The electronic film market is advancing steadily, supported by growing applications in consumer electronics, automotive displays, and industrial sensors. These films provide critical functionalities such as insulation, conductivity, and optical enhancement, aligning with ongoing miniaturization and high-performance trends in the electronics industry.

The current market landscape is shaped by continuous innovation in flexible and transparent film technologies, enabling their integration into touchscreens, photovoltaic cells, and printed circuit boards. Increasing demand for durable, lightweight materials and the rise of electric vehicles have further fueled adoption.

As industries move toward higher energy efficiency and smarter devices, the market outlook remains positive, with polymer-based and non-conductive films leading technological developments. Future growth will be driven by the expansion of flexible electronics manufacturing and increased investment in advanced material research.

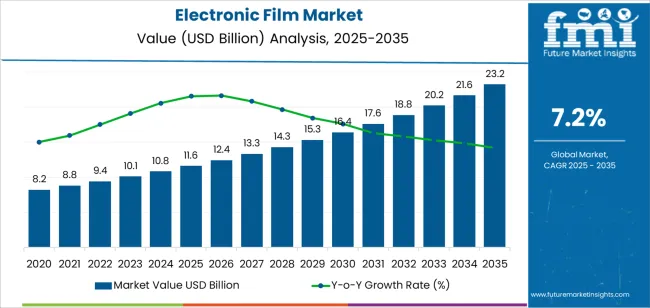

| Metric | Value |

|---|---|

| Electronic Film Market Estimated Value in (2025 E) | USD 11.6 billion |

| Electronic Film Market Forecast Value in (2035 F) | USD 23.2 billion |

| Forecast CAGR (2025 to 2035) | 7.2% |

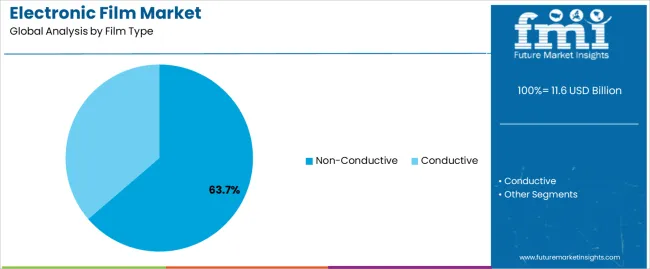

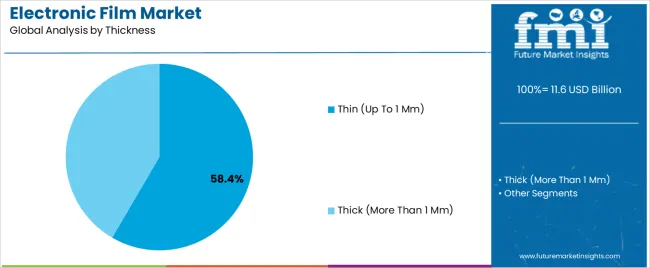

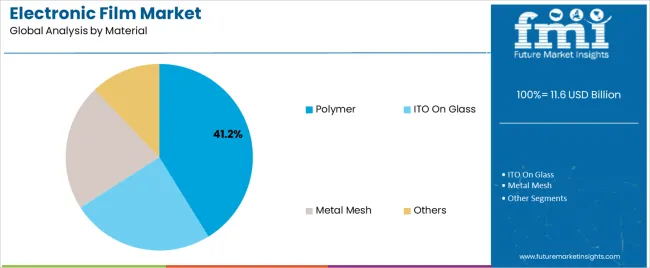

The market is segmented by Film Type, Thickness, Material, and Application and region. By Film Type, the market is divided into Non-Conductive and Conductive. In terms of Thickness, the market is classified into Thin (Up To 1 Mm) and Thick (More Than 1 Mm). Based on Material, the market is segmented into Polymer, ITO On Glass, Metal Mesh, and Others. By Application, the market is divided into Electronic Display, PCB, Wire & Cable, Smart Buildings, and Others. Regionally, the market is classified into North America, Latin America, Western Europe, Eastern Europe, Balkan & Baltic Countries, Russia & Belarus, Central Asia, East Asia, South Asia & Pacific, and the Middle East & Africa.

The non-conductive segment dominates the film type category with approximately 63.70% share, owing to its essential role in providing electrical insulation and protection within electronic assemblies. These films are extensively used in circuit boards, display modules, and cable insulation, ensuring stability and safety in high-voltage environments.

The segment benefits from the rapid expansion of consumer electronics production and the integration of multilayered devices that require advanced dielectric materials. Cost-effectiveness and compatibility with high-speed manufacturing processes have further supported its market prominence.

With the continuing proliferation of portable and smart devices, non-conductive films are expected to retain their leading share throughout the forecast period.

The thin (up to 1 mm) segment holds approximately 58.40% share in the thickness category, attributed to its flexibility, lightweight nature, and suitability for compact device architectures. Thin films enable superior optical clarity, heat dissipation, and space optimization, which are essential in smartphones, tablets, and automotive touch panels.

The segment’s growth is reinforced by the shift toward thinner, more flexible display technologies and advancements in roll-to-roll processing. Manufacturers are focusing on improved coating techniques and surface durability to meet evolving performance standards.

As demand for sleek, energy-efficient devices continues to rise, thin electronic films are expected to sustain dominant market positioning.

The polymer segment leads the material category, representing approximately 41.20% share, driven by its excellent mechanical flexibility, thermal stability, and cost efficiency. Polymer films such as PET, PI, and PEN have become standard materials for electronic insulation, displays, and photovoltaic applications.

Their adaptability to various manufacturing techniques and recyclability further enhance their market appeal. The segment also benefits from continuous innovations in conductive polymer coatings and transparent film formulations, extending their usability in emerging technologies.

With expanding consumer electronics production and growing adoption in energy storage and EV components, the polymer segment is expected to maintain its leadership over the forecast period.

| Attributes | Details |

|---|---|

| Electronic Film Market Value in 2020 | USD 7.2 billion |

| Historical Market Value for 2025 | USD 10 billion |

| CAGR from 2020 to 2025 | 8.6% |

| Attributes | Details |

|---|---|

| Top Film Type | Conductive |

| CAGR (2020 to 2025) | 8.5% |

| CAGR (2025 to 2035) | 7.1% |

| Attributes | Details |

|---|---|

| Top Thickness | Thick (More than 1 mm) |

| CAGR (2020 to 2025) | 8.3% |

| CAGR (2025 to 2035) | 7.0% |

The table below provides an in-depth analysis of the growth potential of the market in major economies such as the United States, the United Kingdom, China, Japan, and South Korea. After careful examination, it is clear that the United Kingdom stands out in this industry, offering lucrative growth opportunities.

| Countries | CAGR (2025 to 2035) |

|---|---|

| United Kingdom | 8.3% |

| South Korea | 8.2% |

| Japan | 7.9% |

| China | 7.6% |

| United States | 7.2% |

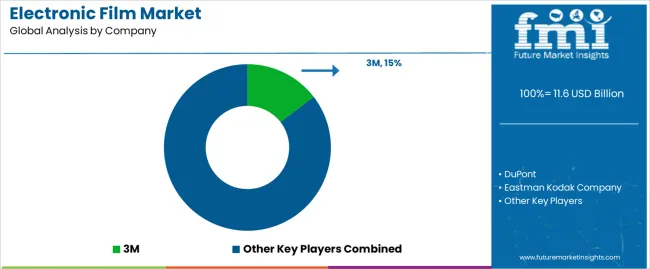

Leading manufacturers are 3M, DuPont, Eastman Kodak Company, Gunze Ltd., and Nitto Denko Co., which control the flexible substrate and electronic device film market. These electronic film providers have become industry leaders by staying at the forefront of innovation and maintaining a strong focus on quality.

3M is a global leader in performance and dependability due to its wide range of products and strong global footprint. With its knowledge of materials science, DuPont offers innovative solutions customized to match its clients' demand for functional films.

With its extensive experience in the image sector, Eastman Kodak Company uses its technological know-how to stay on the cutting edge. While Nitto Denko Co. is a leader in adhesive solutions for electronic applications, Gunze Ltd. is well-known for its expertise in touch panel technology.

By fostering innovation and expanding the realm of what is feasible in producing electronic devices, these electronic film vendors collectively influence the competitive environment of the thin film electronics market.

Latest Advancements

| Company | Details |

|---|---|

| DuPont | As of May 31, 2025, DuPont announced in June 2025 that it had successfully closed the previously disclosed sale of its Biomaterials business unit to the Huafon Group for an estimated USD 240 million. |

| DuPont | Leland Weaver, leader of DuPont's Water & Protection segment, conducted a virtual teach-in on the Shelter Solutions business line in June 2025. |

| KEMET | The three series of PP capacitor films, C44U-M, C44P-R, and R75H, were introduced in July 2024 by KEMET, a well-known supplier of electrical components. These devices were designed with high-power conversion software systems in mind to accommodate industrial, renewable energy, and power storage applications. |

| DuPont | DuPont's USD 8.2 million investment in a new manufacturing unit at the Circleville, Ohio, factory was announced in March 2020. To address the rapidly increasing market demand in consumer electronics, automotive telecom, and defense, these new assets extend the manufacturing of DuPont Kapton Polyimide Film & Pyralux flexible circuit materials. |

| SKC, Inc. | SKC, Inc. and a top electronics manufacturer collaborated to create cutting-edge plastic dielectric films for electrical applications. |

The global electronic film market is estimated to be valued at USD 11.6 billion in 2025.

The market size for the electronic film market is projected to reach USD 23.2 billion by 2035.

The electronic film market is expected to grow at a 7.2% CAGR between 2025 and 2035.

The key product types in electronic film market are non-conductive and conductive.

In terms of thickness, thin (up to 1 mm) segment to command 58.4% share in the electronic film market in 2025.

Our Research Products

The "Full Research Suite" delivers actionable market intel, deep dives on markets or technologies, so clients act faster, cut risk, and unlock growth.

The Leaderboard benchmarks and ranks top vendors, classifying them as Established Leaders, Leading Challengers, or Disruptors & Challengers.

Locates where complements amplify value and substitutes erode it, forecasting net impact by horizon

We deliver granular, decision-grade intel: market sizing, 5-year forecasts, pricing, adoption, usage, revenue, and operational KPIs—plus competitor tracking, regulation, and value chains—across 60 countries broadly.

Spot the shifts before they hit your P&L. We track inflection points, adoption curves, pricing moves, and ecosystem plays to show where demand is heading, why it is changing, and what to do next across high-growth markets and disruptive tech

Real-time reads of user behavior. We track shifting priorities, perceptions of today’s and next-gen services, and provider experience, then pace how fast tech moves from trial to adoption, blending buyer, consumer, and channel inputs with social signals (#WhySwitch, #UX).

Partner with our analyst team to build a custom report designed around your business priorities. From analysing market trends to assessing competitors or crafting bespoke datasets, we tailor insights to your needs.

Supplier Intelligence

Discovery & Profiling

Capacity & Footprint

Performance & Risk

Compliance & Governance

Commercial Readiness

Who Supplies Whom

Scorecards & Shortlists

Playbooks & Docs

Category Intelligence

Definition & Scope

Demand & Use Cases

Cost Drivers

Market Structure

Supply Chain Map

Trade & Policy

Operating Norms

Deliverables

Buyer Intelligence

Account Basics

Spend & Scope

Procurement Model

Vendor Requirements

Terms & Policies

Entry Strategy

Pain Points & Triggers

Outputs

Pricing Analysis

Benchmarks

Trends

Should-Cost

Indexation

Landed Cost

Commercial Terms

Deliverables

Brand Analysis

Positioning & Value Prop

Share & Presence

Customer Evidence

Go-to-Market

Digital & Reputation

Compliance & Trust

KPIs & Gaps

Outputs

Full Research Suite comprises of:

Market outlook & trends analysis

Interviews & case studies

Strategic recommendations

Vendor profiles & capabilities analysis

5-year forecasts

8 regions and 60+ country-level data splits

Market segment data splits

12 months of continuous data updates

DELIVERED AS:

PDF EXCEL ONLINE

Electronics Films Market Size and Share Forecast Outlook 2025 to 2035

ePTFE Electronic Film Market Size and Share Forecast Outlook 2025 to 2035

Flexible Barrier Films for Electronics Market Size and Share Forecast Outlook 2025 to 2035

Film and TV IP Peripherals Market Size and Share Forecast Outlook 2025 to 2035

Electronic Speed Controller (ESC) for Drones and UAVs Market Size and Share Forecast Outlook 2025 to 2035

Film Wrapped Wire Market Size and Share Forecast Outlook 2025 to 2035

Electronic Circulation Pump Market Size and Share Forecast Outlook 2025 to 2035

Electronic Lab Notebook (ELN) Market Size and Share Forecast Outlook 2025 to 2035

Electronic Control Unit in Automotive Systems Market Size and Share Forecast Outlook 2025 to 2035

Film-Insulated Wire Market Size and Share Forecast Outlook 2025 to 2035

Film Forming Starches Market Size and Share Forecast Outlook 2025 to 2035

Electronic Weighing Scale Market Size and Share Forecast Outlook 2025 to 2035

Electronic Packaging Adhesives Market Forecast and Outlook 2025 to 2035

Electronic Sealants Market Size and Share Forecast Outlook 2025 to 2035

Electronic Nasal Spray Devices Market Size and Share Forecast Outlook 2025 to 2035

Electronic Expansion Valves Market Size and Share Forecast Outlook 2025 to 2035

Electronics Adhesives Market Size and Share Forecast Outlook 2025 to 2035

Electronic Tactile Tester Market Size and Share Forecast Outlook 2025 to 2035

Electronic Trial Master File (eTMF) System Market Size and Share Forecast Outlook 2025 to 2035

Electronic Wipes Market Size and Share Forecast Outlook 2025 to 2035

Thank you!

You will receive an email from our Business Development Manager. Please be sure to check your SPAM/JUNK folder too.

Chat With

MaRIA