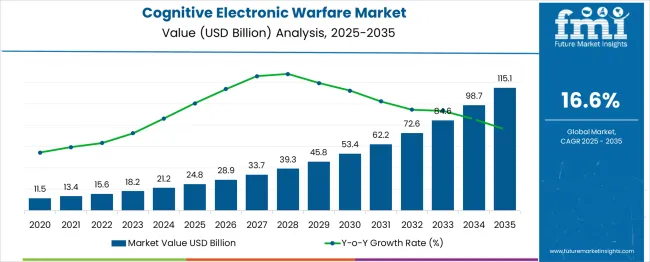

The global cognitive electronic warfare (EW) market is projected to reach USD 24.8 billion in 2025 and is anticipated to expand to USD 115.1 billion by 2035, reflecting a CAGR of 16.6% and an absolute increase of USD 90.3 billion over the forecast period. Between 2025 and 2030, the market is estimated to grow from USD 24.8 billion to USD 53.4 billion, contributing USD 28.6 billion to the total decade-long expansion, which accounts for nearly 32% of the total growth. This early five-year growth block is expected to be driven by rising defense modernization programs, increasing demand for advanced electronic countermeasure systems, and adoption of AI-enabled EW solutions for real-time threat detection and response.

| Metric | Value |

|---|---|

| Market Value (2025) | USD 24.8 billion |

| Forecast Market Value (2035) | USD 115.1 billion |

| Forecast CAGR (2025–2035) | 16.6% |

From 2030 to 2035, the market is projected to accelerate significantly, expanding from USD 45.8 billion to USD 115.1 billion, contributing USD 69.3 billion to the total decade-long growth and accounting for more than 75% of the absolute market expansion. This latter-stage growth is anticipated to be shaped by the integration of machine learning and autonomous decision-making in electronic warfare systems, enabling faster threat detection, adaptive countermeasure deployment, and network-centric battlefield operations. Defense agencies are likely to focus on upgrading legacy systems with cognitive capabilities to address increasingly complex electromagnetic environments. The market is also expected to benefit from strategic collaborations between defense contractors and AI technology providers, facilitating rapid deployment of innovative solutions.

Historical trends between 2020 and 2025 indicate steady growth, with the market rising from USD 11.5 billion to USD 24.8 billion, reflecting the growing focus on electronic warfare modernization and battlefield superiority. Early-stage adoption was supported by experimental integration of cognitive signal processing, real-time data analytics, and advanced radar and communication jamming technologies. The cognitive electronic warfare market is anticipated to maintain year-on-year growth, with increasing global defense budgets, rapid technological innovation, and the need for resilient and adaptive military capabilities serving as primary growth drivers throughout the 2025–2035 period.

Market expansion is being supported by the increasing complexity of modern warfare environments and the growing need for adaptive electronic warfare systems that can respond to evolving threats in real-time. Traditional electronic warfare systems are becoming insufficient against sophisticated adversaries who employ advanced counter-electronic warfare techniques and adaptive technologies. Cognitive electronic warfare systems offer superior capabilities including autonomous threat detection, adaptive response algorithms, and machine learning-based pattern recognition that enhance operational effectiveness.

The rising investment in military modernization programs and the growing focus on artificial intelligence integration in defense applications are driving substantial demand for cognitive electronic warfare solutions. Geopolitical tensions and emerging security threats are encouraging nations to invest in advanced electronic warfare capabilities that provide strategic advantages. The convergence of electronic warfare with cyber warfare and the need for integrated defense systems are creating opportunities for comprehensive cognitive solutions that address multiple threat vectors simultaneously.

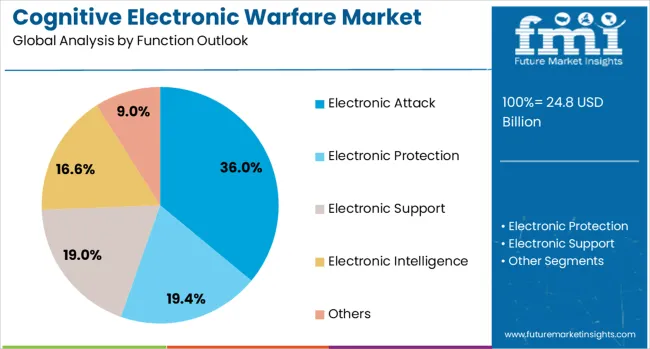

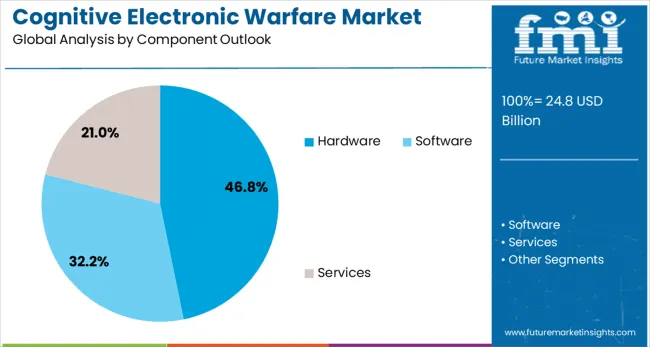

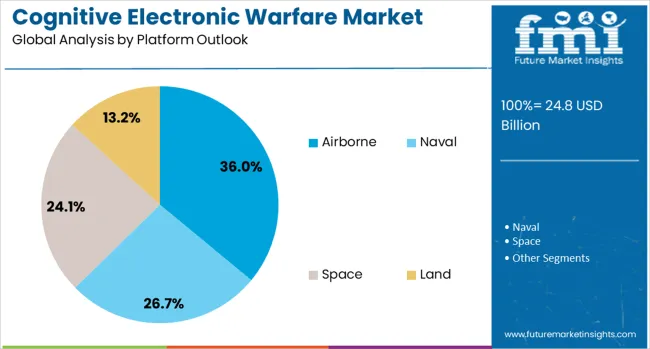

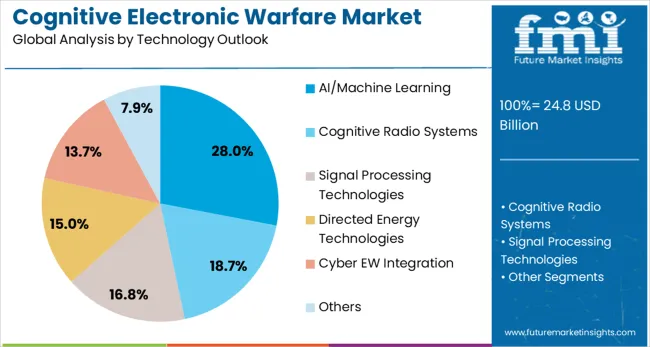

The market is segmented by function, component, platform, technology, end use, and region. By function, the market is divided into electronic attack, electronic protection, electronic support, electronic intelligence, and others. Based on component, the market is categorized into hardware, software, and services. In terms of platform, the market is segmented into airborne, naval, space, land, and others. By technology, the market is classified into AI/machine learning, cognitive radio systems, signal processing technologies, directed energy technologies, cyber EW integration, and others. By end use, the market is divided into defense and military, government intelligence agency, homeland security, commercial, and others. Regionally, the market is divided into North America, Europe, East Asia, South Asia & Pacific, Latin America, and Middle East & Africa.

Electronic attack functions are projected to account for 36% of the Cognitive Electronic Warfare market in 2025. This leading share is supported by the critical importance of offensive electronic warfare capabilities in modern military operations and the growing need for adaptive jamming and disruption technologies. Electronic attack systems utilize cognitive algorithms to identify, analyze, and neutralize enemy electronic systems with unprecedented precision and effectiveness. The segment benefits from increasing investment in offensive electronic warfare capabilities and the development of autonomous attack systems that can operate in complex electromagnetic environments.

Hardware components are expected to represent 46.8% of cognitive electronic warfare system value in 2025. This dominant share reflects the substantial investment required for advanced processing units, antenna systems, and specialized electronic warfare equipment that enable cognitive capabilities. Modern cognitive electronic warfare systems require sophisticated hardware architectures including high-performance computing platforms, advanced signal processing chips, and adaptive antenna arrays. The segment benefits from continuous technological advancement in semiconductor technologies and the development of specialized electronic warfare hardware optimized for cognitive applications.

Airborne platforms are projected to contribute 36% of the market in 2025, representing aircraft-based electronic warfare systems that provide tactical and strategic electronic warfare capabilities. Airborne cognitive electronic warfare systems offer superior mobility, coverage area, and operational flexibility compared to ground-based alternatives. These platforms typically feature advanced radar systems, communication jammers, and electronic intelligence gathering equipment enhanced with cognitive algorithms. The segment is supported by growing investment in military aviation modernization and the development of unmanned aerial vehicles equipped with cognitive electronic warfare capabilities.

AI/Machine Learning technologies are estimated to hold 28% of the market share in 2025. This significant share reflects the fundamental role of artificial intelligence in enabling cognitive electronic warfare capabilities, including adaptive threat recognition, autonomous response generation, and predictive analysis. Machine learning algorithms enable electronic warfare systems to learn from operational experience and improve performance over time while adapting to new threat patterns. The segment benefits from rapid advancement in artificial intelligence technologies and increasing integration of machine learning capabilities in defense applications.

Defense and military applications are expected to represent 41% of cognitive electronic warfare demand in 2025. This dominant share reflects the primary role of military organizations in developing and deploying advanced electronic warfare capabilities for national security applications. Military end users require sophisticated cognitive electronic warfare systems for tactical operations, strategic defense, and force protection missions. The segment benefits from increasing defense budgets, military modernization programs, and a growing focus on electronic warfare superiority in modern military doctrine.

The cognitive electronic warfare market is advancing rapidly due to increasing threat complexity and growing demand for autonomous defense capabilities. The market faces challenges including high development costs, technical complexity requirements, and stringent regulatory compliance standards. Export restrictions and technology transfer limitations continue to influence market accessibility and international collaboration patterns while driving domestic development initiatives.

The growing incorporation of quantum computing technologies is enabling cognitive electronic warfare systems to process vast amounts of electromagnetic data and perform complex analysis in real-time. Quantum-enhanced processing capabilities provide significant advantages in cryptographic applications, signal analysis, and pattern recognition that are essential for advanced electronic warfare operations. These technologies are particularly valuable for countering sophisticated adversaries who employ advanced encryption and electronic countermeasures.

Modern cognitive electronic warfare development is focusing on autonomous systems that can operate independently and coordinate with other platforms to create comprehensive electronic warfare networks. Swarm intelligence and distributed processing capabilities enable multiple platforms to work together in creating complex electronic warfare scenarios that overwhelm enemy defense. Advanced coordination algorithms and communication protocols support seamless integration between different electronic warfare platforms and mission systems.

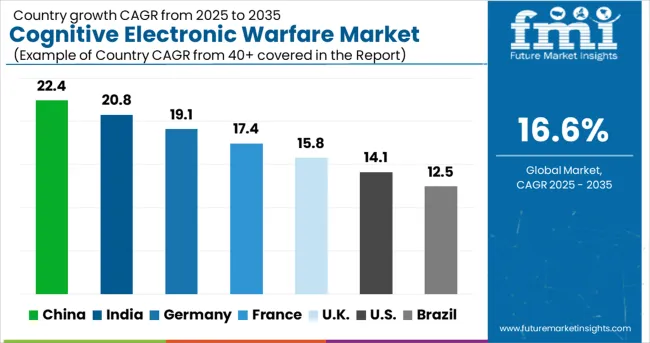

| Countries | CAGR (2025-2035) |

|---|---|

| China | 22.4% |

| India | 20.8% |

| Germany | 19.1% |

| France | 17.4% |

| UK | 15.8% |

| USA | 14.1% |

| Brazil | 12.5% |

The global cognitive electronic warfare market is projected to grow at a CAGR of 17% between 2025 and 2035. China leads this expansion with a 22.4% CAGR, driven by increasing defense modernization, adoption of AI-enabled electronic warfare systems, and rising investment in advanced military technologies. India follows at 20.8%, supported by growing defense budgets, focus on strategic electronic capabilities, and integration of cognitive technologies into defense systems. Germany shows growth at 19.1%, emphasizing technological innovation and modernization of electronic warfare platforms. France records 17.4%, fueled by adoption of AI-assisted defense solutions and collaborative military programs. The UK grows at 15.8%, focusing on advanced cognitive EW applications and defense readiness. The USA stands at 14.1%, reflecting expansion in next-generation warfare systems, while Brazil follows at 12.5%, influenced by increasing military modernization and interest in AI-enabled defense solutions. The analysis covers over 40 countries, highlighting key markets and regional consumption patterns.

The cognitive electronic warfare market in China is projected to grow at a CAGR of 22.4% from 2025 to 2035, driven by advanced military modernization programs and AI integration in defense systems. Cognitive EW technologies are increasingly deployed in electronic attack, electronic protection, and electronic support operations to enhance situational awareness, threat detection, and countermeasure capabilities. Chinese defense contractors and technology firms are developing AI-powered jamming systems, adaptive sensors, and real-time signal processing platforms. Investments in autonomous and unmanned platforms are also fueling demand, with applications in airborne, naval, and ground-based systems. Government initiatives emphasizing digital battlefield integration and cybersecurity protection accelerate market adoption. Collaboration with AI and semiconductor companies enables advanced cognitive signal processing. The expanding defense R&D ecosystem ensures continuous innovation and operational readiness for both tactical and strategic military applications.

The cognitive electronic warfare market in India is anticipated to grow at a CAGR of 20.8% from 2025 to 2035, propelled by military modernization, defense digitalization, and AI-driven EW programs. Indian armed forces are adopting cognitive EW for threat detection, spectrum monitoring, and electronic attack operations across air, land, and maritime domains. Defense R&D centers are collaborating with domestic startups and global technology providers to develop adaptive sensors, signal jammers, and real-time analytics platforms. Integration with unmanned aerial systems, advanced radar, and cybersecurity frameworks enhances operational effectiveness. Government initiatives supporting indigenous defense production and AI integration further strengthen market growth. Cognitive EW adoption is also expanding in joint-force exercises, cross-domain operations, and electronic intelligence missions, reinforcing national security preparedness.

Demand for cognitive electronic warfare systems in Germany is projected to grow at a CAGR of 19.1%, supported by advanced engineering capabilities and strategic focus on NATO interoperability requirements. German defense industry expertise in complex system integration and precision engineering is creating sophisticated cognitive electronic warfare solutions that meet stringent military specifications. The country's commitment to European defense cooperation and technology sharing is driving development of interoperable electronic warfare systems. Major defense modernization programs and capability development initiatives are incorporating cognitive technologies that enhance operational effectiveness. Professional engineering standards and quality requirements are ensuring development of reliable and effective electronic warfare systems. Germany's leadership in automotive and industrial technology is contributing to advanced cognitive electronic warfare system development through technology transfer and cross-industry collaboration.

Demand for cognitive electronic warfare systems in France is expanding at a CAGR of 17.4%, driven by strategic autonomy objectives and comprehensive advanced defense technology development programs. French focus on technological sovereignty and independent defense capabilities is creating substantial investment in cognitive electronic warfare research and development. The country's leadership in aerospace and defense technology is contributing to advanced cognitive system development that incorporates cutting-edge artificial intelligence and machine learning capabilities. Major defense programs and strategic technology initiatives are prioritizing electronic warfare capabilities that provide operational advantages and strategic deterrence. Professional military requirements and operational experience are guiding development of practical cognitive electronic warfare solutions that address real-world operational challenges. France's commitment to European defense cooperation is enabling technology sharing while maintaining strategic independence in critical defense technologies.

Demand for cognitive electronic warfare systems in the UK is projected to grow at a CAGR of 15.8%, supported by comprehensive defense innovation programs and strategic international partnership initiatives. British focus on cutting-edge defense technology and innovation is creating advanced cognitive electronic warfare capabilities that provide operational advantages. The country's strong defense industrial base and research capabilities are contributing to sophisticated cognitive system development that incorporates advanced artificial intelligence technologies. Major defense modernization programs and capability development initiatives are prioritizing electronic warfare systems that enhance operational effectiveness and strategic deterrence capabilities. Strategic partnership programs with allied nations are facilitating technology sharing and joint development of advanced cognitive electronic warfare systems. Professional military requirements and operational doctrine are guiding development of practical electronic warfare solutions that meet contemporary threat environments.

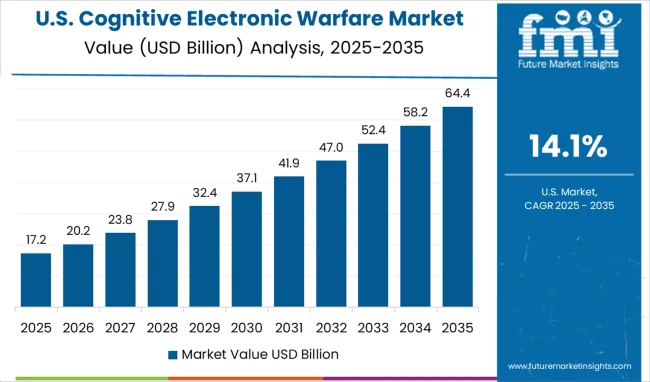

Demand for cognitive electronic warfare systems in the USA is expanding at a CAGR of 14.1%, driven by an established defense industrial base and comprehensive military modernization programs. American leadership in defense technology and substantial research and development investment are creating advanced cognitive electronic warfare capabilities that set global standards. The country's extensive military operational experience and strategic requirements are guiding development of practical cognitive electronic warfare systems that address contemporary threat environments. Major defense contractors and technology companies are developing sophisticated cognitive systems that incorporate cutting-edge artificial intelligence and machine learning capabilities. Government defense spending and procurement programs are supporting substantial investment in cognitive electronic warfare technology development and deployment. Strategic defense initiatives and technology roadmaps are prioritizing electronic warfare capabilities that provide long-term operational advantages and strategic deterrence.

The cognitive electronic warfare market in Brazil is anticipated to grow at a CAGR of 12.5% from 2025 to 2035, supported by modernization of defense forces and adoption of AI-enabled EW solutions. Brazilian armed forces are leveraging cognitive EW technologies for electronic attack, spectrum monitoring, and intelligence operations. Cloud-based and on-premise cognitive EW platforms enable scalable deployment across air, land, and maritime applications. Integration with unmanned systems, radar networks, and cyber defense enhances operational efficiency and threat response. Domestic defense firms are partnering with global technology providers to develop adaptive jamming, signal processing, and real-time analytics platforms. Government initiatives promoting indigenous defense production and AI integration support market expansion. Cognitive EW adoption is focused on enhancing national security, operational readiness, and electronic battlefield resilience.

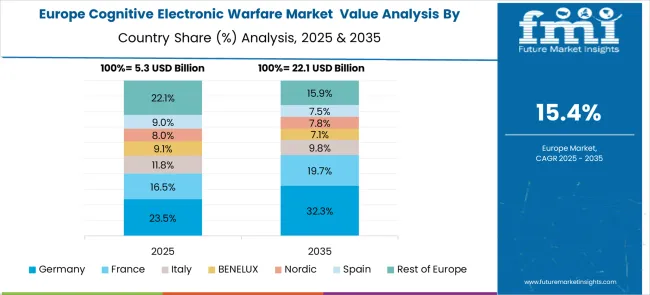

The cognitive electronic warfare market in Europe is projected to grow from USD 6.8 billion in 2025 to USD 28.5 billion by 2035, registering a CAGR of 15.4% over the forecast period. Germany is expected to maintain its leadership with a 28.1% share in 2025, supported by strong defense technology industry and advanced research capabilities. France holds 25.6% market share, followed by the UK at 23.2%, Italy at 12.4%, and Spain at 6.3%. Nordic countries contribute 2.9% to the regional market, while BENELUX accounts for 1.2%. The Rest of Europe region represents 0.3% of the market, driven by emerging defense modernization programs in Eastern European countries.

Companies are investing heavily in artificial intelligence, quantum computing integration, advanced signal processing, and autonomous system capabilities to develop cognitive EW solutions that address evolving military threats and operational requirements. Continuous innovation in adaptive electronic warfare strategies, real-time decision-making systems, and platform interoperability has become critical for maintaining technological leadership. Strategic partnerships, technology acquisitions, and research collaborations are central to gaining a competitive edge in a market that is increasingly defined by rapid technological advancement and defense modernization programs.

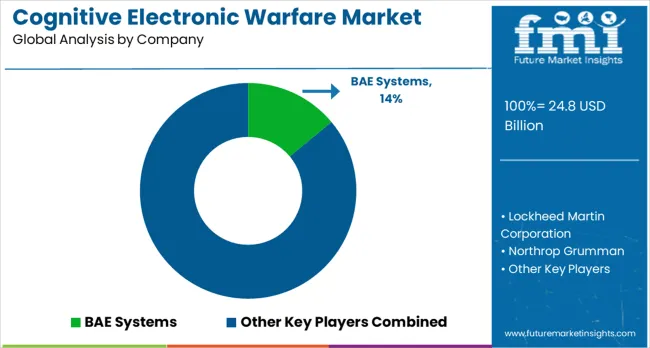

BAE Systems, headquartered in the UK, leads the market with a comprehensive portfolio of cognitive EW solutions that emphasize AI integration, autonomous operational capabilities, and interoperable system design across multiple defense platforms. Lockheed Martin Corporation, USA-based, provides advanced cognitive EW platforms focusing on integrated air defense systems, space-based applications, and next-generation threat detection. Northrop Grumman offers cutting-edge cognitive technologies with a focus on autonomous systems and advanced signal processing, while RTX delivers sophisticated electronic warfare solutions concentrating on cognitive radar systems and fully integrated defense platforms.

L3Harris Technologies Inc., USA, develops cognitive EW systems optimized for communication, signal intelligence, and operational resilience, supporting diverse mission requirements. European and international players have also strengthened market presence. Thales, France, offers advanced cognitive EW solutions aligned with European defense cooperation and strategic autonomy objectives. Leonardo S.p.A., Italy, Hensoldt AG, Germany, and Elbit Systems Ltd., Israel, provide specialized cognitive EW technologies that emphasize platform integration, operational effectiveness, and mission adaptability.

Rohde & Schwarz, Germany, contributes advanced signal processing and measurement systems critical for cognitive EW system development, testing, and deployment. The market remains highly competitive, with leadership determined by innovation, integration capability, and the ability to deliver adaptive, resilient electronic warfare solutions across diverse defense platforms.

| Items | Values |

|---|---|

| Quantitative Units | USD 24.8 billion |

| Function Outlook | Electronic Attack, Electronic Protection, Electronic Support, Electronic Intelligence, Others |

| Component Outlook | Hardware, Software, Services |

| Platform Outlook | Airborne, Naval, Space, Land, Others |

| Technology Outlook | AI/Machine Learning, Cognitive Radio Systems, Signal Processing Technologies, Directed Energy Technologies, Cyber EW Integration, Others |

| End Use Outlook | Defense & Military, Government Intelligence Agency, Homeland Security, Commercial, Others |

| Regions Covered | North America, Europe, East Asia, South Asia & Pacific, Latin America, Middle East & Africa |

| Countries Covered | United States, Germany, India, China, United Kingdom, Japan, Brazil, France |

| Key Companies Profiled | BAE Systems, Lockheed Martin Corporation, Northrop Grumman, RTX, L3Harris Technologies Inc., Thales, Leonardo S.p.A., Hensoldt AG, Elbit Systems Ltd., Rohde & Schwarz |

| Additional Attributes | Revenue analysis by function, component, platform, technology, and end use segments, regional demand patterns across major defense markets, competitive positioning with established defense contractors and technology specialists, military and intelligence agency requirements for different cognitive electronic warfare capabilities, integration with artificial intelligence and machine learning technologies, innovations in quantum computing and advanced signal processing applications, and adoption of autonomous and swarm-based electronic warfare systems for next-generation defense operations. |

The global cognitive electronic warfare market is estimated to be valued at USD 24.8 billion in 2025.

The market size for the cognitive electronic warfare market is projected to reach USD 115.1 billion by 2035.

The cognitive electronic warfare market is expected to grow at a 16.6% CAGR between 2025 and 2035.

The key product types in cognitive electronic warfare market are electronic attack, electronic protection, electronic support, electronic intelligence and others.

In terms of component outlook, hardware segment to command 46.8% share in the cognitive electronic warfare market in 2025.

Full Research Suite comprises of:

Market outlook & trends analysis

Interviews & case studies

Strategic recommendations

Vendor profiles & capabilities analysis

5-year forecasts

8 regions and 60+ country-level data splits

Market segment data splits

12 months of continuous data updates

DELIVERED AS:

PDF EXCEL ONLINE

Cognitive Supply Chain Market Forecast Outlook 2025 to 2035

Cognitive Computing Market Size and Share Forecast Outlook 2025 to 2035

Cognitive Impairment Biomarkers Market Size and Share Forecast Outlook 2025 to 2035

Cognitive Agents Market Size and Share Forecast Outlook 2025 to 2035

Cognitive Network Market Size and Share Forecast Outlook 2025 to 2035

Cognitive Analytics Market Size and Share Forecast Outlook 2025 to 2035

Cognitive Diagnostics Market Analysis & Forecast by Diagnosis, Indication, End User and Region through 2035

Cognitive health supplements market analysis by product type, form, sales channel, functionality, and by region – Growth, trends, and Forecast from 2025 to 2035

Cognitive Neuroscience Market Overview – Trends & Research Insights 2024-2034

Cognitive Assessment and Training Market Report – Trends & Growth Forecast 2024-2034

Cognitive Data Management Market

Cognitive Security Market

Cognitive Systems Spending Market Report – Growth & Forecast 2016-2026

Content Analytics Discovery And Cognitive Systems Market Size and Share Forecast Outlook 2025 to 2035

Content Analytics, Discovery, and Cognitive Software Market Analysis by Product Type, End User, and Region through 2035

Electronic Circulation Pump Market Size and Share Forecast Outlook 2025 to 2035

Electronic Lab Notebook (ELN) Market Size and Share Forecast Outlook 2025 to 2035

Electronic Control Unit in Automotive Systems Market Size and Share Forecast Outlook 2025 to 2035

Electronic Film Market Size and Share Forecast Outlook 2025 to 2035

Electronic Weighing Scale Market Size and Share Forecast Outlook 2025 to 2035

Thank you!

You will receive an email from our Business Development Manager. Please be sure to check your SPAM/JUNK folder too.

Chat With

MaRIA