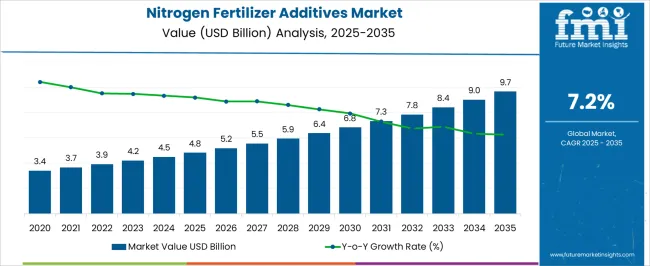

The Nitrogen Fertilizer Additives Market is estimated to be valued at USD 4.8 billion in 2025 and is projected to reach USD 9.7 billion by 2035, registering a compound annual growth rate (CAGR) of 7.2% over the forecast period.

| Metric | Value |

|---|---|

| Nitrogen Fertilizer Additives Market Estimated Value in (2025 E) | USD 4.8 billion |

| Nitrogen Fertilizer Additives Market Forecast Value in (2035 F) | USD 9.7 billion |

| Forecast CAGR (2025 to 2035) | 7.2% |

The Nitrogen Fertilizer Additives market is experiencing steady expansion as agriculture shifts toward efficiency-driven practices and sustainability requirements. Increasing concerns about nitrogen loss through volatilization, leaching, and greenhouse gas emissions are fueling the adoption of advanced additives that enhance nutrient use efficiency. Global demand for staple crops and rising fertilizer consumption are further accelerating the market’s momentum.

Policymakers are promoting environmentally responsible farming practices, encouraging the use of technologies that minimize nutrient waste and reduce the ecological footprint of fertilizer applications. The market is also benefiting from the growing awareness among farmers of the cost benefits tied to higher yield per unit of fertilizer applied, which directly supports profitability.

The ability of these additives to ensure consistent crop productivity even under variable climatic conditions has made them integral to modern crop nutrition strategies As governments and agricultural bodies continue to emphasize food security and climate-resilient agriculture, nitrogen fertilizer additives are positioned as an indispensable component of sustainable farming systems worldwide.

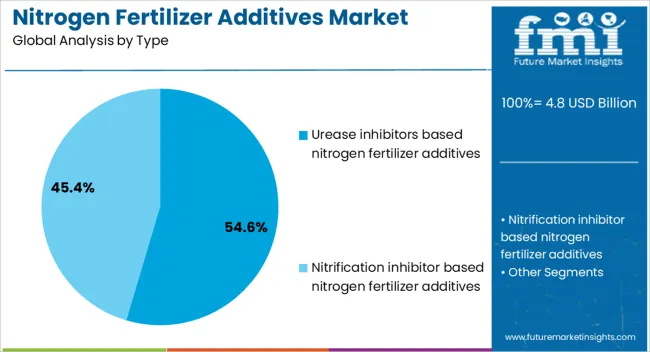

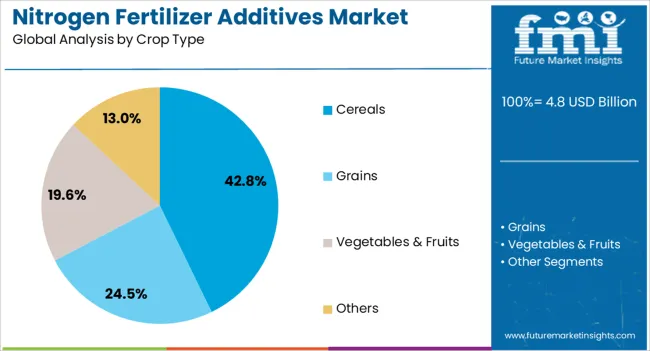

The nitrogen fertilizer additives market is segmented by type, crop type, and geographic regions. By type, nitrogen fertilizer additives market is divided into Urease inhibitors based nitrogen fertilizer additives and Nitrification inhibitor based nitrogen fertilizer additives. In terms of crop type, nitrogen fertilizer additives market is classified into Cereals, Grains, Vegetables & Fruits, and Others. Regionally, the nitrogen fertilizer additives industry is classified into North America, Latin America, Western Europe, Eastern Europe, Balkan & Baltic Countries, Russia & Belarus, Central Asia, East Asia, South Asia & Pacific, and the Middle East & Africa.

The urease inhibitors based nitrogen fertilizer additives segment is projected to account for 54.60% of the total Nitrogen Fertilizer Additives market revenue in 2025, making it the largest segment by type. This leadership is being driven by the critical role of urease inhibitors in reducing ammonia volatilization losses, thereby improving the efficiency of nitrogen fertilizers. The use of urease inhibitors allows nitrogen to remain longer in the soil in plant-available form, which directly contributes to improved crop yields and reduced input costs for farmers.

The segment has gained prominence as farming communities adopt practices that align with environmental regulations focused on curbing greenhouse gas emissions from agriculture. The compatibility of urease inhibitors with widely used urea-based fertilizers has further strengthened their adoption, since they can be seamlessly integrated into existing fertilization programs without major infrastructure changes.

Additionally, ongoing advances in formulation technologies have enhanced the stability and efficacy of urease inhibitors, reinforcing their value proposition The rising emphasis on precision farming and resource optimization is expected to continue propelling this segment’s dominance in the foreseeable future.

The cereals segment is anticipated to capture 42.80% of the total Nitrogen Fertilizer Additives market revenue in 2025, establishing it as the leading crop type segment. This dominance is being attributed to the pivotal role cereals play in global food security, as they constitute the primary source of caloric intake for a large share of the world population. The intensive nutrient requirements of cereals such as rice, wheat, and maize have driven consistent demand for nitrogen fertilizer additives that enhance efficiency and minimize nutrient losses.

The use of these additives in cereal cultivation has been reinforced by the need to maximize yields under conditions of shrinking arable land and increasing population pressures. Farmers have increasingly adopted nitrogen management solutions that can sustain soil fertility and reduce the negative environmental impact associated with conventional fertilizer use.

With cereals being cultivated extensively across diverse geographies, the scale of application further strengthens this segment’s leadership The combination of high global demand, policy support for sustainable intensification, and ongoing innovation in crop nutrition is expected to sustain the growth of this segment in the years ahead.

Nitrogen fertilizers such as urea and ammonium nitrate fertilizers promote crop growth and enhance crop yield. Upon mixing with soil, nitrogen fertilizers convert to nitrate compounds, which are susceptible to denitrification or leaching, if not consumed within the span of their application. To avoid such loses, nitrogen fertilizer additives are mixed with nitrogen fertilizers to delay the process of fertilizer conversion.

The two commonly used types of nitrogen fertilizer additives are urease inhibitors based nitrogen fertilizer additives and nitrification inhibitors based nitrogen fertilizer additives. Among these two nitrogen fertilizer additives, urease inhibitors are used to reduce the volatilization of urea based fertilizers, which is caused by an enzyme called urease. For example, nitrification inhibitor type of nitrogen fertilizer additives are used to temporarily delay or slowdown nitrification by reducing the activity of Nitrosomonas bacteria present in soil.

With the adoption of modern farming techniques across the globe, the demand for agrochemicals has surged to increase the crop yield, which is a major driving factor for the growth of the nitrogen fertilizer additives market. Nitrogen-based fertilizers are consumed during the production of fertilizers to enhance and impart additional properties.

The increasing demand for cereals, grains, fruits and vegetables has augmented the demand for nitrogen fertilizer additives across the globe. Thus, agriculture and horticulture together are identified as the key growth driving end-use sectors of the nitrogen fertilizer additives market. Moreover, nitrogen fertilizer additives offer several benefits such as enhanced fertilizer efficiency, cost effectiveness and environmental benefits, among others. Attributing to these benefits, the demand for nitrogen fertilizer additives is expected to increase over the forecast period. However, the complexity involved in the production of nitrogen fertilizer additives and the stringent polices and regulations in developed regions may hamper the growth of the nitrogen fertilizer additives market. The ill-effects of nitrogen fertilizer additives such as leaching and volatility in agricultural soil may restrain the growth of the nitrogen fertilizer additive market with end users opting for substitutes. The product development of nitrogen fertilizer additives has to be in strict compliance with environment management regulatory standards.

Thus, major manufacturers and players in the nitrogen fertilizer additives market are emphasizing on the same. A suitable example to advocate this trend has been the launch of high-performance and low toxicity level prototypes of nitrogen fertilizer additives by manufacturers. The prices of nitrogen fertilizer additives are expected to grow moderately during the forecast period.

Significant growth of the agrarian countries in South East Asia, Latin America, etc., coupled with the growing per capita expenditure, increasing population, growing food demand and increasing demand for effective fertilizers, is expected to support the growth of the nitrogen fertilizer additives market. The global nitrogen fertilizer additives market is dominated by China in terms of consumption and production. China is a major producer of nitrogen fertilizers and accounted over 33% of the global production in 2025 along with the subsequent production of nitrogen fertilizer additives.

The China nitrogen fertilizer additives market is expected to witness high value-volume growth over the forecast period. The USA and India are also considered as major markets for nitrogen fertilizer additives and are expected to register steady CAGRs over the forecast period. In the Middle East & Africa region, Morocco dominates the nitrogen fertilizer market in terms of production with significant capacity and attributing to this, the demand for nitrogen fertilizer additives in the region is pegged to be high.

Overall, the MEA nitrogen fertilizer additives market is expected to exhibit a steady CAGR over the forecast period. In Europe, Russia accounted for the highest share in terms of nitrogen fertilizer production, which in turn is creating demand for nitrogen fertilizer additives. The Europe Nitrogen fertilizer additives market is expected to register slow growth over the forecast period. Additionally, the Latin America nitrogen fertilizer additives market is expected to register sluggish growth over the forecast period. Australia and New Zealand are also expected to register significant consumption of nitrogen fertilizer additives during the forecast period.

The nitrogen fertilizer additives market report is a compilation of first-hand information, qualitative and quantitative assessment by industry analysts, inputs from industry experts and industry participants across the value chain. The report provides in-depth analysis of parent market trends, macro-economic indicators and governing factors along with market attractiveness as per segments. The report also maps the qualitative impact of various market factors on market segments and geographies.

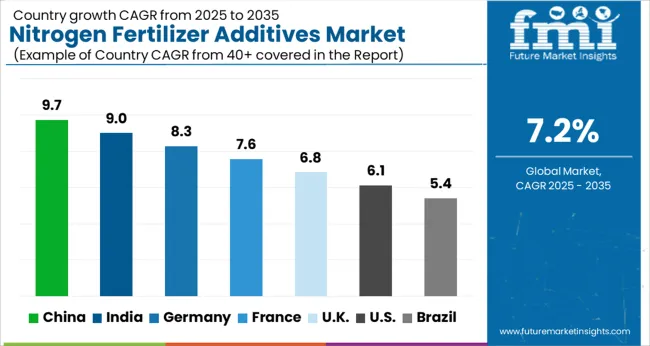

| Country | CAGR |

|---|---|

| China | 9.7% |

| India | 9.0% |

| Germany | 8.3% |

| France | 7.6% |

| UK | 6.8% |

| USA | 6.1% |

| Brazil | 5.4% |

The Nitrogen Fertilizer Additives Market is expected to register a CAGR of 7.2% during the forecast period, exhibiting varied country level momentum. China leads with the highest CAGR of 9.7%, followed by India at 9.0%. Developed markets such as Germany, France, and the UK continue to expand steadily, while the USA is likely to grow at consistent rates. Brazil posts the lowest CAGR at 5.4%, yet still underscores a broadly positive trajectory for the global Nitrogen Fertilizer Additives Market. In 2024, Germany held a dominant revenue in the Western Europe market and is expected to grow with a CAGR of 8.3%. The USA Nitrogen Fertilizer Additives Market is estimated to be valued at USD 1.7 billion in 2025 and is anticipated to reach a valuation of USD 3.1 billion by 2035. Sales are projected to rise at a CAGR of 6.1% over the forecast period between 2025 and 2035. While Japan and South Korea markets are estimated to be valued at USD 233.0 million and USD 143.7 million respectively in 2025.

| Item | Value |

|---|---|

| Quantitative Units | USD 4.8 Billion |

| Type | Urease inhibitors based nitrogen fertilizer additives and Nitrification inhibitor based nitrogen fertilizer additives |

| Crop Type | Cereals, Grains, Vegetables & Fruits, and Others |

| Regions Covered | North America, Europe, Asia-Pacific, Latin America, Middle East & Africa |

| Country Covered | United States, Canada, Germany, France, United Kingdom, China, Japan, India, Brazil, South Africa |

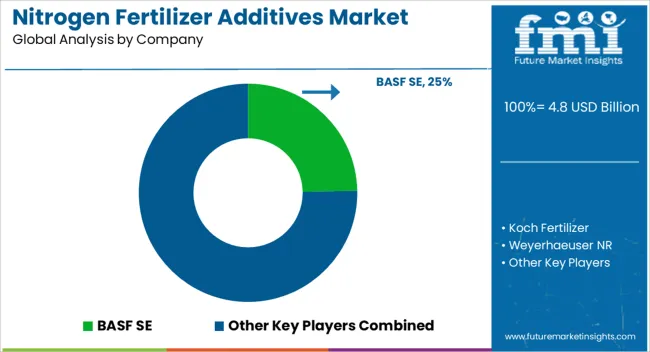

| Key Companies Profiled | BASF SE, Koch Fertilizer, Weyerhaeuser NR, Loveland Products, Helena Agri-Enterprises, Arclin, AgXplore International, and Innvictis Crop Care |

The global nitrogen fertilizer additives market is estimated to be valued at USD 4.8 billion in 2025.

The market size for the nitrogen fertilizer additives market is projected to reach USD 9.7 billion by 2035.

The nitrogen fertilizer additives market is expected to grow at a 7.2% CAGR between 2025 and 2035.

The key product types in nitrogen fertilizer additives market are urease inhibitors based nitrogen fertilizer additives and nitrification inhibitor based nitrogen fertilizer additives.

In terms of crop type, cereals segment to command 42.8% share in the nitrogen fertilizer additives market in 2025.

Our Research Products

The "Full Research Suite" delivers actionable market intel, deep dives on markets or technologies, so clients act faster, cut risk, and unlock growth.

The Leaderboard benchmarks and ranks top vendors, classifying them as Established Leaders, Leading Challengers, or Disruptors & Challengers.

Locates where complements amplify value and substitutes erode it, forecasting net impact by horizon

We deliver granular, decision-grade intel: market sizing, 5-year forecasts, pricing, adoption, usage, revenue, and operational KPIs—plus competitor tracking, regulation, and value chains—across 60 countries broadly.

Spot the shifts before they hit your P&L. We track inflection points, adoption curves, pricing moves, and ecosystem plays to show where demand is heading, why it is changing, and what to do next across high-growth markets and disruptive tech

Real-time reads of user behavior. We track shifting priorities, perceptions of today’s and next-gen services, and provider experience, then pace how fast tech moves from trial to adoption, blending buyer, consumer, and channel inputs with social signals (#WhySwitch, #UX).

Partner with our analyst team to build a custom report designed around your business priorities. From analysing market trends to assessing competitors or crafting bespoke datasets, we tailor insights to your needs.

Supplier Intelligence

Discovery & Profiling

Capacity & Footprint

Performance & Risk

Compliance & Governance

Commercial Readiness

Who Supplies Whom

Scorecards & Shortlists

Playbooks & Docs

Category Intelligence

Definition & Scope

Demand & Use Cases

Cost Drivers

Market Structure

Supply Chain Map

Trade & Policy

Operating Norms

Deliverables

Buyer Intelligence

Account Basics

Spend & Scope

Procurement Model

Vendor Requirements

Terms & Policies

Entry Strategy

Pain Points & Triggers

Outputs

Pricing Analysis

Benchmarks

Trends

Should-Cost

Indexation

Landed Cost

Commercial Terms

Deliverables

Brand Analysis

Positioning & Value Prop

Share & Presence

Customer Evidence

Go-to-Market

Digital & Reputation

Compliance & Trust

KPIs & Gaps

Outputs

Full Research Suite comprises of:

Market outlook & trends analysis

Interviews & case studies

Strategic recommendations

Vendor profiles & capabilities analysis

5-year forecasts

8 regions and 60+ country-level data splits

Market segment data splits

12 months of continuous data updates

DELIVERED AS:

PDF EXCEL ONLINE

Nitrogenous Fertilizer Market

Fertilizer Packaging Market Forecast and Outlook 2025 to 2035

Fertilizer Tester Market Size and Share Forecast Outlook 2025 to 2035

Nitrogen Tester Market Size and Share Forecast Outlook 2025 to 2035

Additives for Metalworking Fluids Market Size and Share Forecast Outlook 2025 to 2035

Fertilizer Value Added Coatings Market Analysis - Size, Share, and Forecast Outlook 2025 to 2035

Fertilizer Applicators Market Size and Share Forecast Outlook 2025 to 2035

Fertilizer Market Size and Share Forecast Outlook 2025 to 2035

Nitrogen Gas Based Air Separation Unit Market Size and Share Forecast Outlook 2025 to 2035

Fertilizer Bags Market Growth - Demand & Forecast 2025 to 2035

Nitrogenated Coffee Market Analysis - Size, Share, and Forecast Outlook 2025 to 2035

Fertilizer Additive Market Report – Growth, Demand & Forecast 2025 to 2035

Nitrogen Flushing Machine Market Report – Trends, Size & Forecast 2025-2035

Nitrogen Gas Springs Market

Fertilizer Injection Pumps Market

Additives for Floor Coatings Market

Biofertilizers Market Size and Share Forecast Outlook 2025 to 2035

NPK Fertilizers Market Analysis - Size, Share, and Forecast 2025 to 2035

Ink Additives Market Growth – Trends & Forecast 2025 to 2035

Wet Fertilizer Spreaders Market

Thank you!

You will receive an email from our Business Development Manager. Please be sure to check your SPAM/JUNK folder too.

Chat With

MaRIA