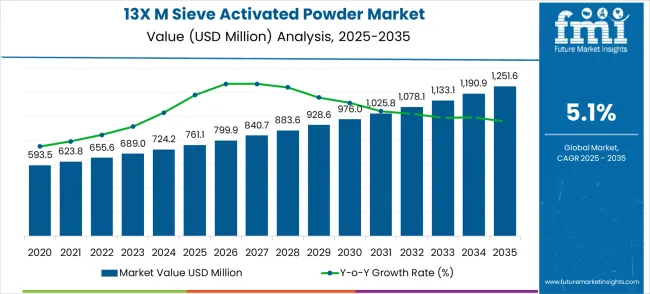

The 13X molecular sieve activated powder market is forecasted to grow from USD 761.1 million in 2025 to USD 1,251.6 million by 2035, reflecting a compound annual growth rate of 5.1%. Year-on-year analysis indicates a consistent upward trajectory, with values increasing steadily across the decade. The growth pattern reflects rising demand across gas separation, air purification, and petrochemical processing, where efficiency in adsorption and moisture control is prioritized.

Early growth from 2025 to 2028 shows gradual expansion, largely driven by adoption in industrial gas applications and refining processes. As industries continue to incorporate higher-grade adsorbents for energy-efficient operations, demand momentum strengthens during the mid-forecast period, supported by enhanced utilization in environmental management and chemical manufacturing. By the final years, stable adoption across diverse end-use sectors highlights the market’s reliability and entrenched positioning as a critical material in separation and purification technologies.

The year-on-year growth trajectory of the 13X molecular sieve activated powder market outlines a curve of steady progression, highlighting its resilience and value proposition within industrial applications. Initial increments between 2025 and 2027 remain moderate, representing a phase of steady uptake. As the forecast advances, annual gains become more pronounced, with demand accelerating in gas drying, carbon capture, and catalysis support systems.

By 2030 onward, the market records stronger incremental increases, reflecting widespread recognition of 13X molecular sieve activated powder’s role in enhancing operational efficiency and product purity. The uniform growth profile suggests that while market expansion is not abrupt, it is stable and reliable, offering long-term prospects. Such predictable year-on-year growth underscores its continued relevance in industries requiring adsorption capacity and structural stability, making it a cornerstone ingredient in advanced processing and purification systems.

| Metric | Value |

|---|---|

| Estimated Value in (2025E) | USD 761.1 million |

| Forecast Value in (2035F) | USD 1,251.6 million |

| Forecast CAGR (2025 to 2035) | 5.1% |

The 13X molecular sieve activated powder market has been positioned as a critical segment within industrial separation and purification applications, with its adoption being linked strongly to its adsorption capacity and consistency. Within the adsorbents market, its share stands near 10.3%, supported by its established role in refining and purification. The industrial gases market reflects a 7.6% contribution, as the powder is used to dry and purify oxygen, nitrogen, and hydrogen. In oil and gas processing, the share is 8.4%, with widespread reliance on molecular sieves for dehydration and contaminant removal.

The petrochemicals market accounts for 6.7% of demand, where purity levels in processing streams must be tightly maintained. Air separation holds a 7.1% share, as molecular sieves are a backbone in oxygen and nitrogen generation units. When combined, the total market share across these parent industries is about 40.1%, underscoring how essential the 13X molecular sieve activated powder has become in supporting reliable industrial operations. This segment is viewed as vital due to its performance-driven role in boosting efficiency, product quality, and operational reliability across end-use domains.

Market expansion is being supported by the rapid increase in industrial applications requiring precise moisture control and the corresponding need for high-performance adsorption materials that can deliver consistent results across diverse operating conditions. Modern manufacturing processes in paints and coatings, adhesives and sealants, and specialty chemicals generate moisture-sensitive environments that require molecular-level moisture removal to ensure product quality and performance. Even trace amounts of moisture can cause significant quality issues and operational disruptions if proper drying technologies are not implemented.

The growing complexity of industrial formulations and increasing emphasis on product quality are driving demand for premium 13X molecular sieve activated powders from certified suppliers with proven adsorption performance and reliability. Manufacturing facilities are increasingly recognizing that advanced moisture control technologies are essential for maintaining product specifications, ensuring process stability, and achieving regulatory compliance. Industry standards and quality requirements are establishing stringent moisture control specifications that necessitate specialized molecular sieve materials with superior performance characteristics.

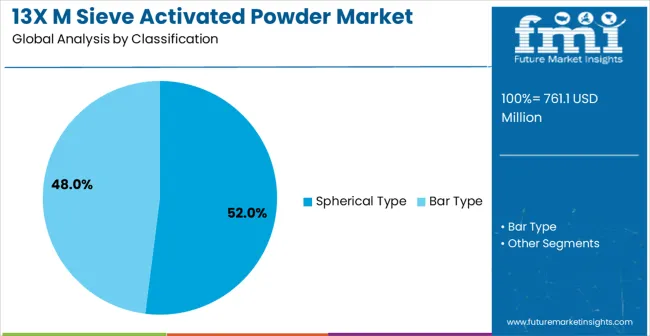

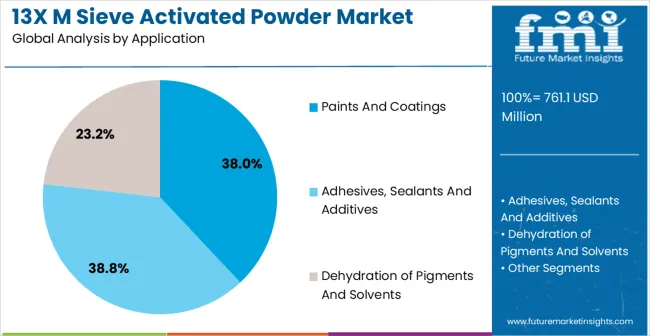

The market is segmented by type, application, and region. By type, the market is divided into spherical type, bar type, and others. Based on application, the market is categorized into paints and coatings, adhesives, sealants and additives, dehydration of pigments and solvents, and others. Regionally, the market is divided into North America, Europe, East Asia, South Asia & Pacific, Latin America, and Middle East & Africa.

Spherical type 13X molecular sieve activated powder is projected to account for 52% of the market in 2025. This leading share is supported by the superior flow characteristics and handling properties of spherical particles, which make them ideal for automated dosing systems and continuous manufacturing processes. Spherical molecular sieves provide excellent dispersion in liquid formulations and offer consistent adsorption performance across varying application conditions. The segment benefits from continuous technological improvements in particle engineering and surface modification that enhance overall adsorption efficiency and product compatibility.

Adhesives, sealants, and additives applications are expected to represent 38.8% of 13X molecular sieve activated powder demand in 2025. This strong share highlights the essential role of moisture control in adhesive formulations and performance stability. 13X molecular sieves are widely utilized to prevent premature curing, viscosity changes, and loss of bonding strength caused by moisture contamination. In sealants and specialty additives, effective moisture management ensures long-term flexibility, adhesion, and resistance to degradation. The segment benefits from rising demand in construction, packaging, automotive, and electronics industries, where high-performance bonding and sealing solutions are critical for structural integrity, durability, and reliability.

The 13X molecular sieve activated powder market is driven by its widespread use in gas separation, air purification, and petrochemical applications. Demand has been strengthened by the need for efficient, high-performance filtration systems across industries like automotive, oil and gas, and healthcare. Opportunities are emerging in the expansion of renewable energy projects and increasing industrialization in emerging economies. Key trends include the shift toward customized sieves and the integration of more efficient production processes. Challenges remain in cost efficiency, raw material sourcing, and market competition.

The demand for 13X molecular sieve activated powder has been fueled by its critical role in gas separation, drying, and purification applications across industries. In opinion, industries such as automotive, oil and gas, and healthcare have increasingly relied on these sieves to meet stringent air quality standards and enhance the efficiency of their operations. The powder’s ability to selectively adsorb molecules like water, carbon dioxide, and hydrocarbons has made it indispensable in applications requiring high adsorption capacity. As environmental regulations tighten, industries are turning to molecular sieves to ensure compliance with air purity standards and to improve the efficiency of catalytic processes in refineries. Furthermore, demand from industries requiring precision filtration, such as pharmaceuticals and food production, is expected to maintain upward pressure on the market. Overall, the growing need for more effective, eco-friendly filtration solutions is pushing the demand for 13X molecular sieve activated powders across various sectors.

Opportunities in the 13X molecular sieve activated powder market are being propelled by its potential in renewable energy applications and the growth of industrial sectors in emerging economies. The powder is being increasingly adopted for gas separation and purification in hydrogen production, carbon capture systems, and other renewable energy projects. In opinion, as governments push for cleaner energy solutions and focus on reducing greenhouse gas emissions, the need for high-efficiency filtration solutions will continue to rise. Furthermore, expanding industrialization in regions like Asia-Pacific has led to higher demand for filtration solutions in petrochemical processing, automotive manufacturing, and air conditioning systems. Industrial sectors are looking to maximize operational efficiency and meet stricter environmental standards, creating more opportunities for molecular sieve suppliers. As a result, market players are focusing on enhancing product customization, scalability, and application-specific innovations to cater to these growing needs. Overall, these opportunities are shaping the market, with key industries aligning their operations with environmental and efficiency goals.

The 13X molecular sieve activated powder market is positioned for growth, fueled by industrial expansion, advanced coatings, and solvent dehydration. By 2035, these pathways together unlock USD 0.45–0.55 billion in incremental revenue opportunities, expanding the market from USD 761.1 million (2025) to USD 1,251.6 million (2035) at a 5.1% CAGR.

Pathway A – Paints & Coatings Stability. 13X spherical molecular sieve powders improve moisture control and pigment stability in paints & coatings. The largest near-term pool worth USD 0.15–0.2 billion.

Pathway B – Adhesives & Sealants. Bar-type 13X powders enhance shelf life and bond performance in adhesives, sealants, and additives. Expected pool: USD 0.1–0.15 billion.

Pathway C – Pigment & Solvent Dehydration. 13X sieves are ideal for dehydration of solvents and pigments, ensuring purity in chemical and specialty applications. Incremental pool: USD 0.08–0.12 billion.

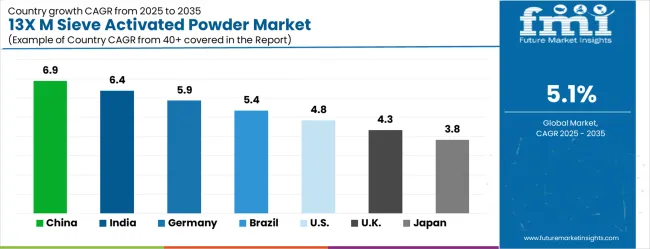

Pathway D – Regional Industrial Expansion. High growth in China (6.9% CAGR) and India (6.4% CAGR) drives demand, with Germany and Brazil contributing from chemical manufacturing. Pool: USD 0.07–0.1 billion.

Pathway E – Advanced Regenerative Systems. 13X molecular sieves support multiple regeneration cycles and fit circular chemistry systems, unlocking USD 0.05–0.08 billion.

Pathway F – Specialty Certified Grades. Certified, high-purity powders for paints, coatings, and electronics open premium pricing niches in EU/US markets. Smaller but impactful pool: USD 0.03–0.05 billion.

| Country | CAGR (2025-2035) |

|---|---|

| China | 6.9% |

| India | 6.4% |

| Germany | 5.9% |

| Brazil | 5.4% |

| United States | 4.8% |

| United Kingdom | 4.3% |

| Japan | 3.8% |

The global 13X molecular sieve activated powder market is projected to grow steadily from 2025 to 2035, with diverse growth rates across various countries. China leads with a CAGR of 6.9%, followed by India at 6.4%, and Germany at 5.9%. Brazil records a growth rate of 5.4%, while the United States shows a CAGR of 4.8%. The United Kingdom follows with 4.3%, and Japan shows the slowest growth at 3.8%. Market expansion is driven by increasing demand for molecular sieves in industrial applications, particularly in gas separation, drying, and catalytic processes. Emerging markets like China and India experience higher growth due to rapid industrialization and infrastructure development, while developed nations focus on improving product efficiency and diversifying applications in various industries. The report covers an in-depth analysis of 40+ countries; the top-performing countries are highlighted below.

The 13X molecular sieve activated powder market in China is growing at a CAGR of 6.9%, supported by the country’s fast-growing industrial sector and increasing demand for advanced separation and drying technologies. China’s manufacturing and petrochemical industries are major consumers of 13X molecular sieves, driving market growth. The country's expanding chemical processing sector, as well as its rising demand for clean energy solutions, further contributes to the market’s expansion. Additionally, China’s emphasis on sustainable industrial practices and the increasing adoption of advanced technologies in manufacturing processes continue to drive the demand for molecular sieve activated powders.

The 13X molecular sieve activated powder market in India is projected to grow at a CAGR of 6.4%, driven by the country’s expanding industrial base and the rising need for efficient separation technologies in chemical and petrochemical applications. India’s growing chemical processing and oil refining sectors are major contributors to the demand for molecular sieve activated powders. Furthermore, the country’s increasing focus on industrial automation and sustainable manufacturing processes further supports the adoption of advanced molecular sieve technologies. With growing investments in infrastructure and technology, the market for 13X molecular sieve activated powder continues to expand rapidly.

The 13X molecular sieve activated powder market in Germany is growing at a CAGR of 5.9%, driven by the country’s strong industrial base and increasing demand for molecular sieves in gas separation, drying, and catalytic processes. Germany’s automotive, chemical, and manufacturing sectors are the primary drivers of market growth, with an increasing focus on optimizing production processes and improving energy efficiency. The market is further supported by the country’s push for cleaner energy solutions and the integration of advanced technologies in manufacturing. Germany's industrial efficiency drive and regulatory frameworks ensure that the demand for molecular sieve activated powders continues to rise.

The 13X molecular sieve activated powder market in Brazil is projected to grow at a CAGR of 5.4%, driven by the growing industrialization in the country and the increasing demand for advanced separation and filtration technologies. Brazil’s petrochemical and mining industries are major consumers of molecular sieve activated powders, particularly in applications involving gas separation, dehydration, and purification. The country’s focus on developing its industrial infrastructure and expanding its chemical processing capacity is further accelerating the adoption of 13X molecular sieve activated powders in various industrial sectors.

The 13X molecular sieve activated powder market in the United States is expanding at a CAGR of 4.3%, driven by growing demand in chemical processing, oil refining, and natural gas industries. USA manufacturers are increasingly adopting molecular sieve activated powders for gas separation, dehydration, and air drying applications. The demand for energy-efficient and sustainable industrial solutions is further contributing to market growth. Additionally, technological advancements in molecular sieve manufacturing processes and the USA commitment to expanding its chemical processing capabilities drive the adoption of these advanced separation technologies.

The 13X molecular sieve activated powder market in the United Kingdom is growing at a CAGR of 4.3%, supported by demand in chemical processing, oil refining, and gas separation applications. The UK industrial sector is increasingly adopting advanced separation technologies to optimize manufacturing processes, improve product purity, and enhance operational efficiency. The demand for molecular sieve activated powders is also fueled by the country’s efforts to promote sustainable energy practices and improve industrial waste management. As the UK continues to invest in advanced manufacturing technologies, the market for molecular sieves is set to grow steadily.

The 13X molecular sieve activated powder market in Japan is growing at a CAGR of 3.8%, driven by the country’s advanced chemical processing, automotive, and energy sectors. Japan's industrial sector is increasingly adopting molecular sieve activated powders for applications such as gas purification, dehydration, and drying in manufacturing processes. The demand for high-performance molecular sieves is also supported by Japan's focus on sustainable energy solutions, improved energy efficiency, and environmental regulations. Though the growth rate is slower than in emerging markets, Japan’s technological advancements and commitment to innovation continue to drive steady demand for molecular sieve solutions.

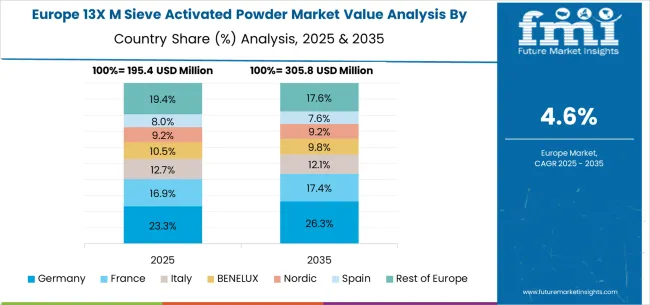

The 13X molecular sieve activated powder market in Europe is projected to grow from USD 195.4 million in 2025 to USD 305.8 million by 2035, registering a CAGR of 4.6% over the forecast period. Germany is expected to maintain its leadership, with its share rising from 23.3% in 2025 to 26.3% by 2035, supported by its strong chemical manufacturing base and advanced R&D infrastructure.

France is projected to remain the second-largest market, holding 16.9% share in 2025 and slightly increasing to 17.4% by 2035, driven by demand from the aerospace and automotive sectors. Italy is expected to contribute 12.7% in 2025, which will grow to 12.1% by 2035, reflecting its continued role in ceramics, construction, and industrial applications.

The BENELUX region is forecast to account for 10.5% in 2025, rising to 9.8% by 2035, underpinned by specialty chemical production and strong logistics infrastructure. The Nordic countries will see their share move from 9.2% in 2025 to 9.2% in 2035, supported by sustainable manufacturing practices and environmental regulations.

Spain is projected to hold 8.0% in 2025, slightly declining to 7.6% by 2035, reflecting moderate growth in construction and infrastructure projects. Meanwhile, the Rest of Europe will account for 19.4% in 2025, easing to 17.6% by 2035, indicating gradual consolidation across Eastern and Southern European chemical markets.

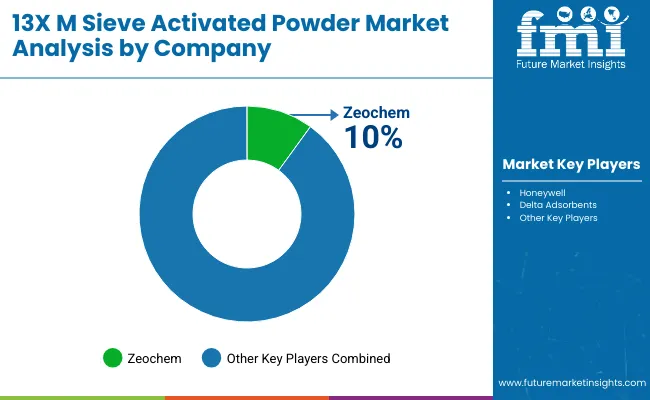

The 13X molecular sieve activated powder market is defined by competition among specialty chemical manufacturers, molecular sieve technology companies, and industrial drying solution providers. Companies are investing in advanced synthesis technologies, specialized application expertise, comprehensive technical support, and global distribution capabilities to deliver high-performance, reliable, and cost-effective molecular sieve solutions. Strategic partnerships, technological innovation, and geographic expansion are central to strengthening product portfolios and market presence.

Zeochem offers advanced 13X molecular sieve products with focus on superior adsorption performance and application-specific formulations for industrial moisture control. Honeywell provides comprehensive molecular sieve solutions with emphasis on process optimization and technical support for diverse applications. Delta Adsorbents focuses on customized molecular sieve formulations with specialized expertise in coating and adhesive applications. CECA delivers high-quality adsorbent technologies with comprehensive global distribution and technical service capabilities.

Jalon Micro-nano New Materials specializes in advanced particle engineering and surface modification technologies that enhance molecular sieve performance. Chinese manufacturers including Xueshan, Guan Shanghai Hengye, Microcrystalline Materials Siyi, Dalian Haixin Chemical Industrial, Shanghai BOJ Molecular Sieve, and Dalian Chuangge provide cost-effective solutions with regional expertise and manufacturing capabilities, supporting diverse industrial applications across emerging markets.

| Items | Values |

|---|---|

| Quantitative Units (2025) | USD 761.1 million |

| Type | Spherical type, bar type, and others |

| Application | Paints and coatings, adhesives, sealants and additives, dehydration of pigments and solvents, and others |

| Regions Covered | North America, Europe, East Asia, South Asia & Pacific, Latin America, Middle East & Africa |

| Country Covered | United States, Canada, United Kingdom, Germany, France, China, Japan, South Korea, India, Brazil, Australia and 40+ countries |

| Key Companies Profiled | Zeochem, Honeywell, Delta Adsorbents, CECA, Jalon Micro-nano New Materials, Xueshan, Guan Shanghai Hengye, Microcrystalline Materials Siyi, Dalian Haixin Chemical Industrial, Shanghai BOJ Molecular Sieve, Dalian Chuangge |

| Additional Attributes | Dollar sales by type and application sectors, regional demand trends across North America, Europe, and Asia-Pacific, competitive landscape with established specialty chemical manufacturers and molecular sieve technology providers, performance comparisons across different molecular sieve formulations, integration with advanced manufacturing and quality control systems, innovations in particle engineering and surface modification technologies, and adoption of customized solutions with enhanced adsorption capacity and compatibility for specialized industrial applications. |

The global 13X molecular sieve activated powder market is estimated to be valued at USD 761.1 million in 2025.

The market size for the 13X molecular sieve activated powder market is projected to reach USD 1,251.6 million by 2035.

The 13X molecular sieve activated powder market is expected to grow at a 5.1% CAGR between 2025 and 2035.

The key product types in 13X molecular sieve activated powder market are spherical type and bar type.

In terms of application, adhesives, sealants and additives segment to command 38.8% share in the 13X molecular sieve activated powder market in 2025.

Full Research Suite comprises of:

Market outlook & trends analysis

Interviews & case studies

Strategic recommendations

Vendor profiles & capabilities analysis

5-year forecasts

8 regions and 60+ country-level data splits

Market segment data splits

12 months of continuous data updates

DELIVERED AS:

PDF EXCEL ONLINE

Molecular Diagnostic Market Size and Share Forecast Outlook 2025 to 2035

Molecular Respiratory Panels Market Size and Share Forecast Outlook 2025 to 2035

Molecular Diagnostics In Pharmacogenomics Market Size and Share Forecast Outlook 2025 to 2035

Molecular Biomarkers For Cancer Detection Market Size and Share Forecast Outlook 2025 to 2035

Molecular Cytogenetics Market Size and Share Forecast Outlook 2025 to 2035

Molecular Biology Enzymes, Kits & Reagents Market Trends and Forecast 2025 to 2035

Molecular Spectroscopy Market Insights - Growth & Forecast 2025 to 2035

Molecular Breast Imaging Market – Trends & Forecast 2025 to 2035

Molecular Quality Controls Market Overview - Trends & Forecast 2025 to 2035

Molecular Imaging Market is segmented by modality type, application and end user from 2025 to 2035

Molecular Microbiology Market

Low Molecular Weight Chondroitin Sulfate Sodium Market Size and Share Forecast Outlook 2025 to 2035

High Molecular Ammonium Polyphosphate Market Size and Share Forecast Outlook 2025 to 2035

Orthomolecular Medicine Market

Viral Molecular Diagnostics Market Size and Share Forecast Outlook 2025 to 2035

At-home Molecular Testing Market Size and Share Forecast Outlook 2025 to 2035

Airborne Molecular Contamination Control Services Market Forecast and Outlook 2025 to 2035

Automated Molecular Diagnostics Testing System Market Size and Share Forecast Outlook 2025 to 2035

Multiplex Molecular Diagnostics Market Size and Share Forecast Outlook 2025 to 2035

Veterinary Molecular Diagnostics Market Growth - Trends & Forecast 2025 to 2035

Thank you!

You will receive an email from our Business Development Manager. Please be sure to check your SPAM/JUNK folder too.

Chat With

MaRIA