The agriculture gateway market was valued at USD 31.4 billion in 2025 and is projected to reach USD 59 billion by 2035, reflecting a CAGR of 6.5%. Observing the compound annual growth rate, the market shows steady expansion from USD 33.4 billion in 2026 to USD 55.4 billion in 2034, before reaching the projected value. This growth trajectory highlights the rising adoption of connected solutions that enhance farm management, monitor crop health, and optimize resource utilization.

The CAGR highlights the growing reliance on digital and IoT-based gateways to provide real-time data and operational control, making them central to modern agricultural strategies. The steady year-on-year increments indicate that the market is being reinforced by demand for precision, monitoring, and efficiency across farming operations.

The agriculture gateway market stood at USD 31.4 billion in 2025 and is anticipated to grow to USD 59 billion by 2035, maintaining a CAGR of 6.5%. Year-on-year growth highlights a consistent increase, with values moving from USD 35.6 billion in 2027 to USD 52 billion in 2033. The market is being shaped by the rising adoption of connected farm solutions that enable the monitoring of soil conditions, irrigation systems, and equipment performance. The CAGR demonstrates that stakeholders are increasingly prioritizing gateways that consolidate data streams, support decision-making, and enhance operational oversight. The steady growth suggests that agriculture gateway solutions are becoming indispensable in achieving operational efficiency, risk management, and productivity improvements across modern farms and large-scale agricultural operations.

| Metric | Value |

|---|---|

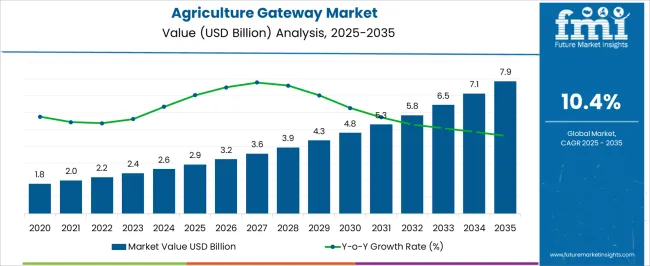

| Agriculture Gateway Market Estimated Value in (2025 E) | USD 2.9 billion |

| Agriculture Gateway Market Forecast Value in (2035 F) | USD 7.9 billion |

| Forecast CAGR (2025 to 2035) | 10.4% |

The agriculture gateway market has been increasingly recognized as a pivotal segment within several broader parent industries, each reflecting significant adoption and operational influence. Within the precision agriculture market, agriculture gateways account for approximately 7.2%, driven by their role in connecting sensors, machines, and field devices to enable efficient data collection, monitoring, and decision-making processes. In the agricultural IoT market, the share is estimated at around 8.1%, reflecting the reliance on gateways for secure, reliable, and real-time data transmission across connected devices in farms and agribusinesses. The farm management systems market records a penetration of roughly 6.5%, as agriculture gateways facilitate seamless integration of software platforms with field operations, allowing enhanced planning, resource allocation, and productivity monitoring.

Within the smart farming equipment market, agriculture gateways hold about 5.9% share, due to their critical function in enabling connectivity and interoperability among automated machinery, sensors, and irrigation systems. In the agri-analytics and data solutions market, the market contributes approximately 5.3%, highlighting the value of gateways in feeding analytical platforms with accurate and timely field data to support operational efficiency and risk management. Collectively, these parent markets indicate that the agriculture gateway market represents around 33% across these industries, emphasizing its strategic relevance in modern farming ecosystems. Its adoption has been driven by the need for connectivity, data reliability, and operational visibility, prompting technology providers and farm operators to integrate agriculture gateways as essential enablers for performance optimization, competitive advantage, and efficient farm management practices.

The agriculture gateway market is advancing steadily, supported by the increasing integration of IoT technologies and data-driven farming practices across global agricultural operations. Hardware and connectivity solutions are being deployed to enhance precision farming, resource optimization, and real-time monitoring of field conditions.

The current landscape reflects strong adoption in both developed and emerging economies, with governments and private stakeholders investing in digital infrastructure for agriculture. Rising demand for scalable and efficient connectivity solutions, coupled with advancements in data analytics, is fostering the use of gateways as central hubs for aggregating and transmitting critical farm data.

The market’s trajectory is also influenced by the growing necessity for cloud-based solutions, enabling remote management and interoperability across devices. As agricultural enterprises continue to prioritize yield optimization and cost efficiency, the adoption of agriculture gateways is expected to expand, driven by supportive policies, increasing rural connectivity, and the rising awareness of technology-enabled farming as a key enabler of sustainable agricultural productivity.

The agriculture gateway market is segmented by component, connectivity, deployment model, technology, application, and geographic regions. By component, agriculture gateway market is divided into Hardware, Software, and Service. In terms of connectivity, agriculture gateway market is classified into Wired and Wireless. Based on deployment model, agriculture gateway market is segmented into Cloud-based and On-premises. By technology, agriculture gateway market is segmented into IoT solutions, Artificial Intelligence and Machine Learning, Big data analytics, and Others. By application, agriculture gateway market is segmented into Precision Farming, Livestock Monitoring, Smart Irrigation, and Others. Regionally, the agriculture gateway industry is classified into North America, Latin America, Western Europe, Eastern Europe, Balkan & Baltic Countries, Russia & Belarus, Central Asia, East Asia, South Asia & Pacific, and the Middle East & Africa.

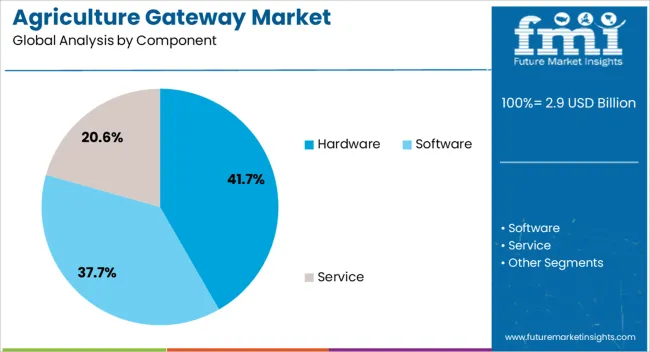

The hardware segment dominates the component category of the agriculture gateway market, accounting for approximately 41.7% of the total share. This leadership is primarily attributed to the essential role of physical gateway devices in enabling seamless data collection and transmission from various agricultural sensors and machinery. The segment’s prominence is reinforced by the durability, scalability, and compatibility of modern hardware solutions, which are designed to withstand harsh environmental conditions common in agricultural settings.

Hardware gateways serve as the backbone of connected farming ecosystems, ensuring reliable connectivity between field devices and data management platforms. Ongoing innovations in ruggedized designs, energy efficiency, and multi-protocol support have further strengthened adoption rates.

Additionally, the growing focus on upgrading legacy systems with advanced gateway hardware is contributing to sustained demand. As agriculture continues its digital transformation, hardware is expected to maintain a pivotal role, underpinned by its indispensable function in linking on-field assets with analytical and decision-making frameworks.

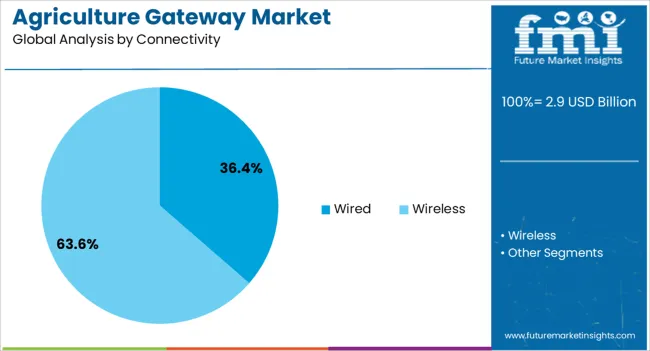

The wired segment leads the connectivity category, holding approximately 36.4% of the agriculture gateway market. This dominance is supported by the reliability, security, and high-speed data transmission capabilities that wired connections offer, which are particularly valued in critical agricultural operations. Wired systems are less susceptible to environmental interference and connectivity disruptions, making them a preferred choice in scenarios where consistent performance is essential.

The segment’s growth has been further driven by established infrastructure in developed regions and the lower susceptibility to cyber vulnerabilities compared to some wireless alternatives. While wireless solutions are gaining popularity for their flexibility, wired connectivity remains integral for fixed-location agricultural applications such as irrigation control, greenhouse monitoring, and livestock facility management.

Additionally, cost-effectiveness over the long term and minimal maintenance requirements have reinforced its adoption. Given its ability to deliver uninterrupted data flow for precision agriculture, the wired segment is expected to retain significant relevance in the market despite the growing expansion of wireless technologies.

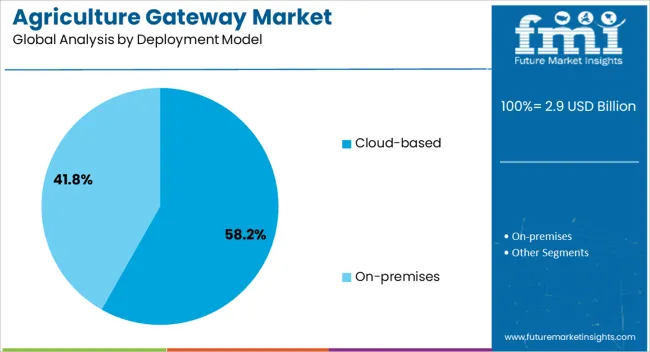

The cloud-based segment is the leading deployment model in the agriculture gateway market, representing approximately 58.2% of the overall share. Its dominance is driven by the scalability, flexibility, and cost-efficiency of cloud infrastructure, which allows agricultural stakeholders to manage and analyze data remotely without heavy investments in on-site storage. Cloud-based deployment supports seamless integration with other digital farming tools, enabling real-time data access and decision-making from virtually any location.

The segment’s growth is reinforced by the increasing penetration of internet connectivity in rural areas and the proliferation of smart farming initiatives. Moreover, cloud solutions facilitate advanced analytics, predictive modeling, and cross-platform interoperability, enhancing operational efficiency for both smallholder farmers and large agribusinesses.

With heightened focus on sustainability and optimized resource utilization, the cloud model aligns well with the need for adaptive and data-centric farming practices. Continuous advancements in cybersecurity, coupled with subscription-based service models, are expected to further strengthen the dominance of cloud-based deployment in the agriculture gateway market.

The agriculture gateway market has been influenced by the rising need for connected farm management, precision monitoring, and remote agricultural data access. Adoption has been driven by increasing digital farming practices, IoT-based farm devices, and enhanced connectivity in rural areas. Opportunities are emerging in cloud-integrated gateways, AI-assisted farm monitoring, and modular solutions for precision agriculture. Trends are being observed in multi-protocol support, real-time data analytics, and energy-efficient gateway deployment, while challenges persist in connectivity limitations, integration complexities, and high deployment costs. Overall, market growth is expected to continue with expanding adoption of smart agriculture solutions.

The demand for agriculture gateways has been strongly influenced by their role in connecting field devices, sensors, and farm management systems. Farmers, agri-tech service providers, and equipment manufacturers have been observed increasingly relying on gateways to collect, transmit, and process real-time agricultural data for improved decision-making. In opinion, this demand has been reinforced by the need for precision agriculture practices that monitor soil health, irrigation, crop growth, and livestock conditions. IoT-enabled devices, including moisture sensors, drones, and automated machinery, require seamless connectivity and reliable data transfer, which agriculture gateways provide. The growing adoption of cloud-based analytics, remote monitoring tools, and automated control systems has further strengthened reliance on these solutions. Overall, demand is being structurally driven by the need for integrated farm management, operational efficiency, and enhanced crop productivity rather than temporary market trends.

Opportunities in the agriculture gateway market have been largely defined by the integration of cloud-based platforms, modular solutions, and data-driven farm management systems. Manufacturers and service providers have been observed developing gateways that support scalable deployment, remote access, and real-time analytics for diverse agricultural applications. In opinion, emerging markets present significant opportunities as digital connectivity expands in rural regions and farmers adopt precision agriculture practices. Cloud-enabled gateways allow for centralized monitoring of multiple fields, predictive maintenance, and data sharing across stakeholders. Modular and multi-protocol gateways provide flexibility for connecting diverse IoT devices, reducing dependency on specific hardware or software ecosystems. These opportunities are further reinforced by collaborations between gateway providers, sensor manufacturers, and agricultural consultancies, creating tailored solutions for crop management, livestock monitoring, and resource optimization. Overall, such opportunities are expected to accelerate adoption and strengthen the digital agriculture ecosystem.

The agriculture gateway market has been shaped by trends in multi-protocol support, energy-efficient designs, and real-time data analytics. Gateways that can seamlessly integrate various communication protocols, including LoRaWAN, NB-IoT, Zigbee, and cellular networks, have been increasingly adopted to ensure connectivity across diverse farm devices. In opinion, energy-efficient and low-power designs are redefining the market as stakeholders aim to deploy gateways in remote areas without constant power sources. Real-time data transmission, cloud connectivity, and compatibility with farm management platforms are strengthening the positioning of agriculture gateways as central components in smart farming. Additionally, edge processing capabilities allow preliminary data analysis locally, reducing latency and enhancing operational efficiency. Overall, these trends are expected to influence product development, competitive strategies, and adoption rates, making flexibility, connectivity, and energy efficiency critical factors for market growth.

The agriculture gateway market has faced ongoing challenges related to limited connectivity in rural areas, complex device integration, and high deployment expenses. Network reliability, signal strength, and compatibility with multiple IoT devices have occasionally constrained the consistent performance of gateways in field conditions. In opinion, integration with legacy farm machinery, heterogeneous sensors, and varied software platforms has created technical barriers for manufacturers and end-users. High capital expenditure associated with advanced gateway solutions can limit adoption among small-scale farmers or price-sensitive markets. Supply chain dependencies for specialized electronic components, firmware updates, and maintenance services have further affected scalability. Addressing these challenges requires strategic partnerships, careful project planning, and standardized protocols for interoperability. Overcoming these barriers is essential to ensure reliable connectivity, seamless integration, and sustained growth in the agriculture gateway market.

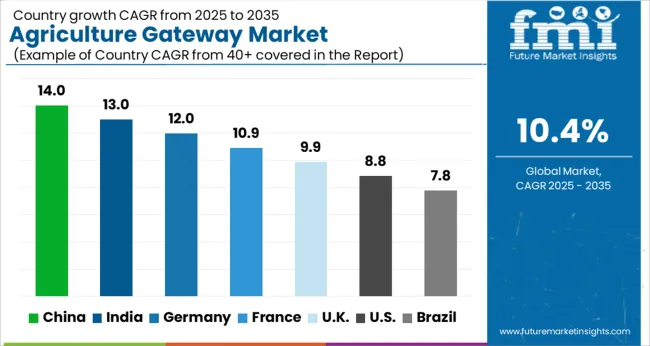

| Country | CAGR |

|---|---|

| China | 14.0% |

| India | 13.0% |

| Germany | 12.0% |

| France | 10.9% |

| UK | 9.9% |

| USA | 8.8% |

| Brazil | 7.8% |

The global agriculture gateway market is projected to grow at a CAGR of 10.4% from 2025 to 2035. China leads with 14% growth, followed by India at 13%, and France at 10.9%. The United Kingdom records 9.9%, while the United States shows 8.8% growth. Expansion is driven by increasing adoption of smart agriculture technologies, demand for efficient farm management systems, and the growing need for real-time data collection and connectivity in farming operations. Emerging markets like China and India experience higher growth due to rising agricultural mechanization, government initiatives supporting precision farming, and increasing digital infrastructure, while developed markets focus on optimizing farm productivity, integrating IoT-based solutions, and enhancing data-driven decision-making processes. This report includes insights on 40+ countries; the top markets are shown here for reference.

The agriculture gateway market in China is growing at a CAGR of 14%, driven by strong adoption of precision agriculture technologies, IoT-based monitoring, and automated farm management systems. Chinese farmers and agribusinesses are increasingly integrating agriculture gateways to enable real-time data collection, remote monitoring, and predictive analytics for crop management. Growth is reinforced by government programs promoting smart farming, technological investments, and large-scale modernization of agricultural practices. Adoption is further accelerated by the increasing use of sensors, connected machinery, and digital platforms to enhance operational efficiency, reduce resource wastage, and improve crop yields. China’s robust agricultural sector and focus on food security create a fertile environment for agriculture gateway deployment.

The agriculture gateway market in India is advancing at a CAGR of 13%, supported by rising demand for smart farming solutions, precision irrigation, and crop monitoring technologies. Indian farmers and agri-entrepreneurs are adopting agriculture gateways to collect real-time field data, monitor soil and crop conditions, and optimize resource utilization. Growth is reinforced by government incentives promoting digital agriculture, increasing use of IoT-based farm equipment, and the expansion of agricultural technology startups. Adoption is also accelerated by the rising need to improve yield, reduce water and fertilizer usage, and support sustainable farming practices across smallholder and commercial farms in India.

The agriculture gateway market in France is projected to grow at a CAGR of 10.9%, driven by adoption of precision agriculture, data-driven farm management, and advanced irrigation systems. French agribusinesses and farmers are integrating gateways to monitor soil health, crop growth, and equipment performance, enabling efficient operations and reduced input costs. Growth is supported by government programs promoting digital agriculture, research initiatives in smart farming, and increasing investment in connected agricultural devices. Adoption is particularly strong in vineyards, large-scale crop farms, and greenhouse operations where real-time data analysis and predictive insights are critical for optimizing productivity.

The agriculture gateway market in the United Kingdom is expanding at a CAGR of 9.9%, fueled by the adoption of connected farm equipment, remote monitoring systems, and precision agriculture solutions. UK farmers and agri-businesses are using agriculture gateways to streamline operations, reduce resource consumption, and make informed decisions through real-time data insights. Growth is supported by digital agriculture initiatives, increasing IoT adoption in agricultural machinery, and focus on improving crop yields and sustainability. Adoption is further reinforced by the integration of gateways with software platforms, cloud analytics, and mobile applications to optimize farm productivity and operational efficiency.

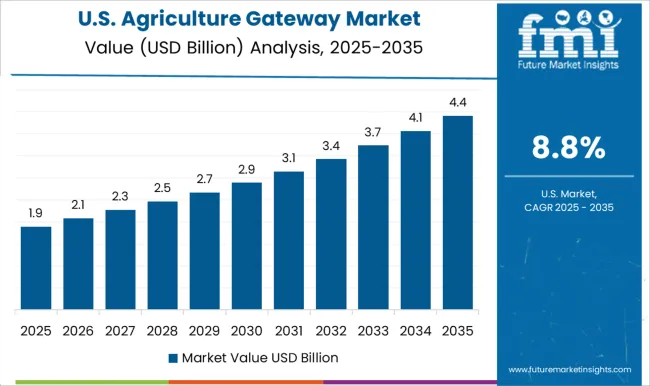

The agriculture gateway market in the United States is growing at a CAGR of 8.8%, supported by the adoption of precision farming technologies, smart irrigation systems, and real-time monitoring solutions. USA farmers and agribusinesses are integrating gateways to enable remote data collection, analyze soil and crop conditions, and optimize resource allocation. Growth is reinforced by the presence of advanced agricultural technology providers, government incentives for digital farming, and the expansion of smart farm infrastructure. Adoption is further enhanced by the need to improve productivity, reduce operational costs, and leverage connected devices and cloud-based analytics for informed decision-making in both large-scale commercial farms and smaller agricultural operations.

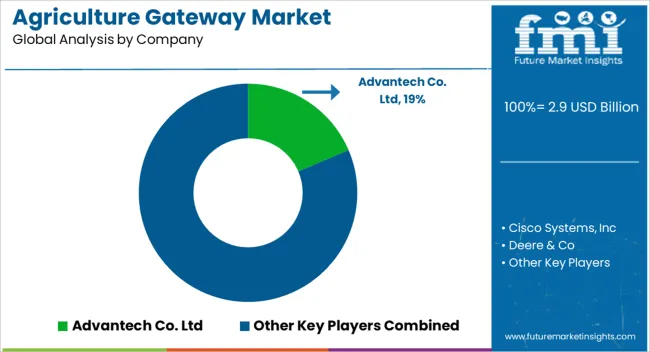

The agriculture gateway market is being shaped by a mix of industrial technology leaders, connectivity specialists, and IoT innovators. Deere & Co and Advantech Co. Ltd are being positioned as front-runners through robust hardware platforms, reliable connectivity, and integration with farm management systems that optimize operational efficiency. Their strategy is being executed with scalable designs, modular deployment, and compatibility with diverse sensors, enabling data-driven decision-making across crop, livestock, and irrigation applications. Cisco Systems, Huawei Technologies, and Kerlink are being recognized for network-focused solutions, emphasizing secure, low-latency, and long-range communication for smart farms.

Libelium Comunicaciones Distribuidas, SensoTerra, Telit Cinterion, and Ubidots are being directed toward IoT-enabled gateways, offering seamless integration with cloud analytics, remote monitoring, and precision agriculture tools. Competition is being defined by connectivity reliability, ease of integration, and multi-protocol compatibility, while market leadership is reinforced through technical support, durability, and proven performance in varied agricultural environments. Product brochures are being curated as compact, persuasive references to convey technical capability, integration flexibility, and field performance. Deere & Co and Advantech brochures highlight device specifications, sensor compatibility, and deployment case studies, using visuals to simplify complex system architectures.

Cisco, Huawei, and Kerlink brochures emphasize secure networks, data throughput, and real-time monitoring, combining diagrams with performance metrics. Libelium, SensoTerra, Telit, and Ubidots brochures focus on IoT connectivity, cloud integration, and scalable sensor management. Each brochure is being structured as a standalone reference, blending concise specifications, visual schematics, and application scenarios. The result is a persuasive portfolio that ensures agriculture gateway offerings are communicated with clarity, credibility, and immediate decision-making value for farmers, agritech providers, and system integrators.

| Item | Value |

|---|---|

| Quantitative Units | USD 2.9 Billion |

| Component | Hardware, Software, and Service |

| Connectivity | Wired and Wireless |

| Deployment Model | Cloud-based and On-premises |

| Technology | IoT solutions, Artificial Intelligence and Machine Learning, Big data analytics, and Others |

| Application | Precision Farming, Livestock Monitoring, Smart Irrigation, and Others |

| Regions Covered | North America, Europe, Asia-Pacific, Latin America, Middle East & Africa |

| Country Covered | United States, Canada, Germany, France, United Kingdom, China, Japan, India, Brazil, South Africa |

| Key Companies Profiled | Advantech Co. Ltd, Cisco Systems, Inc, Deere & Co, Huawei Technologies Co. Ltd, Kerlink, Libelium Comunicaciones Distribuidas S.L, SensoTerra, Telit Cinterion, and Ubidots |

| Additional Attributes | Dollar sales by gateway type (cellular, LPWAN, satellite) and application (precision farming, livestock monitoring, irrigation management, soil and crop monitoring) are key metrics. Trends include rising demand for connected farm solutions, growth in IoT adoption in agriculture, and increasing use of real-time data for operational efficiency. Regional deployment, technological advancements, and regulatory support are driving market growth. |

The global agriculture gateway market is estimated to be valued at USD 2.9 billion in 2025.

The market size for the agriculture gateway market is projected to reach USD 7.9 billion by 2035.

The agriculture gateway market is expected to grow at a 10.4% CAGR between 2025 and 2035.

The key product types in agriculture gateway market are hardware, _sensors, _actuators, _others, software, _analytics, _control systems, _data management, service, _managed and _professional.

In terms of connectivity, wired segment to command 36.4% share in the agriculture gateway market in 2025.

Our Research Products

The "Full Research Suite" delivers actionable market intel, deep dives on markets or technologies, so clients act faster, cut risk, and unlock growth.

The Leaderboard benchmarks and ranks top vendors, classifying them as Established Leaders, Leading Challengers, or Disruptors & Challengers.

Locates where complements amplify value and substitutes erode it, forecasting net impact by horizon

We deliver granular, decision-grade intel: market sizing, 5-year forecasts, pricing, adoption, usage, revenue, and operational KPIs—plus competitor tracking, regulation, and value chains—across 60 countries broadly.

Spot the shifts before they hit your P&L. We track inflection points, adoption curves, pricing moves, and ecosystem plays to show where demand is heading, why it is changing, and what to do next across high-growth markets and disruptive tech

Real-time reads of user behavior. We track shifting priorities, perceptions of today’s and next-gen services, and provider experience, then pace how fast tech moves from trial to adoption, blending buyer, consumer, and channel inputs with social signals (#WhySwitch, #UX).

Partner with our analyst team to build a custom report designed around your business priorities. From analysing market trends to assessing competitors or crafting bespoke datasets, we tailor insights to your needs.

Supplier Intelligence

Discovery & Profiling

Capacity & Footprint

Performance & Risk

Compliance & Governance

Commercial Readiness

Who Supplies Whom

Scorecards & Shortlists

Playbooks & Docs

Category Intelligence

Definition & Scope

Demand & Use Cases

Cost Drivers

Market Structure

Supply Chain Map

Trade & Policy

Operating Norms

Deliverables

Buyer Intelligence

Account Basics

Spend & Scope

Procurement Model

Vendor Requirements

Terms & Policies

Entry Strategy

Pain Points & Triggers

Outputs

Pricing Analysis

Benchmarks

Trends

Should-Cost

Indexation

Landed Cost

Commercial Terms

Deliverables

Brand Analysis

Positioning & Value Prop

Share & Presence

Customer Evidence

Go-to-Market

Digital & Reputation

Compliance & Trust

KPIs & Gaps

Outputs

Full Research Suite comprises of:

Market outlook & trends analysis

Interviews & case studies

Strategic recommendations

Vendor profiles & capabilities analysis

5-year forecasts

8 regions and 60+ country-level data splits

Market segment data splits

12 months of continuous data updates

DELIVERED AS:

PDF EXCEL ONLINE

Agriculture Solar Water Pumps Market Size and Share Forecast Outlook 2025 to 2035

Agriculture Fertilizer Spreader Market Size and Share Forecast Outlook 2025 to 2035

Agriculture Packaging Market Size and Share Forecast Outlook 2025 to 2035

Agriculture Analytics Market Size and Share Forecast Outlook 2025 to 2035

Agriculture IoT Market Size and Share Forecast Outlook 2025 to 2035

Agriculture Enzyme Market Analysis – Size, Share, and Forecast Outlook 2025 to 2035

Market Share Breakdown of Agriculture Packaging Solutions

Agriculture Bags Market

Agriculture Testing Services Market Growth – Trends & Forecast 2018-2028

Non-Agriculture Smart Irrigation Controllers Market Size and Share Forecast Outlook 2025 to 2035

Smart Agriculture Market Size and Share Forecast Outlook 2025 to 2035

Ai In Agriculture Market Size and Share Forecast Outlook 2025 to 2035

Smart Agriculture Solution Market Analysis by Component Type, Application, and Region Through 2035

Egress Gateway Market Size and Share Forecast Outlook 2025 to 2035

Precision Agriculture Market

Secure Web Gateway Market Analysis – Growth & Forecast 2019-2029

Regenerative Agriculture Market Size and Share Forecast Outlook 2025 to 2035

Blockchain in Agriculture and Food Supply Chain Market Size and Share Forecast Outlook 2025 to 2035

Blockchain in Agriculture Market Analysis – Size, Share & Forecast 2024-2034

Crypto Payment Gateways Market Insights - Trends & Growth 2025 to 2035

Thank you!

You will receive an email from our Business Development Manager. Please be sure to check your SPAM/JUNK folder too.

Chat With

MaRIA