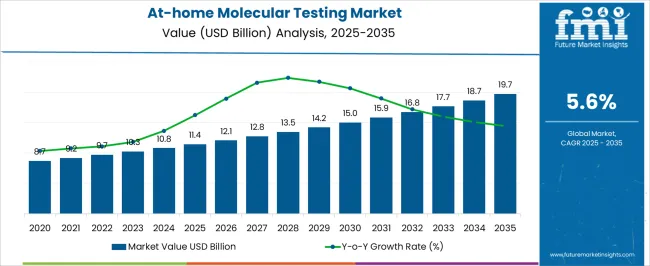

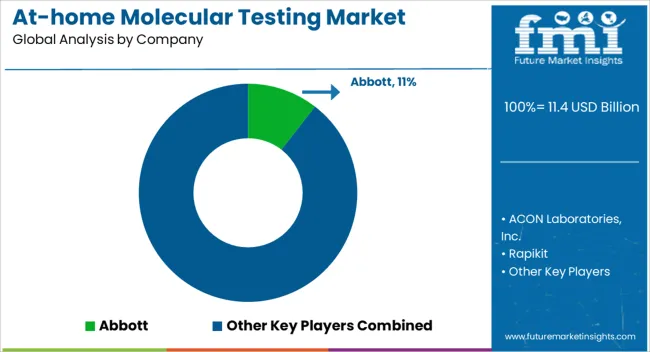

The At-home Molecular Testing Market is estimated to be valued at USD 11.4 billion in 2025 and is projected to reach USD 19.7 billion by 2035, registering a compound annual growth rate (CAGR) of 5.6% over the forecast period.

| Metric | Value |

|---|---|

| At-home Molecular Testing Market Estimated Value in (2025 E) | USD 11.4 billion |

| At-home Molecular Testing Market Forecast Value in (2035 F) | USD 19.7 billion |

| Forecast CAGR (2025 to 2035) | 5.6% |

The At-home Molecular Testing market is witnessing rapid growth, driven by increasing consumer demand for convenient, accurate, and privacy-focused diagnostic solutions. Rising awareness about early disease detection, coupled with the preference for at-home healthcare services, is creating significant demand for molecular testing kits. Technological advancements in assay sensitivity, miniaturized diagnostic devices, and user-friendly interfaces are enhancing accuracy and reliability while ensuring ease of use.

Integration with digital health platforms, including smartphone connectivity and cloud-based result analysis, is further facilitating adoption. Regulatory approvals and growing acceptance among healthcare providers are boosting consumer confidence in at-home testing solutions. Increasing prevalence of chronic diseases, pregnancy monitoring, and infectious conditions is further propelling demand.

Manufacturers are focusing on expanding product portfolios, improving assay performance, and ensuring compatibility with multiple sample types to cater to diverse consumer needs As healthcare systems continue to prioritize decentralization, accessibility, and patient empowerment, the at-home molecular testing market is positioned for sustained growth, supported by innovation and convenience-driven adoption.

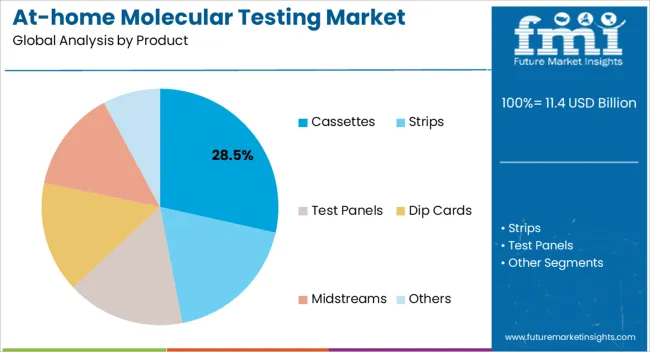

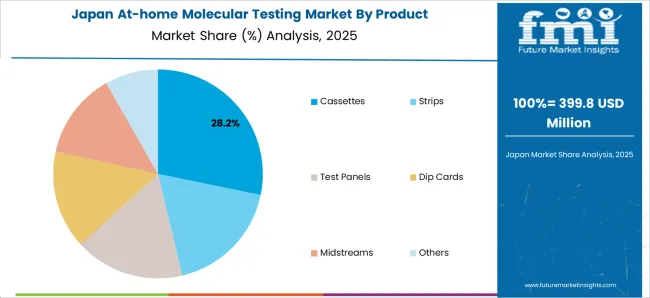

The cassettes product segment is projected to hold 28.5% of the market revenue in 2025, establishing it as the leading product type. Growth in this segment is being driven by its user-friendly design, portability, and compatibility with various molecular assays. Cassette-based tests provide simplified sample handling and reduce the risk of contamination, making them suitable for at-home use.

The compact format allows for easy storage, disposal, and rapid analysis, enhancing consumer convenience. Integration with automated readers or smartphone applications further improves result accuracy and accessibility. Manufacturers are focusing on improving sensitivity, multiplexing capabilities, and compatibility with different sample types to expand adoption.

The ability to deliver fast and reliable results without laboratory intervention has made cassette-based molecular tests a preferred choice among consumers As demand for decentralized and convenient diagnostic solutions continues to grow, the cassettes product segment is expected to maintain its market leadership, driven by operational simplicity, technological advancements, and increasing consumer preference for at-home testing.

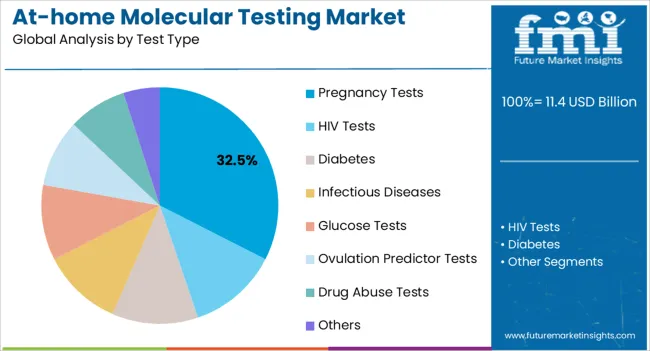

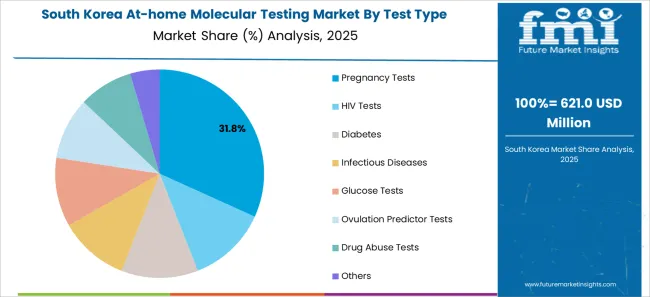

The pregnancy tests test type segment is anticipated to account for 32.5% of the market revenue in 2025, making it the leading test type. Growth is driven by rising consumer awareness, increased family planning activities, and the convenience of at-home monitoring. Molecular pregnancy tests provide high sensitivity and early detection capabilities compared to traditional methods, which reinforces consumer trust and adoption.

Ease of use, rapid results, and compatibility with digital reporting tools further enhance user experience. Healthcare providers are increasingly recommending at-home molecular pregnancy tests for early intervention and prenatal planning.

The ability to integrate testing results with telehealth services or mobile applications allows for more informed decision-making and follow-up care As consumers prioritize privacy, convenience, and accuracy, pregnancy tests are expected to continue dominating the at-home molecular testing segment, supported by technological improvements, greater accessibility, and growing adoption across diverse demographic groups.

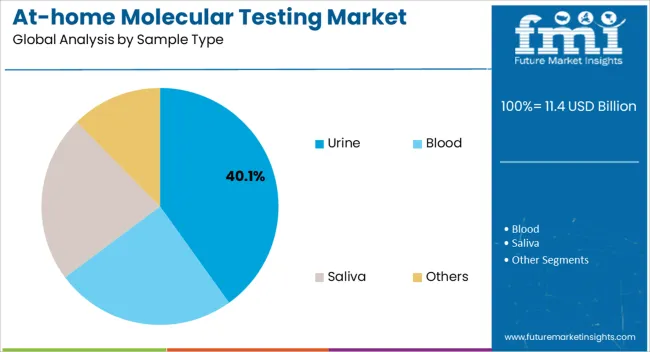

The urine sample type segment is projected to hold 40.1% of the market revenue in 2025, establishing it as the leading sample type. Growth in this segment is being driven by the non-invasive nature of urine collection, ease of handling, and compatibility with multiple molecular assays such as pregnancy and infectious disease tests. Urine-based testing provides reliable biomarker detection while minimizing discomfort and complexity for users.

The ability to integrate urine sample analysis with cassette-based and other at-home testing formats enhances adoption. Technological advancements have improved sensitivity, specificity, and stability of analytes in urine samples, ensuring accurate results without the need for laboratory facilities.

Convenience, combined with safety and user-friendliness, has made urine the preferred sample type for at-home molecular testing As demand for rapid, reliable, and non-invasive diagnostic solutions grows, the urine sample type segment is expected to maintain its leadership, supported by increasing consumer preference for easy-to-use and accurate home-based tests.

From 2020 to 2025, the global at-home molecular testing market experienced a CAGR of 5.4%, reaching a market size of USD 11.4 billion in 2025.

From 2020 to 2025, the global at-home molecular testing market industry witnessed steady growth due to the increased awareness and acceptance of at-home molecular testing. The at-home molecular testing market was in its infancy, primarily focused on genetic testing for ancestry and genealogy purposes.

ompanies like 23andMe and AncestryDNA gained popularity, attracting consumers interested in exploring their genetic heritage. The market witnessed increased awareness and acceptance of at-home molecular testing during this period. More consumers recognized the potential benefits of understanding their genetic health risks and gaining personalized insights. The market diversified to include tests for traits, wellness, and lifestyle factors, such as diet and exercise recommendations based on genetic profiles.

Future Forecast for At-home Molecular Testing Market Industry:

Looking ahead, the global at-home molecular testing market industry is expected to rise at a CAGR of 5.9% from 2025 to 2035. During the forecast period, the market size is expected to reach USD 19.7 billion by 2035.

The at-home molecular testing market industry is expected to continue its growth trajectory from 2025 to 2035. The at-home molecular testing market is expected to witness an expansion of the test menu, offering a wider range of genetic and molecular tests.

As scientific knowledge expands, more disease markers, genetic variants, and actionable insights will be identified, leading to the development of new tests. This diversification will attract a larger consumer base and drive market growth.

The growing focus on personalized medicine and preventive healthcare will fuel the demand for at-home molecular testing. Individuals are increasingly interested in understanding their genetic predispositions, optimizing their health choices, and monitoring disease risks. At-home testing provides a convenient and accessible means to achieve these goals.

| Country | The United States |

|---|---|

| Market Size (USD billion) by End of Forecast Period (2035) | USD 19.7 billion |

| CAGR % 2025 to End of Forecast (2035) | 7.2% |

The at-home molecular testing market industry in the United States is expected to reach a market size of USD 19.7 billion by 2035, expanding at a CAGR of 7.2%. Due to the rising demand for at home diabetic testing kits. In the United States, more than 11.4 million persons have diabetes or prediabetes, according to the Centers for Disease Control and Prevention 2025. Such growing prevalence of diabetes in the country, the demand for at home molecular testing market is high.

| Country | The United Kingdom |

|---|---|

| Market Size (USD billion) by End of Forecast Period (2035) | USD 689.1 million |

| CAGR % 2025 to End of Forecast (2035) | 6.8% |

The at-home molecular testing market industry in the United Kingdom is expected to reach a market share of USD 689.1 million, expanding at a CAGR of 6.8% during the forecast period. The United Kingdom market is projected to growth of the market due to the growing personalized medicine initiatives. The United Kingdom has been at the forefront of personalized medicine initiatives, aiming to provide tailored healthcare based on an individual's genetic profile. At-home molecular testing plays a crucial role in these initiatives, allowing individuals to access genetic information, identify disease risks, and participate in research studies to advance personalized healthcare.

| Country | China |

|---|---|

| Market Size (USD billion) by End of Forecast Period (2035) | USD 1.30 billion |

| CAGR % 2025 to End of Forecast (2035) | 5.1% |

The at-home molecular testing market industry in China is anticipated to reach a market size of USD 1.30 billion, moving at a CAGR of 5.1% during the forecast period. The at-home molecular testing market industry in China is expected to grow prominently due to the increasing chronic disease. China is facing a rising burden of chronic diseases, such as cardiovascular diseases, diabetes, and cancer.

At-home molecular testing offers a way for individuals to monitor their health, detect diseases early, and take preventive measures. The ability to access testing from the comfort of their homes aligns with the increasing emphasis on preventive healthcare.

| Country | Japan |

|---|---|

| Market Size (USD billion) by End of Forecast Period (2035) | USD 1.12 billion |

| CAGR % 2025 to End of Forecast (2035) | 5.8% |

The at-home molecular testing market industry in Japan is estimated to reach a market size of USD 1.12 billion by 2035, thriving at a CAGR of 5.8%. The market in Japan is predicted to grow because of the growing technological advancements.

Japan has a well-established e-commerce infrastructure and a high penetration of smartphones. This has facilitated the growth of online platforms and marketplaces for at-home molecular testing kits. The ease of purchasing and accessing these kits online has contributed to the rising demand in the country.

| Country | South Korea |

|---|---|

| Market Size (USD billion) by End of Forecast Period (2035) | USD 253.9 million |

| CAGR % 2025 to End of Forecast (2035) | 3.6% |

The at-home molecular testing market industry in South Korea is expected to reach a market size of USD 253.9 million, expanding at a CAGR of 3.6% during the forecast period. The market in South Korea is forecasted to witness growth due to the increased awareness and acceptance. There has been a growing awareness and acceptance of at-home molecular testing among the general population in the South Korea. Consumers are increasingly interested in understanding their genetic heritage, health risks, and ancestry. This has contributed to the rising demand for at-home genetic testing kits.

The cassettes are expected to dominate the at-home molecular testing market industry with a CAGR of 6.7% from 2025 to 2035. This segment captures a significant market share in 2025 due to its rapid testing procedures, high efficiency, and improved testing kits.

According to the needs of the consumer, diagnostic cassettes for rapid test for diagnostic kits can be used in a single way or many ways (two or four ways). For immediate results, Plastic Cassettes for Rapid Test (Cassettes for Diagnostic Kits) are frequently utilized. For the best outcomes, it also guarantees improved buffer flow with the right pressure points through the strip.

Infectious diseases are expected to dominate the at-home molecular testing market industry with a CAGR of 6.7% from 2025 to 2035. This segment captures a significant market share in 2025 as incidences of infectious diseases in the globe is on the rise.

The prevalence of infectious diseases in developed and developing regions will have a beneficial impact on market growth. The increasing number of prescriptions for at-home infectious illness diagnostic tests is due to the diagnosis and management of such infections.

The blood sample segment is expected to dominate the at-home molecular testing market industry with a CAGR of 5.5% from 2025 to 2035 and is expected to hold market share of 42.4% in 2025. Blood testing are extremely common. They aid clinicians in the detection of certain diseases and ailments.

They also aid in the evaluation of organ function and the effectiveness of treatments. One of the most popular blood tests is the complete blood count (CBC). It is frequently performed as part of a standard checkup. This test evaluates a variety of blood components, including red blood cells, white blood cells, and platelets.

The drug store in dominating the at home molecular testing market with the CAGR of 6.2%. The ease of availability of the testing kits without prescription in the drug store the adoption is high.

The at-home molecular testing sector is fiercely competitive, with many companies fighting for market dominance. To stay ahead of the competition in such a circumstance, essential players must employ smart techniques.

Key Strategies Used by the Participants

To produce innovative goods that increase efficacy, dependability, and cost-effectiveness, businesses make significant investments in research and development. Product innovation enables companies to stand out from the competition while also meeting the shifting needs of their customers.

Strategic alliances and partnerships with other businesses are regularly formed by major players in an industry to take advantage of each other's advantages and expand their market reach. Through such arrangements, businesses may also obtain access to new technologies and markets.

The market for at-home molecular testing is rising quickly in developing nations like China and India. To boost their presence in these regions, major companies are expanding their distribution networks and building regional manufacturing sites.

Key companies in the at-home molecular testing market routinely employ mergers and acquisitions to strengthen their market positions, broaden their product offerings, and enter new markets.

Key Developments in the At-home Molecular Testing Market:

The global at-home molecular testing market is estimated to be valued at USD 11.4 billion in 2025.

The market size for the at-home molecular testing market is projected to reach USD 19.7 billion by 2035.

The at-home molecular testing market is expected to grow at a 5.6% CAGR between 2025 and 2035.

The key product types in at-home molecular testing market are cassettes, strips, test panels, dip cards, midstreams and others.

In terms of test type, pregnancy tests segment to command 32.5% share in the at-home molecular testing market in 2025.

Full Research Suite comprises of:

Market outlook & trends analysis

Interviews & case studies

Strategic recommendations

Vendor profiles & capabilities analysis

5-year forecasts

8 regions and 60+ country-level data splits

Market segment data splits

12 months of continuous data updates

DELIVERED AS:

PDF EXCEL ONLINE

At-Home Testing Market Analysis - Growth, Demand & Forecast 2025 to 2035

At-Home Cancer Testing Market - Growth & Forecast 2025 to 2035

At-Home Pregnancy Testing Market Size and Share Forecast Outlook 2025 to 2035

At-Home Micronutrient Testing Industry Share, Size, and Forecast 2025 to 2035

Global Advanced At-home Biomarker Testing Market Analysis – Size, Share & Forecast 2024-2034

Molecular Diagnostic Market Size and Share Forecast Outlook 2025 to 2035

Molecular Respiratory Panels Market Size and Share Forecast Outlook 2025 to 2035

Molecular Diagnostics In Pharmacogenomics Market Size and Share Forecast Outlook 2025 to 2035

Molecular Biomarkers For Cancer Detection Market Size and Share Forecast Outlook 2025 to 2035

Molecular Cytogenetics Market Size and Share Forecast Outlook 2025 to 2035

Molecular Biology Enzymes, Kits & Reagents Market Trends and Forecast 2025 to 2035

Molecular Spectroscopy Market Insights - Growth & Forecast 2025 to 2035

Molecular Breast Imaging Market – Trends & Forecast 2025 to 2035

Molecular Quality Controls Market Overview - Trends & Forecast 2025 to 2035

Molecular Imaging Market is segmented by modality type, application and end user from 2025 to 2035

Molecular Microbiology Market

Low Molecular Weight Chondroitin Sulfate Sodium Market Size and Share Forecast Outlook 2025 to 2035

13X Molecular Sieve Activated Powder Market Size and Share Forecast Outlook 2025 to 2035

High Molecular Ammonium Polyphosphate Market Size and Share Forecast Outlook 2025 to 2035

Orthomolecular Medicine Market

Thank you!

You will receive an email from our Business Development Manager. Please be sure to check your SPAM/JUNK folder too.

Chat With

MaRIA