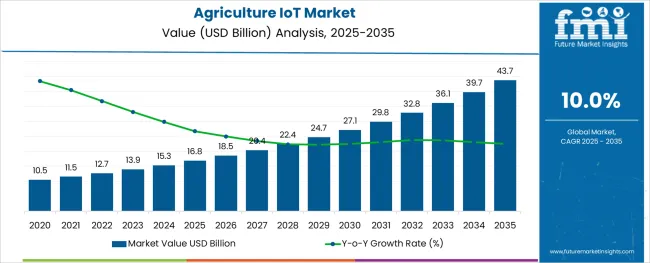

The Agriculture IoT Market is estimated to be valued at USD 16.8 billion in 2025 and is projected to reach USD 43.7 billion by 2035, registering a compound annual growth rate (CAGR) of 10.0% over the forecast period.

The agriculture IoT market is expanding rapidly as farmers and agribusinesses adopt technology to enhance productivity and sustainability. Growing concerns over resource management, climate change, and food security have pushed for digital transformation in agriculture. The integration of IoT devices enables real-time data collection and decision-making to optimize crop yields, water use, and livestock health.

Industry insights highlight the increasing deployment of sensing and monitoring systems that provide precise environmental data and equipment status. Government initiatives supporting smart farming and increasing investment in rural digital infrastructure have also boosted market growth.

Looking ahead, the market is expected to benefit from advancements in sensor technology, data analytics, and wireless communication, enabling more sophisticated and scalable agriculture solutions. Segmental growth is anticipated to be led by hardware components, sensing and monitoring systems, and livestock monitoring applications reflecting their pivotal roles in smart farming.

The market is segmented by Component, System, and Application and region. By Component, the market is divided into Hardware and Software. In terms of System, the market is classified into Sensing and monitoring system, Automation and control system, and Others. Based on Application, the market is segmented into Livestock Monitoring, Smart Greenhouse, Precision Farming, and Others. Regionally, the market is classified into North America, Latin America, Western Europe, Eastern Europe, Balkan & Baltic Countries, Russia & Belarus, Central Asia, East Asia, South Asia & Pacific, and the Middle East & Africa.

The market is segmented by Component, System, and Application and region. By Component, the market is divided into Hardware and Software. In terms of System, the market is classified into Sensing and monitoring system, Automation and control system, and Others. Based on Application, the market is segmented into Livestock Monitoring, Smart Greenhouse, Precision Farming, and Others. Regionally, the market is classified into North America, Latin America, Western Europe, Eastern Europe, Balkan & Baltic Countries, Russia & Belarus, Central Asia, East Asia, South Asia & Pacific, and the Middle East & Africa.

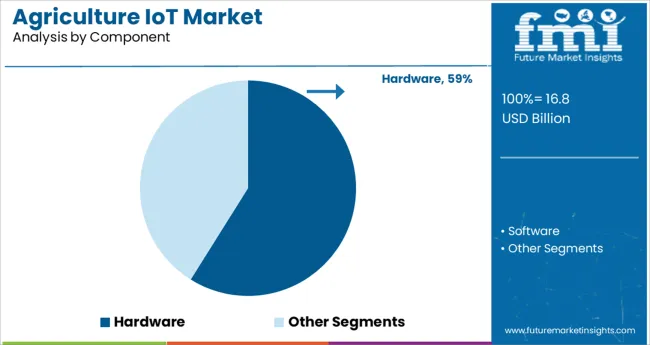

The Hardware segment is projected to hold 58.9% of the agriculture IoT market revenue in 2025, maintaining its dominance. This segment’s growth is driven by the critical role hardware devices play in data acquisition and communication within smart agriculture systems. Sensors, gateways, GPS modules, and control units form the backbone of IoT infrastructure.

Increased adoption of rugged and energy-efficient hardware tailored for harsh agricultural environments has supported the segment’s expansion. Additionally, advances in miniaturization and cost reduction have made hardware solutions more accessible to small and medium-sized farms.

As smart farming practices become widespread, the demand for reliable and robust hardware components is expected to sustain the segment’s market leadership.

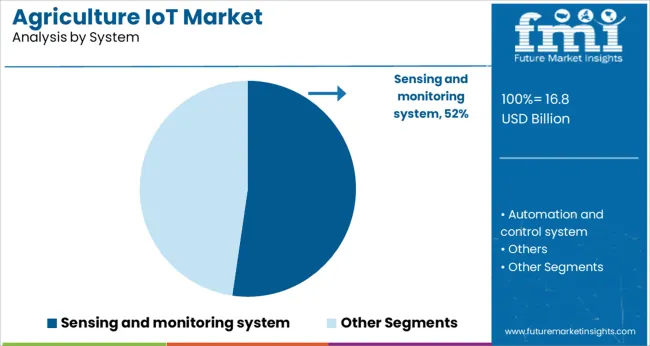

The Sensing and Monitoring System segment is anticipated to generate 52.3% of the market revenue in 2025, positioning it as the leading system type. Growth in this segment stems from the necessity to continuously track environmental and biological parameters such as soil moisture, temperature, humidity, and animal health metrics.

These systems enable precise resource management and early detection of diseases or stress factors. Real-time monitoring supports timely interventions that improve yield quality and reduce losses.

Technological improvements in sensor accuracy and wireless data transmission have further enhanced system effectiveness. As agriculture moves toward automation and data-driven decision-making, sensing and monitoring systems will continue to be essential components of IoT deployments.

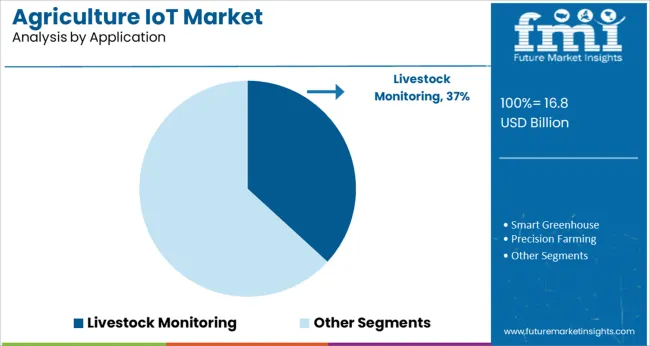

The Livestock Monitoring segment is projected to hold 36.8% of the agriculture IoT market revenue in 2025, reflecting its prominence as a key application. The segment’s growth is influenced by the need for better animal health management, feed optimization, and productivity tracking.

IoT solutions offer continuous monitoring of vital signs, movement patterns, and reproductive status, enabling proactive health interventions. Increasing livestock populations and the demand for high-quality animal products have motivated farmers to adopt such technologies.

The ability to improve animal welfare and reduce operational costs has been a significant driver. With growing awareness of traceability and food safety regulations, the Livestock Monitoring application is poised to remain a major growth area within agriculture IoT.

Greenhouse farming helps to increase agricultural, fruit, and vegetable yields. In greenhouse farming, the ambient conditions are manually regulated, resulting in production losses and a less effective strategy. Smart greenhouses, which utilise IoT to monitor and manage the environment, reduce the need for physical intervention.

Different sensors are utilised to manage the environment depending on the need. Light levels, humidity, pressure, and temperature are all measured by IoT sensors. Through the usage of Wi-Fi, the sensors operate the actuators to regulate the heating, turn on the light, and open a window.

Precision farming is a method of making agricultural procedures more precise and regulated in order to raise livestock and cultivate crops. The utilisation of information technology and objects such as sensors, robots, control systems, automated hardware, and so on are crucial components of this strategy.

VRI optimization, which helps to boost yields and increase water usage efficiency, is one of the products and services offered by Crop Metrics, a precision agricultural company.

Owing to the most farmer groups are unfamiliar with the term 'internet of things' adoption and sales of agriculture IoT are low. Farmers are not provided adequate training in the demand for agriculture IoT, which limits the growth of the agriculture IoT industry.

Geographically, North America and Europe have a major in the agriculture IoT market share, owing to factors such as rising food trade value. Furthermore, the Asia Pacific industrial sales of agriculture IoT systems are predicted to expand as the region's governments embrace precision farming. Agriculture IoT market prospects are emerging in the Middle East and Africa.

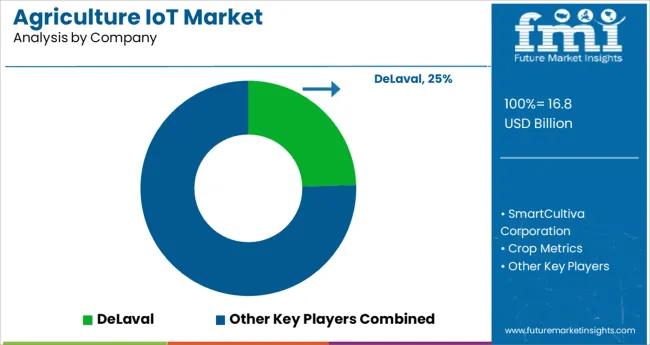

DeLaval, SmartCultiva Corporation, Crop Metrics, Raven Industries, and AeroFarms are among the leading companies in the agriculture IoT industry.

Recent developments in the Agriculture IoT Market:

| Report Attribute | Details |

|---|---|

| Growth rate | CAGR of 10% from 2025 to 2035 |

| Base year for estimation | 2024 |

| Historical data | 2020 to 2024 |

| Forecast period | 2025 to 2035 |

| Quantitative units | Revenue in billion, volume in kilotons, and CAGR from 2025 to 2035 |

| Report coverage | Revenue forecast, volume forecast, company ranking, competitive landscape, growth factors, and trends, Pricing Analysis |

| Segments covered | Component, system, application, region |

| Regional scope | North America; Western Europe; Eastern Europe; Middle East; Africa; ASEAN; South Asia; Rest of Asia; Australia and New Zealand |

| Country scope | USA, Canada, Mexico, Germany, UK, France, Italy, Spain, Russia, Belgium, Poland, Czech Republic, China, India, Japan, Australia, Brazil, Argentina, Colombia, Saudi Arabia, UAE, Iran, South Africa |

| Key companies profiled | DeLaval; SmartCultiva Corporation; Crop Metrics; Raven Industries; and AeroFarms. |

| Customization scope | Free report customization (equivalent to up to 8 analysts working days) with purchase. Addition or alteration to country, regional & segment scope. |

| Pricing and purchase options | Avail of customized purchase options to meet your exact research needs. |

The global agriculture iot market is estimated to be valued at USD 16.8 billion in 2025.

It is projected to reach USD 43.7 billion by 2035.

The market is expected to grow at a 10.0% CAGR between 2025 and 2035.

The key product types are hardware and software.

sensing and monitoring system segment is expected to dominate with a 52.3% industry share in 2025.

Full Research Suite comprises of:

Market outlook & trends analysis

Interviews & case studies

Strategic recommendations

Vendor profiles & capabilities analysis

5-year forecasts

8 regions and 60+ country-level data splits

Market segment data splits

12 months of continuous data updates

DELIVERED AS:

PDF EXCEL ONLINE

Agriculture Gateway Market Size and Share Forecast Outlook 2025 to 2035

Agriculture Solar Water Pumps Market Size and Share Forecast Outlook 2025 to 2035

Agriculture Fertilizer Spreader Market Size and Share Forecast Outlook 2025 to 2035

Agriculture Packaging Market Size and Share Forecast Outlook 2025 to 2035

Agriculture Analytics Market Size and Share Forecast Outlook 2025 to 2035

Agriculture Enzyme Market Analysis – Size, Share, and Forecast Outlook 2025 to 2035

Market Share Breakdown of Agriculture Packaging Solutions

Agriculture Bags Market

Agriculture Testing Services Market Growth – Trends & Forecast 2018-2028

Non-Agriculture Smart Irrigation Controllers Market Size and Share Forecast Outlook 2025 to 2035

Smart Agriculture Market Size and Share Forecast Outlook 2025 to 2035

Ai In Agriculture Market Size and Share Forecast Outlook 2025 to 2035

Smart Agriculture Solution Market Analysis by Component Type, Application, and Region Through 2035

Precision Agriculture Market

Regenerative Agriculture Market Size and Share Forecast Outlook 2025 to 2035

Blockchain in Agriculture and Food Supply Chain Market Size and Share Forecast Outlook 2025 to 2035

Blockchain in Agriculture Market Analysis – Size, Share & Forecast 2024-2034

Controlled Environment Agriculture (CEA) Market Size and Share Forecast Outlook 2025 to 2035

IoT Network Management Market Size and Share Forecast Outlook 2025 to 2035

IoT Spend by Logistics Market Size and Share Forecast Outlook 2025 to 2035

Thank you!

You will receive an email from our Business Development Manager. Please be sure to check your SPAM/JUNK folder too.

Chat With

MaRIA