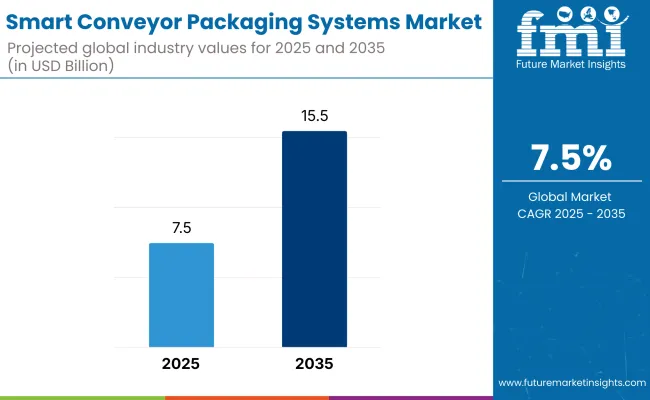

The smart conveyor packaging systems market is expected to grow from USD 7.5 billion in 2025 to USD 15.5 billion by 2035, resulting in a total increase of USD 8.0 billion over the forecast decade. This represents a 106.7% total expansion, with the market advancing at a compound annual growth rate (CAGR) of 7.5%. Over ten years, the market grows by a 2.1 multiple.

| Metric | Value |

|---|---|

| Industry Size (2025E) | USD 7.5 billion |

| Industry Value (2035F) | USD 15.5 billion |

| CAGR (2025 to 2035) | 7.5% |

In the first five years (2025-2030), the market progresses from USD 7.5 billion to USD 10.7 billion, contributing USD 3.2 billion, or 40.0% of total decade growth. This phase is shaped by rising automation adoption in food, beverage, and e-commerce packaging lines. Demand is driven by the need for higher throughput, minimal downtime, and improved handling for diverse product types.

In the second half (2030-2035), the market grows from USD 10.7 billion to USD 15.5 billion, adding USD 4.8 billion, or 60.0% of the total growth. This acceleration is supported by AI-based predictive maintenance, IoT-enabled tracking, and modular conveyor designs. Sustainability goals, including energy-efficient motors and recyclable belt materials, further enhance adoption, positioning smart conveyor systems as central to next-generation packaging operations.

From 2020 to 2024, the smart conveyor packaging systems market grew from USD 6.1 billion to USD 7.2 billion, driven by automation in FMCG, food & beverage, and e-commerce fulfillment. Over 65% of revenue was held by OEMs integrating robotics, vision inspection, and variable-speed controls. Leaders such as Bosch Rexroth, Interroll, and Dorner focused on modularity, hygiene compliance, and energy efficiency.

Competitive differentiation hinged on sensor-enabled load balancing, predictive motor maintenance, and rapid changeover capabilities, while AI-powered optimization was often a secondary feature. Service-based monitoring contracts contributed under 18% of value as most clients invested in capital-intensive upgrades over OPEX-led models.

By 2035, the smart conveyor packaging systems market will reach USD 15.5 billion, growing at a CAGR of 7.50%, with over 40% of revenue from software analytics, predictive servicing, and adaptive automation platforms. Competition will intensify as solution providers offer integrated AI-driven quality control, cloud-based conveyor fleet management, and real-time production analytics.

Established players are shifting toward hybrid offerings combining hardware innovation with SaaS-based optimization tools. Emerging manufacturers such as FlexLink, Intralox, and SSI Schaefer are expanding share through zero-downtime modular designs, advanced safety compliance, and sustainable conveyor materials, targeting high-growth sectors in food safety and rapid e-commerce packaging.

The rising demand for automated, high-speed, and precision-driven packaging operations is propelling growth in the smart conveyor packaging systems market. These systems optimize material flow, reduce labor dependency, and enhance product handling accuracy. Increasing adoption in food, beverage, pharmaceuticals, and e-commerce sectors is further driven by efficiency, safety, and traceability requirements.

Systems featuring IoT connectivity, AI-based quality control, and modular designs are gaining popularity for their ability to adapt to diverse packaging formats. Real-time monitoring, predictive maintenance, and energy-efficient motors improve operational uptime. Integration with smart sensors and data analytics enables enhanced throughput, aligning with sustainability goals and Industry 4.0 initiatives in modern manufacturing environments.

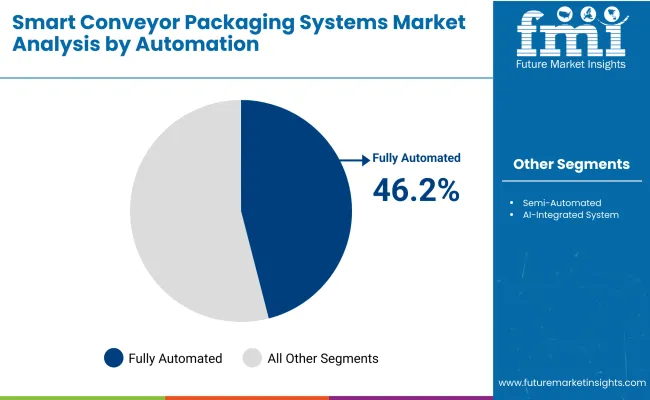

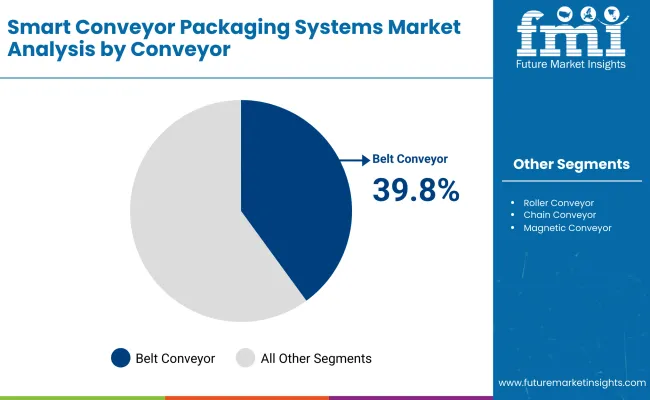

The market is segmented by automation level, conveyor type, smart features, application, end-use industry, and region. Automation level segmentation includes semi-automated, fully automated, and AI-integrated systems, enhancing packaging efficiency and reducing manual intervention. Conveyor type covers belt, roller, chain, and magnetic conveyors, enabling tailored movement for diverse product sizes and weights. Smart features include IoT sensors, predictive maintenance, RFID integration, and vision systems, improving operational monitoring and predictive performance.

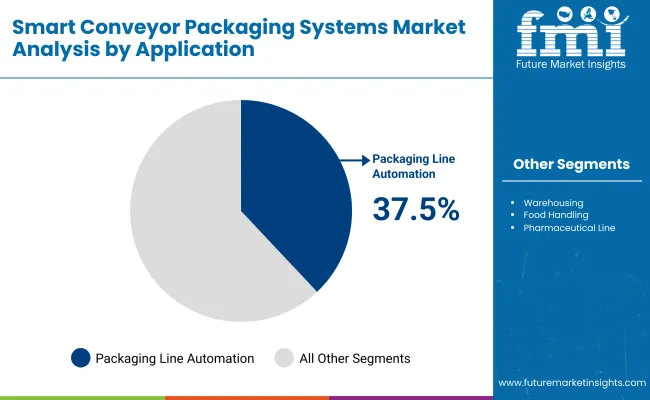

Applications span packaging line automation, warehousing, food handling, and pharmaceutical lines, ensuring streamlined processes across sectors. End-use industries include packaging, e-commerce, logistics, pharmaceuticals, and food & beverage. Regionally, the market is segmented into North America, Europe, Asia-Pacific, Latin America, and the Middle East & Africa.

Fully automated systems are forecast to command a 46.2% share in 2025, driven by their ability to execute packaging operations with minimal human intervention. These systems integrate robotics, PLC controls, and vision-guided alignment to ensure precise product handling and consistent output. The result is reduced labour dependency, lower operational errors, and improved packaging line efficiency.

Adoption is supported by rising labour costs and demand for high-speed, multi-shift operations in manufacturing plants. Fully automated conveyors enable seamless integration with upstream and downstream equipment, enhancing workflow continuity. With predictive maintenance features and adaptive control software, these systems deliver long-term productivity gains and cost optimization.

Belt conveyors are expected to account for 39.8% of the market in 2025, favoured for their adaptability to a wide range of product sizes and shapes. Their smooth, continuous surfaces ensure stable transport, reducing the risk of product damage in packaging lines. Modular designs enable easy cleaning and quick belt replacement.

They are widely used in food, beverage, and consumer goods packaging, where hygiene and product integrity are critical. Belt conveyors can be equipped with speed control, incline/decline configurations, and automated sorting to accommodate diverse packaging formats. Their flexibility supports rapid line reconfiguration for seasonal or custom product runs.

IoT sensor integration is projected to hold a 33.8% share in 2025, enabling continuous performance tracking and early fault detection in conveyor systems. Sensors monitor variables such as belt tension, motor temperature, and vibration levels, transmitting data to centralized platforms for analysis. This minimizes downtime and extends equipment lifespan.

Their role in predictive maintenance aligns with industry trends toward Industry 4.0-enabled operations. IoT-enabled conveyors provide actionable insights that optimize energy use, schedule service proactively, and improve operational transparency. Data connectivity also supports remote diagnostics, enhancing responsiveness in multi-facility packaging networks.

Packaging line automation is forecast to account for 37.5% of market share in 2025, streamlining processes from product infeed to final packing. Smart conveyors equipped with automated sorting, spacing, and merging functions synchronize seamlessly with labelling, sealing, and inspection units. This integrated approach increases throughput and reduces bottlenecks.

The capability to manage high-speed operations with minimal errors supports industries with complex, multi-SKU production schedules. Real-time monitoring ensures precise execution, while adaptive controls accommodate sudden changes in demand. Automation also enhances safety compliance by reducing manual handling of packaged goods.

The packaging industry is expected to represent 31.4% of market demand in 2025, driven by the need for consistent, high-quality product presentation. Smart conveyor systems meet these demands by ensuring precise alignment, spacing, and product flow during packaging. This reduces defects and supports faster delivery cycles.

Manufacturers value their scalability for handling diverse packaging formats, from cartons to flexible pouches. Integration with inspection systems helps maintain brand standards and regulatory compliance. The industry’s push toward efficiency, sustainability, and automation will continue to drive investment in smart conveyor solutions.

The smart conveyor packaging systems market is expanding as manufacturers adopt automation to improve efficiency, reduce labour costs, and increase production flexibility. Rising demand for faster changeovers, precision handling, and integration with Industry 4.0 platforms is boosting adoption across food, beverage, pharmaceuticals, and e-commerce sectors. However, high capital investment and complex integration with existing lines remain key barriers. Innovations in IoT connectivity, AI-driven monitoring, and energy-efficient designs are expected to drive long-term growth.

Automation Efficiency, Flexibility, and Product Safety Driving Adoption

Smart conveyor packaging systems enhance throughput by enabling synchronized product movement, automated sorting, and precision positioning during packaging. Industries such as food and beverage benefit from hygienic designs that meet strict safety standards, while pharmaceuticals rely on these systems for tamper-evident and contamination-free handling.

Their modular configurations allow rapid changeovers between product SKUs, reducing downtime and accommodating varied packaging formats. Integration with vision systems, sensors, and robotics improves quality assurance, enabling real-time rejection of defective items. These capabilities position smart conveyors as essential tools for achieving high-speed, error-free packaging in competitive markets.

High Capital Costs, Integration Challenges, and Workforce Adaptation Barriers

Despite strong benefits, the high upfront cost of advanced conveyor systems, including smart sensors, servo drives, and software controls, limits adoption among smaller manufacturers. Integrating these systems into existing facilities can require significant layout redesigns, additional space, and complex synchronization with upstream and downstream equipment.

Workforce adaptation presents another hurdle, as operators and maintenance staff must be trained to manage automated controls and troubleshoot issues. Additionally, companies face ongoing costs for software updates, spare parts, and predictive maintenance tools, which can slow return on investment in cost-sensitive environments.

IoT Connectivity, AI Optimization, and Sustainability Trends Emerging

Key trends include IoT-enabled conveyors that provide real-time performance monitoring, predictive maintenance alerts, and integration with enterprise resource planning (ERP) systems. AI algorithms are being used to optimize conveyor speed, reduce energy consumption, and adapt packaging flows based on order demand.

Sustainability goals are driving demand for conveyors with energy-efficient motors, recyclable materials, and minimal lubrication requirements. Advances in robotics integration are enabling fully automated end-of-line packaging, reducing labour dependency. These developments are transforming smart conveyors from mechanical transport tools into intelligent, data-driven assets that support operational agility, cost savings, and environmental responsibility.

The global smart conveyor packaging systems market is expanding rapidly, driven by demand for automation, high-speed handling, and real-time quality control in packaging operations. Asia-Pacific is emerging as a prime growth hub, with India and China advancing adoption through manufacturing modernization and smart factory investments. Developed markets like the USA, Germany, and Japan are leading innovations in sensor-based conveyors, AI-driven inspection, and energy-efficient designs to meet efficiency, accuracy, and sustainability requirements.

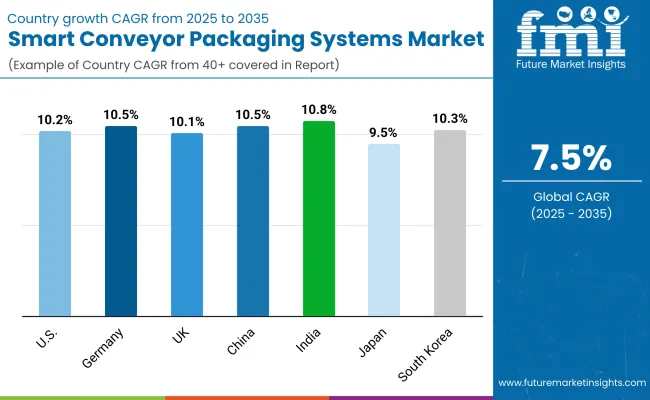

The USA market is projected to grow at a CAGR of 10.2% from 2025 to 2035, driven by strong adoption in food, beverage, and e-commerce fulfilmentcentres. Companies are investing in conveyors with automated sorting, predictive maintenance, and integrated vision systems to improve throughput and reduce labour dependency.

Germany’s market is expected to grow at a CAGR of 10.5%, anchored by its advanced engineering and packaging machinery industries. Manufacturers are integrating robotics with conveyor systems to handle complex product mixes and customized orders. Demand is driven by precision packaging for pharmaceuticals, automotive parts, and premium food products.

The UK market is forecast to expand at a CAGR of 10.1%, driven by growth in online retail, FMCG, and logistics sectors. SMEs are adopting modular conveyor solutions with plug-and-play automation features to scale operations quickly. Compliance with food safety and sustainability standards is pushing upgrades to smart conveyor systems.

China’s market is projected to grow at a CAGR of 10.5%, supported by large-scale manufacturing and government-backed smart industry initiatives. Factories are implementing conveyors with AI-based defect detection and adaptive speed control for high-volume packaging lines.

India is forecast to record the fastest growth at a CAGR of 10.8%, fuelled by rapid expansion in FMCG, pharmaceuticals, and packaged food sectors. Affordable, scalable smart conveyor systems are being adopted by mid-sized manufacturers to enhance efficiency.

Japan is expected to grow at a CAGR of 9.5%, driven by automation in electronics, cosmetics, and precision food packaging. Manufacturers favour compact, high-speed conveyors with real-time inspection systems.

Expansion Outlook for Smart Conveyor Packaging Systems South Korea

South Korea’s market is projected to grow at a CAGR of 10.3%, led by adoption in semiconductor, shipbuilding, and packaged food industries. High-connectivity infrastructure supports advanced conveyor automation and monitoring.

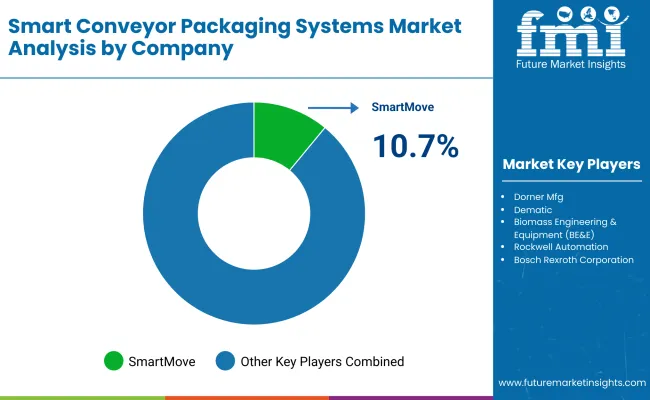

The smart conveyor packaging systems market is moderately fragmented, with automation leaders, material handling specialists, and intelligent controls providers competing across food, beverage, pharmaceutical, and e-commerce fulfilment sectors. Global leaders such as SmartMove, Dorner Mfg, and Dematic hold notable market share, driven by precision motion control, IoT-enabled monitoring, and high-throughput designs meeting stringent industry hygiene and safety standards. Their strategies increasingly emphasize predictive maintenance, modular layouts, and energy-efficient operation.

Established mid-sized players including Biomass Engineering & Equipment (BE&E), Rockwell Automation, and Bosch Rexroth Corporation are supporting adoption of conveyor platforms featuring integrated robotics, real-time diagnostics, and adaptive speed control. These companies are especially active in high-speed packaging, bulk handling, and cold chain operations, offering seamless integration with packaging machinery, SCADA systems, and cloud-based performance analytics.

Specialized intralogistics providers such as Bastian Solutions, SSI SCHAEFER, TGW Logistics, and FlexLink focus on tailored solutions for regional manufacturers and distribution hubs. Their strengths lie in customized conveyor engineering, advanced sortation systems, and deployment of smart sensors and vision technology to enable error-free packaging, optimized product flow, and rapid changeovers in dynamic production environments.

Key Development

| Item | Value |

|---|---|

| Quantitative Units | USD 7.5 Billion |

| By Automation Level | Semi-Automated, Fully Automated, AI-Integrated Systems |

| By Conveyor Type | Belt Conveyor, Roller Conveyor, Chain Conveyor, Magnetic Conveyor |

| By Smart Features | IoT Sensors, Predictive Maintenance, RFID Integration, Vision Systems |

| By Application | Packaging Line Automation, Warehousing, Food Handling, Pharmaceutical Lines |

| By End-Use Industry | Packaging, E-commerce, Logistics, Pharmaceuticals, Food & Beverage |

| Key Companies Profiled | SmartMove, Dorner Mfg, Dematic, Biomass Engineering & Equipment (BE&E), Rockwell Automation, Bosch Rexroth Corporation, Bastian Solutions, LLC, SSI SCHAEFER, TGW Logistics, FlexLink |

| Additional Attributes | Increasing shift toward AI-powered conveyor systems for predictive analytics and process optimization, integration of IoT sensors to monitor performance in real time, adoption of RFID and vision systems for product tracking and quality inspection, growing demand for high-speed and modular conveyor solutions in e-commerce and packaging sectors, and rising automation adoption in food and pharma lines to meet hygiene and throughput requirements. |

The global smart conveyor packaging systems market is estimated to be valued at USD 7.5 billion in 2025.

The market size for the smart conveyor packaging systems market is projected to reach USD 15.5 billion by 2035.

The smart conveyor packaging systems market is expected to grow at a CAGR of 7.5% between 2025 and 2035.

The key automation levels in the smart conveyor packaging systems market include semi-automated, fully automated, and AI-integrated systems.

The fully automated systems segment is expected to account for the highest share of 46.2% in the smart conveyor packaging systems market in 2025.

Our Research Products

The "Full Research Suite" delivers actionable market intel, deep dives on markets or technologies, so clients act faster, cut risk, and unlock growth.

The Leaderboard benchmarks and ranks top vendors, classifying them as Established Leaders, Leading Challengers, or Disruptors & Challengers.

Locates where complements amplify value and substitutes erode it, forecasting net impact by horizon

We deliver granular, decision-grade intel: market sizing, 5-year forecasts, pricing, adoption, usage, revenue, and operational KPIs—plus competitor tracking, regulation, and value chains—across 60 countries broadly.

Spot the shifts before they hit your P&L. We track inflection points, adoption curves, pricing moves, and ecosystem plays to show where demand is heading, why it is changing, and what to do next across high-growth markets and disruptive tech

Real-time reads of user behavior. We track shifting priorities, perceptions of today’s and next-gen services, and provider experience, then pace how fast tech moves from trial to adoption, blending buyer, consumer, and channel inputs with social signals (#WhySwitch, #UX).

Partner with our analyst team to build a custom report designed around your business priorities. From analysing market trends to assessing competitors or crafting bespoke datasets, we tailor insights to your needs.

Supplier Intelligence

Discovery & Profiling

Capacity & Footprint

Performance & Risk

Compliance & Governance

Commercial Readiness

Who Supplies Whom

Scorecards & Shortlists

Playbooks & Docs

Category Intelligence

Definition & Scope

Demand & Use Cases

Cost Drivers

Market Structure

Supply Chain Map

Trade & Policy

Operating Norms

Deliverables

Buyer Intelligence

Account Basics

Spend & Scope

Procurement Model

Vendor Requirements

Terms & Policies

Entry Strategy

Pain Points & Triggers

Outputs

Pricing Analysis

Benchmarks

Trends

Should-Cost

Indexation

Landed Cost

Commercial Terms

Deliverables

Brand Analysis

Positioning & Value Prop

Share & Presence

Customer Evidence

Go-to-Market

Digital & Reputation

Compliance & Trust

KPIs & Gaps

Outputs

Full Research Suite comprises of:

Market outlook & trends analysis

Interviews & case studies

Strategic recommendations

Vendor profiles & capabilities analysis

5-year forecasts

8 regions and 60+ country-level data splits

Market segment data splits

12 months of continuous data updates

DELIVERED AS:

PDF EXCEL ONLINE

Smart Magnetic Drive Conveyor System Market Size and Share Forecast Outlook 2025 to 2035

Smart Packaging Market Size, Share & Forecast 2025 to 2035

Conveyor System Market Size and Share Forecast Outlook 2025 to 2035

Market Leaders & Share in the Smart Tag Packaging Industry

Smart Tag Packaging Market

Smart Food Packaging Market Size and Share Forecast Outlook 2025 to 2035

Smartphone System-on-Chip Market Insights - Trends & Forecast 2025 to 2035

Smart Entry System Market

UV Conveyor Systems Market

Smart Dictation Systems Market Size and Share Forecast Outlook 2025 to 2035

Smart Medication Packaging Market

Smart Entertainment Systems Market Trends- Growth to 2035

Packaging Inspection Systems Market Size and Share Forecast Outlook 2025 to 2035

ASEAN Conveyor System Market Growth - Trends & Forecast 2024 to 2034

Smart Indoor Gardening System Market Size and Share Forecast Outlook 2025 to 2035

Smart Plant Based Food Packaging Market Size and Share Forecast Outlook 2025 to 2035

Smart Baggage Handling System Market Size and Share Forecast Outlook 2025 to 2035

Gravity Conveyor System Market Size and Share Market Forecast and Outlook 2025 to 2035

Modular Conveyor System Market

Smart Elevator Automation System Market Growth - Trends & Forecast 2024 to 2034

Thank you!

You will receive an email from our Business Development Manager. Please be sure to check your SPAM/JUNK folder too.

Chat With

MaRIA