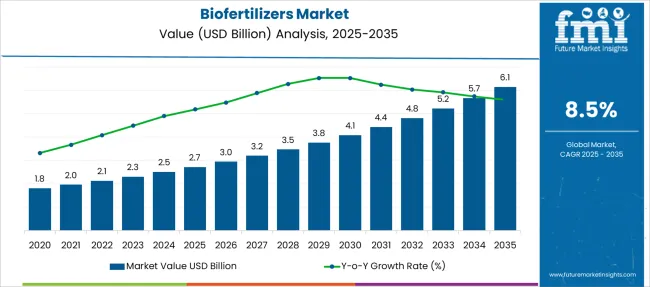

The Biofertilizers Market is estimated to be valued at USD 2.7 billion in 2025 and is projected to reach USD 6.1 billion by 2035, registering a compound annual growth rate (CAGR) of 8.5% over the forecast period.

| Metric | Value |

|---|---|

| Biofertilizers Market Estimated Value in (2025 E) | USD 2.7 billion |

| Biofertilizers Market Forecast Value in (2035 F) | USD 6.1 billion |

| Forecast CAGR (2025 to 2035) | 8.5% |

The biofertilizers market is growing steadily as sustainable agriculture practices gain importance worldwide. The increasing demand for organic farming and the need to reduce chemical fertilizer usage have led to greater adoption of biofertilizers. Advances in microbial technology and increased awareness of soil health have contributed to enhanced crop yields and improved soil fertility.

Government policies promoting eco-friendly farming inputs and rising consumer preference for organic produce have further supported market growth. The expanding cultivation of staple crops such as cereals and grains has boosted demand for crop-specific biofertilizer products.

Future growth is expected to be driven by innovations in formulation technologies and the increasing availability of biofertilizers in liquid form. Segmental growth is likely to be led by nitrogen-fixing biofertilizers, cereals and grains as the primary crop segment, and liquid formulations due to their ease of application and efficiency.

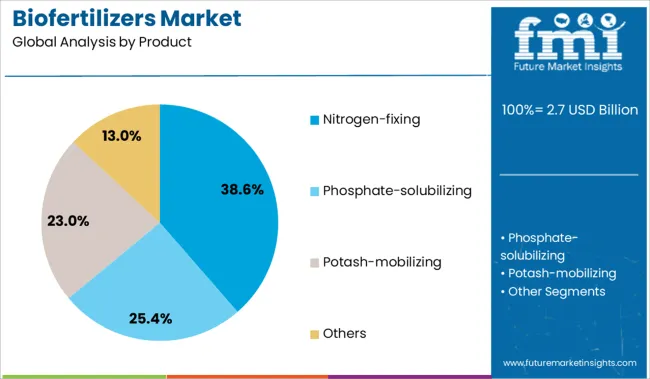

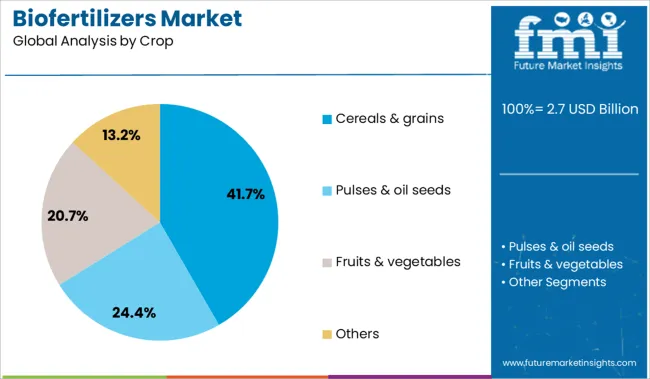

The market is segmented by Product, Crop, Form, and Application and region. By Product, the market is divided into Nitrogen-fixing, Phosphate-solubilizing, Potash-mobilizing, and Others. In terms of Crop, the market is classified into Cereals & grains, Pulses & oil seeds, Fruits & vegetables, and Others.

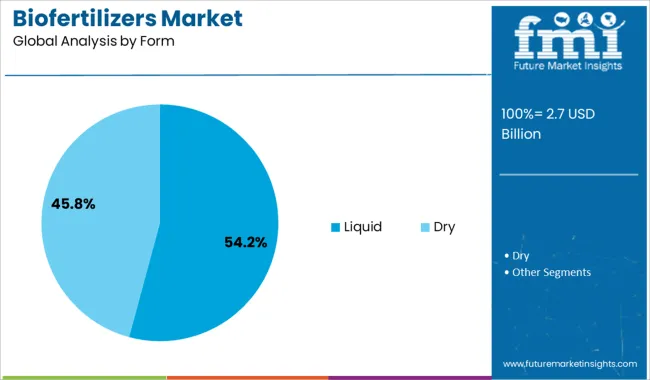

Based on Form, the market is segmented into Liquid and Dry. By Application, the market is divided into Soil treatment, Seed treatment, and Others. Regionally, the market is classified into North America, Latin America, Western Europe, Eastern Europe, Balkan & Baltic Countries, Russia & Belarus, Central Asia, East Asia, South Asia & Pacific, and the Middle East & Africa.

The nitrogen-fixing biofertilizer segment is expected to hold 38.6% of the market revenue in 2025, leading the product categories. This segment’s growth has been driven by its critical role in enhancing nitrogen availability to plants, which is essential for growth and productivity. Nitrogen-fixing biofertilizers improve soil nutrient balance by converting atmospheric nitrogen into forms usable by crops.

They have been widely adopted due to their effectiveness in reducing dependence on synthetic nitrogen fertilizers. The segment benefits from extensive use in cereals and grains, which have high nitrogen requirements.

Advances in microbial strains and inoculation techniques have further supported product efficacy. As sustainable agriculture continues to gain momentum nitrogen-fixing biofertilizers are expected to maintain their leading position.

The cereals and grains crop segment is projected to contribute 41.7% of the biofertilizers market revenue in 2025, making it the dominant crop category. Growth in this segment is attributed to the large global acreage under cereal and grain cultivation and the critical role of biofertilizers in improving yield and soil health in these crops.

Farmers growing wheat, rice, maize, and other cereals have increasingly adopted biofertilizers to meet rising food demand sustainably. The segment benefits from government initiatives encouraging biofertilizer use in staple food production.

Additionally, cereals and grains have high nutrient demands making them ideal candidates for biofertilizer application. With food security remaining a global priority the cereals and grains segment is expected to sustain robust growth.

The liquid biofertilizer segment is projected to hold 54.2% of the market revenue in 2025 establishing itself as the leading formulation type. Liquid formulations offer advantages such as ease of application, better shelf life, and uniform distribution of microbial inoculants. These factors have made liquid biofertilizers increasingly popular among farmers and agronomists.

The liquid form supports foliar application and integration with irrigation systems which enhances nutrient uptake efficiency. Innovations in packaging and preservation techniques have further improved product stability and user convenience.

As agricultural practices become more technology-driven liquid biofertilizers are expected to dominate the market due to their adaptability and performance benefits.

The biofertilizers market is witnessing notable traction due to growing demand for microbial-based alternatives that support soil health restoration and reduce dependency on synthetic inputs. Product uptake is being fueled by farmer-led trials, institutional procurement, and regulatory push for residue-free cultivation. Manufacturers are expanding their carrier-based formulations and liquid concentrate offerings to improve field efficacy and shelf stability.

The increasing success of field demonstrations validating the performance of rhizobial, azotobacter, and mycorrhizal strains has accelerated demand for biofertilizers across key agricultural belts. Regional agricultural universities and public extension networks have facilitated adoption by conducting yield comparisons and soil impact assessments. These trials have confirmed nutrient fixation benefits, phosphorus solubilization, and enhanced root colonization. As a result, growers are substituting a portion of chemical inputs with biofertilizers, especially in pulses, oilseeds, and plantation crops. Product customization by crop type and soil compatibility has emerged as a critical driver. Brands offering dual-function consortia and faster spore activation timelines are outperforming generic formulations, particularly in high-value horticultural and export-grade segments

Carrier material advancements have created strong commercialization opportunities within the biofertilizers market. Traditionally, peat or lignite carriers limited shelf life and microbial load uniformity. Recent shifts toward polymer-encapsulated beads, water-soluble films, and inert clay blends have improved spore stability during transport and field application. These carriers enable controlled release, better root zone adhesion, and compatibility with drip and foliar systems. Players focusing on scalable, non-refrigerated carrier formats are gaining traction in regions lacking cold chain infrastructure. With increased acceptance of liquid and granular biofertilizers, companies offering extended shelf life, high CFU concentration, and precision delivery kits are differentiating themselves. Field-ready kits designed for farmer convenience now serve as a branding tool and a barrier to commoditization.

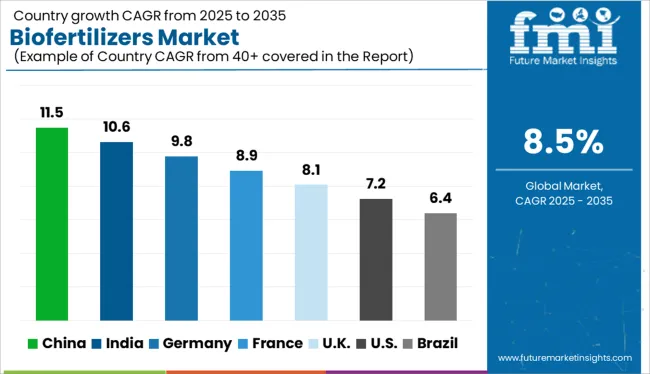

| Country | CAGR |

|---|---|

| India | 10.6% |

| Germany | 9.8% |

| France | 8.9% |

| UK | 8.1% |

| USA | 7.2% |

| Brazil | 6.4% |

Global biofertilizer market demand is growing at a CAGR of 8.5% from 2025 to 2035, yet country-level trajectories show differentiated momentum driven by agro-policy frameworks, microbial research ecosystems, and adoption incentives. China leads with 11.5%, outpacing the global benchmark by three percentage points. Government-subsidized bio-input schemes and mass production of azotobacter and phosphate-solubilizing strains in provinces like Jiangsu and Henan are expanding capacity. India follows at 10.6%, driven by wide uptake among sugarcane and rice cultivators and cluster-based fermentation hubs under PM-PRANAM and state-backed soil health programs. Germany, posting 9.8%, benefits from precision farming initiatives and EU-backed consortia for mycorrhiza and rhizobia-based formulations. France, close to the global rate at 8.9%, is scaling microbial consortia through vertically integrated agri-cooperatives targeting viticulture and cereal belts. The United Kingdom, at 8.1%, trails due to regulatory ambiguity around inoculant registration and slower integration into certified organic protocols. The report covers detailed analysis of 40+ countries and the top five countries have been shared as a reference.

China is anticipated to expand at an 11.5% CAGR through 2035, outpacing the global average. Dominance in organic agriculture and microbial R&D has positioned China as a frontrunner in biofertilizer consumption. Favorable government initiatives promoting green agriculture, combined with the vast rice and horticulture sectors, drive bulk microbial input usage. Provinces like Sichuan and Shandong lead pilot soil microbiome projects. Domestic production scales efficiently, leveraging biotech clusters that strengthen local supply over imports. China’s output scale and institutional backing allow price advantages over Europe’s fragmented approach.

India is projected to grow at a 10.6% CAGR, driven by large-scale use in organic farming and declining soil fertility. Being part of the BRICS bloc, India focuses on microbe-based inputs for legume and cereal crops, supported by public-private extension networks. The Pradhan Mantri Krishi Sinchayee Yojana and PM-PRANAM schemes increase biofertilizer penetration in low-input zones. States like Maharashtra and Tamil Nadu see growing partnerships between cooperatives and bio-agri startups. India’s market remains cost-conscious but is evolving rapidly through tech-enabled field trials and fermentation infrastructure upgrades.

Germany is expected to register a 9.8% CAGR, with expansion centered around regenerative agriculture and EU Green Deal compliance. Biofertilizers see traction in vineyards, oilseed rape fields, and organic wheat belts. Government incentives for N-fixation alternatives and soil health audits support demand. Regulatory approval remains stringent, favoring certified formulations. German manufacturers emphasize strain traceability, carbon scoring, and performance-based trials. While smaller in volume than China or India, Germany’s market monetizes well due to premium positioning and traceable origin credentials, aligning with EU27 priorities.

France, expanding at an 8.9% CAGR, anchors its growth in viticulture and agri-environmental contracts. Biofertilizers are increasingly deployed in regions like Nouvelle-Aquitaine and Occitanie for carbon farming and rotation enhancement. EU-backed soil biodiversity benchmarks foster usage, especially of nitrogen-fixing strains. The shift away from chemical NPK aligns with CAP subsidies, driving microbial inoculant inclusion in sustainable farming certifications. Demand remains quality-driven, with clear separation between basic inoculants and EU-approved microbial consortia. French cooperatives prioritize biofertilizers with verifiable field performance.

The UK market is projected to grow at an 8.1% CAGR through 2035, backed by rising demand in pasture management and regenerative crop systems. Biofertilizers are increasingly applied across arable lands in East Anglia and the Midlands. Post-Brexit regulatory autonomy enables targeted incentives under DEFRA’s Environmental Land Management schemes. Preference is given to homegrown strains and low-carbon input sources, with research centered around rhizobacteria for temperate soils. Unlike EU peers, the UK favors agility in formulation testing and farmer-led field validations.

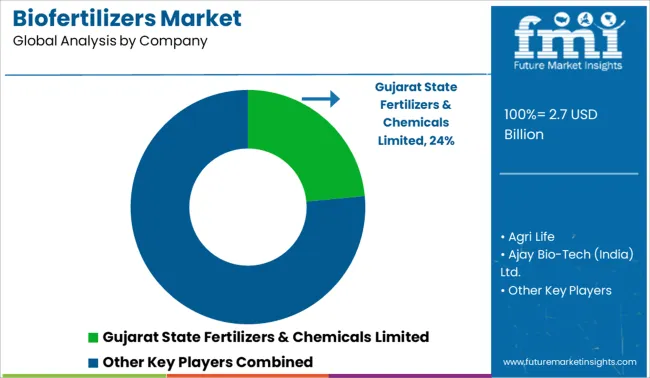

The biofertilizers market comprises a mix of government-supported firms, biotech-focused companies, and agritech innovators addressing microbial soil enrichment and nutrient enhancement. Gujarat State Fertilizers & Chemicals Limited and Madras Fertilizers Limited operate under state-backed mandates, supplying rhizobium, phosphate solubilizing bacteria (PSB), and azotobacter-based formulations to domestic agricultural programs. Their presence is supported by distribution networks aligned with public-sector extension services. Ajay Bio-Tech, Agri Life, and Jay Enterprises concentrate on crop-specific consortia and microbial blends, catering to organic farming trends and zero-residue farming initiatives. These firms have scaled operations across India and parts of Africa through private label partnerships. Kimitec Group and Lallemand Inc. emphasize R&D-driven microbial platforms and fermentation-based inputs, expanding their reach across North America and Europe. Gizatec, Chema Industries, and Cairochem support North African and Middle Eastern markets with customized formulations targeting local soil and crop conditions.

On June 17, 2025, Kimitec and Bayer introduced two advanced biological products—Ambition Complete Gen2 and Ambition Secure Gen2—currently in regulatory review. These bioformulations aim to enhance nutrient assimilation, stress resilience, and calcium uptake in crops.

| Item | Value |

|---|---|

| Quantitative Units | USD 2.7 Billion |

| Product | Nitrogen-fixing, Phosphate-solubilizing, Potash-mobilizing, and Others |

| Crop | Cereals & grains, Pulses & oil seeds, Fruits & vegetables, and Others |

| Form | Liquid and Dry |

| Application | Soil treatment, Seed treatment, and Others |

| Regions Covered | North America, Europe, Asia-Pacific, Latin America, Middle East & Africa |

| Country Covered | United States, Canada, Germany, France, United Kingdom, China, Japan, India, Brazil, South Africa |

| Key Companies Profiled | Gujarat State Fertilizers & Chemicals Limited, Agri Life, Ajay Bio-Tech (India) Ltd., Cairochem, Chema Industries, Gizatec, Jay Enterprises, Kimitec Group, Lallemand Inc., and Madras Fertilizers Limited |

| Additional Attributes | Dollar sales by microbial strain and crop type, share by carrier-based and liquid formulations, adoption in regenerative farming zones, integration with drip and foliar systems, rise in nitrogen-fixing bio-input trials, regional subsidy schemes promoting rhizobium and phosphate-solubilizing consortia, expansion of shelf-stable granule biofertilizer formats for field-level application |

The global biofertilizers market is estimated to be valued at USD 2.7 billion in 2025.

The market size for the biofertilizers market is projected to reach USD 6.1 billion by 2035.

The biofertilizers market is expected to grow at a 8.5% CAGR between 2025 and 2035.

The key product types in biofertilizers market are nitrogen-fixing, phosphate-solubilizing, potash-mobilizing and others.

In terms of crop, cereals & grains segment to command 41.7% share in the biofertilizers market in 2025.

Full Research Suite comprises of:

Market outlook & trends analysis

Interviews & case studies

Strategic recommendations

Vendor profiles & capabilities analysis

5-year forecasts

8 regions and 60+ country-level data splits

Market segment data splits

12 months of continuous data updates

DELIVERED AS:

PDF EXCEL ONLINE

Thank you!

You will receive an email from our Business Development Manager. Please be sure to check your SPAM/JUNK folder too.

Chat With

MaRIA