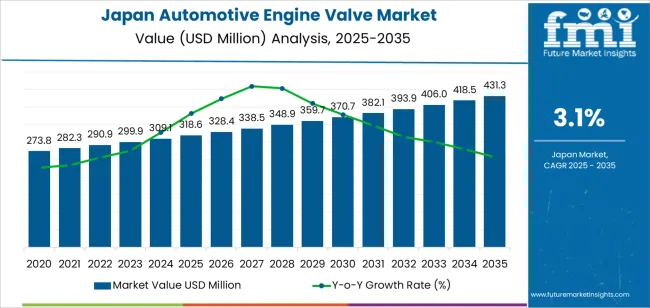

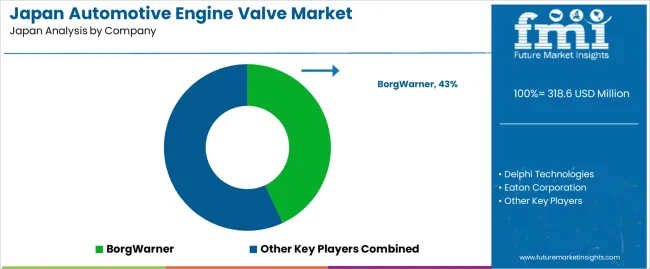

The demand for automotive engine valves in Japan is expected to grow from USD 318.6 million in 2025 to USD 431.3 million by 2035, reflecting a compound annual growth rate (CAGR) of 3.1%. Automotive engine valves play a crucial role in regulating the flow of air and exhaust gases in internal combustion engines, directly impacting vehicle performance and efficiency. As the automotive industry in Japan continues to evolve, advancements in engine technologies focused on fuel efficiency and performance will lead to an increased demand for high-quality engine valves. The growing trend toward hybrid and electric vehicles (EVs), which often require specialized components to optimize engine performance, will further contribute to the rise in demand for automotive engine valves.

Ongoing advancements in engine valve technology, such as the development of lightweight materials and designs that enhance fuel efficiency and reduce emissions, are expected to drive the industry forward. As stricter environmental regulations and emission standards continue to shape the automotive industry, automakers will increasingly adopt advanced engine components, including high-performance valves, to meet these requirements. The need for engine valves that can optimize performance while complying with evolving regulatory frameworks will be a key driver in the coming years.

Between 2025 and 2030, the demand for automotive engine valves in Japan is expected to grow steadily year-on-year, increasing from USD 273.8 million to USD 328.4 million. This steady growth will be driven by continued demand for high-performance engine components across various vehicle segments, with innovations in valve technology playing a crucial role. The automotive industry’s ongoing focus on improving fuel efficiency and reducing emissions will support this demand, as manufacturers seek to integrate advanced valve technologies to meet regulatory and consumer expectations.

From 2030 to 2035, the demand for automotive engine valves is projected to continue to rise, with YoY increases reflecting the widespread adoption of advanced engine technologies and compliance with stricter environmental regulations. The growth will be particularly driven by the transition to more fuel-efficient hybrid and electric vehicles, which require specialized engine components like optimized valves to ensure optimal performance. As automotive technologies advance and the industry faces heightened pressure to meet goals, the industry for automotive engine valves will see more significant growth in the later years of the forecast period. This growth will be accompanied by increasing demand for specialized, high-quality engine valves that can support both traditional and emerging vehicle technologies.

| Metric | Value |

|---|---|

| Demand for Automotive Engine Valve in Japan Value (2025) | USD 318.6 million |

| Demand for Automotive Engine Valve in Japan Forecast Value (2035) | USD 431.3 million |

| Demand for Automotive Engine Valve in Japan Forecast CAGR (2025 to 2035) | 3.1% |

The demand for automotive engine valves in Japan is increasing as vehicle makers focus on optimizing internal‑combustion engines for higher efficiency, lower emissions and advanced propulsion technologies. Japan’s automotive industry is shifting toward hybrid, hydrogen‑combustion and sophisticated internal‑combustion systems, which demand engine valves capable of withstanding higher pressures, temperatures and precision control. These systems call for advanced valve designs and materials, creating growth opportunities for valve manufacturers.

Japan’s regulatory environment and automotive standards play a major role. Strict emission norms and fuel‑economy targets require automakers to adopt components that enhance engine performance and durability. Engine valves are central to controlling air‑fuel intake and exhaust flow, and improvements such as variable valve timing, hollow or sodium‑filled valves, and lightweight alloys are being adopted to meet these demands. As a result, the component value and specification level for engine valves rise.

Manufacturing innovation and materials development also drive the demand. Japanese suppliers and OEMs are investing in valve technologies made from titanium, nickel alloys or other high‑performance materials, enabling lighter, stronger components suited for advanced engines. The use of coating technologies and precision machining further enhances durability and performance. As Japan’s automotive sector evolves and advanced engine technologies become more widespread, the demand for automotive engine valves in Japan is expected to grow steadily through 2035.

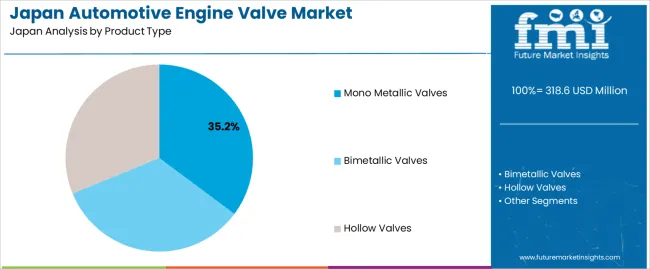

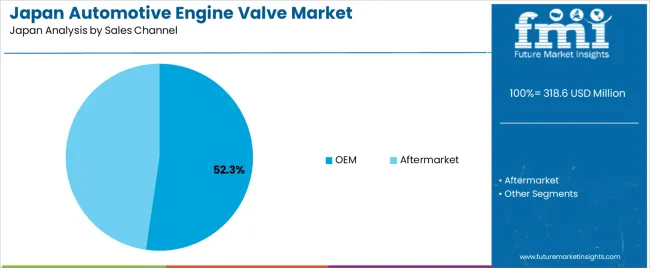

Demand for automotive engine valves in Japan is segmented by product type, sales channel, vehicle type, material type, and region. By product type, demand is divided into mono metallic valves, bimetallic valves, and hollow valves, with mono metallic valves holding the largest share at 35%. The demand is also segmented by sales channel, including OEM (original equipment manufacturer) and aftermarket, with OEM leading the demand at 52%. In terms of vehicle type, demand is divided into passenger cars and commercial vehicles. Regarding material type, demand is segmented into steel, titanium, and nickel alloy. Regionally, demand is divided into Kyushu & Okinawa, Kanto, Kinki, Chubu, Tohoku, and the Rest of Japan.

Mono metallic valves account for 35% of the demand for automotive engine valves in Japan. These valves are highly favored due to their simplicity, cost-effectiveness, and dependable performance across various engine applications. Made from a single type of metal, mono metallic valves offer good strength, heat resistance, and durability. These properties make them ideal for standard engine applications, especially in passenger vehicles.

Mono metallic valves excel at withstanding high pressures and fluctuating temperatures, ensuring optimal engine performance over time. Their affordability, combined with their ability to meet performance requirements, has made them a preferred option for many manufacturers. As the automotive industry continues to evolve and demand more reliable, durable engine components, mono metallic valves are expected to remain a key component in automotive valve production. Their consistent performance and low maintenance make them indispensable in modern automotive engineering.

OEM (original equipment manufacturer) accounts for 52% of the demand for automotive engine valves in Japan. OEM valves are supplied directly to vehicle manufacturers during the vehicle production process, ensuring that all components, including engine valves, meet the precise specifications required for new vehicles. These valves are vital to ensuring engine performance, reliability, and efficiency, which is why OEM remains the dominant sales channel for automotive engine valves. Manufacturers prefer OEM valves because they guarantee the compatibility and long-term reliability of engine components, especially in new vehicle models.

OEM valves are integral to the production of high-quality, high-performance engines that meet increasingly strict industry standards. As automotive technology advances, and the demand for efficient and energy-saving engines rises, the need for OEM-supplied valves will continue to increase. The growing shift toward performance-driven, environmentally friendly engines further solidifies OEM’s leadership in the automotive engine valve industry in Japan.

Key drivers include the stringent emission and fuel‑efficiency regulations in Japan which compel automobile manufacturers to adopt advanced valve technologies (light‑weight materials, variable timing) to improve engine performance and reduce emissions. Also the strong presence of domestic automakers producing hybrid internal‑combustion engines maintains demand for engine valves even as electrification advances. Restraints include the shift toward electric vehicles (EVs) which have fewer or no conventional engine valves, causing structural decline in traditional valve demand. Another restraint is the rising cost of high‑performance materials (titanium, nickel‑alloys) and complex manufacturing processes required for modern valves.

Why is Demand for Automotive Engine Valves Growing in Japan?

In Japan, demand for automotive engine valves is growing due to the increasing need for advanced valves in passenger cars, commercial vehicles, and hybrid powertrains. These valves are essential to meet higher engine speeds, greater thermal loads, and stricter emissions requirements imposed by regulatory bodies. The shift toward hybrid and alternative fuel internal combustion engines sustains the need for high-performance valves as automakers refine traditional combustion engines. The aftermarket replacement demand for older vehicles that still use internal combustion engines contributes to the continued growth in engine valve demand. While electric vehicles (EVs) are gaining ground, the ongoing reliance on combustion engines for hybrid vehicles keeps the need for advanced engine valves strong.

How are Technological Innovations Driving Growth of Automotive Engine Valves in Japan?

Technological innovations are fueling the growth of automotive engine valves in Japan by enhancing their performance, durability, and ability to support advanced combustion technologies. Key innovations include hollow-head valves that reduce weight without compromising strength, and the use of titanium or nickel-based alloys that improve durability under high thermal loads. The integration of variable valve timing (VVT) and cylinder deactivation systems has further increased the complexity and efficiency of modern engines, driving demand for precision-engineered valves. Specialized coatings that reduce wear and improve thermal resistance help extend the lifespan and efficiency of the valves. These technological advancements enable automakers to meet increasingly stringent emissions standards, boost engine performance, and achieve better fuel efficiency.

What are the Key Challenges Limiting Adoption of Automotive Engine Valves in Japan?

A major challenge is the shift toward battery-electric vehicles (BEVs), which do not require conventional engine valves, thus reducing long-term demand for traditional engine components. Another challenge is the high cost associated with developing advanced valve materials and designs, which requires highly specialized manufacturing processes and skilled labor. Supply chain constraints related to the procurement of specialty alloys, such as titanium and nickel, increase production costs and risks. Older engine architectures used in some commercial or industrial vehicles may not support the latest valve technologies, limiting the retrofit potential and slowing the adoption of advanced valves in those sectors.

| Region | CAGR (%) |

|---|---|

| Kyushu & Okinawa | 3.8 |

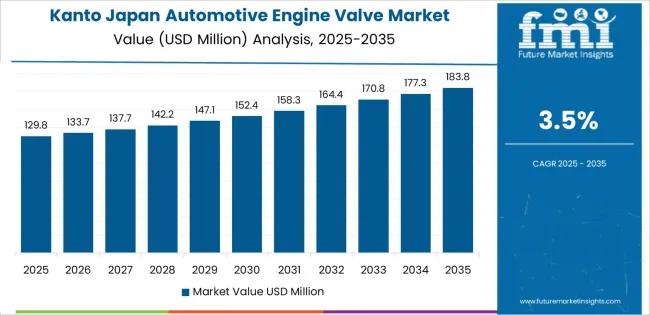

| Kanto | 3.5 |

| Kinki | 3.1 |

| Chubu | 2.7 |

| Tohoku | 2.4 |

| Rest of Japan | 2.3 |

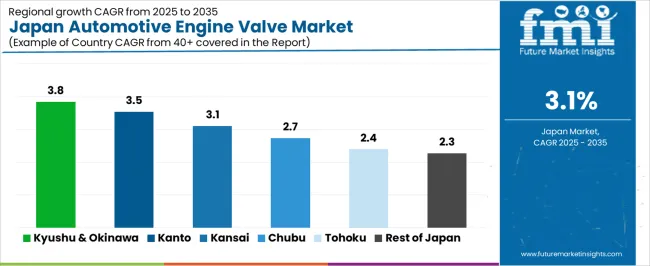

Demand for automotive engine valves in Japan is growing across all regions, with Kyushu & Okinawa leading at a 3.8% CAGR due to a strong automotive manufacturing presence. The Kanto region follows with a 3.5% CAGR, driven by automotive hubs like Tokyo and Yokohama. The Kinki region shows a 3.1% CAGR, supported by a well-established automotive industry in Osaka and Kyoto. The Chubu region has a 2.7% CAGR, bolstered by Nagoya's automotive cluster. Tohoku experiences a 2.4% CAGR, with steady demand from automotive suppliers. The Rest of Japan sees a 2.3% growth, maintaining consistent demand.

Kyushu & Okinawa are experiencing the highest demand for automotive engine valves in Japan, with a 3.8% CAGR. This growth is largely driven by Kyushu’s strong automotive manufacturing base, which is home to major vehicle production plants. The region hosts several prominent automotive manufacturers, particularly in Fukuoka and Kitakyushu, where large-scale production of both domestic and international car brands takes place. As the demand for automobiles increases globally, the need for high-performance engine components such as valves rises accordingly. Kyushu’s focus on advancing automotive technologies, including electric vehicles and fuel-efficient engines, further contributes to the growth in automotive engine valve demand.

The region’s infrastructure for automotive supply chains, which includes specialized suppliers of engine components, is another key factor driving demand. As automotive production continues to expand in Kyushu & Okinawa, the demand for automotive engine valves is expected to remain strong. This growth is further supported by continued investments in manufacturing facilities and the introduction of new automotive models in the region.

Kanto is seeing strong demand for automotive engine valves in Japan, with a 3.5% CAGR. This growth is primarily fueled by the region’s status as the heart of Japan's automotive industry, particularly in cities like Tokyo and Yokohama, which are home to major automakers and their production facilities. Kanto's central role in automotive design, innovation, and manufacturing makes it a key region for engine component demand, including valves. The region's strong automotive sector is also supported by a highly developed supplier network that manufactures various engine components, including valves, to meet the needs of both domestic and international industrys.

As Kanto continues to be a leader in automotive technology development, including the production of electric and hybrid vehicles, the demand for automotive engine valves is expected to remain robust. The shift towards more energy-efficient and environmentally friendly vehicles in the region has further increased the need for advanced engine technologies. As automotive production continues to thrive, Kanto's demand for engine valves will continue to grow steadily.

Kinki, home to major automotive centers like Osaka and Kyoto, is experiencing steady demand for automotive engine valves in Japan, with a 3.1% CAGR. This growth is driven by the region’s well-established automotive manufacturing base and its important role in Japan’s supply chain for engine components. The Kinki region is a key hub for vehicle assembly plants and automotive parts manufacturers, which include suppliers of high-quality engine components such as valves. As automotive production increases in the region, demand for engine valves is expected to rise correspondingly.

Kinki’s focus on automotive research and development, particularly in the area of fuel-efficient and electric vehicles, has further contributed to the demand for automotive engine valves. The region’s proximity to major automotive research institutions and innovation centers ensures that new vehicle technologies, including engine designs, are developed with high-performance components like valves. As Kinki’s automotive industry continues to innovate and expand, the demand for engine valves will remain a critical part of the region’s overall automotive production.

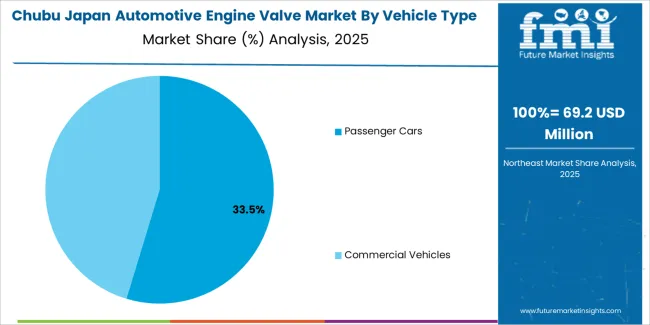

Chubu is experiencing moderate demand for automotive engine valves in Japan, with a 2.7% CAGR. The region is home to Nagoya, one of Japan’s key automotive manufacturing hubs, and is known for its concentration of large automakers and suppliers. The demand for engine valves is driven by the presence of Toyota and its extensive network of automotive component suppliers in the region. As one of the largest automotive clusters in Japan, Chubu’s strong production capacity contributes to the steady demand for automotive engine valves.

Chubu’s automotive sector continues to expand with the production of electric vehicles, hybrid models, and other innovative automotive technologies. As these vehicles require more specialized engine components, the demand for high-performance automotive engine valves remains strong. The region’s established automotive supply chain, including various suppliers of engine components, ensures that demand for valves will continue to grow. As Chubu adapts to new automotive trends and increasing vehicle production, the demand for engine valves is expected to maintain a steady, though moderate, growth trajectory.

Tohoku is experiencing steady demand for automotive engine valves in Japan, with a 2.4% CAGR. This growth is driven by the region’s role as a supplier to Japan’s automotive industry, particularly in areas like Aomori and Sendai, where several automotive component manufacturers are based. While Tohoku does not have the same level of automotive production as other regions like Kanto or Chubu, it remains an essential part of Japan’s automotive supply chain. As vehicle production continues to rise across Japan, the need for high-quality engine components, including valves, remains steady in Tohoku.

The region’s focus on developing eco-friendly automotive solutions, including hybrid and electric vehicles, has also contributed to the growth in demand for automotive engine valves. Tohoku’s manufacturers are increasingly adapting to these new technologies, which require advanced engine components to meet evolving performance standards. As demand for fuel-efficient and environmentally friendly vehicles increases in Japan, Tohoku’s automotive suppliers are expected to continue to contribute to the overall demand for engine valves, supporting steady growth in the region.

The Rest of Japan is experiencing steady but moderate demand for automotive engine valves, with a 2.3% CAGR. This growth is supported by the presence of smaller, regional automotive suppliers and manufacturers who contribute to Japan’s broader automotive industry. While the Rest of Japan does not have the same level of automotive production as major hubs like Kanto or Chubu, it plays an important role in the overall supply chain, particularly in supplying engine components, including valves, to larger manufacturers.

The region's growth is also supported by increasing demand for vehicle production and a focus on eco-friendly automotive technologies. As the automotive sector in Japan continues to expand and diversify, the Rest of Japan will see a gradual increase in demand for automotive engine valves. With automotive manufacturers across the country requiring high-quality, durable engine components, the demand for engine valves in this region is expected to continue growing, albeit at a slower pace compared to the major automotive hubs.

In Japan the demand for automotive engine valves is strongly influenced by the nation’s focus on hybrid and hydrogen‑powered vehicles, rigorous emissions standards, and the legacy manufacturing strength of domestic automakers. Valve systems are essential in internal combustion engines for controlling air intake and exhaust, and their performance impacts fuel efficiency, power output and engine durability. With Japan’s commitment to advanced powertrains, demand for high‑performance valves that tolerate extreme heat and pressure is significant.

Leading suppliers in this segment include BorgWarner (43.1 % share), Delphi Technologies, Eaton Corporation, Mahle GmbH and Fuji Oozx Inc. Their competitive advantage stems from global scale, advanced metallurgy and materials (such as titanium or nickel alloys), close relationships with OEMs, and deep integration into powertrain innovation. BorgWarner’s dominance reflects its leadership in valve actuation and combustion‑system components; other players focus on specialized niche segments or advanced alloy valves.

The competitive dynamics are shaped by several factors. One driver is the need for lighter, more heat‑resistant valve materials to support hybrid and next‑generation combustion engines. A second driver is the shift toward more stringent regulatory norms in Japan, pushing adoption of valves that support higher efficiency and lower emissions. Restraints include shrinking demand for traditional ICE vehicles as electrification progresses, the high cost of advanced materials and manufacturing, and the pressure on suppliers to rapidly develop next‑gen valve technology. Firms that combine metallurgical innovation, reliable supply chains and strong OEM partnerships are best positioned in this evolving Japanese engine‑valve landscape.

| Items | Values |

|---|---|

| Quantitative Units (2025) | USD million |

| Product Type | Mono Metallic Valves, Bimetallic Valves, Hollow Valves |

| Vehicle Type | Passenger Cars, Commercial Vehicles |

| Material Type | Steel, Titanium, Nickel Alloy |

| Sales Channel | OEM, Aftermarket |

| Region | Kyushu & Okinawa, Kanto, Kinki, Chubu, Tohoku, Rest of Japan |

| Countries Covered | Japan |

| Key Companies Profiled | BorgWarner, Delphi Technologies, Eaton Corporation, Mahle GmbH, Fuji Oozx Inc |

| Additional Attributes | Dollar sales by product type and application; regional CAGR and adoption trends; demand trends in automotive engine valves; integration with advanced technologies; vendor offerings including hardware, software, services, and platform integration; regulatory influences; regional infrastructure impacts |

The demand for automotive engine valve in japan is estimated to be valued at USD 318.6 million in 2025.

The market size for the automotive engine valve in japan is projected to reach USD 431.3 million by 2035.

The demand for automotive engine valve in japan is expected to grow at a 3.1% CAGR between 2025 and 2035.

The key product types in automotive engine valve in japan are mono metallic valves, bimetallic valves and hollow valves.

In terms of vehicle type, passenger cars segment is expected to command 32.8% share in the automotive engine valve in japan in 2025.

Our Research Products

The "Full Research Suite" delivers actionable market intel, deep dives on markets or technologies, so clients act faster, cut risk, and unlock growth.

The Leaderboard benchmarks and ranks top vendors, classifying them as Established Leaders, Leading Challengers, or Disruptors & Challengers.

Locates where complements amplify value and substitutes erode it, forecasting net impact by horizon

We deliver granular, decision-grade intel: market sizing, 5-year forecasts, pricing, adoption, usage, revenue, and operational KPIs—plus competitor tracking, regulation, and value chains—across 60 countries broadly.

Spot the shifts before they hit your P&L. We track inflection points, adoption curves, pricing moves, and ecosystem plays to show where demand is heading, why it is changing, and what to do next across high-growth markets and disruptive tech

Real-time reads of user behavior. We track shifting priorities, perceptions of today’s and next-gen services, and provider experience, then pace how fast tech moves from trial to adoption, blending buyer, consumer, and channel inputs with social signals (#WhySwitch, #UX).

Partner with our analyst team to build a custom report designed around your business priorities. From analysing market trends to assessing competitors or crafting bespoke datasets, we tailor insights to your needs.

Supplier Intelligence

Discovery & Profiling

Capacity & Footprint

Performance & Risk

Compliance & Governance

Commercial Readiness

Who Supplies Whom

Scorecards & Shortlists

Playbooks & Docs

Category Intelligence

Definition & Scope

Demand & Use Cases

Cost Drivers

Market Structure

Supply Chain Map

Trade & Policy

Operating Norms

Deliverables

Buyer Intelligence

Account Basics

Spend & Scope

Procurement Model

Vendor Requirements

Terms & Policies

Entry Strategy

Pain Points & Triggers

Outputs

Pricing Analysis

Benchmarks

Trends

Should-Cost

Indexation

Landed Cost

Commercial Terms

Deliverables

Brand Analysis

Positioning & Value Prop

Share & Presence

Customer Evidence

Go-to-Market

Digital & Reputation

Compliance & Trust

KPIs & Gaps

Outputs

Full Research Suite comprises of:

Market outlook & trends analysis

Interviews & case studies

Strategic recommendations

Vendor profiles & capabilities analysis

5-year forecasts

8 regions and 60+ country-level data splits

Market segment data splits

12 months of continuous data updates

DELIVERED AS:

PDF EXCEL ONLINE

Automotive Engine Valve Market Growth – Trends & Forecast 2025 to 2035

Demand for Automotive Engine Valve in USA Size and Share Forecast Outlook 2025 to 2035

Automotive Performance Tuning and Engine Remapping Industry Analysis in Japan Forecast & Analysis: 2025 to 2035

Japan Automotive Load Floor Industry Analysis Size and Share Forecast Outlook 2025 to 2035

Japan Automotive Turbocharger Market Insights – Demand, Size & Industry Trends 2025–2035

Japan Valve Seat Inserts Market Trend Analysis Based on Sales Channel, Material, Engine, End-Use and Provinces 2025 to 2035

Japan Automotive Airbag Market Report – Trends & Innovations 2025-2035

Japan Automotive Composite Leaf Springs Market Insights – Growth & Demand 2025-2035

Japan Automotive Turbocharger Market Growth – Trends & Forecast 2023-2033

Japan Automotive Lighting Market Growth – Trends & Forecast 2023-2033

Japan Automotive Interior Leather Market Growth – Trends & Forecast 2023-2033

Engine Valve Market Size and Share Forecast Outlook 2025 to 2035

Automotive Engine Management Sensors Market Size and Share Forecast Outlook 2025 to 2035

Automotive Valve Spring Market Size and Share Forecast Outlook 2025 to 2035

Automotive Engine Front Module Market Size and Share Forecast Outlook 2025 to 2035

Automotive Engineering Service Outsourcing Market Size and Share Forecast Outlook 2025 to 2035

Automotive Valves Market Size and Share Forecast Outlook 2025 to 2035

Automotive Valve Seat Insert Market Size and Share Forecast Outlook 2025 to 2035

Automotive Engineering Services Market Growth - Trends & Forecast 2025 to 2035

Automotive Valve Stem Seal Market Growth – Trends & Forecast 2024-2034

Thank you!

You will receive an email from our Business Development Manager. Please be sure to check your SPAM/JUNK folder too.

Chat With

MaRIA