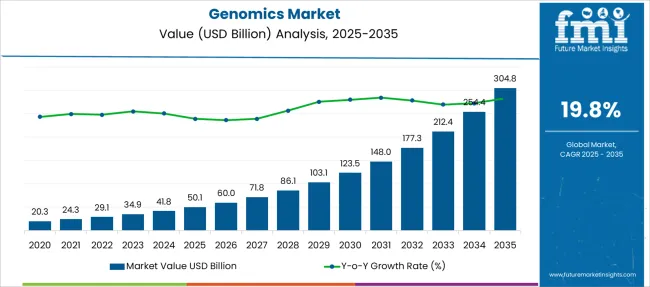

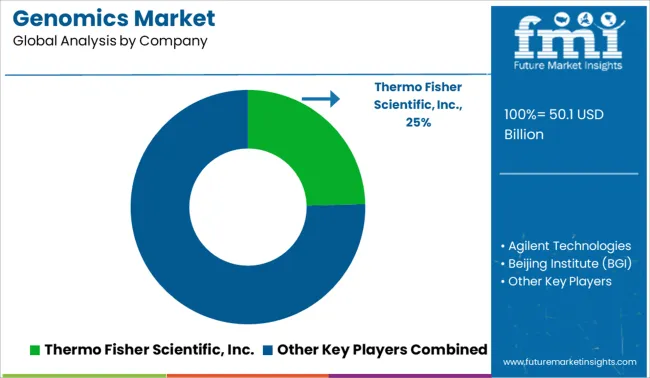

The Genomics Market is estimated to be valued at USD 50.1 billion in 2025 and is projected to reach USD 304.8 billion by 2035, registering a compound annual growth rate (CAGR) of 19.8% over the forecast period.

| Metric | Value |

|---|---|

| Genomics Market Estimated Value in (2025 E) | USD 50.1 billion |

| Genomics Market Forecast Value in (2035 F) | USD 304.8 billion |

| Forecast CAGR (2025 to 2035) | 19.8% |

The genomics market is advancing steadily due to the expanding application of genetic analysis in personalized medicine, targeted drug development, and disease prevention strategies. Increasing affordability of sequencing technologies and improved data interpretation capabilities have led to wider adoption across clinical, research, and pharmaceutical domains.

Public and private sector funding has accelerated innovations in sequencing platforms, bioinformatics tools, and gene editing technologies. Moreover, collaborations between academic institutions and pharmaceutical companies are promoting translational research that integrates genomics into therapeutic development.

As the role of genomics in diagnostics, oncology, rare disease identification, and agricultural biotechnology continues to grow, the market outlook remains strong. The rising focus on precision health and digital biology further ensures the genomics market remains a cornerstone of future healthcare and life sciences innovation.

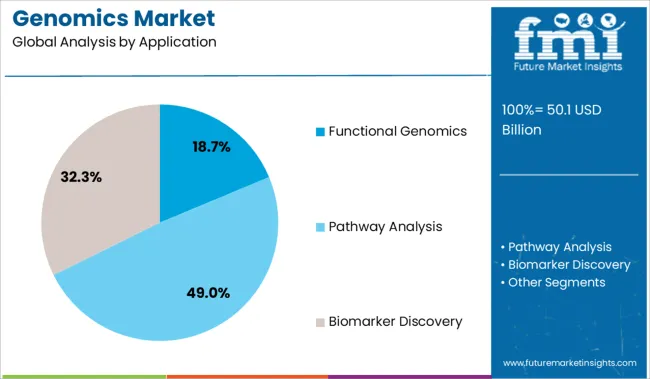

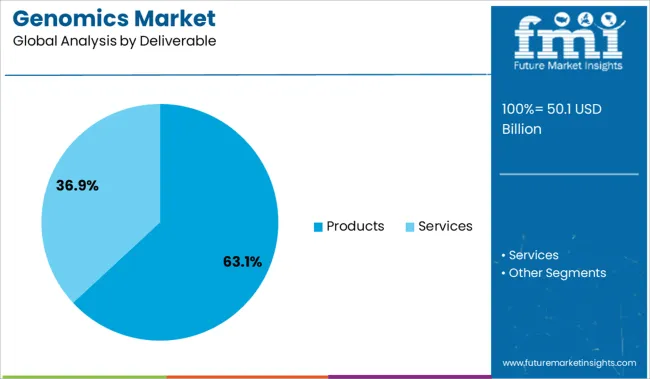

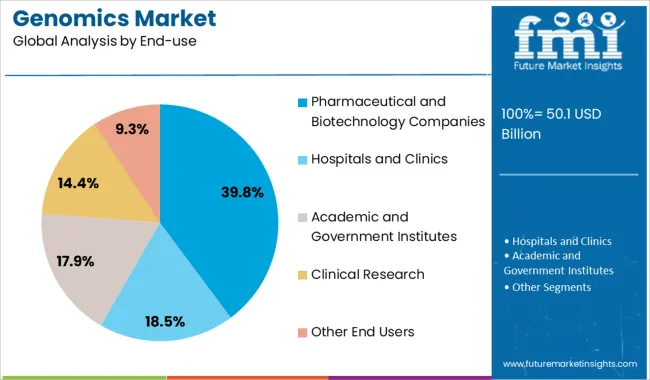

The market is segmented by Application, Deliverable, and End-use and region. By Application, the market is divided into Functional Genomics, Pathway Analysis, Biomarker Discovery, Epigenetics, and Other Applications & Technologies. In terms of Deliverable, the market is classified into Products and Services. Based on End-use, the market is segmented into Pharmaceutical and Biotechnology Companies, Hospitals and Clinics, Academic and Government Institutes, Clinical Research, and Other End Users. Regionally, the market is classified into North America, Latin America, Western Europe, Eastern Europe, Balkan & Baltic Countries, Russia & Belarus, Central Asia, East Asia, South Asia & Pacific, and the Middle East & Africa.

The functional genomics segment is projected to account for 18.70% of the total market revenue by 2025, making it a leading application area. This share is attributed to the increasing need to understand gene expression, interactions, and regulation mechanisms in order to drive advancements in drug discovery and disease modeling.

Functional genomics enables researchers to identify therapeutic targets and biomarkers, helping to streamline early stage development pipelines. The adoption of CRISPR based tools, transcriptomics platforms, and high throughput screening has further boosted interest in this segment.

As the demand for precision medicine and molecular diagnostics rises, functional genomics continues to play a critical role in decoding gene function and its clinical relevance.

The products segment is expected to dominate with a 63.10% share of the market under the deliverable category by 2025. This dominance stems from the continuous demand for consumables, kits, reagents, and instruments that enable genomic workflows across laboratories and clinical settings.

The recurring nature of product usage and the need for specialized tools in sequencing, PCR, sample preparation, and data analysis support sustained revenue generation. Furthermore, the commercialization of novel genomic tools and platform upgrades has kept the product segment at the forefront of market growth.

The reliability, scalability, and innovation embedded in product offerings make them integral to the operational success of genomic applications across end users.

The pharmaceutical and biotechnology companies segment is anticipated to lead the market with a 39.80% revenue share by 2025. This position is driven by the growing integration of genomics in drug discovery, biomarker identification, and clinical trial optimization.

Companies are investing in genomics to enhance R and D efficiency, develop personalized therapies, and improve target validation. The increasing adoption of companion diagnostics and pharmacogenomics is reinforcing the role of genomic technologies in commercial drug development.

Additionally, strategic alliances with genomics service providers and academic researchers have expanded access to cutting edge tools and datasets. As innovation pipelines become more genomically informed, this segment remains at the forefront of end user demand in the genomics market.

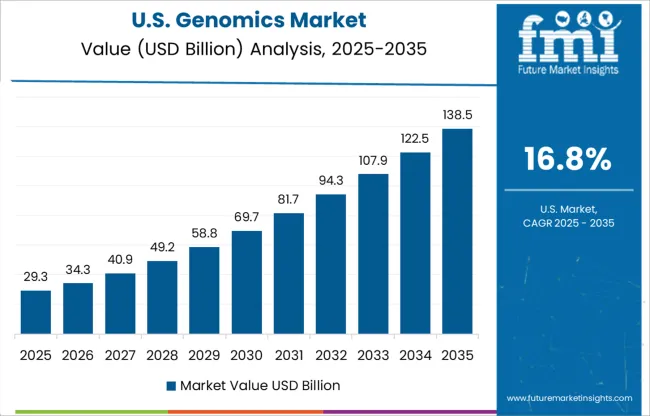

As per the Genomics industry research by Future Market Insights - a market research and competitive intelligence provider, historically, from 2020 to 2024, the market value of the Genomics industry increased at around 16% CAGR, wherein, countries such as the USA, United Kingdom, China, South Korea, and Japan held a significant share in the global market. Owing to this, the Genomics market is projected to grow at a CAGR of 19.8% over the coming 10 years.

Scientists have researched genetic vulnerability and intensity to coronavirus disease 2 by using scientific studies and exploiting existing databases of genetic information. Genome-wide association studies (GWAS) using genomic modeling and multi-omic approaches have revealed different biological networks and social influences on diseases.

Similarly, genomic data such as polygenic risk scores (PRS), ABO blood groups, and HLA haplotypes may be used to discover comorbidities, resistance, and susceptibility to suspected COVID-19 patients. Biobanks that connect electronic health records (EHRs) to genetic data can be utilized to research the association between genomic factors of suspected SARS-CoV-2 patients' health histories.

The COVID-19 Host Genetics Initiative, led by researchers at FIMM, aims to encourage the human genetics community to the analysis of, share, and collect data in order to promote research into elements that explain the severity of COVID-19, the susceptibility of a person to the infection, and its possible outcomes. DeCODE genetics, an Icelandic genomics solutions provider, used SARS-CoV-2 genome analysis to track the virus's propagation.

In addition, the business has also teamed up with the Icelandic government to sequence the genomes of viral hosts. Similarly, the Greek government supported the COVID-19-GR program, which genotyped 3,500 COVID-19 patients, performed WGS on the SARS-CoV-2 genome received from these patients, and performed immunogenomic analysis. The whole collection of these data, as well as extensive clinical information, is available from the Greek COVID-19 registry.

In the foreseeable future, prenatal genetic screening techniques are likely to grow rapidly. Because these programs assist pregnant mothers in spotting genetic problems in their infants, this is the case. Within the next ten years, every newborn's genome is projected to be sequenced and preserved in an electronic medical record.

Emerging firms such as Counsyl and Natera to maintain their competitive advantage in the sector, measuring the future market possibilities of genomics in the newborn screening program, have released several genetic tests.

Research projects in the region involving the use of genomic technology and genomic sequencing are increasing, and the idea is that the growth of one of these initiatives will continue at 20% in the subsequent years. One noteworthy research study is represented by the GenomeAsia 100K Project, which uses whole-genome sequencing (WGS) to facilitate discoveries regarding Asians.

The method was tested throughout the region. Furthermore, by expanding the number of approvals, helpful regulatory authorities contribute to market growth. The National Cancer Center (NCC) of Japan, in collaboration with Foundation Medicine and Chugai Pharmaceutical, Ltd., announced in February 2024 that FoundationOneLiquid would be used in the third stage of Japan's cancer genomic screening consortium. The market for genomic testing services in Japan grew as a result of this.

The USA dominated the global market with a share of over 30% in 2024, due to an increase in the number of research programs, numerous strategic alliances, and a higher share of FDA approvals by the USA FDA. In this market, reimbursement and usage policy decisions may increase the adoption of genetic tests.

In January 2024, Color Genomics, Inc., in collaboration with NorthShore University Health System, implemented clinical genomics into routine care under the United States health program. Furthermore, the company also aided Sanford in its genomics initiative, Imagenetics, to enhance medical decision-making.

The market in the United Kingdom is expected to account for USD 304.8 Billion by 2035. From 2025 to 2035, the market in the country is expected to grow at a CAGR of 20.4% to gross an absolute dollar opportunity of USD 6.3 Billion.

In Japan, the market is projected to reach a valuation of around USD 6 Billion by 2035. The market is expected to score an absolute dollar opportunity of around USD 50.1 Billion, growing at a CAGR of 19.3% from 2025 to 2035.

The market in South Korea is expected to reach a valuation of USD 2.6 Billion by 2035. Growing at a CAGR of 16.2, the market is expected to register an absolute dollar opportunity of USD 2 Billion.

Functional genomics, with a revenue share of 32% in 2024, held the highest revenue share. Real-time PCR was the most profitable method in functional genomics. Real-time quantitative PCR has assisted the absolute quantification of genetic components in genomic DNA.

This method was utilized to see if tissue genomic DNA could be used as a global external reference for speeding up the measurement of any target sequence in different species' genomes.

This approach, when combined with reverse transcription PCR, allows researchers to measure low-abundance mRNA, allowing them to calculate relative gene expression at a specific time.

When it comes to detecting minor changes in gene expression, this technique has been shown to be more sensitive than array technology. As a result, its acceptance rate is steadily increasing. In high-throughput research, however, it requires additional input and is found to be less adaptive.

The products category led the market in 2024 owing to the continual launches of nucleic acid extraction reagents and kits by prominent manufacturers. In May 2024, Omega Bio-tek, Inc. introduced the Mag-Bind Viral RNA Xpress Kit. Its kit for isolating viral RNA rapidly and accurately in nasopharyngeal swabs was certified for use in June 2024.

The release of a new purification kit allows an increase in the range of degradation kits used for COVID-19 testing. Similarly, the PHASE Scientific network launched in April 2024 the PHASIFY VIRAL RNA Extraction Kit, which is used to assist in the diagnosis of and pre-emptive control of coronavirus.

This kit helps to purify and concentrate viral nucleic acid found in Patient-Derived Viral Transposon Media (VTM) samples. Similarly, Tent the lack of Omnia Verum was publicized in anticipation of the release of a new kit to simplify the extraction of viral RNA for purposes of helping with the hunt for the coronavirus in October 2024.

Pharmaceutical and biotechnology firms accounted for more than 60% of the market in 2024. Because of the growing number of genetic research investigations, genomic technologies are in high demand among pharmaceutical and biotechnology corporations. Because genomics is important in drug research and development, multiple companies are using genomic approaches to make the process easier and more efficient.

Over the last few years, companies have begun to offer direct-to-consumer genomic tests, resulting in a shift in business methods. Personal genomics companies generate genomic data that pharmaceutical companies are interested in.

Owing to the accessible data analysis and the availability of cheaper data gathering, several new companies joined the genomics market to meet the growing demand. Furthermore, the need for enhanced gene-editing tools in the market is increasing among biotechnology companies.

Biotechnology businesses are forging strategic alliances or licensing agreements to acquire access to this technology. In October 2024, Merck licensed CRISPR technology to Takara Bio USA, Inc. and PanCELLa, Canada. These licenses are intended to boost drug discovery and, as a result, speed up the development of novel treatments.

Key players in the genomics market are purchasing smaller businesses in order to enhance their products in line with the latest innovations. Illumina, Inc., for example, acquired Bluebee in June 2024 to improve genetic analysis. Bluebee's cloud capabilities are projected to lower the costs of sharing, storing, and maintaining genetic data in new products.

The growing number of brands offering cutting-edge technology Genomics, continuous development of characteristics offering the best consumer experience and at prices suitable for different income groups, and a growing e-commerce sector all contribute to market growth.

The key players in the market include Thermo Fisher Scientific, Agilent Technologies, Beijing Genomics Institute, Bio-Rad Laboratories, Danaher Corporation, F. Hoffmann-La Roche Ltd., GE Healthcare, Illumina Inc., Oxford Nanopore Technologies, QIAGEN N.V., Myriad Genetics, Inc., Quest Diagnostics Incorporated, Eppendorf AG, and Eurofins Scientific.

Some of the recent developments of key Genomics providers are as follows:

Similarly, recent developments related to companies offering Genomics have been tracked by the team at Future Market Insights, which are available in the full report.

The global genomics market is estimated to be valued at USD 50.1 billion in 2025.

The market size for the genomics market is projected to reach USD 304.8 billion by 2035.

The genomics market is expected to grow at a 19.8% CAGR between 2025 and 2035.

The key product types in genomics market are functional genomics, _real-time pcr, _transfection, _snp analysis, _mutational analysis, _microarray analysis, _rna interference, pathway analysis, _microarray analysis, _bead-based analysis, _proteomics tools, _real-time pcr, _mass spectrometry, biomarker discovery, _dna sequencing, _microarray analysis, _real-time pcr, _mass spectrometry, _other biomarker discoveries, epigenetics, _bisulfite sequencing, _microarray analysis, _chromatin immunoprecipitation, _methylated dna immunoprecipitation, _other epigenetics and other applications & technologies.

In terms of deliverable, products segment to command 63.1% share in the genomics market in 2025.

Full Research Suite comprises of:

Market outlook & trends analysis

Interviews & case studies

Strategic recommendations

Vendor profiles & capabilities analysis

5-year forecasts

8 regions and 60+ country-level data splits

Market segment data splits

12 months of continuous data updates

DELIVERED AS:

PDF EXCEL ONLINE

Metagenomics Market Trends - Industry Analysis & Forecast 2025 to 2035

Nutragenomics Market Size and Share Forecast Outlook 2025 to 2035

Synthetic Genomics Market

Molecular Diagnostics In Pharmacogenomics Market Size and Share Forecast Outlook 2025 to 2035

Thank you!

You will receive an email from our Business Development Manager. Please be sure to check your SPAM/JUNK folder too.

Chat With

MaRIA