The global nitrogenated coffee market is projected to grow from USD 741.2 million in 2025 to USD 1,272.4 million by 2035, registering a CAGR of 5.6%. Market growth is fueled by rising consumer demand for innovative, premium coffee beverages and the appeal of nitrogen infusion to enhance texture and visual presentation.

| Metric | Value |

|---|---|

| Industry Size (2025E) | USD 741.2 million |

| Industry Value (2035F) | USD 1,272.4 million |

| CAGR (2025 to 2035) | 5.6% |

The creamy mouthfeel, smooth taste, and aesthetic cascading effect created by nitrogenation make it a preferred choice among specialty coffee drinkers seeking a unique experience.

Nitrogenated coffee holds an estimated 5-8% share within the overall cold brew coffee segment, underscoring its niche yet rapidly expanding presence. It accounts for around 0.6% of the global ready-to-drink (RTD) coffee market, alongside canned and bottled RTD coffee options.

Within the broader non-alcoholic beverages market, nitrogenated coffee contributes approximately 0.03%, reflecting its specialized positioning among gourmet beverage categories. It represents nearly 0.01% of the global food and beverage industry value, highlighting its emerging yet high-margin status in premium drink portfolios.

Regulatory standards impacting the market are primarily linked to beverage safety, nitrogen infusion processes, and packaging integrity. Standards such as the USA FDA regulations for nitrogen-infused beverages, European Union food safety directives, and various national beverage packaging guidelines ensure that nitrogenated coffee meets food safety, quality, and shelf-life benchmarks.

Additionally, in major markets like the United States, Japan, and Australia, rising consumer awareness around clean-label formulations, organic certifications, and sustainability is driving demand for responsibly sourced and packaged nitrogenated coffee, reinforcing the shift toward ethical and eco-friendly beverage supply chains.

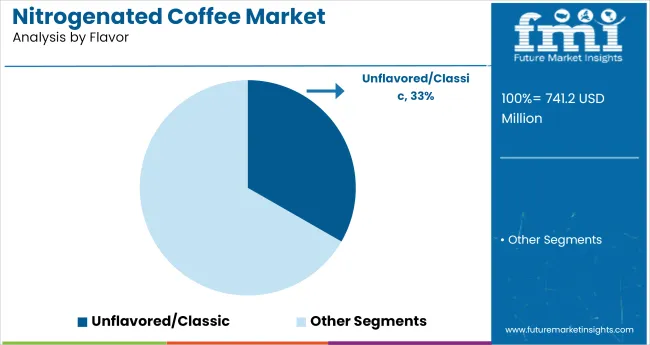

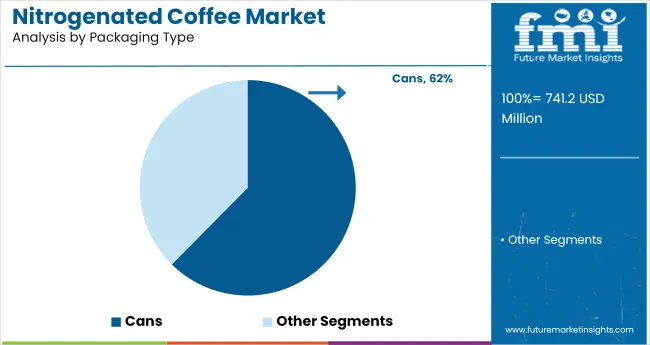

The USA is projected to record strong growth, expanding at a CAGR of 5.4% from 2025 to 2035. The unflavored/classic segment will dominate the flavor category with a 33.3% share, while cans will lead the packaging type segment with a 62.4% share. Germany and Japan are also expected to grow steadily, with CAGRs of 4.9% and 3.5%, respectively.

The market is segmented by flavor, packaging type, distribution channel, and region. By flavor, the market includes unflavored/classic, vanilla, hazelnut, caramel, chocolate, and others (mocha, almond, coconut, mint). Based on packaging type, it is segmented into cans, glass bottles, and others (pouches, tetra paks, cartons, aluminum foil bags).

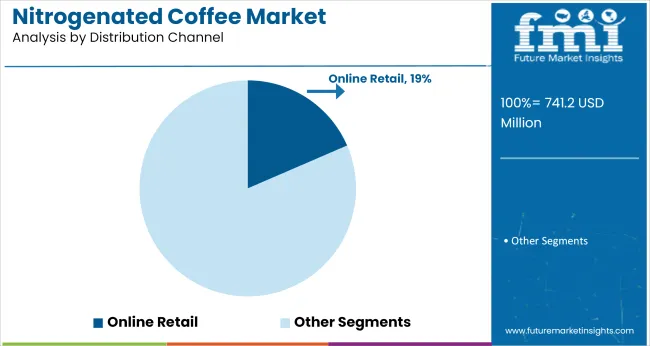

By distribution channel, the market includes HoReCa, cafes, bakeries & patisseries, hypermarkets/supermarkets, convenience stores, wholesale stores, and online retail. Regionally, the market is divided into North America, Latin America, Western Europe, Eastern Europe, Balkans & Baltic, Russia & Belarus, Central Asia, East Asia, South Asia & Pacific, Middle East & Africa.

The unflavored/classic is projected to lead the flavor segment, capturing 33.3% of the market share by 2025.

The cans is expected to dominate the packaging type segment, accounting for 62.4% of the global market share in 2025.

The online retail is projected to dominate the distribution channel segment, accounting for 18.5% of the global market share in 2025.

The global nitrogenated coffee market is witnessing consistent growth driven by increasing demand for premium, smooth, and visually appealing coffee beverages. Nitrogenated coffee enhances texture and mouthfeel, supporting cafe differentiation and brand profitability, particularly within the specialty cold brew segment.

Recent Trends in the Nitrogenated Coffee Market

Challenges in the Nitrogenated Coffee Market

The nitrogenated coffee market in Japan is gaining momentum through its innovative beverage culture and consumer preference for premium RTD drinks. The United States remains the largest market with a robust specialty coffee ecosystem and strong consumer willingness to pay for premium experiences.

The nitrogenated coffee markets in Germany and France maintain steady growth due to an increasing cafe culture and the popularity of RTD specialty beverages. Developed economies such as the USA (5.4% CAGR), UK (4.2%), Germany (4.9%), France (3.8%), and Japan (3.5%) are expanding at approximately 0.62-0.96x of the global growth rate.

The Japan nitrogenated coffee market is poised to grow at a CAGR of 3.5% from 2025 to 2035. Growth is driven by consumer demand for premium cold beverages, supported by the widespread presence of vending machines and convenience stores offering RTD nitrogenated coffee.

The sales of nitrogenated coffee in Germany are poised to expand at a 4.9% CAGR during the forecast period. Growth is driven by the increasing popularity of specialty coffee beverages and cafe culture emphasizing premium, smooth-textured drinks.

The French nitrogenated coffee market is projected to grow with 3.8% CAGR from 2025 to 2035, driven by rising consumer preference for premium cold brews and nitrogenated beverages offered by cafes and gourmet coffee brands.

The USA nitrogenated coffee market is projected to grow at a 5.4% CAGR from 2025 to 2035, approximately 0.96x the global rate. Growth is driven by widespread cafe chains, strong cold brew adoption, and consumer preference for innovative, creamy-textured coffee drinks.

The UK nitrogenated coffee revenue is projected to grow steadily with a 4.2% CAGR during the forecast period, supported by rising consumer awareness of premium cold brew beverages and an increasing focus on RTD specialty drinks.

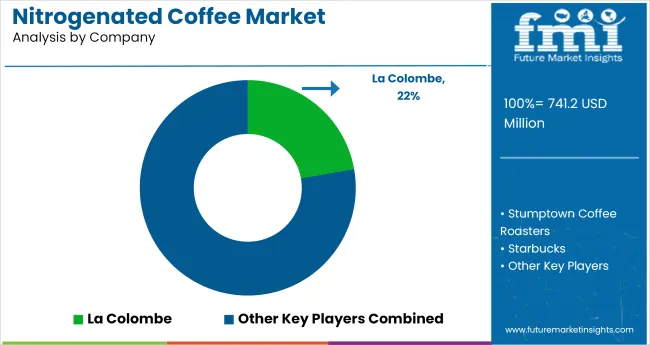

The nitrogenated coffee market is moderately fragmented, with leading players like La Colombe, Stumptown Coffee Roasters, Starbucks, Rise Brewing Co., and High Brew Coffee actively shaping product innovation and consumer adoption. These companies offer nitrogenated cold brews in diverse flavors and packaging formats, focusing on premium quality, clean-label formulations, and sustainability.

La Colombe is known for its Draft Latte and innovative canned nitrogenated coffees, combining smooth texture with specialty-grade beans sourced through ethical partnerships. Stumptown Coffee Roasters emphasizes artisanal brewing techniques and seasonal nitro cold brews that appeal to specialty coffee enthusiasts. Starbucks offers a wide range of nitrogenated cold brews, including oat milk-infused variants, leveraging its extensive retail footprint to drive category awareness.

Rise Brewing Co. specializes in organic nitro cold brews with oat milk and adaptogenic blends, targeting health-conscious consumers seeking clean-label, dairy-free options. High Brew Coffee provides ready-to-drink nitro cold brews that balance convenience with premium taste, catering to busy professionals.

Recent Nitrogenated Coffee Industry News

| Report Attributes | Details |

|---|---|

| Market Size (2025) | USD 741.2 million |

| Projected Market Size (2035) | USD 1,272.4 million |

| CAGR (2025 to 2035) | 5.6% |

| Base Year for Estimation | 2024 |

| Historical Period | 2020 to 2024 |

| Projections Period | 2025 to 2035 |

| Report Parameter | USD million for value/Volume in Million Liters |

| Flavor Analyzed | Unflavored/Classic, Vanilla, Hazelnut, Caramel, Chocolate, and Others (Mocha, Almond, Coconut, Mint) |

| Packaging Type Analyzed | Cans, Glass Bottles, and Others (Pouches, Tetra Paks, Cartons, Aluminum Foil Bags) |

| Distribution Channel Analyzed | HoReCa, Cafes, Bakeries & Patisseries, Hypermarket/Supermarket, Convenience Stores, Wholesale Stores, and Online Retail |

| Regions Covered | North America, Latin America, Western Europe, Eastern Europe, Balkans & Baltic, Russia & Belarus, Central Asia, East Asia, South Asia & Pacific, Middle East & Africa |

| Countries Covered | United States, United Kingdom, Germany, France, Japan, China, India, Brazil, South Korea, Australia |

| Key Players Influencing the Market | La Colombe, Stumptown Coffee Roasters, Starbucks, Rise Brewing Co., High Brew Coffee, Caveman Coffee Co., Lucky Jack Coffee, Califia Farms, Black Rifle Coffee Company, Peet's Coffee |

| Additional Attributes | Dollar sales by flavor and packaging type, share by distribution channel, regional demand growth, consumer trends, competitive benchmarking |

As per flavor, the industry has been categorized into Unflavored/Classic, Vanilla, Hazelnut, Caramel, Chocolate, and Others.

This segment is further categorized into Cans, Glass Bottles, and Others.

This segment is further categorized into HoReCa, Cafs, Bakeries Patisseries, Hypermarket / Supermarkets, Convenience Stores, Wholesale Stores, and Online Retail.

Industry analysis has been carried out in key countries of North America, Latin America, Western Europe, Eastern Europe, Balkans Baltic, Russia Belarus, Central Asia, East Asia, South Asia Pacific, and the Middle East Africa.

The market is valued at USD 741.2 million in 2025.

The market is forecasted to reach USD 1,272.4 million by 2035, reflecting a CAGR of 5.6%.

Unflavored/classic will lead the flavor segment, accounting for 33.3% of the global market share in 2025.

Cans will dominate the packaging type segment with a 62.4% share in 2025.

The USA is projected to grow steadily with a CAGR of 5.4% from 2025 to 2035.

Our Research Products

The "Full Research Suite" delivers actionable market intel, deep dives on markets or technologies, so clients act faster, cut risk, and unlock growth.

The Leaderboard benchmarks and ranks top vendors, classifying them as Established Leaders, Leading Challengers, or Disruptors & Challengers.

Locates where complements amplify value and substitutes erode it, forecasting net impact by horizon

We deliver granular, decision-grade intel: market sizing, 5-year forecasts, pricing, adoption, usage, revenue, and operational KPIs—plus competitor tracking, regulation, and value chains—across 60 countries broadly.

Spot the shifts before they hit your P&L. We track inflection points, adoption curves, pricing moves, and ecosystem plays to show where demand is heading, why it is changing, and what to do next across high-growth markets and disruptive tech

Real-time reads of user behavior. We track shifting priorities, perceptions of today’s and next-gen services, and provider experience, then pace how fast tech moves from trial to adoption, blending buyer, consumer, and channel inputs with social signals (#WhySwitch, #UX).

Partner with our analyst team to build a custom report designed around your business priorities. From analysing market trends to assessing competitors or crafting bespoke datasets, we tailor insights to your needs.

Supplier Intelligence

Discovery & Profiling

Capacity & Footprint

Performance & Risk

Compliance & Governance

Commercial Readiness

Who Supplies Whom

Scorecards & Shortlists

Playbooks & Docs

Category Intelligence

Definition & Scope

Demand & Use Cases

Cost Drivers

Market Structure

Supply Chain Map

Trade & Policy

Operating Norms

Deliverables

Buyer Intelligence

Account Basics

Spend & Scope

Procurement Model

Vendor Requirements

Terms & Policies

Entry Strategy

Pain Points & Triggers

Outputs

Pricing Analysis

Benchmarks

Trends

Should-Cost

Indexation

Landed Cost

Commercial Terms

Deliverables

Brand Analysis

Positioning & Value Prop

Share & Presence

Customer Evidence

Go-to-Market

Digital & Reputation

Compliance & Trust

KPIs & Gaps

Outputs

Full Research Suite comprises of:

Market outlook & trends analysis

Interviews & case studies

Strategic recommendations

Vendor profiles & capabilities analysis

5-year forecasts

8 regions and 60+ country-level data splits

Market segment data splits

12 months of continuous data updates

DELIVERED AS:

PDF EXCEL ONLINE

Coffee Cherry Market Forecast and Outlook 2025 to 2035

Coffee Filter Paper Market Size and Share Forecast Outlook 2025 to 2035

Coffee Roaster Machine Market Analysis - Size, Share, and Forecast 2025 to 2035

Coffee Beauty Products Market Size and Share Forecast Outlook 2025 to 2035

Coffee Processing Machine Market Size and Share Forecast Outlook 2025 to 2035

Coffee Creamer Market Analysis by Form, Nature, Category, Application and Sales Channel Through 2025 to 2035

Coffee Grounds Market Analysis - Size, Share, and Forecast 2025 to 2035

Coffee Concentrate Market - Size, Share, and Forecast Outlook 2025 to 2035

Coffee Grounds for Packaging Market Analysis - Size, Share, and Forecast Outlook 2025 to 2035

Coffee Bottles Market Insights & Industry Trends 2025 to 2035

Coffee Pouch Market Growth - Demand & Forecast 2025 to 2035

Coffee Bags Market Demand & Forecast Analysis 2025 to 2035

Coffee Gummy Market Analysis by sales channel, application and region Through 2025 to 2035

Coffee Syrup Market Analysis by Product type, Application, End User and Packaging Through 2025 to 2035

Coffee Capsules Market Analysis - Growth & Forecast 2025 to 2035

Coffee Bean Grind Machine Market Trends - Growth & Forecast 2025 to 2035

Coffee Extract Market Analysis by Nature, Product, End Use, Formulation, and Region through 2025 to 2035

Market Share Distribution Among Coffee Filter Paper Manufacturers

Coffee Capsules and Pods Market

Coffee Decoction Maker Market

Thank you!

You will receive an email from our Business Development Manager. Please be sure to check your SPAM/JUNK folder too.

Chat With

MaRIA