The electronic weighing scale market is experiencing sustained growth. Increasing demand from retail, industrial, and healthcare sectors is driving adoption. Current market dynamics reflect a shift toward digital precision, automation, and compliance with metrological standards.

Rising trade activities, expanding logistics networks, and stringent accuracy requirements are further contributing to market expansion. Manufacturers are emphasizing technological advancements such as smart connectivity, automated calibration, and data integration to enhance reliability and efficiency. The future outlook indicates steady growth as e-commerce, food processing, and healthcare industries continue to invest in efficient measurement systems.

Growth rationale is founded on the need for high-accuracy weighing solutions, supportive regulatory frameworks, and the availability of diversified product types for different operational environments Continuous improvements in sensor technology and design innovation are expected to strengthen market competitiveness and promote broader application across global industries.

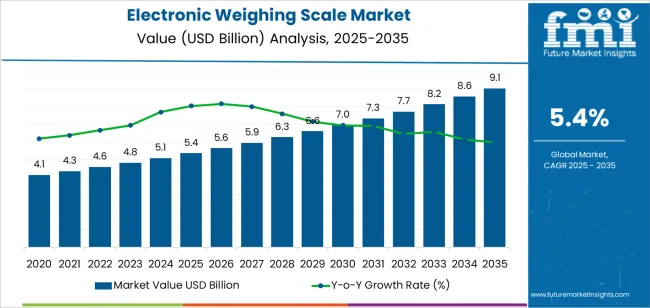

| Metric | Value |

|---|---|

| Electronic Weighing Scale Market Estimated Value in (2025 E) | USD 5.4 billion |

| Electronic Weighing Scale Market Forecast Value in (2035 F) | USD 9.1 billion |

| Forecast CAGR (2025 to 2035) | 5.4% |

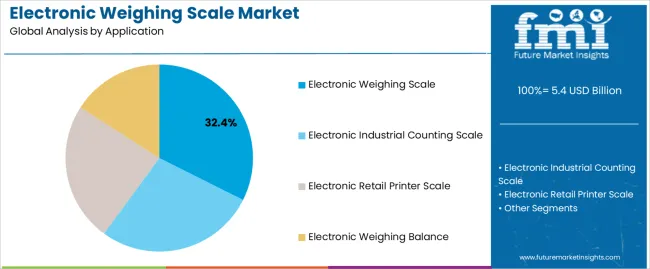

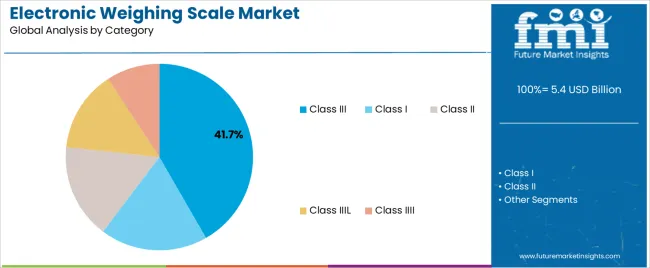

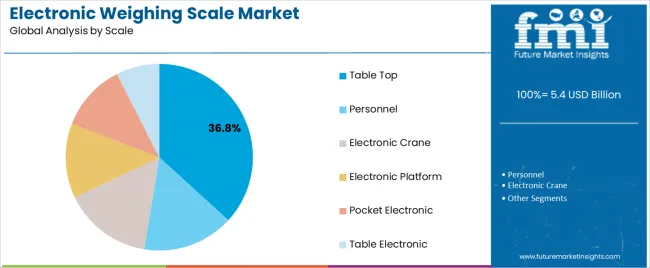

The market is segmented by Application, Category, and Scale and region. By Application, the market is divided into Electronic Weighing Scale, Electronic Industrial Counting Scale, Electronic Retail Printer Scale, and Electronic Weighing Balance. In terms of Category, the market is classified into Class III, Class I, Class II, Class IIIL, and Class IIII. Based on Scale, the market is segmented into Table Top, Personnel, Electronic Crane, Electronic Platform, Pocket Electronic, and Table Electronic. Regionally, the market is classified into North America, Latin America, Western Europe, Eastern Europe, Balkan & Baltic Countries, Russia & Belarus, Central Asia, East Asia, South Asia & Pacific, and the Middle East & Africa.

The electronic weighing scale segment, accounting for 32.40% of the application category, has remained dominant due to its versatile usage across retail, laboratory, and industrial settings. Market preference is supported by high measurement accuracy, durability, and user-friendly digital interfaces.

Adoption has been reinforced by increasing regulatory emphasis on precision weighing and traceable calibration standards. Integration with smart systems and automated data logging capabilities has improved operational efficiency and compliance.

Product innovations focused on energy efficiency and compact design have further enhanced demand This segment’s share is expected to remain stable, driven by the expansion of retail infrastructure, laboratory modernization, and growing emphasis on quality assurance across industries.

The Class III category, representing 41.70% of the category segment, has led the market due to its wide acceptance in trade and commercial transactions where legal-for-trade accuracy is required. The segment’s growth has been reinforced by regulatory compliance with national and international metrology standards.

Manufacturers have focused on providing robust designs and digital calibration systems that maintain consistent accuracy under variable environmental conditions. Adoption has been particularly strong in retail, logistics, and healthcare applications.

Ongoing technological upgrades and extended product lifecycles have reduced ownership costs, further enhancing adoption Continued modernization of trade practices and stricter measurement standards are anticipated to sustain this segment’s leading position.

The table top scale segment, holding 36.80% of the scale category, has maintained its leadership due to widespread use in retail, laboratory, and small-scale industrial operations. Its compact design, cost-effectiveness, and precision performance have supported its dominance.

Increasing demand from grocery chains, laboratories, and manufacturing units requiring quick and accurate measurements has reinforced adoption. Integration with digital display systems, rechargeable power options, and wireless data transfer has further increased utility.

Manufacturers are focusing on enhancing load capacity and durability while maintaining portability Over the forecast period, rising investments in retail automation and product verification systems are expected to drive consistent demand for table top electronic weighing scales across both developed and emerging markets.

| Leading Application | Electronic Industrial Counting Scale |

|---|---|

| Value Share (2025) | 30.20% |

The electronic industrial counting scale is predicted to have a share of 30.20% in 2025. Factors that are catalyzing the expansion of this segment include:

| Leading Scale | Electronic Platform |

|---|---|

| Value Share (2025) | 23.60% |

Based on scale, the electronic platform segment is expected to secure a share of 23.60% in the electronic weighing scale market. Top factors that are positively influencing the demand for the electronic platform are:

| Countries | Forecast CAGR (2025 to 2035) |

|---|---|

| The United States | 2.20% |

| Germany | 0.80% |

| Japan | 0.10% |

| China | 5.90% |

| Australia | 8.90% |

Investments in electronic weighing scales within the United States are predicted to record a CAGR of 2.20% over the forecast period. Key factors that are increasing the prospects for industry participants in the country include:

In Germany, the demand for electronic weighing scales is projected to rise at a CAGR of 0.80% from 2025 to 2035. Certain motivating factors backing this market dynamics are:

Sales of electronic weighing scales in Japan are projected to register a CAGR of 0.10% in the following decade. Some factors that are promising market growth are as follows:

Demand for electronic weighing scales is accelerating in China at a 5.90% CAGR from 2025 to 2035. Key factors that are impelling the growth of this regional electronic weighing scale market are:

The deployment of electronic weighing scales in Australia is observing an 8.90% CAGR, suggesting a promising future for key stakeholders and investors. The market is expected to flourish on account of:

Key players are offering an extensive variety of electronic weighing scales to capture a greater population of potential customers. For instance, companies manufacture compact scales for personal use and specialized scales for certain industries.

Industry participants are introducing new features to digital weighing scales to enhance their functionality. Some of these features include body composition analysis, Bluetooth connectivity, and integration with inventory management software.

To reduce their carbon footprint, players are using eco-friendly materials, which is also attracting the interest of environmentally conscious businesses.

Industry players are offering their products at competitive prices or with flexible payment options to draw in budget-conscious buyers. Additionally, competitors are innovating easy-to-use scales that have intuitive interfaces and enhance customer satisfaction.

Latest Instances Shaping the Electronic Weighing Scale Market

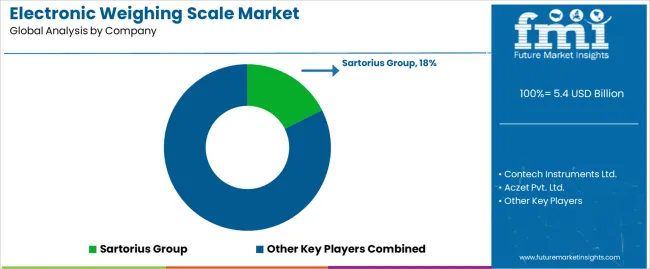

The global electronic weighing scale market is estimated to be valued at USD 5.4 billion in 2025.

The market size for the electronic weighing scale market is projected to reach USD 9.1 billion by 2035.

The electronic weighing scale market is expected to grow at a 5.4% CAGR between 2025 and 2035.

The key product types in electronic weighing scale market are electronic weighing scale, electronic industrial counting scale, electronic retail printer scale and electronic weighing balance.

In terms of category, class iii segment to command 41.7% share in the electronic weighing scale market in 2025.

Our Research Products

The "Full Research Suite" delivers actionable market intel, deep dives on markets or technologies, so clients act faster, cut risk, and unlock growth.

The Leaderboard benchmarks and ranks top vendors, classifying them as Established Leaders, Leading Challengers, or Disruptors & Challengers.

Locates where complements amplify value and substitutes erode it, forecasting net impact by horizon

We deliver granular, decision-grade intel: market sizing, 5-year forecasts, pricing, adoption, usage, revenue, and operational KPIs—plus competitor tracking, regulation, and value chains—across 60 countries broadly.

Spot the shifts before they hit your P&L. We track inflection points, adoption curves, pricing moves, and ecosystem plays to show where demand is heading, why it is changing, and what to do next across high-growth markets and disruptive tech

Real-time reads of user behavior. We track shifting priorities, perceptions of today’s and next-gen services, and provider experience, then pace how fast tech moves from trial to adoption, blending buyer, consumer, and channel inputs with social signals (#WhySwitch, #UX).

Partner with our analyst team to build a custom report designed around your business priorities. From analysing market trends to assessing competitors or crafting bespoke datasets, we tailor insights to your needs.

Supplier Intelligence

Discovery & Profiling

Capacity & Footprint

Performance & Risk

Compliance & Governance

Commercial Readiness

Who Supplies Whom

Scorecards & Shortlists

Playbooks & Docs

Category Intelligence

Definition & Scope

Demand & Use Cases

Cost Drivers

Market Structure

Supply Chain Map

Trade & Policy

Operating Norms

Deliverables

Buyer Intelligence

Account Basics

Spend & Scope

Procurement Model

Vendor Requirements

Terms & Policies

Entry Strategy

Pain Points & Triggers

Outputs

Pricing Analysis

Benchmarks

Trends

Should-Cost

Indexation

Landed Cost

Commercial Terms

Deliverables

Brand Analysis

Positioning & Value Prop

Share & Presence

Customer Evidence

Go-to-Market

Digital & Reputation

Compliance & Trust

KPIs & Gaps

Outputs

Full Research Suite comprises of:

Market outlook & trends analysis

Interviews & case studies

Strategic recommendations

Vendor profiles & capabilities analysis

5-year forecasts

8 regions and 60+ country-level data splits

Market segment data splits

12 months of continuous data updates

DELIVERED AS:

PDF EXCEL ONLINE

Electronic Speed Controller (ESC) for Drones and UAVs Market Size and Share Forecast Outlook 2025 to 2035

Electronic Circulation Pump Market Size and Share Forecast Outlook 2025 to 2035

Electronic Lab Notebook (ELN) Market Size and Share Forecast Outlook 2025 to 2035

Electronic Control Unit in Automotive Systems Market Size and Share Forecast Outlook 2025 to 2035

Electronic Film Market Size and Share Forecast Outlook 2025 to 2035

Electronic Packaging Adhesives Market Forecast and Outlook 2025 to 2035

Weighing Agents Market Size and Share Forecast Outlook 2025 to 2035

Electronic Sealants Market Size and Share Forecast Outlook 2025 to 2035

Electronic Nasal Spray Devices Market Size and Share Forecast Outlook 2025 to 2035

Electronic Expansion Valves Market Size and Share Forecast Outlook 2025 to 2035

Electronics Adhesives Market Size and Share Forecast Outlook 2025 to 2035

Electronic Tactile Tester Market Size and Share Forecast Outlook 2025 to 2035

Electronic Trial Master File (eTMF) System Market Size and Share Forecast Outlook 2025 to 2035

Electronic Wipes Market Size and Share Forecast Outlook 2025 to 2035

Electronic Grade Trisilylamine Market Size and Share Forecast Outlook 2025 to 2035

Electronically Scanned Arrays System Market Size and Share Forecast Outlook 2025 to 2035

Electronics Retailing Market Size and Share Forecast Outlook 2025 to 2035

Electronic Dictionary Market Size and Share Forecast Outlook 2025 to 2035

Electronic Shelf Label Market Analysis - Size, Share, and Forecast Outlook 2025 to 2035

Electronics Films Market Size and Share Forecast Outlook 2025 to 2035

Thank you!

You will receive an email from our Business Development Manager. Please be sure to check your SPAM/JUNK folder too.

Chat With

MaRIA