China, Japan, India, Brazil, South Africa |

| Key Companies Profiled | Thermo Fisher Scientific Inc., Bio-Rad Laboratories, Inc., F. Hoffmann-La Roche Ltd., QIAGEN N.V., illumina Inc., Agilent Technologies Inc., Abbott Laboratories Inc., Becton, Dickinson, and Company, Myriad Genetics, Inc., Sysmex Corporation, Siemens AG, and BioMerieux SA |

The global molecular biomarkers for cancer detection market is estimated to be valued at USD 12.2 billion in 2025.

The market size for the molecular biomarkers for cancer detection market is projected to reach USD 31.6 billion by 2035.

The molecular biomarkers for cancer detection market is expected to grow at a 10.0% CAGR between 2025 and 2035.

The key product types in molecular biomarkers for cancer detection market are breast cancer, lung cancer, prostate cancer, colorectal cancer, cervical cancer and others.

In terms of end user, hospitals segment to command 58.3% share in the molecular biomarkers for cancer detection market in 2025.

Our Research Products

The "Full Research Suite" delivers actionable market intel, deep dives on markets or technologies, so clients act faster, cut risk, and unlock growth.

The Leaderboard benchmarks and ranks top vendors, classifying them as Established Leaders, Leading Challengers, or Disruptors & Challengers.

Locates where complements amplify value and substitutes erode it, forecasting net impact by horizon

We deliver granular, decision-grade intel: market sizing, 5-year forecasts, pricing, adoption, usage, revenue, and operational KPIs—plus competitor tracking, regulation, and value chains—across 60 countries broadly.

Spot the shifts before they hit your P&L. We track inflection points, adoption curves, pricing moves, and ecosystem plays to show where demand is heading, why it is changing, and what to do next across high-growth markets and disruptive tech

Real-time reads of user behavior. We track shifting priorities, perceptions of today’s and next-gen services, and provider experience, then pace how fast tech moves from trial to adoption, blending buyer, consumer, and channel inputs with social signals (#WhySwitch, #UX).

Partner with our analyst team to build a custom report designed around your business priorities. From analysing market trends to assessing competitors or crafting bespoke datasets, we tailor insights to your needs.

Supplier Intelligence

Discovery & Profiling

Capacity & Footprint

Performance & Risk

Compliance & Governance

Commercial Readiness

Who Supplies Whom

Scorecards & Shortlists

Playbooks & Docs

Category Intelligence

Definition & Scope

Demand & Use Cases

Cost Drivers

Market Structure

Supply Chain Map

Trade & Policy

Operating Norms

Deliverables

Buyer Intelligence

Account Basics

Spend & Scope

Procurement Model

Vendor Requirements

Terms & Policies

Entry Strategy

Pain Points & Triggers

Outputs

Pricing Analysis

Benchmarks

Trends

Should-Cost

Indexation

Landed Cost

Commercial Terms

Deliverables

Brand Analysis

Positioning & Value Prop

Share & Presence

Customer Evidence

Go-to-Market

Digital & Reputation

Compliance & Trust

KPIs & Gaps

Outputs

Full Research Suite comprises of:

Market outlook & trends analysis

Interviews & case studies

Strategic recommendations

Vendor profiles & capabilities analysis

5-year forecasts

8 regions and 60+ country-level data splits

Market segment data splits

12 months of continuous data updates

DELIVERED AS:

PDF EXCEL ONLINE

Molecular Diagnostic Market Size and Share Forecast Outlook 2025 to 2035

Molecular Respiratory Panels Market Size and Share Forecast Outlook 2025 to 2035

Molecular Diagnostics In Pharmacogenomics Market Size and Share Forecast Outlook 2025 to 2035

Molecular Cytogenetics Market Size and Share Forecast Outlook 2025 to 2035

Molecular Biology Enzymes, Kits & Reagents Market Trends and Forecast 2025 to 2035

Molecular Spectroscopy Market Insights - Growth & Forecast 2025 to 2035

Molecular Breast Imaging Market – Trends & Forecast 2025 to 2035

Molecular Quality Controls Market Overview - Trends & Forecast 2025 to 2035

Molecular Imaging Market is segmented by modality type, application and end user from 2025 to 2035

Molecular Microbiology Market

Low Molecular Weight Chondroitin Sulfate Sodium Market Size and Share Forecast Outlook 2025 to 2035

13X Molecular Sieve Activated Powder Market Size and Share Forecast Outlook 2025 to 2035

High Molecular Ammonium Polyphosphate Market Size and Share Forecast Outlook 2025 to 2035

Orthomolecular Medicine Market

Viral Molecular Diagnostics Market Size and Share Forecast Outlook 2025 to 2035

At-home Molecular Testing Market Size and Share Forecast Outlook 2025 to 2035

Airborne Molecular Contamination Control Services Market Forecast and Outlook 2025 to 2035

Automated Molecular Diagnostics Testing System Market Size and Share Forecast Outlook 2025 to 2035

Multiplex Molecular Diagnostics Market Size and Share Forecast Outlook 2025 to 2035

Veterinary Molecular Diagnostics Market Growth - Trends & Forecast 2025 to 2035

Thank you!

You will receive an email from our Business Development Manager. Please be sure to check your SPAM/JUNK folder too.

Chat With

MaRIA