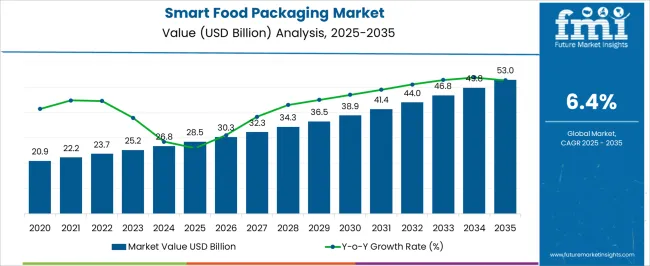

The smart food packaging market is poised for steady growth, projected to increase from USD 28.5 billion in 2025 to USD 53 billion by 2035, with a compound annual growth rate (CAGR) of 6.4%. From 2025 to 2030, the market is expected to grow incrementally from USD 28.5 billion to USD 38.9 billion, driven by increasing consumer demand for packaging solutions that enhance product freshness, safety, and shelf-life. As the food industry becomes more focused on consumer convenience, smart packaging technologies that offer real-time monitoring of food quality, temperature, and spoilage indicators are becoming essential.

These innovations are attracting interest from manufacturers aiming to improve product integrity and consumer experience. Between 2030 and 2035, the market is projected to continue its upward trajectory, reaching USD 53 billion. This period will see further integration of smart technologies within food packaging solutions, such as intelligent labels and RFID systems, to offer more precise tracking and improved logistics. The growing need for packaging that reduces waste, improves traceability, and meets consumer demands for product information will support market growth.

As more food manufacturers adopt smart packaging to meet evolving regulatory standards and consumer expectations, the market is positioned for long-term growth. This segment is likely to thrive, benefiting from the increasing importance of product protection and convenience in food distribution.

| Metric | Value |

|---|---|

| Smart Food Packaging Market Estimated Value in (2025 E) | USD 28.5 billion |

| Smart Food Packaging Market Forecast Value in (2035 F) | USD 53.0 billion |

| Forecast CAGR (2025 to 2035) | 6.4% |

The smart food packaging market holds a specialized position within several broader parent markets. Within the Food Packaging Market, it accounts for approximately 5.3% of the total market share, reflecting its niche application in enhancing food safety, shelf life, and consumer engagement through technology.

In the Smart Packaging Market, the Smart Food Packaging segment comprises about 93.9% of the market share, indicating its dominant role within the smart packaging sector. Within the Active Packaging Market, the Smart Food Packaging segment holds a substantial share, driven by the integration of features like oxygen scavengers and moisture control to maintain food quality.

In the Intelligent Packaging Market, which includes packaging solutions with embedded sensors and communication technologies, the Smart Food Packaging segment represents a significant portion, highlighting its relevance in real-time monitoring and traceability applications. Lastly, in the Food Safety and Traceability Market, the Smart Food Packaging segment contributes to the overall market share, as these packaging solutions play a crucial role in ensuring food safety and traceability throughout the supply chain. These figures underscore the Smart Food Packaging Market's essential role in modern food packaging, driven by technological advancements and increasing consumer demand for safety, sustainability, and convenience.

The Smart Food Packaging market is experiencing notable growth, driven by increasing consumer demand for freshness, safety, and sustainability in packaged food products. Rising concerns over food waste and the need for extended shelf life have accelerated the adoption of packaging technologies that actively monitor and preserve product quality.

Integration of smart sensors, indicators, and active materials is enabling real-time tracking of food conditions, ensuring safety and compliance with regulatory standards. Consumer preference for convenience and transparency is further influencing the uptake of intelligent packaging solutions, while food producers are leveraging these innovations to enhance brand trust and reduce supply chain inefficiencies.

Technological advancements in active and intelligent packaging systems are paving the way for scalable and cost-effective solutions across retail, foodservice, and e-commerce channels With strong investment in R&D and heightened focus on reducing environmental impact, the market is expected to see sustained momentum as both manufacturers and consumers increasingly adopt packaging that combines functionality, safety, and sustainability.

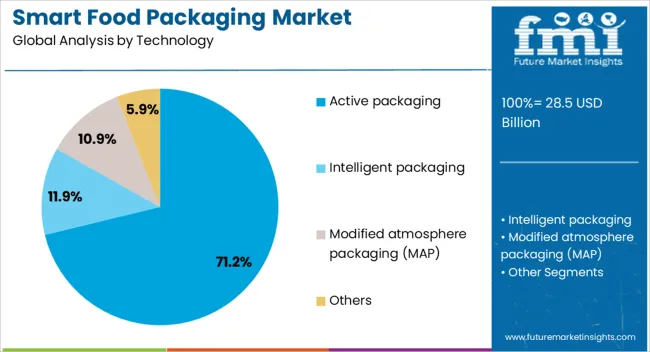

The smart food packaging market is segmented by technology, material, functionality, application, and geographic regions. By technology, smart food packaging market is divided into Active packaging, Intelligent packaging, Modified atmosphere packaging (MAP), and Others.

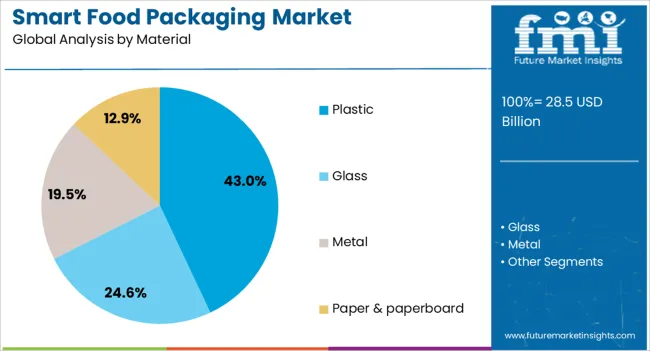

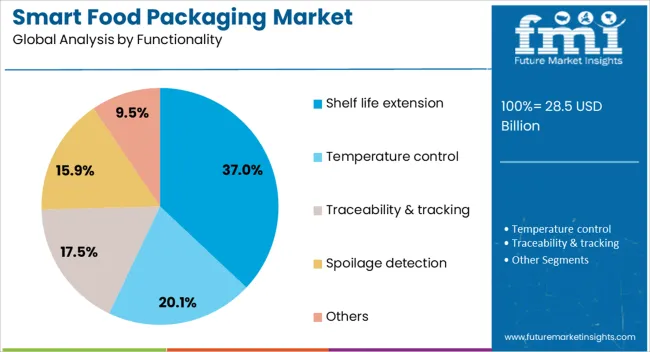

In terms of material, smart food packaging market is classified into Plastic, Glass, Metal, and Paper & paperboard. Based on functionality, smart food packaging market is segmented into Shelf life extension, Temperature control, Traceability & tracking, Spoilage detection, and Others. By application, smart food packaging market is segmented into Dairy products, Meat, poultry, and seafood, Bakery & confectionery, Fruits & vegetables, and Others.

Regionally, the smart food packaging industry is classified into North America, Latin America, Western Europe, Eastern Europe, Balkan & Baltic Countries, Russia & Belarus, Central Asia, East Asia, South Asia & Pacific, and the Middle East & Africa.

The active packaging segment is projected to hold 71.20% of the Smart Food Packaging market revenue share in 2025, making it the leading technology segment. Its growth has been supported by the increasing demand for solutions that interact directly with food products to maintain or improve quality.

Active packaging technologies incorporate components such as oxygen scavengers, moisture absorbers, and antimicrobial agents, which help extend shelf life and ensure safety. The capability to prevent spoilage and preserve nutritional value has made this technology highly preferred in fresh produce, meat, dairy, and ready-to-eat segments.

The adaptability of active packaging to various food categories and its ability to meet evolving regulatory and sustainability requirements have reinforced its dominance Advances in material science and compatibility with smart indicators have also enhanced performance, making active packaging an indispensable choice for producers aiming to reduce waste and deliver fresher products to consumers.

The plastic material segment is anticipated to account for 43% of the Smart Food Packaging market revenue share in 2025, making it the largest material category. The segment’s leadership is attributed to the versatility, durability, and cost-effectiveness of plastics in smart packaging applications. Plastics provide excellent barrier properties against moisture, oxygen, and contaminants, which are critical for preserving food quality.

They are compatible with a wide range of active and intelligent packaging technologies, enabling integration of freshness indicators, sensors, and antimicrobial elements. The lightweight nature of plastics reduces transportation costs, while their adaptability to various shapes and sizes allows for innovative packaging designs.

Ongoing developments in recyclable and bio-based plastic materials are addressing environmental concerns, ensuring continued adoption in markets focused on sustainability The balance of functionality, affordability, and adaptability has ensured the plastic segment maintains its strong market position.

The shelf life extension functionality segment is expected to hold 37% of the Smart Food Packaging market revenue share in 2025, making it the leading functionality category. This segment’s prominence is driven by the global push to reduce food waste and improve supply chain efficiency. Technologies in this segment work by slowing microbial growth, controlling moisture, and managing gas exchange to maintain product freshness for longer periods.

The functionality is especially valued in perishable food categories, where even a small extension in shelf life can significantly reduce losses for retailers and distributors. Adoption is further fueled by consumer demand for products with fewer preservatives and more natural freshness preservation methods.

The compatibility of shelf life extension features with various materials and active packaging technologies has broadened its application range As global food distribution networks expand, this functionality is set to remain a critical factor in ensuring quality, safety, and economic efficiency.

The smart food packaging market is growing rapidly, driven by consumer demand for convenience, transparency, and quality. Opportunities in the e-commerce and online grocery segments are significant as packaging solutions that ensure freshness and traceability gain prominence.

Trends such as active packaging and extended shelf life are shaping consumer preferences, while challenges like high production costs and adoption rates remain. As food packaging continues to evolve, smart solutions are expected to become a mainstream choice for both consumers and producers.

The smart food packaging market is experiencing strong demand driven by consumer preferences for convenience and product information. As consumers seek better product transparency, packaging solutions that provide features such as real-time tracking, temperature monitoring, and freshness indicators are becoming highly sought after.

These packaging solutions not only enhance convenience but also improve the overall food experience by ensuring optimal freshness and quality. As consumer habits shift towards on-the-go meals and e-commerce, smart packaging is positioned for substantial growth.

The rise of e-commerce and online grocery shopping presents lucrative opportunities for the smart food packaging market. With more consumers opting for online shopping, packaging that can ensure product quality and traceability during transportation is crucial.

Smart food packaging solutions, such as QR codes for traceability and indicators of spoilage, are becoming increasingly important. This shift toward online purchasing, combined with the need for secure, safe, and tamper-evident packaging, positions the market for growth as e-commerce continues to dominate food retail.

Consumers are increasingly drawn to packaging that offers convenience, safety, and sustainability, with features like self-heating or self-cooling materials, which enhance user experience. There is also a growing focus on packaging that can extend shelf life without preservatives. Active packaging, which interacts with the environment to prolong food freshness, is gaining traction.

As consumer preferences evolve, manufacturers are aligning their product offerings with these trends, enhancing packaging functionality while delivering better product quality and reducing waste.

Despite the demand, the smart food packaging market faces challenges related to high initial investment costs. The development and manufacturing of smart packaging solutions require advanced technology and materials, which can increase the overall cost of production.

Smaller players in the food industry may face difficulties in adopting these solutions due to budget constraints. Overcoming these challenges while ensuring scalability and affordability for various food producers will be key to expanding the adoption of smart packaging solutions.

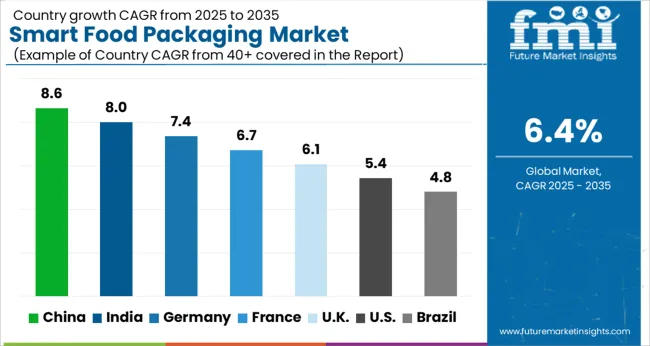

| Countries | CAGR |

|---|---|

| China | 8.6% |

| India | 8.0% |

| Germany | 7.4% |

| France | 6.7% |

| UK | 6.1% |

| USA | 5.4% |

| Brazil | 4.8% |

The global smart food packaging market is projected to grow at a CAGR of 6.4% from 2025 to 2035. China leads with a growth rate of 8.6%, followed by India at 8%, and Germany at 7.4%. The United Kingdom records a growth rate of 6.1%, while the United States shows the slowest growth at 5.4%. The demand for smart food packaging solutions is driven by the growing focus on food safety, waste reduction, and sustainability. Emerging markets like China and India are experiencing rapid adoption due to expanding food industries and increasing consumer demand for convenience, while developed markets such as the USA and the UK emphasize innovation and the integration of advanced technologies for better consumer experiences. This report includes insights on 40+ countries; the top markets are shown here for reference.

The smart food packaging market in China is projected to grow at a CAGR of 8.6%. The rapid expansion of the food and beverage sector, coupled with increasing urbanization and rising disposable incomes, is driving the demand for advanced packaging solutions. Consumers are becoming more aware of the benefits of smart food packaging, such as extended shelf life and improved product freshness. Additionally, the growing trend of sustainability and the Chinese government's initiatives to promote eco-friendly packaging solutions further support the adoption of smart food packaging technologies.

The smart food packaging market in India is expected to grow at a CAGR of 8%. The country’s expanding food processing and retail sectors, combined with the growing demand for food safety and convenience, are driving market adoption. The increasing use of e-commerce platforms for food delivery and the rising preference for fresh, packaged food are contributing to the growth of smart food packaging. Moreover, India’s increasing focus on reducing food waste and enhancing food shelf life supports the adoption of innovative packaging solutions.

The smart food packaging market in Germany is projected to grow at a CAGR of 7.4%. Germany’s well-established food and beverage industry, along with the increasing demand for eco-friendly and sustainable packaging solutions, drives market growth. The country’s stringent regulations on food safety and packaging standards are encouraging the adoption of advanced technologies in food packaging. Moreover, Germany’s strong focus on innovation and consumer demand for convenience, along with growing e-commerce and retail trends, continue to propel the use of smart food packaging solutions.

The smart food packaging market in the UK is projected to grow at a CAGR of 6.1%. With increasing consumer demand for fresh, high-quality food products, the UK market is seeing a rise in the adoption of smart packaging solutions. Growing interest in sustainability and reducing food waste is pushing both food manufacturers and consumers toward more efficient packaging options. The UK’s regulatory framework promoting eco-friendly packaging further drives the market, alongside advancements in food safety and shelf life management.

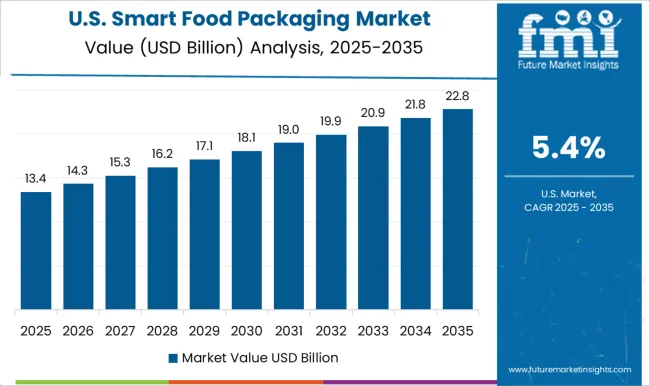

The smart food packaging market in the USA is projected to grow at a CAGR of 5.4%. The USA market is driven by the growing need for food safety and sustainability, particularly in the food service and retail industries. Consumer preference for convenience and quality has led to an increased demand for packaging solutions that improve freshness and shelf life. While the market grows at a slower pace compared to emerging regions, the USA remains a key player in terms of technological advancements and the integration of digital technologies in packaging.

The smart food packaging market is highly competitive, with leading companies like Amcor, Sealed Air, and Tetra Pak dominating the landscape. Amcor, recognized for its global reach, focuses on providing flexible and secure packaging solutions with an emphasis on enhancing product shelf-life and freshness.

Sealed Air differentiates itself by offering intelligent packaging that integrates sensors and indicators to monitor freshness and temperature, ensuring optimal product quality. Tetra Pak, known for its eco-conscious designs, has become a strong player by focusing on packaging solutions that preserve the nutritional value of food, combining innovation with practical functionality. These companies continually refine their offerings, aiming to meet the rising demand for packaging that is both efficient and consumer-friendly, while ensuring a long-lasting impact on product protection.

Other notable competitors, such as Avery Dennison, Stora Enso, and Smurfit Kappa, bring their own specialized strategies to the market. Avery Dennison focuses on providing high-performance labeling solutions, with smart RFID technology to improve traceability and enhance supply chain management. Stora Enso positions itself as a key player in sustainable packaging, using renewable materials to create intelligent packaging systems that engage consumers and offer real-time product information. Smurfit Kappa, with its deep expertise in corrugated packaging, has introduced solutions that enable better product visibility and protect against damage during transportation.

BASF and 3M contribute to the market by offering advanced materials and coatings for food packaging that promote durability and safety. Meanwhile, DS Smith and Crown Holdings provide specialized packaging for a variety of food products, ensuring both protection and brand visibility. As the market continues to expand, each player adapts their strategies to stay ahead in providing smart, efficient, and consumer-oriented packaging solutions.

| Item | Value |

|---|---|

| Quantitative Units | USD 28.5 Billion |

| Technology | Active packaging, Intelligent packaging, Modified atmosphere packaging (MAP), and Others |

| Material | Plastic, Glass, Metal, and Paper & paperboard |

| Functionality | Shelf life extension, Temperature control, Traceability & tracking, Spoilage detection, and Others |

| Application | Dairy products, Meat, poultry, and seafood, Bakery & confectionery, Fruits & vegetables, and Others |

| Regions Covered | North America, Europe, Asia-Pacific, Latin America, Middle East & Africa |

| Country Covered | United States, Canada, Germany, France, United Kingdom, China, Japan, India, Brazil, South Africa |

| Key Companies Profiled | Amcor, Sealed Air, Tetra Pak, Avery Dennison, Stora Enso, Smurfit Kappa, BASF, 3M, DS Smith, and Crown Holdings |

| Additional Attributes | Dollar sales by technology type (RFID, NFC, QR codes, sensors), Dollar sales by application (fresh food, processed food, beverages, ready-to-eat meals), Trends in smart labeling and traceability, Growth in demand for extended shelf-life and temperature-sensitive packaging, Adoption of eco-friendly and biodegradable packaging solutions, Regional patterns of smart packaging adoption in retail and e-commerce sectors. |

The global smart food packaging market is estimated to be valued at USD 28.5 billion in 2025.

The market size for the smart food packaging market is projected to reach USD 53.0 billion by 2035.

The smart food packaging market is expected to grow at a 6.4% CAGR between 2025 and 2035.

The key product types in smart food packaging market are active packaging, intelligent packaging, modified atmosphere packaging (map) and others.

In terms of material, plastic segment to command 43.0% share in the smart food packaging market in 2025.

Full Research Suite comprises of:

Market outlook & trends analysis

Interviews & case studies

Strategic recommendations

Vendor profiles & capabilities analysis

5-year forecasts

8 regions and 60+ country-level data splits

Market segment data splits

12 months of continuous data updates

DELIVERED AS:

PDF EXCEL ONLINE

Smart Plant Based Food Packaging Market Size and Share Forecast Outlook 2025 to 2035

Smart Vision Processing Chips Market Size and Share Forecast Outlook 2025 to 2035

Smart Touch Screen Scale Market Size and Share Forecast Outlook 2025 to 2035

Smart Magnetic Drive Conveyor System Market Size and Share Forecast Outlook 2025 to 2035

Smart Wheelchair market Size and Share Forecast Outlook 2025 to 2035

Smart Mining Technologies Market Size and Share Forecast Outlook 2025 to 2035

Smart Parking Market Size and Share Forecast Outlook 2025 to 2035

Smart Digital Valve Positioner Market Forecast and Outlook 2025 to 2035

Smart Card IC Market Size and Share Forecast Outlook 2025 to 2035

Smart-Tag Inlay Inserters Market Analysis - Size and Share Forecast Outlook 2025 to 2035

Smart TV Market Forecast and Outlook 2025 to 2035

Smart/AI Toy Market Size and Share Forecast Outlook 2025 to 2035

Smart Locks Market Size and Share Forecast Outlook 2025 to 2035

Smart Sprinkler Controller Market Size and Share Forecast Outlook 2025 to 2035

Smart Indoor Gardening System Market Size and Share Forecast Outlook 2025 to 2035

Smart Building Delivery Robot Market Size and Share Forecast Outlook 2025 to 2035

Smart Watch Market Size and Share Forecast Outlook 2025 to 2035

Smart Label Market Size and Share Forecast Outlook 2025 to 2035

Smart Mat Market Size and Share Forecast Outlook 2025 to 2035

Smart Water Management Market Size and Share Forecast Outlook 2025 to 2035

Thank you!

You will receive an email from our Business Development Manager. Please be sure to check your SPAM/JUNK folder too.

Chat With

MaRIA