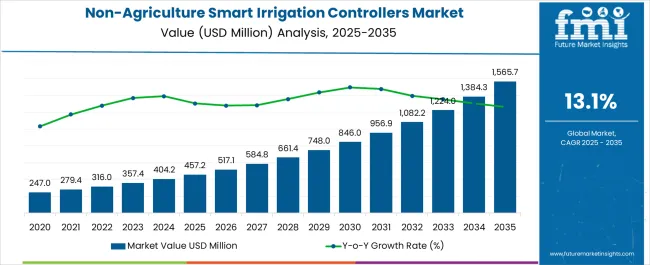

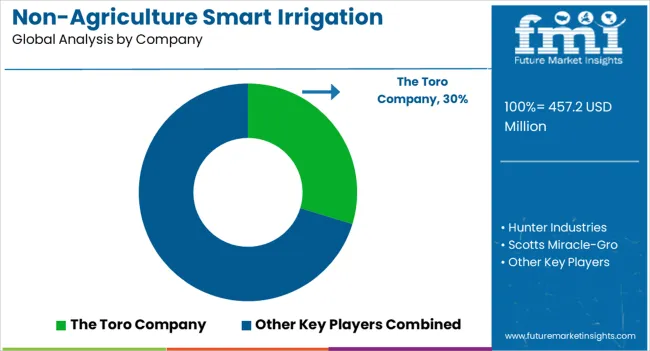

The Non-Agriculture Smart Irrigation Controllers Market is estimated to be valued at USD 457.2 million in 2025 and is projected to reach USD 1565.7 million by 2035, registering a compound annual growth rate (CAGR) of 13.1% over the forecast period.

| Metric | Value |

|---|---|

| Non-Agriculture Smart Irrigation Controllers Market Estimated Value in (2025 E) | USD 457.2 million |

| Non-Agriculture Smart Irrigation Controllers Market Forecast Value in (2035 F) | USD 1565.7 million |

| Forecast CAGR (2025 to 2035) | 13.1% |

The non agriculture smart irrigation controllers market is expanding steadily as industries and commercial establishments adopt intelligent water management solutions to reduce operational costs and support sustainability goals. Rising concerns over water scarcity, combined with regulatory mandates promoting efficient resource usage, are accelerating adoption across industrial landscapes.

The integration of IoT, cloud connectivity, and sensor based technologies is enabling real time monitoring and automated irrigation scheduling, improving both efficiency and accountability. Increasing investments in smart infrastructure and corporate environmental commitments are further driving market demand.

The outlook remains positive as organizations prioritize cost savings, environmental compliance, and scalable water management systems, making smart irrigation controllers a critical component of industrial operations worldwide.

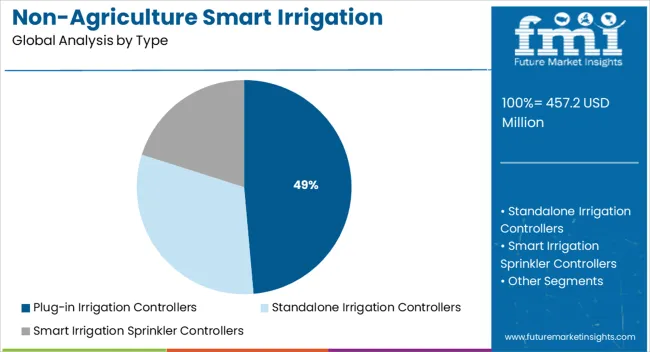

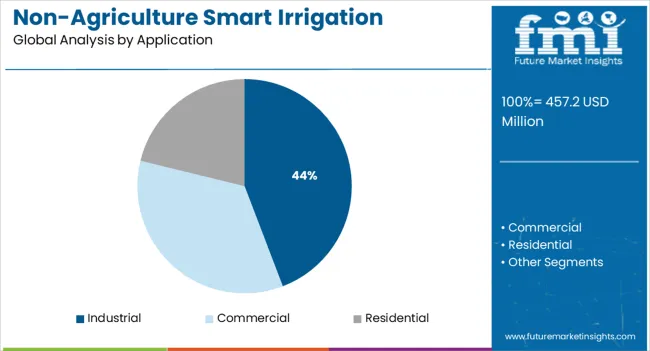

The market is segmented by Type and Application and region. By Type, the market is divided into Plug-in Irrigation Controllers, Standalone Irrigation Controllers, and Smart Irrigation Sprinkler Controllers. In terms of Application, the market is classified into Industrial, Commercial, and Residential. Regionally, the market is classified into North America, Latin America, Western Europe, Eastern Europe, Balkan & Baltic Countries, Russia & Belarus, Central Asia, East Asia, South Asia & Pacific, and the Middle East & Africa.

The plug in irrigation controllers segment is anticipated to hold 48.60% of the total revenue by 2025 within the type category, establishing it as the leading product segment. Its dominance is attributed to ease of installation, cost efficiency, and flexibility in integration with existing irrigation systems.

Plug in controllers are widely preferred in industrial environments where scalable solutions are required without significant infrastructure modifications. The ability to deliver automated scheduling, remote monitoring, and compatibility with advanced sensors has further supported their adoption.

Continuous improvements in connectivity features and simplified user interfaces have strengthened the segment’s role as the most relied upon product type in the market.

The industrial application segment is expected to account for 44.20% of total market revenue by 2025, positioning it as the most significant application area. This growth is driven by rising emphasis on sustainability, water conservation, and operational cost optimization in industrial facilities.

Industries are increasingly deploying smart irrigation systems to maintain landscapes, cooling systems, and other non agricultural water dependent processes with higher efficiency. The demand is further reinforced by regulatory requirements for responsible water use and corporate commitments to environmental stewardship.

The ability of smart controllers to reduce waste, enhance accountability, and integrate with facility management systems has ensured their strong presence in industrial applications, making this segment the key driver of market expansion.

Increasing demand for plug-in irrigation controllers, standalone irrigation controllers, and smart irrigation sprinkler controllers in smart cities for tracking the water quality is the major factor underpinning the growth in the market.

Major concern regarding water wastage is overwatering caused by ineffectiveness in traditional irrigation systems and hence adoption of the smart irrigation controllers in smart cities will boost the market.

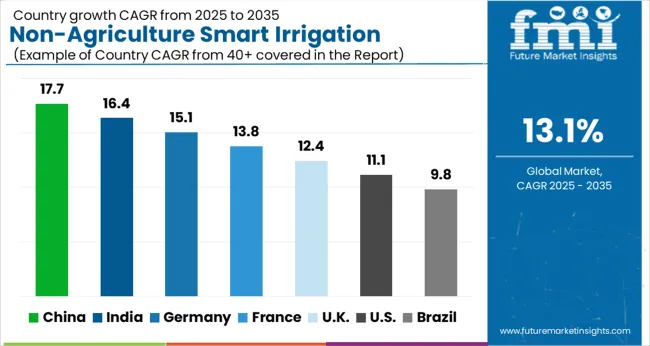

As per Future Market Insights (FMI), the non-agriculture smart irrigation controllers demand is estimated to rise at 13.1% CAGR between 2025 to 2035 in comparison with 11.0% CAGR registered during 2020 to 2025.

Increasing development of smart cities will result in high demand for non-agriculture smart irrigation controllers. Some developing countries such as China, Japan, and India have shown considerable interest in the development of smart cities. Thus, the growth of smart cities is estimated to create opportunities for non-agriculture smart irrigation controller market players. The global non-agriculture smart irrigation controller’s industry is anticipated to witness an increase in revenue from ~USD 457.2 Million in 2025 to ~USD 1,227.5 Million by 2035.

Designing of the irrigation controllers for management of watering schedules and sprinkler management in industrial sector such as golf courses is improving.

Smart irrigation controllers’ manufacturers are also trying to integrate other functionalities to make smart irrigation controllers a single point of control of the whole garden or golf course or stadium.

It also offers features such as lighting control, embedded in irrigation controllers and moisture sensors by key manufactures.

Some of the prominent manufacturers are also focusing on launching new products, especially for gold courses. For instance, The Toro Company has launched new smart irrigation field controllers for golf courses, named Toro Lynx Smart Hub.

The Smart Hub provides incremental benefits related to security, programmability, and sensing. It also has standalone functioning capabilities, and can function even if the central computer is offline.

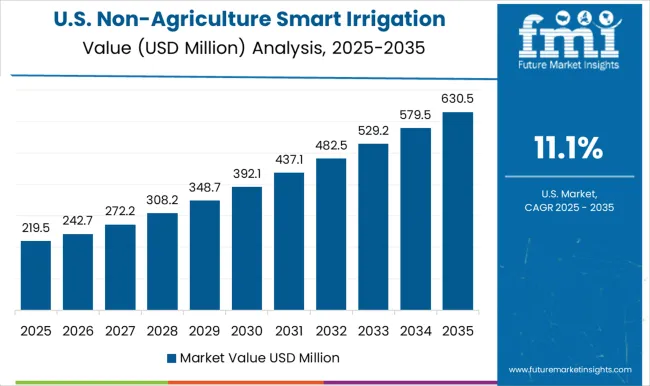

Need for Smart Irrigation Systems in Industrial Sector to Augment the Non-Agriculture Smart Irrigation Controllers Sales in the USA

North America is expected to remain one of the most attractive markets during the forecast period, finds FMI. According to the study, the USA is projected to account for nearly 83% in the North America market through 2035.

The USA is the largest market for non-agriculture smart irrigation controllers due to favourable government initiatives for promoting water conservation. Strong presence of non-agriculture smart irrigation controller’s solution providers is also aiding the growth in the USA market.

Increasing demand for smart irrigation in industrial and residential sectors is expected to drive the non- agriculture smart irrigation controllers demand in the USA

Further, advantages and benefits offered by smart irrigation controllers such as business productivity, real-time farm conditions, and improved field productivity are the factors boosting the USA non- agriculture smart irrigation controller market.

Development of IoT-based Smart Irrigation System in France to Propel the Growth

Demand for non-agriculture smart irrigation controllers in France is expected to rise at 14.8% CAGR over the forecast period. France economy is increasingly powered by Internet of Things (IoT) based smart irrigation system.

IoT based smart irrigation system can shift the agricultural domain from manual and static to intelligent and dynamic, resulting in higher production with less human monitoring.

Governments in European region are increasing their investments in the ag-tech sector. Development of smart home based irrigation controllers is one of the factors driving the sales in France.

Furthermore, increasing demand for a multi-layered security approach in banking and financial institutions is anticipated to drive the growth in the market.

Need for Precision Farming and Adoption of Remote Sensing Technology in India Giving Tailwinds to Growth

Sales of non-agriculture smart irrigation controllers in India are estimated to increase at 22.0% CAGR between 2025 and 2035. The market is projected to witness significant growth due to growing need for water conservation, increasing adoption of precision farming, and preference for modern agricultural practice.

Extensive adoption of automated and mechanized irrigation systems, such as drip and sprinkler irrigation systems has led to a higher demand for smart irrigation controllers in India.

Furthermore, the requirement for smart irrigation controller is high in India as there are stringent government regulation on water-conservation.

Increasing research and development (R&D) activities for energy efficiency and increasing penetration of remote sensing technology across India is fuelling the demand for non-agriculture smart irrigation controllers.

| Country | BPS Change (H2'22 (O) - H2'22 (P)) |

|---|---|

| USA | (+)28 |

| Germany | (+)31 |

| Japan | (+)22 |

| India | (+)19 |

| China | (+)23 |

Increasing water scarcity issues in U.S. drove the BPS change of (+)28 BPS units for H2’22(O)-H2’22(P) for the market because of the growing demand and government incentives for water-saving smart irrigation controllers. Germany saw a BPS change of (+)31 units because of the growth in droughts because of the same reason.

Japan witnessed a BPS change of (+)22 units because of implementation of precision farming solutions, allowing non-agriculture irrigation controller market to grow. Government initiatives to conserve water and the rising awareness of smart irrigation technology allowed the Indian market to witness a BPS change of (+)19 units.

Urbanization and the need for green spaces contribute to the growth of non-agriculture smart irrigation controller market in China, allowing a BPS change of (+)23 units.

Need for Wi-Fi Sprinkler Controller and Smart Irrigation Systems to Increase Standalone Irrigation Controllers Sales

As per FMI, the standalone irrigation controllers segment is expected to showcase higher market share in the coming years. This segment is predicted to account for an exponential share of 58.0% by the end of 2035.

Growth in the segment is underpinned by increasing demand for standalone irrigation controllers in industrial, commercial, and residential applications.

These controllers help to keep landscape healthy and beautiful, improve regional water supply management, cost-effective, and have compatibility with Wi-Fi. Such benefits are expected to drive the demand for non-agriculture smart irrigation controllers during the forecast period.

Non-agriculture smart irrigation controllers’ manufacturers are focusing on new standalone irrigation controllers’ product development to increase business revenue. They are also adopting innovation strategies, enabling vendors to reach new potential customers in emerging markets.

Water Conservation and Adoption of Sprinkler Controllers in Industrial Sector to Drive Sales

On the basis of application, non-agriculture smart irrigation controllers market is sub-segmented into industrial, commercial, and residential.

Non-agriculture smart irrigation controllers are continuously being adopted for industrial applications such as control watering schedules of sprinklers in the selected area, providing real time updates to manage and direct water distribution and usage, and others.

Industrial application segment is set to expand at a CAGR of 13.9% from 2025 to 2035. Growth in the segment is driven by factors such as growing initiatives undertaken by governments across the globe to promote water conservation, increased farming operating costs, and reduced cost of sensors and controllers.

Surging emphasis on improved farm productivity and profits using non-agriculture smart irrigation controllers will also propel the sales over the coming years.

Key players are partnering with end-users and integrating advanced technologies such as Internet of Things (IoT) to upgrade its smart irrigation controller products and gain revenue. They are also focusing on innovation and upgradation of product by offering solution for manufacturing of personalized and uses case specific products for diverse application. For instance:

| Attribute | Details |

|---|---|

| Forecast Period | 2025 to 2035 |

| Historical Data Available for | 2020 to 2025 |

| Market Analysis | USD Million for Value |

| Key Regions Covered | North America; Latin America; Europe; South Asia & Pacific; East Asia and the Middle East & Africa |

| Key Countries Covered | USA, Canada, Germany, United Kingdom, France, Italy, Spain, Russia, China, Japan, South Korea, India, Australia & New Zealand, GCC Countries, Turkey and South Africa |

| Key Segments Covered | Type, Application and Region |

| Key Companies Profiled | The Toro Company; Hunter Industries; Scotts Miracle-Gro; Rain Bird Corporation; Skydrop, LLC; Mottech Water Solutions Ltd.; Holman Industries; FlyBird Farm Innovations Pvt. Ltd; Rachio Inc.; Weathermatic; HydroPoint Data Systems, Inc.; Galcon Ltd.; Banyan Water, Inc.; Netafim; Orbit Irrigation Products LLC; Nelson Irrigation Corporation |

| Report Coverage | Market Forecast, Company Share Analysis, Competition Intelligence, DROT Analysis, Market Dynamics and Challenges, and Strategic Growth Initiatives |

| Customization & Pricing | Available upon Request |

The global non-agriculture smart irrigation controllers market is estimated to be valued at USD 457.2 million in 2025.

The market size for the non-agriculture smart irrigation controllers market is projected to reach USD 1,565.7 million by 2035.

The non-agriculture smart irrigation controllers market is expected to grow at a 13.1% CAGR between 2025 and 2035.

The key product types in non-agriculture smart irrigation controllers market are plug-in irrigation controllers, standalone irrigation controllers and smart irrigation sprinkler controllers.

In terms of application, industrial segment to command 44.2% share in the non-agriculture smart irrigation controllers market in 2025.

Our Research Products

The "Full Research Suite" delivers actionable market intel, deep dives on markets or technologies, so clients act faster, cut risk, and unlock growth.

The Leaderboard benchmarks and ranks top vendors, classifying them as Established Leaders, Leading Challengers, or Disruptors & Challengers.

Locates where complements amplify value and substitutes erode it, forecasting net impact by horizon

We deliver granular, decision-grade intel: market sizing, 5-year forecasts, pricing, adoption, usage, revenue, and operational KPIs—plus competitor tracking, regulation, and value chains—across 60 countries broadly.

Spot the shifts before they hit your P&L. We track inflection points, adoption curves, pricing moves, and ecosystem plays to show where demand is heading, why it is changing, and what to do next across high-growth markets and disruptive tech

Real-time reads of user behavior. We track shifting priorities, perceptions of today’s and next-gen services, and provider experience, then pace how fast tech moves from trial to adoption, blending buyer, consumer, and channel inputs with social signals (#WhySwitch, #UX).

Partner with our analyst team to build a custom report designed around your business priorities. From analysing market trends to assessing competitors or crafting bespoke datasets, we tailor insights to your needs.

Supplier Intelligence

Discovery & Profiling

Capacity & Footprint

Performance & Risk

Compliance & Governance

Commercial Readiness

Who Supplies Whom

Scorecards & Shortlists

Playbooks & Docs

Category Intelligence

Definition & Scope

Demand & Use Cases

Cost Drivers

Market Structure

Supply Chain Map

Trade & Policy

Operating Norms

Deliverables

Buyer Intelligence

Account Basics

Spend & Scope

Procurement Model

Vendor Requirements

Terms & Policies

Entry Strategy

Pain Points & Triggers

Outputs

Pricing Analysis

Benchmarks

Trends

Should-Cost

Indexation

Landed Cost

Commercial Terms

Deliverables

Brand Analysis

Positioning & Value Prop

Share & Presence

Customer Evidence

Go-to-Market

Digital & Reputation

Compliance & Trust

KPIs & Gaps

Outputs

Full Research Suite comprises of:

Market outlook & trends analysis

Interviews & case studies

Strategic recommendations

Vendor profiles & capabilities analysis

5-year forecasts

8 regions and 60+ country-level data splits

Market segment data splits

12 months of continuous data updates

DELIVERED AS:

PDF EXCEL ONLINE

Smart Aerial Work Robots Market Size and Share Forecast Outlook 2025 to 2035

Smart Bladder Scanner Market Size and Share Forecast Outlook 2025 to 2035

Smart School Bus Platform Market Size and Share Forecast Outlook 2025 to 2035

Smart Home Wireless Smoke Detector Market Size and Share Forecast Outlook 2025 to 2035

Smart Bus Platform Market Size and Share Forecast Outlook 2025 to 2035

Smart Vision Processing Chips Market Size and Share Forecast Outlook 2025 to 2035

Smart Touch Screen Scale Market Size and Share Forecast Outlook 2025 to 2035

Smart Magnetic Drive Conveyor System Market Size and Share Forecast Outlook 2025 to 2035

Smart Wheelchair market Size and Share Forecast Outlook 2025 to 2035

Smart Mining Technologies Market Size and Share Forecast Outlook 2025 to 2035

Smart Parking Market Size and Share Forecast Outlook 2025 to 2035

Smart Digital Valve Positioner Market Forecast and Outlook 2025 to 2035

Smart Card IC Market Size and Share Forecast Outlook 2025 to 2035

Smart-Tag Inlay Inserters Market Analysis - Size and Share Forecast Outlook 2025 to 2035

Smart TV Market Forecast and Outlook 2025 to 2035

Smart/AI Toy Market Size and Share Forecast Outlook 2025 to 2035

Smart Locks Market Size and Share Forecast Outlook 2025 to 2035

Smart Sprinkler Controller Market Size and Share Forecast Outlook 2025 to 2035

Smart Indoor Gardening System Market Size and Share Forecast Outlook 2025 to 2035

Smart Building Delivery Robot Market Size and Share Forecast Outlook 2025 to 2035

Thank you!

You will receive an email from our Business Development Manager. Please be sure to check your SPAM/JUNK folder too.

Chat With

MaRIA