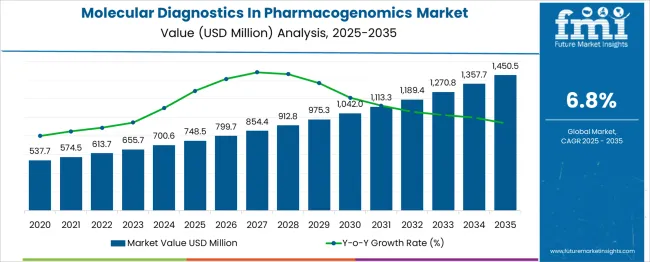

The global molecular diagnostics in pharmacogenomics market is projected to grow from USD 748.5 million in 2025 to approximately USD 1,450.5 million by 2035, recording an absolute increase of USD 702.0 million over the forecast period. This translates into a total growth of 93.8%, with the market forecast to expand at a compound annual growth rate (CAGR) of 6.8% between 2025 and 2035. The market size is expected to grow by nearly 1.94X during the same period, supported by increasing adoption of personalized medicine approaches, growing awareness about drug-gene interactions, and expanding applications in clinical decision-making for optimal therapeutic outcomes.

Between 2025 and 2030, the molecular diagnostics in pharmacogenomics market is projected to expand from USD 748.5 million to USD 1,025.7 million, resulting in a value increase of USD 277.2 million, which represents 39.5% of the total forecast growth for the decade. This phase of growth will be shaped by increasing integration of pharmacogenomic testing in routine clinical practice, expanding reimbursement coverage for genetic testing, and growing pharmaceutical industry adoption for drug development and clinical trials. Healthcare providers are increasingly recognizing the value of pharmacogenomic testing in reducing adverse drug reactions and optimizing therapeutic efficacy.

| Metric | Value |

| Estimated Value in (2025E) | USD 748.5 million |

| Forecast Value in (2035F) | USD 1,450.5 million |

| Forecast CAGR (2025 to 2035) | 6.8% |

From 2030 to 2035, the market is forecast to grow from USD 1,025.7 million to USD 1,450.5 million, adding another USD 424.8 million, which constitutes 60.5% of the ten-year expansion. This period is expected to be characterized by advancement in next-generation sequencing technologies, integration of artificial intelligence in data interpretation, and development of comprehensive pharmacogenomic panels. The growing priority on precision medicine and value-based healthcare will drive demand for sophisticated molecular diagnostic solutions that can guide personalized treatment strategies.

Between 2020 and 2025, the molecular diagnostics in pharmacogenomics market experienced steady expansion, driven by increasing awareness about genetic factors influencing drug response and growing adoption of companion diagnostics. The market developed as healthcare systems recognized the potential of pharmacogenomics to reduce healthcare costs through improved drug efficacy and reduced adverse events. Clinical guidelines began incorporating pharmacogenomic testing recommendations for specific drug-gene pairs, particularly in oncology and psychiatry therapeutic areas.

Market expansion is being supported by the increasing recognition of genetic variability in drug metabolism and response among different patient populations. Healthcare providers are increasingly adopting pharmacogenomic testing to optimize drug selection and dosing, particularly for medications with narrow therapeutic windows or high risk of adverse reactions. The growing body of clinical evidence demonstrating improved patient outcomes through pharmacogenomic-guided therapy is driving acceptance among clinicians and payers.

The advancement in molecular diagnostic technologies, particularly next-generation sequencing and high-throughput genotyping platforms, is making pharmacogenomic testing more accessible and cost-effective. Decreasing costs of genetic testing combined with faster turnaround times are enabling broader implementation in clinical settings. The development of comprehensive multi-gene panels that can assess multiple drug-gene interactions simultaneously is creating value propositions for healthcare systems seeking to implement precision medicine approaches across various therapeutic areas.

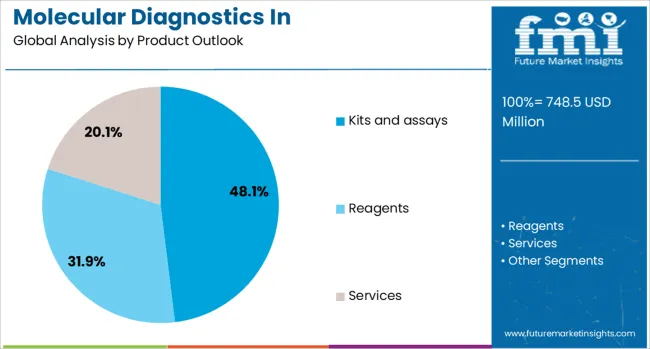

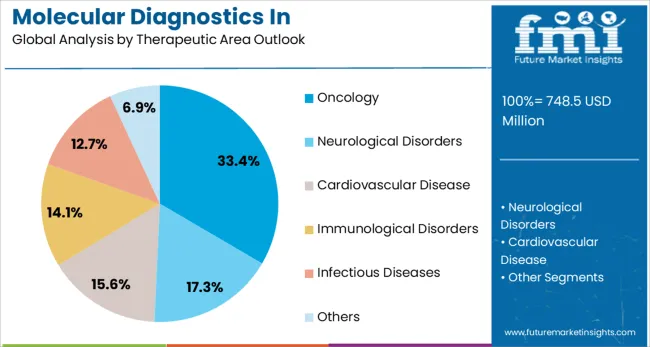

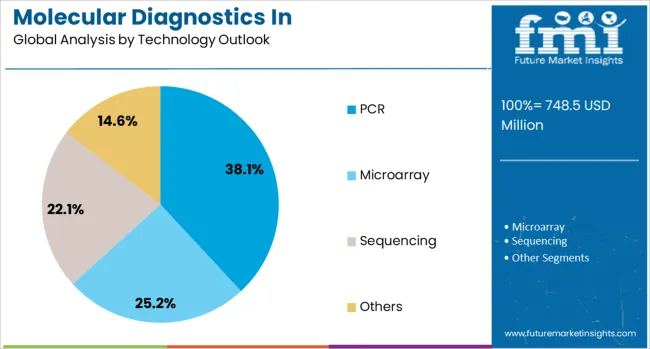

The market is segmented by product outlook, therapeutic area outlook, and technology outlook. By product outlook, the market is divided into kits and assays, reagents, and services. Based on therapeutic area outlook, the market is categorized into oncology (including lung cancer, breast cancer, colorectal cancer, cervical cancer, and others), neurological disorders, cardiovascular disease, immunological disorders, infectious diseases, and others. In terms of technology outlook, the market is segmented into PCR, microarray, sequencing, and others.

The kits and assays segment is projected to account for 48.1% of the molecular diagnostics in pharmacogenomics market in 2025, establishing its position as the dominant product category. This prominence reflects the essential role of ready-to-use testing solutions in clinical laboratories and healthcare facilities seeking to implement pharmacogenomic testing efficiently. Kits and assays provide standardized, validated methodologies that ensure consistent results across different testing environments, which is crucial for clinical decision-making.

The segment benefits from continuous innovation in assay design, including multiplex capabilities that allow simultaneous detection of multiple genetic variants relevant to drug metabolism. FDA-cleared and CE-marked kits provide regulatory compliance and clinical validation that healthcare providers require for routine implementation. The availability of both targeted single-gene assays and comprehensive panel-based solutions allows laboratories to select products appropriate for their testing volumes and clinical needs. As pharmacogenomic testing becomes more integrated into standard care protocols, the demand for reliable, user-friendly kits and assays continues to drive this segment's growth.

Oncology is projected to represent 33.4% of molecular diagnostics in pharmacogenomics demand in 2025, reflecting its position as the leading therapeutic application area. The complexity of cancer treatment and the high stakes involved in therapeutic selection make pharmacogenomic testing particularly valuable in oncology settings. Companion diagnostics for targeted therapies have become standard practice, with genetic testing required or recommended for numerous cancer drugs to identify patients most likely to benefit from specific treatments.

The segment encompasses various cancer types including lung cancer, breast cancer, colorectal cancer, and cervical cancer, each with specific pharmacogenomic markers guiding treatment decisions. The growing pipeline of targeted therapies and immunotherapies further drives demand for molecular diagnostic testing to stratify patients and predict treatment response. The pharmacogenomic testing helps identify patients at risk for severe toxicity from chemotherapy agents, enabling dose adjustments or alternative treatment selections that improve patient safety and quality of life.

The PCR (Polymerase Chain Reaction) technology is forecasted to contribute 38.1% of the molecular diagnostics in pharmacogenomics market in 2025, maintaining its position as the most widely adopted testing platform. PCR's dominance stems from its proven reliability, cost-effectiveness, and widespread availability in clinical laboratories worldwide. The technology offers excellent sensitivity and specificity for detecting specific genetic variants relevant to drug metabolism, making it ideal for targeted pharmacogenomic testing.

Real-time PCR and digital PCR variants provide quantitative capabilities essential for certain pharmacogenomic applications, while the development of multiplex PCR assays enables simultaneous detection of multiple variants in a single reaction. The technology's relatively simple workflow and fast turnaround times make it suitable for routine clinical use, particularly for high-volume testing of common pharmacogenomic markers. As laboratories seek to balance comprehensive testing capabilities with operational efficiency, PCR-based solutions continue to serve as the backbone of pharmacogenomic testing programs.

The molecular diagnostics in pharmacogenomics market is advancing steadily due to increasing adoption of precision medicine approaches and growing evidence supporting pharmacogenomic-guided therapy. The market faces challenges including limited reimbursement coverage, lack of standardized clinical guidelines, and need for healthcare provider education. Innovation in testing technologies and expanding clinical applications continue to influence market development and adoption patterns.

The incorporation of AI and machine learning algorithms is revolutionizing the interpretation of pharmacogenomic data, enabling more sophisticated analysis of complex drug-gene interactions. These technologies help identify patterns and associations that might be missed through traditional analysis methods, improving the clinical utility of test results. Advanced decision support systems are being developed to help clinicians translate genetic information into actionable treatment recommendations, addressing one of the key barriers to pharmacogenomic implementation.

The emergence of point-of-care molecular diagnostic platforms is making pharmacogenomic testing more accessible in various healthcare settings. These rapid testing solutions enable real-time therapeutic decision-making, particularly valuable in acute care situations where drug selection timing is critical. Miniaturized testing devices and simplified workflows are reducing the infrastructure requirements for pharmacogenomic testing, potentially expanding access to underserved populations and resource-limited settings.

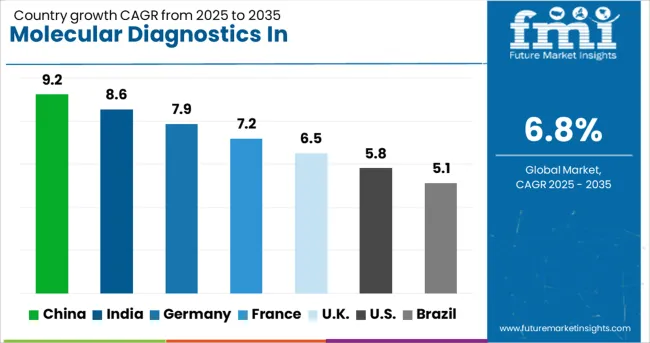

| Country | CAGR (2025-2035) |

| China | 9.2% |

| India | 8.6% |

| Germany | 7.9% |

| France | 7.2% |

| UK | 6.5% |

| USA | 5.8% |

| Brazil | 5.1% |

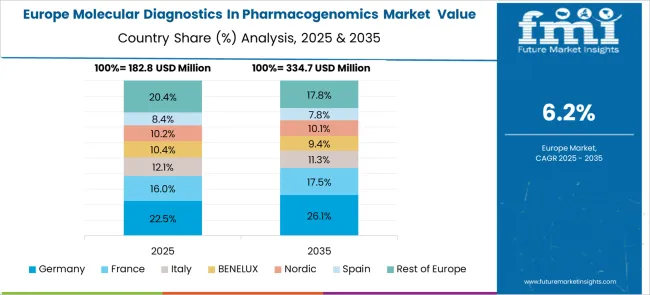

The molecular diagnostics in pharmacogenomics market is experiencing varied growth globally, with China leading at a 9.2% CAGR through 2035, driven by massive healthcare infrastructure investments, growing precision medicine initiatives, and expanding clinical adoption of pharmacogenomic testing. India follows at 8.6%, supported by increasing healthcare expenditure, growing awareness of personalized medicine, and expanding diagnostic laboratory networks. Germany shows strong growth at 7.9%, prioritizing integration of pharmacogenomics into clinical practice and comprehensive reimbursement policies. France records 7.2%, focusing on national genomic medicine programs and coordinated implementation strategies. The UK demonstrates 6.5% growth, prioritizing NHS-led initiatives and clinical guideline development.

The report covers an in-depth analysis of 40+ countries; seven top-performing countries are highlighted below.

Revenue from molecular diagnostics in pharmacogenomics in China is projected to exhibit strong growth with a CAGR of 9.2% through 2035, driven by government-led precision medicine initiatives and substantial investments in genomic research infrastructure. The country's Healthy China 2030 strategy focus personalized medicine as a key component of healthcare modernization. Major hospitals and research institutions are establishing pharmacogenomic testing programs to improve drug efficacy and reduce adverse drug reactions among the Chinese population.

Revenue from molecular diagnostics in pharmacogenomics in India is expanding at a CAGR of 8.6%, supported by increasing healthcare awareness, rising incidence of chronic diseases requiring precision therapeutic approaches, and growing private healthcare sector investments. The country's large patient population and genetic diversity create significant opportunities for pharmacogenomic research and clinical application. Both public and private healthcare institutions are beginning to integrate pharmacogenomic testing into specialty care areas.

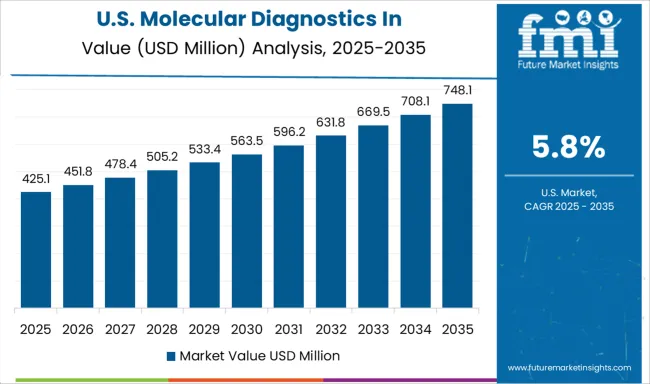

Demand for molecular diagnostics in pharmacogenomics in the USA is projected to grow at a CAGR of 5.8%, supported by well-established precision medicine programs, comprehensive clinical guidelines, and increasing payer coverage for pharmacogenomic testing. American healthcare institutions lead in clinical implementation of pharmacogenomics, with many major medical centers offering routine testing for drug-gene interactions. The market benefits from strong regulatory frameworks and extensive clinical evidence supporting test utility.

Revenue from molecular diagnostics in pharmacogenomics in Germany is projected to grow at a CAGR of 7.9% through 2035, driven by the country's advanced healthcare system and strong focus on evidence-based medicine. German healthcare providers are increasingly adopting pharmacogenomic testing as part of comprehensive patient care strategies, particularly in oncology and psychiatry. The market benefits from favorable reimbursement policies and well-developed molecular diagnostic infrastructure.

Revenue from molecular diagnostics in pharmacogenomics in France is projected to grow at a CAGR of 7.2% through 2035, supported by the France Genomic Medicine 2025 plan and coordinated efforts to integrate pharmacogenomics into routine healthcare. French medical institutions are establishing specialized pharmacogenomic services and developing national guidelines for test implementation across various therapeutic areas.

Revenue from molecular diagnostics in pharmacogenomics in the UK is projected to grow at a CAGR of 6.5% through 2035, driven by NHS England's commitment to embedding pharmacogenomics in routine care and the 100,000 Genomes Project legacy. British healthcare institutions are developing implementation frameworks and clinical pathways for pharmacogenomic testing across multiple specialties.

Revenue from molecular diagnostics in pharmacogenomics in Brazil is projected to grow at a CAGR of 5.1% through 2035, supported by healthcare system improvements, increasing prevalence of chronic diseases, and growing awareness of personalized medicine benefits. Brazilian healthcare providers are beginning to adopt pharmacogenomic testing, particularly in private healthcare settings and specialized treatment centers.

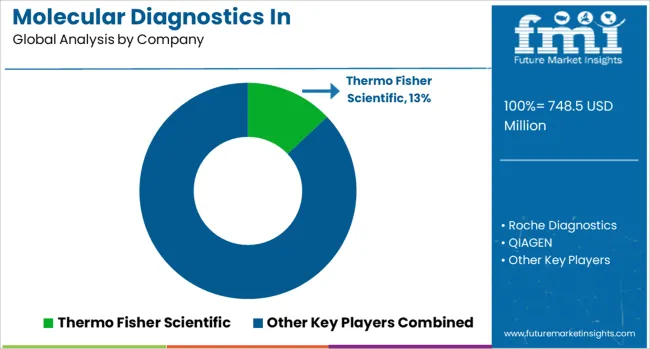

The molecular diagnostics in pharmacogenomics market is characterized by competition among established diagnostic companies, specialized genetic testing laboratories, and emerging technology providers. Companies are investing in platform development, bioinformatics capabilities, clinical validation studies, and market access strategies to deliver comprehensive pharmacogenomic testing solutions. Test menu expansion, technological innovation, and clinical utility demonstration are central to strengthening market positions and driving adoption.

Thermo Fisher Scientific, USA-based, leads the market with 13% global value share, offering comprehensive molecular diagnostic platforms and pharmacogenomic testing solutions with strong research and clinical market presence. Roche Diagnostics provides integrated diagnostic systems with extensive pharmacogenomic test menus and companion diagnostic expertise. QIAGEN delivers sample-to-insight solutions with specialized pharmacogenomic content and bioinformatics capabilities. Illumina, Inc. focuses on next-generation sequencing platforms enabling comprehensive pharmacogenomic profiling.

Agilent Technologies provides molecular diagnostic instruments and reagents supporting pharmacogenomic testing workflows. Abbott Molecular offers automated molecular diagnostic systems with pharmacogenomic testing capabilities. Genomind specializes in psychiatric pharmacogenomics with proprietary testing panels and clinical decision support. OneOme focuses on comprehensive pharmacogenomic testing with medication management tools. Myriad Genetics provides specialized pharmacogenomic tests with strong clinical validation. Invitae delivers pharmacogenomic testing with integrated clinical decision support and medication management platforms.

| Items | Values |

| Quantitative Units (2025) | USD 748.5 million |

| Product Outlook | Kits and assays, Reagents, Services |

| Therapeutic Area Outlook | Oncology (Lung Cancer, Breast Cancer, Colorectal Cancer, Cervical Cancer, Others), Neurological Disorders, Cardiovascular Disease, Immunological Disorders, Infectious Diseases, Others |

| Technology Outlook | PCR, Microarray, Sequencing, Others |

| Regions Covered | North America, Europe, East Asia, South Asia & Pacific, Latin America, Middle East & Africa |

| Countries Covered | United States, Canada, United Kingdom, Germany, France, China, Japan, South Korea, India, Brazil, Australia and 40+ countries |

| Key Companies Profiled | Thermo Fisher Scientific, Roche Diagnostics, QIAGEN, Illumina Inc., Agilent Technologies, Abbott Molecular, Genomind, OneOme, Myriad Genetics, and Invitae (formerly YouScript) |

| Additional Attributes | Market share analysis by technology platform and therapeutic application, regional adoption trends, competitive landscape assessment, reimbursement scenarios across key markets, integration with electronic health records and clinical decision support systems, regulatory pathway analysis for pharmacogenomic tests, clinical utility evidence and health economic outcomes |

The global molecular diagnostics in pharmacogenomics market is estimated to be valued at USD 748.5 million in 2025.

The market size for the molecular diagnostics in pharmacogenomics market is projected to reach USD 1,450.5 million by 2035.

The molecular diagnostics in pharmacogenomics market is expected to grow at a 6.8% CAGR between 2025 and 2035.

The key product types in molecular diagnostics in pharmacogenomics market are kits and assays, reagents and services.

In terms of therapeutic area outlook, oncology segment to command 33.4% share in the molecular diagnostics in pharmacogenomics market in 2025.

Full Research Suite comprises of:

Market outlook & trends analysis

Interviews & case studies

Strategic recommendations

Vendor profiles & capabilities analysis

5-year forecasts

8 regions and 60+ country-level data splits

Market segment data splits

12 months of continuous data updates

DELIVERED AS:

PDF EXCEL ONLINE

Molecular Diagnostic Market Size and Share Forecast Outlook 2025 to 2035

Molecular Respiratory Panels Market Size and Share Forecast Outlook 2025 to 2035

Molecular Biomarkers For Cancer Detection Market Size and Share Forecast Outlook 2025 to 2035

Molecular Cytogenetics Market Size and Share Forecast Outlook 2025 to 2035

Molecular Biology Enzymes, Kits & Reagents Market Trends and Forecast 2025 to 2035

Molecular Spectroscopy Market Insights - Growth & Forecast 2025 to 2035

Molecular Quality Controls Market Overview - Trends & Forecast 2025 to 2035

Molecular Microbiology Market

Molecular Imaging Market is segmented by modality type, application and end user from 2025 to 2035

Molecular Breast Imaging Market – Trends & Forecast 2025 to 2035

13X Molecular Sieve Activated Powder Market Size and Share Forecast Outlook 2025 to 2035

Low Molecular Weight Chondroitin Sulfate Sodium Market Size and Share Forecast Outlook 2025 to 2035

High Molecular Ammonium Polyphosphate Market Size and Share Forecast Outlook 2025 to 2035

Orthomolecular Medicine Market

Viral Molecular Diagnostics Market Size and Share Forecast Outlook 2025 to 2035

At-home Molecular Testing Market Size and Share Forecast Outlook 2025 to 2035

Airborne Molecular Contamination Control Services Market Forecast and Outlook 2025 to 2035

Multiplex Molecular Diagnostics Market Size and Share Forecast Outlook 2025 to 2035

Automated Molecular Diagnostics Testing System Market Size and Share Forecast Outlook 2025 to 2035

Market Share Distribution Among Ultra-High Molecular Weight Polyethylene Manufacturers

Thank you!

You will receive an email from our Business Development Manager. Please be sure to check your SPAM/JUNK folder too.

Chat With

MaRIA